-

CENTRES

Progammes & Centres

Location

The government proposes to give online clearances to coal mining projects. The mine online application system for the entire mining plan approval process is proposed to be made online for application, processing and approval. This system will ultimately interact with PARIVESH portal of the environment ministry and similar portals of other related ministries and organisations of the central and state governments. The coal ministry said has decided to simplify the process of clearance for coal mining projects to expedite operationalisation of already allotted coal blocks and encourage prospective investors in future auctions. The coal ministry has re-engineered the mining plan preparation and approval process, which is likely to slash the approval period from the present 90 days to about 30 days. Illegal coal mining and its transportation have been going on in Assam and the state government is taking action to prevent such activities. The government said that there is no "coal syndicate" operating at present. Currently, the cases of illegal coal mining and its transportation are being investigated by CID wing of the Assam Police. From January 2016 to October 2019, a total of 254 cases of illegal coal transportation have been registered and 422 persons were arrested, while 665 coal-laden vehicles were seized in this period. The Office of the Transport Commissioner has intercepted a total of 10,793 trucks transporting coal for overloading across the state.

The coal ministry has asked CIL to either expedite the operationalisation of 110 additional blocks allotted to it or return the mines to the government. The coal ministry recently enquired from the PSU about the operational status of the additional blocks allotted to it, and whether extraction from these coal blocks is techno-economically feasible. The government was told that of the 110 additional CIL blocks, 50 were explored, 41 were under exploration and balance 19 were partly/regionally explored. Further, out of 50 explored blocks, project reports of 25 blocks have been prepared, the coal ministry was informed. CIL accounts for over 80 percent of domestic coal output. The firm had earlier said that it will produce 750 mt of coal in the next financial year. The PSU will further produce 1 bt of coal by FY2024. CIL is targeting to produce 660 mt of the dry fuel in 2019-20 compared to 607 mt in the last fiscal. The Union power ministry has formulated a methodology for conducting coal auctions for power plants without sufficient PPAs. The methodology paves the way for such units to apply for coal linkages, provided electricity produced from this coal is sold through spot power exchanges or through the government’s ‘DEEP’ portal, where bidding is conducted for bilateral short-term supply. This move is part of the Scheme for Harnessing and Allocating Koyala (Coal) Transparently in India (Shakti scheme), which was amended in March after the Cabinet Committee on Economic Affairs had approved certain recommendations of a high-level empowered committee constituted to address issues of stressed thermal power projects. The original version of the Shakti scheme allowed coal supply only to power generation capacities with long-term and mid-term PPAs. According to the latest guideline, CIL and Singareni Collieries Company will have to earmark mines for such auctions within the next 45 days. The quantity of coal supplied through this route should help the plant run for three months, the government said. Winning bidders will have to intimate their lenders every month that the net surplus generated after meeting operating expenses are being used to service debts. If it is found that a power plant has diverted this coal for other use, it will be barred from receiving coal through this policy for three years. The coal ministry allotted five coal mines to Birla Corp, Vedanta, Prakash Industries and Powerplus Traders in the first block auction in four years, which for the first time gives operators the freedom to sell 25 percent output in the market. The freedom to sell a quarter of the output is seen as the harbinger of commercial mining in the country, which has been cleared by the government. Birla Corp bagged the Bikram and Brahmapuri blocks in Madhya Pradesh, quoting prices of Rs154 and Rs156/tonne, respectively. Vedanta quoted Rs1,674/tonne for Jamkhana mine in Odisha. Prakash Industries bagged Bhaskarpara block in Chhattisgarh at Rs1,100/tonne and Powerplus Traders was allottd Jagannathpur B block in West Bengal at Rs185/tonne. The ministry expects revenue share of Rs171.36 bn, excluding royalties, levies and taxes in their 30-year life. The auction was launched for 27 mines for non-regulated sectors. The government believes production from these mines will ease the need for imports and create direct and indirect livelihood opportunities. The Odisha-based Earthmovers has awarded contract to implement an 'intelligent mine' solution at the Pakri Barwadih coal mining project in Jharkhand to Finnish-Russian digital solutions provider Zyfra. Thriveni, through its joint venture TSMPL, operates the power generator NTPC Ltd’s Pakri Barwadih coal mining project. The collaboration with Zyfra was to ensure availability of the latest technology intelligence, like IIOT and AI capabilities, Thriveni said. The government has collected Rs49.72 bn in revenue from auctioned coal blocks since financial year 2014-15. Of the total revenue garnered till 31 October, the maximum of Rs12.8 bn was mopped up in 2018-19. In 2017-18, the revenue stood at Rs11.15 bn while in the preceding fiscal, it was Rs10.18 bn.

Coal production and offtake were higher in the month of November 2019 sequentially over the previous month by 27 percent and 17 percent respectively, as CIL has been gradually recovering from the impacts of the monsoon. CIL production for November was at 50.02 mt an absolute increase of 10.67 mt compared to that in the previous month of October registering a growth of 27.1 percent. But, the monthly production under review was down nearly 4 percent over the corresponding month of the previous year. While coal off-take for November 2019 grew by almost 17 percent month-on-month comparison supplying 47.37 mt of coal. Besides monsoon, law and order problem at Mahanadi Coalfields Ltd that accounts for 25 percent of total production for the PSU miner continues to affect production. CIL has a plan to add fresh production capacity of over 400 mt over the next five years. This includes 92 mtpa capacity from 55 greenfield projects and additional 310 mtpa that will come from the expansion of existing 193 brownfield projects. Prior to ongoing tranche of coal allocation, coal blocks were allocated to private companies for captive use purpose only and not for the sale of coal. In the current tranche of the auction process, 25 percent of coal production has been allowed for sale of coal for private companies, he said. The coal ministry has launched portal-based monitoring of on-going projects to ensure their timely completion and has introduced mass production technologies including Powered Support Longwall technology and Continuous Miner technology in underground coal mines to boost production. NLC India Ltd said it is planning to invest more than Rs170 bn for its thermal power projects and has embarked upon afforestation programme inside and outside the coal mining area in Odisha. The company will produce 20 mt of coal per annum from Talabira II and III coal blocks to fuel its 4,200 MW of thermal power projects.

Coal’s use for power in India is set to shrink for the first time in at least 14 years as demand slows and policy driven renewable push erode the fossil fuel’s share. Coal generation fell for a fourth month in November, the longest such streak in government data going back to 2005. When demand is down, utilities end up reducing offtake from costlier coal plants. Power generation from coal, the most polluting fossil fuel, slumped 11 percent from a year earlier in November. Output in the year to November fell 2.4 percent, the first ever drop for the 11-month period. India has a coal-fired generation capacity of almost 198 GW, which accounts for about 54 percent of its installed generation capacity. India’s coal fleet used barely 51.4 percent of its capacity in November, compared with 60.5 percent a year earlier, Central Electricity Authority data showed. Rajasthan, Tamil Nadu and Karnataka could follow in the footsteps of Gujarat and Chhattisgarh to declare a 'no new coal' policy on account of slow or stagnant growth in demand. In Rajasthan, the total installed coal capacity stands at 11.6 GW whereas renewable energy and hydro stands at 11.1 GW. In Karnataka, installed capacity of non-fossil stands at 63 percent, coal capacity stands at 9 GW whereas renewable energy and hydro stands at 17.9 GW. Similarly, in Tamil Nadu, non-fossils exceeds fossils by 2.3 GW, coal stands at 13.5 GW whereas renewable energy and hydro stands at 15.6 GW. Coal power is also more expensive there due to low availability and high transportation cost. Poor demand has however not meant there is no shortage of coal. Despite 20 percent of the total coal production in the country, various thermal power plants and industries in Chhattisgarh are starving for a sufficient supply of fuel. Over 7000 MW capacity industries have been shut down due to lack of coal available to them. Chhattisgarh has nearly 18 percent of the nation’s coal reserves. South Eastern Coalfields Ltd, a subsidiary of CIL operates with a production target of 165 mtpa though the state requires just 19 percent of it, which is around 32 mt for coal-fired power stations and industries. However, merely 50 percent of the state’s small requirement of coal are cited to be met. Owing to huge coal reserves in Chhattisgarh over 200 units have set up their operations expecting convenient access to coal supply from the mines.

India expects imports of coking coal from Russia to increase significantly in coming months. Steelmakers had started testing samples of Russian coal. India long depended on Australia to meet most of its coking coal requirements but has progressively cut down on imports from the country in the last three years. Shipments of coking coal from the US and Canada rose to a sixth of all Indian imports of the fuel during the year ended March 2019, according to government data, while Australia’s share fell to 71 percent from about 88 percent three years ago. Interruptions to Australian supply in recent years, including a flood in a major coal producing region in February and a cyclone which tore into Queensland in 2017, raised concerns in India. Overall coking coal imports to India, one of the world’s fastest growing major economies, rose 10.3 percent to 51.84 mt in 2018/19, with demand for the fuel expected to more than double over the next 10 years. The country plans to increase annual crude steel production to 300 mt by 2030 from 132 mt currently, with steelmakers importing the bulk of their coal due to scarce domestic production. India’s top aluminium and copper producer Hindalco Industries has signed an MoU with Russia’s Far East Agency for investment in minerals such as copper and thermal coal, the steel ministry said. CIL is in talks with Russian coal company Vostok-Coal-Diskon to participate in the extraction of coking coal and its imports from mines in the Siberian districts of Russia. VostokCoal-Diskon is developing coal extraction facilities at the Taimyr coal basin of Taymyr Peninsula in central Siberia. As a first step, CIL signed MoUs with two Russian entities in September. The first was with Far Eastern Agency for Attracting Investments and Supporting Exports, for cooperation in mining coking coal in the Russian Far East and Arctic Region. The second MoU was between CIL and Eastern Mining Company for exploring, identifying, sourcing, negotiating and consummating mutually beneficial investment opportunities in mining in the Russian Far East. These two MoUs will follow an arrangement between CIL and VostokCoal for mining and importing coal to India.

Global coal demand is expected to remain stable until 2024 as growth in Asia offsets weaker demand from Europe and the US, the IEA said. The IEA report is being published just after negotiators from more than 190 countries met in Madrid over the last two weeks to try to thrash out rules to meet the 2015 Paris Climate Agreement, which demands a virtual end to coal power by 2050. World coal demand is expected to expand at a compound annual growth rate of 0.5 percent, reaching 5,624 mtce in 2024, the IEA said. Global electricity production from coal is expected to fall 3 percent in 2019, the largest drop on record, the Institute for Energy Economics and Financial Analysis has estimated. In an analysis it said this would amount to a reduction of around 300 TWh more than the combined total output from coal in Germany, Spain and the UK last year. The projected fall is due to record falls in developed countries, including Germany, the EU overall and South Korea, which are not being matched by increases elsewhere. The largest absolute reduction is taking place in the US as numerous large coal fired power plants close. Generation growth in China is stagnant. The main counteracting force is from continuing increases in coal generation in south-east Asia, but demand from these countries is still small relative to the global total. The global decline means an economic hit for coal plants due to reduced average running hours, which are set to reach an all-time low.

China raised its coal-fired power capacity by 42.9 GW, or about 4.5 percent, in the 18 months to June, connecting new projects to the grid at a time when capacity in the rest of the world shrank, according to a study. China has another 121.3 GW of coal-fired power plants under construction, US based research network Global Energy Monitor said in its report, nearly enough to power the whole of France. China’s total coal-fired power capacity stands at more than 1,000 GW. China’s coal imports plunged 19 percent in November from the previous month as tighter import rules at ports curbed shipments towards the year’s end. China, the world’s top coal importer, brought in 20.78 mt of the fuel last month, the General Administration of Customs data showed. That compares with 25.69 mt in October and 19.15 mt in November last year. Customs officials at several ports in Guangdong, Jiangsu and Shandong province in eastern China have halted clearance for vessels carrying coal since late October. In the first 11 months of 2019, China imported a total of 299.3 mt of coal, already exceeding 2018’s total shipments of 281.2 mt. Falling profit margins at coal mines in Indonesia, China’s second-biggest supplier behind Australia, had also discouraged miners there from selling to China last month, analysts and traders said. Benchmark coal prices for 2019 long-term contracts have been set at $76/tonne during China’s winter coal trade fair, unchanged from 2018. China is carrying out a new round of safety inspections on coal mines across the country from 27 November until 27 February, the National Coal Mine Safety Administration said. China, the world’s largest coal miner and consumer, has reported six coal mine accidents since October and aims to address the poor safety record. Coal mines typically rush to ramp up output between November and February to meet annual production targets. China produced 3.06 bt of coal over the first 10 months this year, up 4.5 percent from the same period in 2018.

South Korea will idle up to a quarter of its coal-fired power plants between December and February to help limit air pollution while its remaining plants are expected to supply sufficient power, the energy ministry said. The shutdown will be applied to 8 to 15 plants including two older 500 MW plants which have higher emission levels than others, the ministry said. The ministry said that the remaining coal power plants will operate at no more than 80 percent capacity from December to February. South Korea, Asia’s fourth-largest economy, has about 60 coal-fired power plants, generating 40 percent of the country’s electricity. But it aims to reduce its use of coal power over the long term to reflect growing public calls for cleaner air. In early November, the government said it would close the country’s 6 older coal-fired power plants by 2021, a year earlier than planned. Thailand’s EGAT International Company started construction of a $2.37 bn coal-fired power plant in central Vietnam. The 1,320 MW Quang Tri 1 plant is being built in Quang Tri province. EGAT International is a wholly owned subsidiary of the Electricity Generating Authority of Thailand. Vietnam’s coal imports in the first 10 months of this year more than doubled from a year earlier to 36.8 mt government data showed. The coal, sourced mainly from Australia and Indonesia, is used mostly for an expanding fleet of coal-fired power plants. Indonesia is considering lowering the minimum quantity of coal required to be sold to domestic buyers to 20 percent of the production from the current 25 percent, the energy ministry said. The government is reviewing rules that require coal miners to sell a portion of their coal to local buyers as suppliers struggle to meet the requirements. Meanwhile, price cap for the coal sold to local power plant operators may stay at $70/tonne. Around 124 mt of coal were estimated to be sold to local buyers this year, compared with 128 mt of target, ministry data showed.

US coal mining output has declined by about 37 percent over the past decade, as the sector faced stiff competition from natural gas and renewable sources for power generation, the US EIA said. Coal production fell to 756 mt from 679 mines in 2018 from 1.2 bt from 1,458 mines in 2008, with production in the Appalachian region nearly halving, the EIA said. The operator of New York state’s last active coal-fired power plant, located north of Buffalo in Somerset, filed with state utility regulators for permission to shut as soon as 15 February, saying it wants to build a data center at the site. Somerset Operating Company asked the New York State Public Service Commission to waive the state’s 180-day notice requirement before shutting the plant. The company said that it is retiring the plant due to stricter emissions regulations designed to eliminate coal in New York and deteriorating power market conditions. In May, the New York Governor said state environmental regulators adopted rules to reduce carbon dioxide emissions from power plants that will force generators to stop burning coal in the state by the end of 2020.

Canadian National Railway Company said it has entered a long-term deal to ship steelmaking coal from some of Teck Resources Ltd’s operations in British Columbia. Under the terms of deal, Canadian National Railway will ship steelmaking coal from four of Teck’s operations in the province, between Kamloops and Neptune terminals, and other west coast ports. Italian bank UniCredit has pledged to halt all lending for thermal coal projects by 2023, joining a growing band of financial companies striving to improve their green credentials. UniCredit said new projects in thermal coal mining and coal-fired power generation would be off-limits, setting strict commitments to reduce reliance on coal for customers of its corporate financing business. France’s AXA said it was strengthening its climate strategy by committing to exit coal more quickly across a greater number of countries, as policymakers seek a faster transition to a low-carbon economy. AXA said that as an investor it would exit completely from the coal industry across countries in the OECD and the European Union by 2030, and the rest of the world by 2040. AXA said that as an insurer, it would restrict coal underwriting policy and stop selling insurance contracts, apart from employee benefits offers, to clients developing new coal projects that exceed 300 MW in capacity. Poland’s Jastrzebska Spolka Weglowa, the EU’s biggest coking coal producer, will produce more than 15 mt of coal this year, close to 2018 levels.

| CIL: Coal India Ltd, FY: Financial Year, PSU: Public Sector Undertaking, mt: million tonnes, bt: billion tonnes, mn: million, bn: billion, PPAs: power purchase agreements, mtpa: million tonnes per annum, MW: megawatt, GW: gigawatt, MoU: Memorandum of Understanding, US: United States, IEA: International Energy Agency, TWh: terawatt hour, UK: United Kingdom, EU: European Union, EIA: Energy Information Administration, OECD: Organization for Economic Cooperation and Development |

24 December. Pepfuels, a Uttar Pradesh (UP)-based start-up currently involved in providing doorstep delivery of diesel in the National Capital Region (NCR) to Business-to-Business (B2B) customers is eyeing cities like Bengaluru and Hyderabad to expand its operations rising on the back of the recent liberalisation of fuel marketing regulations, Founder Tikendra Yadav said. The company operates around seven diesel Mobile Dispensing Units (MDUs) and is presently selling around 5 lakh litre of diesel every month around NCR. He said the company is looking to add 100 MDUs in the next fiscal year if certain policy suggestions are accepted. He said the company will be able to clock Rs180-200 mn as revenue in the current financial year (2019-2020) and overall margins will improve in the light of the decision by the oil ministry allowing authorised start-ups to directly source fuel from oil depots as compared to an earlier requirement of sourcing from petrol pumps alone. He said that as there was no regulation for this business model back in 2016 the company had to propose the potential of the idea to officials in the oil ministry, commerce ministry and the oil marketing companies. Tthe Pepfuel app was launched in May 2017 and the first consignment of diesel was delivered to Uttam Toyota. It received a boost in October 2018 when the oil ministry liberalised the policy dealing with fuel marketing and allowing doorstep delivery of diesel for heavy equipment and machineries. He said the potential of catering to B2B customers around NCR is immense and the company is looking at increasing its diesel sale to 10 lakh litre per month starting February or March next year.

Source: The Economic Times

23 December. Latin America’s share of Indian oil imports plunged in November to its lowest in 20-months, tanker arrival data showed, as refiners bought similar heavier grades from the Middle East to reduce shipping costs. India, the world’s third largest oil consumer, bought about 390,400 barrels per day (bpd) of Latin American oil during November, or 9.1 percent of the country’s total imports, down from 12 percent in October, data showed. India’s overall imports from the United States (US), Canada, and Africa also declined from October, data showed. Freight rates surged in October after nearly 300 oil tankers globally were placed off limit by oil firms and traders for fear of violating US sanctions against Iran and Venezuela. Middle Eastern oil accounted for 68 percent of India’s imports in November, up from 57 percent in October, the data showed, with Saudi Arabia regaining its status as top supplier a month after losing it to Iraq. Overall, India imported about 4.28 mn bpd in November, down 6 percent from October and 1.2 percent higher than a year earlier, data showed.

Source: Reuters

22 December. A new LPG bottling plant set up at a cost of Rs1.03 bn by Bharat Petroleum Corp Ltd (BPCL) in Odishas Balangir district will be inaugurated by Vice President M Venkaiah Naidu on 27 December. The plant with a capacity to produce 42 lakh cylinders per year is scheduled to be dedicated to the nation by the vice president at Barkani in Balangir district, BPCLs State Head, LPG - Odisha and Jharkhand, Sanjay Sharma, said. BPCL already has a LPG bottling plant at Khurda and the new plant at Balangir will be the second for the company in Odisha. The foundation stone of Balangir LPG bottling plant was laid on 21 May 2018 by Oil Minister Dharmendra Pradhan. Odisha had 20.22 lakh LPGG consumers in 2014 which has grown up to 88.10 lakh in 2019. The LPG penetration in Odisha was 20 percent in 2014 which has increased to 81.3 percent by 2019 thus an increase of 61.3 percent in penetration. Amongst the Oil Marketing Companies (OMCs), BPCL itself has 21.59 lakh customers who consume approximately 78 lakh cylinders in a year. This consumption is expected to increase from 78 lakh cylinders to 105 lakh cylinders by end of 2020. With LPG demand growing, particularly in Western and South-western Odisha, need for putting up a new bottling plant was felt and the historical town of Balangir was chosen for locating the plant considering the logistics advantage of the location. The LPG plant at Balangir is spread over

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Falling petroleum products consumption is a sign of economic slowdown! < style="color: #ffffff">Bad! |

23 acres and have a capacity to produce 42 lakh cylinders per year. Balangir plant once commissioned will supply LPG cylinders to the consumers in 14 districts of Odisha - Balangir, Jharsuguda, Sundargarh, Sambalpur, Bargarh, Kalahandi, Sonepur Koraput, Malkangiri, Nowrangpur, Boudh, Kandhamal, Raygada and Nuapada, Sharma said.

Source: Business Standard

22 December. Consumers may feel the pinch of higher fuel prices in coming months as the government is considering a proposal to allow oil marketing companies charge a premium on retail prices of petrol and diesel to recover their investment in producing less polluting fuel. Public and private sector Oil Marketing Companies (OMCs) have appealed to petroleum ministry to support a plan to raise consumer prices of auto fuels to help them recover a portion of investments made in upgrading their refineries to produce BS Stage-VI fuel. If this proposal is accepted by the government, retail prices of petrol and diesel would come at a premium of about ₹0.80 a litre and ₹1.50 a litre, respectively for the next five years much to the discomfort of consumers. Refineries of public sector companies (Indian Oil, Hindustan Petroleum and Bharat Petroleum) have spent close to ₹800 bn to reach BS-VI levels after rolling out BS-IV complaint fuel for national introduction in April 2017. Even private refiners, Nayara Energy (formerly Essar Oil) and Reliance Industries have spent heavily to upgrade their facilities ahead of nationwide launch of BS-VI compliant fuel from 1 April 2020. Government support on pricing is being explored as there is very little difference in prices of petrol and diesel at pump level and uniformity needs to be given if cost recovery is allowed.

Source: Livemint

21 December. India expects its oil consumption to expand at the slowest pace in six years as the economy sputters. The nation’s consumption of petroleum products in the financial year to March 2020 is expected to rise by 1.3 percent to 216 million tonnes (mt), the oil ministry’s Petroleum Planning and Analysis Cell (PPAC) said in its estimates. That’s the slowest since the 0.9 percent demand growth in 2013-14, when crude oil averaged over $100 a barrel. Fitch Solutions slashed its 2020 forecast for India’s oil demand growth to 3 percent from an earlier estimate of 5 percent because of weaker economic growth prospects in the coming quarters. The International Energy Agency, which expects the country to be the fastest-growing oil consumer through 2040, expects India’s demand growth to slow to 145,000 barrels a day in 2019 and recover to 180,000 barrels in 2020. Consumption of diesel, the most-consumed petroleum fuel and the lifeblood of Indian manufacturing, transport and agriculture, is estimated to grow at the slowest pace in six years at 0.9 percent, according to the PPAC.

Source: Business Standard

20 December. The Bihar State Road Transport Corp (BSRTC) has decided to introduce 30 new compressed natural gas (CNG) buses in the city from March 2020 and convert the 100 existing diesel-driven buses into CNG by the end of next year. The BSRTC has initiated the bidding process for procuring 200 new AC and non-AC buses, including 30 CNG buses. While diesel and petrol are sold at Rs71.45 and Rs79.64 per litre respectively, the cost of one kilogram of CNG is just Rs63.47 in Patna. There are, however, only three CNG fuelling stations in the city. The transport department said the number of CNG stations in the city would be increases to 10 by March next year. GAIL (India) Ltd said the city will get two new CNG stations soon.

Source: The Economic Times

20 December. India will overtake China as the largest growth market for energy in volume terms by 2030, Oil Minister Dharmendra Pradhan said. India, Asia’s second biggest energy consumer since 2008, had in 2015 overtaken Japan as the world’s third largest oil consuming country, behind the United States and China. While energy consumption will grow by 4.5 percent per annum -- faster than all major economies in the world – India’s consumption growth of fossil fuels would be the largest in the world. The country is 83 percent dependent on imports to meet its oil needs and sources half of its natural gas from overseas. He said that India is moving towards a gas-based economy and investments of about $100 bn are underway in India’s energy infrastructure, including renewables.

Source: Business Standard

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Identifying and developing economic coal reserves will increase efficiency and profitability! < style="color: #ffffff">Good! |

24 December. New areas for additional coal reserves, economical for mining should be identified at a faster pace, Coal Secretary A K Jain said. He emphasised on the need for a paradigm shift from present exploration method to new technologies according to Coal India’s exploration arm, Central Mines Planning & Design Institute (CMPDIL). Nevertheless, last year, CMPDIL, added 6.6 billion tonnes (mt) of coal to its proven category of reserves – meaning it can be economically extracted and could fuel almost 145 GW of power plants for 10 years. The company also prepared 31 coal mining project reports which when taken up by CIL could produce 128 mt of additional coal a year. Addition to the proven the category was achieved through detailed exploration and exploratory drillings in 114 blocks ning 260 square kilometre. At present, 148.8 bt of coal has been categorised under proven reserves in India and CMPDIL has been adding at least 5 bt to this reserve every year since 2012.

Source: The Economic Times

23 December. In a first of its kind, Coal India Ltd (CIL) has started buying 6,000 tonnes per day from the Manoharpur captive mine of OCPL, owned by the Odisha government. Mahanadi Coalfields Ltd (MCL), a subsidiary of CIL, and Odisha Coal and Power Ltd (OCPL) have entered into an MoU (Memorandum of Understanding) for provisioning of selling excess fuel from Manoharpur coal block in Jharsuguda to the miner. The coal will be delivered to MCL at the notifed price, the company said. Manoharpur block with a production capacity of 8 million tonnes per annum (mtpa) was allocated to OCPL in August 2015 to supply coal to the 1,200 MW IB thermal power plant, owned by Odisha Power Generation Corp (OPGC). Though coal production from the captive mine has started, the fuel could not be reached to the thermal power plant due to evacuation bottlenecks, forcing OCPL to stop mining. Till the time production started from this block, MCL stepped in to supply coal to OPGC through bridge linkage to the tune of 4.8 mtpa.

Source: Business Standard

20 December. A study by US (United Stats)-based think tank Institute for Energy Economics & Financial Analysis (IEEFA) has projected that the country’s net coal-powered capacity by 2030 would be lower than the government estimates. According to IEEFA’s prediction, India's net coal-fired capacity by FY2030 is pegged at 230 GW, implying an incremental addition of 26 GW over the present nameplate capacity. India’s coal-based capacity to be 266.8 GW – a net addition of 64 GW on the current installed capacity. CEA’s projection exceeds National Electricity Plan 2018 by 17 GW. Projects tend to rely on Coal India Ltd (CIL), a state-owned coal mining giant supplying more than 80 percent of India’s thermal coal demand to generators.

Source: Business Standard

19 December. The coal ministry has allocated two coal blocks in Jharkhand to NMDC for commercial mining. The coal blocks - Rohne and Tokisud North - are located at Hazaribagh District of Jharkhand. The Rohne coal block has extractable reserves of 191 million tonnes (mt) and planned production capacity of 8 million tonnes per annum (mtpa). The Tokisud North coal block has extractable reserves of about 52 mt of thermal coal and planned production capacity of 2.32 mtpa. NMDC is exploring the possibility for setting up of coal washeries for Rohne Block. NMDC is going to execute allotment agreement of Tokisud North coal block on 24 December 2019. The Rohne coal block allotment agreement would be executed as per the directives from Ministry of Coal with respective execution date.

Source: Business Standard

19 December. Diversified metals and mining conglomerate Vedanta Ltd is betting on the Jamkhani block in Odisha to enhance its coal security. Vedanta was recently declared the successful bidder for Odisha’s Jamkhani coal block located in Sundargarh district. The company aims to commence mining from this coal block within a year of getting the requisite letter from the state authorities. The Jamkhani coal block has geological reserves of 222 million tonnes (mt) of which mineable reserves are 14 mt. Initially, Vedanta plans to extract 2.6 mt each year which may be ramped up later. Vedanta had emerged as the highest bidder for Jamkhani block in the government’s 10th tranche of coal block auction for captive use. Since the Jamkhani coal reserve is located close to Vedanta’s aluminium smelting units at Jharsuguda- a standalone smelter and a Special Economic Zone, it is expected to help the company achieve cost competitiveness in metal production.

Source: Business Standard

23 December. Tata Power said that it received a letter of intent (LoI) for a power distribution licence in Odisha’s five circles. The company aims to grow its power distribution business fourfold in the next three years. The Odisha Electricity Regulatory Commission awarded the LoI to The Tata Power Company, informing the company’s selection as the successful bidder to own the licence for the distribution and retail supply of electricity in Odisha’s five circles, the company said. The five circles together fall under the ambit of the Central Electricity Supply Utility of Odisha. The five circles will add 2.5 mn consumers to Tata Power’s existing consumer base of 2.5 mn through its other distribution areas — Mumbai, Delhi and Ajmer. Tata Power has been offered the licence for 25 years, initially.

Source: Business Standard

23 December. The power ministry has scrapped the auction to procure 2,500 MW electricity for medium term (three years) under a scheme to provide relief to thermal power plants plagued by short coal supplies, NHPC Ltd said. The ministry has advised nodal agency Power Finance Corp-arm PFC Consultancy Ltd (PFCCL) to call the bids again. Under the scheme, the NHPC as an aggregator was in the process to finalise supply of 2,500 MW through various coal-based thermal power plants for medium term at a tariff of Rs4.41 per unit discovered in a reverse auction. Some southern states discoms (distribution companies) had evinced interest for procuring power at Rs4.41 per unit the scheme. But aggregated power supply of 2,500 MW under the auction could not be tied up with discoms. Under Pilot Scheme-I, in October 2018, PTC India as an aggregator had finalised the supply of 1,900 MW capacity under the first such scheme at a tariff of Rs4.24 per unit and power purchase agreements were signed on 29 October 2019. The procuring discoms under Scheme-I were Telangana and Tamil Nadu for 550 MW each, West Bengal and Bihar for 200 MW each, while Haryana had consented to sign for 400 MW.

Source: The Economic Times

23 December. In order to save money on power bills and to create awareness on energy conservation among students, the Government Lower Primary School in Kilimanoor has set up an energy club in association with the Kerala Energy Management Centre and the Kerala State Electricity Board (KSEB). With the demand for electricity rising, the club’s objective is to make children aware about the effective energy management at home and school. As part of the project, each student will bring monthly electricity bill to the school and with the help of teachers, they will record the details, including consumer number, bill amount, units of energy consumed, appliances used, etc in an ‘Energy Register’. After conducting an energy audit, teachers will give awareness classes on saving electricity.

Source: The Economic Times

22 December. Nagaland state’s electricity sector has for years been returning widening revenue-purchase gap. A variety of reasons, mostly local in nature, ranging from state governmental apathy and aging power infrastructure to pilferage and inconsistent revenue collection have been recurring themes, while yearly tariff hikes has not been of much help. Talking of tariff, energy cost in Nagaland has steadily increased during the past decade with a marked jump observed in the revised tariff schedule for 2019-20. The hike averaged 39 paise in the Domestic category, the steepest since 2012-13 when an average hike of 45 paise was affected. Per unit cost has increased by over 54 percent, roughly corresponding to Rs 2 per unit during 2011-12 to 2019-20 in the ‘Domestic’ category, which comprises most urban consumers. While a steady rise of Rs2 in 9 years may not seem much, an independent assessment of the prevailing tariffs in the Domestic category across India points to Nagaland being among the states with the highest electricity retail rate. It places Nagaland in number 9 in the top 10 states with the highest tariffs currently. Along with Assam and Tripura, it is one among 3 north east states figuring in the top 10. As per the estimation, Bihar ranked 1st followed by Maharashtra (excluding Mumbai), Karnataka, Assam, Jharkhand, West Bengal (excluding Kolkata), Punjab, Tripura, Nagaland and Rajasthan. Mandatory charges were not considered. Jharkhand applies a single or flat fixed rate irrespective of the quantum of consumption. Going by the Nagaland 2019-20 tariff chart, consumption of 300 units a month in the Domestic category would translate into Rs1763, excluding the charges for public lighting and meter. The ‘Domestic’ category makes up 47.5 percent of the total 2.87 lakhs metered consumers, as per the Department of Power, Nagaland 2018-19 data. The latest data for 2019-20, estimates the total consumers at 3.3 lakhs with the Domestic category, including BPL (Below Poverty Line) consumers, making up a little over 3 lakhs of the total.

Source: Morung Express

22 December. The Joint Electricity Regulatory Commission (JERC) has asked the UT (Union Territory) administration to submit details of power projects along with its deadline. Recently, the UT had submitted city’s 20-year power infra roadmap before the commission, but no deadline was mentioned for the implementation of specific projects. But now the JERC had directed the electricity department to mention deadlines for the completion of these proposed projects, which were mentioned in the detailed project report (DPR). The UT power department had submitted that there are five 33 kV (kilovolt) sub-stations and thirteen 66 kV sub-stations located in different parts of the city. As per laid down norms, a sub-station has a life of 25 years. Around six 66 kV sub-stations have crossed their life and the number of such sub-stations will continue to grow. As per the plan, a total of 12 new 66 kV grid sub-stations will be established while all the existing 66 kV sub-stations will be upgraded in the next 10 years. There is overhead transmission line of 2037 kilometre in the city, which will be converted into underground line.

Source: The Times of India

21 December. The Kolhapur unit of the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) said that all the defected distribution transformers that were affected due to floods have been fixed. There were as many as 7,602 transformers, of which, more than 2,000 were not fixed until the first week of November owing to the monsoon. However, they have now been repaired. If still inadvertently any farmer’s electricity connection is yet to be restored, they can contact on 7875769103 and report the same. The complaint will be addressed on an urgent basis. Earlier in August, floods caused a blackout for over 3.38 lakh electricity consumers across urban and rural areas of Kolhapur and Sangli districts. Supply to around 3.23 lakh consumers was resumed as floodwater receded by the end of August. However, for the remaining connections, especially agriculture pumps, continuous rainfall and muddy terrain near river banks proved to be a hindrance. In many areas across the district, electricity poles were uprooted or washed away in the floods. The floods had caused an estimated loss of around Rs490 mn and Rs470 mn in Kolhapur and Sangli districts respectively. Over 7,000 transformers were affected due to the floods while 42 sub-stations had to be shut down.

Source: The Economic Times

20 December. Punjab State Power Corp Ltd (PSPCL) has decided to aggressively collect the pending power bills. PSPCL authorities have prepared a list of defaulting senior government officials including its own staffers who have failed to clear their power dues. PSPCL chairman-cum-managing director Baldev Singh Sran said officials who had failed to clear the pending bills had been asked to do so by 31 December or face disconnection of power supply.

Source: The Economic Times

24 December. The Rajasthan Government has fine-tuned the rates for developer contributions towards the Renewable Energy Development Fund (REDF) for solar projects in the Solar Energy Policy 2019. Industry players expressed dissatisfaction over the contribution demanded under the draft policy at between Rs2.5 lakh and Rs5 lakh/MW per year as cess for supplying power to utilities other than discoms (distribution companies) in Rajasthan. The Rajasthan Renewable Energy Corp said in its Solar Energy Policy 2019 that large-scale integration of wind and solar power into the grid requires upgradation of transmission and distribution infrastructure of power utilities, leading to increase in system-level cost. To meet this requirement, the government has come out with a REDF. In case of solar power projects developed in Rajasthan for sale of power to parties other than discoms of Rajasthan, developers will have to contribute towards the fund.

Source: The Financial Express

24 December. The OMCs (Oil Marketing Companies) under the Sustainable Alternative Towards Affordable Transportation (SATAT) scheme have issued over 500 letter of intents (LoIs), as of date, to private developers to set up compressed biogas (CBG) plants across the country. The OMCs have also extended the last date for expression of interest (EoI) to March 2020 as it failed to generate satisfactory response from developers initially. In October, Oil Minister Dharmendra Pradhan launched the SATAT Scheme under which oil & gas marketing companies including Bharat Petroleum Corp Ltd (BPCL), Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL), GAIL (India) Ltd and Indraprastha Gas Ltd have invited EoI from potential entrepreneurs to set up around 5,000 CBG plants, and produce over 15 mn metric tonne of CBG annually by 2023. The developers will set up the plant in an year’s time from the date of LoI and OMCs will procure the gas at Rs46 per kilogram (kg) plus Rs2.5 as GST (Goods and Services Tax). The minimum plant size has been fixed at 2 tonne per day and is expected to cost between Rs20 mn to Rs60 mn. Majority of the LoIs have been issued in Uttar Pradesh, Chandigarh, Maharashtra, Haryana and Punjab.

Source: The Financial Express

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Falling demand growth rather than RE generation is key reason for decline in thermal generation! < style="color: #ffffff">Ugly! |

24 December. Electricity generation by thermal power stations declined 2.15 percent during April-October of this financial year compared with the corresponding period of FY19. Data collated by the Central Electricity Authority (CEA) showed that total generation from thermal power producers fell from 627.19 bn units to 613.55 bn units. While electricity output from the thermal power stations subsided, nuclear energy and hydro power recorded spike in production. Generation from nuclear plants rose 27 percent whereas hydro power was up by 16 percent. Imports from Bhutan soared 21.8 percent in the period. Overall electricity generation in the country from all sources inched up 1.15 percent till October end. However, electricity generation has trailed the targets in the period under review by 12.88 percent. While 115.46 bn units of electricity was envisaged to be produced from all sources till October, actual achievement is only 113.51 bn units. According to a report by CARE Ratings, the share of thermal power in the overall power generation has dropped to its lowest level since 1991-92 at 72.8 percent during the current financial year. Hydro power and Nuclear power generation peaked to multi-year highs during the fiscal and along with renewable, constituted 27 percent of the total power generated in the country. Power generated from small hydro and non-grid solar-rooftop has also contributed to the fall in demand for grid-based power.

Source: Business Standard

24 December. Bharat Heavy Electricals Ltd (BHEL) said it has successfully commissioned the first lignite-based 500 MW thermal unit of the 2 x 500 MW Neyveli new thermal power project in Tamil Nadu. Significantly, this is the country’s first lignite-fired 500 MW power plant. It is also the highest rating pulverised lignite-fired thermal unit commissioned in the country so far. The plant is based on once-through and tower type boiler design which has been adopted for the first time in the country for a lignite-based thermal unit, BHEL said. BHEL has successfully delivered higher rated units of 600 MW, 660 MW, 700 MW and 800 MW thermal sets in the past with a high degree of indigenisation.

Source: Business Standard

24 December. The Union Cabinet gave ex post facto approval to a pact with Saudi Arabia for cooperation in the renewable energy sector. The Union Cabinet, chaired by Prime Minister Narendra Modi, was apprised of an MoU (Memorandum of Understanding) between the Ministry of New and Renewable Energy and the Ministry of Energy of the Kingdom of Saudi Arabia for cooperation in the field of renewable energy. The MoU aims at setting up a framework for cooperation between the two countries in renewable energy, including upgrading the level of technologies and their applications in the sector. The framework would also focus on contributing to renewable energy to raise its efficiency in the national energy combination in Saudi Arabia. The framework also includes developing renewable energy projects in solar, wind, biogas, geothermal and other fields of clean energy and development and localisation of value chain in the field.

Source: Business Standard

23 December. The Delhi Cabinet approved the Electric Vehicle Policy with an aim to check vehicular pollution in the national capital. Chief Minister Arvind Kejriwal said that Delhi government estimates that 5 lakh electric vehicles will be registered in the next five years.

Source: The Economic Times

22 December. As part of 'Operation Goodwill', the Army distributed solar rechargeable lanterns in a remote village of Rajouri district in Jammu and Kashmir (J&K). The lanterns were distributed in Kheta Basha village, which has about 100 houses with only a handful having electricity connections, Udhampur-based Army PRO Lt Col Abhinav Navneet said.

Source: Business Standard

21 December. The Andhra Pradesh (AP) High Court (HC) directed power distribution companies (discoms) to pay Rs14.5 bn to solar and wind power producers towards arrears to be paid to them for the power supplied by them. A division bench of the high court comprising chief justice J K Maheshwari and justice Venkata Ramana issued interim orders on a petition filed by various renewable energy developers. These developers had said that the state government had not been paying their dues for the power supplied to the discoms in the past. The bench directed the discoms to make the payment to these power producers within four weeks. The producers brought to the notice of the high court that despite the court orders, the discoms had not been purchasing power and clearing their previous dues.

Source: Hindustan Times

20 December. Singareni Collieries Company Ltd (SCCL) has received green signal for expansion of its Rs58.79 bn thermal power project in Telangana. Union environment ministry has granted the clearance to the proposed project with some riders after taking into account the recommendation of a green panel. The company’s proposal is to expand the existing thermal power plant from 1,200 MW to 2,000 MW at Pegadapalli village in Macherial district. Currently, the SCCL’s two thermal units with a capacity of 600 MW each in Macherial district are generating power in full load. The setting up of a proposed third unit with 800 MW capacity is an effort towards making Telangana self-reliant on power generation.

Source: Business Standard

19 December. After the solar-powered airport, the state government is planning to use solar energy to power spinning mills since power has been a major area of concern for textile mills in the country. A feasibility study by textile mills — the sector is one of the biggest consumers of power — found that switching to solar energy will significantly slash operational costs. Cannanore Cooperative Spinning Mills Ltd and Malabar Cooperative Textiles Ltd (Malcotex) in Kannur have sought the government’s formal nod for switching to solar power. Agency for Non-Conventional Energy and Rural Technology will be the implementing agency. But the agency for implementing the solar power project at Cannanore Cooperative Spinning Mills is yet to be finalised.

Source: The New Indian Express

18 December. India is planning to set up more than 100 biogas plants and provide thousands of farmers with machines to dispose of crop stubble in a bid to halt the choking crop-burning pollution that blights the country every winter. A major source of the smog that engulfs vast swathes of northern India, including the capital New Delhi, is the burning the straw and stubble of the previous rice crop to prepare for new planting in October and November. New Delhi is regularly judged to be one of the world’s most polluted major cities. Government-backed Indian Oil Corp (IOC) will invite private companies to apply to set up 140 biogas plants that will use rice stubble as feed stock. The plants would cost Rs35 bn ($487.67 mn) and each would require two tonnes of crop residue every hour for at least 300 days to produce “an optimum amount” of compressed natural gas (CNG). The government would earmark funds for the project that would make it attractive for farmers to sell their waste rather than burn it. Other than helping farmers sell their residue to the new biogas plants, the government would provide 100,000 new machines every year to farmers to dispose of the farm waste in their fields.

Source: Reuters

24 December. Qatar Petroleum (QP) will start pricing its crude oil grades of Qatar marine and Qatar land on a prospective pricing basis in February 2020, the company said. QP currently prices the two grades on a retroactive basis but will move this to forward pricing, a more popular approach used by other Middle East crude exporters such as Saudi Arabia that better matches the trading cycle of crude. The new step will improve the overall competitiveness of Qatar Marine and Qatar Land, and allow existing and new customers to make better comparisons between the Qatari crude grades and other grades, QP said. By changing the pricing methodology, QP is following the United Arab Emirates’ Abu Dhabi National Oil Company (ADNOC), which in November introduced a new pricing mechanism for its flagship Murban crude. ADNOC said it expected to implement its new Murban forward pricing mechanism between the second and third quarters of 2020. Middle East sour crude grades are typically traded two months forward in the Asia market, meaning that next year’s March-loading crude cargoes will be traded in January.

Source: Reuters

23 December. Russia’s Gazprom plans to produce more than 12 million tonnes (mt) of oil equivalent from its Achimov formation in Western Siberia this year and increase output to at least 14 mt in 2020. Yury Masalkin, in charge of Gazprom Neft’s department on exploration and resources, also told Gazprom’s inhouse magazine that the output could double by 2025.

Source: Reuters

22 December. Israel’s Navitas Petroleum said it had purchased 50 percent of the rights in four producing oil fields in Texas from oil and gas company Denbury Resources for $45 mn. Navitas’ share in current production under the deal will be 1,363 barrels of oil a day, and it said it intends to carry out further development at the projects.

Source: Reuters

24 December. Oil and gas producer Woodside Petroleum Ltd said it has signed an agreement to supply liquefied natural gas (LNG) to German utility Uniper SE for 13 years starting 2021. Under the agreement, Woodside said it would initially supply up to 0.5 million tonnes per annum (mtpa) of LNG, which could increase to 1 mtpa from 2025. Woodside is looking to develop Scarborough to feed a new 5 mtpa production unit, called a train, at its Pluto LNG plant in Western Australia. The finalization of the deal follows Woodside’s announcement in September, when the two companies signed an initial agreement for LNG supply.

Source: Reuters

23 December. US (United States) natural gas futures fell nearly 5 percent on expectations of warmer weather, which would lead to a reduction in heating demand. Front-month gas futures for January delivery on the New York Mercantile Exchange were down 11 cents, or 4.7 percent, at $2.218 per million metric British thermal units (mmBtu). Prices are likely to stay flat or go even lower if the weather is not much colder than normal in the next several weeks, hen Zhu, economist at Oklahoma City-based C.H. Guernsey, said. Traders noted prices have dropped 20 percent since hitting an eight-month high of $2.905 per mmBtu in early November due to milder than usual weather and expectations inventories will still rise over the five-year average in coming weeks. Near-record production enables utilities to leave more gas in storage, wiping away lingering concerns of supply shortages and price spikes during the winter.

Source: Reuters

20 December. Pavilion Energy Singapore and a unit of French oil major Total said they have signed a 10-year deal to develop a liquefied natural gas (LNG) bunker supply chain in the port of Singapore. The binding agreement between Pavilion, which is owned by Singapore’s Temasek Holdings, and Total Marine Fuels Global Solutions follows an initial non-binding one in June last year. The cooperation includes the shared long-term use of the newly built 12,000-cubic metres GTT Mark III LNG bunker vessel that will allow each party to supply LNG bunker to its customers. Singapore aims to position itself as an LNG trading hub for Asia to capitalise on an expected rise in LNG imports in the region, driven by depleting gas production and growing electricity demand. Shipowners are looking at fuelling vessels with LNG as part of a number of options to comply with new rules by the International Maritime Organization that will go into effect in 2020.

Source: Reuters

18 December. Plans for the $2 bn Tanglawan LNG hub venture in the Philippines have been put on hold by backers CNOOC Gas and Power of China and Phoenix Petroleum Philippines Inc. The facility was supposed to have a capacity of 2.2 million tonnes (mt) per year, with a targeted start-up by 2023. The two firms jointly requested the Department of Energy put the project on hold after Phoenix parent Udenna Corp acquired a 45 percent stake in the Malampaya natural gas consortium, Phoenix said.

Source: Reuters

23 December. Three US (United States) Democratic senators have asked the investigative arm of Congress to evaluate a $1 bn-a-year subsidy for burning chemically treated refined coal, after research has shown that some power plants using the fuel produced surging amounts of mercury and smog instead of cutting pollution. Senator Sheldon Whitehouse of Rhode Island, as well as Senators Elizabeth Warren of Massachusetts and Sherrod Brown of Ohio, requested the Government Accountability Office investigate the tax credit program for refined coal. The Internal Revenue Service, which oversees the tax credit program, allows large companies to qualify for the tax credits by burning relatively small amounts of refined coal during one-day tests in a laboratory in lieu of real-world testing at power plants. The use of refined coal has increased in recent years, accounting for about 20 percent of US coal consumption, according to the US Energy Information Administration (EIA). Several dozen US power plants are on track to burn about 150 million tonnes (mt) of refined coal this year, according to EIA data. Each ton of burned refined coal generates a tax credit of $7.17, or about $1.1 bn in tax credits for US corporations in 2019. After this year, tax credits expire on 2009-era refined coal facilities. But most of the plants in production still have until the end of 2021 to generate tax credits.

Source: Reuters

23 December. Indonesian coal miner PT Bukit Asam targets to produce around 30 million tonnes (mt) of coal in 2020, compared with an estimate of 28.5 mt produced this year, its director Adib Ubaidillah said. He said 60 percent of the 2020 targeted production will be bought by state power utility PLN and 30 percent will be shipped overseas, mostly to India.

Source: Reuters

18 December. Poland is considering scrapping plans to develop an open-pit lignite coal mine in central Poland, due to rising costs of burning the fossil fuel and stricter EU (European Union) climate policies. The project at Zloczew, owned by Poland’s biggest energy group PGE, was meant to extend the life of PGE’s Belchatow power plant - Europe’s biggest polluter - beyond the 2030s. The project’s costs are estimated at between 10 bn and 15 bn zloty ($2.6 bn-$3.9 bn). Earlier Poland was the only EU state to oppose the bloc’s proposed 2050 climate neutrality goal.

Source: Reuters

24 December. The remote Tsonyi in Nagqu City in Tibet, regarded as the world's highest county, was connected to China’s state grid, enabling stable power supply to more than 7,000 local residents. In the county seat with an altitude of more than 5,000 meters above sea level, power workers braved a coldness of minus 20 degrees Celsius to start the equipment. Deputy County chief of Tsonyi Jing Qi said the county used to adopt power rationing in winter, which disrupted daily work and life. In March, the State Grid Tibet Power Co, Ltd began to lay power lines towards the county, passing through a vast stretch of unpopulated Changtang National Nature Reserve. The power grid construction was completed with a government investment of 600 mn yuan ($86 mn).

Source: Business Standard

22 December. Mexican President Andres Manuel Lopez Obrador promised in a speech to dramatically expand electricity company CFE’s power generation business if private power companies do not boost their investments in the sector. Lopez Obrador, a leftist who has long-favored more robust state control over oil and power industries, said the CFE’s share of Mexican power generation market could grow to as much as 70 percent from about 56 percent currently by the end of his term in 2024.

Source: Reuters

20 December. The UN (United Nations) set itself a daunting challenge aimed at improving the lives of displaced people, reining in climate change and even preventing conflict: to bring electric power to all refugee camps by 2030. The target is enormously ambitious given that more than 90 percent of refugees living in camps currently have little or no access to electricity, while surrounding communities can also live with overloaded electrical systems and long power outages. Lack of power poses a challenge for cooking, keeping warm or studying, while women and girls especially face far greater safety risks in camps shrouded in darkness. With many of the nearly 26 mn refugees registered worldwide living in camps, the target of providing sustainable and reliable power to all such settlements and surrounding communities within a decade is staggering. Ugandan Energy Minister Mary Goretti Kimono, whose country hosts 1.3 mn refugees, also appealed for more solidarity in addressing the energy needs of the displaced.

Source: The Economic Times

24 December. Germans will have to change their lifestyles, cutting back on holidays and paying a real price to master the challenge of climate change, the speaker of Germany’s parliament Wolfgang Schaeuble said. Schaeuble said climate change would demand sacrifices of Germans. A climate protection package agreed envisages sharp cuts to emissions of the greenhouse gas carbon dioxide over coming decades, as well as investment in railways, energy-efficient housing and electric vehicles. But Schaueble said that, even if the package will seek to minimise the direct cost to consumers, Germans will all pay a price for the change.

Source: Reuters

24 December. China plans to promote investment in repairing environmental damage caused by mining, and wants a mixture of public and private entities to contribute, the natural resources ministry said. More than 3.6 mn hectares of land in China was used and damaged by mining activities at the end of 2018, the ministry said.

Source: Reuters

20 December. Switzerland’s Muehleberg nuclear power station went off the grid after 47 years, marking the end of an era as the shutdown starts the country’s exit from atomic power. The 373 MW capacity plant which opened in 1972 has generated enough electricity to cover the energy consumption of the nearby city of Bern for more than 100 years. The closure is the first of Switzerland’s five nuclear reactors to be shuttered following the 2011 nuclear accident in Fukushima, Japan, which triggered safety concerns about nuclear power around the world. Neighbouring Germany is due to abandon nuclear power stations by 2022, while Switzerland’s government has said it would build no new nuclear reactors and decommission its existing plants at their end of their life. The Swiss decision to quit nuclear power was upheld in a 2017 referendum which also supported government plans to push forward sustainable energy with subsidies to develop solar, wind and hydroelectric power. As recently as 2017, Switzerland’s nuclear power stations generated a third of the country’s power, compared with around 60 percent from hydroelectric and 5 percent from renewable.

Source: Reuters

20 December. The Dutch High Court (HC) ordered the government of the Netherlands to step up its fight against climate change and cut greenhouse gas emissions faster than planned. The HC said the government had not done enough to protect its citizens from the dangerous effects of climate change, which can “threaten their lives and wellbeing”. Home to many large industries, Europe’s main seaport and an abundant supply of cheap natural gas, the Netherlands is among the largest polluters in Europe. To live up to its obligations, the government needs to ensure that CO2 (carbon dioxide) emissions are at least 25 percent below 1990 levels by the end of 2020, the court said in a final verdict, upholding a 2015 decision by a lower court. The ruling meant a final defeat for the government in the case brought by environmental group Urgenda Foundation, on behalf of nearly 900 Dutch citizens. Emissions in the Netherlands were 15 percent lower than in 1990 last year, and are expected to be reduced by around 23 percent in 2020, the government’s environmental advisory body PBL said. Prime Minister Mark Rutte said his government would do everything it could to reach the goal of reducing CO2 emissions by 25 percent next year, without elaborating on possible measures.

Source: Reuters

20 December. Norwegian power company Statkraft signed a 10-year deal to purchase power from five solar parks owned by Spain’s Solaria Energia, the companies said. The projects under construction in Castilla y Leon and Castilla La Mancha will have a combined installed capacity of 252 MW and generate enough energy for more than 150,000 Spanish homes per year, it added. Statkraft, which generates most electricity from hydropower plants, mainly in Norway, is also aiming to boost its own solar power capacity to 2 GW by 2025. In October, it acquired nine Irish solar projects with a combined capacity of 320 MW.

Source: Reuters

19 December. Japanese Environment Minister Shinjiro Koizumi said criticism heaped on the Asian nation for its coal policies at UN (United Nations) climate talks had helped raise his countrymen’s awareness of fossil fuels and climate change. Koizumi, tipped as a future prime minister, told the conference in Madrid that global criticism of his country’s “addiction to coal” was hitting home, but warned he had yet to win wider government buy-in for his hopes of weaning the country off fossil fuels. Koizumi said there was very high interest in nuclear power generation among Japanese citizens, but they had paid very little attention to coal-fired power plants, causing a huge gap between the views of the global and Japanese communities.

Source: Reuters

18 December. Namibia’s electricity generation has dropped to below 40 percent of its capacity as the worst drought in almost a century has hit the country’s own hydropower plant and others in the region reliant on water from dams and rivers. The drought, plus power blackouts at South Africa power company Eskom, on which Namibia relies for 70 percent of its energy requirements, has put the security of the country’s electricity supply at risk. State power firm NamPower said that electricity generation at Namibia’s only hydropower plant currently ranges between 90 MW and 160 MW, compared to an installed capacity of 374 MW. NamPower managing director Simson Haulofu said the company had reduced generation at the plant during peak hours to save water. Namibia can also fall back on renewable energy from independent power producers, one coal power station and an emergency diesel station, but its hydropower plant its biggest domestic power source. The Kariba hydroelectric plant, which serves Zimbabwe and Zambia and is fed by the Zambezi river, has also been hit by a substantial fall in water levels.

Source: Reuters

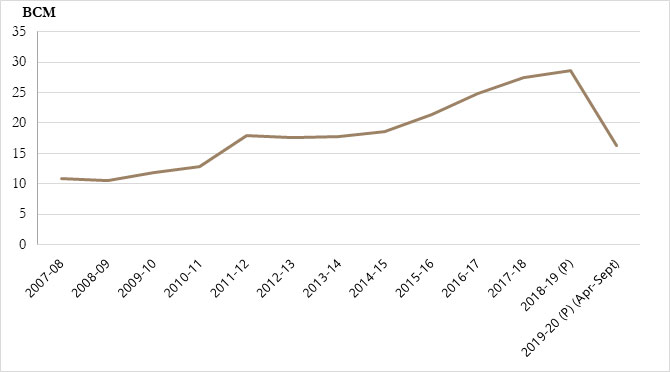

Billion Cubic Meters

| Year | Production | Consumption |

| 2008-09 | 32.8 | 42.3 |

| 2009-10 | 47.5 | 58.3 |

| 2010-11 | 52.2 | 64.1 |

| 2011-12 | 47.6 | 64.5 |

| 2012-13 | 40.7 | 57.4 |

| 2013-14 | 35.4 | 52.4 |

| 2014-15 | 33.7 | 51.3 |

| 2015-16 | 32.3 | 52.5 |

| 2016-17 | 31.9 | 55.7 |

| 2017-18 | 32.7 | 59.2 |

| 2018-19 (P) | 32.9 | 60.7 |

| 2019-20 (P) (April-September) | 16.0 | 31.8 |

Trends in Natural Gas (LNG) Imports

P: Provisional

P: Provisional| This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485. Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team). Publisher: Baljit Kapoor Editorial Adviser: Lydia Powell Editor: Akhilesh Sati Content Development: Vinod Kumar |

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.