-

CENTRES

Progammes & Centres

Location

The downstream regulator is planning to end marketing monopoly of Indraprastha Gas, Mahanagar Gas, Gail Gas, Gujarat Gas and more city gas distributors in at least 30 license areas by declaring their network as ‘common carrier', which would force them to reserve a part of their capacity for third party. In the next few months, the PNGRB will likely be ready with a regulatory framework for elimination of monopolies. Several CNG and piped cooking gas distributors have enjoyed exclusive marketing rights far longer than the usual 3-5 years that licenses permit. Introducing competition was necessary for market efficiency and increased consumer benefit. PNGRB is unlikely to terminate all eligible monopolies in one go. Once a network is declared a common carrier, the distributor will have to reserve a fifth of its capacity for third parties, including suppliers and customers, as per the draft. Existing CNG stations will continue to be exclusively operated by the licensee. But third-party entities can install new CNG stations, which will be permitted firm access by licensees. CNG stations shall receive natural gas only through the city gas network of the authorised entity. The license holder shall declare on its website its own requirement and the capacity allocated on a firm contract basis which may be verified by the PNGRB every month or at any other intervals the board desires, as per the draft. The PNGRB has proposed 44 new geographical areas for the upcoming 11th round of bidding for CGD. According to the new tentative list, the highest number of CGD areas will fall in Tamil Nadu (8), to be followed by Maharashtra (7) and Madhya Pradesh (6). At present, the CGD network covers 232 geographical areas spread over 407 districts in 27 states. Under the ninth and 10th rounds of bidding for CGD networks, the numbers of CNG stations and domestic PNG connections are expected to increase by 8,181 and 42 mn, respectively, in the next 8-10 years.

To facilitate better price discovery of domestically produced natural gas, the government plans to undertake further reforms to make natural gas pricing more transparent. The national gas grid will be expanded to 27,000 km from 16,200 km currently. Domestically produced natural gas currently is not determined by the demand-supply dynamics. The country currently uses a formula to price domestically produced natural gas, revised bi-annually. The country’s upstream players have on many occasions voiced concerns on the country’s natural gas pricing formula for domestically produced gas and argued that low prices for domestically produced gas is acting as a deterrent for monetisation of various gas fields. ONGC has claimed that low gas prices have resulted in the company bearing losses of more than ₹51 bn between financial year 2017-2019. In a bid to incentivise production of natural gas the government had in March 2016 offered pricing freedom for gas produced from deep water, ultra-deep water and high pressure-high temperature areas. The government has set a target to increase the share of natural gas in the country’s energy basket to 15 percent by 2030.

The Centre wants the states to limit the VAT rates on CNG and LNG at under 5 percent. The Centre has also pitched for lowering of road taxes for vehicles running on CNG/LNG by states to make these on par with the rates charged on electric vehicles. These proposals are part of the draft policy for CGD prepared by the MoPNG which, the government expects will become a template for every state to come up with their own CGD policies. Different states charge different VAT on CNG. For example, while Delhi completely exempts VAT on CNG, the same in Uttar Pradesh, Maharashtra and Gujarat is as high as 12.5 percent, 13.5 percent and 15 percent, respectively. It remains to be seen if the states agree to reduce the VAT on CNG as suggested by the MoPNG, and forego the income they earn from this source. According to experts, having a uniform tax rate for CNG will address the long-standing demand of including gas under the ambit of the GST.

The 438 km Kochi-Koottanad-Mangaluru RLNG pipeline that GAIL (India) Ltd is laying could be commissioned by March this year. Completion of this line will help GAIL commence RLNG supply to industries and other stakeholders. This comes after GAIL failed to meet the September 2018 deadline due to issues in laying the pipeline across the Chandragiri and Nethravathi rivers. GAIL had awarded the contract to lay the 111 km pipeline in north Kerala and Karnataka at an estimated cost of ₹1.6 bn in August 2017. Work on laying the pipeline across the Nethravathi to a length of 410 metres between Innoli and Arkula should be completed by 15 February. CGD in Mangaluru with CNG as auto fuel will take time as the contractor has to lay the distribution pipelines across the city. The pipeline is designed to transport 16 million cubic meters of RLNG.

According to MNGL, they will provide CNG for 200 city buses by March-end. According to MNGL, CNG stations will be operational at six locations in the city. These locations have been leased out by the NMC. MNGL’s promises came during a joint meeting of officials from MNGL and NMC. Initially, MNGL will transport LNG through tankers to the city and then convert it to CNG. LNG will be transported by roadways from the nearest import storage location (Dahej) and will be stored in containers in Nashik. The six locations identified for the proposed CNG stations include Adgaon, NMC’s fire brigade station in Panchavati, Truck Terminus at Chehedi, Pathardi, Tapovan and Sinnar Phata. MNGL has already signed a lease agreement with the NMC for first four sites while agreement for the remaining two sites — Tapovan and Sinnar Phata — will be signed. Once the feeder pipeline between Mahaskal-Titwala and Nashik is laid, the LNG station would be decommissioned since natural gas would be transported from the transmission pipelines through the feeder pipelines.

As of September 2019, there were 1,815 CNG stations and 5.42 million domestic connections across the country. Currently, about 76 percent of the CNG stations and 80-90 percent of the PNG connections are concentrated in Delhi, Gujarat and Maharashtra. The MoPNG has prepared a draft policy for CGD, which, the government expects, will become a template for every state to come up with their own CGD policies. CGD network operators are seen to benefit from a sustained weakness in global spot LNG prices and an expected decline in domestic gas prices. At present, the coverage of the CGD network s across 232 geographical areas spread over 407 districts in 27 states. Under the 9th & 10th rounds of bidding for CGD networks, the number of CNG stations and domestic PNG connections are expected to increase by 8,181 and 42 mn in next 8-10 years. According to Kotak Institutional Equities, CGD companies source around 15 percent of their domestic gas requirement from the PMT fields. After the expiry of Panna-Mukta-Tapti (PMT)’s production sharing contract in December 2019, gas from this field is seen to the levels of $3.6/mmBtu against its earlier contracted price of $5.7/mmBtu. Kotak expects domestic gas price to decline by around $1/mmBtu in the upcoming revision for the first half of FY21. Apart from GAIL Gas, Gujarat Gas, Indraprastha Gas, Mahanagar Gas, IOC, HPCL and private entities such as AGL and Torrent Gas have significant presence in the sector.

AGL will invest up to ₹90 bn in setting up city gas distribution network over the next 10 years to retail CNG to automobiles and piped cooking gas to households in those areas where it won licences in the recent bidding round. AGL on its own and in a joint venture with state-owned IOC has won city gas licence for 38 geographical areas spread over 71 districts in 15 states in recent bid rounds. As part of the government vision to raise the share of natural gas in the energy mix to 15 percent by 2030 from current 6.2 percent, the oil regulator PNGRB has in last couple of years conducted two licensing rounds that have expanded the coverage of city gas network to over 400 districts covering 70 percent of the population of the country. Entities winning city gas licences have committed to supply piped natural gas to about 50 mn homes and set up 10,000 CNG dispensing stations. While a push is being made towards a gas-based economy with open access and gas exchange being planned, key issues such as the inclusion of natural gas in the GST regime and ban on polluting fuels remain critical. At the end of September 2019, AGL had six city gas projects operational with 86 CNG stations and 0.41 mn residential customers. It supplied 1.55 mmscmd of gas through these. The company plans to scale up the CNG outlets to 1,550 by 2027 and connect 6 mn households with piped natural gas.

ONGC plans to invest ₹32 bn to drill around 115 wells across eight oil and gas fields in Tripura. In an application to the environment ministry the proposed 115 development drilling locations of ONGC are expected to lead to further development of Agartala Dome, Baramura, Kunjaban, Konaban, Manikyanagar, Sundalbari and Sonamura Fields in Sipahijala, West Tripura, North Tripura and Gomati districts of Tripura state. This can help meet the consumer demand in the future and thereby fulfil the energy requirement of the North-Eastern states. While gas was discovered in Tripura in the 1970s and commercially viable gas reserves were found in more than 11 structures over time, poor infrastructure and absence of adequate industrial development in the region did not allow full utilisation of gas reserves in the region. The company expects Tripura asset to produce around 5 mmscmd of natural gas and condensate of around 8 tonne per day for the next 15 years. ONGC plans to transport the gas produced from Tripura asset to different Group Gathering Station of respective fields. The company’s Tripura asset has five Gas Collecting Stations – Agartala Dome, Baramura, Konaban, Rokhia & Sonamura for processing well fluids coming from seven developed field. ONGC accounts for 75 percent of the country’s natural gas production. It had witnessed a 9 percent decline in its natural gas production at 1,998 mmscm in December 2019. In the first nine months of the current financial year, the company’s natural gas production declined 2.70 percent to 17,918 mmscm. ONGC’s gas production from Tripura increased 2.62 percent to 1,174 mmscm during the April-December period of 2019. The company had earlier voiced concerns on the country’s natural gas pricing formula for domestically produced gas saying that low prices are acting as a deterrent for monetisation of various gas fields RIL and BP Plc have claimed their joint venture completed the safe cessation of production in a planned manner from the D1 D3 field in block KG-D6 off the east coast of India. The D1 D3 field was India’s first deep-water gas field to be put on production in April 2009. Through innovation and application of first-of-their-kind solutions, the field’s life was extended for almost five years, to February 2020, maximising the recovery from the field. The KG D6 block has so far produced an overall 3 TCFe resulting in energy import savings of over $30 bn. These fields also established several global benchmarks in terms of operational performance including 99.9 percent uptime and 100 percent incident-free operations. The JV has committed an additional $5 bn (₹350 bn) of investments towards monetising about 3 TCFe (about 500 mn barrels of oil equivalent) reserves from three projects -- R cluster, satellite cluster and MJ fields. These projects will utilise the existing gas production infrastructure. Further, this infrastructure can act as a hub for the development of any discovery from contiguous areas. The first-gas from these fields is expected in mid-2020. The peak production from these three fields is expected to reach 1 BCFe per day which is about 15 percent of the then envisaged India's demand.

India’s top gas importer Petronet LNG and US LNG developer Tellurian Inc are preparing to sign a $2.5 bn deal. India and the US have built close political and security ties and want to strengthen trade links, with Trump aiming to boost energy supplies to India, the world’s third biggest oil importer. Petronet will invest the money over a five-year period in Tellurian’s proposed $27.5 bn Driftwood LNG export project in Louisiana and the deal will give Petronet an equity stake in the project and rights for up to 5 mtpa of LNG. The delivered price of gas to India would be below $6/mmBtu. This will work out to about 30 percent cheaper than the country’s current long-term deals with Qatar. The two companies signed a preliminary non-binding deal in September 2019. India wants to raise the share of gas in its energy mix to 15 percent by 2030 from the current 6.2 percent as it battles high levels of pollution in many big cities, including the capital New Delhi. India pressed its largest LNG supplier Qatar to lower price of gas supplied under long-term contract to reflect falling rates of the spot or current market. Qatar supplies 8.5 mt of LNG annually to India at a price linked Brent crude oil. Landed price comes to $9-10/mmBtu while the same gas is available in spot market at half the rate. India has in the past used its status as Asia’s third-largest LNG buyer to renegotiate deals with Qatar, Australia, and Russia. In 2015, it renegotiated the price of the long-term deal to import 7.5 mt per year of LNG from Qatar, helping in saving ₹80 bn. In 2017, it got ExxonMobil Corp to lower the price of Gorgon LNG and a year later convinced Gazprom to lower rates also. India’s Essar Steel is seeking 36 LNG cargoes for delivery over 2021 to 2023. This is likely a reissue of an earlier tender by the company in November last year for the same volumes and delivery period.

According to MoPNG India is likely to witness investments to the tune of a whopping $60 bn in the natural sector as part of efforts to transform the country into a gas-based economy using natural gas a transition fuel. The government is actively encouraging use of LNG among others, for long-haul trucking along expressways, industrial corridors and inside mining areas, marine applications, apart from making natural gas easily available at doorsteps for users through mobile dispensing. The government is said to be trying to “Reform, Perform and Transform” the sector through policy and market reforms in key areas including exploration and production, refining, marketing, natural gas and global cooperation.

Qatar has delayed choosing Western partners for the world’s largest LNG project by several months after surprising the industry with a big expansion plan despite a collapse in global gas prices. The reported delay comes as the global gas industry faces the major challenge of a supply glut due to booming US production and a drop in Chinese demand. Qatar, the lowest cost producer of LNG, sits on the world’s largest gas field and offers terms that led oil majors ExxonMobil and Royal Dutch/Shell to invest tens of billions of dollars in the past. The moratorium was lifted two years ago and QP shortlisted six Western majors for the next phase of expansion. QP would announce partners in the first quarter of 2020. But late last year QP said it had decided to expand LNG production by 60 percent to 126 mtpa by 2027 instead of the original plan for a 40 percent increase. Global LNG prices collapsed to an all-time low in Asia in January as China reduced energy consumption because of the spread of coronavirus. Lower demand from China undermined hopes that the biggest user of the fuel would soak up excess supply to reduce its dependence on coal. One standard LNG train with capacity of 8 mt a year costs around $10 bn, meaning QP would need to spend at least $60 bn on the expansion. Exxon, Shell, Total and ConocoPhillips have been partners in Qatar’s existing LNG plants since the country began its journey toward becoming a top player only 20 years ago.

The UAE announced a new gas find with 80 tcf of shallow gas resources, a discovery that could help the country’s goal to achieve gas self-sufficiency. The find was made within an area of 5,000 square km between Abu Dhabi and Dubai, with ADNOC drilling more than 10 exploration and appraisal wells. The gas produced will be supplied to Dubai Supply Authority to support Dubai’s economic growth and enhance its energy security, according to the statement. ADNOC, the top national energy company of the UAE, a key member of the OPEC produces about 3 mn barrels of oil and 10.5 bcf of raw gas a day. The UAE wants to achieve gas self-sufficiency and possibly become a net gas exporter. The country holds the seventh-largest proven reserves of natural gas in the world, at slightly more than 215 tscf, according to the US Department of Energy. Last year, the UAE announced a rise in oil and gas reserves as well as new unconventional gas discoveries in the emirate of Abu Dhabi. That boost would move the UAE to sixth place in the global gas rankings with 273 tscf of conventional gas. The UAE became a net gas importer in 2008 due to growing demand for power and as it needed gas to reinject into its oilfields to enhance crude production. It has been importing gas from Qatar via the Dolphin Gas pipeline.

NLNG has signed a deal with Italian energy major Eni for the supply of 1.5 mt of LNG per year. The volumes will be supplied on both a FOB and delivered ex-ship basis for 10 years from Trains 1, 2 and 3 of a six-train NLNG production facility on Bonny Island. The deal follows a similar deal with France’s Total announced and a 0.5 mt per year deal with commodity trader Vitol signed in December.

Iran’s Petropars will develop phase 11 of South Pars, the world’s largest gas field, after the withdrawal of French oil major Total and the China National Petroleum Corp. The offshore field, which Iran calls South Pars and Qatar calls North Field, is shared between Iran and Qatar.

Israel’s energy ministry limited production at the new Leviathan natural gas field to 60 percent after a malfunction was discovered in the project’s subsea pipeline. Leviathan, one of the largest offshore gas discoveries of the past decade, just last month began selling gas to Egypt and Jordan, as well as the Israeli market. It had been producing at around 65 percent of its capacity during the initial operation period. The ministry informed the project operator, Texas-based Noble Energy, that production must not rise above 60 percent until an investigation is completed.

The US is rapidly increasing LNG export capacity to drain a large domestic surplus. Gas prices have been so low for so long in the US that many shale-gas firms have struggled to raise debt and pioneers such as Chesapeake Energy are battling to stave off bankruptcy. US gas producers had hoped that exports would raise the value of their fuel, but instead they are contributing to a supply glut is pushing down prices worldwide. PennEast Pipeline Co LLC has asked federal energy regulators for permission to build the Pennsylvania part of its proposed natural gas pipeline first due to difficulty in gaining approvals in New Jersey. The company expects to be able to complete the Pennsylvania section of the pipeline by November 2021. As for New Jersey, the company was targeting completion of the second phase of the project from Pennsylvania into New Jersey in 2023. FERC approved PennEast’s request to build the pipeline in January 2018, and the company promptly sued in federal court under the US Natural Gas Act to use the federal government’s eminent domain power to gain access to properties along the route. PennEast needs the New Jersey land to build its 193 km pipeline, which is designed to deliver 1.1 bcf/d of gas from the Marcellus shale formation in Pennsylvania to customers in Pennsylvania and New Jersey. One bcf is enough gas to supply about 5 mn US homes for one day.

CNOOC, China’s biggest importer of LNG, has suspended contracts with at least three suppliers amid the rapid spread of the coronavirus. CNOOC, which operates nearly half the terminals in China that receive LNG, had declared force majeure, which allows companies to suspend their obligation to fulfil contracts after unexpected events such as strikes and natural disasters. The biggest suppliers of LNG to CNOOC include Anglo-Dutch energy company Royal Dutch Shell, France’s Total, Australia’s Woodside Petroleum and Qatargas. The force majeure notice covers CNOOC’s LNG purchases for February and March. China is the world’s second-largest importer of LNG, and its spot purchases of the super-chilled fuel and other energy products have almost ground to a halt as the coronavirus spreads rapidly throughout the country. LNG traders were reportedly scrambling to divert shipments or find new outlets for cargoes destined for China, driving spot prices for LNG in Asia to record lows. China has restarted talks with US LNG marketers to buy more LNG but they are worried that any purchases may come too late to keep natural gas prices from falling further due to a glut of global supply. China pledged to buy an additional $18.5 bn in US energy products this year, but the US-China trade agreement left tariffs in place, including a 25 percent levy on LNG imports that puts US LNG at a disadvantage for producers. Exports of LNG are the fastest growing source of US gas consumption, more than doubling since 2017 largely on Asian demand. Prices have tumbled due to rising global supply, and the glut is expected to grow. This situation will pressure LNG producers to cut output, and adding to hurdles for developers looking to finance multibillion-dollar projects. China’s state-controlled Beijing Gas Group has won state approval to build a terminal to receive LNG in the northern Chinese city of Tianjin. The approved capacity of the terminal is for 5 million tonnes a year, giving no timeline on when the facility would be built.

British wholesale gas prices fell, pressured by decreasing demand and expectations that mild weather will continue. Britain’s gas system was undersupplied by 12.4 mcm with demand forecast at 320.3 mcm and supply at 307.9 mcm/day, National Grid data showed.

Asian spot prices for LNG plummeted to multi-year lows, pressured by a lack of demand to consume abundant supplies. As milder-than-usual winter in both Asia and Europe is curbing demand, there were deals done below $4/mmBtu the lowest level in more than 10 years. The average LNG price for March delivery into northeast Asia LNG-AS was estimated at around $4.00/mmBtu, down $0.60/mmBtu. The Brunei LNG export plant sold a cargo for 30-31 March delivery at about $3.90 to $3.95/mmBtu. Commodity trader Vitol sold a cargo to BP for 22-26 March delivery at $3.95/mmBtu in the S&P Global Platts Market on Close window. With the global gas market heavily oversupplied, new cargo offers further saturated the market. Russia’s Gazprom has offered 18 cargoes for loading at Belgium’s Zeebrugge terminal between the second half of February 2020 and 31 December 2021.

Australia’s government began a push to boost gas supply and renewable energy as part of a A$2 bn ($1.37 bn) deal with its most populous state, looking to cut carbon emissions in the wake of devastating bushfires. The NSW government has committed to help bring on new supply of 70 petajoules per year of gas for the east coast market, which faces a sharp decline in supply from its main gas source in the Bass Strait off Australia’s south coast. Plans to double gas exports from Papua New Guinea within the next four years are in doubt after the government walked away from talks with Exxon Mobil Corp on a key gas project needed for the $13 bn expansion. Papua New Guinea called off negotiations with Exxon on the P’nyang field, blaming the energy giant for failing to budge on a proposed deal that was “out of the money”. The expansion of LNG exports is crucial for the impoverished Pacific nation, but is vying with several proposed LNG projects in Australia, Mozambique, Qatar, Russia and the US. The P’nyang agreement was one of two agreements needed for Exxon and its partners to go ahead with a $13 bn plan to double LNG exports from the Pacific nation. The other agreement, the Papua LNG pact, was sealed with France’s Total SA in September.

| PNGRB: Petroleum and Natural Gas Regulatory Board, CNG: compressed natural gas, CGD: city gas distribution, PNG: piped natural gas, km: kilometre, mn: million, bn: billion, ONGC: Oil and Natural Gas Corp, VAT: Value Added Tax, LNG: liquefied natural gas, MoPNG: Ministry of Petroleum and Natural Gas, RLNG: regasified liquefied natural gas, MNGL: Maharashtra Natural Gas Ltd, NMC: Nashik Municipal Corp, PMT: Panna, Mukta and Tapti, mmBtu: million metric British thermal units, AGL: Adani Gas Ltd, FY: Financial Year, IOC: Indian Oil Corp, HPCL: Hindustan Petroleum Corp Ltd, mmscmd: million metric standard cubic meter per day, mmscm: million metric standard cubic meter, KG: Krishna-Godavari, TCFe: trillion cubic feet equivalent, BCFe: billion cubic feet equivalent, JV: joint venture, US: United States, QP: Qatar Petroleum, mtpa: million tonnes per annum, UAE: United Arab Emirates, bcf: billion cubic feet, tcf: trillion cubic feet, ADNOC: Abu Dhabi National Oil Company, tscf: trillion standard cubic feet, mcm: million cubic meters, NLNG: Nigeria LNG, FOB: free-on-board, FERC: Federal Energy Regulatory Commission, CNOOC: China National Offshore Oil Corp, UK: United Kingdom |

| To read article ‘Universal Access to Electricity in India: Evolutionary or Revolutionary? Part IV (Final) (2015-2020)’ please refer to India Energy Analysis (https://indiaenergyanalysis.wordpress.com/2020/03/04/universal-access-to-electricity-in-india-evolutionary-or-revolutionary-part-iv-final-2015-2020/) or https://www.linkedin.com/pulse/universal-access-electricity-india-evolutionary-part-policy-india-/) |

25 February. Sell-off-bound Bharat Petroleum Corp Ltd (BPCL) has procured 500 mn barrels of distress crude (five shiploads) at a discount of $3-5 per barrel to the already low prevailing price following order cancellations by coronavirus-hit China. Since the outbreak of the epidemic, crude prices have plunged over $15 a barrel to around $50 now as large parts of China, the largest importer and consumer of crude, are under Beijing-ordered lockdown and millions of factories are closed. Meanwhile BPCL has been the biggest customer of US (United States) crude since the last two years, when that country lifted the ban on exporting crude for the first in decades. Meanwhile, a report from New Delhi quoting the visiting US energy secretary Dan Brouillette said in the past two years, Indian imports of crude from the US has jumped 10-folds to 2,50,000 barrels a day. In 2017, the country imported just 25,000 barrels per day (bpd) from the US. India began importing crude oil from the US in 2017 as it looked to diversify its import basket beyond the OPEC (Organization of the Petroleum Exporting Countries) block. It bought 1.9 mt (38,000 bpd) crude from the US in FY18 and another 6.2 mt (1,24,000 bpd) in FY19. In the first six months of FY20, the US supplied 5.4 mt crude oil to India. Oil Minister Dharmendra Pradhan later said India is the fourth largest export destination for US crude now, while LNG import from the US is also increasing progressively ever since import started in March 2018. India is now the fifth largest destination of US LNG exports. Pradhan said the bilateral hydrocarbon trade has increased exponentially during the past three years touching $7.7 bn mark in FY19, accounting for 11 percent of total two-way trade. Iraq is India’s top crude oil supplier, meeting close to one-fourth of oil needs. It sold 26 mt crude to India in April-September, relegating Saudi Arabia to the second spot with 20.7 mt. The country meets as much as 83 percent of oil demand through imports and has shipped in 111.4 mt during April-September.

Source: Business Standard

25 February. Indian Oil Corp (IOC) has made it mandatory for its LPG (liquefied petroleum gas) refill delivery staff to carry with them weighing scales and leak detectors to ensure customers get a full cylinder, without any leaks. Domestic cylinders will have their empty weight printed on them and gas agencies should fill it with 14.2 kilogram (kg) LPG. The gross weight of the cylinder should be arrived at by adding empty weight and weight of the LPG — 14.2 kg. P Jayadevan, executive director, IOC (Tamil Nadu and Puducherry) urged LPG consumers to pay for refills online so that there is no scope for delivery persons to demand tips. Though there was resistance from delivery persons on ‘no tips’ fiat, he said each dealer gets ₹60 per cylinder as commission and the delivery person gets ₹20 from the dealer. IOC is also on the verge of sending out text messages which will have details of subsidy amount that gets refunded.

Source: The Economic Times

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">India can gain from lower price in global oil markets! < style="color: #ffffff">Good! |

24 February. Indian refining companies are snapping up rare crude grades as the coronavirus outbreak curtails China’s demand for processing, executives and traders said, with prices for some grades falling by as much as 15 percent. Chinese refiners have slashed output by at least 1.5 mn barrels a day in February, or over 10 percent, after the virus outbreak hit domestic fuel demand, leading to swelling stocks. Refiners in India, the world’s third-biggest oil importer, rarely get the opportunity to buy suitable grades from areas like the Mediterranean and Latin America due to higher freight rates. However, shipping rates have plunged by nearly half since the virus outbreak, and after the US (United States) partially lifted sanctions on part of Chinese shipping firm COSCO.

Source: Reuters

21 February. Existing oil wells operating in the Cauvery Delta can continue operations but there will be no more fresh allocations as a new law passed in the Tamil Nadu Assembly protects five districts in the Cauvery Delta from natural resource mining that may harm farming. The Tamil Nadu Protected Agricultural Zone Development Act 2020 was passed in the Assembly even as the DMK staged a walkout. According to documents from the ministry of petroleum and natural gas, there have been 28 petroleum mining licences rolled out for extraction to ONGC, covering an onland acreage of 3,516 square kilometre (sq km). The oil ministry has also allotted four exploration and mining licences to private and joint venture players covering over 410 sq km.

Source: The Economic Times

20 February. India will switch to the world’s cleanest petrol and diesel from 1 April as it leapfrogs straight to Euro-VI emission compliant fuels from Euro-IV grades now - a feat achieved in just three years and not seen in any of the large economies around the globe. India will join the select league of nations using petrol and diesel containing just 10 parts per mn of sulphur as it looks to cut vehicular emissions that are said to be one of the reasons for the choking pollution in major cities. IOC (Indian Oil Corp) chairman Sanjiv Singh said almost all refineries began producing ultra-low sulphur BS-VI (equivalent to Euro-VI grade) petrol and diesel by the end of 2019 and oil companies have now undertaken the tedious task of replacing every drop of fuel in the country with the new one. State-owned oil refineries spent about Rs350 bn to upgrade plants that could produce ultra-low sulphur fuel. This investment is on top of Rs600 bn they spent on refinery upgrades in the previous switchovers. But oil marketing companies switched over to supply of BS-VI grade fuels in the national capital territory of Delhi on 1 April 2018. The supply of BS-VI fuels was further extended to four contiguous districts of Rajasthan and eight of Uttar Pradesh in the National Capital Region (NCR) on 1 April 2019, together with the city of Agra. Singh said the new fuel will result in a reduction in NOx (nitrogen oxide) in BS-VI compliant vehicles by 25 percent in petrol cars and by 70 percent in diesel cars.

Source: Business Standard

20 February. Oil and Natural Gas Corp (ONGC), the country’s largest petroleum explorer, expects oil and gas production to decline in a range between 3 percent and 4 percent in the current financial year ending March 2020. The company’s oil production during the first nine months (April-December) of the current financial year declined 4.3 percent to 17.53 million tonnes (mt). ONGC had also announced oil production will witness a marginal increase by 2024, from the current annual levels of 23-24 mt.

Source: The Economic Times

25 February. The downstream regulator is planning to waive a key condition for city gas distributors — of signing natural gas purchase pacts within 180 days from the award of licence — in response to companies’ reluctance to go for such deals amid a global supply glut that has led to a sharp decline in prices and amplified volatility. The idea behind mandating licensees to compulsorily tie up supplies was to ensure security of supply and smooth services. But the US (United States) shale revolution and construction of several gas export facilities worldwide over the past few years have made supplies plentiful and cheaper, prompting Petroleum and Natural Gas Regulatory Board (PNGRB) to revisit this condition. The removal of such restriction will enable city gas distributors to better respond to market situations and serve consumers better, he said, speaking on condition of anonymity. The proposed move would help several companies that won licences in the ninth and tenth rounds of city gas auction held in the past two years. Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL), Hindustan Petroleum Corp Ltd (HPCL), Adani, Torrent and AG&P were the biggest winners in the last two rounds in which 136 licences, covering nearly half of India’s population, were awarded. India imports about half of the gas it consumes. City gas companies get cheap local gas for distribution to homes and vehicles, but depend mostly on imported liquefied natural gas (LNG) for serving industries and commercial establishments. The minimum volume of natural gas for which such a pact can be entered into is equal to the expected consumption in five years based on the work programme promised during the bid.

Source: The Economic Times

25 February. Global energy major Exxon Mobil and Indian Oil Corp (IOC) have signed an agreement to help deliver natural gas in containers to Indian cities outside the pipeline network. The move can significantly increase the use of the clean fuel in the country, and deepen the rapidly growing US (United States)-India energy ties. The US has emerged as an important energy supplier for India, with total crude oil and liquefied natural gas (LNG) imports worth an estimated $6.7 bn. Chart Energy & Chemicals - a US company specialising in the supply chain of liquefied gas - will also be a part of the "letter of cooperation" along with ExxonMobil India LNG and IOC, coinciding with US President Donald Trump’s visit to India. The agreement is expected to help India achieve its target of raising the share of gas in the energy basket to 15 percent in 10 years, from 6.2 percent now.

Source: The Economic Times

23 February. Natural gas prices in India are likely to be cut by a steep 25 percent beginning April, in line with the slump in global rates. The price of most of the natural gas produced by ONGC (Oil and Natural Gas Corp) and Oil India Ltd (OIL), which account for the bulk of India’s existing gas output, is likely to be cut to around $2.5 per million metric British thermal unit (mmBtu) for the six-month period beginning 1 April, from $3.23 as of now. This will be the second reduction in six months and will reduce rates to the lowest in two-and-half-years. The price of gas produced from difficult fields too is likely to be cut to $5.50 from $8.43 per mmBtu now. Natural gas price was last cut by 12.5 percent on 1 October. Rates were cut to $3.23 per mmBtu from earlier $3.69. For difficult fields, the rates were cut from an all-time high of $9.32 per mmBtu to $8.43. The reduction would impact revenues of India’s biggest producer ONGC as well as Reliance Industries Ltd (RIL) and its partner BP plc which plan to start gas production from their 'second-wave' of discoveries in eastern offshore KG-D6 block from mid-2020.

Source: Business Standard

21 February. LNG (liquefied natural gas) logistics company AG&P said it will commission an LNG import facility at Karaikal in Puducherry by the fourth quarter (Q4) of 2021. The company had a ground-breaking ceremony for the project. Owned and operated by AG&P, the LNG terminal is being built on a 12-hectare site within the Karaikal Port, which enjoys the only deep-water access on the East Coast. Karaikal LNG, which will have an initial capacity of 1 mt per annum, will include a floating storage unit (FSU) leased through a long-term charter agreement with ADNOC Logistics and Services from 2021, providing an efficient solution that will enable the supply of this clean fuel to be affordable. AG&P develops and builds LNG import terminals in nascent and growing markets around the world. These facilities encourage the development of a downstream gas value chain and unlock latent demand. At Karaikal LNG, AG&P has developed a flexible configuration combining floating storage and onshore facilities, such as truck-loading. Beyond Karaikal, AG&P has won city gas distribution licence for 12 geographic areas across Tamil Nadu, Andhra Pradesh, Kerala, Karnataka and Rajasthan.

Source: The Economic Times

20 February. GAIL (India) Ltd has issued a swap tender offering three cargoes of liquefied natural gas (LNG) for loading in the United States (US) and seeking three for delivery to India. It offered cargoes from the Cove Point plant in the US on a free-on-board basis loading on 20-22 March, 25-27 April and 25-27 May. GAIL is looking to buy two cargoes for delivery to Dabhol in India on 28 February-15 March and 1-8 May, as well as one cargo for delivery to Hazira on 10-15 September. The tender closes on 20 February.

Source: Reuters

19 February. The Supreme Court has upheld award of city gas licence for Chennai to Torrent Gas, rejecting Adani Gas’ plea that the winner's "unreasonably high bid" should have been rejected by the regulator. Torrent had won the licence to lay city gas distribution infrastructure in the Districts of Chennai and Tiruvallur in Tamil Nadu following a competitive bid organised in 2019 by Petroleum and Natural Gas Regulatory Board (PNGRB), the downstream regulator. The court has rejected all contentions of Adani Gas and dismissed its appeal against the PNGRB’s award. The judgement will help begin work on laying city gas infrastructure in Chennai and Tiruvallur, Torrent said.

Source: The Economic Times

25 February. India will require 180 million tonnes (mt) of coking coal by 2030-31 to cater to the steel industry, which is aiming to produce 300 mt of steel by then. The coal ministry has been asked to make sure 35 percent of the demand for coking coal be met indigenously. Coal India Ltd’s exploration arm CMPDIL (Central Mines Planning & Design Institute) said Rs1.9k bn was spent on the imported coal and hence utilizing domestic coking coal in metallurgical sector was the need of the hour. However, the quality of coking coal reserves in the country was very poor in terms of ash and is difficult to beneficiate. Majority of coking coal produced in India is of Washery Grade-V and beyond. The plan is to receive integrated association of washery operators and consumers with coal producers to work on optimization of available resources. Increased coordination among academia-research institutions and coal industry would facilitate realistic solutions for critical problem in bridging demand and supply gap of coking coal and thus saving of foreign exchange.

Source: The Economic Times

25 February. With the railways witnessing significant decline in transport of coal, which has impacted its revenue from the freight segment, the state-run transporter is targeting a five-fold increase in its share of transporting automobiles by 2025. The total coal transported by railways stood at nearly 606 million tonnes (mt) in 2018-19 and as per the revised estimate of 2019-20, it’s set to reduce to 592 mt. According to the budget document, freight loading by railways in 2019-20 is likely to be 1,223 mt by March and nearly 50 percent of this is coal. But during 2020-21, this share is estimated to reduce to 40 percent.

Source: The Economic Times

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Price difference between subsidised and non-subsidised coal will lead to diversion! < style="color: #ffffff">Ugly! |

22 February. Local crime branch (LCB) has intensified probe into the alleged coal scam and has dispatched four teams to industries that are suspected to be involved in sale of subsidized coal in open market at premium rates. LCB in-charge PI Omprakash Kokate informed that cops had summoned representatives of the industries that had lifted the coal from mines for questioning. However, as none of the industries responded, a team each has been dispatched to four separate districts to investigate the records of subsidized coal taken and utilized by the beneficiary units. LCB team had detained 26 trucks loaded with subsidized coal at a private coal depot near Nagada village. The coal was allotted to seven industries by Maharashtra State Mining Corp (MSMC) at subsidized rate for industrial use. However, the coal was taken to the private depot where the LCB team conducted the raid. MSMC allocates quota of subsidized coal to hundreds of industries across the state every month. There is possibility that many of these companies are seeking excessive quota, while a bunch of them might be closed and still claiming the coal and selling it in the open market through traders.

Source: The Times of India

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Decline in coal supply is a warning sign of sluggish demand! < style="color: #ffffff">Bad! |

21 February. Coal India Ltd (CIL)’s coal supply to the power sector registered a decline of 6.8 percent to 377.86 million tonnes (mt) in the April-January period of the ongoing fiscal. The commodity despatch by CIL to the power sector in the year-ago period was 405.61 mt. However, the coal despatch by CIL to the power sector in January registered an increase of 2.9 percent to 43.20 mt, over 42 mt in the corresponding month of the previous fiscal, it said. The supply of dry-fuel by Singareni Collieries Company Ltd (SCCL), a state-owned coal miner, in the April-January period also registered a decline of 2.6 percent to 44.03 mt, over 45.22 mt in the year-ago period. Stating rain as the 'enemy of the coal sector', a government official had earlier blamed extended monsoon for the loss of coal output for a few months (from July) in the current fiscal. CIL saw its production decline by 3.9 percent to 451.52 mt in April-January period, over 469.65 mt in the year-ago period. The firm had earlier said that it will produce 750 mt of coal in the next financial year. The firm will further produce 1 billion tonnes (bt) of coal by FY2024, Coal Minister Pralhad Joshi had said.

Source: Business Standard

20 February. Auction of coal linkages under the SHAKTI policy to independent power projects (IPPs) will have a positive impact on coal-based power plants, ratings agency ICRA said. The Central government had recently notified the third round of auction for award of coal linkages under SHAKTI (Scheme for Harnessing and Allocating Koyala (Coal) Transparently in India) to independent power projects having long-term power purchase agreements (PPAs), ICRA said. The latest discount is higher than 1 paise per unit base discount set under the first round of auction held in September 2017 and 4 paise per unit base discount set under the second round of auction for coal linkages held in May 2019. ICRA said the availability of coal linkage would enable the plants to declare normative availability allowing recovery of fixed charges and improve their merit order position.

Source: Business Standard

25 February. India’s Energy Efficiency Services Ltd (EESL) has announced the completion of installation of 10 lakh smart meters across India under the Government of India’s Smart Meter National Programme. EESL has set the target to install 250 mn smart meters over the course of next few years. Finance Minister Nirmala Sitharaman in her budget speech this year allocated Rs220 bn for the power and renewable energy sector and urged state governments to implement smart meters in a time frame of over three years, which would give the consumers the right to choose suppliers and the rates. She addressed the fact that power distribution companies are under great financial stress and the way ahead is to move towards implementation of smart meters. Union Energy Minister R K Singh said EESL has distributed over 360 mn LED (light emitting diode) bulbs.

Source: The Economic Times

22 February. Rajasthan Chief Minister Ashok Gehlot announced an ambitious Rs20 bn plan to reboot the power distribution network and enhance the capacity of the existing infrastructure to make day power a reality for farmers. Gehlot laid out a three-phase timeline with number of districts in each one and said by April 2023, 13 lakh farmers in all the districts able to get day power. In the first phase that would be completed by 1 April 2021, 16 districts have been included in the plan. Five districts have been included in second phase that would be completed by April 2022, while third phase will have 13 districts. The government would need to spend more for giving peak hour power to farmers.

Source: The Economic Times

22 February. India’s electricity demand grew 7.5 percent in the first 18 days of February with early onset of summer in the South and West, offering some relief to the stressed thermal power sector which can now operate at higher capacities. Currently, thermal power projects are operating at 58 percent capacity. Power demand had grown 3.7 percent in January, turning around after five months of decline. Demand for electricity stood at 1,05,289 MW in January against 1,01,570 MW in December 2019. It was also 3.5 percent higher than the 1,01,713 MW in January 2019, data available with the Central Electricity Authority showed. In February so far, demand was 15–20 GW higher than peak-hour demand for the same period last year. Power demand for the April-January period of the current financial year was 10.7 percent higher than in the same period last fiscal year. The monthly data of power requirement for January, however, showed that demand contracted between December and January in Gujarat and Maharashtra, the two most industrialised states in the country, while it was higher in most other states. India’s power demand grew just 1.1 percent in 2019. In December, the country’s power demand fell 0.5 percent from the year-ago period, a fifth straight month of decline, compared with a 4.3 percent fall in November. The fall was the most in October, at 13 percent, led by a sharp reduction in demand from Gujarat and Maharashtra.

Source: The Economic Times

21 February. Power tariff in Assam may go up by 24 percent from April due to a rise in the cost of electricity the state is purchasing from outside to meet its requirements. The Assam Electricity Regulatory Commission (AERC) said it has become virtually impossible for the state-run power companies to continue with the existing tariff as PSUs (Public Sector Undertakings) selling electricity have significantly increased the charges in recent times. While the power tariff may be hiked from the existing Rs7.25 kilowatt hour (kWh) to Rs8.85 kWh in the domestic category, it may be increased to Rs9.45 kWh from Rs7.60 kWh in the commercial category of the same range. Once finalized, the increase in energy charge per unit is going to be Rs1.60 and Rs1.85 for domestic and commercial category consumers respectively. The AERC said the "costly power" procured for distribution to the state’s consumers has compelled the Assam Power Distribution Company Ltd (APDCL) to send a proposal to hike the power tariff.

Source: The Economic Times

20 February. Working towards providing reliable power supply for its customers, the BSES discoms (distribution companies) have started using drones to map distribution assets, detection of power theft, inspection of rooftop solar installations and for other similar purposes. Drones fitted with high definition camera for visual inspection and an infrared camera for thermal imaging for identification of the hot-spots are being used, BSES said. A programme has been drawn for using drones to monitor the health of the electricity network, including high voltage lines and grid sub-stations. In BSES Yamuna Power Ltd (BYPL) areas, inspections were undertaken over a 45-day period at BYPL’s Vivek Vihar grid and the EHV Circuit between the Vivek Vihar and Patparganj grid in East Delhi.

Source: Business Standard

25 February. Petrol dealers in the state, including those in the city, would soon start selling compressed biogas (CBG) to boost its usage, oil marketing companies (OMCs) stated. CBG, produced naturally through anaerobic decomposition from waste or biomass sources, is an environment-friendly alternative to compressed natural gas (CNG) used in vehicles. OMCs stated that they were inviting applications from entrepreneurs to set up CBG plants. CBG would be sold to customers for Rs55.25 per kg, close to the CNG price of Rs55.5 per kg in the city. All India Petrol Dealers Association (AIPDA) president Ajay Bansal said they had so far received nearly 79 applications for setting up of CBG plants in Maharashtra. Bansal said since Maharashtra had many sugar factories, press mud from the factories could be used for manufacturing CBG.

Source: The Economic Times

23 February. Prime Minister (PM) Narendra Modi hailed the use of a mixture of 10 percent indigenously produced bio-jet fuel to fly an Indian Air Force transport aircraft, saying such efforts will not only help bring down carbon emissions, but also reduce the country's dependence on imported crude oil. He said "history was made" when an IAF AN-32 aircraft took off from Leh’s Kushok Bakula Rimpoche airport using a mixture of 10 percent Indian bio-jet fuel. He said that the bio-jet fuel is prepared from "non-edible tree borne oil" and is procured from various tribal areas of India.

Source: Business Standard

20 February. Madhya Pradesh has surpassed its earlier record of thermal power generation by producing 1099.7 lakh units in one day. The Madhya Pradesh Power Generating Company has created a new record by producing 1099.7 lakh units of thermal power on 18 February. The state’s previous highest power generation in a day was recorded at 1074.5 lakh units on 25 March last year. In this record production, Amarkantak Thermal Power Station in Chachai generated 50.6 lakh units, while Sanjay Gandhi Thermal Power Station in Birsinghpur produced 289.6 lakh units. Satpura Thermal Power Station in Sarni and Shri Singaji Thermal Power Project at Khandwa produced 261.8 lakh units and 497.7 lakh units respectively.

Source: Business Standard

25 February. The United States (US) is preparing to impose more sanctions on Venezuela’s oil sector, US President Donald Trump said, in an attempt to choke financing to President Nicolas Maduro’s government. The US imposed sanctions on Rosneft Trading SA as it emerged as a key intermediary for the sale of Venezuelan oil. India and China are the important buyers of Venezuelan oil, with India importing about 342,000 barrels per day (bpd) for Venezuela in 2019, according to tanker data. Reliance Industries Ltd (RIL), operator of the world’s biggest refining complex, and Nayara Energy, part-owned by Rosneft, are the only Indian buyers of Venezuelan oil. The two firms had been purchasing Venezuelan oil from Rosneft. US Special Representative for Venezuela Elliott Abrams said that new sanctions against Venezuela’s oil sector will be more aggressive in punishing people and companies that violate them. Rosneft units take Venezuelan oil as repayment for billions of dollars in loans extended to Venezuela in recent years. Other firms taking Venezuelan oil as repayment of loans or late dividends - including US oil major Chevron Corp and Spain’s Repsol SA - have not been sanctioned by Washington.

Source: Reuters

25 February. Norway’s Equinor ASA has abandoned plans to explore for oil in the deep waters off Australia’s south coast, saying it was not “commercially competitive”, following in peers’ footsteps in a move hailed as a big win by green campaigners. Equinor’s decision, announced, comes after Chevron Corp, BP Plc and Karoon Energy Ltd all walked away from promising exploration acreage in the Great Australian Bight, which industry consultants Wood Mackenzie have estimated could hold 1.9 bn barrels of oil equivalent. Oil companies eyeing the Great Australian Bight have long battled opposition from green groups concerned about potential damage to fishing towns, whale breeding grounds and an unspoiled coastline. Australian regulators had approved Equinor’s drilling plan in December, despite vocal opposition. But Equinor said that following a review of its global exploration portfolio it had decided there were better exploration opportunities elsewhere.

Source: Reuters

25 February. Saudi Aramco will shut its largest oil refinery for five to six weeks from 1 June, the plant’s general manager Fawwaz Nawwab said. The 550,000 barrel per day (bpd) Ras Tanura refinery on the shores of the Gulf supplies over a quarter of the kingdom’s fuel supply. The plant will shut down completely to connect new units and refit older units to produce cleaner fuels, Nawwab said. The company is undertaking a $2.4 bn overhaul of Ras Tanura to reduce the sulphur content of the gasoline and diesel the refinery produces.

Source: The Economic Times

24 February. Iran will be able to produce more than 1 billion cubic meters (bcm) of gas per day once the final platform is installed at the South Pars offshore field, Oil Minister Bijan Zanganeh said. South Pars, which Qatar calls North Field, is the world’s largest gas field and is shared between Iran and Qatar. Separately, Zanganeh said that coronavirus is to blame for price fluctuations in the oil market.

Source: Reuters

24 February. China Resources Gas Group, the country’s biggest city gas distributor, will bring forward the implementation of off-season natural gas prices by two months to February, following a rare instruction from Beijing to support the virus-hit economy. China’s state planner for the first time urged natural gas suppliers and distributors to implement off-season prices earlier for industrial and commercial users, to help mitigate companies’ losses from the coronavirus outbreak. Off-season natural gas prices are typically implemented from mid-March or early April until mid-November in China. Under China’s price mechanism, gas suppliers are allowed to raise prices by as much as 20 percent from benchmark city gate prices, set by local authorities, and there is no limit for off-peak season price reductions.

Source: Reuters

22 February. Saudi Aramco plans to invest $110 bn to develop unconventional gas reserves in Saudi Arabia’s Jafurah field. The Jafurah deposits are estimated to hold 200 trillion cubic feet (tcf) of wet gas and the phased development of the field is expected to gradually increase production to 2.2 tcf by 2036 if fully completed. It said the field was expected to produce 130,000 barrels per day (bpd) of ethane and 500,000 bpd of gas liquids and condensates. Saudi Arabia aims to become gas exporter by 2030. Prince Mohammed had ordered gas produced from Jafurah to be prioritised for domestic industries, including mining, to support the kingdom’s Vision 2030 development plan.

Source: Reuters

21 February. Belarus said fair price for Russian gas $90 per 1,000 cubic metres MINSK, - Belarus President Alexander Lukashenko said he believed $90 was fair price for 1,000 cubic metres of Russian gas. Minsk and Moscow have previously agreed to maintain the cost of gas at $127 per 1,000 cubic metres for this year.

Source: The Economic Times

20 February. Global demand for liquefied natural gas (LNG) is expected to double to 700 million tonnes (mt) by 2040 as gas will continue to play an important role in a lower-carbon energy system, Royal Dutch Shell’s annual market outlook said. Global LNG demand grew by 12.5 percent to 359 mt last year.

Source: Reuters

20 February. Qatar Petroleum will subscribe to three million tonnes (mt) per year of capacity at Elengy’s Montoir-de-Bretagne LNG (liquefied natural gas) terminal for a term up to 2035, Elengy said. Elengy, a unit of French gas and power group Engie, said Montoir-de-Bretagne will thus become a new LNG import terminal position for Qatar Petroleum in Europe, facilitating the supply of Qatari and internationally sourced LNG to French and European customers.

Source: Reuters

25 February. Japan will launch a review by the end of June aimed at tightening conditions for the export of coal-fired power plants, environment minister Shinjiro Koizumi said. The move follows global criticism over the Japanese government’s support for building coal-fired plants in countries like Indonesia and Vietnam, as well as the roll-out of new plants in Japan. He said in December that global criticism of his country’s “addiction to coal” was hitting home, but warned he had yet to win wider support to reduce backing for fossil fuels. He said the environment ministry had agreed the review with other ministries, including the finance ministry and the powerful industry ministry, which has traditionally held more sway over coal policy. Under its current policy, Japan supports coal-fired power plant projects if and when a country which needs to choose coal as a power source requests Japan to provide its highly-efficient coal power technology.

Source: Reuters

24 February. North Macedonia is planning to end its use of coal for energy production by 2040 at the latest and sees a phase-out by 2025 as the cheapest option in two of three scenarios, environmental groups which helped draw up the strategy said. A final decision on which pathway the country will take will be made later this year, the groups said. While Western Europe has been moving away from coal to meet climate goals, the Western Balkans remains home to seven of the ten most polluting coal-fired power plants in Europe. About 1,600 people are estimated to die prematurely every year as a result of exposure to air pollution in North Macedonia, where coal accounts for about a half of power generation, the World Bank said in a report.

Source: Reuters

20 February. Management at Poland’s biggest coal producer, the state-run PGG, agreed to increase its miners’ salaries by 6 percent after the company’s trade unions threatened to stage a protest in Warsaw. The PGG miners held a two-hour warning strike to demand a 12 percent increase in salaries and a clear national energy plan guaranteeing a future role for coal. Poland’s ruling Law and Justice (PiS) party, which is keen to secure coal miners’ votes in a presidential election in May, has said Poland will continue to use coal as its main fuel for years to come. PiS rose to power in 2015 partly on promises to sustain the then troubled coal mining. Since then the industry has recovered, as coal prices rebounded and the government closed some of the most loss-making mines. Last year, however, the Polish coal industry started to face new problems because of increased coal imports and falling demand, leaving coal-mining companies with unsold stocks.

Source: Reuters

20 February. Indonesian coal exports are being disrupted because the government has not issued technical guidance on the implementation of new shipping rules, an industry group said. Indonesia, the world’s biggest thermal coal exporter, in 2018 issued regulations requiring its coal and palm oil exporters to use domestic insurance and shipping companies. The insurance requirement was implemented last year and the shipping requirement will begin in May. Most coal sales from Indonesia are under free-on-board contracts, so overseas buyers who are in charge of securing vessels are still waiting for the Trade Ministry to issue technical guidance, the Indonesia Coal Miners Association (ICMA) said. Some buyers, such as those from Japan, have started to divert their coal purchases to other countries due to the unclear protocol for vessel use, the ICMA said.

Source: Reuters

25 February. Senegal inaugurated the first large-scale wind farm in West Africa, a facility that will supply nearly a sixth of the country’s power when it reaches full capacity later this year. With the wind farm, Senegal will get 30 percent of its energy from renewable sources, which has been a goal of President Macky Sall. The 158 MW wind farm was built by British renewable power company Lekela, which also has wind farms in South Africa and Egypt and an upcoming one in Ghana. Senegal’s first solar plant came online three years ago, and the country has since built several more. Other countries in the region are following suit with solar but are much further behind in terms of wind, Macri said. The wind farm will provide enough electricity for 2 mn people and prevent the emission of 300,000 tonnes of carbon dioxide annually, according to Senelec.

Source: Reuters

21 February. Beside the green pastures and sugarcane plantations surrounding the farming town of Porto Feliz is the strange sight of hundreds of blue, silicon panes turned towards the sun. This solar farm, about 150 km (93.2 miles) from Sao Paulo, produces electricity for around 40 homes and small businesses like restaurants and gyms. Such “distributed generation,” or DG, operations are quickly multiplying in Brazil as investors bank on the long hours of strong sunlight across the continent-sized country, a late adopter of solar technology, and enjoy subsidies that have been pared back in countries like the United States (US). Corporate and private investors are boosting solar panel production in one of Brazil’s few domestic manufacturing industries, as well as driving imports from China. Brazil’s solar power industry group Absolar sees DG investments tripling to 16 bn reais ($3.64 bn) in 2020 from last year. Those installations should add 3.4 GW of power generation capacity in Brazil this year. Canadian Solar has a plant in Brazil to assemble the modules with imported parts. Many Chinese companies, such as Risen, Trina, Jinko and Yingli, are also supplying the market.

Source: Reuters

20 February. The US (United States) Agriculture Department announced a goal for biofuels to make up 30 percent of U.S. transportation fuels by 2050, a move that could bolster an industry that has been otherwise battered by the Trump administration. Refineries are currently required to blend 20.09 bn gallons of biofuel in 2020, about 10 percent of projected crude oil production, according to the US Energy Information Administration. President Donald Trump has been criticized by the corn-based ethanol industry after his Environmental Protection Agency (EPA) granted exemptions to the blend requirement for dozens of oil companies over the last two years. The biofuel goal, which also included getting the blend rate to 15 percent in 10 years, is part of a new department-wide sustainability initiative aiming to boost farm production by 40 percent and cut the farm sector’s environmental impact by 50 percent during the same period. The environmental goal also could deflect criticism from farmers and ethanol producers in an election year.

Source: Reuters

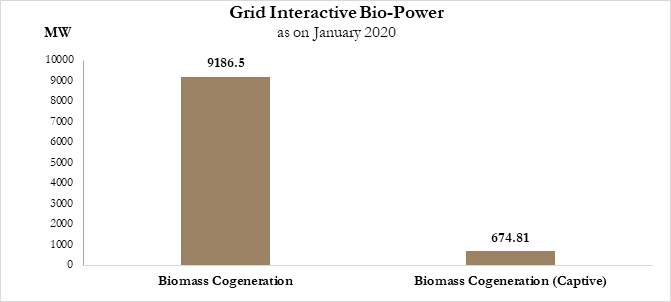

As on January 2020

| State/UT | Installed Capacity (MW) |

| Andhra Pradesh | 500.34 |

| Bihar | 121.2 |

| Chhattisgarh | 230.5 |

| Gujarat | 77.3 |

| Haryana | 205.66 |

| Himachal Pradesh | 7.2 |

| Jharkhand | 4.3 |

| Karnataka | 1,882.8 |

| Kerala | 0.72 |

| Madhya Pradesh | 120.75 |

| Maharashtra | 2,528.69 |

| Meghalaya | 13.8 |

| Odisha | 59.22 |

| Punjab | 327.85 |

| Rajasthan | 121.3 |

| Tamil Nadu | 1,003.95 |

| Telangana | 177.6 |

| Uttar Pradesh | 2,115.51 |

| Uttarakhand | 130.5 |

| West Bengal | 319.92 |

| Delhi | 52.0 |

| Total (MW) | 10,001.11 |

Source: Ministry of New & Renewable Energy

Source: Ministry of New & Renewable Energy| This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485. Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team). Publisher: Baljit Kapoor Editorial Adviser: Lydia Powell Editor: Akhilesh Sati Content Development: Vinod Kumar |

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.