MINERS’ STRIKE DISRUPTS COAL SUPPLY

Monthly Coal News Commentary: September - October 2019

India

A high level committee, comprising cabinet secretary, Department of Economic Affairs secretary, revenue secretary, coal secretary and Niti Aayog vice-chairman, has recommended some sweeping policy changes to reform the coal sector. Government said that a high-level panel has recommended reforms to privatise the coal sector. One of the biggest recommendations is to move away from any allocation of captive coal mines. A one-year roadmap has been recommended to shift all concessions to commercial mining. All new auctions or allotments of coal mines has been recommended for commercial purpose only. The committee recommend removal of private sector’s disadvantageous position by doing away with the direct coal allotment to PSUs. Other recommendations included privatising CIL’s washeries to reduce India’s 80 percent import dependency on coking coal for steel, in addition to incentivise the private sector by auctioning coking coal linkages for 20 years. CIL should auction 222 non-operational, loss making mines on production sharing basis, the committee recommended.

In a bid to liberalise the coal sector, the government is planning to invite global players for the roll out of auction plan for commercial mining by December this year. The maiden move aimed at cutting coal exports is set to end the monopoly of domestic giant CIL that accounts for over 80 percent of the India’s dry-fuel output. The country’s coal imports increased by 28.7 percent to 24.14 mt in June as against 18.75 mt in the corresponding month of the previous fiscal. Total imports of thermal coal rose to 56.23 mt during the quarter as compared with the year-ago period. The country’s coal imports swelled by about 13 percent to 235.2 mt during the year-ended 31 March 2019. CIL along with the PSU SCCL are the only companies that till now were allowed to mine and sell coal. CIL is the single largest coal producer in the world, operating through 82 mining areas with seven wholly owned coal producing subsidiaries and a mine planning and consultancy company, it accounts for about 600 mt annual production.

A day long strike by the trade unions of CIL has not impacted the current coal stock availability at the thermal power plants. According to the National Power Portal, there are 114 power plants (out of 131) in the country with 12 days of coal stock available in September. There are only three plants with less than four days of coal stock. Two plants have less than seven days of stock. This means that most of the thermal power plants in the country have adequate coal available with them. The situation will be normalised after the day-long strike, called by five CIL trade unions, namely the Indian National Mineworkers’ Federation, Hind Khadan Mazdoor Federation, Indian Mineworkers’ Federation, All India Coal Workers’ Federation and All India Central Council of Trade Unions. The unions are demanding that roll back of the decision to allow 100 percent FDI in the coal mining sector. Coal production in Telangana’s SCCL was affected as the miners went on a day-long strike called by various unions. The coal production in almost all the mines spread across six districts of Telangana was hit as majority of the over 50,000 employees joined the strike. The strike might result in production loss of nearly 200,000 tonnes. The company is estimated to suffer a loss of over ₹500 mn. MCL said at least 6,000 tonne coal supply and 5,000 cubic meter of overburden removal work were affected due to two incidents of work disturbances recently at its Talcher colliery. Overburden removal at Ananta OCP was affected after a man of Burdabanpur village unauthorisedly entered the mine premises and damaged equipment to stop dewatering operations from the sump to the external mine area, the company said. Coal transportation was obstructed at Biswal Chhak near Dera village in Talcher, due to which the supply of about 6000 tonne coal from Bhubaneswari OCP was affected. Estimated loss due to this was ₹24 mn. South Eastern Coalfields Ltd is supplying only 47 percent of the 12 mt coal sanctioned for Rajasthan, while Northern Coalfields is supplying only 69 percent of the sanctioned 4.15 mt because of the strike of trade unions.

CIL will manage to step up production to near its targeted level despite floods hitting mining operations. Ratings agency ICRA estimates CIL’s production is likely to fall short of its current year target by 55-75 mt. Its target for this year is 660 mt. Existing coal stocks have helped meet coal demand and production has picked up. ICRA said CIL has registered a year-on-year production fall of 23.5 percent in September 2019, as operations were impacted by flooding of key mines due to heavy rains and labour issues. ICRA said in order to achieve the targeted annual production or come anywhere close to the annual guidance, CIL would have to step up to an average run-rate of 2.3 mt coal production per day for the rest of the year. The company will start producing 1,500,000 tonnes of coal by the end of October.

Economic slowdown has impacted coal import cargo in the H1 of this fiscal, as overall cargo growth at major ports registered a marginal growth of 1.9 percent to 294 mt rating agency ICRA said. Healthy volume growth in container, crude and iron ore segments was offset by the decline in coal and some other bulk cargo volumes, it said. Coal volumes at major ports grew 11 percent in FY19. Over the long-term, a sustainable pick-up in industrial activity and power demand will be crucial for the sustenance of healthy coal imports as domestic production also ramps up to meet the incremental demand, it said. ICRA said CIL’s supply is likely to increase every year by 5-7 percent at least and this will continue to be a risk for port players that are highly dependent on coal volumes for optimal utilisation of their port capacities. In FY19, total cargo handled at Indian ports had registered a moderate increase of 5.9 percent to 1,280 mt from 1,209 mt during FY18. Major ports handled 699 mt, whereas non majors handled 581 mt.

The government has launched a portal for better coordination among the ministries of power, coal and Indian Railways for coal supply to power plants. The Prakash portal – ‘Power Rail Koyla Availability through Supply Harmony’ – will enable all stakeholders to monitor coal right from mines to transportation. This project will ensure adequate availability optimum utilisation of coal at thermal power plants. The Portal is designed to help in mapping and monitoring entire coal supply chain for power plants, viz - - coal stock at supply end (mines), coal quantities/ rakes planned, coal quantity in transit and coal availability at power generating station. Through the portal, coal companies will be able to track stocks and the coal requirement at power stations for effective production planning. Indian Railways will plan to place the rakes as per actual coal available at siding and stock available at power stations while power stations can plan future schedule by knowing rakes in pipe line and expected time to reach.

GIDC has applied for yet another coal block as part of the sixth tranche of coal mines opened by CIL. If successful in its bid, the corporation will mine both the additional coal block along with the Dongri Tal II coal block already allocated to Goa. GIDC intended to rope in validated consultants to help the state with the coal block utilisation and with the auction of the industrial land returned by the special economic zone promoters.

After the Centre recently offered a coal block at the Singrauli coalfield in Madhya Pradesh to Goa government there was a demand for a whitepaper on the allotment. This is the second time that the Centre has allocated a coal block to Goa. GIDC, on behalf of Goa government, had applied for two tranches that are part of the Dongri Tal Phase II coal block of the Singrauli coalfield. The coal block, if accepted by the GIDC, could address Goa’s power needs for the next 15 to 20 years due to the high coal reserves at the Dongri Tal Phase II tranche 5.

SCCL has acquired the ‘New Patrapada’ coal block in Odisha, which is three times bigger than the already acquired ‘Saini’ coal block. The block was allotted by the coal ministry. Once all permissions are sought and production starts ‘New Patrapada’ will be considered to be one of the biggest coal blocks in the country. Presently Singareni extracts 68 mt of coal from its 48 mines but 20 mt of coal can be extracted from this mine alone, SCCL said. ‘New Patrapada’ is one of the many coal blocks in Chandipada Thahasil area in Odisha and is approximately 15 km away from Saini Coal block which has already been allotted to it. The coal ministry responded favourably to Singareni’s request to allot more coal blocks in Orissa along with Saini Block. The area of ‘New Patrapada’ is 31 square km which is almost 3108 hectares. Coal reserves in this area are 1040 mt. Singareni will start coal extraction at Saini Block from 2021 onwards and arrangements are being made to start extraction at ‘New Patrapada’ at the same time. Presently Singareni was producing 67 mt of coal and in the next seven years the target was to achieve 100 mt.

The coal ministry inked an agreement with WBPDCL for allotment of Deocha Pachami Dewanganj-Harinsingha coal block. The project is expected to address the immediate and future coal and power requirements of the region. In accordance with the provisions of Coal Block Allocation Rules, 2017, made under the Mines and Minerals (Development and Regulations) Act, 1957, the WBPDCL has been allocated the coal block located in West Bengal containing an area of 12.28 square kilometre with estimated reserves of 2102 mt for power generation.

With the Odisha government losing huge revenues due to non-revision of royalty on coal, it once again urged the Centre to revise the royalty on coal, which is due since April 2015. Responding to state’s demand the federal government said increase on coal royalty may lead to hike in the prices of power. While royalty on coal at present is 14 percent, the state government has been demanding to revise to 20 percent. Royalty on coal was last revised in April 2012. Though the Centre should revise the rate in every three years, the rate remained unchanged for the past six years. In 2018-19, the state government has earned ₹19.48 bn as royalty from coal. Odisha produces about one-fifth of the total coal production in the country. The Centre had constituted a sub-group to study coal royalty revision which has submitted its report in February 2018.

Adani Power said power regulator MERC has allowed pass through of higher coal prices for its Tiroda plant. The coal mine allocated to Tiroda plant was de-allocated and the company had to make arrangement for fuel supplies at higher cost. Adani Power arm APML runs Tiroda plant. As per the referred order from the MERC, the de-allocation of the Lohara coal block by the coal ministry would qualify as Change in Law, and APML is entitled to compensation for alternative coal used to meet the shortfall from the commencement of power supply under the PPA. Adani Power said APTEL has allowed its subsidiary Adani Power Rajasthan to charge a higher cost of coal regarding a 1,200 MW power supply agreement with discoms of Rajasthan. The tribunal has allowed the compensation due to the shortage of domestic coal, the company said. APTEL has allowed compensation for domestic coal shortfall arising from change in law pertaining to the New Coal Distribution Policy, 2007, and the Scheme for Harnessing and Allocating Koyala (Coal) Transparently in India policy of the Government of India (SHAKTI Policy).

Rest of the World

China will aim to shut a total of 8.66 GW of obsolete coal-fired power capacity by the end of this year, its energy regulator said, part of its efforts to curb smog and greenhouse gas emissions. The National Energy Administration didn’t say how much of the target, equal to just under 1 percent of total capacity, had already been met. All provinces and regions have been ordered to shut coal-fired power units with a capacity of less than 50,000 kW the regulator said. Larger units of up to 100,000 kW in regions covered by large-scale power grids will also be eliminated, along with those that have reached the end of their designed service period, it said. China has promised to ease its dependence on coal, and it has also forced most of its coal-fired power plants to install ultra-low emissions technology in a bid to curb smog. But while China has cut the share of coal in its total energy mix from 68 percent in 2012 to 59 percent last year, overall consumption has continued to increase and environmental groups estimate that it still has more than 200 GW of new coal-fired capacity in the pipeline. The China Electricity Council, which represents the country’s power industry, predicts that total coal-fired capacity could eventually peak at 1,300 GW, up from around 1,000 GW now. China’s coking coal futures prices fell for a sixth straight session to hit an over five-month low due to weak demand for the steelmaking raw material, amid production curbs on steel and coke ahead of China’s National Day celebrations. The most-traded coking coal on the Dalian Commodity Exchange, for January 2020 delivery, slumped as much as 3.8 percent to $175.12/tonne, its weakest since 19 April this year. China’s coking coal purchases, meanwhile, have been “quite strong”, surging 20 percent to 53 mt in the first eight months of this year, after a brief period of import control in November and December last year.

South Korea should close up to a quarter of its coal-fired power plants between December and February and nearly half in March in a bid to tackle pollution, an advisory body headed by former UN Secretary General Ban Ki-moon said. South Korea operates some 60 coal-fired plants, generating about 40 percent of the country’s electricity, but is facing growing calls to improve air quality, rated as the worst among its peers in OECD in 2017. South Korea has halted some ageing coal-fired power plants in recent years to reduce air pollution. The committee also recommended capping operations at other coal-fired power plants during those months at 80 percent.

Local authorities in Poland’s Silesia coal-mining region urged the nationalist Law and Justice (PiS) government to drop proposed legislation that would give it the option to open new mines without their consent. Facing an election, PiS has maintained its strong support for coal mining as a key energy source for Poland, which generates 80 percent of its electricity from coal. But there is growing opposition to mining in Silesia, one of the most polluted coal regions in Europe, potentially putting pressure on PiS. Opinion polls show the party is likely to win vote with about 40-44 percent.

Cerrejon, one of Colombia’s largest coal mines, will reduce its operations by up to 18 percent because of a fall in international prices and amid an ongoing court case. Colombia, the world’s fourth-largest exporter of coal, faces a potential spending crunch next year as royalties from the fuel decline amid a supply glut and slowing economic growth in China. Cerrejon, owned by BHP Group Ltd, Anglo American Plc and Glencore, will have output of just 26 mt for the next five years, compared to the more than 30 mt it was regularly producing until last year.

The South African government is in talks with coal firms that supply struggling power utility Eskom to reduce coal prices in a bid to lower energy costs and boost the mining sector. In March, energy regulator Nersa granted Eskom average tariff increases of 9.4 percent, 8.1 percent and 5.2 percent over the next three years. Eskom owns and operates more than 13 coal-fired power stations and has supply agreements with firms including Exxaro Resources and South32.

Russian steel and coal producer Mechel agreed to pay around $461 million for Gazprombank’s 34 percent stake in the Elga coal project. Elga is one of the world’s largest coking coal deposits with reserves of 2.2 bt. In 2016, Gazprombank paid 34.4 bn roubles to buy a 49 percent stake in Elga from Mechel, which owns the remainder of the project, as part of the coal producer’s debt restructuring.

German climate protection plans involving the closure of some coal plants might cost €1.2 bn ($1.32 bn) by 2030 without achieving the desired reductions in carbon emissions, an independent study said. A draft law detailing the plan to shut hard coal fired power plants by offering operators fiscal incentives in auctions, showed Germany will start shutting coal plants from next year, under a long-term exit plan up to 2038.

Australian coal producer New Hope Corp Ltd said coal markets would likely remain volatile in the near term though demand is strong for high-quality thermal coal across Asia, as it posted a 41 percent rise in annual net profit. New Hope in the past year signed a $600 mn debt facility to fund its Bengalla purchase and to develop the Acland mine and Burton project, based on expectations of demand for its higher-quality thermal coal.

| CIL: Coal India Ltd, PSUs: Public Sector Undertakings, mt: million tonnes, bt: billion tonnes, mn: million, bn: billion, SCCL: Singareni Collieries Company Ltd, FDI: foreign direct investment, MCL: Mahanadi Coalfields Ltd, OCP: opencast project, H1: first half, FY: Financial Year, GIDC: Goa Industrial Development Corp, WBPDCL: West Bengal Power Development Corp Ltd, MERC: Maharashtra Electricity Regulatory Commission, APML: Adani Power Maharashtra Ltd, PPA: power purchase agreement, APTEL: Appellate Tribunal for Electricity, discoms: distribution companies, kW: kilowatt, GW: gigawatt, UN: United Nations, OECD: Organization for Economic Cooperation and Development |

NATIONAL: OIL

After Iran sanctions, India ups crude oil imports from US, Nigeria and Russia

13 October. India’s top sources of crude oil have gone through a marked change over the last year, primarily due to the US (United States)’ sanctions on Iran. With oil supplies from what had been India’s third-largest supplier mostly cut off, other countries have begun climbing up the list. Not least of these is the US itself, with crude oil imports from the country nearly doubling. According to data from the Directorate General of Commercial Intelligence and Statistics (DGCIS), crude oil imports from the US stood at 4.49 million tonnes (mt) during the April-August period of this year, a 72 percent jump from the 2.6 mt imported during the same period last year. The country is now India’s sixth-largest oil supplier by volume. Iran, on the other hand, is no longer among India’s top ten crude oil suppliers with just 1.97 mt shipped during the period, an 85 percent decline from last year’s 13.3 mt. Other countries that have increased crude oil supplies to India include Nigeria and Russia. Data from DGCIS for this fiscal year shows that Nigeria has taken Iran’s erstwhile spot on the list, becoming India’s third-largest oil supplier with a 22 percent increase in crude oil shipments from 5.8 mt in April-August 2018 to 7.17 mt this year. Imports from Russia have also risen significantly. The period saw India buying around 2.13 mt from the Eurasian powerhouse, a two-fold increase from 973,389 tonnes it supplied during the same period last year.

Source: The New Indian Express

Indian refiner RIL to resume Venezuela oil loadings after 4-month pause

9 October. Indian refiner Reliance Industries Ltd (RIL) is scheduled to resume loading Venezuelan crude in October after a four-month pause, according to sources and internal documents from PDVSA, a move that could help Venezuela’s state-run company drain its large oil inventories. The United States (US) in January imposed the toughest sanctions yet on Venezuela’s oil industry, depriving the OPEC member of the main destination for its crude exports. China National Petroleum Corp and its units stopped taking Venezuelan oil in August. Others, including RIL, have recently been buying Venezuelan crude from Russian major Rosneft. RIL needs the type of heavy sour crude that Venezuela sells because its refineries are configured to process it. US sanctions on both Venezuela and Iran have made it harder for the refiners to find supplies of these crude grades. The Indian firm is sending at least two vessels, the very large crude carriers Antonis I. Angelicoussis and Maran Castor, to Venezuela’s Jose port for loading in late October, according to the PDVSA documents. The tankers are currently passing the Suez canal.

Source: Reuters

NATIONAL: GAS

GAIL offers 2 US LNG cargoes and seeks one for India delivery

15 October. GAIL (India) Ltd has issued a swap tender offering two cargoes of liquefied natural gas (LNG) for loading in the United States (US) and seeking one for delivery to India. The offer is for two cargoes loading from the Cove Point plant on 10-12 November and 16-18 December. The sought cargo is for delivery to either the Dahej or Dabhol terminal in India on 20-23 November. The tender closes on 16 October, with validity expiring on the same day.

Source: Reuters

Cabinet to consider splitting GAIL, pipeline business not to be sold before 2022

15 October. The Union Cabinet may by next month consider a proposal to hive off gas utility GAIL (India) Ltd’s pipeline business into a separate entity but its sale to a strategic investor may not happen before 2022. GAIL is India’s biggest natural gas marketing and trading firm and owns more than two-thirds of the country’s 16,234 kilometre (km) pipeline network, giving it a stranglehold on the market. Users of natural gas have often complained about not getting access to GAIL’s 11,551 km pipeline network to transport their fuel. To resolve the conflict arising out of the same entity owning the two jobs, bifurcating GAIL is being considered. A proposal is likely to be moved before the Union Cabinet for transferring the pipeline business into a 100 percent subsidiary. The proposal may be considered and approved by the Cabinet this month or latest by November. After the Cabinet approval, a consultant will be appointed to transfer the pipeline business into a separate subsidiary. This would take 8-10 months to accomplish. However, selling off the pipeline subsidiary to a strategic investor is not likely before 2022 as the thinking in the government is that the gas market will not be mature before that and state support would be needed for GAIL to accomplish building a national gas pipeline grid. GAIL will continue to own the marketing business as also the stakes in liquefied natural gas (LNG) terminals. GAIL already keeps separate accounts for its gas pipeline and marketing businesses, making it easier to split them into two entities. By unbundling GAIL and opening the sector, the government hopes to increase gas use to 15 percent of the energy mix by 2030 from current 6.2 percent. When talk of splitting first started in January last year, Oil Minister Dharmendra Pradhan had stated that GAIL should focus on laying pipelines, suggesting hiving of the marketing business.

Source: Business Standard

India’s 100 tcf gas reserves enough to meet half of demand till 2050: BP

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Increase in domestic gas reserves is a pleasant surprise!

< style="color: #ffffff">Good! |

14 October. UK (United Kingdom) supermajor BP plc Chief Executive Officer (CEO) Bob Dudley said there are 100 trillion cubic feet (tcf) of yet-to-be-discovered natural gas reserves in India that would be enough to meet half of the nation’s gas demand till 2050. BP in partnership with Reliance Industries Ltd (RIL) is investing about $5 bn to bring about 1 billion cubic feet a day of new domestic gas onstream beginning mid-2020, he said. India, he said, has the right policy framework of providing a higher cap price for natural gas produced from difficult areas such as deepsea. The government mandates a cap price based on alternate fuels for gas from difficult areas, which for the October 2019 to March 2020 period is $8.43 per million metric British thermal unit (mmBtu), more than double the $3.23 per mmBtu rate for other domestic gas.

Source: Business Standard

Total to buy 37 percent stake in Adani Gas for $600 mn to expand India footprint

14 October. French energy giant Total SA is spending $600 mn to expand its presence in one of the world’s fastest growing natural gas markets. Total agreed to purchase a 37.4 percent stake in India’s Adani Gas Ltd, a distributor of the fuel that is developing import terminals and a national chain of vehicle-filling outlets. Total said that the acquisition will cost about $600 mn taking into account its divestment in another Indian LNG (liquefied natural gas) terminal earlier this year. The deal will give Total access to India’s natural gas market and support its drive to become one of the world’s top LNG players. India’s annual LNG demand will hit 28 million tonnes (mt) by 2023, making it the world’s fourth largest importer of the fuel. Adani is developing the Mundra and Dhamra LNG import terminals in India. It plans to expand its distribution network in the next decade to about 6 mn homes and 1,500 retail outlets for natural gas vehicles.

Source: Business Standard

Dispute-hit Mundra LNG terminal to be commissioned by December

14 October. More than a year since its inauguration, Gujarat government-backed LNG (liquefied natural gas) project at Mundra, built at an estimated cost of ₹55 bn, may finally get commissioned by December. A commercial dispute between the partners Gujarat State Petroleum Corp (GSPC) and Adani Group had stalled commissioning of the 5 million tonnes (mt) a year liquefied natural gas (LNG) import facility. The terminal was mechanically completed in mid-2018 and was inaugurated by Prime Minister Narendra Modi. However, the commissioning has been stalled due to delay in finalisation of certain lease and sub-commission agreements between the promoters and the Gujarat government. A commissioning cargo from the US (United States) had arrived at Mundra LNG terminal last November, but it had to be diverted to Hazira after it was not allowed to discharge at Mundra. The Mundra terminal, whose capacity will be expandable to 10 mt per annum in the future, is designed to have a berth for receiving LNG tankers of sizes 75,000 cubic metres to 2,60,000 cubic metres, two LNG storage tanks of capacity 1,60,000 cubic metres each, facilities for regasification and gas evacuation.

Source: Business Standard

IOC, ExxonMobil sign MoU for collaboration in LNG business

14 October. American oil and gas firm, ExxonMobil, said it has signed a Memorandum of Understanding (MoU) with Indian Oil Corp (IOC), India’s largest fuel retailer, to expand liquefied natural gas (LNG) initiatives in the country. The MoU was signed between IOC and ExxonMobil India LNG Ltd, an affiliate of ExxonMobil. It said that the MoU builds on the long history of productive cooperation between IOC and ExxonMobil in the LNG space.

Source: The Economic Times

India to invest $60 bn in developing gas supply, distribution: Pradhan

13 October. India is investing over $60 bn in developing natural supply and distribution infrastructure as it chases the target of more than doubling the share of natural gas in its energy base to 15 percent by 2030, Oil Minister Dharmendra Pradhan said. Natural gas currently constitutes 6.2 percent of all energy consumption in the country. The government is giving special impetus to develop gas infrastructure across the length and breadth of the country connecting north to south and east to west parts of India, he said. City gas distribution network will soon cover 70 percent of India’s population, he said.

Source: Business Standard

RIL puts off gas bid to 6 November on bidders request due to festive season

10 October. Reliance Industries Ltd (RIL) has put off bidding for the new gas it plans to produce from eastern offshore KG-D6 block to next month following a request from potential bidders. RIL and its partner BP Plc of the UK (United Kingdom) had put out Notice Inviting Offer (NIO) seeking bids from potential users for the 5 million metric standard cubic meter per day (mmscmd) of natural gas they plan to produce from the R-Cluster Field in KG-D6 block from the second quarter of 2020. The bidding was to happen on 11 October, according to the bid document. However, the bidding has been postponed based on requests of some bidders given the holiday/festival period during October. Bidding will now happen on 6 November. The rate sought compares to the government-mandated $3.23 price that its currently producing D1 and D3 fields in KG-D6 block get. The government gas pricing policy, however, provides for a higher cap price for future gas produced from difficult fields like those in deepsea. This cap currently is fixed at $8.43 per million metric British thermal units (mmBtu). RIL-BP is developing three sets of discoveries in KG-D6 block -- R-Cluster, Satellites and MJ -- by 2022 that can produce a peak of 30 mmscmd of gas. The quantity offered for bidding in the NIO is 5 mmscmd from R-Series fields which will start production in mid-2020. Peak output from R-Series is 12 mmscmd, while Satellites will produce another 7 mmscmd beginning mid-2021. MJ field, which will start production in the second half of 2022, also has a planned peak output of 12 mmscmd. The NIO said the gas price would be lower of the quoted rate or the government-mandated ceiling for the difficult fields. The formula RIL is using to price gas for R-Series fields is different from its last price discovery it made for the coal-bed methane (CBM) from its Sohagpur coal-bed methane blocks in Madhya Pradesh. RIL ended up buying the CBM gas from its block after it bid deducting $1.836 per mmBtu, lower than $3.156 bid by rival Piramal Glass and $3.495 bid by GAIL (India) Ltd.

Source: Business Standard

NATIONAL: COAL

India readies policy to attract foreign investment in coal mining

15 October. India expects to have formulated a policy within the next two weeks to attract foreign investment to its coal mining industry, the country’s Coal Minister Pralhad Joshi said. The country planned to invite bids for coal mining blocks by the end of 2019. It is also creating a coal price index as part of plans to open the sector to outside investment. India’s recently concluded thermal coal mine auctions received a tepid response, with 15 out of 21 attracting fewer than three bidders. Joshi said the government was looking to make investing in coal mines more attractive to bidders. Joshi said he expects India’s coal demand to rise more than 21 percent from current levels to 1.2 billion tonnes in 2023, adding that coal would be necessary for the next three decades.

Source: Reuters

Private companies may have easy criteria for commercial coal mining auction

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Privatisation of coal mining will not necessarily commercialise coal mining!

< style="color: #ffffff">Ugly! |

14 October. The government plans to keep minimal qualification criteria for companies to participate in the auction of coal blocks for commercial mining. The government has identified 15 large blocks for the pilot round of bidding in December, adding that rules, bid documents and agreements for commercial mining are likely to be finalised soon. Each of the 15 identified coal blocks will have a capacity to produce 4 million tonnes per annum. The government plans to cap the upfront payment for some large blocks which might otherwise run into a huge amount. Many private steel and cement companies did not participate in the latest round of auction for captive coal mines because they wanted to hold on to their cash for commercial coal auctions. However, the companies said the blocks were too far from the end use plants. The Coal Mines Nationalisation Act of 1973 mandates that only companies registered in India can participate in auctions. The Coal Mines Special Provision Act 2015, which provides for opening up of commercial coal mining to private and public entities, is an offshoot of the 1973 Act.

Source: The Economic Times

Agitations hit coal supplies from MCL mines in Odisha

13 October. The coal supplies from Talcher and IB valley collieries under the Mahanadi Coalfields Ltd (MCL) in Odisha were severely hit due to the ongoing agitations by local people demanding employment. At least 60,000 tonnes of coal could not be supplied to various consumers from Balram open cast project (OCP) at Hingula area in Talcher coalfields due to the "illegal" stoppages by the residents of Danara village since 6 October, the MCL said. Coal dispatch of around 15,000 tonnes is also affected due to which MCL has been losing around ₹14.7 mn of revenue directly while the government exchequer is losing ₹20.58 lakh per day. Similarly, the residents of Ubuda village stopped mining operations at a mine of Lakhanpur OCP of Ib Valley Coalfields in Jharsuguda district, demanding employment. The Lakhanpur OCP is supposed to produce around 65,000 tonne of coal daily but it has now come down to 26,000 tonnes due to disturbances. The Odisha Power Generation Corp (OPGC) is one of the major consumers of coal from Lakhanpur OCP.

Source: The Economic Times

Agreement for Madhya Pradesh coal block after financial approval: Industries Minister

12 October. Industries Minister Vishwajit Rane said that the state government was yet to grant financial approval for the acceptance of the coal block allotted to Goa Industrial Development Corp (GIDC) at Singrauli, Madhya Pradesh. Once the financial approvals come through, GIDC would go ahead and ink an agreement with the Union coal ministry to take over the allocated coal block for utilisation, Rane said. The Dongri Tal II coal block at Singrauli has been allocated to Goa and Rane had earlier announced that the state would ink the agreement on 10 October. Coal mines have been allotted to state governments for sale of coal under the Coal Mines (Special Provisions) Act, 2015. The Dongri Tal II coal block has been allocated to the GIDC from the fifth tranche of the allotment by the coal ministry. Rane had earlier announced that GIDC would rope in validated consultants to help the state with the coal block utilisation.

Source: The Economic Times

HC refuses to stay coal handling at Goa port

11 October. The Bombay High Court (HC) Bench in Goa refused to stay coal handling operations at the Mormugao Port Trust (MPT). It also sought pollution data on the port town of Vasco, before making a call in the case. The court was hearing a petition filed by Goa Foundation, a non-government organisation, and others seeking end of coal and coke handling operations at the MPT. The next hearing is scheduled for 11 December. Vosco residents fear increase in coal and dust pollution.

Source: The Economic Times

Coking coal shipments rise 15 percent to 29 mt at 12 state-run ports in April-September

9 October. Coal shipments handled by India’s 12 major state-run ports during April-September rose by 15.25 percent to 29.29 million tonnes (mt), according to a ports' body. The state-run ports had handled 25.41 mt of coking coal cargo in the corresponding period of the previous fiscal. Shipments of thermal or steam coal, however, declined by 13.20 percent to 44.87 mt, the Indian Ports Association (IPA) data showed. The IPA said these ports handled 51.69 mt of thermal coal in the April-September period of the previous fiscal. According to rating agency ICRA, the country’s overall thermal coal import is likely to cross 200 mt mark in 2019-20. It said that Coal India Ltd (CIL)’s production might fall short of its 2019-20 target of 660 mt by around 55-75 mt. CIL accounts for over 80 percent of the country’s domestic coal requirement. Overall, the 12 major ports recorded a marginal 1.48 percent upswing in cargo handling at 348.44 mt in April-September this fiscal against 343.37 mt in the year-ago period. These 12 major ports are -- Deendayal (erstwhile Kandla), Mumbai, JNPT, Mormugao, New Mangalore, Cochin, Chennai, Kamarajar (earlier Ennore), V.O.Chidambaranar, Visakhapatnam, Paradip and Kolkata (including Haldia). These ports handle about 60 percent of the country’s total cargo traffic.

Source: The Economic Times

NATIONAL: POWER

Over 2.5k held in last 18 months for power theft in Delhi

13 October. As part of a crackdown on electricity theft that causes annual losses running into hundreds of crores of rupees, the power distribution companies (discoms) in Delhi have filed over 5,500 complaints in the last one and half years leading to arrest of more than 2,500 violators. Over 4,500 FIRs were registered on the basis of the complaints and there have been more than 200 convictions in the same period, discom said. There are three power discoms - BSES Yamuna Power Ltd (BYPL), BSES Rajdhani Power Ltd (BRPL) and Tata Power Delhi Distribution Ltd (TPDDL) - providing electricity to over 6 mn consumers in Delhi. Power theft attracts heavy penalty along with jail term of up to five years. In August-September this year, the special electricity court of Karkardooma had directed attachment (and sealing) of 21 properties in East Delhi in connection with power theft cases. Since privatisation of power distribution in 2002 in Delhi, the discoms have been able to bring down aggregate technical and commercial losses from as high as 55 percent to 8 percent currently.

Source: The Economic Times

Andhra Pradesh government seeks Centre’s assistance to resolve power-related issues

13 October. Andhra Pradesh government requested the Central government to constitute a committee to resolve the power-purchase related issues as it is incurring a financial burden on the state. State Power Minister Balineni Srinivas Reddy, in a letter to Union Power Minister R K Singh, said that the power tariffs, power purchasing agreements in the state are a matter of concern. The Minister claimed that the abnormal integration of Variable Renewable Energy (VRE) into the grid is causing heavy financial burden to the state government. The Minister, thereby, sought the Centre’s co-operation in the matter to resolve the issue.

Source: The Economic Times

Power discoms ramp up ratings with better service, less losses

12 October. Power distribution companies (discoms), which are gearing up to ensure round-the-clock supply during festive season, have registered improvement in their ratings, according to the 7th annual integrated rating report published by the power ministry. Principal secretary (energy) and chairman of Uttar Pradesh Power Corp Ltd (UPPCL) Alok Kumar said discom rating had improved on account of reduction in aggregate technical and commercial losses, timely finalisation of audit accounts, improvement in consumer service and increased power supply. Kumar said the rating of all discoms, except Paschimanchal Vidyut Vitran Nigam Ltd covering west UP, had been upgraded by a notch. Rating of Purvanchal distribution company, covering east UP, has increased by two notches. Kumar said around 46,000 consumer service centres for payment of electricity bills were running across the state to improve consumer service. Kumar said discoms successfully installed around 5.3 lakh smart meters in urban areas.

Source: The Economic Times

BSES allows users to recharge prepaid metres using e-wallets

11 October. The BSES discoms (distribution companies) will let users recharge their pre-paid electricity metres through e-wallets or its mobile application and website. The BSES discoms—BYPL (BSES Yamuna Power Ltd) and BRPL (BSES Rajdhani Power Ltd) have extended the facility to recharge pre-paid metres online through e-wallets like Paytm and PhonePe and also through company’s mobile app and website. The company is leveraging technology and digital platforms to provide a hassle free experience to its consumers in a big way. Consumers can connect with the discom and apply for a host of services, including applying for new connections, registering complaints, from their homes and offices using online platforms of the BSES.

Source: Business Standard

Union Power Minister directs states to clear dues of power generating companies

11 October. Union Power Minister R K Singh directed the state governments to clear dues of power generation companies, a step which he said will boost investor sentiment and attract investments. He said that attracting investments is one of the major challenges that is being faced by the sector. He said state departments owe about ₹490 bn to electricity distribution companies (discoms), so if this amount is recovered then a large portion of dues will be cleared which will ultimately lessen the burden on the power producers.

Source: Business Standard

Large consulting rooms attached to houses will attract commercial power tariff: TNERC

11 October. Tamil Nadu Electricity Regulatory Commission (TNERC) has clarified that a consulting room attached to a residence will attract commercial tariff if its size is more than 200 square feet. Commercial tariff is much more than domestic tariff. Professionals like advocates, doctors, engineers, chartered accountants and others have small rooms attached to their residence. Some have a separate meter for the consulting room. In most of the cases, the rooms are part of the residence and only domestic tariff is charged. In case of consulting rooms attached to a house, the substantial use of electricity would be for domestic use. In case of consulting rooms not attached to the residence of professionals, power is used for non-domestic purposes, according to TNERC. The clarification has been issued based on a directive from the Madras high court.

Source: The Economic Times

NIIF, EESL partner for deployment of smart meters pan India

10 October. The National Investment and Infrastructure Fund (NIIF) has joined hands with Energy Efficiency Services Ltd (EESL) to implement, finance and operate the smart meter roll-out programme of power distribution companies. NIIF and EESL announced a new joint venture, IntelliSmart Infrastructure Private Ltd (IntelliSmart), for the smart meter roll-out programme. This comes against a backdrop of the government planning to install 250 mn smart meters in the next few years. With the replacement of 250 mn conventional meters with smart meters, billing efficiency can improve from 80 percent to 100 percent, and has the potential to increase revenues of electricity distribution companies (discoms) by ₹1,104 bn. IntelliSmart will work collaboratively with all stakeholders to procure, deploy and provide operations and maintenance for the smart meter infrastructure.

Source: Business Standard

Delhi government’s free-electricity scheme an example of smart governance: CM

10 October. The Delhi government’s free-electricity scheme will be an example of "smart governance" as it is encouraging Delhiites to reduce their power consumption, Chief Minister (CM) Arvind Kejriwal said. In August, the Aam Aadmi Party (AAP) government had announced free-electricity of up to 200 units for domestic consumers and later extended the scheme to tenants residing in the national capital. He said residents of the city were trying to consume less than 200 units of electricity to avail the benefit. He further claimed that 14 lakh consumers in the city who consumed less than 200 units of electricity received zero bill. There are around 48 lakh domestic consumers in the national capital. Under the scheme, people consuming electricity between 201 units and 400 units are eligible to avail 50 percent subsidy from the government on their bills. He had announced 'Mukhyamantri Kirayedar Bijli Meter Yojna' under which tenants can also avail the free-electricity scheme.

Source: Business Standard

UP Power Department working on zero-tolerance for corruption

10 October. With zero-tolerance against corruption, the Power Department in Uttar Pradesh (UP) has ordered a special audit of the e-tenders in Bahraich, Balrampur, Shravasti and Gonda. Based on the audit reports of these districts, inquiries will also be ordered into e-tenders of other districts to ensure transparency in working. In order to ensure that inquiry in these cases of corruption is completed without any delay and strict action is taken against those found guilty, the department has done constant follow-up at the higher level as well. The Uttar Pradesh Power Corp Ltd (UPPCL) has a vigilance unit working under an Additional Director General of Police, who has recommended registering of cases against those found guilty in different inquiries. The Power Department undertakes services through outsources in large number and in the past, there have been large number of complaints for payment of dues to such employees and labourers.

Source: The Economic Times

Power ministry asks state to expedite reforms, advises to stick to PPAs

9 October. With the country achieving electrification for all households, the Union power ministry is gearing up for another set of reforms – to improve the availability and quality of power. As the Centre passes the baton to the states to take forward the reforms, payment delay by power distribution companies (discoms), resulting in over dues to power generators, is a major cause of worry. At the same time, several states are reviewing or cancelling power purchase agreements (PPAs) with renewable power projects. In its agenda note, the Centre has issued an advisory, asking states not to reopen power purchase agreements. To strengthen last-mile transmission and distribution network of the state to ensure seamless power supply, the Centre has set the deadline of March 2020 to complete all IPDS (Integrated Power Development Scheme)-related strengthening work. States must ensure metering of feeders and distribution transformers, along with centralised collection of the meter data for monitoring and analysis by next year.

Source: Business Standard

Punjab discom agrees to revised tariff plan for Tata’s Mundra unit

9 October. Tata Power Company that is awaiting a compensatory tariff nod from four procurer states — Punjab, Haryana, Rajasthan and Maharashtra — for the Mundra UMPP (Ultra Mega Power Project), said the Punjab discom (distribution company) has agreed to the tariff plan recommended by the high level committee, and the matter is now awaiting state cabinet approval. The Supreme Court allowed the CERC (Central Electricity Regulatory Commission) to amend the PPAs (power purchase agreements) of the imported-coal based power plants as per the recommendations of a high-power committee (HPC) constituted by the Gujarat government in 2018. The HPC had recommended reduction in fixed charge by ₹0.20/unit, which would necessitate banks to reduce debts by ₹42.40 bn for Tata, ₹38.21 bn for Adani and ₹23.24 bn for Essar Power.

Source: The Financial Express

Average spot power price falls to two-year low of ₹2.77 per unit in September: IEX

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Low spot price for power signals stagnant demand!

< style="color: #ffffff">Bad! |

9 October. The average spot power price fell to a two-year low of ₹2.77 per unit in September owing to factors like low demand, improved coal supply and higher power generation, according to the Indian Energy Exchange (IEX). The price at ₹2.77 per unit was 41 percent lower than September 2018’s rate of ₹4.69, the IEX said. All-India peak demand at 173 GW in September 2019 declined 1 percent over the demand of 175.6 GW in the same month last year. Energy met at 105 billion units declined 5 percent year-on-year, according to data issued by National Load Dispatch Centre (NLDC).

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Indian Railway to become world first ‘net-zero’ carbon emitter by 2030: Railway Minister

15 October. Indian Railways will become the world first “net-zero” carbon emitter by 2030, Railway Minister Piyush Goyal said. As per the NITI Aayog data, Carbon Dioxide emission from Indian Railway was around 6.84 million tonnes (mt) in 2014. Amid global concern over climate change, Indian railways is also working to reduce the carbon emission. Goyal said that the Indian railways will be 100 percent electrically run by 2023.

Source: Hindustan Times

IIT Madras, ExxonMobil Research join hands for biofuel research

14 October. The Indian Institute of Technology Madras (IIT Madras) said it has entered into an agreement with ExxonMobil Research and Engineering Company (EMRE) for research on energy and biofuels. IIT Madras said it will be a five year joint research agreement focusing on biofuels, data analytics, gas conversion and transport, and is intended towards finding low-emission solutions.

Source: The Economic Times

India to install 2.9 GW wind capacity in 2019

14 October. India is likely to install more wind capacity in 2019 than it did last year, but it will still be well below what it used to be earlier. The country will install 2.9 GW in 2019 against 2.3 GW in 2018. In 2016-17, 5.4 GW was added, while 3.4 GW was achieved in 2015-16. Auctions were conducted for 5.2 GW until August 2019 but only 2.9 GW was awarded because of lack of developer interest. In the latest wind auction conducted by the Solar Energy Corp of India (SECI), the nodal agency of the Ministry of New and Renewable Energy (MNRE), only two developers took part. Even though the original size of the tender was 1800 MW, allotment was reduced to 440 MW. The new YSR Congress government in Andhra Pradesh has been attempting to renegotiate wind and solar PPAs (power purchase agreements).

Source: The Economic Times

India recognises the need for environmentally sustainable development strategy: IMF

13 October. The International Monetary Fund (IMF) looks at India as a country that recognizes the need for an environmentally sustainable development strategy as the global community gears up for a decisive fight against climate change. Noting that India is particularly concerned about prospects for the poorest segments of its population in the context of this process of development, he explained how does climate change fit into the framework. India is fully committed to the Paris agreement. It has made its nationally determined contribution pledges, and that implies reducing emissions of carbon dioxide (CO2) by a third below 2005 levels that is relative to the energy intensity of GDP and India seems to be on track to deliver on its pledges, the IMF’s Fiscal Affairs Department director Vitor Gaspar said. He said the IMF make the point that the nationally determined contributions that were made by countries for the Paris agreement will not deliver safe levels of temperature increases. He said the IMF has shown that for a $50 per tonne carbon tax, the net benefits for India would be more than 2 percent of India’s GDP (Gross Domestic Product).

Source: Business Standard

Bharathidasan University plans to double solar power generation

12 October. Bharathidasan University plans to double solar power generation from the existing 500 kWp (kilowatt peak) on its main campus at Palkalaiperur on the outskirts of the city. Utilising funding under RUSA (Rashtriya Uchchatar Shiksha Abhiyan), the university has established a grid interactive 500 kWp Solar PV (photovoltaic) Power Plant at a cost of ₹ 48.5 mn in 2016. While the RUSA funding was ₹40 mn, the university chipped in with the rest. The solar plant generating 2,300 units electricity per day with an average of 69,000 units per month has reduced the monthly energy bill to the tune of ₹5.5 lakh.

Source: The Hindu

Renewable energy sector adds 4.2 GW in H1

11 October. Even as industry analysts warn of slowdown in the renewable energy sector, the segment has added 4,273 MW of new capacity to the grid during the first half (H1) of this fiscal, which is one of the highest additions in a first-half year period in the last several years. However, the addition to capacity during the April-September 2019 is only 36 percent of the target (11,802 MW) set for the fiscal. Solar power segment continues to be the major contributor of new capacity growth in the renewable energy sector with a share of more than two-thirds of the new capacity. 2,921 MW (includes 2,479 MW ground-mounted and 442 MW rooftop) capacity during April-September 2019, according to the Union Ministry of New and Renewable Energy (MNRE). Wind sector continues to show progress and it added about 1,304 MW of new capacity. During the last fiscal, this segment added 1,481 MW and this year it is expected to add more capacity. As on 30 September 2019, total grid-connected installed renewable power capacity in India stood at 82,589 MW. Industry analysts have warned that the clean energy sector is slipping into slowdown mode though the government is ambitious about its targets in the sector. MNRE said that the government of India has set a target of installing 175 GW of grid connected renewable power capacity by 31 December 2022. However, a CRISIL report has warned that India’s installed capacity in renewable energy could increase by just 40 to 104 GW by fiscal 2022 from 64.4 GW in fiscal 2019, because of enduring policy uncertainty and tariff glitches. This means the sector will be 42 percent short of target.

Source: The Hindu Business L ine

Assam steps up efforts for strategic lower Subansiri hydro project in Arunachal

11 October. In an attempt to ensure that India’s efforts to revive work on the long-pending 2,000 MW Lower Subansiri project in Arunachal Pradesh doesn’t get derailed, Assam has constituted a high power state level task force to facilitate work on the strategic project. Any delay in building hydropower projects in Arunachal Pradesh on rivers originating in China will affect India’s strategy of establishing its prior-use claim over the waters, according to international law. India and China have a dispute over the diversion of the Brahmaputra river, which originates in Tibet. Even as India explores a diplomatic option, accelerating hydroelectric projects such as Lower Subansiri would give it user rights. In order to facilitate transportation of equipment to the NHPC Ltd’ project, it is imperative that law and order situation is in control in Assam.

Source: Livemint

175 GW renewables by December 2022, clarifies government

10 October. The Ministry of New and Renewable Energy (MNRE) clarified that the deadline for installing 175 GW of renewable energy is 31 December 2022. Thanks to the devaluation of the rupee, rising finance costs, government-mandated tariff caps in reverse auctions and cancellation of renewable project tenders, the pace of adding renewable generation capacities already slowed down in FY19, when the country added 8.6 GW against 11.3 GW and 11.8 GW added in FY17 and FY18, respectively. The installed renewable capacity now stands at 81.3 GW. Prime Minister Narendra Modi announced in the United Nations General Assembly that the country aims to have 450 GW renewable energy capacity. Source: The Financial Express

Solar thermal players eye 10 percent growth after GST rate cut

10 October. Solar thermal industry players are confident of getting back into the boom trajectory and expect the sector to clock a growth of 10 percent after the reduction of GST (Goods and Services Tax) rate on inputs for solar components from 18 percent to 5 percent. Solar Thermal Federation of India (STFI) secretary general Jaideep Malaviya said they approached GST directorate general and the finance minister and convinced them to consider solar thermal components as part of solar energy and apply 5 percent GST on them. Almost 1.5 mn evacuated tubes for solar water heater were imported during 2018, Malaviya said.

Source: The Financial Express

INTERNATIONAL: OIL

OPEC, allies to sustain oil market stability beyond 2020: Barkindo

15 October. The Organization of the Petroleum Exporting Countries (OPEC) and its allies are committed to sustaining oil market stability beyond 2020 with global physical supplies currently relatively tight, OPEC Secretary-General Mohammad Barkindo said. He said that compliance with production quotas among OPEC and its allies was at 136 percent.

Source: Reuters

Shell consortium, Petronas win oil blocks off Brazilian coast

10 October. A consortium of Royal Dutch Shell Plc, Chevron Corp and Qatar Petroleum won oil exploration and production rights in the C-M-713 block off the coast of Brazil, paying the government a signing bonus of roughly 551 mn reais ($133 mn). Shortly before, Petronas won a separate offshore block, C-M-661, with a signing bonus of roughly 1.116 bn reais.

Source: Reuters

Russian President to discuss stabilising oil prices during Saudi visit

10 October. Russian President Vladimir Putin plans to discuss stabilising world oil prices when he visits Saudi Arabia for talks with Saudi King Salman and Crown Prince Mohammed bin Salman. Russia hopes to expand its joint investments with UAE (United Arab Emirates) to $7 bn from $2.3 bn.

Source: Reuters

Several Asian refiners to get full Saudi oil supplies in November

10 October. At least seven Asian refiners will receive the full crude volumes they requested from Saudi Arabia for November loading, a sign that Saudi production has stabilized after disruptions last month. Most of the refiners are getting the crude grades that they want, adding that there was no request from oil company Saudi Aramco for them to change grades. Saudi Aramco’s oil processing facilities at Abqaiq and Khurais were attacked by missiles and drones on 14 September, shutting down 5.7 mn barrels per day (bpd) of its production, or more than 5 percent of global supplies.

Source: Reuters

South Sudan to launch auction of licenses for 8 oilfields

9 October. South Sudan will kick-start an auction of licenses to develop eight oilfields around the country, the oil ministry said. South Sudan’s oil production has reached 178,000 barrels per day (bpd) and the country aims for output to reach 200,000 bpd within the next two years, the ministry said. Long-term, South Sudan aims to ramp up production to 350,000 bpd, Arkangelo Okwang Oler, director-general for planning, training and research at South Sudan’s oil ministry, said. South Sudan made a small oil discovery in Northern Upper Nile State in August, its first since independence in 2011. Oler said Oil Minister Awow Daniel Chuang would officially launch the tender for the licenses at a conference in the capital Juba on 29-30 October, and that South Sudan would declare the results in the first quarter of 2020.

Source: Reuters

INTERNATIONAL: GAS

Iran discovers gas field near Gulf

14 October. Iran has discovered a gas field near the Gulf with enough reserves to supply the capital for 16 years. The Eram field contained 19 trillion cubic feet (538 billion cubic meters) of natural gas, the National Iranian Oil Company said. The oil ministry said the field was located in Fars province, about 200 km (kilometre) south of Shiraz.

Source: The Economic Times

CNOOC looks to replace COSCO-linked LNG tankers after US sanctions

11 October. China National Offshore Oil and Gas Company (CNOOC) is on the hunt for liquefied natural gas (LNG) tankers to charter, looking to replace ships it had previously hired that are linked to a Chinese company sanctioned by the United States for allegedly transporting Iranian oil. Now, prompt demand by Chinese state giant CNOOC for LNG ships has caused freight rates for such tankers to nearly double to $130,000-$150,000 a day from about $80,000 late, shipbrokers said.

Source: Reuters

Brazil’s Petrobras, Oslo-based Equinor tie up for natural gas projects

10 October. Brazil’s oil company Petroleo Brasileiro SA (Petrobras) said it has signed a Memorandum of Understanding (MoU) with Oslo-based Equinor ASA focussed on the joint development of natural gas business projects. The companies aim to maximize downstream value through thermoelectric generation as well as feasibility studies related to gas processing assets and pipelines owned by Petrobras in the Rio de Janeiro region where a natural gas processing plant is being built in Itaboraí. The companies intend to combine efforts in investment in the natural gas, liquefied natural gas (LNG) and power generation segments.

Source: Reuters

INTERNATIONAL: COAL

China’s September coal imports slip 8.1 percent from previous month

14 October. China’s coal imports in September dropped 8.1 percent from a month earlier, as traders held up purchases amid an increase in domestic supply and slowing demand for the fuel from power generation companies. Arrivals of coal, including thermal and coking coal, last month were 30.29 million tonnes (mt), the General Administration of Customs data showed. Shipments stood at 32.95 mt in August. Imports were up 20.5 percent from 25.14 mt in September last year. In the January to September period, China, the world’s top coal consumer, took in 250.57 mt of coal, up 9.5 percent from the same period in 2018, the customs data showed.

Source: Reuters

Australian state water utility objects to South 32 coal mine extension

11 October. Australia’s New South Wales water authority has lodged a strong objection to a planned extension of the life of a coal mine operated by South 32 because of its predicted impact on water resources that support Sydney. The Dendrobium metallurgical coal mine is part of South 32’s Illawarra metallurgical coal division in the southern coalfields of New South Wales, Australia’s most populous state, about 75 km (kilometre) south of Sydney.

Source: Reuters

Australia’s NAB trims coal price forecast for 2020

9 October. National Australia Bank (NAB) has trimmed its forecasts for metallurgical coal and thermal coal for next year given weakening longer term demand prospects, it said. It now sees thermal coal prices averaging at $70 a tonne in 2020, from $76 previously, and hard coking coal averaging at $150 a tonne from an earlier forecast of $156 a tonne, it said. Australia is the world’s biggest coal exporter.

Source: Reuters

China completes major railway transporting coal from north to south

9 October. A major railway in China transporting coal from the country’s northern production hub to consumers in the south has gone into operation. The Haoji railway, which links China’s biggest coal production region Inner Mongolia to Jiangxi province in the south via central provinces including Hubei and Hunan, will significantly cut coal transportation times.

Source: Reuters

INTERNATIONAL: POWER

South Africa’s Eskom challenges latest power tariff decision in court

11 October. South Africa’s struggling power utility Eskom said it was challenging in court the regulator’s latest tariff decision, a move it said was necessary to avert financial disaster. Eskom, which produces more than 90 percent of the country’s electricity, implemented some of most severe power cuts in several years this year and is reliant on government bailouts to survive. In March, regulator Nersa granted Eskom tariff increases of 9.4 percent, 8.1 percent and 5.2 percent over the next three years, far below what the utility had sought. At the time Eskom said the tariff awards left it with a projected revenue shortfall of around 100 bn rand ($6.7 bn). Eskom said its board of directors had decided to challenge the tariff awards after reviewing the reasons for Nersa’s decision.

Source: Reuters

VPower Group wins Myanmar’s emergency power tender

11 October. Hong Kong-listed VPower Group said its consortium with Myanmar’s Zeya & Associates had been provisionally awarded four of the five emergency power projects tendered by the energy ministry in June. The consortium said it won three projects that would use imported liquefied natural gas in Rakhine’s Kyaukphyu, Yangon’s Thanlyin and Thaketa, totalling 900 MW. It also secured a 20 MW project that would use gas supplied by the government in Kyun Chaung. Letters of acceptance for each of the projects have been issued by the Ministry of Electricity and Energy’s Electric Power Generation Enterprise, VPower said. The consortium still needs to negotiate terms of the contract - including the power purchase agreement - with the government. As of 2018 Myanmar’s electricity generation capacity totalled 3539 MW, according to ministry estimates, making VPower an important player in the power market. After failing to attract private investment in power generation over the past few years, the government tendered these emergency projects to ensure Myanmar could avoid serious power shortages next hot season, which would be some months before the 2020 general elections. Demand for power consumption in the country is increasing annually by 15-17 percent, while less than 40 percent of the national population has access to electricity. VPower has already completed several emergency power projects in Myanmar and together with Zeya & Associates it started operating a 90 MW plant in Myingyan in March under a five-year contract.

Source: Myanmar Times

Power cut to millions as California faces heightened wildfire risks

9 October. Electricity was shut off to nearly 750,000 California homes and workplaces as Pacific Gas and Electric Co (PG&E) imposed a string of planned power outages of unprecedented scale to reduce wildfire risks posed by extremely windy, dry weather. The power cut knocked out traffic signals, forced school closures and shut businesses and government offices across northern and central California. Some of California’s most devastating wildfires were sparked in recent years by damage to electrical transmission lines from recurring bouts of high winds that then spread the flames through tinder-dry vegetation into populated areas.

Source: Reuters

Zimbabwe quadruples electricity prices, pummelling impoverished consumers

9 October. Zimbabwe hiked its average electricity tariff by 320 percent to ramp up power supplies at a time of daily blackouts, but the move will anger consumers already grappling with soaring inflation that is eroding their earnings. The southern African nation is experiencing its worst economic crisis in a decade, seen in triple-digit inflation, 18-hour power cuts and shortages of US (United States) dollars, medicines and fuel that have evoked the dark days of the 2008 hyperinflation under late President Robert Mugabe. The second increase in the price of electricity inside three months follows sharp rises in fuel and basic goods prices. The Zimbabwe Energy Regulatory Authority (ZERA) said it had approved an application by Zimbabwe Electricity Transmission and Distribution Company (ZETDC) to raise the tariff to 162.16 cents (10.61 US cents) from 38.61 cents.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

German renewable power levy to rise by 5.5 percent in 2020

15 October. A fee levied on German consumers to support renewable power will rise by 5.5 percent to 6.756 cents per kWh (kilowatt hour) in 2020. The levy is a key part of Germany’s policy to switch to lower carbon sources of energy, known as Energiewende, but has sparked criticism from consumers because it makes up 21 percent of their final bills.

Source: Reuters

Climate change activists target BlackRock in London

14 October. Climate activists targeted BlackRock, the world’s biggest asset manager, in London, demanding that major financial institutions starve fossil fuel companies of the money they need to build new mines, wells and pipelines. Extinction Rebellion, which uses civil disobedience to highlight the risks posed by climate change and the accelerating loss of plant and animal species, is midway through a new two-week wave of actions in cities around the world. Extinction Rebellion wants to cause enough disruption to force governments to rapidly cut carbon emissions and reverse the collapse of ecosystems to avert the worst of the devastation scientists project if business as usual continues.

Source: Reuters

EDF Renewables commissions 130 MWp in solar energy capacity in Egypt

14 October. EDF Renewables said it had commissioned 130 megawatt power (MWp) worth of solar energy capacity in Egypt, as it steps up the pace of its development in North Africa. EDF said the latest plants moved it closer to meeting its goal of doubling its net renewable energy capacity in France and worldwide to a net amount of 50 GW between 2015-2030.

Source: Reuters

Russia ready to work with US to build Saudi nuclear power plant: Rosatom

14 October. Russia’s state nuclear corporation Rosatom would be ready to cooperate with partners from the United States, Europe and Asia to build a nuclear power plant in Saudi Arabia, Rosatom’s CEO (Chief Executive Officer) Alexey Likhachev said.

Source: Reuters

Dubai utility gets record low bid to build solar power plant

13 October. Dubai Electricity & Water Authority (DEWA) selected a contractor that submitted a “record” low bid to build a 900 MW solar power plant in the emirate, Chief Executive Officer Saeed Mohammed Al Tayer said. The contractor bid 1.7 cents per kWh (kilowatt hour) for the photovoltaic plant. The decision requires a lengthy evaluation before DEWA can publicly announce the winner, he said. DEWA required offers of less than 2.4 cents per kWh. The plant will be the fifth phase of a sprawling facility in in the desert outside Dubai -- the Mohammed bin Rashid Al Maktoum Solar Park, which will have 5 GW of installed capacity by 2030 if DEWA completes it as planned. The United Arab Emirates, of which Dubai is the financial hub, had 594 MW of installed solar capacity at the end of 2018 -- more than any other country in the Persian Gulf region, according to the International Renewable Energy Agency. Dubai is on track to produce 7 percent of its electricity from solar power by 2020 and targets meeting 75 percent of its needs from solar and other renewables by 2050, according to the UAE (United Arab Emirates)’s clean energy strategy.

Source: Bloomberg

China begins new environmental probe in smog-prone Hebei province

11 October. China has launched a new audit into environmental compliance in the northern industrial province of Hebei surrounding Beijing, as it looks to ensure officials are not dodging efforts to combat pollution. China launched countrywide audits in 2015 to help ensure compliance with efforts to curb pollution, with many local authorities accused of turning a blind eye to pollution in order to guarantee growth and employment. Hebei, which produces a quarter of China’s steel and is responsible for much of the smog drifting over the capital, was the test site for the first probe. Hebei has already been under pressure to curb industrial output over the past month in order to reduce air pollution across China’s coastal regions.

Source: Reuters

Equinor to invest nearly $550 mn in floating wind power off Norway

11 October. Equinor said it will invest nearly 5 bn Norwegian crowns ($549 mn) to build floating turbines to supply power to several North Sea oil and gas platforms, in a move that will allow the Norwegian firm to cut carbon emissions. The 88 MW capacity project, called Hywind Tampen, consisting of 11 turbines, would meet about 35 percent of electricity needs at the Gullfaks and Snorre fields, Equinor said. The project will allow Equinor to reduce CO2 (carbon dioxide) emissions from gas turbines on offshore installations by about 200,000 tonnes per year, an equivalent of emissions from 100,000 cars every year, it said.

Source: Reuters

British Airways owner IAG commits to net zero carbon emissions by 2050

10 October. British Airways owner IAG said it will achieve net zero carbon emissions by 2050, becoming the first major airlines group to make such a commitment. The aviation industry is under intense pressure from climate change activist such as Extinction Rebellion, which is aiming to shut down London’s City Airport. IAG said it would achieve its target with steps such as carbon offsetting for British Airways’ domestic flights from 2020, investing in sustainable aviation fuel and replacing older aircraft with more efficient jets over the next five years. IAG said the steps would help the airline contribute both to Britain’s goal for a net zero carbon economy by 2050 and a United Nations objective to limit global warming to 1.5 degrees. IAG said that aviation represented only 2 percent of global CO2 (carbon dioxide) emissions, and that the airline group’s steps were one part of a broader solution to make aviation less polluting.

Source: Reuters

Indonesia launches agency to manage environment funds

9 October. Indonesia launched an agency to manage funds for climate change management as part of its efforts to meet its climate goals. The new agency is expected to start operation on 1 January 2020 and will have an initial fund of around 2 tn rupiah ($141 mn). The funds will come from land reclamation payments and fines the government collects from environment criminal cases, as well as from donors. Finance Minister Sri Mulyani Indrawati said the agency could potentially raise up to 800 tn rupiah ($56 bn) in environmental funds. Indonesia aims to cut carbon emission by 29 percent by 2030 by its own efforts and 41 percent with international assistance.

Source: Reuters

Poland plans to triple solar energy capacity this year

9 October. Poland, which generates most of its electricity from coal, is planning to triple its solar energy capacity this year, Prime Minister Mateusz Morawiecki said. Morawiecki said that Silesia, which is still largely dependent on coal despite a recent contraction in the industry, will be one of the regions hardest hit by measures taken to combat climate change. In June Poland led a handful of eastern EU (European Union) states in blocking a push by France and others to commit the bloc to net zero emissions by mid-century. Morawiecki said at that time that Warsaw wanted a strong compensation package for its industrial sector in exchange for agreeing to commit the target. Earlier in October the Polish energy minister put the cost of reaching a net zero emissions economy in Poland at €700-900 bn.

Source: Reuters

DATA INSIGHT

Scenario of Coal Transportation through Railways

Coal Loading through Railways

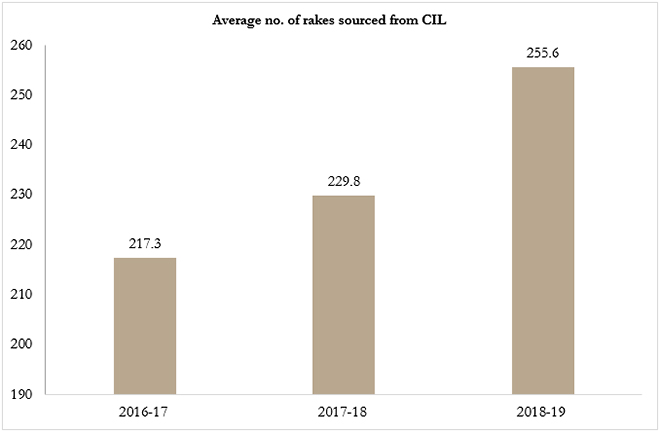

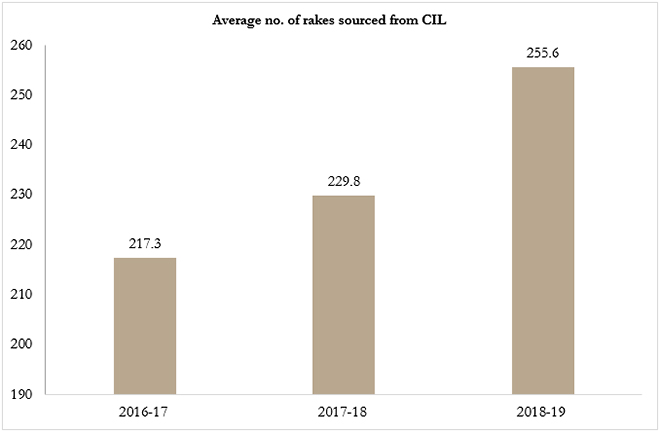

| Year(s) |

Average number of rakes per day

sourced from CIL |

| 2016-17 |

253.1 |

| 2017-18 |

265.5 |

| 2018-19 |

280.7 |

Coal Loading through Railways for Power Sector

Source: Compiled from Parliament Questions for Ministry of Coal

Source: Compiled from Parliament Questions for Ministry of Coal

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

Source: Compiled from Parliament Questions for Ministry of Coal

Source: Compiled from Parliament Questions for Ministry of Coal PREV

PREV