< lang="EN-US" style="color: #0069a6">BLENDED RE AND NON RE PROJECTS TO ADDRESS INTERMITTENCY

Non-Fossil Fuels News Commentary: January 2020

India

RE Policy and Market Trends

India has embarked on an ambitious target of having 450 GW of renewable energy by 2030 and also provide 1.7 million solar pumps to farmers under Pradhan Mantri-Kusum Yojana in coming days to capitalise on this clean resource. The country is already working on the target of having 175 GW of renewable energy by 2022 which includes 100 GW of solar and 60 GW of wind energy. As of December 2019, 86 GW of renewable energy capacity has already been achieved. This includes 34 GW of solar and 38 GW of wind energy. Besides, around 36 GW of clean energy is under installation and about 35 GW is under bidding stage. Under the second phase of the solar roof top programme, the target is to generate 38 GW of electricity. In September last year, the government doubled India’s non-fossil fuel target to 450 GW at Climate Action Summit at UN headquarters. India needs a total land footprint of about 55,000 to 125,000 square kilometre, which is roughly the size of Himachal Pradesh or Chhattisgarh, respectively, to meet its 175 GW RE target by 2022, according to a recent research. India’s 27 percent area is classified as wasteland, which is enough for renewable goals deployment. It is possible for India to meet the lofty renewable energy target of 175 GW by 2022 by placing renewable energy infrastructure on already degraded lands that have lower potential conflict. One of the biggest obstacles in achieving the 450 GW renewable energy target is acquiring land for establishing infrastructure for renewable energy.

The government’s rooftop solar target of 40 GW by 2022 is unrealistic and it is highly unlikely that it will be met on time, Parliamentary standing committee on energy has said. The Committee said in its latest report that as per the year-wise targets set to install 40 GW by 2022, there should have been an installed rooftop solar capacity of 16,000 MW by 2018-19 but as of October 15, 2019, only 1,826 MW capacity has reportedly been installed, which means that the achievement is only 11.50 percent of the target. The panel noted National Institute of Solar Energy has estimated a rooftop solar potential of 42.8 GW and accordingly, a target of 40 GW of installed capacity by 2022 has been set by the government. The Cabinet Committee on Economic Affairs has now revised the yearly rooftop solar targets, according to which 3,000 MW capacity has to be commissioned during 2019-20. The Committee said MNRE should give this programme a serious relook otherwise it will derail the entire National Solar Mission. The panel recommended that the process of subsidy disbursement should be made simpler and faster and the ministry needs to proactively advertise the benefits of having rooftop solar installations and the incentives provided by the government for the same. The Committee expressed concern about the lack of domestic solar manufacturing capacity in the country and said it is necessary for India to support domestic solar manufacturing as over-reliance on any foreign country puts Indian solar sector at a risk of disruption in supply chain.

SECI intends to blend inherently unsteady renewable power with power from steady generation sources including coal-fired thermal plants. Blending, according to SECI’s EoI document, would allow it to provide round the clock supply to consumers to meet their baseload and enhance renewable penetration at discom and other consumers. It is also expected to cater to the requirements of consumers by providing them round the clock firm power by blending RE power with the power from hydro, gas, pumped storage, thermal sources of energy. It will also allow commercial and industrial consumers who have captive plants to meet their renewable power purchase obligation through the purchase of renewable power through long or medium-term open access. SECI may sign power purchase agreements with generators, the validity of which may vary from one to 25 years as per consumer requirements and shall be for those blocks in a day where renewable power falls short in meeting the conditions of round the clock firm power. SECI recently informed that it will be organising a pre-bid meeting for the 4 MW floating solar power plant in Andaman & Nicobar Islands. It would be for the selection of solar power developer for the floating power plant with 2 MW/1 MWh battery energy storage system at Kalpong Dam in Diglipur, North Andaman. SECI had invited bids for setting up the 4 MW grid-connected floating solar power plant. It said that the projects would be developed on a build-own-operate basis, and the last date for the submission of bids is 13 February 2020.

The government is planning to extend the safeguard duty imposed on imported solar power equipment from China. Domestic solar equipment manufacturers have met Union Commerce and Industry and suggested the duty be retained. This comes at a time when the safeguard duty impacted addition in solar power generation capacity over the past two years. The domestic manufacturing industry has argued China was actively looking to divert major export flows en-route to India after major buyers from the US cancelled bulk orders. The US has ratcheted up tariffs on Chinese imports, especially in the electronics space, with Washington DC threatening in December that more restrictions might follow soon. In 2018, the government announced imposition of safeguards duty on solar cells and modules for two years — 25 percent in the first year, 20 percent for six months and, thereafter, 15 percent. Apart from Malaysia, the duty specifically impacted the exports coming from China, as more than 85 percent of India’s solar capacity is built on Chinese panels. For 2018-19, the tendering target set by the ministry of new and renewable energy was 30,000 MW. Ongoing tenders total up to 26,000 MW and none has been closed yet due to lack of bids. India has set target of 100,000 MW of solar power production by 2022. The current solar power capacity stands at 30,000 MW. The MNRE has recommended to its commerce and finance counterparts to impose basic customs duty on the imports of solar cells and modules mainly from China. The revenue department of the finance ministry had in July 2018 imposed a Safeguard Duty on solar imports based on a recommendation from the Directorate General of Trade Remedies. That duty was imposed at 25 percent on solar cells and modules from China and Malaysia for one year beginning 30 July 2018; followed by 20 percent for the next six months and 15 percent for another six months period ending July 2020. Currently India attracts 20 percent safeguard duty and no basic customs duty on imported solar cells and modules from China, Malaysia and Vietnam. The government had launched a manufacturing-linked tender with inbuilt subsidy for solar projects in order to boost domestic production.

The MNRE has proposed a draft policy for the supply of RTC power to discoms which would be a mix of renewable energy and electricity generated in coal-based plants. The idea is to address the biggest issue with large scale uptake of clean energy – intermittency. Solar and wind energy are not available throughout the day severely limiting their use in modern grids. According to the draft, a generator has to supply power such that at least 51 percent of the annual energy supplied corresponds to RE and the balance is drawn from thermal sources. The generator will supply RE power complemented with thermal power, in RTC manner, keeping at least 80 percent availability on an annual basis.

Indian Railways has planned to source around 1,000 MW solar power and 200 MW of wind power by 2021-22 across zonal railways and production units, the rail ministry said. Of this, 500 MW solar plants are to be installed on the roof top of Railway buildings which will be used to meet non-traction loads at Railway Stations while 500 MW land based solar plants will be used to meet both traction and non-traction requirements. South Central Railway zone is implementing several measures aimed at energy conservation by harnessing renewable energy. This includes installation of solar panels at stations and service buildings across the zone. The Nandyal–Yerraguntla section in Guntakal Division has been declared as the first solar section in South Central Railway. Across the network of Indian Railways, 16 stations have already been declared green which are meeting energy needs completely either through solar or wind power.

The MERC has issued a draft policy announcing its renewable purchase obligation from 2020 to 2025. The solar targets mentioned in the policy draft will start at 4.5 percent in 2020-21 and go up to 13.5 percent over the next five years. MSEDCL has protested stating that the commission’s proposal to revise the solar target to 13.5 percent by 2024-25 was quite stiff and that despite best efforts, it would not be able to achieve it. Total solar capacity of 12,500 MW would be required by 2024-25 to achieve the target against the present capacity of 4,200 MW. While protesting the target, MSEDCL is doing its best to scuttle solar rooftop, which can help it in meeting the MERC target. The MERC has done away with the plan to have a compulsory gross metering for solar power generation. The measure was one of the alleged provisions in the draft regulations that did not find any place in the final regulations declared by the regulatory body. While the draft regulations had also envisaged an arrangement by which the power supplying companies were entitled to bill the power produced by solar users at allegedly higher rate, this too has been also made consumer-centric now. Notably, Maharashtra has a target of producing 11,926 MW of solar power by 2022 as part of renewable cumulative power target of 175,000 MW to be achieved the country. The demand to make net billing compulsory for solar rooftop consumers has been rejected by the MERC after it considered all the suggestions and objections to the proposal. According to MERC (Grid Interactive Rooftop Renewable Energy Generating Systems Regulations) 2019, it is up to the consumer to decide whether he wants net metering or net billing. The net billing system proposed by MSEDCL would have made solar rooftop impractical for residents and had been opposed by all consumers including Maharashtra Solar Manufacturers Association. Under the current system, consumers who generate solar power, utilise their share and sell the remaining power units to MSEDCL in exchange for no charge on its regular consumption of electricity supplied by MSEDCL.

Roof Top Solar Projects

The MNRE issued a clarification regarding the second phase of the solar rooftop programme, for which it provides CFA. Meant for the residential sector, the CFA is provided at a 40 percent of the benchmark cost, or the cost discovered through the transparent bidding by the implementing agency- whichever is lower for rooftop systems. The CFA is applicable up to a capacity of 3 kW. For a total system capacity beyond 3 kW but up to 10 kW, CFA is provided at 20 percent of the benchmark cost, or again through transparent bidding. For group housing societies or residential welfare associations, the CFA will be limited to 20 percent for solar rooftop plants for supply of power to common facilities. The MNRE said that the discoms should be prepared for quality measures as prescribed, and quality checks be conducted if deemed necessary by the ministry. The phase II of the solar rooftop programmed was initiated in August last year, with an aim of achieving cumulative capacity of 40,000 MW through solar rooftop projects by 2022.

Rooftops of 140,000 buildings have the potential to generate 2,500 MW of installed solar capacity, according to a BESCOM survey using aerial light detection and ranging technology. The survey was carried out across 1,176 square kilometre in the city. Only 205 MW capacity of SRTPV has been installed till July 2019 in the state, while Karnataka’s solar policy of 2014-21 set an ambitious target of 2,400 MW for grid-connected solar rooftop projects. BESCOM will soon allow third-party investors to rent rooftops of domestic consumers and set up SRTPV systems under various business models. BESCOM has proposed a capital expenditure of ₹12.75 bn for installation of hybrid solar rooftop plants with storage, with a capacity of 1060 MW.

Installation of solar panels at educational institutions will begin in Haryana shortly. Electricity generated by the solar plant will make the college self-sufficient in terms of energy needs, besides reducing its power bill of ₹70,000 to ₹45,000. Several government buildings in Patna including divisional commissioner’s office, have cut down energy bill by 70-80 percent after installation of solar panels. Aimed at promoting renewable source, altogether 23 government buildings across the city were identified for installation of solar panels. As part of PSCL, 10 solar rooftop panels have so far been set up in the city – one each at DM’s residence, divisional commissioner’s office, Indira Gandhi Planetarium, Bihar Rajya Police Parivahan Mukhyalay and Sachchidanand Sinha Library and four at Bankipore Girls’ High School. PSCL said Bihar Renewable Energy Development Agency has already conducted surveys of the remaining locations. Altogether 181 kW solar panels have started generating electricity at DM’s residence, divisional commissioner’s office and Bankipur Girls’ High School.

The Ludhiana Smart City mission will soon begin second phase of installation of rooftop solar panels and under this government schools and colleges will be covered. The Ludhiana Smart city limited and Punjab Energy Development Authority has signed an agreement wherein the latter will install the rooftop solar panels while funding will come through Smart City Mission. For this project the site survey is almost over and officials have claimed that by the last week of January or first week of February installation process will start. According to the proposal, government schools, government colleges and meritorious schools will get rooftop solar panels. As many as 25 locations have been identified for the purpose. The total capacity of these rooftop panels will be around 800 kW and will cost ₹40.3 mn. The PEDA has already conducted a site survey at the locations. The purpose of the project is to reduce hefty electricity bills at government educational institutions.

Hartek Solar, the rooftop solar division of the Chandigarh based Hartek Group, has marked its presence in the newly merged union territories of Dadra & Nagar Haveli and Daman & Diu by bagging 40 rooftop solar projects of capacity 1 MW in the industrial category in Daman. So as to accelerate the adoption of rooftop solar in Dadra & Nagar Haveli and Daman & Diu, the MNRE had embarked on a big campaign for rooftop solar market aggregation last year. The industrial and commercial categories accounting for 70 percent of India’s total installed rooftop capacity, Hartek Solar has set a target of executing 10 MW rooftop projects in the industrial domain by the end of this year.

The IOC will soon have all its retail outlets in the state run on solar energy. Work on two outlets is complete, while eight more stations are being readied, and is expected to be ready by June. In a first-of-its-kind initiative by SCR, a new booking office with a solar panel roof has been constructed at Kamareddy railway station under the Hyderabad railway division. These types of structures are very useful for small establishments and wayside railway stations in terms of both energy and revenue savings, while ensuring uninterrupted power supply, SCR said.

Utility Scale Solar Projects

The government is set to ink an agreement with NTPC Ltd for developing a 925 MW solar park in Jaisalmer that would fetch nearly ₹40 bn investment. The ultra-mega solar park at Nokh, spread over 1850 hectare, will be the first project for developing a park under the new solar policy announced. RRECL said that discussions and decisions with NTPC have taken a definite shape for developing the Nokh Ultra Mega Solar Park and an agreement is likely to be signed very soon. In the new solar policy that aims to achieve a target of 30,000 MW solar power projects, RRECL has laid emphasis on setting up Ultra Mega Renewable Energy Power Parks in joint venture. RRECL has already had preliminary discussions with Power Finance Corp, SECI, and National Hydroelectric Power Corp for developing solar parks.

Solar power producer, Azure Power, is planning to invest about $3.7 bn by the end of financial year 2024-25, the company said. According to its capex forecast, it will make investment in a range between $2.6 bn and $3.7 bn from 2020-21 to 2024-25, with the highest being $9 bn in FY21. The New Delhi-based firm also said it is not entering into manufacturing but has partnered with Waaree Energies -- one of the largest solar manufacturers in India -- for 500 MW capacity and closed discussions with another manufacturer for another 500 MW. Azure Power had recently won a 4 GW project to develop grid-connected solar generation capacity, expected to be commissioned by 2022 and completed by 2025.

Adani Renewable Energy, a step down subsidiary of Adani Green Energy, has commissioned its 75 MW wind power project having power purchase agreement with MSEDCL at ₹2.85/kWh for 25 years. Commercial sale of power from the project to MSEDCL is expected to commence from 1 January 2020. The Adani group is aiming to become the world’s largest solar power company by 2025 and the biggest renewable energy firm by 2030. In 2019, the Adani Group was ranked as the sixth largest solar player globally and as a part of this journey. Eden Renewables and Adani group have proposed to invest ₹20.72 bn in the renewable power sector and both the projects have been given 100 percent exemption from stamp duty and conversion charges under the new Rajasthan Investment Promotion Scheme. As per the proposals, Eden Renewables will set up 300 MW solar energy project with an investment of ₹15.72 bn in the 3716 bigha. Similarly Adani Group has proposed a 50 MW project for wind energy having investment of ₹5 bn.

Wind Projects

The government is expected to look at incentivising exports of wind turbines by increasing the discount available for companies on export duty to 5 percent from the existing 2 percent under the MEIS. The centre had launched MEIS in 2015 which allows incentives to exporters at a specified rate which varies from product to product and from country to country. The percentage of incentives varies from 2 percent to 5 percent. Indian Wind Turbine Manufacturers Association said that India has a wind energy potential of 302 GW at a hub height of 100 metre. The industry also wants the government to announce an investor-friendly policy for repowering of turbines.

Biomass / Biogas Projects

First waste to energy plant of Indian Railways has been commissioned at Carriage Repair Workshop, Mancheswar, of East Coast Railway. It is the fourth such plant in the country. The plant has a catalytic converter and it converts the waste materials into light diesel oil, gas, carbon powder and water through ‘Polycrack’ technology. The East Coast Railway can sell light diesel oil, use gas and water in its workshop and make carbon powder into bricks. The plant does not create any waste from this process.

Punjab has written to the Centre reiterating its demand for viability gap funding for biomass power projects and biomass solar hybrid power projects to check stubble burning in the state. It has requested framing of scheme/ guidelines for promoting biomass power projects by providing one-time viability gap funding in a phased manner, and for a pilot biomass solar hybrid power project, as suggested by the state government on several occasions. This would go a long way in complying with the directions of the Supreme Court of India for tackling the problem of stubble burning in Punjab. The Punjab government has requested ₹50 mn per MW of biomass power projects and ₹35 mn per MW for biomass solar hybrid power projects to help the state address the problem of pollution arising from stubble burning. The Punjab government has decided to build a 7 MW waste to energy plant at Simgauli village in Mohali district. The project of building the plant in over 50 acre area will be under the Build Own Operate model. The project will be completed within the next two years and the waste to energy plant would generate power from 600 tonnes per day waste collected from Mohali and Patiala. The project will contribute to the implementation of the State Action Plan on Climate Change and also the Swachh Bharat Abhiyan. The MSW had always posed a major challenge to urban local bodies but with this project, it could now be effectively used as a source of renewable energy. The MSW had not been harnessed systematically on a significant scale and hoped that the project would pave the way for more such initiatives.

A Pune-based NGO Keshav Sita Memorial Foundation Trust has approached NMC with a solution to the ever-worsening problem of plastic waste. Under its CSR initiative, the NGO has offered to set up a plant to produce fuel from plastic waste at Bhandewadi dumping yard. Non-bio-degradable plastic has already become a major concern for the civic body. Despite ban on single-use plastic carry bags, city infrastructure like sanitation, water supply and rivers are being badly affected by plastic waste. If the project starts, the NMC will also get royalty from the sale of fuel produced apart from the disposal of plastic waste.

Nuclear Energy

To boost the commercial use of civil nuclear energy in the country, the government has decided to commission a nuclear reactor every year. A 700 MW pressurised heavy water reactor at the Kakrapar nuclear plant in Gujarat is likely to be commissioned by April, the DAE said. The Nuclear Power Corp of India Ltd’s 22 reactors with an installed capacity of 6780 MW are operational, the DAE said. The DAE said the Tarapur atomic power reactors — units 1 and 2 — completed 50 years of operation this year. The two boiling water reactors — the first in the country — were commissioned in October 1969.

Rest of the World

Global

Renewable energy should supply 57 percent of global power demand by the end of the decade, up from 26 percent, according to IRENA. Additional investments bring significant savings by minimising losses caused by climate change because of inaction. Savings could amount to between $1.6 tn and $307 tn annually by 2030, IRENA said. IRENA data shows that 60 percent of new electricity access can be met by renewables in the next decade through stand-alone and mini-grid systems.

China

China will allocate 1.5 bn yuan ($217.27 mn) to new solar power projects in 2020, its energy administration said. Of the funds, 500 mn yuan will be given to distributed power projects for residential users, and the remaining 1 bn yuan will be split between large-scaled solar stations and distributed power projects for industrial and commercial users. China has planned to scale back its total renewable power subsidy to 5.67 bn yuan in 2020 from 8.1 bn yuan last year, as Beijing believes clean energy sources are capable of competing subsidy-free with coal-fired power. China extended anti-subsidy duties on solar-grade polysilicon from the US to another five years, the country’s commerce ministry said. The anti-subsidy tax rate applicable on polysilicon from companies in the US is 2.1 percent, with some firms exempt from the duty. China, the world’s largest solar polysilicon producer, began imposing anti-subsidy duties on the US polysilicon producers in 2014.

Rest of Asia

Indonesian government plans to remove old coal-fired power plants with plants using renewable energy. The country will replace coal power plants aged 20 years and older. Indonesia, a major coal exporter, uses coal to power around 60 percent of its electricity needs but the government is aiming to double the contribution of renewables, which include solar power, geothermal and hydropower, among others.

Middle East and Africa

The UAE grew its renewable energy portfolio by more than 400 percent in the last 10 years, and is on track to double that again in the coming decade, ADNOC said. ADNOC will reduce greenhouse gas intensity by an additional 25 percent. ADNOC said it would expand the capacity of its Al Reyadah carbon capture, utilization and storage facility, aiming to reach 5 million tonnes of carbon dioxide per year by 2030. Through initiatives such as the Mohamed bin Rashid Al Maktoum Solar Park and Masdar, renewable energy projects totalling almost 12 GW were launched in the UAE and in more than 30 countries around the world. The ADNOC said the company would further strengthen its commitment to environment stewardship by reducing greenhouse gas emission intensity by 25 percent by the year 2030. It will limit fresh water consumption to below 0.5 percent of total water use and increase carbon capture, utilisation, and storage program by 500 percent. The UAE’s nuclear power plant’s first reactor is ready to start operating. Barakah is the UAE’s first nuclear plant and the world’s largest when complete, with four reactors and 5,600 MW of capacity. It is being built by Korea Electric Power Corp. Qatar has signed an agreement with France’s Total and Japan’s Marubeni to build a solar power project with capacity of about 800 MW. The cost of the project is about 1.7 bn riyals ($467 mn). Qatar’s Siraj Energy, a joint venture owned by QP and Qatar Electricity and Water Company, will hold a 60 percent stake in the solar plant. The remaining 40 percent will be owned by both Marubeni and Total. The project will reach full capacity by the first quarter of 2022. Qatar, the world’s largest supplier of LNG plans more solar projects as the country aims to reduce carbon emissions and minimise its impact on the environment. Qatar commissioned a carbon capture and storage plant and aims to sequester 5 mt of carbon from its LNG operations by 2025.

Europe and UK

A group of Barclays shareholders coordinated by responsible investment lobby group ShareAction want the bank to phase out financing fossil fuels, stepping up pressure on one of Europe’s biggest funders of the sector. Eleven institutional investors have filed a resolution to be voted on at Barclays’ annual meeting in May, requiring the bank to set out plans to stop providing all financial services to firms not aligned with the Paris climate agreement. The pressure on Barclays comes at a time when shareholders, prompted by activists and mounting public concern, are increasingly urging the companies they invest in to do more to combat the climate crisis. Up to now, investors have largely focused their collective efforts on big oil and gas companies responsible for producing fossil fuels, with resolutions at companies including Royal Dutch Shell, BP and Equinor. The Barclays resolution will mark the first time a European bank has faced such shareholder action on fossil fuel financing.

RWE, Germany’s largest power producer, could become a takeover target as big industry players strive to expand their renewable portfolios around the world, Goldman Sachs said. Following an asset swap with E.ON, RWE last year became Europe’s third-largest renewables player after Spain’s Iberdrola and Italy’s Enel, and the world’s No.2 offshore wind player after Denmark’s Orsted. Goldman said the global renewables market was fragmented, and that consolidation to add scale was becoming increasingly important to deliver profitable growth. Germany’s four power grid operators said that a sharp rise in the country’s renewable generation capacity was needed over the next 15 years to meet demand from the electrification of heating, transport and other industries. Presenting their capacity planning needs through 2035, the four high voltage transmission grid firms said that Europe’s biggest economy will need installed renewable power capacity of between 235 and 276 GW by 2035 compared with 116 GW in 2018. Germany needs to meet a target of renewable energy sources contributing 65 percent of power output in 2030 - compared with 40 percent now - as part of the country’s overall goal to cut CO2 emissions by 55 percent compared with 1990 levels by that date. Portuguese oil and gas company Galp Energia will buy solar power projects from Spain’s ACS, envisaging total spending of €2.2 bn in the next four years and making Galp the leading solar power producer in Iberia. Galp said it would pay ACS €450 mn when the deal for a total of 2.9 GW of capacity, most of it yet to be built, is closed, and assume €430 mn worth of project finance debt. It expects to close the deal in the second quarter of this year. The rest will be invested in the development and construction of the projects, it said. It saw potential opportunities to bring in a partner to its renewable energy ventures.

Britain, the birthplace of coal power, produced more electricity from zero-carbon sources such as wind, solar and nuclear than from fossil fuel plants for the first time in 2019, National Grid said. Having built the world’s first coal-fired power plant in the 1880s, coal became Britain’s dominant electricity source and a major economic driver for the next century. But last year Britain became the first G7 country to commit to reaching net-zero emissions by 2050 and in November will host the United Nations’ international climate talks in Glasgow. The National Grid data shows wind, solar, hydro, nuclear and imports produced about 48.5 percent of Britain’s electricity in 2019 while fossil fuels such as coal and gas contributed about 43 percent. The rest came from biomass. The increase in zero-carbon power marks a huge shift from almost two decades ago when fossil fuels provided about three quarters of the country’s electricity. The shift has been mainly thanks to a rapid increase in Britain’s renewable power capacity, with wind, solar and hydro producing more than a quarter of the country’s electricity in 2019, up from only 2.3 percent in 1990. The data shows that 8 percent of Britain’s electricity came from imports from Europe via interconnectors with France, Belgium, the Netherlands and Ireland. About 66 percent of these imports came from zero-carbon generation. Britain’s windy coastlines in particular have proved to be an ideal host for large wind projects, with the northwest coast of England home to the world’s largest offshore wind farm, Orsted’s Walney Extension.

Denmark sourced almost half its electricity consumption from wind power last year, a new record boosted by steep cost reductions and improved offshore technology. Wind accounted for 47 percent of Denmark’s power usage in 2019, the country’s grid operator Energinet said, up from 41 percent in 2018 and topping the previous record of 43 percent in 2017. European countries are global leaders in utilising wind power but Denmark is far in front of nearest rival Ireland, which sourced 28 percent of its power from wind in 2018 according to data from industry group WindEurope. Across the European Union, wind accounted for 14 percent of consumption last year, the group said. The higher proportion of wind energy in Denmark last year was partly due to Vattenfall starting operations at the Horns Rev 3 offshore wind farm in the North Sea in August. The share of power from wind turbines at sea increased to 18 percent last year from 14 percent in 2018, Energinet said. Onshore wind accounted for 29 percent last year. Denmark aims to reduce greenhouse gas emissions by 70 percent by 2030, with a new climate law passed late last year targeting an increase in the share of electricity sourced from renewable power to 100 percent.

The French government, which has asked state-controlled utility EDF to look into the feasibility of building six new EPR reactors, said it would not decide whether to go ahead before the end of 2022. The decision on new reactors will come after the start-up of EDF’s Flamanville 3 EPR reactor, which is under construction in the north of France. France will proceed with shutting down 14 nuclear reactors as indicated in its long-term plan, if all conditions are met, and will continue to diversify its energy mix. France aims to cut the share of nuclear power in its electricity mix to 50 percent by 2035 from around 75 percent now, while increasing the share of renewable solar, wind and biomass. The two oldest reactors at Fessenheim will halt production in February and June this year. Two others will be halted in the middle of the decade, two others in 2027 and 2028, and the remaining reactors by 2035. France could shut down its next two nuclear reactors in 2025-2026 if market conditions are right, earlier than expected as it presses ahead with plans to close 14 reactors by 2035, a government consultation document showed. Nuclear-dependent France aims to reduce the share of atomic power in its electricity generation to 50 percent by 2035 from 75 percent currently. France’s oldest two reactors at the Fessenheim nuclear plant will stop production in February and June this year. The next closures had been expected in 2027-2028. State-controlled utility EDF, which operates France’s 58 nuclear reactors, has proposed to the government that it studies the shutdown of pairs of reactors at its Blayais, Bugey, Chinon, Cruas, Dampierre, Gravelines and Tricastin plants as part of the nuclear phase out.

South America

Canada’s Brookfield Asset Management Inc has received the go-ahead from Brazilian antitrust regulator Cade for certain solar energy projects in the country’s northeast. The solar power plants, to be built in the state of Ceará, will have total capacity to produce 278 MW of electricity, according to a description of the projects in Cade’s decision. The move underscores Brookfield’s drive to expand its presence in Brazil’s electricity sector, where it operates hydro power dams, wind farms and electricity transmission assets.

| RE: Renewable Energy, MW: megawatt, GW: gigawatt, mn: million, bn: billion, tn: trillion, UN: United Nations, MNRE: Ministry of New and Renewable Energy, SECI: Solar Energy Corp of India, EoI: Expression of Interest, discom: distribution company, MWh: megawatt hour, US: United States, RTC: round-the-clock, MERC: Maharashtra Electricity Regulatory Commission, MSEDCL: Maharashtra State Electricity Distribution Company Ltd, CFA: Central Financial Assistance, kW: kilowatt, BESCOM: Bangalore Electricity Supply Company, LNG: liquefied natural gas, SRTPV: solar rooftop photovoltaic, PSCL: Patna Smart City Ltd, IOC: Indian Oil Corp, SCR: South Central Railway, RRECL: Rajasthan Renewable Energy Corp Ltd, FY: Financial Year, MEIS: Merchandise Export from India Scheme, MSW: Municipal Solid Waste, NMC: Nagpur Municipal Corp, DAE: Department of Atomic Energy, CO2: carbon dioxide, IRENA: International Renewable Energy Agency, ADNOC: Abu Dhabi National Oil Company, UAE: United Arab Emirates, UK: United Kingdom |

NATIONAL: OIL

States to decide when petroleum products are to be taxed under GST: Finance Minister

10 February. Finance Minister Nirmala Sitharaman said that petrol and petroleum products are already under Goods and Services Tax (GST) and the states have to decide when they want petrol and petroleum products to be taxed under GST. She said that the petroleum products have been placed under the GST regime due to the foresight of the late Finance Minister Arun Jaitley.

Source: Livemint

IOC’s Mathura refinery starts producing 100 percent BS-VI fuel ahead of deadline

8 February. Indian Oil Corp (IOC)’s Mathura refinery completed the revamp of its all units to produce BS-VI grade fuels ahead of the deadline for roll out of newer emission norms from April 2020. The refinery had undertaken projects to upgrade its diesel and gasoline units for bringing down sulphur level by nearly 80 percent, Mathura Refinery Executive Director Arvind Kumar said. With the commissioning of these facilities, Mathura Refinery is now supplying 100 percent of its MS (Petrol) and HSD (diesel), meeting BS-VI norms, he said. A deadline was also set for rolling out cleaner (BS-VI compliant) fuel across the National Capital Territory (NCT) by 18 April and National Capital Region (NCR) by 19 April, however Mathura Refinery completed the task , ahead of stipulated time, he noted.

Source: Business Standard

Oil leak from ONGC pipeline damages agricultural land, crops in Tiruvarur

8 February. Oil spill from the underground pipeline of ONGC (Oil and Natural Gas Corp) carrying natural oil has damaged a fertile land cultivated with black gram crop in Tiruvarur district. Due to the oil leakage, a portion of the land is inundated with the crude oil. Beneath Panneerselvam’s cultivation field, ONGC had installed pipeline to carry the crude oil extracted from ONGC’s oil wells in Kamalapuram locality to one Early Production System near Moolangudi, where the crude oil will be collected for further processing. ONGC Cauvery asset managing the natural oil and gas exploration in Cauvery delta districts including Tiruvarur said that a study will be done in the pipeline running below the Moolangudi village in Tiruvarur district to prevent such incidents in future.

Source: The Economic Times

BPCL commences export of very low sulphur fuel oil from Kochi

8 February. With the export of its first parcel of IMO 2020 grade Very Low Sulphur Fuel Oil (VLSFO) from Kochi to Singapore, Bharat Petroleum Corp Ltd (BPCL) has become the first oil marketing company to export this cleaner shipping fuel from the country. The tanker MT Alnic MC carrying the first parcel of 15 thousand metric tonne (tmt) VLSFO to Singapore was flagged off by Cochin Port Trust Chairperson M Beenafrom the Cochin Port, BPCL said.

Source: Business Standard

Numaligarh refinery gets 200 acre land within Paradip port for oil terminal

7 February. Paradip Port Trust (PPT) has alloted 200 acres of land to Numaligarh Refinery Ltd (NRL) on long-term lease basis to set up a crude oil terminal within the port premises. The facility will enable NRL to import crude oil via the major port at Paradip to cater to its requirement post ramp up of its refinery from three million tonnes per annum (mtpa) to nine mtpa. In April 2017, NRL had signed a Memorandum of Understanding (MoU) with PPT and Indian Oil Corp (IOC) for imports of crude oil through the major port. Under NRL’s proposed refinery expansion project, a 28 inch diameter, 1400 kilometre (km) crude oil pipeline of one mtpa capacity will be laid for transporting six mtpa of imported crude oil from Paradip Port in Odisha to Numaligarh in Assam. The MoU provides for utilizing IOC’s spare capacity of existing SPMs (Single Point Mooring) at Paradip. PPT will extend land space for installation of crude storage tanks, pump house and township at Paradip.

Source: Business Standard

LPG coverage 96.9 percent as on 1 January: Oil Minister

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">High share of LPG coverage does not imply household level use of LPG!

< style="color: #ffffff">Ugly! |

5 February. There are about 275 mn LPG (liquefied petroleum gas) or cooking gas connections in the country and the coverage has reached 96.9 percent as on 1 January 1 this year, Rajya Sabha was informed. Responding to a query on lower LPG connections in Bihar, Oil Minister Dharmendra Pradhan said the state had achieved 22-23 percent coverage when the scheme was launched. Now, the penetration has increased to 75 percent in the last five years. The initiative to provide more LPG connections in Bihar in the future will continue, he said. The average penetration of LPG connections in these two states was 20-25 percent. However in the last five years, it has increased to 75 percent in Chhattisgarh and 77 percent in Jharkhand, he said. To another query if the government has plans to allot cooking gas agencies or petrol pumps to people losing their kerosene business on promotion of LPG connection, he said kerosene, cooking gas and petrol pump businesses are different. He said that kerosene distribution is a state subject and the state governments can take a decision on mandatory stamping of ration cards to mark the existence of a LPG connection, for Direct Benefit Transfer (DBT) of kerosene to a ration cardholder.

Source: Business Standard

Common man suffers high fuel prices even as world oil market slides

5 February. The high retail price of petrol and diesel continues to impact the common man even though global market has thrown enough cues for a sharp cut in the price of auto fuels. While the Coronavirus scare and continued flat demand for oil has pushed down the global crude price that has fallen sharply by over 24 percent to $53 a barrel over last one month, there has been less than proportional decrease in retail price of petrol and diesel with oil companies building a cushion for possible increase in oil prices later this year. Petrol is being retailed at Rs72.98 a litre while diesel at Rs66.04 a litre in Delhi when crude oil price of Indian basket is about $55 a barrel. At this level of crude in September-October 2017 (crude price between $ 54-56 a barrel), petrol was being retailed between Rs69 and Rs70 a litre and diesel between Rs57 and Rs58 a litre in Delhi. Again on a crude price of $57-59 a barrel in December-January FY19, petrol prices remained close to Rs71 a litre while diesel at Rs64 a litre.

Source: The Economic Times

Indian Oil Corp signs annual deal on option to buy crude from Rosneft

5 February. Indian Oil Corp (IOC) has signed a deal with Russian oil major Rosneft giving it an option to buy up to 2 million tonnes (mt), or 40,000 barrels per day (bpd) of crude in 2020, Oil Minister Dharmendra Pradhan said. India has been diversifying its sources of crude oil imports, in order to hedge political risks that threaten to choke off supplies from a particular region or country. India’s top refiner will exercise its option to buy Urals crude under this first annual deal with Rosneft whenever the price is low enough to compensate for freight costs, IOC said. The contract gives IOC has the option to take as much as 40,000 bpd of oil this year. Indian state refiners typically buy Russian oil via the spot market rather than under contract. The nation’s crude imports from Russia have typically been low since the freight costs tend to exceed those for Middle East supplies. India is the world’s third-biggest oil consumer and importer. It ships in more than 80 percent of its crude needs, usually relying on the Middle East for most of its supply. Last year, however, the Middle East’s share of India’s crude

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Easier norms for commercial coal blocks will attract investment!

< style="color: #ffffff">Good! |

imports shrank to 60 percent, down from 65 percent in 2018 and its lowest since 2015, as record output from the United States and countries like Russia offered alternatives for importers to tap.

Source: Reuters

NATIONAL: GAS

Government identifies 44 new areas for CGD auctions

6 February. The Petroleum and Natural Gas Regulatory Board (PNGRB) has proposed 44 new geographical areas for the upcoming 11th round of bidding for city gas distribution (CGD). According to the new tentative list, the highest number of CGD areas will fall in Tamil Nadu (eight), to be followed by Maharashtra (seven) and Madhya Pradesh (six). At present, the CGD network covers 232 geographical areas spread over 407 districts in 27 states. Under the ninth and 10th rounds of bidding for CGD networks, the numbers of CNG stations and domestic piped natural gas (PNG) connections are expected to increase by 8,181 and 42 mn, respectively, in the next 8-10 years. The present share of gas in the energy basket of the country is 6.2 percent, and the target is to take it to 15 percent by 2030. As of September 2019, there were 1,815 CNG (compressed natural gas) stations and 54.2 lakh domestic connections across the country. Currently, about 76 percent of the CNG stations and 80-90 percent of the PNG connections are concentrated in Delhi, Gujarat and Maharashtra. The Ministry of Petroleum and Natural Gas has prepared a draft policy for CGD, which, the government expects, will become a template for every state to come up with their own CGD policies. CGD network operators are seen to benefit from a sustained weakness in global spot LNG prices and an expected decline in domestic gas prices.

Source: The Financial Express

NATIONAL: COAL

Coal industry seeks easier norms for commercial blocks

7 February. Industry has sought easier norms for commercial coal blocks, including lesser payment and more lenient requirement of minimum production. Potential bidders want upfront payment to be halved and computed on the basis of extractable reserves in a block and not on the total reserves estimate. The draft rules provide for minimum 70 percent production on an average over a three-year period, while yearly minimum production has to be 50 percent. Potential miners want this changed to 60 percent average production in a five-year period and no yearly production stipulations. Prayas Energy Group, a non-government organisation working in the power sector, suggests yearly production stipulation may be too restrictive given the uncertainty of future coal demand, particularly considering that mine life is likely to be upwards of 25 or 30 years.

Source: The Economic Times

CIL looking to tap non-power sectors for incremental coal

5 February. Mining major Coal India Ltd (CIL) is keen to tap non-power consumers to feed its incremental production post the monsoon period. The miner is looking to ramp up production to meet its targets for the current fiscal at a time when the economic slowdown is impacting demand for the dry fuel by power plants. Coal despatch to the power sector in the first nine months of the current fiscal was down by 8.1 percent at 334.27 million tonnes (mt) as against the figure in the corresponding period a year ago. Coal alloted for spot e-auction, however, was 5.07 mt in December, nearly a 50 percent jump over the same month a year ago. The miner is banking on sectors like cement and sponge iron for incremental coal.

Source: Livemint

NATIONAL: POWER

India’s electricity demand picks up after being hit by sluggish economy

11 February. Electricity demand in India rose in January for the first time in six months, government data showed, after declining since August as the economy slowed. Electricity demand, which rose 3.5 percent in January from a year earlier according to the data, is seen by economists as an important indicator of industrial output. January demand for electricity totalled 105.29 bn units, CEA (Central Electricity Authority) data showed. However, the rise was from a low base, as electricity demand grew in January 2019 at the slowest pace in nearly two years, CEA data showed. Industry use accounts for more than two-fifths of India’s annual electricity consumption, according to government data, with households accounting for nearly a quarter and commercial establishments another 8.5 percent. In 2019, electricity demand in India grew at its slowest pace in six years, amid a broader economic slowdown that led to a drop in sales of everything from cars to food products and also has led to factories cutting jobs.

Source: Reuters

Power tribunal likely for payment disputes

10 February. The government proposes to set up an electricity tribunal to resolve disputes over payment between state distribution companies and generating companies in a time-bound manner, keeping intact powers of the existing appellate tribunal and electricity regulators. The proposed tribunal will have original jurisdiction, meaning it will be able to take up original petitions. The government proposes to amend the Electricity Act, 2003 to provide for a dedicated mechanism for fast dispute resolution, Union Power Minister R K Singh said. The power ministry is likely to introduce the bill in this respect in the budget session itself, he said. He said that the amendment to the Electricity Act will allow imposition of stricter penalties to enforce sanctity of all power related contracts.

Source: The Economic Times

Stage set for more private funds in power distribution business

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Privatisation of discoms will solve the problem of efficiency at the cost of equity!

< style="color: #ffffff">Bad! |

10 February. Leading private power companies have pledged interest in distribution companies (discoms), which could come their way under a new government policy, but added a few caveats: payment guarantee in terms of timely release of government subsidies and receipt of dues from public sector entities, performance incentives and long-term contracts that gel with the long-gestation nature of the power distribution business. The government is framing a new scheme for discoms to finance infrastructure upgrade. According to this scheme, discoms with more than 18 percent aggregate technical and commercial (AT&C) losses will have to involve private players in their operations. State government owning the discoms can choose between allowing full freedom to private players to run discoms under appropriate public private partnership model, or issue franchisee licences to non-government entities to execute specific, segregated operations.

Source: The Financial Express

Chandigarh power department project sees ray of hope, 4 firms come forward

9 February. The UT (Union Territory) electricity department’s ambitious project under the Smart City Mission of conversion of existing overhead lines to the underground system and replacement of infrastructure in Sector 8, finally see ray of hope as four companies have come forward. Already three years have passed, but the project failed to start in Chandigarh. The planning work on this project was started in January 2017 and the UT planned to carry out project after Chandigarh was selected as one of the fast-track cities under the Smart City Mission of the ministry of urban development, Government of India. The UT administration had finalised project of conversion of existing overhead lines to the underground system and replacement of infrastructure in Sector 8. The Joint Electricity Regularity Commission (JERC) has already accorded approval for capital expenditure of Rs178.9 mn for the project on pilot basis. The project was a part of the UT electricity department’s 20-year roadmap for improving power infrastructure in the city. As per the plan, a total of 12 new 66 kilovolt (kV) grid sub-stations will be established while all the existing 66 kV sub-stations will be upgraded in the next 10 years. There is overhead transmission line of 2,037 kilometre (km) in the city, which will be converted into underground line. The department has set a deadline of 10 years for completion of the work. There is also a plan to install new 1,825 distribution transformers.

Source: The Economic Times

KSEB to face severe challenges on open access regime

7 February. KSEB (Kerala State Electricity Board) is facing serious challenges due to the open access regime and promotion of decentralized renewable energy generation. The economic review report said that the twin challenge was eroding the cream of its consumer base considerably and this could eventually lead to a steep tariff hike. However, cases of power theft and connected abnormalities were very low in the state due to strict enforcement of law and awareness in society. KSEB has an anti-power theft squad constituted to detect pilferage and misuse of electricity in all districts.

Source: The Economic Times

50 percent of Delhi population received electricity subsidy in FY20 under AAP

6 February. Around 50 percent of the population of Delhi have had subsidised electricity bills in the current financial year, which is a record of sorts. Half the subsidised population received zero electricity bills during the past five months. This is the highest number receiving subsidy in the last five years of the Aam Aadmi Party (AAP)’s governance in Delhi. In 2014-15, the number of people availing of subsidy was close to 2.5 mn. In the current year, the number has doubled. Since it came to power, AAP has consistently pushed for reduction in electricity rates every year. In July this year, the Delhi Electricity Regulatory Commission (DERC) approved a new model of subsidy over and above the existing scheme. Under it, the fixed charge was cut by more than half. The fixed charge for up to 2 kilowatt (kW) was decreased to Rs20 from Rs125. For the more than 2 kW and less than 5 kW bracket, it was reduced to Rs50 from Rs140. The fixed charge for the more than 5 kW and less than 15 kW was reduced to Rs100 from Rs175. The DERC also gave 100 percent subsidy to the consumption bracket of 0-200 units. An electricity bill comes with two components — a fixed charge, which remains the same every month, and energy charge, which is calculated in accordance with consumption. In the 2019-20 Budget, the Delhi government set aside Rs17.2 bn for 50 percent subsidy in power bills. It passed a supplementary demand for grants, including Rs5.35 bn to cover the additional subsidy announced in July. Industry executives estimate the cost of subsidy to be around Rs22.5 bn, which is likely to increase as consumption goes up every year.

Source: Business Standard

Average spot power price falls 14 percent to Rs2.86 per unit in January on IEX

6 February. Average spot power price in January dipped 14 percent to Rs2.86 per unit as compared to the year-ago month on the Indian Energy Exchange (IEX). The electricity market on the IEX recorded a total trade of 5,062 mn units in January. The market witnessed a significant 50 percent year-on-year jump in traded volumes and continued to be favourable for the buyers. The increase in traded volumes on the Exchange was largely due to a surge in demand by the distribution utilities as well as the open access consumers from almost all parts of the country, primarily southern, western and northern states. On an all-India basis, the peak demand at 171 GW in January 2020, rose 5 percent year-on-year over demand of 162 GW in January 2019. The energy met at 106 bn units in January saw an increase of 3 percent over 103 in January 2019.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

BHEL commissions 300 MW hydro power generating units at Kameng project in Arunachal

10 February. Bharat Heavy Electricals Ltd (BHEL) announced it has commissioned two units of 150 MW capacity each at the Kameng Hydroelectric Project (HEP) in Arunachal Pradesh. The 600 MW run-of-the river project will utilize the flow from Bichom and Tenga rivers. Being developed by North Eastern Electric Power Corp, the greenfield hydro project is located in West Kameng district of the state.

Source: The Economic Times

India’s national transmission grid must urgently modernise to increase rate of renewable energy adoption

10 February. India’s national transmission grid must urgently modernise to increase rate of renewable energy adoption, a study by Institute for Energy Economics and Financial Analysis (IEEFA) suggests. As of December 2019, India had installed 86 GW of renewable energy capacity. The country has an ambitious target of 175 GW of variable renewable energy by 2022, rising to 450 GW by 2030. However renewable energy is intermittent, requiring balancing from peaking power supply, electricity storage like batteries and pumped hydro storage, and/or demand response technologies, as well strong interstate grid connectivity.

Source: The Economic Times

Rajasthan to bring policy for environmental protection

9 February. Rajasthan Chief Minister Ashok Gehlot said the state government will soon bring a new policy for environmental protection as he noted that global climate change is a serious challenge. He said media can play an important role in connecting the younger generation to environmental protection. He said there are immense possibilities of solar and wind energy in Rajasthan. The state government has introduced a new policy to encourage them, he said.

Source: Business Standard

India has closed 170 old and polluting power stations to meet emission norms: Environment ministry

7 February. India is moving towards ultra super critical power plants to burn coal responsibly and has retired 170 old and inefficient power units so far, assuring the nation’s commitment to 40 percent non-fossil fuel based energy by 2030, the environment ministry said. The centre will advise utilities to close thermal power plants which are in violation of National Clean Air Programme (NCAP) norms. The budget allocated Rs44 bn for NCAP for 2020-21.

Source: The Economic Times

Solar power for schools in rural Maharashtra

7 February. Solar panels will be installed at government schools in rural areas of Maharashtra to combat frequent power shutdown and improve digital education. With increasing digitization of schools — e-learning schemes, digital attendance and more — schools need to be self-reliant in terms of electricity to address the need of the hour. The state government will soon install solar panels in every school that would generate 1-1.5 kilovolt (kV) electricity. The solar panel project would be initiated with the help of Maharashtra Energy Development Agency.

Source: The Economic Times

20 government departments to be powered by solar plant in Bijnor

5 February. Work on installation of a 50 kilowatt (kW) solar power plant has begun at Vikas Bhavan building. The building houses at least 20 government departments. The district’s largest solar plant, constructed at a cost of Rs23 lakh, will be offering excess power to the electricity department. The solar power generation plant will be a boon for environment as it will curb use of diesel generators during power cuts at Vikas Bhavan. Besides, these generators emit smoke and cause air pollution.

Source: The Economic Times

INTERNATIONAL: OIL

Guyana aims to agree to oil prices with Exxon before government’s first export

11 February. Guyana is aiming to complete talks with the Exxon Mobil Corp-led consortium producing oil off its coast over crude pricing, lifting costs, and scheduling before the government exports its first cargo, energy director Mark Bynoe said. Exxon Mobil and partners Hess Corp and China National Offshore Oil Corp (CNOOC) inaugurated oil output in December at the prolific offshore Stabroek block, aiming to ramp it up to 120,000 barrels per day (bpd) this year. Guyana had no prior history of crude production. The government plans to export its first cargo of 1 mn barrels, following two shipments chartered by Exxon, Bynoe said. The Liza-1 field, the first to produce in the massive 26,800 square kilometre concession, has produced more than 2.7 mn barrels of crude since output began. The ramp-up of Guyana’s nascent oil industry comes ahead of 2 March presidential elections. The opposition has pledged to review oil deals signed under President David Granger’s government if it wins the vote.

Source: Reuters

Belarus takes oil from non-transit part of Druzhba pipeline

11 February. Belarusian state oil firm Belneftekhim said it had taken oil for its refineries from the non-transit part of the Druzhba oil pipeline to Europe from Russia and that transit would not be affected. A dispute between Moscow and Minsk over oil supply led the traditional suppliers to Belarus — Rosneft, Lukoil, Gazprom Neft and Surgutneftegaz — to halt oil exports to the state on 1 January.

Source: Reuters

Iraq to cut oil output at Nahr Bin Omar oil field

9 February. Iraq’s Basra Oil Company (BOC) will cut crude oil output at the Nahr Bin Omar field to a minimum because of pollution and gas emissions. BOC director general Ihsan Abduljabbar said it has been decided to cut crude oil production to minimum and to stop operating all oil wells to provide environmental protection.

Source: Reuters

Iran supports unanimous OPEC output cut plan: Zangeneh

8 February. Iran supports deeper crude oil cuts by the Organisation of the Petroleum Exporting Countries (OPEC) if a majority of members agreed with it, Oil Minister Bijan Zangeneh said. A technical panel, known as the JTC, that advises OPEC and its allies led by Russia - a grouping known as OPEC+ - proposed a provisional cut of 600,000 barrels per day (bpd). OPEC producers in OPEC+ are currently discussing whether to meet earlier than their scheduled gathering in Vienna on 5-6 March.

Source: Reuters

Shell boosts crude output in top US shale field to 250k bpd

5 February. Royal Dutch Shell, which plans billions of dollars in spending on shale drilling projects, boosted output in the top US (United States) shale field to 250,000 barrels per day (bpd) in December. Shell plans to spend about $3 bn per year for the next five years on shale projects. Its Permian Basin production rose more than 100,000 bpd in the last year. Shell and rival oil majors Exxon Mobil, Chevron and BP are spending billions in the Permian Basin of Texas and New Mexico. The companies see shale as a short-cycle asset that complements projects such as deepwater wells that take years to bring into production. The Permian has 30 years of so-called “tier one” high quality drilling inventory and will remain at the heart of US oil growth. The US drilling industry flared or vented more natural gas in 2019 for the third year in a row, as soaring production in Texas, New Mexico, and North Dakota have overwhelmed regulatory efforts to curb the practice, according to state data and independent research estimates.

Source: Reuters

INTERNATIONAL: GAS

China’s biggest LNG importer suspends some contracts as virus spreads

6 February. China National Offshore Oil Corp (CNOOC), the country’s biggest importer of liquefied natural gas (LNG), has suspended contracts with at least three suppliers amid the rapid spread of the coronavirus. CNOOC, which operates nearly half the terminals in China that receive LNG, had declared force majeure, which allows companies to suspend their obligation to fulfill contracts after unexpected events such as strikes and natural disasters. The biggest suppliers of LNG to CNOOC include Anglo-Dutch energy company Royal Dutch Shell, France’s Total, Australia’s Woodside Petroleum and Qatargas. The force majeure notice covers CNOOC’s LNG purchases for February and March. China is the world’s second-largest importer of LNG, and its spot purchases of the super-chilled fuel and other energy products have almost ground to a halt as the coronavirus spreads rapidly throughout the country. LNG traders said they were scrambling to divert shipments or find new outlets for cargoes destined for China, driving spot prices for LNG in Asia to record lows.

Source: Reuters

INTERNATIONAL: COAL

Chinese coal traders hunt for short-term buys amid virus disruption

11 February. Chinese coal traders and small coal-fired utilities are scrambling to lock in supplies of fuel from miners, worried about the prospects of market tightness as downstream users return to work after an extended national holiday. Coal consumption is expected to pick up as work resumes at factories such as cement makers and chemical plants but the market worries increasing downstream demand will outstrip the pace of recovery in production by coal mines. Medium- and small-sized coal-fired utilities not bound by long-term contracts with coal mines are scrambling for spot market purchases, as concern grows about supply in coming weeks, according to analysts and four coal traders. Benchmark thermal coal with energy content of 5,500 kilocalories a kg in China stood at 576 yuan ($82.56) per tonne, its highest since mid-October. Production has resumed at 57.8 percent of coal mines, the National Development and Reform Commission said.

Source: Reuters

US energy secretary hopes Mexico, Canada will help export American coal

8 February. US (United States) energy secretary Dan Brouillette said that Canada and Mexico could help export US coal to Asia to get around the blocking of shipments by West Coast states concerned about the impact of the fuel on climate change. Brouillette said he expects the two US neighbours will offer opportunities to export coal in talks that could be facilitated by the new North American trade agreement, the US-Mexico-Canada Agreement (USMCA) that President Donald Trump signed. Wyoming is a top US coal producing state, but its exports have been hampered. The states of California, Washington and Oregon have blocked permits for coal ports on concerns about coal’s impact on climate change. Some US lawmakers have complained about a lack of environmental standards in the USMCA. The West Coast Canadian province of British Columbia already exports some US coal. Brouillette said the Energy Department will direct up to $64 mn in funding for research and development into more efficient coal plants. Brouillette said some types of coal could be processed to remove minerals for electric batteries that are in demand for electric vehicles and storing renewable power.

Source: Reuters

INTERNATIONAL: POWER

Egypt’s power subsidy falls to zero in second half of 2019

11 February. Egypt spent nothing on electricity subsidies in the second half of 2019, down from 7.992 bn Egyptian pounds ($510.02 mn) the same period a year earlier, a finance ministry semi-annual report showed. The North African country has increased electricity prices for both households and industry by an average of about 15 percent over the 2019-2020 fiscal year that began in July. It said its goal is to cut electricity subsidy spending to four billion Egyptian pounds for the full fiscal year. The report showed Egypt also cut its spending on energy subsidies, excluding power, to 9.88 bn Egyptian pounds in the second half of 2019 from 30.17 bn in the second half of 2018.

Source: Reuters

South Africa plans new generating firm to boost power security

6 February. South Africa is planning to create a new power generating company separate from struggling state-owned utility Eskom to boost energy security. Eskom, which generates more than 90 percent of the country’s electricity, is mired in financial crisis and suffers frequent breakdowns at its coal-fired power plants, forcing it to implement power cuts that have dented economic output. Mineral Resources and Energy Minister Gwede Mantashe said he wanted industry to partner with the government on its formation, but it is not clear what that partnership would entail. It is also not clear which generating technologies it would employ.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Chinese firm applies to build $1.4 bn hydropower power plant on the Nile: Uganda

11 February. A Chinese firm has applied to Ugandan authorities for a licence to develop a $1.4 bn hydropower plant that could potentially expand the country’s generation capacity by 40 percent. The firm, POWERCHINA International Group Ltd, wants to develop the Ayago Hydroelectric Power Station, located on a section of River Nile between the lakes Kyoga and Albert, according to its licence application. Electricity Regulatory Authority licences all power generators in the country and is also responsible for setting generation and end-user power tariffs. The project could potentially ramp up Uganda’s generation capacity by 40 percent to about 2,800 MW, according to the energy ministry data.

Source: Reuters

Global CO2 emissions from power generation flatten out: IEA

11 February. Global carbon dioxide (CO2) emissions from power production flattened last year to 33 gigatonnes after two years of increase, even though the world economy expanded, the International Energy Agency (IEA) said. The growth of renewable energy and fuel switching from coal to natural gas led to lower emissions from advanced economies. Milder weather in several countries and slower economic growth in some emerging markets also contributed, the IEA said. Late last year, international climate experts warned that global temperatures could rise sharply this century with “wide-ranging and destructive” consequences after greenhouse gas emissions hit record levels in 2018. Governments face a deadline this year to set more ambitious emissions cut targets under the 2015 Paris Agreement, a global climate pact aimed at limiting global warming this century. European Union emissions fell by 160 million tonnes (mt) or 5 percent last year from a year earlier due to more use of natural gas and wind power in electricity generation. The United States recorded a fall of 140 mt or 2.9 percent in emissions from the previous year. Japan’s emissions fell by 45 mt, or around 4 percent, as output from recently restarted nuclear reactors increased. But emissions in the rest of the world increased by nearly 400 mt in 2019, with almost 80 percent of the growth coming from countries in Asia where coal-fired power generation continued to rise. China’s emissions rose at a slower pace than previously due slower economic growth and higher output from low-carbon sources of electricity such as nuclear and renewables. Emissions growth in India was “moderate” last year, according to the IEA. Coal-fired power generation in the country fell for the first time since 1973 but fossil fuel demand in other areas such as transport offset the decline in India’s power industry.

Source: Reuters

Australia plans new bank stress tests to assess climate change impact

11 February. Australian regulators plan to introduce mandatory stress tests soon that will look at the impact of climate change on banks, insurers and the A$3 tn ($2 tn) pension fund industry. The Australian Prudential Regulatory Authority (APRA) said that the development of a climate-change stress test was a key measure as it boosts scrutiny of how financial institutions manage their climate risks. Australian banks have already started taking steps to combat the effects of climate change on their business models. In December, the Bank of England (BoE) said Britain’s top banks and insurers should be tested together for the first time in 2021 to quantify the potential financial damage from climate change. The BoE chairs an international group of regulators that is developing a global climate stress test.

Source: Reuters

Google plan to buy into largest African wind farm ended by delay

10 February. Google’s plans to buy a 12.5 percent stake in Africa’s largest wind farm have been canceled after delays to the project, Danish wind turbine maker Vestas said. The 310 MW Lake Turkana wind farm in Kenya was initially set for completion 2017, after which Google had committed to buy the stake from Vestas. But the delay led to the cancellation of the deal with Google in 2019, Vestas said.

Source: Reuters

Brazil environment agents surprised by deforestation through rainy season

7 February. Aggressive deforestation is starting in Brazil’s Amazon rainforest, environmental enforcement agents said, with government data showing destruction doubling in January compared with a year ago. More than 280 square kilometre (km) of rainforest were destroyed, according to preliminary statistics released by space research agency INPE. The agency released data only for the first 30 days of the month, without explanation. President Jair Bolsonaro has said he is unfairly demonized by environmentalists and that Brazil remains a model for conservation. Destruction is down from highs of more than 1,000 square km per month in July through September, due to the onset of the rainy season, when the forest floor turns to mud, making ground transport difficult in places.

Source: Reuters

Shell to build its first solar farm in Australia

7 February. Oil and gas major Royal Dutch Shell said it plans to build its first utility-scale solar farm in Australia, part of a global push into the power business and cleaner energy. The 120 MW solar farm at Wandoan in the state of Queensland is expected to be completed in early 2021. The move follows Shell’s acquisition last year of Australian industrial electricity retailer ERM Power and a stake in Australian solar developer ESCO Pacific. It has said it plans to boost annual spending on its power strategy to between $2 bn and $3 bn by 2025.

Source: Reuters

DATA INSIGHT

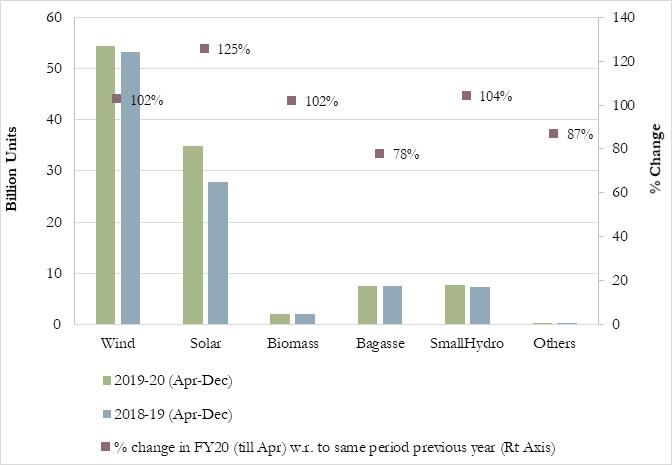

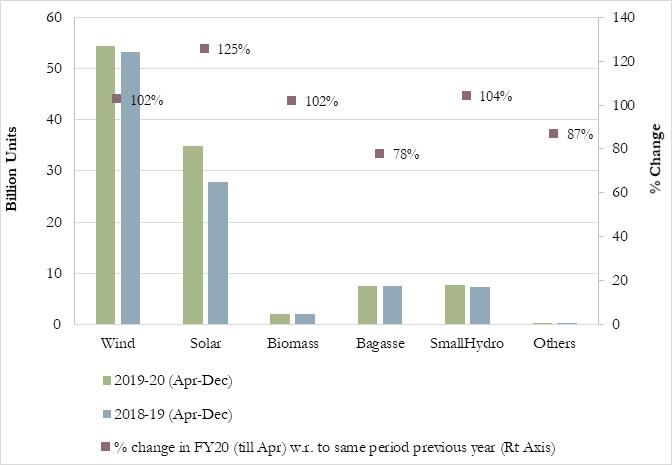

All India (Renewables) Electricity Scenario

| Renewable Electricity Type |

Installed Capacity MW (as on December 2019) |

| Wind |

37,505.18 |

| Solar |

33,730.56 |

| Biomass & Bagasse |

9,861.31 |

| Small Hydro |

4,671.557 |

| Others |

139.8 |

| Total |

85,908.41 |

Renewables Electricity Generation for FY20

Source: Central Electricity Authority

Source: Central Electricity Authority

|

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar |

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Central Electricity Authority

Source: Central Electricity Authority PREV

PREV