< lang="EN-US" style="color: #0069a6">GAS EXCHANGE MOVES FORWARD

Gas News Commentary: September 2019

India

IEX rose 1.91 percent after the company said its board has approved a proposal to create a subsidiary for setting up an exchange for trading of gas. IEX said its board approved the incorporation of a wholly owned subsidiary company in India to undertake the business of developing a gas exchange for transacting, clearing and settling trades in various types of gas based contracts including all other forms/types of energy, with an initial investment upto ₹100 mn in the form of subscribed and paid-up capital. The announcement was made after market hours yesterday, 19 September 2019.

The government has decided against giving gas transportation company GAIL (India) Ltd majority stake in the proposed gas exchange to prevent conflict of interest seeping into the latest reform initiative that would pave the way for free trading of natural gas - both short-term and long-term - through dedicated exchanges. PNGRB said that draft regulations on gas exchanges has already been finalised by it that clearly specifies that a gas pipeline company will not be allowed to take majority stake in these new exchanges. The proposed gas trading hub will come up in the country early next year (first quarter of FY21) as PNGRB would take at least six to eight months to finalise regulations. Rating agency CRISIL has been appointed to assist the regulator and the government in framing rules for the exchange. The Ministry of Petroleum and Natural Gas is expected to approach the Cabinet to set up a gas exchange. The move is aimed to provide market-driven pricing gas and pool domestic natural gas with imported LNG. The gas exchanges could evolve both physical and virtual trading hub. The location will depend on where the major pipelines are connected. The major pipelines are currently connected in Gujarat, Maharashtra and Kakinada in Andhra Pradesh. The government is looking to unbundle marketing and transportation operations of gas in the country, a move that would end up splitting GAIL, which owns most of nation’s natural gas transportation network. The government is hoping to raise the share of natural gas in the country's energy mix to 15 percent by 2030 from the current 6 percent. It is also planning to double its gas pipeline network and gas import terminal capacity over the next few years.

The un-bundling of state-owned natural gas utility GAIL must happen for the country’s plan to set up a gas trading hub to achieve its desired purpose, H-Energy said. H-Energy plans to spend around ₹40 bn over the next 3-4 years in order to set-up pipeline infrastructure and two LNG terminals on the Eastern coast. The 4 mtpa LNG terminal in Jaigarh, Maharashtra is ready and only a small stretch of 60 km natural gas pipeline connecting the terminal to Dabhol-Bangalore natural gas pipeline is pending, which is expected to be completed by December 2019. On the Eastern side, H-LNG is setting up two terminals -- a 3 mtpa terminal in Kukrahati in West Bengal and another 3 mtpa terminal in Kakinada, Andhra Pradesh. The company expects both the terminals to be completed by mid-2022. The company is exploring various avenues of collaboration with Russia gas giant Novatek including setting up a joint gas marketing company, sourcing LNG from Novatek and investment opportunities in LNG terminals in Russia. LNG retail infrastructure is growing at a very slow pace in the country which is discouraging transporters to adopt the fuel. The company has received approval from Petroleum and Explosives Safety Organization for setting up an LNG retail outlet at Panvel in Maharashtra and the firm is keen on expanding its presence in the space. Kakinada Seaports Ltd has the concession for Kakinada deep water port from Andhra Pradesh government. It will develop an LNG hub at the Kakinada Port catering to the needs of domestic customers in Andhra Pradesh, H-Energy said. LNG imported at Kakinada would be shipped to H-Energy’s upcoming Kukrahati terminal in West Bengal and neighbouring countries like Bangladesh and Maynmar through small LNG vessels. H-Energy is setting up an LNG terminal at Jaigarh in Maharashtra and also developing a natural gas pipeline of more than 1,000 km connecting its import facilities to the downstream gas markets. The company said it will start the commercial operation of its FSRU based LNG receiving terminal at the Jaigarh port in Maharashtra by end of 2019 along with a 60 km natural gas pipeline to Dabhol. It is also laying a 635 km natural gas pipeline from Jaigarh to Mangalore, which will connect to gas customers in Maharashtra and Karnataka and a 242 km line from Kanai Chhata to Shrirampur (at India-Bangladesh border), which will supply re-gasified LNG to customers in West Bengal and Bangladesh.

Petronet LNG Ltd, India’s biggest LNG importer, has signed a preliminary deal to buy a stake in Tellurian Inc’s proposed Driftwood project in Louisiana and import 5 mtpa of LNG. The deal is worth about $2.5 bn. Tellurian and Petronet will endeavour to finalise the transaction agreements by 31 March 2020, it said. India is targeting to raise share of natural gas in its energy basket to 15 percent by 2030 from 6.2 percent currently and is expanding its pipeline network and building new LNG import terminals to encourage use of the cleaner fuel. At present, GAIL has 20-year LNG contracts to buy 5.8 mttp of US LNG, split between Dominion Energy Inc's Cove Point plant and Cheniere Energy Inc's Sabine Pass facility in Louisiana.

RIL has stated that it will start natural gas production from R-Cluster gas field in the flagging KG-D6 block in the Bay of Bengal from the second half of the 2020-21 fiscal. RIL and its partner BP Plc of UK had in June 2017 announced an investment of ₹400 bn in the three sets of discoveries to reverse the flagging production in KG-D6 block. These finds were expected to bring a total 30-35 mcm of gas a day onstream, phased over 2020-22. R-Cluster will be first to come on stream. RIL has so far made 19 gas discoveries in the KG-D6 block. Of these, D1 and D3 -- the largest among the lot -- were brought into production from April 2009 and MA - the only oilfield in the block, was put to production in September 2008. The government had in 2012 approved a $1.529 bn plan to produce 10.36 mmscmd of gas from four satellite fields of block KG-D6 by 2016-17. The four fields have 617 bn cubic feet of reserves and can produce gas for eight years. However, the companies did not begin the investment citing uncertainty over gas pricing. After the government allowed a higher gas price for yet-to-be-developed gas finds in difficult areas like the deep sea, RIL and BP decided to take up their development. RIL-BP have kept the $3.18 bn investment plan for D-34 or R-Series gas field in the same block, which was approved in August 2013. About 12.9 mmscmd of gas for 13 years can be produced from D-34 discovery, which is estimated to hold recoverable reserves of 1.4 tcf. RIL is seeking a minimum price of $5.4/mmBtu for the natural gas it plans to produce from newer fields in the Bay of Bengal block KG-D6 as it changed parameters to suit government policies. RIL and its partner BP Plc of the UK have sought bids from potential users for the 5 mmscmd of natural gas they plan to produce from the R-Cluster Field in KG-D6 block from second quarter of 2020, according to the bid document. It set a floor or minimum quote of 9 percent of dated Brent price -- which means bidders would have to quote 9 or a higher percentage for seeking gas supplies. At $60 per barrel price, the gas price comes to $5.4/mmBtu. E-bidding would happen on 10 October, the bid document said. The rate compares to the government mandated $3.69 rate that its currently producing D1 and D3 fields in KG-D6 block are getting. The government gas pricing policy however provides for a higher cap price for future gas produced from difficult fields like those in deepsea. This cap currently is fixed at $9.32/mmBtu. RIL and BP are developing three sets of discoveries in KG-D6 block -- R-Cluster, Satellites and MJ by 2022. The document said the gas price would be lower of the quoted rate or the government mandated ceiling for the difficult fields. The formula Reliance is using to price gas for R-Series fields is different from its last price discovery it made for the CBM from its Sohagpur CBM blocks in Madhya Pradesh. For Sohagpur CBM, it had in 2012 sought bids at a benchmarked rate at 12.67 percent of Japan Customs-Cleared Crude, plus $0.26/mmBtu. At $60/barrel oil price, CBM from its Madhya Pradesh block was to cost $7.8/mmBtu. RIL ended up buying the CBM gas from its block after it bid deducting $1.836/mmBtu, lower than $3.156 bid by rival Piramal Glass and $3.495 bid by GAIL.

Mumbai’s Ruia family-owned Essar plans to double production of coal-seam gas or CBM from its Raniganj east block in West Bengal as a vital Urja-Ganga gas pipeline connecting users in eastern India gets commissioned by year-end. EOGEPL currently produces about 0.45 mmscmd due to constraints of pipelines that could take the gas to consumers. The company plans to ramp up the production to more than 1 mmscmd. This would be the highest production of CBM from any block in the country. The firm has already invested ₹40 bn in the project, which encompassed drilling of 348 wells, setting up the supply infrastructure, and laying pipelines to Durgapur and nearby industrial areas. The current production from the Raniganj east CBM block is significantly lower than its capacity with the company having to throttle the output at about 0.45 mmscmd because of lack of a pipeline to take the gas to consumers. The Urja Ganga natural gas pipeline transverses from Jagdishpur in UP to Haldia in West Bengal and Bokaro in Jharkhand and Dhamra in Odisha. The pipeline is being commissioned in phases and the last leg is scheduled for completion by December 2019. This will help gas supplies to reach four fertiliser plants in Gorakhpur, Sindri, Barauni and Panagarh, besides more than two dozen towns where city gas distribution rights have been awarded recently. The total demand in the region is envisaged at about 20 mmscmd. CBM is natural gas stored or absorbed in coal seams and contains 90-95 percent methane. According to the Directorate General of Hydrocarbons, India has the fifth-largest proven coal reserves in the world and, therefore, holds significant prospects for exploration and exploitation of CBM. Raniganj east block is India’s most prolific CBM block, holding 1 tcf of recoverable reserves. EOGEPL is planning to drill additional wells in accordance with the approved field development plan for the block.

IGL has won a licence to retail CNG to automobiles and piped cooking gas to households in Hapur district in UP. The government had in June 2010 given IGL a city gas distribution licence for UP’s Ghaziabad district. PNGRB has decided to give IGL the licence for Hapur as well. Hapur is the smallest district of UP and is 60 km from New Delhi. It comprises three tehsils Hapur, Garhmukteshwar and Dhaulana - and IGL will begin work soon after a formal order is issued. Hapur has paper, textiles and steel tube industries which could be a major natural gas consumer. With a modest beginning in 1998, IGL is now one of India’s biggest CGD companies in the country.

The Punjab government slashed value added tax on natural gas to 3.3 percent from 14.3 percent earlier to encourage industries to shift to the eco-friendly fuel. However, the VAT on compressed natural gas, used mainly as auto fuel, will remain at 14.3 percent. The major consumer of gas is NFL, which uses the gas at its plants at Bathinda and Nangal. Before March 2015, the VAT rate on natural gas was 6.05 percent. From March 2015 onwards, it was increased from 6.05 percent to 14.3 percent. Due to increase in VAT rate, NFL started interstate billing of natural gas, due to which VAT collection on natural gas decreased.

Torrent Gas, a part of the Torrent Pharma Group, is expanding its CGD business by acquiring three companies. This is in addition to the 13 geographical areas it won in bidding. The fresh acquisitions take the company’s reach to 16 geographical zones in 32 districts and 7 states. The company plans to invest around ₹100 bn in the business. The company has acquired Mahesh Gas in Pune from the Mahesh Group. It took over Siti Energy in Moradabad and Dholpur CGD from Essel Group. Mahesh Group could not start operations in Pune and exited the business with the sale to Torrent.

CNG price in Delhi and its suburbs was hiked for the third time since April due to rise in input cost following appreciation of US dollar against the rupee. This revision in prices would result in an increase of ₹0.50/kg in the consumer prices of CNG in Delhi, Rewari, Gurugram and Karnal, and ₹0.55/kg in Noida, Greater Noida and Ghaziabad, IGL, the city gas operator in the national capital region, said. The new consumer price will be ₹47.10/kg in Delhi and ₹53.50/kg in Noida, Greater Noida and Ghaziabad. The price of CNG sold to automobiles in Gurugram and Rewari would be ₹58.95/kg and in Karnal it would be ₹55.95/kg, IGL said. This is the third increase in rates since April and the eighth since April 2018. Rates were last revised upwards by 0.90/kg in July. Prior to that, CNG price was hiked in April by ₹1/kg because of a rise in the price of domestic natural gas and fall in rupee’s value against the dollar. In all, rates have gone up by ₹7.39/kg since April 2018. IGL, however, did not raise the price of PNG it supplies to households in these cities for cooking purposes. Rates of CNG and PNG vary in different cities due to the incidence of local taxes. IGL said it will continue to offer a discount of ₹1.50/kg in the selling prices of CNG for filling between 12.00 am to 6.00 am at select outlets in Delhi, Noida, Greater Noida, and Ghaziabad. The base price of natural gas being procured by IGL from all sources is dollar linked, thereby making the entire input price totally dependent on price of dollar vis-a-vis rupee. IGL sells CNG to over 1.05 million vehicles in the national capital region through a network of over 500 CNG stations. It also supplies PNG to over 11.20 lakh households in Delhi and NCR cities.

Rest of the World

US dry natural gas production will rise to an all-time high of 91.39 bcfd in 2019 from a record high of 83.39 bcfd last year, the EIA said. The latest output projection for 2019 was up from EIA’s 91.03 bcfd forecast in August. EIA projected US gas consumption would rise to an all-time high of 84.51 bcfd in 2019 from a record 82.07 bcfd a year ago.

The rate of growth in China’s natural gas consumption is expected to slow to around 10 percent in 2019 from 17.5 percent last year amid pressure on the country’s production, storage and sales network, a government research report published showed. The report, conducted by the oil and gas department at the National Energy Administration, forecast consumption to be about 310 bcm and to continue growing until 2050. The report also called an increase in domestic output increase, especially in Sichuan, the Erdos basin and in offshore production bases, to ensure security of the country’s energy supply. PetroChina said that certified, newly added proven shale gas geological reserves at Changning-Weiyuan and Taiyang blocks in the Sichuan basin totalled 740.97 bcm. China’s state-run energy producers are raising spending on domestic oil and gas drilling to a multi-year high this year, answering Beijing’s call to boost energy supply security as import reliance soars amid an escalating trade war with the US. PetroChina said the firm has made a breakthrough in unconventional oil and gas exploration. Qingcheng has a total estimated geological reserve at 693 mt while the Sichuan shale gas blocks have a total proven geological reserve at 1.06 tcm the firm said.

Bangladesh’s state oil and gas company Petrobangla plans to buy more than 1 mt of LNG on the spot market next year, seeking to capitalise on lower prices for the super-chilled fuel. Asian spot LNG prices are currently seasonally at their lowest in years due to new supply entering the market from the US and as demand growth slows in major economies. Petrobangla, in charge of LNG imports into the South Asian country, plans to issue a spot tender some time over January or February next year. Petrobangla will buy eight cargoes of 140,000 tonnes each, or a total of about 1.1 mt, in 2020. The purchase will mark Bangladesh’s first spot tender for LNG. The nation of 160 mn people is expected to become a major LNG importer in Asia, alongside Pakistan and India, as domestic gas supplies fall. Bangladesh currently has two FSRUs with a total regasification capacity of 1 bcfd equal to about 7.5 mt a year. Petrobangla already imports about 300-400 mcfd of LNG - equivalent to 3.5 mt per year in total - through two long-term contracts with Oman and Qatar. Bangladesh has shortlisted 17 companies for its spot tender process as it plans to buy around 1 mt of LNG next year to capitalise on lower prices for the super-chilled fuel. Petrobangla, in charge of LNG imports into the South Asian country, plans to sign sales and purchase agreements with the shortlisted companies after it receives cabinet approval. The companies shortlisted are Mitsui, Marubeni, Osaka Gas, AOT Energy, Diamond Gas, Summit Oil & Shipping, Excelerate Energy, Jera, Gazprom, Vitol, Trafigura, Woodside Petroleum, Eni, Petronas, CNOOC, Cheniere and Chevron. Asian spot LNG prices LNG-AS are currently at their lowest in years due to new supply entering the market from the United States, and as demand growth slows in major economies. Traders who sign the sales and purchase agreements will then be able to participate in spot tenders Petrobangla will issue when cargoes are needed. The nation of 160 mn people is expected to become a major LNG importer in Asia, alongside Pakistan and India, as domestic gas supplies fall. Bangladesh’s annual imports of LNG could nearly triple to at least 10 mt over the next three to four years. The country currently has two FSRUs with a total regasification capacity of 1 billion cubic feet per day - equal to about 7.5 mt a year. Bangladesh has a 10-year LNG import deal with Oman Trading International. That LNG is priced at 11.9 percent of the three-month average price of Brent crude oil plus a constant price of $0.40/mmBtu.

Pakistan has selected groups that include Exxon Mobil Corp and Royal Dutch Shell to build five LNG terminals as it aims to triple imports and ease gas shortages. The terminals could be in operation within two to three years. Pakistan is chronically short of gas for power production and to supply manufacturers such as fertilizer makers, hobbling the country’s economy. The five must submit plan details to the ministry of ports and shipping by 5 November for approval, but cabinet has already approved them, Khan said. Pakistan’s two LNG terminals currently have 1.2 bcfd of capacity, and a third expected to come on line next year will add 600 mcfd. The country has sought bids for a 10-year LNG supply tender for the current terminals and the results will be announced in two to three weeks. The cost of building the terminals and finding buyers for the gas will be up to the groups, and they will pay Pakistan a royalty based on volume. Pakistan’s contribution will be funding construction of a $2 bn north-south pipeline to distribute the gas, and storage facilities. Commodity trader Gunvor offered the lowest prices to supply LNG to Pakistan for the majority of the cargoes the importer sought between October and December, despite attracting interest from Asian companies. Gunvor submitted the lowest offers for six cargo delivery slots with DXT Commodities, Vitol, a unit of PetroChina and Socar Trading submitting the lowest bids for the remaining four delivery slots, a Pakistan LNG document showed. Nine companies in all qualified in the tender to supply four cargoes in October, two in November and four in December. They included Japan’s JERA Global Markets, part of the world’s biggest LNG buyer JERA, and a unit of China’s top oil and gas company PetroChina Company Ltd. Despite being big buyers of LNG, Asian firms such as JERA and PetroChina have sought to expand their portfolio trading to optimise costs and as demand in Japan and China remained lacklustre this year. But seasoned LNG trader Gunvor, which submitted the lowest offers in all the previous tenders but one this year, came out top again. Pakistan LNG does not announce awards of its tenders, only the lowest bidders. Pakistan’s LNG tenders are eagerly watched by traders because it reveals the prices offered, shedding light on an often opaque market. The prices are expressed as a percentage of Brent crude price. The prices in this tender ranged from 8.3 percent of Brent crude oil prices for a late October cargo, submitted by Vitol, to 10.9 percent of Brent for a late December cargo, submitted by Gunvor. At oil prices of about $60/barrel, that equates to $4.98/mmBtu for the cheapest October cargo and $6.54 per mmBtu for the most expensive December cargo. Asian spot LNG prices were heard at $4.30 to $4.50/mmBtu for October and at $5.20 to $5.50 for November.

French oil major Total has completed the acquisition of Anadarko’s APC.N 26.5 percent stake in Mozambique’s liquefied natural gas project for $3.9 bn. Anadarko led an LNG project in Mozambique, but was replaced by Total after the French oil major agreed to buy Anadarko’s African assets for $8.8 bn as part of the Occidental takeover. Total said closing operations for Anadarko assets in Algeria, Ghana and South Africa were still ongoing. It said that nearly 90 percent of the Mozambique LNG production has already been sold through long-term contracts with key LNG buyers in Asia and in Europe. The project is expected to come into production by 2024.

Japanese gas distributor Tokyo Gas aims to renegotiate long-term contracts with LNG suppliers to boost flexibility by scrapping clauses that restrict where the cargoes can be sold. Japan’s Fair Trade Commission in 2017 ruled that destination restrictions preventing the resale of contracted LNG cargoes breached competition rules, but Japanese companies have been slow to bring the terms of existing deals into compliance. Buyers and suppliers typically review the prices of long-term contracts every four to five years. Tokyo Gas has stepped up its efforts to diversify supply sources and price formulas by using different types of price index in an effort to improve competitiveness. The company signed a deal with Royal Dutch Shell for the long-term supply of LNG, partly using a coal-linked pricing formula - an unusual move for an Asian LNG buyer.

Equinor revealed that it has found gas in the Orn exploration well south-west of the Marulk field in the Norwegian Sea. Recoverable resources are estimated at 8–14 mcm oil equivalent, or 50–88 mn boe, Equinor highlighted. Norway headquartered Equinor currently operates 42 fields on the Norwegian continental shelf and produces around 2.5 mn barrels a day, including the volumes from its partners, according to the company.

Iran signed a $440 mn contract with local company Petropars to develop the Belal gas field in the Gulf. Under the deal signed with a subsidiary of the National Iranian Oil Company, Petropars is to produce 500 mcfd of gas.

Cameron LNG, an LNG facility in Louisiana operated be Sempra Energy has declared force majeure due to technical problems at the export terminal but the impact on volumes was not immediately clear, LNG traders said. The export terminal is one of three new facilities to have come onstream this year, boosting US LNG production and prompting a wave of imports into Europe which has depressed gas prices there. Traders said they were notified by Cameron LNG of the force majeure. Cameron LNG has sent out eight cargoes since May, reaching a level of three cargoes a month in August, Refinitiv shipping data showed. The last cargo left on 7 September. Cameron LNG’s first plant, or train, has a capacity of 5 mtpa with another two trains of 5 mtpa each due to start up in the first and second quarters of 2020. The US exported 22 mtpa last year, as Train 5 of Sabine Pass and Train 1 of Corpus Christi, operated by Cheniere Energy and the Cove Point terminal of Dominion Energy began operations.

Germany has ordered the Gazprom and Wintershall DEA controlled Opal gas pipeline to stop selling a significant amount of capacity to ship gas from the subsea Nord Stream 1 pipeline to onshore European grids, its energy regulator, the Bundesnetzagentur, said. The European Court of Justice overruled a previous European Union decision that allowed the operator of Opal, Opal Gastransport, and Gazprom to sell and ship more supply, after Poland contested the arrangement. Gazprom is building the Nord Stream 2 pipeline parallel to the first as it tries to bypass Ukraine, still its main gas transit route to Europe despite rows about prices, while Belarus and Poland serve as routes on the Yamal pipeline. Gazprom supplies around a third of Europe’s gas needs, but exports via Ukraine were partly suspended on several occasions due to disputes over price. Some European countries including Poland have begun importing LNG to diversify purchasing away from Russia.

Privately owned Western Gas said it has appointed Goldman Sachs to advise on finding a partner for its Equus LNG project off Western Australia, as it aims to start producing from the $3.5 bn project in 2024. Western Gas wants to develop the field using a 2 mtpa floating LNG facility, rather than feeding into larger existing facilities as contemplated by the field’s previous owner, Hess Corp. The project will be competing against large new developments led by Woodside Petroleum, also off Western Australia, designed to feed the North West Shelf LNG plant and an expansion of Woodside’s Pluto LNG plant. To achieve its target of first production from Equus in 2024, Western Gas will need to make a final investment decision on the project in 2020.

Plans to start exporting gas from Israel to Egypt are on track but further steps are still needed before exports can commence. The gas will be supplied via the East Mediterranean Gas subsea pipeline following a landmark $15 bn export deal struck last year. The pipeline operator has signed a deal to use a terminal belonging to Israel’s Europe Asia Pipeline Company, one of the final hurdles before starting exports, the companies said. Egypt’s Damietta LNG plant would restart operations as planned before the end of the year. The plant in northern Egypt has been idled for years due to lack of gas supply amid a dispute with Union Fenosa Gas, a joint venture between Spain’s Gas Natural and Italy’s Eni. Egypt’s gas production will rise by next year to around 7.5 bcfd from 7 bcfd for the current year.

Iraq will struggle to generate enough electricity unless it continues to use Iranian gas for three to four more years resisting US pressure to stop the imports from its Middle East neighbour. Iraq has a US waiver to import Iranian gas, but Washington has been pressing Baghdad to phase them out. Exports of gas to Iraq and exports of refined products to global markets remain an important source of revenues for Iran. Iranian gas imports could be reduced if Iraq used more of its gas reserves rather than flaring it, or burning off the associated gas that is produced during oil extraction. Four projects are underway to help convert 1.2 bcf of associated gas into liquids and significantly reduce flaring.

Russian President Vladimir Putin told the head of state-controlled Gazprom to consider making Russian gas exports to China via Mongolia, the Kremlin said. Gazprom is due to start exporting gas to China in December via the eastern Power of Siberia pipeline.

Russia and Moldova are close to reaching agreement on gas supplies. Moldova purchases gas from Russian gas giant Gazprom as part of an accord signed in 2008 that expires on 31 December. It currently pays $240 per 1,000 cubic metres. Based on Moldova’s current annual gas consumption of 3 bcm the 30 percent price reduction would be equal to $200 mn.

UK regulator Ofgem has fined a unit of France’s Engie for market abuse after one of its traders manipulated wholesale British gas prices over a three month period in 2016. The regulator said it had not found more widespread market manipulation but it had fined EGM (Engie Global Markets) £2.1 mn ($2.6 mn) because it did not have enough measures to prevent or detect the market abuse. Ofgem said EGM had fully cooperated with its investigation and has since taken measures such as increasing surveillance of its traders. British gas prices, especially its day-ahead and month-ahead contracts, are seen as benchmark for European gas prices, alongside the Title Transfer Facility Dutch gas prices.

| < style="color: #000000">FY: Financial Year, IEX: Indian Energy Exchange, mn: million, bn: billion, PNGRB: Petroleum and Natural Gas Regulatory Board, LNG: liquefied natural gas, mtpa: million tonnes per annum, km: kilometre, FSRU: floating storage and regasification unit, US: United States, RIL: Reliance Industries Ltd, UK: United Kingdom, KG: Krishna-Godavari, mmBtu: million metric British thermal units, CBM: coal-bed methane, EOGEPL: Essar Oil and Gas Exploration and Production, mmscmd: million metric standard cubic meter per day, tcf: trillion cubic feet, IGL: Indraprastha Gas Ltd, UP: Uttar Pradesh, CGD: city gas distribution, VAT: Value Added Tax, NFL: National Fertilisers Ltd, CNG: compressed natural gas, kg: kilogram, PNG: piped natural gas, bcfd: billion cubic feet per day, mcfd: million cubic feet per day, EIA: Energy Information Administration, bcm: billion cubic meters, tcm: trillion cubic meters, mt: million tonnes, CNOOC: China National Offshore Oil Corp, boe: barrels of oil equivalent, mcm: million cubic meters |

NATIONAL: OIL

India signs LPG import pact with Bangladesh

6 October. India signed three pacts with Bangladesh, including one for importing liquefied petroleum gas (LPG), with Prime Minister (PM) Narendra Modi saying the motto behind such initiatives is to ensure ease of living in both the countries and strengthening bilateral ties. The pacts were signed after detailed talks between Modi and visiting Bangladesh Prime Minister Sheikh Hasina. Referring to the pact on LPG, the PM Modi said that the bulk supply of the fuel from Bangladesh will benefit both the countries. The MoU (Memorandum of Understanding) for supply of LPG will involve export of the fuel by Omera Petroleum and Beximco LPG to Indian Oil Corp (IOC), which will bottle and sell it to consumers.

Source: The Economic Times

Petrol, diesel prices in India reach 10-month high on oil price volatility

2 October. Petrol and diesel prices across the country remained unchanged, staying at 10-month high levels on the back of oil price volatility in the global market. The price of petrol and diesel in the national capital remained unchanged at Rs74.61 per litre and Rs67.49 per litre, respectively. The price in Mumbai also remained same at Rs80.21 per litre and Rs70.76 per litre. OMCs (Oil Marketing Companies) fix the price of petrol and diesel at retail outlets based on an average of the past 15 days of the benchmark prices of petrol and diesel in the Middle East. OMCs have hiked the price of petrol and diesel by Rs2.64 per litre and Rs2.12 per litre in the national capital since 14 September, the day of the historic drone attack on Saudi oil facilities. Oil prices are now below the levels reached during the attacks as Saudi Arabia has restored its full oil production and capacity. Market research agencies have projected that Indian refiners may increase prices of both the automobile fuels by Rs5-6 per litre.

Source: The Economic Times

Iran not disappointed with India for not buying oil from Tehran: Jaishankar

2 October. India has a strong political and cultural relationship with Iran where it operates a strategic port, External Affairs Minister S Jaishankar has said, rejecting reports that Tehran is disappointed at New Delhi for not buying oil from the oil-rich nation in view of the tough US (United States) sanctions. The Chabahar port - considered a gateway to golden opportunities for trade by India, Iran and Afghanistan with the central Asian countries - is located on the Indian Ocean in the Sistan and Baluchistan province of Iran. Iranians were disappointed with India’s decision not to buy oil from them to avoid American sanctions regime. Iran is India’s third-largest oil supplier behind Iraq and Saudi Arabia. Iran supplied 18.4 million tonnes (mt) of crude oil during April 2017 and January 2018 (first 10 months of 2017-18 fiscal).

Source: Business Standard

NATIONAL: GAS

IGL slashes CNG price by Rs2 per kg on cheaper domestic gas

3 October. Indraprastha Gas Ltd (IGL) reduced CNG (compressed natural gas) price by Rs1.90 per kg in Delhi and Rs2.15 per kilogram (kg) in Noida, Greater Noida and Ghaziabad as a result of 12 percent reduction in the cost of gas produced from domestic fields. The clean-burning automotive fuel will now cost Rs45.20 per kg in Delhi and Rs51.35 per kg in Noida, Greater Noida and Ghaziabad. The price will remain unchanged “as of now” in other markets being supplied by IGL, the company said. After the revision, CNG would be 56 percent cheaper than petrol and 33 percent than diesel at current price levels. The company announced a new cashback scheme for consumers who refuel using IGL Smart Card during off-peak hours at the company’s CNG stations. The price of CNG in Delhi continues to remain lowest in the entire country. The company will offer a discount of Rs1 per kg between 12 am to 6 am at select outlets in Delhi, Noida, Greater Noida and Ghaziabad from now. Thus, the consumer price of CNG would be Rs44.20 per kg in Delhi and Rs50.35 per kg in Noida, Greater Noida and Ghaziabad between 12 am and 6 am at the select CNG stations. This is being done to prompt consumers to refuel during the night. IGL introduced a special cashback scheme of 50 paise per kg on refuelling done only at IGL CNG stations through IGL Smart Cards between 11 am and 4 pm, as well as 12 am and 6 am.

Source: The Economic Times

12.5 percent cut in natural gas price is credit negative for ONGC: Moody’s

3 October. The 12.5 percent cut in domestic natural gas price is credit negative for India’s biggest producer ONGC (Oil and Natural Gas Corp) as its earnings will fall by over Rs14 bn, Moody’s Investors Service said. On 30 September, the government announced a 12.5 percent reduction in domestic natural gas price to $3.23 per million metric British thermal units (mmBtu) from $3.69 per mmBtu (on a gross calorific value basis). This is the first reduction in gas price in India since April 2017. The decline in natural gas revenue and earnings will have a limited effect on ONGC’s metrics for fiscal 2020 because its gas business is small compared with its total upstream business, it said. The reduced price is applicable for 1 October 2019 to 31 March 2020. Prices are calculated using a formula implemented in November 2014 and domestic natural gas prices are revised every six months. Gas prices in India are determined by taking a volume-weighted annual average of the prices prevailing in Henry Hub (US), National Balancing Point (UK), Alberta (Canada) and Russia.

Source: Business Standard

NATIONAL: COAL

CIL likely to meet targeted output despite heavy rains

8 October. Coal India Ltd (CIL) will manage to step up production to near its targeted level despite floods hitting mining operations. Ratings agency ICRA estimates CIL’s production is likely to fall short of its current year target by 55-75 million tonnes (mt). Its target for this year is 660 mt. Coal Secretary Anil Jain said existing coal stocks have helped meet coal demand and production has picked up. ICRA said CIL has registered a year-on-year production fall of 23.5 percent in September 2019, as operations were impacted by flooding of key mines due to heavy rains and labour issues. ICRA said in order to achieve the targeted annual production or come anywhere close to the annual guidance, CIL would have to step up to an average run-rate of 2.3 mt coal production per day for the rest of the year. The company will start producing 1,500,000 tonnes of coal by the end of October.

Source: The Economic Times

Disturbances affect coal supply, overburden removal in MCL Bhubaneswar

6 October. Mahanadi Coalfields Ltd (MCL) said at least 6,000 tonne coal supply and 5,000 cubic meter of overburden removal work were affected due to two incidents of work disturbances recently at its Talcher colliery. Overburden removal at Ananta opencast project (OCP) was affected after a man of Burdabanpur village unauthorisedly entered the mine premises and damaged equipment to stop dewatering operations from the sump to the external mine area, the company said. Earlier, some people obstructed coal transportation from 11 am to 1 pm at Biswal Chhak near Dera village in Talcher, due to which the supply of about 6000 tonne coal from Bhubaneswari OCP was affected. Estimated loss due to this was Rs24 mn.

Source: The Economic Times

Government launches portal for monitoring coal supply to power plants

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Portal for monitoring coal supply will increase transparency!

< style="color: #ffffff">Good! |

4 October. The government has launched a portal for better coordination among the ministries of power, coal and Indian Railways for coal supply to power plants. The Prakash portal – ‘Power Rail Koyla Availability through Supply Harmony’ – will enable all stakeholders to monitor coal right from mines to transportation, Power Secretary SC Garg said. This is a laudable project in ensuring adequate availability optimum utilisation of coal at thermal power plants, Coal Secretary Anil Jain said. The Portal is designed to help in mapping and monitoring entire coal supply chain for power plants, viz - - coal stock at supply end (mines), coal quantities/ rakes planned, coal quantity in transit and coal availability at power generating station. Through the portal, coal company will be able to track stocks and the coal requirement at power stations for effective production planning. Indian Railways will plan to place the rakes as per actual coal available at siding and stock available at power stations while power stations can plan future schedule by knowing rakes in pipe line and expected time to reach.

Source: The Economic Times

Goa government eyes another coal block in sixth tranche allotment

4 October. Goa Industrial Development Corp (GIDC) has app lied for yet another coal block as part of the sixth tranche of coal mines opened by Coal India Ltd (CIL). If successful in its bid, the corporation will mine both the additional coal block along with the Dongri Tal II coal block already allocated to Goa. GIDC intended to rope in validated consultants to help the state with the coal block utilisation and with the auction of the industrial land returned by the special economic zone promoters.

Source: The Economic Times

NATIONAL: POWER

UP to supply 24x7 power till Diwali

8 October. More than two years after BJP (Bharatiya Janata Party) charged the then Akhilesh Yadav-led SP (Samajwadi Party) regime with minority appeasement by providing uninterrupted power supply during Ramzan while not doing the same during Hindu festivals, the Yogi Adityanath government announced round-the-clock power for the state from Dussehra till Diwali. Uttar Pradesh (UP) Power Minister Srikant Sharma said UP Power Corp Ltd has made an additional arrangement of 4,000 MW daily, mainly from energy exchange, to meet the demand, which is expected to touch around 20,000 MW in the festive season. Currently, power demand is around 16,000 MW, with the state government providing 24-hour supply to cities and 18 hours to villages. Significantly, the demand witnessed a dip this month due to fall in day temperature and humidity. During the holy month of Ramzan between May and June this year, UPPCL provided uninterrupted power in minority-dominated pockets.

Source: The Economic Times

Goa government departments in list of defaulters with Rs1.4 bn power dues

4 October. Various government departments in Goa owe approximately Rs1.45 bn to the state power department, which is reeling under financial crisis due to non-payment of total Rs3.5 bn dues by consumers. After going through the balance sheets of all the sub-divisions, it came to light that total Rs3.5 bn are outstanding from the power consumers, including the government agencies, individuals and private firms, State Power Minister Nilesh Cabral said. According to him, from November, the power department will start filing RRC (revenue recovery certificate) cases against the defaulters. The power department had disconnected the electricity supply of Panaji municipal market for non-payment of Rs50 mn dues pending since 2003.

Source: Business Standard

New transmission corridor to boost power sector

3 October. The commissioning of the Edamon-Kochi corridor in the Tirunelveli-Madakkathara inter-state power transmission corridor has brought a drastic change in the electricity sector of the state. The power sector of the state has seen a change equivalent to the installation of a new 500 MW power station. Chief Minister Pinarayi Vijayan said after charging the line, the voltage has increased by 2 kilovolt (kV) in Palakkad, Kochi and Kottayam. A total of 447 towers were needed for the Edamon-Kochi stretch. The Power Grid Corp of India Ltd (PGCIL) launched the work of the Tirunelveli-Madakkathara project in 2008 with the deadline of 2010. The Tirunelveli-Edamon portion was completed in 2010 and the Madakkathara (Thrissur)-Kochi (Pallikkara) component the following year. However, the remaining work on the Edamon-Kochi stretch was stalled due to the objection of people living in the area through which the transmission line passes through. According to KSEB (Kerala State Electricity Board), the new power transmission network helps in increasing the power import capacity of the state by 800 MW. It is also possible now to bring in power to Kerala from any part of India.

Source: The New Indian Express

Uttarakhand CM launches awareness campaign to stop power theft

3 October. Uttarakhand Chief Minister (CM) Trivendra Singh Rawat launched an awareness campaign -- Urjagiri -- which aims at stopping power theft and saving. The CM emphasised on the need to speed up the process for wider awareness to avoid power loss in Uttarakhand. He instructed the officers of UPCL (Uttarakhand Power Corp Ltd) Vigilance Cell to effectively stop the power theft.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

States asked to forego free power to make hydro projects viable

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Hydro-power needs more than just elimination of free power!

< style="color: #ffffff">Bad! |

8 October. The Centre is persuading state governments to forego their share of free power from hydroelectric plants to make the projects viable and put the hydropower sector on track. It proposes to hold a formal interaction on the issue with state governments at the ensuing review meeting in Gujarat between Union Power Minister R K Singh and power ministers of states. India is targeting production of 75,000 MW of hydropower by 2030, up from 45,000 MW at present, to balance the electricity grid as the country aims to add 175 GW of renewable capacity. The power ministry has been emphasising on taking up only hydropower projects which are commercially viable. The ministry has been urging state governments to play their part in making hydropower competitive by foregoing, deferring or staggering free power and, if need be, their share of goods and services tax (GST). The Himachal Pradesh government signed agreements with NTPC Ltd, NHPC Ltd and SJVN Ltd for setting up 10 hydropower projects of 2,917 MW on Chenab river entailing an investment of about Rs280 bn. The government had approved measures in March to promote hydroelectric projects, including treating them as renewable projects and increasing debt repayment period to 18 years from 12 years to reduce tariffs in initial years.

Source: The Economic Times

ReNew load shedding sees 300 MW of solar assets put on the block

7 October. ReNew Power, which until recently was a major acquirer of renewable assets in India, has put 300 MW of solar assets on sale as the company tries to cope with rising uncertainty in the industry. The move to raise capital through sale of assets comes at a time when the renewable energy sector is facing several challenges. The Andhra Pradesh government’s decision to renege on contracts signed by the previous Telugu Desam Party-led state government to buy power from green energy producers has unnerved investors. The 300 MW solar assets, which have been put up for sale, are located in southern states.

Source: Livemint

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Asset shedding is a sign of stress in the renewable sector!

< style="color: #ffffff">Ugly! |

NTPC yet to get approval for 800 MW wind power projects

7 October. The fate of around 800 MW out of 1,200 MW of wind power auctioned by NTPC Ltd last year remains uncertain because the state-owned firm has not been able to get regulatory approvals. Hero Future Energies, Renew Power, Continuum Wind, Sprng Energy, EDF and Mytrah Energy had emerged as the biggest winners of the auction conducted in August 2018, with tariffs ranging between Rs2.77 and Rs2.83 per unit.

Source: The Economic Times

NHPC inks pact to acquire 500 MW Teesta VI hydro project

4 October. NHPC Ltd signed an agreement to acquire 500 MW Teesta VI hydro power project, which it bagged under corporate insolvency resolution process. It would supply power at a levelised tariff of Rs4.07 per unit and would be completed in next five years, NHPC chairman and managing director Balraj Joshi said. The company will tie-up with state discoms for entering into power purchase agreements (PPAs) because its existing PPA (power purchase agreement) with Maharashtra is not valid anymore, he said. NHPC has signed the definitive agreement for implementation of approved resolution plan for takeover and resolution of Lanco Teesta Hydro Power Ltd, which was executing the 500 MW (125 MWx 4) Teesta VI hydro project on Teesta river in Sikkim.

Source: Business Standard

Russian firm ships second steam generator to KNPP

4 October. Russia’s Roastom State Atomic Energy Corp said it has shipped the second steam generator for the under-construction fourth unit of Indo-Russian joint venture Kudankulam Nuclear Power Plant (KNPP) in Tamil Nadu. Rosatom State Atomic Energy Corp is the technical consultant and main equipment supplier to KNPP and the first steam generator was supplied in May this year, it said. Four steam generators were required for one power unit of a nuclear power plant of this type. The heat generated from the power plant is removed from the reactor’s core by coolant, which passes through the core. Under the pact with Russia, the KNPP would have six units of 1000 MWe (megawatt electrical) each. The first and second units started commercial operations in December 2014 and March 2016 respectively. According to the Nuclear Power Corp of India Ltd, the unit III and IV, currently under different stages of construction, are expected to begin commercial operations in March and November 2023 respectively.

Source: Business Standard

Patanjali Renewal Energy among four bidders in fray for Lanco Solar

4 October. Patanjali Renewal Energy is among four bidders that are in the fray for Lanco Solar. Bagadiya Brothers, Kundan Gupta, and JC Flowers Asset Reconstruction Company are the other companies. The companies will be carrying out due diligence on the beleaguered Lanco group company that manufactures solar panels and sets up rooftop solar projects. Four firms of the Hyderabad-based group — Lanco Teesta, Lanco Amarkantak, Lanco Kondapalli, and Lanco Solar — faced insolvency process after the group defaulted on payments. Axis Bank had filed for insolvency against Lanco Kondapalli Power, an Andhra Pradesh-based gas-fired power project, and Amarkantak and solar companies. The last day for submission of bids for Lanco Solar was 30 September. Resolution plans for the company will be submitted by 16 November.

Source: Business Standard

Electric mobility in India needs a common framework

3 October. Even as more states are framing policies to promote electric mobility, the need is to develop a common framework for consistency and to accelerate adoption of electric vehicles (EVs). Rather than only a collection of incentives, goes a report from the World Economic Forum (WEF), the International Organization for Public-Private Cooperation and the Ola Mobility Institute (OMI). The report takes stock of 10 states and Union Territories (UT) that are building momentum for EV usage across the areas of manufacturing, infrastructure and services. Given the nascent market, the role of government is important in accelerating adoption, diffusion and deployment of electric mobility. For a price-sensitive market, incentives for electric (clean) kilometres run versus electric vehicles purchased make economic sense and is suggested as the guiding principle for national strategy. While variation is understandable, a common framework for gauging the sustainability and longevity of EV policies across India is necessary for policy makers, businesses and practitioners alike, the report said. Most of the states studied have provision for installation of charging infrastructure in public and private places. For instance, Uttar Pradesh is targeting 200,000 charging stations by 2024. Andhra is targeting 100 percent electrification of buses by 2029. The places studied — nine states and the UT of Delhi — have all published draft EV policies or notified final ones. The nine states being Andhra, Bihar, Delhi, Karnataka, Kerala, Maharashtra, Tamil Nadu, Telangana, Uttarakhand, and Uttar Pradesh.

Source: Business Standard

INTERNATIONAL: OIL

Sanctions have led to Iran’s oil industry falling behind: Oil Minister

8 October. Sanctions have led to Iran’s oil industry falling behind but Iran will resist, Iranian Oil Minister Bijan Zanganeh said. The conditions in Iran are in a way that once every few years the oil industry receives a deadly blow and the economic sanctions can be considered one of those, he said.

Source: Reuters

Russia’s Rosneft tenders to sell first batch of oil products for 2020

7 October. Russia’s Rosneft has announced the first tenders to sell oil products from its refineries for delivery in 2020, the company said. The buyers were invited to bid for gasoline, vacuum gasoil, naphtha and fuel oil from Rosneft's refineries. The tenders will close on 25 November.

Source: The Economic Times

Russia will find ways to help Cuba get oil: Medvedev

5 October. Russia will find ways to help Cuba secure supplies of oil and petroleum products, Russian Prime Minister Dmitry Medvedev said. Medvedev pledged to help develop Cuba’s energy sector during a visit to the island, but did not announce any short-term measures to provide relief for the island from crippling fuel shortages in the wake of tougher US (United States) sanctions. A flotilla of shipments from Venezuela gave Cuba some respite. But the support from two of its closest allies looks unlikely to resolve Cuba’s pressing fuel problems, which have seen the government extend many of the energy-saving measures it has introduced over the past month. Cuba’s oil production currently meets an estimated 40 percent of its needs.

Source: Reuters

Exxon Mobil bars use of oil tankers linked to Venezuela

4 October. Exxon Mobil Corp banned the use of vessels linked to oil flows from Venezuela in the last year, putting new pressure on the US (United States) sanctioned country and on global crude freight rates. Some measures have led tanker operators to stop carrying oil for Venezuela’s state-run PDVSA oil firm. The decision by world’s largest publicly-traded oil producer to ban the Venezuela-linked tankers should affect about 250 vessels. A lack of vessels willing to carry Venezuelan oil exports is hurting Cuba, the crisis-torn country’s main political ally, which imposed fresh austerity measures last month due to power cuts and an acute shortage of fuel.

Source: Reuters

INTERNATIONAL: GAS

Exxon to make $500 mn initial investment in Mozambique LNG project

8 October. Exxon Mobil plans to invest more than $500 mn in the initial construction phase of its liquefied natural gas (LNG) project in Mozambique. The United States oil company’s $30 bn Rovuma LNG project, jointly operated with Italy’s Eni, has a capacity of more than 15 million tonnes per annum (mtpa) and is set pump much-needed cash into the southern African nation’s ailing economy. The Exxon project, along with Total’s $20 bn 13 mtpa facility and Eni’s $8 bn 3.4 mtpa floating plant, mean Mozambique will have the ability to export 31 mtpa of natural gas, about 10 percent of global market.

Source: Reuters

US natural gas output, demand seen rising to record highs in 2019

8 October. US (United States) dry natural gas production will rise to an all-time high of 91.63 billion cubic feet per day (bcfd) in 2019 from a record high of 83.39 bcfd last year, the Energy Information Administration (EIA) said. The latest output projection for 2019 was up from EIA’s 91.39 bcfd forecast in September. EIA projected US gas consumption would rise to an all-time high of 84.25 bcfd in 2019 from a record 81.86 bcfd a year ago. EIA projected output in 2020 would rise to 93.50 bcfd, and demand would rise to 84.96 bcfd. US became a net gas exporter in 2017 for the first time in 60 years. The EIA projected gas would remain the primary US power plant fuel in 2019 and 2020 after supplanting coal in 2016. It projected the share of gas generation would rise to 37 percent in 2019 and 2020 from 34 percent in 2018.

Source: Reuters

PetroChina still negotiating prices of extra gas supplies from Russia

3 October. PetroChina Co, Asia’s largest oil and gas producer, is still in talks with Russia’s Gazprom on the price of additional volumes of gas supplies, PetroChina Vice President Ling Xiao said. PetroChina has already in place an agreement with Gazprom on gas prices for Power of Siberia pipelines, he said.

Source: Reuters

INTERNATIONAL: COAL

Polish coal region wants its say on new mines

7 October. Local authorities in Poland’s Silesia coal-mining region urged the nationalist Law and Justice (PiS) government to drop proposed legislation that would give it the option to open new mines without their consent. Facing an election, PiS has maintained its strong support for coal mining as a key energy source for Poland, which generates 80 percent of its electricity from coal. But there is growing opposition to mining in Silesia, one of the most polluted coal regions in Europe, potentially putting pressure on PiS. Opinion polls show the party is likely to win vote with about 40-44 percent.

Source: Reuters

Colombia’ coal mine Cerrejon to reduce output amid low prices

7 October. Cerrejon, one of Colombia’s largest coal mines, will reduce its operations by up to 18 percent because of a fall in international prices and amid an ongoing court case. Colombia, the world’s fourth-largest exporter of coal, faces a potential spending crunch next year as royalties from the fuel decline amid a supply glut and slowing economic growth in China. Cerrejon, owned by BHP Group Ltd, Anglo American Plc and Glencore, will have output of just 26 million tonnes (mt) for the next five years, compared to the more than 30 mn it was regular producing until last year.

Source: Reuters

South African government in talks with coal miners to cut prices for cash-strapped Eskom

3 October. South Africa’s Mines and Energy Minister Gwede Mantashe said he was in talks with coal firms that supply struggling power utility Eskom to reduce coal prices in a bid to lower energy costs and boost the mining sector. In March, energy regulator Nersa granted Eskom average tariff increases of 9.4 percent, 8.1 percent and 5.2 percent over the next three years. Eskom owns and operates more than 13 coal-fired power stations and has supply agreements with firms including Exxaro Resources and South32

Source: Reuters

Russia’s Mechel to pay $461 mn for stake in Elga coal project

3 October. Russian steel and coal producer Mechel agreed to pay around 30 bn roubles ($461 mn) for Gazprombank’s 34 percent stake in the Elga coal project. Elga is one of the world’s largest coking coal deposits with reserves of 2.2 billion tonnes. In 2016, Gazprombank paid 34.4 bn roubles to buy a 49 percent stake in Elga from Mechel, which owns the remainder of the project, as part of the coal producer’s debt restructuring.

Source: Reuters

INTERNATIONAL: POWER

Japan’s JERA buys $330 mn stake in Singapore power unit of Bangladesh’s Summit

7 October. Japan’s JERA Co has acquired a 22 percent stake in Summit Power International, a Singapore-based unit of Bangladesh’s Summit Group, for $330 mn, both companies said. The unit is a holding company of all power assets of Summit Group. The investment was finalised four months after a Memorandum of Understanding was signed between JERA and Summit in Tokyo.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

France’s Total begins construction of third solar power plant in Japan

8 October. French energy group Total said it has begun the construction of its third solar power plant in Japan, the Miyagi Osato Solar Park, planned for a peak capacity of 52 MW. The project is to start up in 2021 and will provide clean and reliable electricity to Japanese households, Total said. Total has made a series of deals this year as it builds up its presence in the renewable energy sector.

Source: Reuters

Germany presents plan to strengthen onshore wind power after lull

7 October. Germany’s economy ministry presented a schedule to help revive onshore wind turbine construction that has declined due to bureaucracy and citizens’ opposition, hampering efforts to build up renewable energy and meet climate targets. The ministry said various wildlife regulations needed to be aligned and added that new turbines should be built in step with the expansion of electricity networks. Onshore turbine constructions fell 82 percent to 287 MW in the first half of 2019, the lowest level in nearly two decades.

Source: Reuters

French utility EDF nuclear power generation fell 8.6 percent in September

7 October. Electricity generation from French nuclear reactors operated by utility EDF fell 8.6 percent year-on-year in September to 27.5 terawatt hours (TWh) due to a high number of reactor outages, the company said. The state-controlled utility said total output from its nuclear reactors since the start of the year stood at 288.2 TWh, down 0.6 percent compared with the same period a year ago. EDF’s nuclear electricity generation in France was at 393.2 TWh in 2018 and it is targeting 395 TWh in 2019.

Source: Reuters

PSALM to rebid Malaya thermal power plant

7 October. The Power Sector Assets and Liabilities Management Corp (PSALM) will rebid the 650 MW Malaya thermal power plant in Pililla, Rizal. PSALM has set on 22 November, the deadline for the submission of bid proposals. The Malaya plant consists of a 300 MW unit with a once-through type boiler and a 350 MW unit fitted with a conventional boiler.

Source: Business Mirror

US eliminating tariff exemption for imports of new solar panel technology

5 October. US (United States) trade officials said they were eliminating the exemption for bifacial solar panels from the Trump administration’s tariffs on overseas-made solar products. The office of the US Trade Representative (USTR) said it was withdrawing the exclusion for imported bifacial solar panels, a new technology through which power is produced on both sides of a cell. The USTR had announced the exemption in June. Under tariffs imposed in early 2018, the rate for solar panels had been set at 30 percent and then lowered to 25 percent.

Source: Reuters

Uzbekistan announces winner of international tender for solar power plant construction

5 October. Uzbek energy ministry announced United Arab Emirates' Masdar Clean Energy as the winner in the country’s first competitive tender for a solar power public-private partnership (PPP) project. Masdar was awarded the project with a bid to supply solar power at 2.7 US (United States) cents per kilowatt hour, one of the lowest tariffs in emerging markets, and is expected to build a 100 MW solar power plant in Navoi region of the country within a year, the ministry said. This announcement opens new markets for private investment and makes progress towards the country’s goal to increase use of renewable energy, International Finance Corp (IFC) said. Uzbekistan plans to establish 25 100 MW solar power factories by 2030 to diversify the country’s energy mix and soon announce two more tenders for an additional PPP for 400 MW and 500 MW solar power plants.

Source: Xinhua

Russia, Philippines to study building nuclear power plant

4 October. Russia’s state nuclear corporation Rosatom and the Department of Energy of the Philippines sign an agreement to study the possibility of building a nuclear power plant in the Philippines. The agreement of intent was signed at the Russian-Philippine business forum in Moscow timed with the visit of Philippine President Rodrigo Duterte to Russia. Russia proposed to the Philippines a project to build a floating nuclear power plant. The Philippines built a nuclear power plant in 1980s in response to an energy crisis, but it never went into operation for fear of disasters over the decades.

Source: Xinhua

Denmark calls for EU strategy to phase out diesel and petrol cars from 2030

4 October. Denmark, backed by 10 other European Union (EU) countries, called for a strategy to phase out diesel and petrol cars, including allowing the ban of sales at member state-level by 2030 to combat climate change. Denmark made the proposal came during a meeting of EU environment ministers in Luxembourg. The 2050 goals are part of Ursula van der Leyen’s plans, the new president of the European Commission, to make Europe the first climate neutral continent by 2050. Denmark made headlines in October 2018 when its government announced that it would ban the sale of all new fossil fuel-powered cars by 2030 but it subsequently scrapped the idea because this would have breached EU rules.

Source: Reuters

New biofuel mandates to be calculated based on three-years of data: US EPA

4 October. The US (United States) Environmental Protection Agency (EPA) will calculate its new biofuel blending volumes requirements under the Renewable Fuel Standard based on the amounts waived over the previous three years. The ranges are informed by the last three compliance years, EPA said.

Source: Reuters

Chevron aims to cut intensity of greenhouse gas emissions from production

3 October. Chevron Corp aims to reduce the intensity of greenhouse gas emissions from its oil production by 5 percent to 10 percent over a seven-year period ending 2023 as part of an ongoing effort to combat global climate change, the US (United States) energy major said. Chevron, part of the Oil and Gas Climate Initiative (OGCI) along with Exxon Mobil Corp and BP Plc, said it will also target a reduction of 2 percent to 5 percent in greenhouse gas emissions intensity from gas production over the same period. However, Chevron’s goals do not include plans to cut Scope 3 emissions or those from its customer’s use of its fuels and other products. The OGCI, formed in 2014, is a group of 13 major oil companies that account for 32 percent of global oil and gas production. It aims to reduce methane emissions and increase carbon efficiency. The companies have also been investing in carbon capture technology that traps carbon in caverns or porous spaces underground. Chevron said it had so far spent more than $1 bn on carbon capture and storage projects in Australia and Canada and the investment is expected to reduce greenhouse emissions by about 5 million metric tonnes per year.

Source: Reuters

China firms complete building Argentina’s largest solar farm

2 October. Chinese companies have built a 300 MW solar farm in the highlands of northern Argentina, the largest of its kind in the South American nation. The farm, with a total installed capacity of 315 MW and a contract value of $390 mn, started construction in April 2018, after Chinese firms PowerChina and Shanghai Electric Power Construction Co Ltd jointly won a tender to build it.

Source: Reuters

DATA INSIGHT

All India Electricity Scenario

| Source |

Installed (Monitored) Capacity*

as on 30 June 2019

(in GW) |

| Thermal |

226.32 |

| Nuclear |

6.78 |

| Hydro |

45.40 |

| Total (conventional) |

278.50 |

| Renewable Sources |

79.79 |

| Total (Conventional & Renewable) |

358.29 |

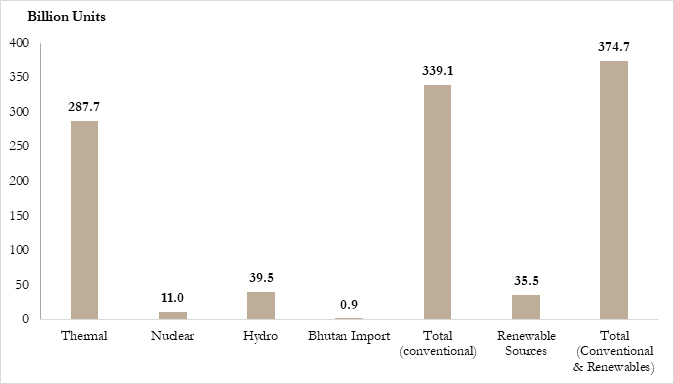

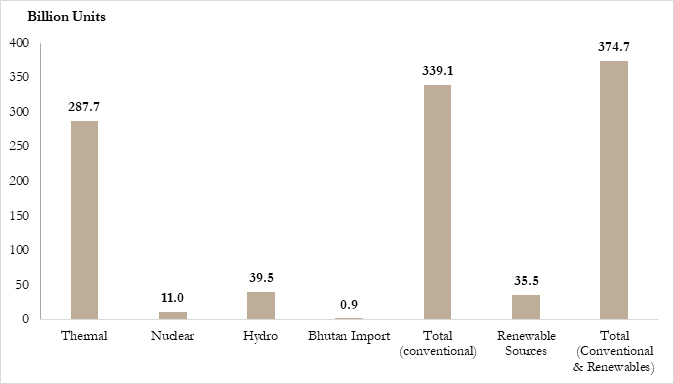

All India Electricity Generation for FY20 (from April to June 2019)*

*Provisional based on actual-cum-assessment

Source: Lok Sabha Questions

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV