< lang="EN-US" style="color: #0069a6">DROP IN POWER DEMAND SENDS SHOCKWAVES ACROSS THE SECTOR

Power News Commentary: October - November 2019

India

Demand

The biggest drop in India’s electricity demand in at least 12 years is hindering efforts of Indian lenders to recover a pile of loans to power producers that have soured. Banks had about ₹1.8 tn ($25 bn) of stressed loans to India’s coal-fired power generators as of last year, according to the State Bank of India. Prospective bidders for these stressed generators are wary as demand from the country’s power distribution utilities contracted in three straight months to October. India’s electricity demand is closely linked to its industrial output, which contracted in September to its lowest level in eight years. An overwhelming majority of data is pointing to continued weakness in the economy that expanded 5 percent in the quarter ended June -- the slowest pace in six years. Drop in demand is adding to the weak financial health of the discoms. These state-controlled utilities often serve the populist plans of their political masters by selling power below cost to certain groups of consumers, which leaves them financially broke. However, some power projects, including GMR Chhattisgarh Energy Ltd., and SKS Power Generation Chhattisgarh Ltd. have found new bidders, while some others including RattanIndia Power Ltd’s Amravati project in Maharashtra and GMR Kamalanga are nearing a resolution with lenders writing off part of the loans. India’s power demand fell 13.2 percent in October from a year ago, posting its steepest monthly decline in over 12 years, government data showed, reflecting a deepening growth slowdown in Asia’s third-largest economy. India’s June quarter GDP grew at its weakest pace in six years as consumer demand and government spending slowed, and economists see the falling electricity demand as a reflection of a further slowdown. Consumption in heavily industrialized states such as Maharashtra and Gujarat led the decline. Power demand in Maharashtra declined by 22.4 percent and in Gujarat by 18.8 percent, the data from the CEA showed. Barring four small states in the country’s north and the east, demand fell across regions, the data showed. Populous states such as UP and MP saw demand fall - with MP’s electricity requirement falling by over a fourth and UP seeing a decline of 8.3 percent. Power consumption figures indicate a decline in pomp and show during Kali Puja with many organisers shifting focus to the more popular Durga Puja over the past three-four decades. According to CESC Ltd, the number of Kali Pujas in Kolkata is far higher than Durga Puja. However, many Kali Puja pandals are smaller and quite often organisers manage without a special power connection. The maximum demand for power in Kolkata is estimated around 1,850 MW, which is slightly higher than last year’s 1,799 MW. The total load applied by all Kali puja committees is 19 MW, a third of the 52 MW load applied by Durga pujas. An analysis of data by IIT Kanpur has concluded that peak power demand for power during Diwali has declined in the last three years.

IEX traded 3,391 mn units of power at an average price ₹2.71/kWh the lowest in the last two years. Average market clearing price was down by 54 percent vis-à-vis price of ₹5.94/kWh in October’18 and 2 percent on month-on-month basis. All India peak demand at 164 GW in October’19 declined 4 percent over demand of 171 GW in October’18 and the energy met at 99 bn units declined 13 percent yoy (year-over-year), according to the National Load Dispatch Centre data. Extended monsoon was also one of the key reasons for decline in the demand for power. In the day-ahead-market, total monthly sell bids were 9,771 mn units while buy bids were 3,923 mn units. With sell side liquidity at three times of the buy bids coupled with lower clearing pries, the market helped save on high cost of power for discoms as well as commercial & industrial consumers. The deplorable state of the power sector has been hampering execution and cash flows of the power equipment maker BHEL. Land acquisition delays coupled with slower customer approvals and payment delays have dragged down its power segment sales by 18 percent y-o-y. Some relief has come in the form of a 24 percent y-o-y growth in its industrial segment sales.

Supply

In order to give relief to power generation companies, the Centre has enforced a payment security mechanism where discoms are required to open letters of credit for getting power supply. In a bid to offset the burden of power shortage during the thick of summer, KSEB is planning to engage in power-banking agreements with power utilities and traders elsewhere in the country. Through the power-banking option, power utilities and traders will park with one another excess power available with them during a particular period in a year and reclaim the same from the other when they face shortage of power later. KSEB had engaged in such a practice on several occasions in the past, but it is the first time that the board has decided to opt for a competitive bidding process to choose its power-banking partners.

Tariff & Revenue Recovery

Nearly 84 percent residents of MP are paying less than ₹400 as their monthly power bills, thanks to a ‘smart subsidy’ scheme that encourages low power consumption. Close to 10 mn consumers are now covered by Indira Griha Jyoti Yojana — under which those who use 150 units of power or less a month pay only ₹1 for the first 100 units, and the rest is billed as per the tariff prescribed by MP Electricity Regulatory Commission. The government reimburses what’s left of the dues for the first 100 units. The maximum subsidy a consumer gets is ₹531 per month in urban areas, and ₹521 per month in villages. It has translated into big savings in a state that has one of the highest power tariffs in the country. The scheme has, however, drained the coffers of ₹3.5 bn in the first month of implementation. At this scale, it will cost the government ₹40 bn a year. The previous government had rolled out two power schemes in June-July 2018 — one for waiver of dues and the other, named Saral Bijli Bill Scheme, for providing power at a flat rate of ₹200 per month to unorganized sector workers. Both came into effect six months ahead of the assembly polls. With a change of guard in the state, the present government announced in the first week of February that it would fulfil its poll promise by cutting power bills by 50 percent and that beneficiaries will need to pay only ₹100 for 100 units of power. If they exceed 100 units, consumers will have to bear the rest of the cost, it said.

Transmission

The power ministry recently said that it will reconstitute the NCT with amended composition and TOR. It said that the committee will be headed by the chairperson of the CEA. Under the revised TOR, the NCT will evaluate the functioning of the national grid on a quarterly basis and consider the review of the Regional Power Committee for Transmission Planning for system expansion and strengthening of the transmission system. The CTU is required to carry out periodic assessment of transmission requirements under inter-state transmission system. It said that after considering the recommendations of the CTU and the regional committees, the NCT would be required to assess the trend of growth in demand, generation in various regions, and identify constraints in the inter-state, inter-region transfer system. Other functions of the committee will include proposing construction of transmission lines, grid stations, and will draw up perspective plans keeping 10 to 15 years time in mind. The recently inaugurated 148 km long Edamon-Kochi power highway which will increase Kerala’s power import capability by 800 MW. 93 percent work of this project which had begun in 2005 has been completed. Out of the total 148 km line, this government completed 138 km within just over three years. The Edamon-Kochi line passes through Kollam, Pathanamthitta, Kottayam and Ernakulam. The new line reduces power import via inter-state Udumalpet-Palakkad and Mysore-Arikode lines. Kerala imports around 3000 MW from the Central pool to meet its daily power requirements. The UP government took a slew of decisions in its Cabinet meeting to address the problem of power roasting and overloading. Now, UPPCL will be setting up power grids in four UP districts-- Rampur, Sambhal, Meerut and Sindhauli. With a budget of ₹1.15 bn, 765 kV transmission will be setup in Meerut and Rampur and 400 kV in Sambhal and Sindhauli, on public private partnership mode. Soon after the Cabinet meeting, the government said that three bids were received for 765 kV transmission in Meerut and 400 kV transmission at Sindhauli. The power grid was awarded on the basis of a proposal of ₹1.15 bn. Its work will be completed by 2021. Approval has also been given to power grids for 765 and 400 kV transmission lines at Rampur and Sambhal. It will also be completed by 2021. A total of 13 districts of Western UP will benefit from this.

Regulation and Governance

The Union power ministry has an ambitious plan for 100 percent smart metering over the next two years. However, not all state discoms see a financial benefit from smart meters. Also, vendors are reluctant to supply to some states, on payment concerns. A smart meter has a modem (communication device) and a remote switch by which demand, supply and billing can be monitored and controlled remotely. Data from these is collected in a cloud server. This reduces energy theft, improves billing and bill collection. It also helps discoms collect data on consumer demand patterns, useful for improved planning of supply. At present, smart metering is being pushed through two ways. One is where states can go ahead and make a capital expenditure by changing to smart metering. This involves huge upfront outgo. The second way is to allows discoms to move to smart meters through the operating expenditure (opex) model, where nodal agencies like EESL step in to fund it. EESL has installed 400,000 smart meters till date, in Uttar Pradesh, Delhi, Haryana, Bihar and Andhra Pradesh. In addition to some unwilling discoms, there are supply-side concerns. The Uttarakhand government has decided to switch over to prepaid power meters in all government buildings. The UPCL would be installing the prepaid power meters from next month at the government offices. UPCL has over 8,397 power connections of 25 kW belonging to the state government offices, departments and establishment and the meters would be installed in a phased manner. At present, 5,000 prepaid power meters have been given to temporary consumers at different sites. The prepaid power meters recharge value would be between ₹100 and ₹15,000 per month. To begin a campaign for installing pre-paid smart meters at the residence of government officials and ministers, UP Energy Minister installed a meter at his official residence. The government had on 30 October announced a campaign to install prepaid smart meters at the residence of officials, elected representatives and Ministers. The UP government departments owe more than ₹130 bn in electricity bills to the state power utilities, which also makes the state top ranked among peers in this regard. While UP has emerged as the chart topper with its various government departments, state agencies and urban local bodies collectively owing ₹133.61 bn in power arrears till September 2018-19, Telangana and Andhra Pradesh stood distant 2

nd and 3

rd with corresponding figure of ₹67.37 bn and ₹49.13 bn respectively. Recently, the 15

th Finance Commission had also red-flagged the burgeoning losses of UP power utilities, which currently stand at ₹180 bn even after the implementation of UDAY. The Yojana was aimed at financial restructuring of discoms that were struggling under collective losses of ₹3.6 tn. In UP, UDAY was projected to accrue savings of ₹330 bn for the state discoms and help them raise fresh capital for future investments. However, the discoms have continued to grapple with challenges due to high AT&C losses, low bill realisation and rampant power theft. Meanwhile, in the pecking order of the top 10 power defaulter states, Maharashtra, Chhattisgarh, Kerala, Tamil Nadu, Punjab, Bihar and Haryana trail top ranked UP, Telangana and Andhra Pradesh, with the collective dues amounting to ₹372.11 bn. Interestingly, UP government departments with ₹133.61 bn outstanding, comprise almost 36 percent of the total power dues pertaining to the top 10 states. The UPPCL has decided to start a new scheme under which consumers can pay dues in instalments. Now consumers living in urban areas, having electricity connections up to a load of 5 kW can pay their dues in 12 easy instalments. For rural consumers the dues can be paid in 24 instalments. The scheme will be only for LMV-1 or domestic consumers of urban areas up to 4 kW load and all consumers of rural areas. However, only those consumers would be eligible for the scheme who continue to pay power bills regularly on time. Payment would only be accepted online and all queries of consumers would be answered through the toll-free number 1912 and power department offices. After furore over a senior official of UPCL running an electricity bill of ₹400,000 over two years but paying only ₹425 per month due to power being made available to corporation staff at highly subsidised rates, the state’s power firms - UPCL, PTCUL and UJVNL - have informed Uttarakhand High Court about their plan to put a cap on the quantity of electricity provided to their employees. The High Court asked the firms to provide year-wise details on the quantum of electricity provided free of cost to their employees. UPCL along with PTCUL and UJVNL are tasked with generation, transmission and maintenance of electricity in the hill state. The High Court had pulled up UPCL for providing electricity to its employees at highly subsidised rates. Jaipur discom has busted over 28,000 cases of power theft and misuse in the last five months and earned ₹910 mn in fines and revenues. The discom had launched an intense vigilance campaign against power theft and misuse at the feeders from June where the highest pilferage of power was reported under municipal areas. Under the anti-power theft campaign in 13 circles 28,657 cases of power theft from June to October were identified. A penalty of ₹680 mn had been imposed on consumers found stealing power and ₹231.8 mn recovered in revenue. Recovery of remaining penalty and legal action was being taken against guilty individuals/consumers. Power theft prevention police stations had registered 4,527 FIRs during the same period and 131 persons had been arrested. AVVNL, as part of its campaign against electricity theft in 11 districts across the state, has registered 1,606 cases of power theft and imposed penalty of ₹30 mn and 1.2 million. The campaign was started to check the cases of electricity theft in the 11 districts of the state that fall under AVVNL’s jurisdiction. Different teams were constituted to carry out the campaign in Ajmer, Bhilwara, Nagaur, Sikar, Jhunjhunu, Udaipur, Banswara, Chittorgarh, Rajsamand, Dungarpur and Pratapgarh districts. In serious cases of electricity theft, FIRs have been registered against offenders as the burden of electricity theft is borne by the consumers. Bihar government is considering a proposal to fine power distribution companies for load-shedding as part of its ambition to provide uninterrupted power supply to each household in the state as a matter of consumer rights. The proposed “No load-shedding policy” has been placed before the state cabinet committee recommending discoms be penalised even for short outages. India had achieved the dual targets of generating surplus power and electricity connection to every household and was now working towards the next milestone of 24x7 power supply. If implemented this will assign blame on power outages on Discoms. This is not necessarily to according to experts. Power outages are a tool of management of revenue shortfall arising from government policy to subsidise or give away electricity free to household and agricultural consumers along with government failure to disburse subsidy and revenue shortfall payments to discoms on time. By imposing a penalty on power outages on discoms the government abdicates its responsibility in contributing to the problem and deflects it on discoms experts said. CESC has decided not to pursue the demerger of its power generation and distribution business, which it had earlier planned. Demerger of these two lines of business into CESC and Haldia Energy had met with opposition from the West Bengal Electricity Regulatory Commission. It had flagged concerns over asset distribution between the two firms in the case of a demerger, and had questioned if the demerged entities had received any favour from parent CESC. The power regulator refused to approve CESC’s planned power purchase agreement in case of a split. Previously, CESC had said that owing to the complexity of the power generation business in the country, and the low yield from this business, CESC will focus on strengthening its distribution business. On the other hand, investments in power generation are expected to be frozen.

Private Sector

Tata Power said it will create an arm, TP Renewable Microgrid, to set up 10,000 microgrids to provide power to five millions homes across the country. The TP Renewable Microgrid would be set up in collaboration with Rockefeller Foundation, which will provide technical support to the offshoot for achieving its objective. The TP Renewable Microgrid represents important scaling up of efforts to provide access to affordable, reliable and clean electricity in India, and will serve as a model for expanding access to more than 800 mn people who are without power worldwide, Tata Power said.

Cross Border Electricity Trade

As part of India’s strategy of creating a new energy ecosystem for the neighbourhood, the government is exploring to set up an overhead electricity link with Sri Lanka to supply power to the island nation. The electricity link is part of India’s strategy to negate the growing influence of strategic rival China in the Indian Ocean region and South Asia. The earlier plan involved PGCIL setting up a link for 1,000 MW between India and Sri Lanka, of which 30 km will be under the sea. The India-Sri Lanka transmission link was to run from Madurai in Tamil Nadu to Anuradhapura in Sri Lanka’s north-central province. Sri Lanka’ Ceylon Electricity Board has an installed power generation capacity of 35.8 GW. India has an installed power generation capacity of 360.45 GW, with the national grid capable to transfer 99,000 MW of electricity from any corner of the country.

Rest of the World

Africa

South Africa plans a sweeping overhaul of its power sector by breaking up loss-making state utility Eskom over the next three years and opening the industry up to more competition, a long-awaited government paper showed. The paper set out a vision for a restructured electricity supply industry, where Eskom could relinquish its near-monopoly and compete with IPPs to generate electricity at least cost. The government plans to set up a transmission unit within Eskom by the end of March 2020 and complete the legal separation of all three units in 2022. One or more Eskom generation units will be created to compete with IPPs and the distribution model will be reformed so more power can be procured from small-scale producers. The aim is to change a situation where South Africa is reliant on Eskom’s creaking fleet of mainly coal-fired power stations for more than 90 percent of its electricity and has rigid rules for power procurement. Nationwide power cuts spread over several weeks in the first three months of the year contributed to a steep economic contraction, sending Eskom’s operational and financial crisis to the top of the government’s to-do list. South Africa’s NUM threatened to shut down the country’s power sector over the government’s decision to forge ahead with a plan to break up struggling state power firm Eskom. NUM, one of the largest unions at Eskom, fears that the government’s plan to split Eskom into different units for generation, transmission and distribution will lead to job losses. Kenya’s energy ministry and a Chinese firm, China Aerospace Construction Group, have launched the construction of a major power transmission project outside the capital, Nairobi. Once completed, the 40 km, 400 Kva Konza-Isinya Transmission Line Project will ensure reliable power supply for Konza Technopolis, south of Nairobi. Zimbabwe’s state-owned electricity distributor, grappling with drought and ageing equipment, said it will disconnect mines, farms and other users as it looks to recover $77 mn in unpaid bills. The southern African nation is experiencing daily power cuts lasting up to 18 hours after a severe drought reduced water levels at the country’s biggest hydro plant. The ZETDC is also being hampered by ageing coal-fired electricity generators which constantly break down. ZETDC said in a public notice it was owed 1.2 bn Zimbabwe dollars ($77 mn) and it was targeting to recover the money from mining, agriculture, commercial and domestic users. The country imports up to 400 MW from South Africa and Mozambique when they have spare capacity. Zimbabwe hiked its average electricity tariff by 320 percent to increase power supplies, angering consumers already grappling with soaring inflation and the country’s worst economic crisis in a decade. The US has cancelled $190 mn in grants to Ghana under the “Power Africa” initiative in response to the Ghanaian government’s termination of a contract with a private utility provider, the US embassy said. The Millennium Challenge Corp, a US government foreign assistance agency, agreed in 2014 to provide $498 mn in funding to Ghana’s power sector to help stimulate further private investment. The financing was the largest by the US under Power Africa, which was launched in 2013 by then President Barack Obama and aims to bring electricity to tens of millions of households in Africa. One reform under the agreement involved handing over operations at Electricity Company of Ghana in March to Ghana Power Distribution Services, a consortium led by Philippine electricity company Meralco. But Ghana’s Finance Minister informed US officials that the government was cancelling the 20-year concession it had signed with PDS, saying payment guarantees provided were not satisfactory.

Europe

European power exchanges operating in Britain plan separate day-ahead interconnector capacity auctions if the UK exits the bloc without a divorce deal, operator Nord Pool said. In the event of a no-deal Brexit, Britain would no longer be coupled to European power markets. That means capacity allocations via power interconnectors that connect Britain to mainland Europe would be made in a common bidding zone only until 31 October for delivery the next day. Britain’s two market operators are Nord Pool and EPEX SPOT. European wholesale electricity prices could soar by around 30 percent by 2025 due to a recovery in gas and carbon emissions prices and the planned phase out of some coal and nuclear power generation units, S&P Global rating said in a report. S&P said the supply gap would likely be filled by the rise in renewable solar capacity in Europe which could increase to 43 percent of the electricity mix from 23 percent in 2018. S&P said wholesale power prices are set fall in 2020 compared with 2019 but will rise across all markets until 2023 due to a combination of increased fuel and carbon emissions permit prices, and the “large-scale” power plant closures. Germany’s Uniper lifted its full-year earnings outlook, seeing itself a beneficiary of the revival of the British power capacity market programme. The British government gave the go-ahead to reinstate the power capacity market scheme after the European Commission approved it, compensating providers for making output capacity available regardless of whether electricity is delivered. Uniper, which opposes a takeover bid by Finnish state-owned company Fortum, said it was now targeting €750 mn ($827 mn) to €950 mn in 2019 adjusted earnings before interest and tax (EBIT), up from the 550-850 mn it previously predicted. The Dutch are opposed to the Maasbracht (Netherlands) power station, currently shut down, being used in the future to supply Belgium alone with electricity. The power station has a 1,304 MW capacity, the equivalent of the amount consumed by 3 mn domestic users, and is located near the Belgian-Dutch border at Maasbracht in the Netherlands. Its owner, the energy consortium RWE, and the Luxembourg company Nuhma have already given notice of their project to deploy an underground high-voltage power line to link the power station to the Belgian grid by 2020.

USA

The San Francisco-based PG&E has said that strong winds could lead to another power outage in Northern California. PG&E said that it was monitoring a potentially strong offshore wind event on 20 November, which suggests a possible prevention measure of Public Safety Power Shutoff that will cut power supply for some customers in North Valley, North Bay and the Sierra Foothills.

| CEA: Central Electricity Authority, discoms: distribution companies, mn: million, bn: billion, tn: trillion, GDP: Gross Domestic Product, UP: Uttar Pradesh, MP: Madhya Pradesh, kW: kilowatt, MW: megawatt, GW: gigawatt, IIT: Indian Institute of Technology, IEX: Indian Energy Exchange, kWh: kilowatt hour, BHEL: Bharat Heavy Electricals Ltd, y-o-y: year-on-year, KSEB: Kerala State Electricity Board, NCT: National Committee on Transmission, TOR: terms of reference, CTU: Central Transmission Utility, km: kilometre, UPPCL: UP Power Corp Ltd, kV: kilovolt, EESL: Energy Efficiency Services Ltd, UPCL: Uttarakhand Power Corp Ltd, UDAY: Ujwal Discom Assurance Yojana, AT&C: Aggregate Technical and Commercial, PTCUL: Power Transmission Corp Ltd, UJVNL: Uttarakhand Jal Vidyut Nigam Ltd, AVVNL: Ajmer Vidyut Vitaran Nigam Ltd, CESC: Calcutta Electric Supply Corp, PGCIL: Power Grid Corp of India Ltd, IPPs: independent power producers, NUM: National Union of Mineworkers, ZETDC: Zimbabwe Electricity Transmission and Distribution Company, US: United States, PDS: Power Distribution Services, UK: United Kingdom, PG&E: Pacific Gas and Electric Company |

NATIONAL: OIL

India’s crude oil production falls 5.83 percent in April-October 2019

26 November. Domestic Crude oil production during October, 2019 was 2738.44 thousand metric tonne (tmt) which is 7.21 percent lower than target and 5.09 percent lower when compared with October 2018. Cumulative crude oil production during April-October, 2019 was 19110.46 tmt which is 4.91 percent and 5.83 percent lower than target for the period and production during corresponding period of last year respectively.

Source: Business Standard

Only 61 percent households used LPG for cooking as of December 2018, shows NSO data

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Divergence in data over LPG use by government and NSO will undermine LPG access policy implementation!

< style="color: #ffffff"> Bad! |

26 November. About 61 percent of total households in India used liquefied petroleum gas (LPG) for cooking in India in 2018, according to the latest National Statistical Office (NSO) survey report. Last year, the government had claimed around 90 percent LPG penetration across the country by December 2018. Only 48.3 percent of the rural households used LPG, while the figures were much higher in urban areas at 86.6 percent, according to the NSO’s 76

th round survey on ‘Drinking Water, Sanitation, Hygiene and Housing Condition’ released. The survey was conducted for the period between July and December 2018. To be sure, the NSO asked over 100,000 households across the country about their primary source of fuel. Interestingly, 44.5 percent of the houses in villages were still using firewood, crop residue and chip for cooking as their primary source of fuel, against 5.6 percent in cities during 2018. The survey highlighted that around 13 percent households have received benefits related to LPG connections. The ministry of statistics and programme implementation said that these estimates may likely be "under-reported" because of tendency of people to give a "negative reply" to survey officers on expectation of receiving certain benefits from the government. The National Democratic Alliance government claims that LPG penetration has reached 96.5 percent in the country by October this year, touting one of its flagship schemes, Pradhan Mantri Ujjwala Yojana (PMUY), as a major success. According to the data by Petroleum Planning and Analysis Cell (PPAC), LPG penetration stood at 89.5 percent as of December 1, 2018. Interestingly, 44.5 percent of the houses in villages were still using firewood, crop residue and chip for cooking, against 5.6 percent in cities during 2018. The NSO has captured LPG connections for the first time in its survey, so comparison with the previous surveys was not possible. The LPG usage by households was low in major states such as Odisha (32.6 percent), Jharkhand (32.9 percent), West Bengal (42.8 percent), Rajasthan (48.1 percent), Madhya Pradesh (48.3 percent), and Uttar Pradesh (50.2 percent). Despite a huge push for the PMUY, launched by Prime Minister Narendra Modi in May 2016, about 11 percent households reported receiving any benefits related to LPG connections in the past three years from when the survey was conducted.

Source: Business Standard

BPCL rolls out digital fuelling initiative

25 November. NextGen Digital Fuelling initiatives, aimed at providing greater transparency and building customer trust, has been launched by public sector Bharat Petroleum Corp Ltd (BPCL). Some of the initiatives include 100 percent assured quality and quantity of fuel delivered to BPCL fuel stations through tankers, 100 percent secured payments, new retail visual identity and automated SMS updates after fuelling transactions. BPCL chairman and managing director D Rajkumar along with senior officials recently launched the NextGen Digital Fuelling Initiatives for BPCL Fuel Stations, part of the Pure for Sure programme launched by the company in 2001, at a retail outlet. The roll out of the new NextGen initiatives will happen in six cities, starting with Chennai, followed by New Delhi, Kolkata, Bengaluru, Mumbai and Hyderabad under Phase I. The second phase roll out would take place across 42 'A' and 'B' class cities next year. BPCL has over 8,600 certified Pure for Sure retail outlets across the country.

Source: Business Standard

Government’s privatisation plan may end complex cross-holding in oil PSUs

24 November. The government may end the cross-holding structure existing in the oil sector as it looks to further consolidate operations of public sector enterprises and go ahead with its privatisation plan by getting a fair valuation of assets. All oil sector PSUs (Public Sector Undertakings) would be asked to exit from their investments made in equity shares of other state-owned entities. The cross-holding structure among oil PSUs was built in the late 1990s as the government sold its shares in Oil India Ltd (OIL), Oil and Natural Gas Corp (ONGC), GAIL (India) Ltd and Indian Oil Corp (IOC) in a bid to raise funds. Estimates suggest that if the government divests its stake by taking the entire proceeds from sale of shares cross-held by oil PSUs, it could mobilise upwards of Rs400-Rs500 bn. The oil ministry has already indicated to ONGC to exit from its investments in oil refiner and marketer IOC and GAIL, while the other two would also sell all their equity in the upstream company. It is not that companies have made major gains from cross-holdings. In fact, with volatility in the oil market and the government’s decision to seek OMCs (Oil Marketing Companies) take up some burden to soften the rise in petrol and diesel prices have taken a toll on OMC shares in the past and has thus reduced the value of their investments.

Source: Business Standard

NATIONAL: GAS

India’s natural gas production declines 5.6 percent in October 2019

26 November. India’s natural gas production declined 5.6 percent to 2.64 billion cubic meters (bcm) in October 2019 over a year ago. Natural gas output of ONGC dipped 7.4 percent to 1.95 bcm, while that of Oil India Ltd (OIL) rose 1.6 percent to 0.24 bcm. Further, the natural gas production of private and JV (joint venture) companies declined 1.0 percent to 0.45 bcm in October 2019. Natural gas output fell 2.1 percent to 18.65 bcm in April-October 2019 over April-October 2018.

Source: Business Standard

ONGC ends shale exploration

26 November. Oil and Natural Gas Corp (ONGC) has wound up its shale exploration programme mid-way after spending five years and hundreds of crores of rupees, concluding that India may not have enough commercially-extractable shale reserve. ONGC recently told the government that it was ending its shale exploration programme ahead of schedule as the results hadn’t been encouraging. It also told the government to get the country’s shale potential reassessed by a competent international agency. The oil ministry is considering launching a new resource assessment programme for all unconventional hydrocarbons, including shale, coal-bed methane and gas hydrate. Past estimates of India’s shale reserves vary widely from ONGC’s 187 trillion cubic feet (tcf) of shale gas in 5 basins to US (United States) Energy Information Administration’s 584 tcf of shale gas and 87 bn barrels of shale oil in 4 basins, and oilfield services provider Schlumberger’s 300 to 2100 tcf gas.

Source: The Economic Times

Nashik buses will get 16k kg of CNG from Pune every day

23 November. The initial supply of green fuel for 200 compressed natural gas (CNG)-run buses that the Nashik Municipal Corp (NMC) is planning to operate from April next year will come from Pune. The Maharashtra Natural Gas Ltd (MNGL) has been mandated by the civic body to supply CNG for these buses that would ply on city roads to strengthen the public transport system. The company has already decided to ferry about 16,000 kilogram (kg) of CNG in cascades by light motor vehicles on a daily basis once the CNG-run buses. The NMC has already earmarked land for MNGL to establish storage facility at Pathardi Phata where LNG would be converted into CNG for supply. The MNGL has planned to set up 15 CNG stations in the district by March next year. Of the 15 stations, 12 will be set up on the premises of existing fuel stations of oil marketing companies like IOC (Indian Oil Corp), HPCL (Hindustan Petroleum Corp Ltd) and BPCL (Bharat Petroleum Corp Ltd). The remaining three would be established on the land provided by the NMC and would be operated by the MNGL.

Source: The Economic Times

PNGRB constitutes high-level committee to formulate model CGD policy

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Clear policy formulation on CGD is the need of the hour for the gas sector!

< style="color: #ffffff">Good! |

22 November. India’s downstream oil sector regulator Petroleum and Natural Gas Regulatory Board (PNGRB) has constituted a high-level committee for creating a draft city gas distribution (CGD) policy, which can act as a reference point for state governments to formulate their own CGD policies for streamlining the process of setting-up CGD networks. The draft CGD policy will include guidelines on setting up a nodal agency by state governments to coordinate to get single-window clearance, procedure to grant time-bound right of way permissions for CGD network, procedure for timely availability of permissions from National Highway Authority of India (NHAI), railways, environment approvals and timely allocation of domestic natural gas, beside others. Post the completion of the tenth CGD round, natural gas will be available in 228 Geographical Areas, covering 27 states and union territories, which will result in access to gas for 70 percent of the country’s population and 50 percent of its geographical area. Under the revised 2018 CGD policy, pre-determined penalty will be levied on players within three months from the end of each contract year, if the physical performance target provided by the player is not achieved at the end of one contract year. The regulator will impose a penalty of Rs750 for shortfall in each piped gas connection, Rs1,50,000 for missing each inch-kilometre of pipeline, and Rs20 lakh for each natural gas station not installed. The regulator has invited stakeholder inputs for formulation of draft CGD policy by 30 November.

Source: The Economic Times

Fuel shortages push India to build strategic natural gas reserve

21 November. After oil, India is set to build strategic reserve of natural gas, to further strengthen country’s energy security and shield itself from supply disruptions coming from perennial political risk in the prime energy supplying countries in the Middle East and Africa. The reserve will also help the country cope with demand spike and price rise in the event of border skirmishes and war like situation that played out with Pakistan recently. For building strategic gas reserve, the plan is to inject depleted gas fields with the fuel or develop storage in large salt caverns. The plan for strategic gas reserves emerges from an official study that suggests that consumption of natural gas would grow two-folds by 2030 resulting in large gap between demand and domestic production. At present, almost of half of domestic consumption of natural gas is met from imports. The suggestion for building strategic gas reserve has also come from Niti Aayog that is finalising a national Energy Policy. The policy draft has made a case for a gas storage required, if consumers have to be assured of un-interrupted supplies. For India strategic storage of gas would work well also because the domestic gas production has remained stagnant for past few years. In the current fiscal (FY20), upto September while gas production has declined by 1.5 percent, LNG (liquefied natural gas) imports has risen 7.9 percent.

Source: The Economic Times

India’s hunger for natural gas being fed by costly imports amid dismal local production

20 November. India’s hunger for natural gas to feed key industries in the power and fertilizer sectors is continuing to grow unabated but that demand is increasingly being met by costly imports on the back of dismal domestic production. The country consumed 174 million metric standard cubic meter per day (mmscmd) of natural gas in September 2019, a 6 percent increase over the consumption of 164 mmscmd in the same month last year. The over demand growth stood at 3 percent in the April-September 2019 period, according to data shared by research firm India Ratings. However, the 6 percent growth in consumption in September fuelled a massive 18 percent jump in costly imports of regasified-liquefied natural gas (R-LNG).

Source: The Economic Times

NATIONAL: COAL

India’s Steel Minister expects to increase coking coal imports from Russia

26 November. India’s Steel Minister Dharmendra Pradhan said he was confident India’s imports of coking coal from Russia would increase significantly in coming months. Steelmakers had started testing samples of Russian coal. India long depended on Australia to meet most of its coking coal requirements but has progressively cut down on imports from the country in the last three years. Shipments of coking coal from the United States and Canada rose to a sixth of all Indian imports of the fuel during the year ended March 2019, according to government data, while Australia’s share fell to 71 percent from about 88 percent three years ago. Interruptions to Australian supply in recent years, including a flood in a major coal producing region in February and a cyclone which tore into Queensland in 2017, raised concerns in India. Overall coking coal imports to India, one of the world’s fastest growing major economies, rose 10.3 percent to 51.84 million tonnes (mt) in 2018/19, with demand for the fuel expected to more than double over the next 10 years. The country plans to increase annual crude steel production to 300 mt by 2030 from 132 mt currently, with steelmakers importing the bulk of their coal due to scarce domestic production. India’s top aluminium and copper producer Hindalco Industries has signed a Memorandum of Understanding (MoU) with Russia’s Far East Agency for investment in minerals such as copper and thermal coal, the steel ministry said.

Source: Reuters

Operationalise additional blocks soon or return them: Government to CIL

25 November. The coal ministry has asked Coal India Ltd (CIL) to either expedite the operationalisation of 110 additional blocks allotted to it or return the mines to the government. The coal ministry recently enquired from the PSU (Public Sector Undertaking) about the operational status of the additional blocks allotted to it, and whether extraction from these coal blocks is techno-economically feasible. The government was told that of the 110 additional CIL blocks, 50 were explored, 41 were under exploration and balance 19 were partly/regionally explored. Further, out of 50 explored blocks, project reports of 25 blocks have been prepared, the coal ministry was informed. CIL accounts for over 80 percent of domestic coal output. The firm had earlier said that it will produce 750 million tonnes (mt) of coal in the next financial year. The PSU will further produce 1 billion tonnes (bt) of coal by FY2024, Coal Minister Pralhad Joshi had said. CIL is targeting to produce 660 mt of the dry fuel in 2019-20 compared to 607 mt in the last fiscal.

Source: Business Standard

Government mops up Rs49.7 bn revenue from auctioned coal mines since FY 2014-15

25 November. The government has collected Rs49.72 bn in revenue from auctioned coal blocks since financial year 2014-15. Of the total revenue garnered till 31 October, the maximum of Rs12.8 bn was mopped up in 2018-19. In 2017-18, the revenue stood at Rs11.15 bn while in the preceding fiscal, it was Rs10.18 bn.

Source: Business Standard

NATIONAL: POWER

KSEB to hold public adalat from 14 January

25 November. Kerala State Electricity Board (KSEB) would carry out a social audit in 12 electrical sections on an experimental basis, Power Minister M M Mani has said. In order to address public grievances in power sector, public adalats would be organised from 14 January to 4 February, he said. KSEB chairman and managing director N S Pillai said the board was committed to complete all power distribution projects on time. Pillai asked officials concerned to take steps for replacing of all faulty meters before 1 January.

Source: The Economic Times

8.12 lakh consumers in Nashik district owe Rs1.1 bn to power utility

22 November. A total of 8.12 lakh Maharashtra State Electricity Distribution Company Ltd (MSEDCL) customers across the district owe as much as Rs1.11 bn to the state power utility. The MSEDCL has decided to launch a special drive for recovery of dues and is going to use the threat of immediate disconnection of power supply to force people to make the payments. The Nashik district is divided into two circles - Nashik and Malegaon - that are further divided into various divisions. Nashik city 2 division, which is a part of Nashik Circle and the rural areas surrounding the city, has the highest number of consumers who have not cleared the dues. The second highest defaulters are from Malegaon City of Malegaon Circle where 1.08 lakh consumers owe Rs250.8 mn. Kalwan division has the lowest number of defaulters - 20,537 consumers owing Rs18.6 mn.

Source: The Economic Times

Power duty waiver system goes online in Gujarat

22 November. Gujarat government launched a web portal for applying online for waiver of electricity duty. Under this initiative, industrial units will have the facility to make online application for waiver of electricity duty. Energy Minister Saurabh Patel said that for availing waiving of electricity duty, industrial units will have to make online registration and submission of application along with uploading of mandatory documents on the web portal:

www.ceiced.gujarat.gov.in.

Source: The Economic Times

Over 67k schools functioning without electricity in Madhya Pradesh

22 November. A primary school in Sarotipura, Bhopal does not have electricity or water connection, however, it is not alone as there are 67,902 such schools which are lacking in basic amenities in the state. Official stats reveal that there are 855 schools that are forced to function without electricity and other basic amenities in the state capital of Bhopal alone while in the Chhindwara district, which is home of Chief Minister Kamal Nath 2,620 schools are functioning similarly.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

UP government introduces blockchain to allow trading of surplus solar power

26 November. The Uttar Pradesh (UP) government has introduced the blockchain technology to the rooftop solar power segment, allowing consumers to trade their surplus solar energy. Two state power utilities — UP Power Corporation Ltd (UPPCL) and UP New and Renewable Energy Development Agency (UPNEDA) — have launched the ambitious project as a pilot in select government buildings in Lucknow with installed rooftop solar power plants. According to state energy watchdog UP Electricity Regulatory Commission (UPERC), Phase-I of the pilot project is expected to be completed in six months. The pilot project drafted by UPPCL and UPNEDA will demonstrate the technical feasibility of peer-to-peer energy trade between rooftop solar photovoltaic (PV) ‘prosumers’ using the modern blockchain technology. Power consumers who also produce electricity through rooftop solar PV system are referred to as ‘prosumers’.

Source: Business Standard

India asks state-run firms to clear over $1 bn owed to green energy firms

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">The exuberance over affordability of green energy must be read in the context of dues from buyers!

< style="color: #ffffff">Ugly! |

26 November. India has asked state lenders to provide over $1 bn to government power distribution companies to clear longstanding debts to green energy firms that could hinder further investment. The companies owe solar and wind power generators including Goldman Sachs-backed ReNew Power and Softbank-backed SB Energy over Rs97 bn ($1.35 bn), according to the Central Electricity Authority. Adding to the problems of the power generators, a new government in Andhra Pradesh state - which owes renewable energy firms more than any other state - wants to renegotiate its contracts, saying the prices it pays are inflated. Foreign investment is central to India’s green energy ambitions, and a slowdown in overseas funding could hurt Prime Minister Narendra Modi’s commitment to increase adoption of renewable energy. India is looking to install 175 GW in renewable energy capacity by 2022, solar and wind power generators said. Japan’s SoftBank Group Corp has plans to invest up to $100 bn in solar power generation in India. Andhra Pradesh, which accounts for about a 10

th of India’s renewable energy capacity, owes green energy generators Rs25.1 bn ($353 mn), over a fourth of all dues.

Source: Reuters

CIL, ISRO tie up to develop satellite-based air pollution system

26 November. Coal India Ltd (CIL) has tied up with the Indian Space Research Organisation (ISRO) to develop a satellite-based system to provide air pollution data online to the company and the government. In the recent past, five CIL subsidiaries were slapped a total fine of Rs533.31 bn by states for producing in excess of available environmental clearance limits in at least 60 mines. If CIL has to pay the levies, its finances will be critically hit as the penalty far exceeds its reserves of Rs380 bn. CIL has used services of satellites for monitoring land reclamation and reforestation.

Source: The Economic Times

440 MW of nuclear power plants in Tamil Nadu, Karnataka soon

26 November. A total of 440 MW of Nuclear Power generation is expected to begin in Tamil Nadu and Karnataka between 27 November and 1 December this year, as per Power System Operation Corp Ltd (POSOCO). The two units of 220 MW each belongs to India’s nuclear power operator Nuclear Power Corp of India Ltd (NPCIL). The NPCIL has two units of 220 MW each at MAPS (Madras Atomic Power Station) and four units of 220 MW each at Kaiga Generating Station.

Source: The Economic Times

Inox Wind gets SECI extension to commission 550 MW wind projects in Gujarat

25 November. Wind energy solutions provider Inox Wind said it has been granted extension by SECI (Solar Energy Corp of India) for the scheduled commissioning of 550 MW inter-state transmission system (ISTS) connected wind power projects in Gujarat. The time extension has been granted by SECI due to delay in operationalisation of long-term access by the central transmission utility, Inox Wind said. Inox Wind is a player in the wind energy market with three manufacturing plants in Gujarat, Himachal Pradesh and Madhya Pradesh. The company’s manufacturing capacity stands at 1,600 MW per annum.

Source: Business Standard

Power regulator refuses to fix trading margin for SECI

23 November. National electricity regulator Central Electricity Regulatory Commission (CERC) has refused to approve the trading margin of 7 paise/unit to the Solar Energy Corp of India (SECI), which is the nodal agency for implementing central government’s renewable energy projects across the country. The decision can be detrimental for SECI which relies majorly on trading margins for being the aggregator of renewable energy. Under this model, SECI supplies power to a number of states from solar and wind plants owned by other developers, earning a trading margin of Rs0.07/unit from such transactions. The development comes at a time when, states such as Andhra Pradesh, Punjab and Bihar have been requesting power regulators to reduce the trading margin for renewable aggregators to Rs0.02/unit.

Source: The Financial Express

Chennai power plant seeks more time to install emission-cutting equipment

23 November. TANGEDCO (Tamil Nadu Generation and Distribution Corp) has requested the power ministry to extend deadlines to install emission reducing fuel gas desulphurisation (FGD) systems in two units at its North Chennai power plant by another two years. The additional time has been sought even after the timeline to comply with new power plant emission norms were extended to 2022 after the earlier deadline of December 2015 was missed. While the company wants to extend the deadline for two of its units at the plant, TANGEDCO is waiting for the budgetary offer from BHEL (Bharat Heavy Electricals Ltd) for installing the pollution-cutting equipment in the remaining three units. According to projected figures, installation of emission-reducing equipment would necessitate a significant rise of Rs0.62-0.93/unit in power tariffs. The states had sought access to the Centre-operated Power System Development Fund and the National Clean Energy Fund (NCEF) to meet the additional expenditure required to install FGDs. The NCEF was created out of cess on coal produced or imported in FY11, and abolished from July 2017, on account of GST implementation.

Source: The Financial Express

India not responsible for climate change: Javadekar

22 November. Union Environment Minister Prakash Javadekar announced that India was not responsible for climate change, the per person carbon emission of the country is not more than two tonnes which is very less compared to the US (United States), Europe and China. He said carbon dioxide exists in the atmosphere for around 100 years but the pollutants are found in the atmosphere for a short period and then disappear. He said that the production of carbon dioxide increased with the burning of coal and the colourless gas - which has a density about 60 percent higher than the dry air -- settled in the atmosphere.

Source: The Economic Times

India’s solar power installations increase by 36 percent y-o-y at 2.1 GW in Q3

22 November. Installations in the Indian solar market rose by 36 percent year-on-year (y-o-y) during third quarter (Q3) of calendar year 2019, reaching 2,170 MW from 1,592 MW a year ago. Compared to the second quarter of 2019, installations are up by 44 percent. However, solar installations in the first nine months of 2019 reached 5.4 GW, down 19 percent from 6.7 GW of capacity added in the first nine months of 2018, according to Mercom India Research. Total power capacity addition during nine months of 2019 was 13 GW from all power generation sources. Of this, renewable energy sources accounted for nearly 56 percent of installations, with solar representing 41.4 percent of new capacity and wind with 13.6 percent. Tamil Nadu was the top state for large-scale solar installations in Q3 2019, followed by Rajasthan and Karnataka.

Source: Business Standard

Government plans to set up 14 MW solar power units in Leh, Kargil

21 November. The government is planning to set up 14 MW solar power projects in Leh and Kargil, Minister of State for Power and New & Renewable Energy R K Singh said. The projects will be developed under the Prime Minister Development Package 2015, Singh said. Singh said that the government has set an installation target of 175 GW of grid-connected renewable power capacity by 2020.

Source: Business Standard

Solar panels reduce bills by 50 percent: Delhi Power Minister

21 November. Under the Mukhyamantri Solar Power Yojana, Delhi government’s flagship scheme launched in 2018, 146 MW solar capacity has been achieved in 2,900-odd installations that has helped reduce 500 tons carbon dioxide (CO

2)-eq emissions daily, Delhi Power Minister Satyendar Jain said. Last year, 25 percent of the societies in Dwarka availed the scheme. It also explained that if any society wanted to install solar panels, Delhi government provided subsidy worth 30 percent of the cost of the plant.

Source: The Economic Times

Indian scientist, others design device that can store solar energy

21 November. Storing solar energy for later use has always been a big challenge. A young Indian scientist who is currently a postdoc in a US (United States) university and colleagues may have just overcome this hurdle, at last. The device designed by Varun Kashyap and others at the University of Houston is not only capable of harvesting solar energy efficiently, but also storing it until it is required. The work can have a range of applications from power generation to desalination to distillation, the scientists said in a paper. Unlike solar panels and solar cells, which rely on photovoltaic technology for the direct generation of electricity, the hybrid device captures heat from the sun and stores it as thermal energy.

Source: The Hindu Business L ine

Government sets up over 56 MW power capacity from waste in last 3 yrs: Singh

21 November. As part of its efforts to promote waste-to-energy, the government has set up a total capacity of 56.34 MW for power generation from waste in last three years. So far 199 waste-to-energy projects for generation of biogas/bio-CNG/ power based on urban, industrial, agriculture waste and municipal solid waste have been successfully established in the country as on 31 October 2019, Minister of State for Power, New and Renewable Energy R K Singh said. The MNRE is implementing a scheme 'Programme on Energy from Urban, Industrial and Agricultural Wastes/Residues' for promoting setting up waste-to-energy to recover energy in the form of biogas or bio-CNG from urban industrial and agricultural wastes.

Source: Business Standard

Lucknow Municipal Corp to generate biogas, CNG from cow dung

20 November. In a bid to make the city’s Gaushalas self-dependant, Lucknow Municipal Corp has proposed a project that will generate biogas and compressed natural gas (CNG) from cow dung. Earlier in October, Union Minister for Micro, Small and Medium Enterprises (MSME) Nitin Gadkari had launched cow dung soaps and bamboo bottles on the eve of Gandhi Jayanti under a special sales campaign of Khadi and Village Industries Commission in Delhi.

Source: Business Standard

INTERNATIONAL: OIL

Oil prices steady amid hopes for US-China trade deal

26 November. Oil prices were steady, holding onto gains from the previous session, after positive comments from the United States (US) and China kept alive hopes that the world’s two largest economies are soon to agree an end their trade war. On the supply side, the Organization of the Petroleum Exporting Countries (OPEC) meets on 5 December at its headquarters in Vienna, followed by talks with other oil producers, including Russia, that combined with the cartel make up the OPEC+ group. The broader producer group is widely expected to extend a supply cut to mid-2020.

Source: Reuters

Norwegian energy company Equinor CEO sees oil prices staying at around $60 a barrel

26 November. Oil prices are set to stay at around $60 a barrel in the short and medium term, and will likely increase afterwards, Norwegian energy company Equinor CEO (chief executive officer) Eldar Saetre said. The oil market has yet to feel the inevitable supply impact from investment cuts that took place during the industry’s 2014-2016 slump, he said.

Source: Reuters

US government releases draft proposal for expanded Alaska oil development

22 November. Environmentally sensitive but potentially oil-rich areas of Arctic Alaska will be opened to oil development under a new Trump administration proposal to undo Obama-era protections. The proposed changes are described in a draft environmental impact statement for managing the National Petroleum Reserve in Alaska, a 23 mn-acre (9.3 mn-hectare) unit of federal land on the western side of Alaska’s North Slope. The most aggressive would allow oil development in 81 percent of the reserve. Under the Obama-era management plan enacted in 2013 and currently in effect, about half the reserve is open to oil development and half is protected for its wildlife and cultural values. New oil discoveries and the westward spread of North Slope oil-field development justifies increased access for drilling. The Trump administration has taken other steps to open up Arctic Alaska territory to new oil development. The administration proposed opening vast areas of Arctic waters to oil drilling.

Source: Reuters

US Gulf set for record 2020 with oil production

22 November. The US (United States) Gulf of Mexico is positioned for another year of record oil production in 2020, according to Norway-based energy research firm Rystad Energy. The Gulf of Mexico’s oil production has risen every year since 2013, with an average of 104,000 barrels per day (bpd) annually. So far in 2019, the top contributors to supply growth have been the Big Foot and Crosby fields, but the Appomattox field is expected to make a significant impact by the end of the year by ramping up towards its processing capacity of 175,000 barrels of oil equivalent per day.

Source: Rigzone

Russia to continue cooperation with OPEC to keep oil market balanced: Putin

20 November. President Vladimir Putin said that Russia and OPEC (Organization of the Petroleum Exporting Countries) have ‘a common goal’ of keeping the oil market balanced and predictable, and Moscow will continue cooperation under the global supply curbs deal. The OPEC meets on 5 December in Vienna, followed by talks with a group of other exporters, including Russia, known as OPEC+. Saudi Arabia’s King Salman said that the kingdom’s oil policy aims to promote stability in global oil markets, and serves consumers and producers alike. In October, Russia cut its oil output to 11.23 mn barrels per day (bpd) from 11.25 mn bpd in September but it was still higher than a 11.17-11.18 mn bpd cap set for Moscow under the existing global deal.

Source: Reuters

INTERNATIONAL: GAS

Qatar plans to boost LNG production to 126 mt by 2027

25 November. Qatar topped up its expansion plan for its vast liquefied natural gas (LNG) production facilities after drilling and appraisal work at its gas fields and now expects to produce 126 million tonnes (mt) a year by 2027. The announcement by the world’s biggest LNG supplier comes as prices for the super-chilled gas languish at multi-year lows thanks to a surge in production from the United States, Russia and Australia. Qatar Petroleum said the rise in output estimates is a result of new drilling and appraisal work in the expanded North Field mega field that confirmed gas reserves now exceeded 1,760 trillion cubic feet (tcf). The allure is cheap gas from the North Field, the world’s biggest natural gas field which Qatar shares with Iran. Qatar’s gas extraction costs are some of the lowest in the world. Qatar has dominated the LNG market for over a decade and has been able to influence its mechanisms such as bedding down inflexible supply contracts with very long-term buyers.

Source: Reuters

Ukraine’s Naftogaz pledges to press on with Russia gas talks

25 November. Ukrainian state energy firm Naftogaz has pledged to press on with talks on gas transit with Russian gas exporter Gazprom and the European Union. Gazprom, which owes Ukraine around $3 bn, may repay that debt with gas supplies, Naftogaz said. Gazprom said it had sent Ukraine a letter to formally propose extending a deal supplying gas to the country either for its own use and for transit to Europe, or the signing of a new one-year agreement. The current deal is set to expire at the end of 2019. Ukraine is one of the main routes by which Russia exports gas to Europe. Moscow’s construction of new pipelines, such as Nord Stream 2 and TurkStream, will cut Russian gas transit through Ukraine. Last year, Kremlin-controlled Gazprom supplied Europe with more than 200 billion cubic meters (bcm) of gas, of which 87 bcm went through Ukraine, providing Kiev with transit income of around $3 bn. Ukraine halted its own imports of Russian gas in November 2015 after a row with Gazprom over prices and payments.

Source: Reuters

Gunvor to market LNG produced at $4 bn US export project

25 November. Gunvor Group Ltd agreed to double the maximum amount of liquefied natural gas (LNG) it plans to buy from a $4 bn export project in Louisiana and said it will recruit additional customers for the terminal. The trading firm will purchase as much as 3 million tonnes (mt) of LNG per year from Commonwealth LNG, the Houston-based developer said. Gunvor will also market the remaining volumes from the facility, which will be able to produce about 8.4 mt a year. LNG developers need to sign enough customers to secure financing, and competition is intensifying. New terminals from Russia to Australia are flooding the market with supply, while the trade war has made it all but impossible for American exporters to sign deals with Chinese buyers. Trading houses, meanwhile, are becoming bigger players in LNG project development. Cheniere Energy Inc, America’s first and biggest shipper of shale gas, struck a 15-year agreement last year to sell the fuel to Vitol Group. Gunvor is on course to lead LNG ship charters this year after seeing its trading of the super-chilled fuel jump in 2018. Gunvor had reached a preliminary agreement with Commonwealth in June to buy 1.5 mt of LNG a year for 15 years.

Source: Bloomberg

Total criticises EIB’s decision not to finance gas

21 November. Total criticised the European Investment Bank (EIB)’s decision to stop financing all fossil fuel projects including gas, saying companies that might switch to gas-fired power plants from heavy-polluting coal could now reconsider. The EIB said that it would stop funding fossil fuel projects at the end of 2021, a landmark decision that potentially deals a blow to billions of dollars of gas projects in the pipeline.

Source: Reuters

Energean to sell gas to MRC Alon Tavor in $1 bn deal

21 November. Energean Oil & Gas said it signed a $1 bn deal to sell natural gas to Israel’s MRC Alon Tavor from its offshore Karish gas field. Energean said the gas sales and purchase agreement includes the sale of about 0.5 billion cubic meters (bcm) of gas a year, or up to 8 bcm in total, over 15 years. Revenue from the deal is estimated to top $1 bn over the term of the contract, the company said. Energean said it now has firm agreements for the supply of 5 bcm a year of gas into the Israeli domestic market.

Source: Reuters

CNPC’s $8.5 bn gas storage project starts construction

20 November. China National Petroleum Corp (CNPC)’s unit Liaohe Oilfield of CNPC kicked off construction of its gas storage group project in Panjin city in Liaoning province. The project, jointly invested in by Liaohe Oilfield of CNPC and the Panjin government to the tune of about 60 bn yuan ($8.5 bn), is aiming for storage capacity of 11.5 billion cubic meters (bcm). The Liaohe project is expected to become the biggest underground natural gas storage centre in northeast China and the Beijing-Tianjin-Hebei region. CNPC said it planned to build 23 more gas storage facilities by 2030 and expand 10 existing ones to secure supplies of natural gas during peak demand seasons.

Source: Reuters

INTERNATIONAL: COAL

Italy’s UniCredit to exit thermal coal financing by 2023

26 November. Italian bank UniCredit has pledged to halt all lending for thermal coal projects by 2023, joining a growing band of financial companies striving to improve their green credentials. UniCredit said new projects in thermal coal mining and coal-fired power generation would be off-limits, setting strict commitments to reduce reliance on coal for customers of its corporate financing business.

Source: Reuters

Poland’s JSW sees 2019 coal output over 15 mt

22 November. Poland’s Jastrzebska Spolka Weglowa (JSW), the European Union’s biggest coking coal producer, will produce more than 15 million tonnes (mt) of coal this year, close to 2018 levels, the company’s Deputy Chief Executive Tomasz Sledz said.

Source: Reuters

Thailand’s EGAT International builds $2.3 bn coal-fired power plant in Vietnam

22 November. Thailand’s EGAT International Company started construction of a 55 tn dong ($2.37 bn) coal-fired power plant in central Vietnam. The 1,320 MW Quang Tri 1 plant is being built in Quang Tri province. EGAT International is a wholly owned subsidiary of the Electricity Generating Authority of Thailand. Vietnam’s coal imports in the first 10 months of this year more than doubled from a year earlier to 36.8 million tonnes (mt), government data showed. The coal, sourced mainly from Australia and Indonesia, is used mostly for an expanding fleet of coal-fired power plants.

Source: Reuters

Last coal plant operating in New York seeks to shut in February

21 November. The operator of New York state’s last active coal-fired power plant, located north of Buffalo in Somerset, filed with state utility regulators for permission to shut as soon as 15 February, saying it wants to build a data center at the site. Somerset Operating Company asked the New York State Public Service Commission (NYSPSC) to waive the state’s 180-day notice requirement before shutting the plant. The company said that it is retiring the plant due to stricter emissions regulations designed to eliminate coal in New York and deteriorating power market conditions. In May, New York Governor Andrew Cuomo said state environmental regulators adopted rules to reduce carbon dioxide emissions from power plants that will force generators to stop burning coal in the state by the end of 2020.

Source: Reuters

China coal-fired power capacity still rising, bucking global trend

20 November. China raised its coal-fired power capacity by 42.9 GW, or about 4.5 percent, in the 18 months to June, connecting new projects to the grid at a time when capacity in the rest of the world shrank, according to a study. China has another 121.3 GW of coal-fired power plants under construction, US (United States)-based research network Global Energy Monitor said in its report, nearly enough to power the whole of France. China’s total coal-fired power capacity stands at more than 1,000 GW.

Source: Reuters

INTERNATIONAL: POWER

Philippine senator urges probe into Chinese 'threat' to power grid

26 November. A senator in the Philippines urged lawmakers to investigate China’s access to its power grid, warning of a security threat and possible sabotage due to its stake in the nation’s only transmission firm. Risa Hontiveros filed a resolution warning of Chinese-engineered power and internet outages and interference in elections if safeguards remained absent, citing confirmation from a Philippine power executive that a “hostile third party” had the ability to cause blackouts. Concern about China’s involvement in the power grid was first raised during the energy department’s 2020 budget hearing in the Senate. China’s State Grid Corp owns a 40 percent share in a consortium called the National Grid Corporation of the Philippines, which in 2008 won a 25-year-franchise.

Source: Reuters

Nigeria to complete construction of 10 power generation plants

25 November. Nigeria is set to complete the construction of 10 power generation plants to improve the volume of electricity being generated in the country. The project is being undertaken by the Niger Delta Power Holding Company (NDPHC). NDPHC said that out of the 10 power generation plants embarked upon by the company, eight have been completed, while the remaining two are under construction. NDPHC said that the Lafia substation, which is 95 percent completed, would be capable of supplying 23 hours of electricity to Lafia metropolis and its environs when inaugurated.

Source: Construction Review

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Poland’s PGE, Denmark’s Orsted aim to sign offshore wind deal by year-end

26 November. Polish energy group PGE is close to signing a deal to sell 50 percent stakes in two planned offshore wind projects in the Baltic Sea to Denmark’s Orsted, the companies said. The projects, which have a total capacity of up to 2.5 GW, are key to developing the offshore wind sector in otherwise coal-reliant Poland. For coal-reliant Poland, offshore wind, together with other renewables, is seen as an opportunity to put the energy industry on a greener path. The Polish government has set a target of generating at least 10 GW of offshore wind power by 2040 compared to zero, and is finalizing the legal framework to support this.

Source: Reuters

IFC invests $450 mn in Pakistan’s 6 wind power projects

25 November. The International Finance Corp (IFC) has led the financing of a first-of-its-kind programme to build six wind power projects in Pakistan, named the Super Six, with a total investment of $450 mn. The programme aims to help deliver cleaner, cheaper power to meet the country’s critical demand for energy and reduce reliance on expensive imported fossil fuels. The Super Six plants, with a combined capacity of 310 MW, will deliver among the lowest-cost power generation in the country to date. The programme is also expected to lead to emission reductions of about 650,000 tons of carbon dioxide (CO

2) per year.

Source: ESI Africa

China aims to boost revenue for renewable power firms

25 November. China plans to make power purchasers take fair returns into account when buying electricity from renewable power generators, according to a draft rule issued by the National Energy Administration (NEA) aimed at improving their revenues. The draft rule will apply to non-hydropower resources, including wind, solar, biomass, geothermal and ocean power. China said it will cut its renewable power subsidy by 30 percent to 5.67 bn yuan ($800 mn) in 2020, and plans to stop funding large solar power stations and onshore wind farms in the coming two years, partly due to a payment backlog. China, the world’s largest energy consumer, has been boosting consumption of clean energy by forcing grid firms to prioritise renewable power resources and to maximise purchases from local renewable power providers. In future, local energy administrations would also need to take into account “fair returns” for renewable power producers, the NEA said.

Source: Reuters

Waste storage at Africa’s only nuclear plant brimming

25 November. Spent fuel storage at South Africa’s Koeberg nuclear plant will reach full capacity by April as state power utility Eskom awaits regulatory approval for new dry storage casks, the company said. Storage of high-level radioactive waste is a major environmental concern in the region, as South Africa looks to extend Koeberg’s life for another two decades and mulls extra nuclear power plants. Koeberg, Africa’s only nuclear facility, is situated about 35 km (21.75 miles) from Cape Town and was connected to the grid in the 1980s under apartheid. Anti-nuclear lobby group Earthlife Africa said South Africa could not afford the social, environmental and economic costs associated with nuclear waste.

Source: Reuters

Australia’s Genex Power secures funding for 2 solar projects

21 November. Australian power generation company Genex Power said it received credit approval to fund two of its solar projects in the country. The A$175 mn ($118.97 mn) debt facility will be used to fund the construction of its 50 MW Jemalong Solar Project (JSP) in the state of New South Wales and to refinance the existing debt facility for the 50 MW Kidston Solar One Project in Queensland state, the company said.

Source: Reuters

Brazil seeks more funding to combat environmental destruction

20 November. Brazil’s plans for environmental protection remain unchanged even as deforestation skyrockets, but Environment Minister Ricardo Salles said the country was looking for more money to implement those plans. Salles largely repeated previously announced plans to bring more development, economic zoning and improved enforcement of environmental laws to the Amazon rainforest region, where deforestation has surged to its highest point in 11 years. The government will strive to reduce deforestation by the time annual figures are next announced in late 2020, Salles said in a briefing alongside state governors from the Amazon region. Salles said the country will seek more resources to enact its environmental policies and would ask for additional funding for developing countries at the COP25 United Nations climate meeting in Madrid in December. Under the structure of the Paris Agreement on climate change, developed economies have committed to mobilizing $100 bn annually in financing by 2020 to help developing countries tackle global warming, which Salles said has yet to materialize.

Source: Reuters

China to cut renewable power subsidy to $807 mn in 2020

20 November. China will cut its renewable power subsidy to 5.67 bn yuan ($806.50 mn) in 2020 from 8.1 bn yuan in 2019, the finance ministry said, as the country will soon stop funding large solar power stations. The subsidy for 2020 will be allocated to wind farms, biomass power generators and distributed solar power operators, as well as solar power projects for poverty alleviation purposes, in 11 regions across the country, according to the finance ministry. Total subsidies for solar projects are set at 2.63 bn yuan, while wind farms will receive 2.97 bn yuan and biomass generators will get 73.39 mn yuan. The amount of new installed solar capacity was 16 GW in the first three quarters of this year, the National Environmental Administration has reported. China plans to end subsidies for new onshore wind power projects at the start of 2021. Surging renewable power capacity in the recent years has left the finance ministry with a subsidy payment backlog of at least 120 bn yuan and endangered the cash flow of renewable power operators.

Source: Reuters

Fossil fuel polluters from US to China far off climate targets: UN

20 November. The world’s major fossil fuel producers are set to bust global environmental goals with excessive coal, oil and gas extraction in the next decade, the United Nations (UN) and research groups said in the latest warning over climate crisis. The report reviewed specific plans from 10 countries, including superpowers China and the United States (US), as well as trends for the rest of the world and estimated that global fossil fuel production by 2030 would be at levels between 50-120 percent over Paris Agreement targets. Under that 2015 global pact, nations committed to a long-term goal of limiting the average temperature increase to within 1.5-2 degrees Celsius above pre-industrial levels.

Source: Reuters

South Africa’s Eskom needs $12 bn to comply with new emissions laws

20 November. South Africa’s power utility Eskom needs around 187 bn rand ($12.60 bn) to comply fully with existing legislation curbing harmful emissions. Eskom, which uses mainly coal-fired power plants to generate electricity, was one of 37 top domestic polluters, including Sasol, granted a five-year reprieve by government until 2020 to meet air emission standards. The new minimum emissions standards for air quality laws in South Africa, which cover particulate, sulfur dioxide and nitrogen oxide emissions, came into effect on 1 April 2015.

Source: Reuters

DATA INSIGHT

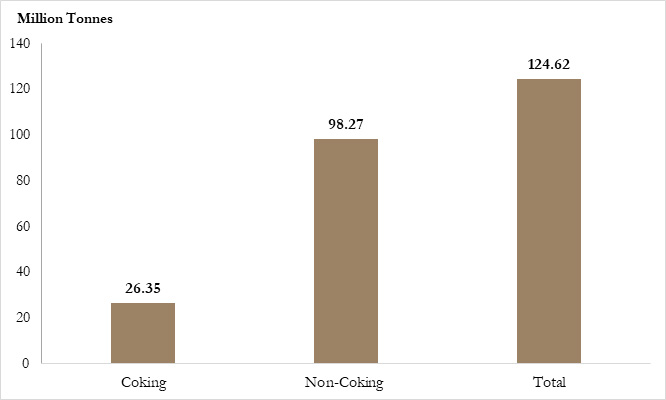

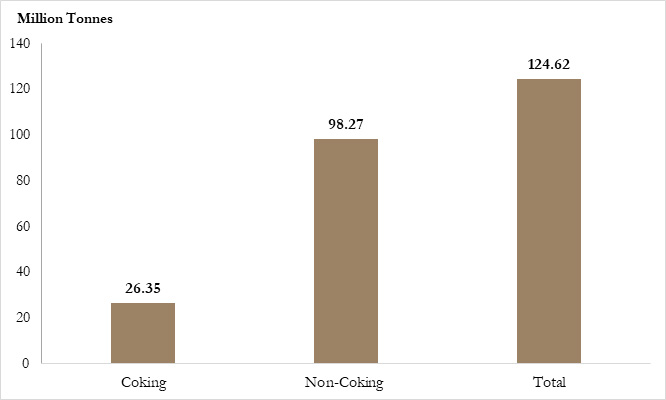

Coal Imports by Type

Million Tonnes

| Type of Coal |

2017-18 |

2018-19 (P) |

% change w.r.to previous year |

| Coking |

47.00 |

51.84 |

10% |

| Non-Coking |

161.25 |

183.51 |

14% |

| Total |

208.25 |

235.35 |

13% |

Coal Imports for 2019-20 (April to September) (P)

P: Provisional

Source: Ministry of Coal and Ministry of Commerce & Industry

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.