OIL DEMAND PLUMMETS AFTER LOCKDOWN

Monthly Oil News Commentary: March - April 2020

India

Demand

Oil demand in India, the world’s third-biggest consumer has collapsed by as much as 70 percent as India endures the planet's largest national lockdown. The estimate for the current demand loss is a stark reminder of the challenge facing oil producers as they haggle over a deal to cut supply and prop up the global energy industry. Consumption for the entire month could average about 50 percent below last year’s levels but that is based on India's three-week lockdown ending 15 April as planned. India consumed 4.48 mn barrels a day of oil in April 2019, including about 690,000 barrels a day of gasoline and 1.8 mn barrels of diesel, according to government data.

India’s annual fuel demand grew 0.2 percent in 2019/20, its worst growth rate in over two decades, dragged down by a hefty 17.8 percent decline in local consumption in March as steps taken to prevent the spread of Covid-19 dented transport fuel sales. Consumption of refined fuels, a proxy for oil demand, totalled 16.08 mt in March according to PPAC. Falling refined fuels sales in March points to sluggish industrial activity which according to some analysts is forecast to grow at 1.5-2 percent in 2020/21, its lowest in decades. Consumption of diesel, which normally accounts for two-fifths of overall refined fuel consumption, declined 24.2 percent in March from a year earlier, its deepest decline since April 1998. PPAC does not provide monthly growth numbers for before April 1998. Sales of gasoline, or petrol, used by automobiles fell by 16.4 percent from a year earlier, its worst slide since March 1999, the data showed. Jet fuel consumption declined by 32.4 percent as the lockdown has hit air travel. LPG sales rose about 1.9 percent to 2.31 mt and naphtha sales rose 15.7 percent to 1.39 mt. With flights grounded since mid-March, ATF consumption fell 32.4 percent to 484,000 tonnes.

Petrol and diesel consumption, which saw its biggest ever decline in the aftermath of a nationwide lockdown, is likely to pick up in the second half of the month as the government has allowed trucks to ply as well as farmers and industries in rural areas to resume operations after 20 April. Petrol and diesel sales had fallen by over 66 percent and ATF consumption collapsed by 90 percent as the unprecedented nationwide lockdown shut factories, stopped road and rail transportation and suspended flights. Due to lower demand of liquid fuels, refinery run-rates have been lowered by 25-30 percent - meaning they would produce up to 30 percent less of all fuel petrol, diesel, ATF, naphtha and LPG.

India, the world’s third largest energy consumer, has enough petrol, diesel and cooking gas or LPG in stocks to last way beyond the three-week nationwide lockdown as all plants and supply locations are fully operational.

Production

India’s oil production fell 6.4 percent in February as a decline in output from fields operated by private firms negated a rise in production from ONGC fields. Crude oil production at 2.39 mt in February was 6.41 percent lower than 2.56 mt output in the same month a year back, according to the oil ministry data. ONGC reported a 4.64 percent rise in production at 1.67 mt as output from its offshore fields saw a pick-up. However, fields operated by the private sector firms reported a 32.6 percent drop with those in Rajasthan seeing a sharp 32.3 percent lower production.

Domestic oil and gas operators have approached the government seeking a reduction and deferment of royalty, cess and profit petroleum paid by companies to the government, with the Covid-19 pandemic hitting demand and pushing international crude prices to new lows. In addition, companies batted for a higher gas price compared to the existing $2.39/mmBtu, effective from April to September this year. In a letter to the finance ministry, the Association of Oil and Gas Operators said oil and gas operations are now unviable owing to the higher share of government taxes. The industry body’s move comes after a decline in oil prices by around 60 percent since 1 January, leading to a 97 percent decline in operator revenue.

Fitch Ratings said it has downgraded ratings of Vedanta Group firm CIHL’s rating as a drop in oil prices will hurt earnings of the company. Fitch expected the EBITDA contribution from oil and gas business to drop by about 45 percent in FY21 and 20 percent in FY22 due to falling oil prices and volume growth. CIHL also expects further cost cuts, as contractor prices are typically negotiated lower in case of a persistent low oil-price environment, it said. Vedanta has the ability to defer capex for some of its oil and gas and other mineral projects to mitigate a drop in cash flow from the low-price environment.

Vedanta has cut oil production at its prolific Rajasthan block by a tenth as refiners, faced with deep demand destruction due to nationwide lockdown, have reduced intake, India’s largest private sector oil producer has said. The production has fallen to 160,000 boepd from 180-190,000 barrels. IOC, Nayara Energy and a couple of other refiners are Vedanta’s key oil customers. With taxes and government profit share eating away more than three-fourth of revenue, India’s biggest private oil producer Cairn Oil and Gas has sought a review of taxation system during low oil price regime, saying funding exploration will be difficult in the present scenario. According to Vedanta the government levies 20 percent cess on oil price realised and an equivalent amount has to be paid to the state government in royalty. The outbreak of Covid-19 has cost the company 50,000 barrels of oil and oil equivalent gas in production. The company was producing 180,000 boepd from its flagship Barmer oil and gas fields in Rajasthan before it took a maintenance shutdown in February. The shutdown was meant to hook up a new project that could have helped ramp up production further but it could achieve only 160,000 boepd.

Imports

Despite efforts by the government to increase crude oil production and reduce the country’s oil import bill, India's domestic crude oil output fell to 32,173 tmt in 2019-2020, the lowest level of production in at least 18 years for which data is publicly available. The last fiscal year’s production was down 6 percent as compared to 34,203 tmt of oil produced in 2018-19. In March, domestic oil production declined 5.36 percent to 2,701 tmt. The declining trend in production had pushed the country’s crude oil import dependence to an all-time high of 86.7 percent in the April-February period of 2019-2020. The oil ministry is yet to publish data on crude oil import dependence for the full financial year 2019-2020 and March 2020. The government had in March 2015 set a target for the government to decrease oil import dependence by 10 percent by 2022. India’s oil import dependence stood at 78.6 percent in 2014-2015. The government had recently indicated there may be a need to revisit the existing strategy if the goal to cut oil imports had to be met.

LPG

Though the outbreak of Covid-19 has hit the demand for petrol, diesel, fuel oil, bitumen, ATF and other petroleum products, the requirement for LPG has gone up, according to BPCL. The crude oil processing has been reduced now to around 60 percent in view of the lower product demand. To meet the rising demand for LPG, BPCL had taken steps to improve LPG production in its refineries by appropriately modifying operations.

According to the government over 15 mn free LPG cylinders have been distributed as part of the government’s stimulus aimed at helping poor tide over hardships of lockdown. Under the Pradhan Mantri Garib Kalyan Yojana, several relief measures have been announced by the central government for the welfare of poor, one of them being providing three LPG cylinders (14.2 kg) free to over 80 mn beneficiaries of PMUY between April and June. For the seamless implementation of the scheme, the OMCs have been transferring an advance equal to the retail selling price of cylinder to the accounts of beneficiaries. The beneficiaries can potentially use this money to buy LPG refill. Marketing guidelines have not been provided post the announcement and it is still not clear whether consumers will be able to lift more than one LPG cylinder in a month.

The OMCs are distributing 5 to 6 mn cylinders per day, which includes about 1.8 mn free cylinders. The demand for LPG by PMUY consumers increased in the country after the centre announced free LPG cylinder refills for them. IOC’s Mathura refinery has enhanced the production of LPG owing to a sudden spurt in demand for the cooking fuel amid the nationwide lockdown to contain the spread of coronavirus. All precautions are being taken to protect our employees amid the coronavirus outbreak, however, the "round the clock" production of fuel has not been affected.

IOC has assured residents of Chhattisgarh that there was no shortage of petrol and diesel or LPG cylinders across the state and there is no need for any panic buying. Consequent to lockdown, initially there was a spike in the LPG cylinder refill booking by around 30 percent during 24 to 26 March which got tapered down to normal levels, now. All of IOCs LPG bottling plants in the state are functioning at more than 120 percent of their rated capacity and are following due precautions adhering to health protocols. Also, all of IOCs LPG distributorships are fully operational.

With demand for cooking gas increasing amid the lockdown, some parts of the city saw long queues outside LPG dealer outlets as staff shortage affected home delivery of cylinders. The supply of LPG from oil marketing firms and the delivery of gas cylinders to dealers across Mumbai is normal. In some areas, people complained that they had to pay a 'premium' for a gas cylinder refill. In other parts of Mumbai region, LPG cylinder delivery was on, though the waiting list was 2-3 days.

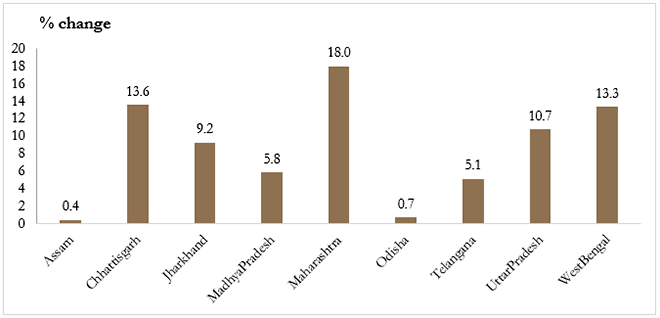

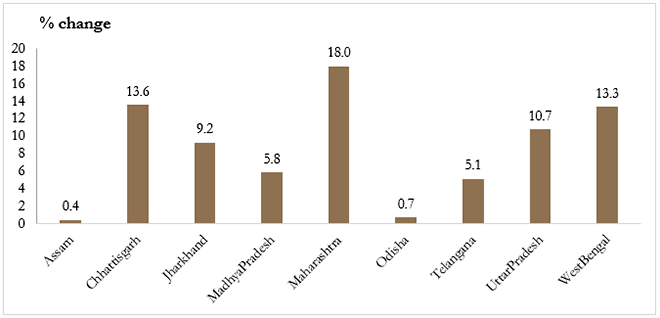

Expecting a 70 percent hike in LPG demand in Assam in April due to the government’s policy to give three free cylinders to PMUY beneficiaries over a three- month period, IOC has introduced night shift in two of its major bottling plants to "handle the additional load". While the rise in demand has been estimated at 57 percent across the country for the current month compared to March, it is pegged at 70 percent for Assam and 45 percent for the north-eastern region.

IOC aims at ramping up capacity at its Kandla LPG import terminal from 600,000 tonnes per year to 2.5 mtpa at a cost of ₹5.88 bn. The capacity is being increased to feed LPG into the proposed 2,757 km long Kandla-Gorakhpur LPG pipeline, billed as the longest LPG pipeline in the world. To be laid at a total cost of ₹100.88 bn, the 8.25 mtpa capacity pipeline would connect four big ports including Kandla, Mundra and Pipavav on Gujarat coast, four refineries and 22 LPG bottling plants in Gujarat, Madhya Pradesh and Uttar Pradesh. The Kandla-Gorakhpur pipeline will be a joint venture of three oil marketing companies. The pipeline will connect the two refineries including IOC’s 13.7 mtpa Koyali refinery and the 6 mtpa Bina refinery in Madhya Pradesh.

IOC, BPCL and HPCL announced an ex-gratia of ₹500,000 in case of coronavirus-related death of any LPG delivery boy or other personnel involved in the supply chain. While the entire country has been locked down with most confining themselves to homes, LPG supplies have continued uninterrupted with all the distributors and hundreds of delivery boys providing cylinders to 275 mn users on demand. Though the LPG distributor agencies and their staff, including delivery boys, are not part of oil company staff, they have been provided with protective gear by the three firms. But, the risk to the delivery boys and other staff remained as the Covid-19 infection spreads. Recognising the threat, IOC, BPCL and HPCL announced the ex-gratia. LPG being an essential commodity has been exempted from the lockdown, and the personnel are required to attend duty during this crisis period to maintain uninterrupted LPG cylinder supplies across the country to all customers.

Amid the nationwide coronavirus lockdown, LPG cylinder prices were cut by up to ₹65 per cylinder. The price cut follows the huge fall in global crude prices over the past few weeks. As per IOC’s revised rate list that was made public, the 14.2 cylinder will cost ₹744 in Delhi, down ₹61.5 from the last list (₹805.5 per cylinder). For Kolkata the new rate is ₹774.5 (earlier price 839.5), for Mumbai ₹714.5 (earlier price ₹776.5), and for Chennai 761.5 (earlier price ₹826). Rate revision is the second consecutive fall in cylinder prices in the past two months.

Strategic Reserves

India in a concerted effort to step up its energy security and taking advantage of prevailing very low crude oil prices in the international market is playing an active role through coastal Karnataka based MRPL in filling ISPRL underground crude oil caverns in Mangaluru and Padur. The other strategic reserve of ISPRL is located at Vishakapatnam. The oil ministry has mandated ISPRL to work closely with public sector oil companies including MRPL to achieve the target of filling up Mangaluru and Padur caverns. Series of crude oil cargos of varying volumes from 1 to 2 mn barrels that MRPL, IOC and BPCL have sourced, will be unloaded in the single point mooring of MRPL under jurisdiction of New Mangalore Port Trust during April and May before onset of monsoon in the region. According to MRPL the first consignment of 2 mn barrels by MRPL and second consignment of 1 mn barrel by IOC has already been successfully unloaded into the caverns.

India is capitalizing on low global oil prices to fill its underground strategic oil reserves, with the first shipload of 1 mn barrels of crude oil from the UAE arriving at Mangalore as part of efforts to shore up supplies to meet any supply or price disruption. While the 5.33 mt of emergency storage, enough to meet its oil needs for 9.5 days, was built in underground rock caverns in Mangalore and Padur in Karnataka and Visakhapatnam in Andhra Pradesh by the government, state-owned oil firms have been asked to buy oil at cheaper rates from the market and fill them up. The storages at Mangalore and Padur are half-empty and there was some space available in Vizag storage as well. These will now be filled by buying oil from Saudi Arabia, the UAE and Iraq. The Strategic Petroleum Reserve entity of India built the underground storages as insurance against supply and price disruptions. It allowed foreign oil companies to store oil in the storages on condition that the stockpile can be used by New Delhi in case of an emergency.

Refining

Two Indian refiners declared force majeure on crude purchases from the Middle East after fuel demand plummeted due to a nationwide lockdown to stem the spread of coronavirus and the companies' tanks are full. IOC the country’s top refiner, has reduced its crude processing by 30 percent to 40 percent and shut its naphtha cracker plant in northern India because of falling demand and "to avoid tank top-up situation". IOC, which owns about a third of the country’s 5 mn bpd refining capacity, has sent a force majeure notice to most Middle Eastern suppliers. The company is yet to decide whether to reduce its crude supplies or cancel lifting of oil cargoes altogether in April. IOC has declared force majeure on crude purchases from four of its biggest suppliers - Saudi Arabia, Iraq, UAE and Kuwait - as refinery run rates have been cut down in view of plummeting fuel demand following a nationwide lockdown. IOC has asked the four suppliers to defer some of the volumes they were to deliver in April. The company has reduced processing at its refineries by at least one-fourth as shutting down of businesses, suspension of flights and most vehicles staying off road due to the 21-day nationwide lockdown has led to drastic fall in demand. Petrol sales fell 8 percent in March compared to February, while diesel demand was down 16 percent.

Southern India-based MRPL has already shut a third of its 300,000 bpd refining capacity and is preparing to shut the remainder as demand slumped. MRPL, Karnataka’s only oil refinery has declared ‘force majeure’ to contracted crude oil supplies. With its tanks full and OMCs not lifting petroleum products, MRPL will shed 0.5 mt of crude up to first week of May. Supplying fuel to entire Karnataka and even neighbouring Kerala and other Southern states, this ‘force majeure’ move by MRPL will in no way disrupt fuel availability. Consequently, MPRL with an annual refining capacity of 15 mt has shut down its phase one operations completely. With downstream processing of crude, a common part of functioning of all three-phases, every product – petrol, diesel, LPG, distillates – is produced when the refinery operates.

Retailing

Consortium of Indian Petroleum Dealers, which represents the interests of the dealers of around 60,000 retail outlets across the country, has sought a 'stimulus financial package' from oil marketing corporations – BPCL, IOC and HPCL. The package, to be offered for 120 days, is to compensate for the expenditures being incurred by the outlets, which are functioning round-the-clock to meet emergencies, during the lockdown. The retail outlet dealerships have remained open during the ongoing crisis, to meet the needs of the police, ambulances, municipal corporations, gram panchayats, district collectors, state governments and emergency of citizens, even postponing leave and holidays of staff. The oil marketing corporations want recompense by way of reimbursement, as 'stimulus financial package' as dealer margins based on government-approved charges. Dealer margins work on 'litre sales', whose original volume has been curtailed below 10 percent during this crisis, while cost and expenditures remains constant.

Digital payments platform Paytm has announced that it has entered into a partnership with IOC to enable digital transactions across its fuelling stations as well as LPG cylinder delivery ecosystem in the country. With this, IOC customers will now be able to book and pay for LPG cylinders on the Paytm app. IOC’s delivery executives will also carry the Paytm All-in-One Android POS device and All-in-One QR code to facilitate digital transactions at the time of delivery. IOC’s brand Indane Gas has now started accepting digital payments through Paytm All-in-One Android POS and All-in-One QR for home delivery of gas cylinders. It has been working with Paytm and promoting cashless payments to help stop the spread of coronavirus. Paytm’s POS machine will be integrated with Indane delivery application to enable digital recording and updating of cylinder delivery. It will generate an e-invoice or physical copy of the bill as well. IOC retail outlets will also carry Paytm’s All-in-One payment services for unlimited acceptance of Paytm Wallet, UPI from all apps and Rupay cards. Along with this, every customer paying at petrol pumps using Paytm will automatically get credited with points under Indian Oil ‘XtraRewards’ Loyalty Program. These points can be redeemed on the Paytm app for purchasing free fuel from IOC outlets. Paytm users can order their IOC cylinder refills by tapping on 'Book a Cylinder' icon in the 'Other Services' section of the app. The entire process requires minimal details and does not require them to re-enter details on every purchase. They only need to provide their consumer number or the linked mobile number along with the name of the gas agency. Humsafar, an online diesel delivery startup has announced that it will provide the service to the emergency services like healthcare sector, during the ongoing lockdown that has been imposed for 21 days till 14 April, by the Indian government, in a bid to contain the spread of the Covid-19 virus. The startup caters to the bulk diesel buyers like housing societies, hotels, hospitals, malls, construction sites, industries, banquets at their doorstep. The service can be booked using their mobile app called Fuel Humsafar, as claimed by the company.

Environmental Regulation

The Union government had set a deadline for rolling out BS-VI compliant fuel by 1 April 2020, however, Mathura refinery achieved the target on 1 February 2020 despite being shut for in December 2019 and January 2020 for revamping its units. India joined a select league of nations having the world's cleanest petrol and diesel as oil companies rolled out Euro-VI emission compliant fuels without either disruption or a price increase. Leapfrogging from BS-IV grade fuel straight to BS-VI grade, equivalent to Euro-VI fuel, petrol and diesel would have resulted in an up to ₹1/litre increase in cost but oil companies decided against passing this on to consumers and instead adjusted it against the reduction warranted from international oil prices plummeting to a 17-year low. Oil companies have not changed petrol and diesel price for over a fortnight now as they first adjusted the reduction warranted against the ₹3/litre increase in excise duty and now are setting off the increased cost of BS-VI fuel. Petrol and diesel rates were last revised on 16 March. A litre of petrol in Delhi comes for ₹69.59 and diesel is priced at ₹62.29. IOC said the switch over from BS-IV to BS-VI was achieved in just three years, a feat not seen in any of the large economies around the globe. India will join the select League of Nations using petrol and diesel containing just 10 ppm of sulphur as it looks to cut vehicular emissions that are said to be one of the reasons for the choking pollution in major cities.

Rest of the World

OPEC and OPEC+

Oil markets have been particularly hard hit because of a battle for market share between Saudi Arabia and Russia that has increased supply while demand has been destroyed by lockdowns to try to prevent the spread of the new coronavirus. Refiners have been cutting back activity as storage fills and profit margins shrink, which could eventually boost prices of some refined products such as LPG. OPEC and allies led by Russia agreed to a record cut in output to prop up oil prices amid the coronavirus pandemic in an unprecedented deal with fellow oil nations, including the US that could curb global oil supply by 20 percent. Measures to slow the spread of the coronavirus have destroyed demand for fuel and driven down oil prices, straining budgets of oil producers and hammering the US shale industry, which is more vulnerable to low prices due to its higher costs. The group, known as OPEC+ had agreed to reduce output by 9.7 mn bpd for May and June, after four days of talks and following pressure from the US to arrest the price decline. OPEC+ expected total global oil cuts to amount to more than 20 mn bpd, or 20 percent of global supply, effective 1 May. OPEC had the same figure in its draft statement but removed it from the final version. The biggest oil cut ever is more than four times deeper than the previous record cut in 2008. Producers will slowly relax curbs after June.

Behind a Saudi-Russian truce to stabilise oil markets with a record output cut, market players are seeing the two production heavyweights still trading blows in the physical market. Russia has relied on Asian markets as a destination for its oil output since launching the 1.6 mn bpd ESPO pipeline. This connects Russian fields to Asian markets through the port of Kozmino, the country’s main eastern export outlet, and also via a pipeline spur with China, the biggest Asian consumer. Saudi sales to Europe are poised to surpass 29 mn barrels in April, slightly less than the record of August 2016, shipping data showed. Supplies of Aramco’s Arab crude oil including Arab Light, the closest grade to Russian flagship in terms of quality, will rise to Italy, Turkey, Greece, France and Poland in April. All of these countries are regular buyers of Russian oil. Polish refineries will import a record 560,000 tonnes of Arab Light crude via Gdansk in April, the data shows. Poland will not import any sea-borne Russia’s Urals crude, for the first time in a long period, while Arab Light oil supplies to Poland will be steady in May. Russian domestic oil prices for April delivery fell by more than 75 percent from a month ago to 5,272 roubles ($67.2) per tonne, or $9.2/barrel, at a Rosneft tender following the collapse on global oil markets. It was the lowest domestic price in Russia’s Volga River region since Reuters began tracking it in 2009. The prices are indicative for the domestic market and have not been approved yet by Rosneft, which sets up the domestic tenders via a joint venture with China’s Sinopec, Udmurtneft.

The US said it could slap “very substantial tariffs” on oil imports if prices stay low, but does not expect it will need to, since neither Russia nor Saudi Arabia, which are locked in an oil price war, would benefit from continued low prices. US had previously said that it expects the two countries to arrive at a deal to cut output by as much as 15 mn bpd. Neither country has confirmed his comments, but the US expects that tariffs can be avoided. The US in recent years has become the world’s biggest oil producer, at times putting its exports in competition with Russia and members of the OPEC. As oil prices drop, many heavily leveraged US energy companies face bankruptcies and workers are at risk of layoffs. The American Petroleum Institute and other energy interests have told the US government they oppose tariffs, fearing the measures would add costs to importing crude and materials for refineries.

The US would help Mexico contribute to global oil output reductions, in a surprise move that could break an impasse among the world’s major oil producers over cutbacks aimed at stabilizing crude prices. The US reductions will amount to 250,000 bpd. The cuts would depend on the approval of other oil-producing nations. Oil prices have cratered under the pressure of a price war and the devastating economic impact of the coronavirus global pandemic. US had previously warned Saudi Arabia that it could face sanctions and tariffs if it did not reduce production enough to help the US oil industry. US said it had not made assurances to Saudi Arabia that the US would not bail out US oil producers. Mexico was pressed to make cuts of 400,000 bpd, or 23 percent of current output, before the group lowered the target to 350,000 bpd. US offered to help before Mexico announced it would cut output by only 100,000 bpd.

The coronavirus pandemic and resulting plunge in crude prices will result in a leaner, stronger oil industry but raise the risk of shortages further down the line according to Goldman Sachs. Crude prices suffered another sharp fall as the pandemic worsened and the Saudi Arabia-Russia price war showed no signs of abating. This would in turn cause an oil shortage, pushing prices above the Wall Street bank’s $55/barrel target for 2021. This will likely be a game changer for the industry according to the bank.

USA

Crude oil futures fell, with US futures touching levels not seen since 1999, extending weakness on the back of sliding demand and concerns that US storage facilities will soon fill to the brim amid the coronavirus pandemic. The oil market has been under pressure due to a spate of reports on weak fuel consumption and grim forecasts from the OPEC and the IEA. The volume of oil held in US storage, especially at Cushing, Oklahoma, the delivery point for the US West Texas Intermediate contract, is rising as refiners throttle back activity due to slumping demand. Production cuts from OPEC and its allies such as Russia will also kick from May. The group has agreed to reduce output by 9.7 mn bpd to stem a growing supply glut after stay-at-home orders and business furloughs to curb the Covid-19 pandemic.

As a standoff over oil shipments emerged between Texas pipeline operators and shale producers, a state energy regulator has renewed a controversial call for mandated cuts to address a growing crude glut. Oil prices have fallen more than 60 percent this year as the coronavirus pandemic has destroyed fuel demand and Saudi Arabia and Russia kicked off a price war in a battle for market share. Oil in Midland, Texas, home of the biggest US shale field, traded for under $10/barrel, far below the cost of production. In the latest sign of a growing oil glut in the state, crude oil purchasers across Texas have warned producers that storage will be limited in May and output must be cut. A US court ruled against the US Army Corps of Engineers’ use of a permit that allows new energy pipelines to cross water bodies, in the latest setback to TC Energy Corp’s plans to build the Keystone XL oil pipeline. Keystone XL, which would carry 830,000 bpd of crude from Alberta to the US Midwest, has been delayed for more than a decade by opposition from landowners, environmental groups and tribes, but construction was finally supposed to start this spring. Alberta in March said it would invest $1.1 bn in Keystone XL and back TC Energy’s $4.2 bn credit facility to get the project built.

US shale oil output is expected to drop by 194,000 bpd in April, most on record, to about 8.7 mn bpd, according to the US EIA as producers slash drilling activity after oil prices plunged. Shale production has been sliding for several months, but the declines are expected to accelerate as demand has fallen by roughly 30 percent worldwide due to the coronavirus pandemic. Numerous producers, including US majors Exxon Mobil Corp and Chevron Corp, have announced plans to rein in spending and are forecasting reduced output in coming months. April’s decline is forecast to be followed by fall in May by 183,000 bpd to 8.53 mn bpd, which would be the lowest since June 2019, and a sixth straight month of declines, according to the EIA. Crude oil prices dropped by more than 65 percent in the first quarter as demand plummeted due to the coronavirus pandemic and supply ballooned due to a price war between Saudi Arabia and Russia. Output at every shale formation is expected to fall in May, with the biggest drop forecast in the Permian, the biggest US basin according to the EIA.

Major Oil Producers

Saudi Aramco has allocated around 4 mn bpd of crude oil to its Asian customers, which is lower than its full contractual volumes to Asia by about 2 mn bpd. Aramco said that it would supply its customers inside the kingdom and abroad with around 8.5 mn bpd of crude, in line with a supply cut pact agreed by OPEC and other leading oil producers. Saudi Aramco, the world’s largest oil producer, is weighing the sale of a stake in its pipeline unit to raise money amid a slump in crude prices. Aramco may need to raise cash this year as it confronts a historic rout in oil prices and a burgeoning list of spending obligations. Aramco is ramping up oil supply at a time demand is falling off a cliff as travel restrictions are placed on people all around the world to stop the spread of coronavirus. The emirate of Abu Dhabi said it had sold $7 bn of bonds in the third major sale this month by Gulf sovereigns seeking to counter slumping oil prices. The richest of seven sheikhdoms that make up the United Arab Emirates, Abu Dhabi sits on the bulk of the federation’s oil wealth. The six GCC member states, which also include Bahrain and Oman, depend heavily on oil income for between 65 percent and 90 percent of public revenues. Iraq has sent a proposal to all international oil companies asking them to reduce the budgets of developing oilfields by 30 percent as the slump in oil prices has hit government revenues, but said the proposed cuts should not affect crude output. International firms operate in Iraq’s southern oilfields under service contracts. Under the contracts, they are paid a fixed dollar fee for volumes produced and Baghdad repays companies for the cost of building projects and approve oilfields development plans. Energy companies around the world are slashing spending after the benchmark Brent oil price more than halved since the start of the year, to trade around $26/barrel. Iraq, OPEC’s second-biggest oil producer, pumps around 4.6 mn bpd. Iraq’s oil ministry said there had been discussions with the oil companies on cost cuts but a decision on that should be taken when there is more clarity on the impact of the coronavirus crisis on the oil market. Meanwhile, ExxonMobil, which is the main developer of the West Qurna 1 oilfield in southern Iraq, has also asked all its suppliers in Iraq to reduce costs, according to a letter seen by Reuters. Exxon Mobil Corp has said it was notifying contractors and vendors of planned near-term cuts in capital and operating expenses due to the coronavirus pandemic. Other Arab oil producers are also reviewing their spending plans. Kuwait Petroleum Corp has instructed all subsidiaries to cut spending this year due to an “unprecedented” decline in oil prices caused by the collapse of a global oil supply cut pact and the spread of the coronavirus which has hit demand. Abu Dhabi National Oil Company has also notified contractors and suppliers that it will review existing deals to find ways to cut costs. Saudi Aramco, the world’s top oil producing planned to cut capital spending for 2020 to between $25 bn and $30 bn, from $32.8 bn in 2019.

Egypt’s 2020-21 draft budget is based on an oil price of $61/barrel down from $68 in the current budget which ends on June 30 but around three times higher than the present price. Oil prices fell sharply, with US crude briefly dropping below $20 and Brent hitting its lowest in 18 years, on heightened fears that the global coronavirus shutdown could last months and demand for fuel could decline further.

Sanctions

Gasoline shortages in Venezuela are worsening after US officials have told foreign firms to refrain from supplying the fuel to the sanctioned South American nation and only provide diesel. Since late 2019, US officials have asked most of Venezuela’s fuel suppliers to avoid sending gasoline to the crisis-stricken nation. In the latest round of calls in early March between US officials and oil firms, they repeated the ban, despite worsening humanitarian conditions in the country. The US Treasury Department sanctioned Venezuela’s PDVSA over a year ago as a measure to oust its President. The restriction on crude oil-for-gasoline swaps with Venezuela is being maintained as the country’s own once-formidable refining industry collapses, with almost no gasoline produced in recent months, leading to chronic shortages across the country. Both Repsol and Eni send PDVSA diesel, not gasoline, as part of their swaps. In March, Eni delivered two diesel cargoes, while Repsol sent one and Rosneft did not send any. Fuel shortages began well before the sanctions because of plunging refining in Venezuela, which has a total capacity of 1.3 mn bpd of crude processing. Of that, PDVSA only refined 101,000 bpd of crude in March, according to an internal PDVSA document, increasing the crisis-stricken nation’s dependence on imports. Venezuelan state oil company PDVSA is trying to repair the catalytic cracker at its 146,000 bpd El Palito refinery in an effort to restart gasoline production at the facility after years of inactivity. US sanctions on PDVSA have made it more difficult for Venezuela to import fuel, resulting in widespread gasoline shortages. The OPEC country’s refineries, which can process up to 1.3 mn bpd, are producing at a small fraction of capacity due to years of lack of maintenance. A plunge in global oil prices as a result of falling demand due to the coronavirus pandemic, as well as a price war between producers Russia and Saudi Arabia, has also left cash-strapped Venezuela with even fewer funds to import goods like fuel.

China

China began trading LPG options on the Dalian Commodity Exchange, only a day after the debut of an LPG futures contract, as the bourse experiments with simultaneous launches. The LPG futures contract for November delivery fell 9 percent, its first day of trade, but rallied 7 percent to settle at 2,513 yuan per tonne. During the session, it hit its trading limit as the global oil price staged a recovery from a deep sell-off triggered by the impact of the coronavirus crisis on demand. The derivatives for LPG, a refined oil product used as a fuel in vehicles and for cooking, are the third type of oil and gas product to be listed in China.

S America

Ecuadorean authorities were scrambling to limit the environmental impact of a crude oil spill in the country’s Amazon region, where pipeline bursts prompted by a landslide caused crude to enter the Coca River. The energy ministry had placed barriers around the spill in an area home to several indigenous communities and near the source of drinking water for the city of El Coca, with some 45,000 residents. Ecuador produces some 530,000 bpd of crude, the cash-strapped country’s main source of export revenue. According to the government the incident will not affect crude exports or domestic fuel supply.

Europe

Western Europe’s largest oil and gas producer Norway said it would consider cutting its oil production if a global deal to curb supply is agreed by the world’s biggest producers. OPEC and its allies are working on a deal for an oil output cut equivalent to about 10 percent of world supply in what member states expect will be an unprecedented global effort including the US.

Norway is in a dialogue with other oil producing countries regarding production cuts. Norway, which meets about 2 percent of global oil demand, is not a member of OPEC. It has cut its oil output several times before, including in 1990, 1998 and in 2002, always in tandem with other producers when prices fell. During the first half of 2002, Norway cut its output by around 150,000 bpd after oil prices fell to below $20 a barrel following attacks in the US on 11 September 2001. Norway’s crude oil production stood at 1.75 mn bpd in February, up 26 percent from a year ago thanks to the ramp-up of state-controlled Equinor’s giant Johan Sverdrup oilfield. Norway’s Supreme Court will hear a lawsuit opposing the country’s Arctic oil exploration brought by Greenpeace and other environmental groups, it said, in a landmark case for Western Europe’s largest oil and gas producer. The environmental groups argue that the Norwegian government’s decision to grant oil exploration licences in 2016 in the Arctic Barents Sea to oil firms, including Equinor, was illegal. Oil companies have already drilled exploration wells in some licences awarded in 2016, but have not made any significant discoveries.

| PPAC: Petroleum Planning and Analysis Cell, LPG: liquefied petroleum gas, mn: million, bn: billion, mtpa: million tonnes per annum, ATF: aviation turbine fuel, ONGC: Oil and Natural Gas Corp, mmBtu: million metric British thermal units, CIHL: Cairn India Holdings Ltd, FY: Financial Year, boepd: barrels of oil equivalent per day, tmt: thousand metric tonne, BPCL: Bharat Petroleum Corp Ltd, PMUY: Pradhan Mantri Ujjwala Yojana, kg: kilogram, OMCs: Oil Marketing Companies, IOC: Indian Oil Corp, HPCL: Hindustan Petroleum Corp Ltd, MRPL: Mangalore Refinery and Petrochemicals Ltd, ISPRL: Indian Strategic Petroleum Reserves Ltd, UAE: United Arab Emirates, mt: million tonnes, ppm: parts per million, OPEC: Organization of the Petroleum Exporting Countries, US: United States, bpd: barrels per day, IEA: International Energy Agency, EIA: Energy Information Administration, PDVSA: Petróleos de Venezuela |

NATIONAL: OIL

Cairn supporting India’s energy security along with stringent measures to combat Covid-19

28 April. Cairn Oil & Gas said it continues to produce oil and gas for the country’s energy security needs despite the twin challenges of global oil prices tanking along with Covid-19 pandemic and ensuing lockdown. India’s largest private oil and gas exploration and production company has maintained production at 160 thousand barrels of oil equivalent per day (kboepd), marginally down from 180 kboepd it was producing before the pandemic in the face of reduced offtake from customers owing to falling demand. The company has contributed ₹50 mn to the Rajasthan Chief Minister’s Covid-19 Mitigation Fund in addition to ₹50 mn contributed by Vedanta’s Udaipur-based Hindustan Zinc. Both the Rajasthan-based Vedanta companies have undertaken extensive and expansive measures to ramp up community outreach spends already worth ₹80 mn. In its operations of 20 years, Cairn has opened four frontier basins with numerous discoveries, 38 in Rajasthan alone.

Source: The Economic Times

Government distributes 11 lakh free LPG cylinders to Ujjwala beneficiaries in Maharashtra

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">LPG cylinders to Ujjwala beneficiaries will ease pain of lockdown!

< style="color: #ffffff">Good! |

26 April. Indian Oil Corp (IOC) along with other Oil Marketing Companies (OMCs) have distributed more than 11 lakh free LPG (liquefied petroleum gas) cylinders under the Ujjwala (PMUY) beneficiaries under the Pradhan Mantri Garib Kalyan Yojana in Maharashtra, the government said. While the nation is under lockdown to fight the Covid-19 crisis, a scheme to provide relief to PMUY (Pradhan Mantri Ujjwala Yojana) beneficiaries has been implemented under the Pradhan Mantri Garib Kalyan Yojana in association with IOC and other Oil Marketing Companies (OMCs), the government said. In the state, for the month of April, booking of 13 lakh refills have been done by PMUY beneficiaries till date, out of which about 11 Lakh cylinders have been delivered.

Source: The Statesman

Refiners stare at ₹250 bn inventory loss as oil prices slump: Crisil

23 April. Indian oil refiners may have incurred an inventory loss of ₹250 bn in the January-March period as oil prices slumped and are now likely seeing a plunge in refining margins in the current quarter, Crisil Ratings said. Crude prices nosedived from an average $55 per barrel in February to $33 in March and around $20 at the end of March as demand slumped because of the coronavirus (Covid-19) pandemic. The mayhem in the oil market meant that by the time crude oil is processed and converted into fuel, the rates have fallen, resulting in inventory losses. India has a total refining capacity of 250 mn metric tonnes per annum and refiners keep an inventory of 20-50 days of crude on average to avoid disruption in operations. The rapid fall in crude oil prices would mean an inventory loss of $10-20 per barrel.

Source: Business Standard

Assam government hikes prices of petrol, diesel by ₹5 per litre

23 April. Assam increased petrol and diesel prices by ₹5 per litre each to make up for an anticipated loss of about 50 percent in its crude oil royalty from oil producing companies if prices in the international market drastically fall due to the Covid-19 crisis. Assam, which is an oil-producing state, earns about ₹1.66 bn a month on an average as crude oil royalty from oil producing companies like Oil India Ltd and ONGC (Oil and Natural Gas Corp).

Source: The Times of India

RIL’s Jamnagar refinery cuts crude processing by 24 percent as demand slumps

23 April. Reliance Industries Ltd (RIL) has slashed crude oil processing at its exports-only refinery at Jamnagar in Gujarat in March by close to one-fourth as coronavirus induces a slump in fuel consumption. RIL’s 35.2 million tonnes (mt) a year SEZ refinery processed 2.51 mt of crude oil into fuel in March, a drop of 24 percent year-on-year, according to the oil ministry data. However, the company’s older refinery at the same site processed 5.7 percent more crude at 3.01 mt. Refineries started to cut down on crude processing only in the latter half of March after travel restrictions first imposed by states followed by a nationwide lockdown beginning 25 March evaporated fuel demand. Fuel demand in nations where Indian refiners exported products like diesel and petrol has also stalled following the outbreak of the pandemic. Public sector refineries in India processed almost 4 percent less fuel in March. Private sector Nayara Energy’s Vadinar refinery in Gujarat too cut crude processing by a similar proportion. The data showed that RIL’s SEZ refinery operated at 83.98 percent capacity in March, as compared to 110.51 percent capacity utilisation in the same month a year back. Its old refinery, that caters predominately to the domestic market, operated at 101.67 percent of its 33 mt a year capacity. RIL’s twin refineries at Jamnagar produced 4.16 percent more petroleum products in March at 7.3 mt. Nayara Energy produced 3.33 percent fewer petroleum products at 1.64 mt while PSU (Public Sector Undertaking) refineries produced almost 2 percent less product at 11.95 mt. Overall, Indian refineries processed 5.7 percent less crude oil at 21.2 mt in March and produced 22.9 mt of petroleum products.

Source: Business Standard

Indian refiners export diesel to China as Beijing recovers from Covid-19

23 April. Indian refiners have started exporting commodities like diesel, a large share of which is going to China, where economy is on a recovery path. This comes as fuel sales have dropped by more than half and product storage facilities are getting exhausted. The demand for diesel for the first half of April dropped 61 percent compared to the same time last year in India. On the other hand, China is seeing a demand recovery in infrastructure and manufacturing sectors. Apart from China, countries, like South Korea and Japan, have also placed quotes for importing petroleum products from India amid lockdown. Industry experts indicate that such exports are likely to be from coastal refineries at Visakhapatnam, Paradip, Kochi and Mumbai. According to a report by ICICI Securities, companies like Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL) have cut throughput at their refineries by 10-40 percent. On the other hand, the demand of diesel and petrol in India is only 40 percent of what it was prior to the lockdown period. During the month of April last year, 7.323 million tonnes (mt) was sold. Industry experts indicate the situation of lower demand is likely to continue for at least six more months.

Source: Business Standard

Meghalaya government increases taxes on petrol, diesel

22 April. The Meghalaya government has increased taxes on petrol and diesel amid the nationwide lockdown and plunging crude oil prices. A litre of petrol now costs ₹74.9 while price of diesel becomes ₹67.5. 2 percent sales tax surcharge will also be levied on both petrol and diesel. The price hike of the fuel triggered outrage from the opposition party Congress which said people will face hardship due to the move. The state government should rollback the tax hike.

Source: Business Standard

ONGC asks government to waive cess, royalty as plummeting oil prices not enough to cover operating cost

22 April. ONGC (Oil and Natural Gas Corp) has asked the government to waive payment of oil cess and royalty as plummeting international oil prices have meant that the rate it now gets does not even cover the operating cost. While the slump in international oil prices to more than two-decade low is good news for fuel consumers, it is spelling economic havoc on oil and gas producers. ONGC management has told the government its average price realization of $22 per barrel in April is not enough to cover even the operating cost. On top of it, the drop in natural gas prices to a decade low of $2.39 per mn metric British thermal unit is leading to a loss of about ₹60 bn annually. ONGC has asked the government to abolish oil development cess if price realized by producers is less than $45 per barrel. It also wants royalty that the central government charges on oil and gas produced from the offshore area to be waived. The central government charges 10-12.5 percent royalty on oil produced from offshore areas. The company wants the royalty charged by the central government to be waived for now. Cutting the cess rate will make over 200 mn barrel of oil equivalent of production viable at the entire industry level.

Source: The Financial Express

NATIONAL: GAS

India’s natural gas production falls 14 percent in March as demand dries up, 2019-2020 production lowest in 18 years

23 April. The ongoing Covid-19 pandemic has dented the demand of petroleum products in India and also reduced the demand for natural gas, forcing Exploration and Production (E&P) companies to scale down production in March 2020, the petroleum ministry data showed. India’s production of natural gas in March declined 14 percent to 2,411 mn metric standard cubic meter (mmscm), as compared to the corresponding month a year ago. According to a report by the oil ministry natural gas production by Indian E&P players had been impacted in March on account of decreased production in response to less off take by gas power plants, fertilizer plants, industrial customers as well as operational issues faced by E&P companies. The country’s natural gas production during 2019-2020 declined 5 percent to 31,180 mmscm, the lowest recorded output in at least 18 years. The record low production of natural gas comes at a time the country’s crude oil production is also at a multi-year low. Production by Oil and Natural Gas Corp (ONGC), the country’s largest E&P company, in March declined 11 percent to 1,906 mmscm, as compared to the corresponding month a year ago. Also, cumulative production during financial year 2019-2020 declined 4 percent to 23,746 mmscm, as compared to the year ago period. Other reasons included less gas production from Vasistha wells, non-realization of gas production planned from WO-16 cluster and less than planned gas production from Bassein field, Daman Tapti Block and marginal fields. Oil India Ltd, the country’s second government-owned oil and producer, posted a 10 percent decline in gas production at 212 mmscm in March 2020, as compared to the corresponding month a year ago. Cumulative natural gas production during financial year 2019-2020 declined 2 percent to 2,668 mmscm, as compared to the year ago period. According to the ministry, lower production during the month was attributed to decline in production potential of gas wells consequent to shut-in during protest and bandhs, controlled production because of low market demand from the tea sector during lockdown due to Covid-19, shut-down of Brahmaputra Valley Fertilizer Corp, low off-take from Numaligarh Refinery besides other reasons. Natural gas production from fields operated by private players and joint ventures declined 34 percent to 294 mmscm in March 2020, as compared to the corresponding month a year ago. Oil Minister Dharmendra Pradhan had in December last year said the ministry expects natural gas production to increase significantly from the current levels but the domestic oil production is expected to plateau.

Source: The Economic Times

RIL-BP unlikely to commence KG Basin production in May

23 April. Gas production from Reliance Industries Ltd (RIL)-BP’s new fields in the KG (Krishna-Godavari) Basin may not begin in May, as was widely expected, because of the pandemic that has brought in lockdown and triggered an oil price collapse, which can reduce deep-sea gas price to less than $2 per unit. RIL said it was striving to complete its KG-D6 projects in time. In November, the joint venture of RIL and BP had auctioned its planned output of 5 mn metric standard cubic meter per day (mmscmd) of gas from R-cluster field in its KG-D6 block. Customers were told that supply would begin between 15 May and 10 November. By 1 April, the supplier was supposed to give buyers a 45-day window in which output would start. No such notice was given to customers, one of the buyers said.

Source: The Economic Times

NATIONAL: COAL

NLCIL launches coal mining operations in Odisha

28 April. NLC India Ltd (NLCIL) has commenced operations to mine coal at Talabira mines in Odisha. NLCIL has established a facility to mine 20 million tonnes (mt) of coal per annum. The coal mined in the region will be used to meet the requirement of the company’s existing and future coal-fired power plants. By launching the project during the difficult time of Covid-19 lockdown, our team has not only helped the company on its growth path but also contributed for the energy security of the country especially when avoiding import of coal is the topmost priority, NLCIL chairman cum managing director Rakesh Kumar said.

Source: The Times of India

CIL extends deadline for EoI submission for rationalisation of coal linkages

24 April. Amid nationwide coronavirus lockdown, Coal India Ltd (CIL) has extended the deadline for submission of Expression of Interest (EoI) from power generation companies (gencos) for rationalising coal linkages. The linkage rationalisation refers to transfer of coal supply source of a power plant from a far-end mine to the nearer one. Earlier, CIL had invited expression of interest from the desired state/central gencos proposing for rationalising their existing linkages. Earlier, the coal ministry had written to CIL stating that as per the methodology, linkage rationalisation for two independent power producers (IPPs) have been done by the PSU (Public Sector Undertaking) for a quantity of 2 million tonnes (mt). It had asked the PSU to commence the next round of linkage rationalisation and apprise the Centre about the final result of the linkage rationalisation by 30 June. Under coal linkage rationalisation, the fuel linkage of a thermal power plant of an independent power producer is transferred from one coal company to another based on the fuel availability and future coal production plan of the coal company. The linkage rationalisation is considered only for IPPs having linkages through allotment route. The IPPs which have obtained linkages through auction process are not eligible for rationalisation under this scheme. CIL which accounts for over 80 percent of the domestic coal producer is a major supplier of dry fuel to the power sector.

Source: Business Standard

CIL’s April average daily output down 11.3 percent year-on-year

23 April. Coal India Ltd (CIL)’s daily average production in April has halved from March and is down 11.3 percent versus April 2019. The world’s largest coal miner produced an average of 1.34 million tonnes (mt) during the first 22 days of April, down from 1.51 mt per day April 2019. It produced 2.72 mt per day on average in March. Coal Minister Pralhad Joshi said the state-run miner is targeting production of 710 mt, or 1.94 mt per day, during the year ending in March 2021. The company’s annual production fell in 2019/20 for the first time since 1998/99 as the heaviest rainfall in 25 years battered coal mining regions and a broad economic slowdown stifled demand. Lower demand due to a nationwide lockdown to prevent the spread of the coronavirus has created record high fuel stocks at utilities, CIL’s biggest clients, prompting many power plants to avoid buying more coal.

Source: The Economic Times

NATIONAL: POWER

Average spot power price remains low at ₹2.36 a unit during lockdown

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Low power prices signals demand decline and economic slowdown!

< style="color: #ffffff">Ugly! |

28 April. Average spot power price has remained as low as ₹2.36 per unit on the Indian Energy Exchange (IEX) during the lockdown period so far, which began last month to contain the spread of coronavirus. The IEX has witnessed heightened activity among power distribution companies (discoms) since the coronavirus-induced nationwide lockdown on 25 March, according to the IEX. With a decline in peak demand by almost 25 percent, the Exchange has witnessed high sell-side liquidity, almost at 2.7 times the demand side, which is helping keep the price in the market under check. The average price in the IEX day-ahead market has been as low as ₹2.36 per unit during the period from 24 March to 20 April. Power procurement by discoms from southern, western and northern states, such as Andhra Pradesh, Telangana, Tamil Nadu, Maharashtra, Gujarat, Uttar Pradesh, Bihar and Punjab, have continued and increased over the past several weeks, owing to ample power availability and attractive prices, IEX said. The average spot power prices in March and April last year stood at over ₹3 per unit. Earlier, the IEX announced its commitment to assuring round-the-clock access to its platform to facilitate uninterrupted power supply to the nation.

Source: The Economic Times

Power ministry extends deadline for feedback on draft Electricity Bill till 5 June

27 April. The power ministry extended the deadline for submission of stakeholders' comments on the draft Electricity Amendment Bill by four weeks till 5 June. The ministry had circulated the draft bill on 17 April 2020 with a deadline to submit comments in three weeks till 8 May. Earlier the All India Power Engineers' Federation (AIPEF) had shot off a letter to Power Minister R K Singh demanding that the proposed date of receipt of comments on the draft bill should be extended to 30 September as no discussion can take place due to the lockdown. The ministry has come out with fourth draft of the Electricity (Amendment) Bill since 2014, which seeks to set up an Electricity Contract Enforcement Authority (ECEA) having power of a civil court to settle disputes related to power purchase agreement between discoms (distribution companies) and gencos (generation companies). The draft provides that the ECEA will have sole authority to adjudicate matters related to specific performance of contracts related to purchase or sale of power, between power gencos and discoms. The decision of the ECEA can be challenged at the Appellate Tribunal for Electricity (APTEL) and, subsequently, at the Supreme Court. The AIPEF had strongly condemned the timings of the power ministry’s move to bring back the Electricity Amendment Bill 2020 when the whole country is fighting against the Covid-19 pandemic.

Source: Business Standard

CERC to fix provisional tariff hike

27 April. Central Electricity Regulatory Commission (CERC) will chart out a mechanism to determine provisional increase in electricity tariff from power plants that install emission control equipment, in some relief to power companies and lenders. However, lenders and power companies have said that most projects have not placed orders for the equipment and hence it was not possible for them to complete retrofitting these equipment by 2022. Some financial institutions have sought the government’s intervention in advancing the deadlines by two years. While state-run power generating companies and PSUs (Public Sector Undertakings) including NTPC Ltd have placed orders for the equipment, private companies are yet to catch up. Private companies have said lenders were not comfortable in lending to the stressed power sector without clarity on tariff hike.

Source: The Economic Times

Jaipur Vidyut Vitran Nigam to borrow ₹5 bn to pay to power companies

27 April. The Jaipur Vidyut Vitran Nigam Ltd is gearing up to borrow ₹5 bn from banks to purchase electricity from private companies. As the department recovered only ₹7.99 bn against a total amount of ₹14.21 bn from collection of bills, a situation of crisis situation prevailed. The decision was taken after receiving no relaxation from the Central Electricity Regulatory Commission (CERC) in this regard. The borrowed amount will be used by the department to clear the dues of private companies, so that there is no disruption in power supply. To ensure timely payments to electricity generation utilities, the Centre had made it mandatory for state distribution companies (discoms) to offer letters of credit as part of the payment security mechanisms in power purchase agreements starting 1 August. Till 30 June 2020, the payment security mechanism to be maintained by discoms with the generating companies for dispatch of power shall be reduced by 50 percent.

Source: The Times of India

Providing uninterrupted power supply amid lockdown: NTPC

25 April. NTPC Ltd said it is providing uninterrupted electric supply despite the current lockdown. NTPC has 70 power stations - 24 Coal, 7 combined cycle gas/liquid fuel, 1 hydro, 13 renewables along with 25 joint venture power stations, having total installed capacity of 62,110 MW, the company said. NTPC is also efficiently managing the coal supplies for continuous supply of electricity, the company said.

Source: Livemint

Peak power demand dips to 70 percent in Chandigarh

25 April. With industrial units and shops coming to a standstill due to the coronavirus lockdown, the power demand has dipped all time low in the city during the curfew period. According to the official figures, the power demand, which used to range between 300 and 400 MW during summers, has dipped to maximum 135 MW in April till date. In the last financial year, the peak power demand was 421 MW. Currently, the UT (Union Territory) administration has not allowed operation of industries as the city falls under the hotspot district. Similarly, shops are also closed, which has resulted in dip in the demand of power supply. According to the estimates, the peak power demand during the summers was expected to touch 448 MW in the financial year 2021-22. But as shops and industries are closed, therefore there is not much demand for electricity.

Source: The Times of India

Delhi’s peak power demand reduces by up to 49 percent during lockdown

24 April. Delhi’s peak power demand has reduced by up to 49 percent with commercial and industrial activities virtually at a standstill due to the lockdown imposed to contain the spread of coronavirus, discom (distribution company) and power department said. The peak power demand during the day has reduced by 40-50 percent, while the peak electricity demand during the night has reduced by around 20-30 percent. The higher reduction in the day’s power demand is due to the closure of commercial and industrial establishments in the lockdown which has led to around 70-90 percent reduction of electricity demand in this segment. Since the Janta Curfew on 22 March which was followed by the nationwide lockdown, the city’s peak power demand has reduced by up to 49 percent in comparison with the peak electricity demand last year. The power demand situation is expected to remain the same till the lockdown is in force. Delhi’s peak power demand in March considerably declined, even before the lockdown was announced. On 15 March, the national capital’s peak power demand was 3421 MW that sharply reduced by around 33 percent on 22 March to 2294 MW. The city’s electricity demand was 4016 MW in March last year, while this year, it was 3775 MW. Since the lockdown, Delhi’s highest peak power demand has been 2486 MW on 25 March 2020, they said. Delhi’s peak electricity demand in April last year was 5664 MW, while the peak demand till April 22 this year was 3169 MW — reduced by 44 percent. With the lockdown expected to be eased out in a phased manner from 3 May, the demand is expected to pick up (as per projections) in June and July. For May, the demand is expected to be reduced by about 15 percent from the projected values if the lockdown is lifted. But if the lockdown gets extended, the average reduction in demand is expected to be around 43-45 percent in comparison to last year’s peak electricity demand during the month.

Source: The Financial Express

Low demand keeps 26 power units shut in Gujarat

24 April. The decline in power demand resulting from reduced electricity consumption by industrial and commercial establishments has led to temporary shutting down of 26 power generating units in Gujarat, including both state-run and private company operated entities. A single power station has multiple units with different power generation capacity. As many as 16 units of Gujarat government-owned Wanakbori, Ukai, Gandhinagar and Sikka coal-fired power stations as well as Dhuvaran gas-based power plant are currently closed. One more unit of Bhavnagar Lignite Thermal Power Station is non-operational due to lignite feeding problem, shows data available with the state load dispatch centre. Two units each at power stations located at Sikka near Jamnagar and Ukai in Tapi districts are also closed.

Source: The Times of India

Punjab CM writes to PM for fiscal package for power sector

23 April. Punjab Chief Minister (CM) Captain Amarinder Singh asked Prime Minister (PM) Narendra Modi for a financial package for the Power sector, while suggesting a slew of measures to rescue PSPCL (Punjab State Power Corp Ltd) and other from the current crisis and ensure that the consumers are not harassed or hassled in these difficult times. Power Finance Corp, Rural Electrification Corp Ltd and other Financial Institutions should provide loans to Power sector at reduced rates 6 percent per annum for bridging Revenue Gap, suggested Captain Amarinder. Asserting that his Government was committed to providing uninterrupted 24x7 power supply to the people of Punjab, especially to all Healthcare Institutions, Captain Amarinder said the entire workforce of the power sector is currently mobilised round the clock. However, due to the restrictions imposed to control the spread of the Covid-19 pandemic, the communities, business and consumers are facing economic hardship and unable to pay their dues to the State Discom Punjab State Power Corp Ltd.

Source: The Economic Times

Power tariff remains unchanged in Odisha

23 April. The Odisha Electricity Regulatory Commission (OERC) announced that power tariff will remain unchanged in Odisha for the financial year 2020-21. The commission issued this order by rejecting the request of power distribution companies like CESU, Southco, Nesco and Wesco to hike power tariff in the state. The hearing on the tariff hike was conducted by the OERC in the capital city between 3 and 14 February. Now the tariff is set at ₹2.50 per unit for the first 50 units, ₹4.30 per unit for consumption above 50 units upto 200 units. If the consumers use electricity between 200 and 400 units, they have to pay ₹5.30 per unit. If they consume more than 400 units, they will pay ₹5.70 per unit. The OERC had last hiked power tariff by 10 paisa per unit for ten financial year 2017-18. In view of the pandemic situation and slowdown in industry sector, Patnaik said, OERC has allowed to give concession for industries. Industrial consumers with extra high tension connection will get 10 paisa per unit connection if the industries use more than 80 per of the load factor within a month.

Source: The Economic Times

Power ministry asks states to allow construction activities in power plants, smooth functioning of transmission network

23 April. The power ministry has asked state authorities to ensure no restrictions are imposed on construction activities in power plants and on smooth operation and functioning of interstate and intra-state transmission network in the country. The ministry wrote a letter to state power officials, police, district magistrates and urban local bodies. It comes in the wake of the extension of nationwide lockdown till 3 May due to the coronavirus outbreak. As per an order from the Ministry of Home Affairs, select activities have been allowed with effect from 20 April 2020 during the nation-wide lockdown.

Source: The Economic Times

Sterlite Power commissions 765 kV Khandwa substation in Madhya Pradesh

23 April. Sterlite Power announced commissioning of the 765 kilovolt (kV) Khandwa substation in Madhya Pradesh. This will help in stepping down high-voltage 1,320 MW power from the Khargone Power Plant to further distribute it downstream to 50 mn households across the states of Madhya Pradesh, Maharashtra and Gujarat. So far, Sterlite Power has commissioned 5 out of 6 elements in the project – 765 kV substation at Khandwa, 765 kV DC Khandwa-Indore transmission line, 400 kV DC Khandwa-Khargone transmission line, 400 kV line-in line-out, and Dhule Bay Extension.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

In post-Covid-19 times, renewable energy to face stiff competition from fossil fuels

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Low priced fossil fuels may slow down renewables!

< style="color: #ffffff">Bad! |

28 April. The lessons learnt by countries using significant amounts of renewable energy (RE) are important for India, which is set to announce a bailout package for the power sector shortly. Faced with the herculean task of restarting and reviving their economies, many major countries are going backwards on their promises to promote RE. Some energy-rich economies are even relaxing environmental restrictions. Coal mining and coal-power are getting renewed support in countries where it is a prominent source of energy or export revenue. In India, the renewable sector, including large hydro, accounted for 15.6 percent of the generation in January, which is a lean season for hydro. Solar, wind, small hydro, biomass ― officially referred as RE in India ― contributed 9.11 percent, up from 8.55 percent in the same period last year. Currently, the renewable purchase obligation (RPO) varies from state to state for distribution utilities.

Source: The Hindu Business L ine

MNRE urges Haryana to honour signed green contracts

27 April. The Ministry of New and Renewable Energy (MNRE) has urged Haryana to honour signed renewable energy contracts and provide them the connectivity they need to start transmitting power. In the past few months, Haryana has been reluctant to give connectivity to 1000 MW of ‘open access’ solar projects whose construction it had earlier okayed. As a result, these projects are being denied formal approval. The Distributed Solar Power Association said that they are likely to file a petition on the issue before the Haryana Electricity Regulatory Commission.

Source: The Economic Times

India missed utility-scale solar capacity addition target for FY20 by 24 percent

23 April. India added about 5.7 GW of new utility-scale solar capacity in the financial year 2019-20 (FY20), which is 24 percent less than the 7.5 GW target set for this year, JMK Research and Analytics in its report said. It said that in FY20, Rajasthan added a maximum capacity of 1.8 GW, followed by Tamil Nadu with 1.3 GW addition, and Karnataka with 1.1 GW addition.

Source: The Economic Times

PVUNL to resume construction of 4 GW thermal power plant

23 April. NTPC Ltd said it will resume construction of its upcoming 4,000 MW thermal power plant in Patratu. The construction of the plant, which is being built by NTPC and the Jharkhand government under the name Patratu Vidyut Utpadan Nigam Ltd (PVUNL), was stalled since 22 March to prevent the spread of Covid-19 among the construction staff. Around 80 percent of PVUNL’s current construction workforce hail from hamlets within 2 kilometre (km) radius of the plant site. The first phase, which will have three units of 800 MW each, is to be commissioned within two years. Ramgarh deputy commissioner Sandeep Singh said PVUNL could start its construction work with adherence to sanitation protocols and social distancing norms.

Source: The Times of India

SECI to take pre-bid queries online for 15 MW floating solar plant at SCCL

22 April. The Solar Energy Corp of India (SECI) asked all bidders for the 15 MW floating solar plant at the Singareni Collieries Company Ltd (SCCL) to send their pre-bid queries online, as a result of the extended nationwide lockdown due to the Covid-19 outbreak. It has requested for the online submission of queries by 24 April 2020. The pre-bid meeting was scheduled for 20 April 2020.

Source: The Economic Times

INTERNATIONAL: OIL

Virtually all Equatorial Guinea oil business on hold: Hydrocarbons Minister

27 April. Virtually all oil and gas projects and licensing rounds are on hold in Equatorial Guinea as it braces for an extended oil downturn because of the coronavirus pandemic, the country’s Hydrocarbons Minister Gabriel Obiang Lima said. Equatorial Guinea, a tiny west African nation that relies on oil and gas for 90 percent of state revenue, had already been grappling with falling output and the desire of certain oil majors, such as ExxonMobil, to exit the country. The Minister said the country would offer quick licence extensions and generous leeway on drilling requirements to keep companies afloat during the historic downturn that has sent oil prices to 20-year lows. The flexibility being offered by the government could help Equatorial Guinea’s oil and gas industry to remain attractive to international oil companies, the Minister said. The Minister said the government would also roll out new regulations that would require international oil companies to award more work to local firms.

Source: Reuters

Venezuela receives gasoline imports from shipping magnate amid fuel shortage

27 April. Venezuela has received a 150,000-barrel shipment of gasoline from a company owned by shipping magnate Wilmer Ruperti, as the OPEC (Organization of the Petroleum Exporting Countries) nation suffers from the worst fuel shortages in decades. The shipment from Ruperti’s company, Maroil Trading, arrived aboard the Aldan tanker to the port at central Venezuela’s El Palito oil refinery. The arrival of the gasoline will only partly alleviate a fuel crisis in Venezuela, whose 1.3 mn barrel per day (bpd) refining network has all but completely collapsed. US (United States) sanctions aimed at ousting socialist President Nicolas Maduro have also complicated gasoline imports. Despite the shipment, authorities were still dispatching just 30,000 bpd of gasoline to service stations across the country.

Source: Reuters

Pakistan resuming oil imports as demand picks up

26 April. Pakistan will allow the resumption of oil imports as it eases some coronavirus lockdown restrictions and as farmers start wheat harvesting, the energy ministry said. The ministry asked fuel retailers and refiners to cancel crude oil and oil product imports from April due to weak demand. Pakistan has announced the reopening of some industries in phases beginning with construction and allied industries while its lockdown is currently set to run until 9 May. Byco Petroleum Pakistan Ltd’s 155,000 barrel per day (bpd) refinery and National Refinery Ltd’s 64,000 bpd plant stopped operations.

Source: Reuters

Russia halves Western sea oil exports in May after OPEC+ deal

24 April. Russia plans to halve oil exports from its Baltic and Black Sea ports in May according to the first loading schedule for crude shipments since it agreed this month along with other major oil producers to cut output. Russian exports next month from its two Baltic ports and Novorossiisk in the Black Sea will total 1.3 mn barrels per day (bpd), down from 2.2 mn bpd in April. The Organization of the Petroleum Exporting Countries (OPEC)+ group led by Saudi Arabia within OPEC and Russia for non-OPEC states has agreed to cut oil production by 9.7 mn bpd from 1 May, with Moscow reducing its output to 8.5 mn bpd from a baseline of 11 mn. Russian oil companies are now preparing for their biggest output cuts ever, which could lead to some oilfields shutting down permanently.

Source: Reuters

Global oil supply to fall 6 percent by 2030 due to delayed projects

24 April. Global oil supplies may be 6 percent less than expected by 2030 because of delays to investments by energy companies in response to falling crude prices due to the coronavirus crisis, data from energy analysts at Rystad showed. Delayed final investment decisions (FID) for projects which take years to come on stream are already expected to shrink global supply of oil and gas by 5.6 percent by 2025, with the majority of the revisions coming from shale oil, mostly found in the United States, Rystad said. Continental Resources, the largest oil producer in North Dakota has halted most of its production in the US (United States) state and notified some customers it would not supply crude after prices dived into negative territory. All this leaves the global oil and gas supply on track to drop off by 6.3 percent by 2030 compared with what was expected before the price crash, the Rystad data showed.

Source: Reuters

China’s March gasoline exports rise as pandemic cuts domestic demand

23 April. China’s gasoline exports in March rose by 8.2 percent from a year earlier as refineries scrambled to increase sales to overseas markets amid tepid domestic demand from the disruptions of transport and industry caused by the coronavirus outbreak. Gasoline shipments were 1.82 million tonnes (mt), the General Administration of Customs data showed. That compares to 1.69 mt in March 2019. Exports were 2.72 mt in January and February combined. The export increase occurred even as Chinese state-backed refineries deepened their cuts to crude oil processing rates in March in response to the lukewarm demand, with gasoline output last month dwindling 21 percent from a year earlier and diesel production falling 9.4 percent. Diesel exports climbed to 2.83 mt in March, up from 2.71 mt in the same period last year. The exports were 3.47 mt combined for the first two months of the year. China’s jet kerosene exports in March plunged 15.3 percent from a year earlier to 1.48 mt, customs data showed. The exports were 2.93 mt combined for January and February.

Source: Reuters

Azerbaijan imposes oil cuts on BP-led fields

23 April. Azerbaijan’s BP-led Azeri-Chirag-Guneshli (ACG) project will have to cut output sharply from May for the first time ever as the country moves to meet its commitment under a global deal to cut production. Oil majors operating large production sharing deals in the ex-Soviet states of Azerbaijan and Kazakhstan have been previously excluded from any government-imposed production decisions because such foreign investment is highly-prized. But the scale of the coronavirus-driven oil crisis has made it impossible for Azerbaijan to cut output without imposing restrictions on BP and its partner shareholders, which include Hungary’s MOL, US (United States) ExxonMobil, Norway’s Equinor and Japan’s Inpex. Azerbaijan is not a member of the Organization of Petroleum Exporting Countries (OPEC) but is a part of a wider group known as OPEC+, which led by Saudi Arabia on the OPEC side and Russia for other producers outside the organisation.

Source: Reuters

Iran will fare better than others after oil price drop: President