LOW SPOT PRICES MAKE LNG IMPORTS ATTRACTIVE

Monthly Gas News Commentary: August 2019

India

India said it will look at reviewing the pricing of its long-term LNG deals at an “appropriate time” due to a fall in spot prices. The spot price of imported LNG into Japan, one of world’s biggest importers of the super-cooled fuel, has more than halved in the last year. India’s biggest gas importer Petronet LNG Ltd said that it would consider renegotiating its long-term LNG supply deals if spot prices remained weak for a prolonged period. India is investing up to ₹5 tn ($70 bn) to boost its natural gas sector, including city gas distribution projects, setting up LNG liquefaction facilities and natural gas exploration.

India’s top gas importer Petronet LNG will consider renogiating its long-term supply deals to secure lower LNG prices if spot prices remain weak for two to three years. An inexorable decline in spot market prices for LNG is driving some buyers in Japan and China to request delays in term cargoes, while others are looking to lift lower volumes under their term contracts from LNG sellers. Petronet has a deal to buy 7.5 mt of LNG annually from Qatar’s Rasgas and 1.44 mt from Exxon’s Gorgon project in Australia. The Indian company is buying gas under these deals at $8.25-$9.50/mmBtu, while spot LNG LNG-AS prices are around $4 per mmBtu.

The government is planning to introduce a wave of reforms in the natural gas sector, aimed at local discovery of prices and development of a national gas market. The oil ministry has prepared a Cabinet note that proposes snapping the power sector’s priority access to cheap local gas, setting up a gas trading platform to encourage market-discovery of prices, and hive off GAIL (India) Ltd’s transportation unit to enhance third-party access to its pipelines. At present, India produces just half of the gas it consumes, a government set formula determines rates for most local gas, and the absence of market price deters producers from investing in the country. By allowing marketing freedom to gas from new discoveries, the government has tried to address much of the investors’ concerns in recent years but officials think developing a free market was essential to sustained investment in the sector. Which is why the government wants to build a gas trading platform that can facilitate market discovery of prices. A gas exchange will enhance trade transparency, boost consumer confidence, and increase market opportunities for suppliers. The oil ministry has, therefore, proposed to knock off the power sector, the biggest consumer of local gas, from the so-called priority list. It has proposed limiting the allocation to city gas (CNG vehicles and households) and the fertiliser sector. The power sector consumes about 31 percent of the local gas while the fertiliser and city gas sectors consume 24 percent and 22 percent, respectively.

Petronet LNG is in talks with IGL and GSPC to jointly set-up LNG pumps in six locations on the Delhi-Mumbai Expressway. In order to increase the use of natural gas in the mobility sector, the company has been trying to push for introducing LNG in the heavy vehicle category. The company had originally planned to set-up LNG pumps across the Delhi to Trivandrum highway, however, after further evaluation it decided to first focus on the Delhi-Mumbai Expressway. The company had also requested the petroleum ministry to ask finance ministry for exempting custom duty on LNG trucks. Discussions for setting up a floating LNG terminal for Sri Lanka has shown progress. Petronet along with Japan’s Mitsubishi, Sojitz Corp and Sri Lanka Port Authority plan to set-up a 2.6-2.7 mt floating LNG terminal near Colombo, Sri Lanka.

BPCL plans to invest ₹15-17 bn in building a floating LNG import terminal at Krishnapatnam in Andhra Pradesh by 2022. BPCL is betting big on gas business in anticipation of energy consumption basket undergoing change as focus shifts to cleaner sources. The company will hold 74 percent interest in the project while the remaining 26 percent will be with Petronet LNG Ltd. The project is likely to be commissioned by 2022. The global oil and gas market is going through a transformation as mounting climatic concerns drive changes in the energy mix in favour of natural gas and renewables. In India, natural gas demand is slated to grow at a rate much faster than oil as the share of environment-friendly fuel rises in the energy basket. To tap this opportunity, BPCL has made a foray into CGD and is now looking to set up an LNG import terminal of its own. Krishnapatnam will be the sixth LNG terminal to be announced, on the coast. Petronet had previously signed a firm and binding term sheet for developing a land-based LNG terminal at Gangavaram Port in Andhra Pradesh with an initial capacity of 5 mt with Gangavaram Port Ltd but later dropped it. GAIL too had planned a facility at Paradip in Odisha but it also dropped the plans. GAIL had also previously announced plans for setting up an LNG terminal at Kakinada in Andhra Pradesh but the project has not taken off. BPCL is transferring its gas business to a new subsidiary, Bharat Gas Resources Ltd.

Shell India, the local arm of the Netherlands-based Royal Dutch Shell Plc, exited the city gas business in the country after it sold its 10 percent stake in MGL for ₹7.7 bn. MGL, where the majority stake is owned by state-owned GAIL, sells CNG to automobiles and piped-cooking gas to households in and around Mumbai. When MGL was listed in July 2016, Shell and GAIL held 32.5 percent stake each in the company. The government of Maharashtra has 10 percent shareholding in MGL, while the remaining is with the public. Shell sold its stake in the open market after GAIL waived off its first right of refusal. Shell operates a 5 mt a year LNG import terminal at Hazira in Gujarat.

GAIL’s plan for supply of CNG and domestic PNG in Jharkhand has hit the forest clearance and land acquisition hurdle. The company plans to commission 22 stations for supply of CNG to 125,000 vehicles in Ranchi and Jamshedpur. It also plans to lay down a 551 km pipeline for supply of PNG to 1.046 mn households across 12 districts, including Ranchi, Chatra, Giridih, Hazaribagh, Bokaro, Ramgarh, Dhanbad, Saraikela, Khunti, Gumla, Simdega and East Singhbhum.

India is set to test using LNG to power fishing boats ahead of stricter international rules on marine fuel emissions next year, in a move that could help an under-used LNG terminal in the south of the country. The South Asian country’s K-DISC, which is a think-tank and advisory body set up by the government of Kerala, issued an EOI for a pilot project to use LNG to fuel a fishing boat. It is looking to retrofit an existing marine diesel engine system in a fishing boat currently in the city of Kochi to enable it to operate on both LNG and diesel in what is known as a dual fuel system. Fishing boats are typically fuelled by diesel, but a new regulation by the International Maritime Organisation that limits the sulphur content of fuel used in ships by 2020 could push governments to explore the use of cleaner fuels. The project will also involve the installation of an LNG fuel storage tank and other associated equipment and pipelines by modifying the boat hull, according to the EOI. K-DISC has asked for the work to be done in 18 weeks and is requesting proposals by 7 September, with commercial bids to be submitted by late October.

Gujarat State Petronet Ltd’s ambitious project of developing a natural gas pipeline project from Mehsana all the way up to J&K is expected to get a major boost with revocation of special status to J&K under Article 370. The project is divided in two phases. Work on first phase connecting Gujarat and Punjab has been on. The second phase, covering J&K, has been stuck for a long time. Also, the Central government’s plans for industrial development in J&K will create a market for the clean fuel option. The J&K Gas Pipeline Act, 2014 with provisions of Right of User needed amendments that got stuck with the state government for a long time. The Centre’s decision to do away with the special status for J&K paves way for the project as it will now fall under the Union government’s Petroleum and Minerals Pipeline Act, 1962. The construction work for first phase to build a 1,670 km gas pipeline from Mehsana to Bhatinda will begin in a month’s time. The first phase will be commissioned in 2020 following which construction for the second phase will begin.

Even as the government pushes the idea of electric vehicles by doling out tax incentives, CGD companies are embarking on their most ambitious network expansion plan ever and reaching out to customers. Publicly traded CGD entities—including IGL, MGL, and Gujarat Gas Ltd—will set up nearly 340 CNG stations across their geographical areas in the next two years. Among these companies, Delhi-based IGL will add 100 CNG stations taking its tally to over 600 CNG stations. The company is spending ₹6 bn on setting up the 100 CNG stations. While Gujarat-based GGL will set up 200 CNG outlets over two years, Mumbai-based MGL will add 40 CNG stations over the same period to its existing network of network of 240 CNG stations.

A month after the Central Pollution Control Board ordered closure of industries that are not using PNG members of Gurugram’s industrial association met Union Environment Minister raising their concerns over making the use of PNG mandatory for industries. The members informed the Minister that the cost of conversion of boilers from other fuel to PNG would cost them a huge amount and they needed at least a year’s time to switch to PNG.

India offered for bidding seven new areas for prospecting of oil and natural gas on revamped exploration terms that look to expedite cut in import dependence by raising domestic output. Five blocks offered are in little-explored Vindhyan sedimentary basin, while one block is in Bengal Purnea basin. The remaining block is the proven basin of Rajasthan, according to the DGH. In all, 18,509.69 square km of area for exploration of oil and gas has been offered in the fourth bid round of OALP. The government has under the previous three OALP rounds awarded 87 blocks covering an area of 118,000 square kilometre. OALP-IV is the first round being held on revamped terms approved in February 2019. The last date for bidding for OALP-IV blocks is 31 October.

RIL and BP Plc will together invest ₹350 bn for bringing to production three sets of natural gas fields in the KG basin block in the Bay of Bengal. The three projects will help reverse the falling gas output from what was once the biggest gas-producing block in the country. The joint venture is expected to monetise over 3 tcf of discovered resources in the KG-D6 block.

Rest of the World

Cargoes of LNG are trading in Asia below $4/mmBtu for the first time in several years, as new supply floods the global pool and as demand from North Asia remains weak. The last time a cargo traded below $4 was likely about three to four years ago. Indian Oil Corp bought a cargo for delivery in the second half of August from commodity trader Trafigura at $3.69/mmBtu through a tender. Separately, China National Offshore Oil Corp bought a cargo for delivery in early September from Vitol at $3.90/mmBtu. Spot LNG prices in Asia were at $10/mmBtu at the same time last year, after reaching a four-year high in June 2018, Eikon data showed. They have been steadily dropping after a mild winter reduced demand last year and by new supply this year. European spot LNG prices have been trading at a discount to the benchmark Dutch month-ahead gas price at levels below $3.40/mmBtu.

The price Japanese utilities paid for spot cargoes of LNG last month were at their lowest in more than three years, data from the METI showed. The price for spot LNG shipped to Japan in July fell to an average of $4.70/mmBtu the lowest since May 2016, when the price was $4.10/mmBtu, data showed. The July price was the third lowest for monthly spot cargoes since METI began compiling the data in March 2014 and was down from $5.50/mmBtu in June. The drop in spot LNG prices LNG-AS is helping Japan’s utilities cut costs but their overall import price in June was much higher, at $9.14/mmBtu, because most of their fuel purchases are done via contracts linked to oil prices. METI surveys spot LNG cargoes bought by Japanese utilities and other importers, but only publishes a price if there is a minimum of two eligible cargoes reported by buyers.

US natural gas demand is at an all-time high and expected to keep rising - and yet, prices are falling. US gas futures collapsed to a three-year low, while spot prices were on track to post their weakest summer in over 20 years. In other markets, such lackluster pricing would cause investment to retrench and supply to contract. But gas production is at a record high and expected to keep growing. Demand is rising as power generators shut coal plants and burn more gas for electricity and as rapidly expanding LNG terminals turn more of the fuel into super-cooled liquid for export. Analysts believe the natural gas market is not trading on demand fundamentals because supply growth continues to far outpace rising consumption. So much associated gas is coming out of the ground that gas prices in the Permian basin in Texas and New Mexico, the biggest US shale oil formation, have turned negative on multiple occasions this year. The US EIA projects gas production will rise 10 percent to 91 bcfd in 2019 after soaring 12 percent to a record 83.4 bcfd in 2018, its biggest annual percentage increase since 1951. US LNG exports, particularly to Asia, are powering increased demand. They are expected to rise from a record 3.0 bcfd in 2018 to 6.9 bcfd in 2020, according to EIA projections, making LNG the nation’s fastest-growing source of demand. Still, LNG exports account for only about 5 percent of total US gas use.

Europe’s two biggest suppliers of pipeline gas, Norway’s Equinor and Russia’s Gazprom, have lost market share for the first time in at least four years amid a tripling in LNG imports into the region over the past 10 months. LNG imports into Europe have jumped amid lower than expected spot demand from Asia, which has helped to send European gas prices to 10-year lows and filled European storages to multi-year highs. Data compiled by Refinitiv showing changes in the market share of gas from Norway, Russia and LNG sources is the latest example of how LNG is transforming Europe’s gas market. The share of LNG in gas supplied to western and central Europe increased to 14 percent between October 2018 and August 2019 from 5 percent in the same period of 2017-18. The share of Norwegian gas dropped to 33 percent from 38 percent, a multi-year low, calculations by Refinitiv show. Gazprom’s share was around the average of the past three years, edging down by 1 percent from the previous year to 32 percent. But it was the first year-on-year drop since 2014-2015, when it was hit by low gas demand in Europe. Despite its market share loss, Gazprom’s total gas exports to Europe rose as the region imported 9 percent more gas from October to August, compared with the same period in 2017-2018.

Global oil and gas major BP has published its master sales and purchase contract templates for its LNG trading business and says it is the first of its peers to do so. BP, which has a global LNG portfolio made up of volumes it has produced or bought, said it expects that publishing its LNG MSPA templates will “contribute to the broader discussion around standardization and liquidity for LNG transactions.” The LNG industry has been pushing to streamline and standardize the contracts that govern its market to cut down on red tape and lengthy negotiations to speed up the commodity’s transition to an oil-like trading model. An MSPA is a complex framework agreement between two counterparties spelling out the general terms for their LNG deals. Unlike in oil markets, where standardized GT&Cs like BP’s provide a framework for traders to refer to, in LNG markets, companies typically draft separate contracts for every deal.

Ukraine’s gas transport company Ukrtransgaz has upgraded several gas pumping stations so it can provide gas to eastern and southern regions of the country if there is a disruption in supply from Russia, the company said. More than a third of Russia’s gas exports to the European Union cross Ukraine, providing Kiev with valuable transit income. Ukraine traditionally uses some of the gas pumped by Russia to European consumers for its own needs in eastern and central regions and then compensates for this by deliveries from gas storage located in the west of the country. But the Russia-Ukraine gas transit agreement is due to expire in January and Ukrainian energy authorities are worried that Moscow could stop gas supplies through Ukraine, leaving some Ukrainian regions without gas in winter.

Australia, the world’s top LNG exporter, said it would consider forcing gas producers to reserve some supply for the domestic market, as it looks to cut energy bills for households and manufacturers. This means a review of a range of policies, including so-called gas reservation, pipeline access and price transparency to come up with options by February 2021. Australian conservative and Labor governments have long resisted calls for domestic gas reservation on the view that interfering in the market could distort prices and deter new production in the long run. However, following a tripling in wholesale gas prices over the past five years after the start-up of LNG exports from eastern Australia, the government has come under pressure to boost supply and cut prices. Any gas reservation would not affect the state of Western Australia and would only apply to future developments. Two years ago the government introduced the controversial Australian Domestic Gas Security Mechanism, which requires the Resources Minister to decide each year whether to limit LNG exports from Queensland state to avert any forecast local shortage. Australia’s petroleum industry said it would work closely with the government on its gas policy review, but warned that market intervention could come at a cost, including increasing the perceived risk of doing business in the country.

Mozambique started constructing a $25 bn LNG project offshore, operated by the US energy giant Anadarko on the country’s remote northern coast. The country’s gas deposits are estimated at 5,000 bcm and would make Mozambique a major exporter of LNG. Annual production is expected to start in 2024 with an estimated output of 12 mt. Mozambique is hoping the discovery of the gigantic gas reserves at the beginning of the decade will bring about economic rebirth in the southeast African nation. Anadarko has previously said Mozambique’s natural gas reserves, "are among the best and the largest in the world".

Ukraine has accumulated 15.9 bcm of gas in storage as of 31 July, up from 12.8 bcm at the same time last year, Ukrainian state energy firm Naftogaz said. It said the country added 2.3 bcm in July and aimed to stockpile a total of 20 bcm by mid-October, when the 2019/20 heating season starts. Ukraine last year stored 16.9 bcm of gas for the 2018/19 heating season that ended in April. Naftogaz said the country would need to store more gas to avoid a shortage this winter. Its 10-year contracts with Russian giant Gazprom for gas supply and transit expire at the end of the year, but negotiations about further deals have not yet started. Ukraine consumed 32.3 bcm of gas in 2018, 10.6 bcm of which was imported from European markets outside Russia.

| LNG: liquefied natural gas, CNG: compressed natural gas, PNG: piped natural gas, mmBtu: million metric British thermal units, mn: million, bn: billion, tn: trillion, mt: million tonnes, IGL: Indraprastha Gas Ltd, GSPC: Gujarat State Petroleum Corp, BPCL: Bharat Petroleum Corp Ltd, CGD: city gas distribution, MGL: Mahanagar Gas Ltd, km: kilometre, K-DISC: Kerala Development and Innovation Strategic Council, EoI: Expressions of Interest, J&K: Jammu and Kashmir, DGH: Directorate General of Hydrocarbons, OALP: Open Acreage Licensing Policy, RIL: Reliance Industries Ltd, KG: Krishna-Godavari, tcf: trillion cubic feet, METI: Ministry of Economy, Trade and Industry, US: United States, EIA: Energy Information Administration, bcfd: billion cubic feet per day, MSPA: master sales and purchase agreement, bcm: billion cubic meters |

NATIONAL: OIL

Chandigarh robbing its states of fuel revenue: Petroleum dealers

3 September. The administration of the capital of Punjab and Haryana is responsible for revenue losses to the two states from the sale of fuel — a charge levelled by the Mohali and Panchkula petrol dealers’ associations battling losses owing to difference in the rates in the Tricity. The Chandigarh administration has continuously slashed VAT (Value Added Tax) rates since October 2017, leading to a total shift of petroleum trade from the bordering districts of Punjab to Chandigarh, according to the Petrol Pump Dealers Association, Mohali. The Punjab government had reduced VAT on petrol by ₹5 and diesel by ₹1 per litre on 18 February, but petrol in Mohali is still expensive by ₹4.54 per litre and diesel by ₹2.74 per litre as compared to Chandigarh. Dealers have suggested an increase in the VAT rates in Chandigarh — being the capital of Punjab— to bring them at par with the state, or a dual pricing within Punjab, with VAT rates in neighbouring districts, like Mohali and Rupnagar, being at par with Chandigarh. Mohali Petrol Dealers Association claimed a drop of almost 70 percent in sales at petrol pumps in Mohali since October 2018. Chandigarh dealers have gained 45 percent from the sale of diesel during this year and 17 percent from petrol as compared to their counterparts in Mohali and Panchkula, the associations have claimed. Dealers in Mohali alleged they have lost 28 percent in diesel sale, while there has been no change in the sale of petrol. Petroleum trade in Punjab, more so in the areas adjoining other states, has witnessed a downfall from five years. Mohali and Rupnagar are the worst-affected districts. A huge discrepancy in rates between Mohali and Chandigarh and Rupnagar and Himachal exist.

Source: The Economic Times

Jharkhand CM launches PMUY in Gumla

3 September. Jharkhand Chief Minister (CM) Raghubar Das inaugurated Pradhan Mantri Ujjwala Yojna (PMUY). Every village will be under an Ujjwala official to carry out the distribution of the cylinders. In August, Das had announced second gas cylinder refill under Pradhan Mantri Ujjwala Yojana in Ranchi.

Source: The Economic Times

Government hikes ethanol price to cut oil import bill by $1 bn

3 September. The government raised the price of sugarcane-extracted ethanol used for blending in petrol by up to ₹1.84 per litre as it looked to cut oil import bill by $1 bn annually through its greater use in auto fuels. State-owned oil marketing companies will buy ethanol from sugar mills, for mixing in petrol, at enhanced rates for ethanol year beginning 1 December, Oil Minister Dharmendra Pradhan said. The price of ethanol from 'C-heavy molasses' has been raised by 29 paise per litre to ₹43.75 while the same from 'B-heavy molasses', also called as intermediary molasses, by ₹1.84 to ₹54.27 a litre. Pradhan said that the higher price is expected to increase the procurement of ethanol to 2.6 bn litres between December 2019 and November 2020, up from 2 bn litres bought in the previous ethanol year. The percentage of ethanol being doped in petrol will rise from about 6 percent now to 7 percent next year and to 10 percent by 2021-22, Pradhan said. India spent $112 bn on import of 226 million tonnes (mt) of crude oil in 2018-19. Currently, petrol contains 6 percent of ethanol.

Source: India Today

Tripura to get supply of LPG from Middle East via Bangladesh

31 August. India will transport LPG (liquefied petroleum gas) imported from the Middle East to Tripura using Bangladesh’s Mongla port, Debashish Basu, Secretary for Food, Civil Supplies and Consumer Affairs, Tripura, said. India has earlier used it to ferry petroleum and food products from other parts of the country to Tripura.

Source: The Economic Times

India nudges Russia to get OPEC to price oil at reasonable rates

30 August. India has nudged Russia to use its influence on oil suppliers cartel OPEC (Organisation of Petroleum Exporting Countries) to balance the global oil market, ensuring adequate supply with responsible and reasonable price. Oil Minister Dharmendra Pradhan, on a three-day visit to Moscow, met his Russian counterpart Alexander Valentinovich Novak to review “the entire spectrum of oil and gas cooperation,” Pradhan said. India, the world’s third-biggest oil consumer, has been pressing the OPEC for responsible pricing of oil and gas, saying the volatility in rates are far detached from market fundamentals and are hurting importing nations.

Source: The Hindu Business L ine

Production of crude oil completes 10 yrs in Rajasthan

28 August. It was a decade ago, when the desert region of Thar witnessed first barrel of crude oil going out to a refinery. The region has established itself as the frontrunner in oil producing blocks. The state of Rajasthan is contributing over 25 percent of India’s domestic crude production while aiming to achieve the 50 percent mark. On 29 August 2009 the then Prime Minister Manmohan Singh had formally inaugurated the crude oil production from Barmer’s Mangala oil field. Cairn Oil and gas, the company operating the oil fields of Barmer, is celebrating the ten years of production as “Mangal Dashak” – an auspicious decade of oil production. The impact of crude oil production is visible on ground as well. Among all 33 districts in Rajasthan, Barmer has the highest per capita income. This is a 650 percent rise in just 10 years. Currently, the oil fields of Barmer are producing around 1.75 lakh barrel oil per day. The company has started working on Enhanced Oil Recovery (EOR) technology while injecting polymer into the oil reserves, thus increasing reservoir pressure leading to increased production. The Director General of Hydrocarbon (DGH), as per the Open Acreage Licensing Policy (OALP), has allotted eight new blocks to the company. These blocks are situated in Barmer, Jaisalmer, Jalore and Bikaner districts. Seismic survey and exploratory drilling will start very soon in these blocks to discover more oil reserves.

Source: The Economic Times

NATIONAL: GAS

CNG price in Delhi hiked by 50 paise, third since April

1 September. CNG (compressed natural gas) price in Delhi and its suburbs was hiked for the third time since April due to rise in input cost following appreciation of US dollar against the rupee. This revision in prices would result in an increase of ₹0.50 per kilogram (kg) in the consumer prices of CNG in Delhi, Rewari, Gurugram and Karnal, and ₹0.55 per kg in Noida, Greater Noida and Ghaziabad, Indraprastha Gas Ltd (IGL), the city gas operator in the national capital region, said. The new consumer price will be ₹47.10 per kg in Delhi and ₹53.50 per kg in Noida, Greater Noida and Ghaziabad. The price of CNG sold to automobiles in Gurugram and Rewari would be ₹58.95 per kg and in Karnal it would be ₹55.95, IGL said. This is the third increase in rates since April and the eighth since April 2018. Rates were last revised upwards by 90 paise per kg in July. Prior to that, CNG price was hiked in April by ₹1 per kg because of a rise in the price of domestic natural gas and fall in rupee’s value against the dollar. In all, rates have gone up by ₹7.39 per kg since April 2018. IGL, however, did not raise the price of piped natural gas (PNG) it supplies to households in these cities for cooking purposes. Rates of CNG and PNG vary in different cities due to the incidence of local taxes. IGL said it will continue to offer a discount of ₹1.50 per kg in the selling prices of CNG for filling between 12.00 am to 6.00 am at select outlets in Delhi, Noida, Greater Noida, and Ghaziabad. The base price of natural gas being procured by IGL from all sources is dollar linked, thereby making the entire input price totally dependent on price of dollar vis-a-vis rupee. IGL sells CNG to over 10.5 lakh vehicles in the national capital region through a network of over 500 CNG stations. It also supplies PNG to over 11.20 lakh households in Delhi and NCR cities.

Source: Business Standard

India keen to import more LNG from Australia but wants affordable pricing: Pradhan

29 August. India is looking to raise import of liquefied natural gas (LNG) from Australia but wants the fuel at affordable price to meet the energy needs of the world's fastest-growing economy. Oil Minister Dharmendra Pradhan met with Australian Minister for Resources Matthew Canavan to discuss bilateral energy cooperation. India already imports 1.44 million tonnes per annum (mtpa) of LNG from Australia on a long-term contract. India has set a target of raising the share of natural gas in the overall energy basket to 15 percent by 2030 from the current 6.2 percent. This shift would cut down the usage of polluting hydrocarbon fuels. Besides Australia, India imports 8.5 mtpa of LNG from Qatar under two long-term contracts and has tied up 5.8 mt a year supplies from the US (United States). It also has a 2.5 mt import contract with Gazprom of Russia. While long-term LNG comes for $8-9 per million metric British thermal unit (mmBtu), the same gas is available in the spot market for less than half the price. India has in the past used its status as Asia's third-largest LNG buyer to renegotiate deals with Qatar, Australia, and Russia. In 2015, it renegotiated the price of the long-term deal to import 7.5 mtpa of LNG from Qatar, helping save ₹80 bn. In 2017, it got Exxon Mobil Corp to lower the price of Gorgon LNG to save ₹40 bn in import bill and last year convinced Gazprom to lower rates too.

Source: The Economic Times

Government mulling ₹54 bn funding to Northeast gas grid

28 August. In only the second instance of providing funds for a gas pipeline, the government is considering shelling out about ₹54 bn in viability gap funding for a proposed Northeast gas grid. The 1,656 kilometre (km) North-East Natural Gas Pipeline Grid will connect Guwahati in Assam to major cities in the region such as Itanagar, Dimapur, Kohima, Imphal, Aizwal, Agartala, Shillong, Silchar, Gangtok, and Numaligarh. However, in the absence of anchor customers, the ₹90 bn pipeline is not economically viable. The oil ministry is supporting the proposal and it is likely to be considered by the Cabinet soon. The Northeast pipeline grid is to be implemented by Indradhanush Gas Grid, a joint venture of GAIL (India) Ltd, Indian Oil Corp (IOC), Oil and Natural Gas Corp (ONGC), Oil India Ltd (OIL) and Numaligarh Refinery Ltd (NRL). The government has envisaged developing the National Gas Grid. At present, about 16,788 km natural gas pipeline is operational and about 14,239 km gas pipelines are being developed to increase the availability of natural gas across the country.

Source: Business Standard

NATIONAL: COAL

NTPC units faced coal shortage in FY17-19

2 September. NTPC Ltd, the country’s largest power generator, has said many of its units faced a coal shortage in the past two financial years, owing to low production and the Centre’s restriction on importing it. In a recent petition to the Central Electricity Regulatory Commission (CERC), it said this led to slippage in power availability at four of its units, leading to less payment from states. CERC denied any relief to NTPC, saying power purchasers should not pay for the generator’s fuel supply risk. NTPC petitioned CERC for relief on the Normative Annual Plant Availability Factor (NAPAF) of at least 85 percent. NAPAF indicates the period for which a power plant is available for supplying the agreed quantity of electricity. NTPC said Coal India Ltd (CIL), the government-owned monopolist, was to blame for its below-optimum production, apart from the no-coal import policy the central government had announced in 2015. In the last two financial years, NTPC could not recover full annual fixed charges at units which faced a coal shortage. The governments of Gujarat, Maharashtra, Madhya Pradesh, Andhra Pradesh, Telangana, Karnataka, West Bengal and Kerala were in dispute with NTPC on the issue. During the hearing, they, especially Gujarat, argued NTPC alone should bear the risk on fuel availability. CERC also rejected the request of NTPC to ensure and regulate coal supply during peak demand periods. This January, the Union power ministry allowed NTPC and states to import coal.

Source: Business Standard

CIL output drops 10.3 pc in August

1 September. Coal India Ltd (CIL) said its production in August fell by 10.3 percent to 34.77 million tonnes (mt). CIL’s production in the same month a year ago stood at 38.78 mt. Coal offtake during August too contracted by 10.4 percent to 40.47 mt as compared with 45.15 mt in the year-ago month, CIL said.

Source: Business Standard

India to overtake China as largest importer of coking coal: Fitch Solutions

30 August. India will overtake China as the largest importer of coking coal by 2025, Fitch Solutions Macro Research said. While China will remain dominant in terms of overall market share, India will become increasingly important in terms of seaborne demand, it said. High frequency indicators show that while the largest importer of Australian coking coal, India, saw a 25.8 percent year-on-year (y-o-y) increase in coking coal imports from Australia in the second quarter of 2019, China, the second largest importer of Australian coking coal, decreased imports by 8.8 percent y-o-y in the same period.

Source: The Economic Times

Cabinet approves 100 percent FDI in coal mining

29 August. The Union Cabinet chaired by the Prime Minister Narendra Modi has approved to permit 100 percent FDI under automatic route for sale of coal, for coal mining activities including associated processing infrastructure with an aim to attract international players to create an efficient and competitive coal market. This would be subject to provisions of Coal Mines (special provisions) Act, 2015 and the Mines and Minerals (development and regulation) Act, 1957 as amended from time to time, and other relevant acts on the subject. As per the present FDI policy, 100 percent FDI under automatic route is allowed for coal & lignite mining for captive consumption by power projects, iron & steel and cement units and other eligible activities permitted under and subject to applicable laws and regulations. Further, 100 percent FDI under automatic route is also permitted for setting up coal processing plants like washeries subject to the condition that the company shall not do coal mining and shall not sell washed coal or sized coal from its coal processing plants in the open market and shall supply the washed or sized coal to those parties who are supplying raw coal to coal processing plants for washing or sizing.

Source: Business Standard

NATIONAL: POWER

Electricity to cost more in Uttar Pradesh, tariff hiked up to 12 percent

3 September. The Uttar Pradesh Electricity Regulatory Commission (UPERC) approved up to 12 percent hike in power tariff for different categories of power consumers. The UPERC has approved a hike of 8 to 12 percent in power tariffs. Similarly, the Industrial Sector category will have to shell out more money due to the in the range of 5-10 percent. The electricity tariffs have also hiked in the urban and rural areas. However, Bahujan Samaj Party (BSP) chief Mayawati strongly condemned the new electricity tariff hike and lambasted the BJP (Bharatiya Janata Party) for approving the hike in rates. Launching a sharp attack on Mayawati-led BSP, Uttar Pradesh Energy Minister Shrikant Sharma said that some categories of electricity rates had to be raised due to economic irregularities of the former governments. Sharma said that now the electricity supply has been extended to many districts but earlier only desired districts used to get electricity supply.

Source: Business Standard

Reliance Power signs pact with Japan’s JERA for 750 MW power project in Bangladesh

3 September. Reliance Power said it has signed a partnership agreement with Japan’s energy major, JERA, for jointly setting up 750 MW gas-based power project at Meghnaghat in Bangladesh. Reliance Power will hold 51 percent stake while JERA will hold 49 percent stake in the joint venture company. The project agreements for Phase-1 were signed with the authorities in Bangladesh. Scheduled to be set-up within 36 months of signing the agreements, this project will be the largest foreign direct investment in Bangladesh’s power sector. The agreement includes a power purchase agreement and land lease agreement with Bangladesh Power Development Board, gas supply agreement with Titas Gas, a subsidiary of Petrobangla, and implementation agreement with the Ministry of Power. Reliance Power had signed an MoU (Memorandum of Understanding) during Prime Minister Narendra Modi’s visit to meet his Bangladeshi counterpart, Sheikh Hasina in June 2015, for setting up a 3,000 MW gas-based combined cycle power project in phases in Bangladesh.

Source: The Economic Times

Power ministry puts conditions to ring fence package for stressed units

3 September. The power ministry has put conditions to check possible misuse of the rescue package for stressed coal-fired power stations as well as ensure fair play by both generation and distribution companies on the issue of making payments on time. The government had in March approved a slew of measures, recommended by a high-level committee, to de-stress power plants with aggregate capacity of 40,000 MW. According to the package, coal linkages of power plants that cancel PPAs (power purchase agreements) because of payment default by discoms were to be valid for two years. This was done to allow generation companies adequate time to look for alternative PPAs. At a meeting held by power secretary S C Garg, it was decided that power stations cancelling PPAs for payment default by discoms (distribution companies) will not be allowed to sell electricity bilaterally but only through the government’s DEEP portal or power exchanges at market-determined price for maximum two years. It was also decided that even in case of payment default by discoms, generation units will be able to cancel PPAs only in accordance with the provisions of the agreement. To create a market for the stressed power plants, procurement of bulk power by a nodal agency against pre-declared linkages was approved with the provision to allow Central/state generating companies to act as aggregators.

Source: The Economic Times

Delhi’s power demand peaks at night this summer

1 September. The power demand in Delhi this summer peaked at night with "cooling load" due to the use of AC, coolers and fans contributing to maximum consumption of electricity. Data from Delhi’s state load dispatch centre (SLDC) shows that on 90 days between May and August, the city’s power demand peaked during night. Delhi’s peak power demand has increased by over 250 percent since 2002, when it was 2,879 MW. It clocked an all-time high of 7,409 MW on 2 July this year, according to the data. Air conditioning can account for up to 30-50 percent of annual energy cost of a company or households. During summers, Delhi’s power demand peaked during night on 89 days - 19 in May, 18 in June, 24 in July and 28 days in August, the data shows. In fact, even on 2 July, when Delhi’s demand clocked an all-time high of 7,409 MW, power demand in South and West Delhi first made an all-time high record on 3,159 MW in the afternoon only to again breach it during the night (3,189 MW), discom (distribution company) said.

Source: Business Standard

PowerGrid board okays investment of ₹25 bn for transmission project in Rajasthan

28 August. Power Grid Corp said the company’s board has approved an investment of ₹25.7 bn for an electricity transmission project for a solar energy zone in Rajasthan. The board of directors in their meeting held on 27 August 2019 has accorded investment approval for transmission system for solar energy zones in Rajasthan at an estimated cost of ₹25.7 bn with commissioning schedule as December 2020.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Himachal Pradesh signs agreements to tap 250 MW solar power

3 September. Himachal Pradesh signed two pacts for setting up solar power plants with an outlay of ₹10 bn. One pact for ₹6 bn was signed with Renew Energy Private Ltd for setting up a 150 MW solar plant, which is proposed to commission by 2021, while the second was signed with CSE Development (India) Private Ltd for setting up a 100 MW plant. Chief Minister Jai Ram Thakur said the state would facilitate the companies to obtain permissions and clearances from authorities at the earliest so that work on these projects could be started soon. The solar plants would be set up in Una and Kangra districts. He said the state aims to tap 776 MW solar power by 2022.

Source: The Economic Times

Rajasthan government, US state to collaborate in energy sector

3 September. The Rajasthan government and Utah state of the US (United States) have entered into a partnership for knowledge sharing in the energy sector. The two states signed an MoU (Memorandum of Understanding) to advance state-level policy exchange, share emerging knowledge of innovative energy solutions and to develop direct ties between Utah and the Rajasthan government agencies and private sector energy companies for creating new grid and off-grid energy availability. The two states during a meeting discussed challenges and opportunities for collaboration between the two states, including renewable energy integration, power plant flexibility, transmission and distribution sector issues, energy storage and electric mobility, the US embassy said. Laura Nelson, energy advisor to the governor of Utah and the executive director of the Utah Governor’s Office of energy development, said that Utah has experienced a 150 percent growth in renewable energy in advancing affordable, reliable and clean power options for its thriving economy and high quality of life.

Source: The Economic Times

103 private hydro projects fail to take off in Arunachal

30 August. As many as 103 private hydropower projects in Arunachal Pradesh totalling about 35 GW are still to take off despite the government’s Act East policy focus. This comes against the backdrop of growing concerns on the delay in India’s plans to generate power from rivers originating from neighbouring China. The projects that are estimated to require investments of about ₹3.5 trillion were awarded to the private power producers by the Arunachal Pradesh government. The state government has approached the Centre to explore whether state-run power producers such as NHPC Ltd would want to take over the projects. The Arunachal Pradesh government has already issued termination notices to 21 such projects totalling around 2.5GW. A delay in building hydropower projects in Arunachal Pradesh on rivers originating in China will affect India’s strategy of establishing its prior-use claim over the waters, according to international law. India is concerned that hydropower projects planned in Arunachal Pradesh may be affected by the neighbouring country’s plan to divert water from rivers that flow into the Brahmaputra towards the arid zones of Xinjiang and Gansu. India’s north-eastern region, along with Bhutan, has a total hydropower generation potential of about 58 GW. Of this, Arunachal Pradesh alone accounts for 50.32 GW. India at present has an installed generation capacity of 357.87GW, of which 13 percent or about 45.4 GW comes from hydropower projects.

Source: Livemint

IOC plans to procure biogas, sell it at retail outlet

30 August. The government plans to set up around 5,000 compressed biogas plants by 2022, producing 15 million tonnes (mt) or 40 percent of India’s current annual consumption of compressed natural gas of 44 mt. Indian Oil Corp (IOC) plans giving a big boost to the compressed biogas business by procuring biogas from across India and selling it at its retail outlets, as part of India’s strategy to reduce dependence on imported fuel and double farm income by 2022. Biogas, produced naturally through anaerobic decomposition from waste or biomass sources like agriculture residue, cattle dung, sugarcane press mud and solid waste, also provides an additional source of income to farmers. The company has already issued 200 letters of intent (LoIs) out of 250 issued by all PSUs (Public Sector Undertakings) put together for supply of gas in 250 kilogram (kg) cascades at a price of ₹48/kg for a distance of 50 kilometre (km). The gas procured will be sold through fuel retail outlets or separate CBG stations at the retail outlets not only to the domestic customers but also to the industrial customers. The companies also plan to integrate compressed biogas networks with city gas distribution networks to boost supplies to domestic and retail users in existing and upcoming markets. This scheme was initiated by PSU oil marketing companies and GAIL (India) Ltd as an alternative source of fuel to reduce India’s dependence on imported fossil fuel by 10 percent by 2022, and help double farm income. The government plans to set up around 5,000 compressed biogas plants by 2022, producing 15 mt or 40 percent of India’s current annual consumption of compressed natural gas of 44 mt.

Source: The Financial Express

Adani Green Energy to acquire 205 MW operating solar assets of Essel Group

29 August. Adani Green Energy signed a securities purchase agreement for acquisition of 205 MW operating solar assets of Essel Green Energy and Essel Infra projects. The assets are located in Punjab, Karnataka and Uttar Pradesh. All the assets have long term power purchase agreements (PPAs) with various state electricity distribution companies. The portfolio is relatively young with average remaining PPA life of approximately 22 years. The closing of the transaction is subject to customary approvals and conditions. The acquisition of these assets is at an enterprise valuation of approximately ₹13 bn. The existing long-term funding will continue.

Source: Business Standard

Government has decided to achieve 100 percent electrification of railway in 10 yrs: Goyal

28 August. The government has decided to move towards achieving 100 percent electrification of railways, as part of efforts to curb carbon footprints, Union Railways Minister Piyush Goyal said. He has a mission that in next 10 years, Indian Railways will be running on renewable energy. He said more than half of the trains that come to New Delhi are still based on diesel but the ministry is working on their electrification. The railways is taking various environment-friendly or energy-efficient measures to reduce carbon footprint and protect the environment. In 2018-19, Indian Railways consumed about 20.44 bn units of electricity and 3.1 bn litres of high-speed diesel (HSD) for its energy requirement.

Source: Business Standard

INTERNATIONAL: OIL

Russia aims for full compliance with global oil output cut deal in September

3 September. Russia aims to fully comply with the global oil output cut deal struck in September, Russian Energy Minister Alexander Novak said. He said Russian oil production decreased by 143,000 barrels per day in August from October last year, the baseline for the global oil deal aimed at a reduction of oil output.

Source: Reuters

Saudi Arabia may raise light crude prices for Asia in October

2 September. Top oil exporter Saudi Arabia is expected to raise prices for light crude grades it sells to Asia in October on stronger Middle East benchmarks and gasoil margins. The official selling price (OSP) for Arab Light crude in October is expected to rise by 40-50 cents a barrel, according to five of the six respondents in a survey. The OSP for Arab Extra Light crude may be increased by as much as about $1 a barrel, the survey showed. State oil giant Saudi Aramco sets its crude prices based on recommendations from customers and after calculating the change in the value of its oil over the past month, based on yields and product prices.

Source: Reuters

Norway grants Equinor permission to start Sverdrup oilfield in autumn

2 September. Energy firm Equinor has won permission to start its giant North Sea Johan Sverdrup oilfield in the autumn, the Norwegian Petroleum Directorate (NPD) said. The company notified oil market participants that the 2.2-3.2 bn barrel field could begin oil shipments in October, earlier than previously expected. The first loading program lists 11 cargoes in October, implying output of around 226,000 barrels per day (bpd). Production is expected to hit 440,000 bpd in the summer of 2020 and should rise further to 660,000 bpd once the second phase comes on stream in late 2022, Equinor has said. Sverdrup, discovered by Lundin Petroleum in 2010, is the third-largest field off Norway by reserves, and is expected to produce oil for the next 40 years, the NPD said.

Source: Reuters

Mexico nearing $1 bn oil hedge program

30 August. Mexico is close to executing its annual oil hedging program, after oil price volatility and a coming change to marine fuel regulations slowed the process. Mexico has spent more than $1 bn on financial contracts in past years to protect revenue from oil sales against price volatility. Mexico aims to discreetly secure the best price for put options that grant the holder the right to sell oil at a fixed price in the future. The government’s 2019 oil sales were hedged at an average price of $55 per barrel in a deal worth $1.23 bn. State oil company Pemex separately hedges its own sales, resuming the practice in 2017 for the first time in 11 years.

Source: Reuters

INTERNATIONAL: GAS

China’s gas demand growth rate to slow in 2019

2 September. The rate of growth in China’s natural gas consumption is expected to slow to around 10 percent in 2019 from 17.5 percent last year amid pressure on the country’s production, storage and sales network, a government research report published showed. The report, conducted by the oil and gas department at the National Energy Administration, forecast consumption to be about 310 billion cubic meters (bcm), and to continue growing until 2050.

Source: The Economic Times

US to help Poland, Ukraine disconnect from Russian gas

31 August. The United States (US), Poland and Ukraine agreed to enhance cooperation over secure gas supplies in the region which still relies on Russia. The Polish government official responsible for energy infrastructure, Piotr Naimski, said Poland, which has increased purchases of liquefied natural gas (LNG) from the United States in recent years, would be able to send 6 billion cubic meters (bcm) of gas to Ukraine starting from 2021 compared to the current capability of 1.5 bcm. US Energy Secretary Rick Perry, Naimski and Ukraine’s Secretary of National Security Oleksandr Danylyuk signed a memorandum of understanding to enhance security of gas supplies in the region via LNG supplies from the US through Poland’s and Ukraine’s infrastructure which still has to be expanded. More than a third of Russia’s gas exports to the European Union cross Ukraine, which traditionally uses some of the gas pumped by Russia to European consumers for its own needs in eastern and central regions. But the Russia-Ukraine gas transit agreement is due to expire in January and Ukrainian energy authorities are worried that Moscow could stop gas supplies through Ukraine, leaving some Ukrainian regions without gas in winter. Also Poland, which is seen as one of Washington’s closest allies in Europe, still buys most of the gas it consumes from Russia, has taken steps to cut this reliance after 2022 when its long-term deal on gas supplies from Gazprom expires. Poland’s imports of LNG, including from the US, via the Baltic Sea terminal at Swinoujscie have jumped in recent years as part of a wider plan to cut reliance on Russian supplies. Poland’s state-run gas firm PGNiG said that it bought a cargo of liquefied natural gas from the US and sold it to Ukraine.

Source: Reuters

ConocoPhillips updates East Timor contracts for Bayu Undan gas

31 August. Liquefied natural gas (LNG) producer ConocoPhillips announced new production sharing contracts with East Timor for the ageing Bayu Undan gas field, following the implementation of a new maritime border with Australia. The gas condensate deposit in the Timor Sea, 250 km (155 miles) south of East Timor and 500 km (311 miles) north of Australia, now falls within the small Pacific nation’s jurisdiction, after it ratified the Maritime Boundary Treaty. The field is projected to run out of gas around 2022. The Bayu Undan to Darwin pipeline, built in 2006 to feed the ConocoPhillips-operated Darwin LNG plant in Northern Australia, remains in Australia’s jurisdiction. The Darwin LNG plant produces 3.7 million tonnes (mt) each year, and needs to secure more feedstock once Bayu Undan runs dry. Conoco and partners Santos and South Korea’s SK E&S have agreed to do preliminary design work to develop the Barossa field, 300 km (188 miles) north of Darwin, to supply Darwin LNG.

Source: Reuters

British energy provider SSE launches sale of North Sea gas fields in single package

30 August. British energy provider SSE has kicked off the process to sell its 140 million cubic feet per day portfolio of North Sea gas fields in a single package, a sale document showed. SSE said in May it was looking to sell its gas production assets. The package includes a 20 percent stake in the Total-operated Greater Laggan Area in the West of Shetlands, including the Shetland Gas Plant, and the Bacton Catchment Area in the Southern North Sea. Total estimates it has found around 1 trillion cubic feet of recoverable resources in the area.

Source: Reuters

Papua New Guinea opposition leader urges PM to back Total gas deal

30 August. Papua New Guinea’s opposition leader, Patrick Pruaitch, pressed the nation’s Prime Minister (PM) to back a gas deal with France’s Total SA rather than seek changes and delay a $13 bn expansion of the country’s gas exports. The government, led by James Marape, suddenly called for talks with Total to revise the Papua LNG gas agreement, one of two needed for Total, Exxon Mobil Corp and their partners to go ahead with two major projects.

Source: Reuters

German Chancellor and Russian President agree need to speed gas talks

29 August. German Chancellor Angela Merkel agreed in a phone call with Russian President Vladimir Putin on the need to speed up talks on future gas transit agreements, the German government said. Germany has demanded that Ukraine continues to serve as a transit country for gas to Europe after the opening of the Nordstream 2 pipeline. Gas transit via Ukraine is seen as a crucial guarantor of its independence and security.

Source: Reuters

Japan imports first LNG cargo from China as utilities try to cut costs

29 August. Japan imported its first cargo of liquefied natural gas (LNG) from China in July as utilities from the world’s biggest buyer of the fuel seek out new suppliers and try to lower costs amid tough competition at home. The shipment illustrates the increasing flexibility of the Asian LNG market. China has become the world’s second-largest LNG buyer amid a surge in domestic gas usage. However, the country has started to re-export shipments amid a lull in summer gas consumption and Japanese buyers are scooping up the cargoes to reduce their fuel expenses. The cargo of 70,560 tonnes of LNG was shipped from the Hainan LNG Terminal, which is operated by CNOOC Ltd, to Chita near Nagoya, where Toho Gas jointly operates an LNG terminal with JERA. It was delivered at $5.68 per million metric British thermal units (mmBtu), below Japan’s average import cost of $9.50 per mmBtu for LNG during July, according to the finance ministry data. A search through Japan’s official trade statistics show it is the first LNG cargo from China since 1988, when the Japanese government started publishing import and export figures. Prices for spot LNG in Asia have sunk to near record lows in recent weeks as a wave of new supply from the United States (US) and Australia comes onto the market.

Source: Reuters

Maintenance at Norway’s Troll field to cut gas availability by 1.8 bcm in 2020

28 August. Norway’s Troll gas field, the country’s largest gas export source to Britain and continental Europe, will see its output availability cut by 1.8 billion cubic meters (bcm) in 2020, early maintenance estimates showed. The estimates from system operator Gassco are lower than Troll’s total maintenance in 2019 - both conducted and scheduled - which is expected to result in some 4.5 bcm of reduced gas production availability. Gassco’s estimates are preliminary and the system operator can amend them or add additional maintenance at a later stage. During April and May, for about 40 days, Troll is expected to see reduced availability of 17 million cubic meters (mcm) of gas per day. In June, output capacity will also be cut for 21 days, with an impact of 42 mcm/day. Gassco has also scheduled availability cuts for September 2020, which will last half a month and will affect Troll’s gas production capacity by 18 mcm/day. Troll has a huge production capacity of up to 120 mcm/day, and Gassco’s preliminary maintenance figures do not show that it will be fully shut at any given point in 2020. The field feeds Norway’s Kollsnes gas processing plant, which will also see reduced gas processing capacity when Troll’s output will be unavailable, as Gassco schedules its maintenance simultaneously to optimize production.

Source: Reuters

Dutch to end Groningen gas production quicker than predicted: Economy Minister

28 August. The Dutch government will end production at the vast Groningen natural gas field sooner than previously announced, Dutch Economy Minister Eric Wiebes said. Output at Europe’s largest onshore gas field, operated by Royal Dutch Shell Plc and Exxon Mobil Corp, has been slashed in recent years as tremors blamed on drilling have damaged buildings and sparked unrest in the region. The Dutch government said in June that output at Groningen looked set to drop 20 percent more than previously announced, to 12.8 billion cubic meters (bcm) in the year starting October 2019.

Source: Reuters

Platts to add new pricing LNG assessment in Singapore

28 August. S&P Global Platts will add a free-on-board Singapore liquefied natural gas (LNG) assessment from 1 October, the company said. The netback assessment will be calculated by subtracting the freight rate from Singapore to Japan or Korea from its benchmark Japan-Korea-Marker (JKM) assessment, the company said in a note to subscribers

Source: Reuters

INTERNATIONAL: COAL

Germany to spend up to $44 bn to cushion coal exit

28 August. Germany’s Cabinet approved a plan to spend up to €40 bn ($44.4 bn) by 2038 to cushion the impact of abandoning coal on mining regions. Economy Minister Peter Altmaier said funds will start flowing once parliament has passed separate legislation setting out the dates and terms of Germany’s exit from coal, likely in the coming months. In January, a government-appointed panel recommended Germany stop burning coal to generate electricity by 2038 at the latest, as part of efforts to curb climate change. Germany gets more than a third of its electricity from burning coal, generating large amounts of greenhouse gases that contribute to global warming. Germany’s last deep-shaft black coal mine closed in December, but open-cast lignite, or brown coal, mines still operate.

Source: The Economic Times

INTERNATIONAL: POWER

Spanish power generation rises 1.7 percent in August

2 September. Spanish power generation in August rose 1.7 percent year on year to 21.3 terawatt hour (TWh) with gas-fired output hitting a 10-year high, TSO Red Electrica said. Output in mainland Spain from combined cycle gas turbine plants, the main contributor to the country’s power mix, almost trebled to 7.1 TWh, its highest since September 2009. It also came despite a 2.9 percent contraction in total mainland power demand to 21.4 TWh.

Source: Montel

Poland wins EU approval to help energy-intensive companies cut electricity bills

30 August. Poland secured EU (European Union) approval to launch a €417 mn ($465 mn) scheme to compensate energy-intensive companies hurt by higher electricity prices. The European Commission said the project, which will run until the end of next year, complies with EU state aid rules, which seek to ensure that EU governments do not grant unfair support to companies. When it announced the plan in June, the Polish government said that around 300 companies would be entitled to receive compensation. The EU has criticized Poland for its heavy use of polluting coal for electricity. However, the Polish government has said the scheme would encourage companies to stay in Poland and not move production elsewhere. Wholesale power prices in Poland soared last year as carbon emission costs and coal prices surged because the country generates most of its electricity from coal. Companies eligible for the compensation scheme must submit appropriate documents to the energy regulator by end of March every year.

Source: Reuters

Pakistan PM’s office faces power cut over non-payment of bills

28 August. The electricity supply to Pakistan Prime Minister (PM) Imran Khan’s Secretariat faces disconnection over non-payment of bills running into crores of rupees. The Islamabad Electric Supply Company (IESCO) issued a notice to this effect. The Pakistan PM’s Secretariat currently owes over ₹41 lakh to IESCO. For the previous month, this amount was ₹35 lakh. According to IESCO, the Secretariat has failed to pay the dues in spite of several reminder notices. Power cuts have worsened in Pakistan in recent years, becoming one of the main sources of discontent in the South Asian nation, often leaving entire neighbourhoods without electricity for up to half a day in the sweltering summer months.

Source: Khaleej Times

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Nuclear power generation up 12 percent in Asia

3 September. Nuclear power generation grew most rapidly in Asia, where generation increased 12 percent, up 56.3 terawatt hour (TWh) to 533.0 TWh, now more than one-fifth of global generation. Worldwide nuclear generation increased for the sixth successive year, reaching 2,563 TWh in 2018. Nuclear power catered to more than 10 percent of global electricity demand according to data compiled by World Nuclear Association, an international organisation that represents the global nuclear industry. In 2019 five reactors will reach 50 years of operation, a milestone that is being achieved for the first time. Many reactors in operation are planning to operate for 60-80 years.

Source: The Economic Times

Federal Government to inaugurate solar power plant in BUK

3 September. The Federal Government will inaugurate an off-grid solar hybrid power plant in Bayero University Kano (BUK) under its Energising Education Programme. The Rural Electrification Agency said that the inauguration would include the launch of 11.41 km (kilometre) of solar-powered street lights as well as a world-class renewable energy training centre. 55,815 students and 3,077 staff members have access to electricity supply from the university’s 7.1 MW solar hybrid power plant. The solar power plant in Bayero University is the second project to be inaugurated under Phase One of the Energising Education Programme.

Source: The Punch

Israel inaugurates vast Negev thermo-solar power plant

30 August. The largest renewable energy project in Israel – a vast thermo-solar power plant near Ashalim in the Negev – was inaugurated at a ceremony attended by Energy Minister Yuval Steinitz and senior government and business officials. Spanning approximately 390 hectares – larger than the central city of Givatayim – the 121 MW solar power facility will supply electricity to approximately 70,000 households in Israel, or approximately 0.75 percent of all electricity generated in Israel. The power plant, Steinitz said, will contribute significantly to Israel’s target of making 10 percent of the country’s electricity supply renewable by 2020, and 17 percent by 2030. At full capacity, the plant will reduce approximately 245,000 tons of carbon dioxide emissions from fossil fuel sources, equivalent to taking 50,000 vehicles off the road.

Source: The Jerusalem Post

France to launch tenders for solar power projects in 2020

30 August. France will launch a bidding process for rights to build solar power projects for a total capacity of 2 GW in 2020, the ministry in charge of energy transition said. The French government, which targets a fourfold increase in the country’s solar power capacity by 2028, will initiate two tenders, one for bidders eager to build solar power projects on the ground and another for projects on building roofs. These projects would add 20 percent to the country’s solar power installed capacity, the ministry said.

Source: Reuters

China pushes regions to maximize renewable energy usage

30 August. China’s parliament will send inspection teams throughout the country to ensure regions are prioritizing renewable energy resources, in a bid to cut waste and boost the sector’s profitability. China’s total renewable power amounted to 728 GW at the end of 2018, up 12 percent on the year and amounting to 38 percent of total installed generation capacity. This included hydro and biomass as well as solar and wind. But regulators want plants to operate without state subsidies, partly in order to ease a payment backlog of more than 100 bn yuan ($14 bn). China operates a so-called traffic light system to improve what it calls the rhythm of renewable infrastructure construction, giving regions the green light to approve new projects only if they have sufficient transmission capacity to take them on. China said the rate of wastage in the solar power sector fell 1.2 percentage points to 2.4 percent in the first half of this year, but it was still at 25.7 percent in Tibet and 10.6 percent in Xinjiang.

Source: Reuters

US President to announce plan to boost biofuel demand soon: Agriculture Secretary

28 August. US (United States) President Donald Trump will announce a plan to boost demand for biofuels, Agriculture Secretary Sonny Perdue said. The spat over the waivers has left the White House caught between the oil industry, which wants its refineries freed from obligations to blend ethanol into the fuel supply, and farmers in key election states who grow the corn used to make the ethanol. The Trump administration has scrambled Cabinet members for several weeks now to churn out a plan that would quell the uproar among the farmers, who say the biofuel waivers granted by the Environmental Protection Agency (EPA) to small refining facilities undermine demand for the corn-based fuel. The EPA announced a decision to grant 31 biofuel waivers to refineries facing financial hardship. The US Renewable Fuel Standard (RFS) requires refiners to blend 15 bn gallons of ethanol into their gasoline each year, or buy credits from those that do. Small refining facilities can seek exemptions from the RFS if they believe the requirement will do them financial harm, but Trump’s EPA has vastly expanded the waiver program and has provided waivers to facilities owned by big profitable companies like ExxonMobil and Chevron.

Source: Reuters

Chinese firm to build renewable power projects in Bangladesh

28 August. Bangladesh has set up a $400 mn joint venture with a Chinese company to build renewable energy projects to provide a total 500 MW of power by 2023. The venture (JV) between China National Machinery Import and Export Corporation (CMC) and Bangladesh’s North-West Power Generation Company (NWPGC) is the latest sign of Beijing’s growing role in Bangladesh’s energy sector. The renewable energy generation projects included 50 MW of wind power projects, NWPGC said. Bangladesh currently produces 25 MW from solar energy and has set a target to meet 10 percent of its power demand from renewable energy by 2021.

Source: Reuters

DATA INSIGHT

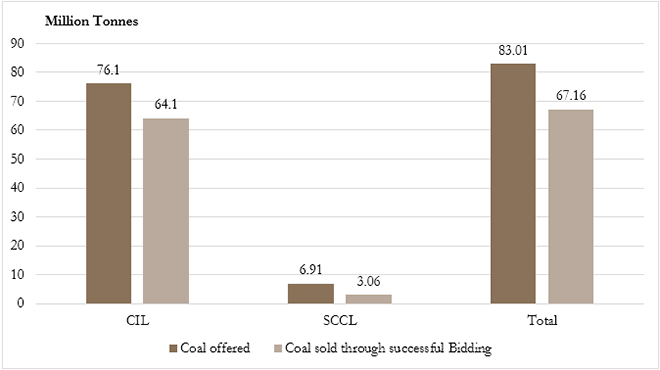

Scenario of Coal Auctions by Coal PSUs in India

Million Tonnes

|

Total Quantity Offered |

Total Successful Bid Quantity |

| Coal Auctions: CIL |

| 2014-15 |

56.1 |

48.8 |

| 2015-16 |

136 |

78.6 |

| 2016-17 |

312.4 |

113.6 |

| 2017-18 |

160.9 |

95.9 |

| Coal Auctions: SCCL |

| 2014-15 |

5.51 |

3.14 |

| 2015-16 |

10.46 |

3.33 |

| 2016-17 |

6.14 |

2.13 |

| 2017-18 |

7.1 |

3.56 |

Recent Coal Auctions (April 18 - January 19)

Source: Parliament Questions for Ministry of Coal

Source: Parliament Questions for Ministry of Coal

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

Source: Parliament Questions for Ministry of Coal

Source: Parliament Questions for Ministry of Coal PREV

PREV