-

CENTRES

Progammes & Centres

Location

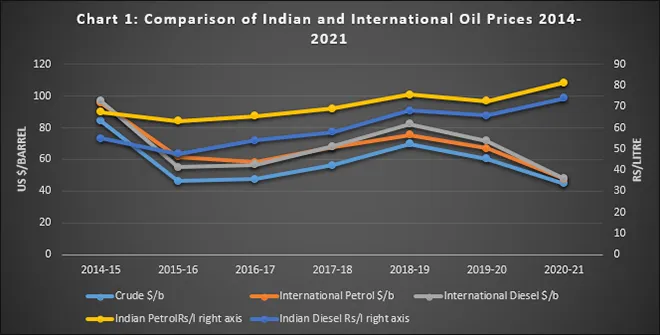

The retail price of petrol and diesel in India started increasing in 2014-15 just as international crude oil prices began collapsing under a supply glut and a slowing global economy. In 2014-15, the price of crude (Indian basket) was US $84.16 /barrel (b) and in 2015-16 it fell to US $46.17 /b, increased to US $69.88 /b in 2018-19 and fell to US $44.82 /b in 2020-21 on account of COVID 19 induced recession (chart 1). The price of petrol and diesel in the international market followed the same trend but the retail price of petrol and diesel in India have shown a consistent upward trend (INR ₹60-80 /litre (l), yellow and dark blue lines in chart 1).

Source: PPAC

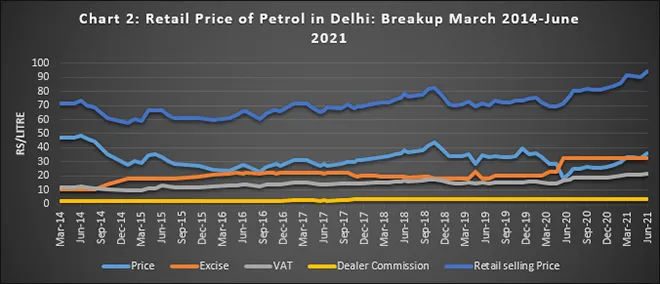

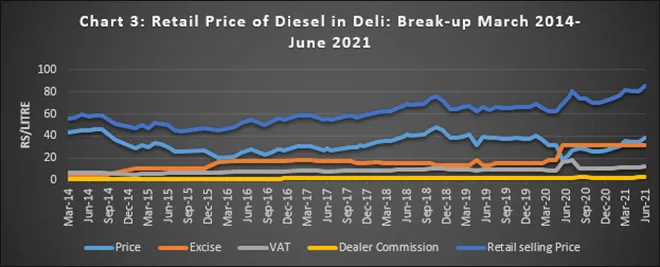

Source: PPACSince 2015, the central government has used the fall in international crude prices to increase taxes and effectively keep the retail prices of petrol and diesel relatively high. If the fall in global crude oil prices in the last five years were fully passed through to consumers, the retail price of refined products would have been lower by INR 0.50 /litre (l) for every US $1 /b reduction in crude prices. In other words, every US $1 /b reduction in crude price is an opportunity to increase taxes by INR ₹0.50/l. The burden of tax increase so far has fallen more on diesel than on petrol. In March 2014, a litre of diesel was cheaper than petrol by about INR 15 /l on average across the country. On average, taxes accounted for 31 percent of the retail price of petrol and about 19 percent of the retail price of diesel respectively. In June 2020, the tax component on petrol and diesel in Delhi was at 69 percent and 58 percent respectively. The retail price of diesel exceeded the retail price of petrol in Delhi briefly in June 2020 and the discount on the price of diesel was less than a rupee or two compared to the retail price of petrol across the country. Excise (central tax) on petrol increased by over 200 percent from about INR 10.38/l in March 2014 to INR 32.98/l in September 2020 (chart 2). For diesel, the increase was a more dramatic 600 percent in the same period (March 2014-September 2020) from INR 4.58/l to INR 31.83/l (chart 3). Increase in Value Added Tax (State tax)

Source: PPAC; Note: Price is the base price before taxes

Source: PPAC; Note: Price is the base price before taxesSince January 2021, the price of crude in the international market has shown an upward trend driven by signs of economic revival following the successful vaccination campaigns in the USA, Europe, and China. In May 2021, the price of crude (Indian basket) was US $66.95/b, an increase of about 22 percent since January 2021. In this period, the price of petrol in Delhi increased by about 14 percent and the price of diesel by about 15 percent which can be attributed mostly to the increase in international crude prices though there was a marginal increase in VAT on both petrol and diesel in this period. In fact, the high rate of tax cushioned the retail price of petrol and diesel from the impact higher crude prices.

Source: PPAC; Note: Price is the base price before taxes

Source: PPAC; Note: Price is the base price before taxesThe retail price of petrol and diesel in India vary across states depending on the rate of VAT in each state. On 1 June 2021, petrol was most expensive in Madhya Pradesh at INR 104.01/l and least expensive in Andhra Pradesh (AP) at INR 88.9/l. Among states (not including union territories), AP also had the cheapest diesel prices at INR 83.81/l while Arunachal Pradesh had the most expensive diesel at INR 96.43/l (Read it at ORF).

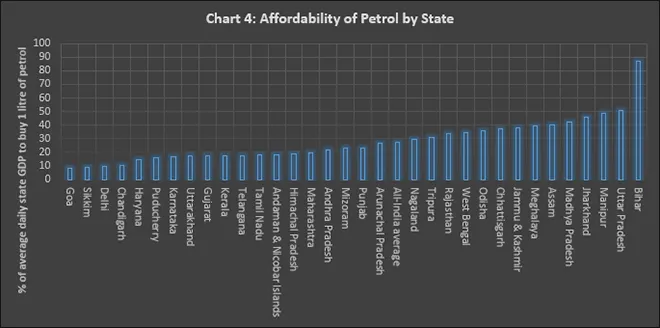

Source: RBI for state GDP (mostly 2019-20), PPAC & IOC for petrol prices on 12 June 2021.

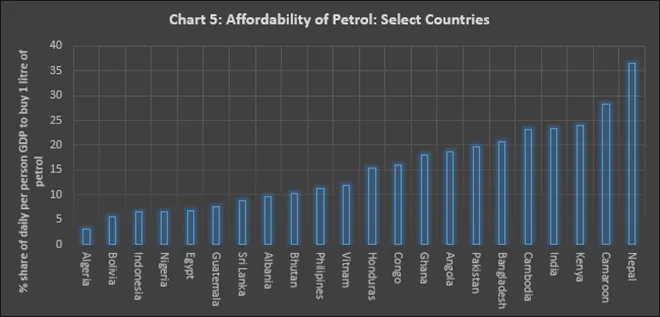

Source: RBI for state GDP (mostly 2019-20), PPAC & IOC for petrol prices on 12 June 2021. Overall, the price of petrol and diesel were the highest in India among South Asian countries and also amongst countries with comparable gross domestic product (GDP) per person. A more accurate measure of affordability of fuels is the share of average daily GDP per capita that is required to purchase a litre of petrol. Amongst Indian states petrol was most affordable in Goa with about 7 percent of average daily state GDP required to buy a litre of petrol closely followed by Sikkim and Delhi at 8 percent. Petrol was most expensive in Bihar which required about 80 percent of average daily state GDP required to buy a litre of petrol followed by UP and Jharkhand with 47 percent and 45 percent (chart 4).

Source: World Bank for GDP (mostly 2019 data), global Petrol Price for petrol prices on 14 June 2021

Source: World Bank for GDP (mostly 2019 data), global Petrol Price for petrol prices on 14 June 2021Even among countries with GDP per person in the range US $1000 to US $ 5000, India has one of the most expensive petrol. The share of per person daily GDP required to buy a litre of petrol in India (GDP per person US $2099 <2019 data>) was about 23 percent and in Nepal (GDP per person US $1071) about 36 percent both of which are high compared to 3 percent in Algeria (GDP per person US $3552) and 6 percent in Indonesia (GDP per person US $4135) (chart 5). People move into the category of energy poverty when the energy expenditure of a household or an individual is above 10 percent of disposable income. Though this definition does not include expenditure on transportation fuels in general, it is not inaccurate to say that the average Indian, who is dependent on personal vehicles (primarily two wheelers for economic activity) is in energy poverty. (Read for an earlier version of the article).

India’s deadly second COVID-19 wave has brought an abrupt halt to its nascent recovery from the pandemic, with the resurgence expected to drag on fuel demand for weeks in a setback for the global oil market. The combined consumption of diesel and petrol in April is poised to plunge by as much as 20 percent from a month earlier due to renewed restrictions, including a week-long lockdown in the capital New Delhi. While major oil processors were still buying crude recently, there are signs starting to emerge that refining operations will likely need to be scaled back to adjust for plummeting demand. India, so far, has instituted localised lockdowns, with the government seeking to avoid repeating the nationwide shutdown seen last year that drove demand to the lowest in more than a decade in April 2020. The South Asian nation is the world’s third-biggest oil importer, which means an extended impact will likely ripple through the global market, even as China and the US rebound strongly. Restrictions are also hobbling the India’s trucking industry—considered the backbone of its economy and oil demand—which was slowly clawing its way back from the worst of 2020.

Market data for the first fortnight of the month shows petrol sales dropping more than 5 percent and diesel consumption, a bellwether for economic activities, sliding almost 3 percent from a month ago. Consumption of jet fuel and LPG (liquefied petroleum gas) or household cooking gas, too shrank more than 7 percent and sales 6 percent, respectively. LPG consumption is certainly taking a knock as sales were down more than 3 percent from the last year’s level, while petrol and diesel sales posted growth of 196 percent and 150 percent, respectively, from the lockdownhit rock bottom base of 2020. The fall in LPG consumption can be explained by the sharp increase in price since December totalling INR 175/ cylinder. The state-run retailers cut the price only by INR 10/cylinder on 1 April, the first reduction in four months.

The country's oil demand in 2021 is likely to fall below the level of demand seen in 2019, according to research firm S&P Global Platts. The firm has revised down India’s oil demand growth for 2021—still positive—to 350,000 barrels per day (bpd) after a sharp contraction of 470,000 bpd last year. As a result, the country's oil demand in 2021 is expected to remain below the level of 2019. The oil demand in 2021 has been revised down in India, Western Europe and Latin American due to more restrictions stemmed from second and third waves of COVID-19 but progress in vaccination offers hope and global oil demand growth in 2021 is expected to stand at 5.5 millionbpd.

India consumed 7.8 mt (million tonnes) of petrol in the fourth quarter ended March 2021, a 9.7 percent jump as compared to 7.12 mt of the fuel consumed in the same quarter previous fiscal year (2019-20), despite record high prices. Consumption of diesel, the other key automobile fuel, also increased 4.1 percent to 20.60 mt during the January-March 2021 quarter according to the research firm ICICI Securities. Overall, consumption of all petroleum products was up 2.5 percent during the quarter. The three-month period was marked by record high retail rates of the fuels. Non-branded petrol was priced in range between INR 81/ litre(l) and INR 90/l while diesel was priced between INR 73/l and INR80/l in Delhi during the quarter.

IOC (Indian Oil Corp) has renewed insurance cover for petrol pump attendants and LPG delivery boys as it looked to secure its frontline workers against health emergencies. Besides renewing medical insurance for frontline workers, IOC will continue to provide ex-gratia assistance to the family of the deceased. The medical insurance will continue to cover the personnel along with their spouse and two children. Claims up to INR 100,000 can be availed for expenses on hospitalisation and COVID-related diseases. On accidental death of an insured, the family will be eligible for compensation of INR 200,000. IOC’s Karma Yogi Swasthya Bima Yojana was launched in March 2020 to provide a safety net to the field force, who were braving the pandemic to cater to the fuel needs of the country. On expected lines, oil companies did not wait long post declaration of state election results to raise the price of auto fuels—petrol and diesel across the country. Accordingly, the petrol and diesel prices increased by 15 paise and 18 paise per litre to INR 90.55/l and INR80.91/l respectively in Delhi. Prior to the increase, petrol and diesel were being retailed at INR90.40/l and 80.73/l respectively in the national capital. The two auto fuel prices were static for 18 days prior to this increase. Across the country as well the petrol and diesel prices increased but its quantum varied depending on the level of local levies in respective states.

Petrol and diesel prices were hiked for the sixth time this month, propelling prices to cross the INR100/l mark in places from Nanded in Maharashtra to Rewa in Madhya Pradesh (MP) to Jaisalmer in Rajasthan. Petrol price was hiked by 27 paise a litre and diesel by 30 paise per litre, according to a price notification by state-owned fuel retailers. The increase took petrol and diesel prices to their highest-ever level across the country. In Delhi, petrol now comes for INR 91.80/l diesel is priced at INR 82.36/l. Fuel prices differ from state to state depending on the incidence of local taxes such as VAT (Value Added Tax) and freight charges. Rajasthan levies the highest VAT on petrol in the country, followed by MP. Sri Ganganagar district of Rajasthan had the costliest petrol and diesel in the country at INR 102.70/l and INR95.06/l respectively. Also in Rajasthan, petrol crossed the INR 00/l in Jaisalmer (INR 100.71/l) and Bikaner (INR 100.70/l) while it neared that mark in Barmer (INR 99.82/l). Oil companies, who have in recent months resorted to unexplained freeze in rate revision, had hit a pause button after cutting prices marginally on 15 April. This coincided with electioneering hitting peak to elect new governments in five states including West Bengal. No sooner had voting ended, oil companies indicated an impending increase in retail prices in view of firming trends in international oil markets. Central and state taxes make up for 60 percent of the retail selling price of petrol and over 54 percent of diesel. The union government levies INR 32.90/l of excise duty on petrol and INR 31.80/l on diesel.

IOC’s refineries are operating at about 95 percent of their capacity, down from 100 percent at the same time last month. Coronavirus cases have surged in India, leading to curbs on movement across the country, a move analysts say could hit fuel demand in the world's third largest oil importer and consumer. Consultancy FGE estimates gasoline demand will drop by 100,000 bpd in April and by more than 170,000 bpd in May, if further restrictions are imposed. India's total gasoline sales came to nearly 747,000 bpd in March. Diesel demand is expected to contract by 220,000 bpd in April and by another 400,000 bpd in May, according to FGE. India’s diesel consumption, a key indicator linked to economic growth and which accounts for about 40 percent of overall refined fuel sales in India, was 1.75 million bpd in April. While curbs to restrict movement are in place in many parts of India, it has not imposed a total shutdown as it did in March last year. Most businesses are still operating normally. Gasoline and diesel sales by India’s state fuel retailers in the first 21 days of April were higher than in 2020, industry data showed, mainly because of lower demand last year during the complete lockdown. Diesel demand was lower compared with the same period of 2019, while gasoline demand was up 2 percent. FGE cut its LPG consumption estimates for April and May marginally, with the delivery of LPG cylinders to households likely to be hit in the coming weeks with more lockdown announcements and travel curbs.

Indian state refiners placed orders for regular supplies from Saudi Aramco for June, after reducing purchases this month, drawn by lower prices by the world’s top oil exporter. The refiners—IOC, BPCL, HPCL, and MRPL—normally buy 14.8 million-15 million barrels of Saudi oil a month. India, the world’s third-biggest oil importer and consumer, imports more than 80 percent of its oil needs and relies heavily on the Middle East. Earlier this year, New Delhi blamed cuts by the Saudis and other oil producers for driving up crude prices as its economy tries to cope with the pandemic and advised state refiners to cut purchases. India urged refiners to diversify crude sources to cut reliance on the Middle East and directed them to reduce intake of Saudi oil. The refiners cut purchases by over a third in May. Indian refiners cannot continue with the cuts from Saudi Arabia on a sustained basis as the companies have to lift the volumes under annual contracts.

ONGC (Oil and Natural Gas Corp) spent about one-fifth less than its budget Capex in 2020-21 fiscal after COVID-19-related restrictions delayed projects but fuel marketers such as IOC exceeded targeted capital spending, a government report showed. ONGC had budgeted INR 325.02 billion of capital spending in the fiscal from April 2020 to March 2021 but ended up spending only INR 264.41 billion, according to the report of the oil ministry’s PPAC (Petroleum Planning and Analysis Cell). Oil and gas exploration and production projects typically involve the supply of equipment from overseas suppliers. Also, some facilities like rigs are operated by foreign crews. Lockdowns in several parts of the world, including India, restricted the movement of labour as well as disrupted supply chains. ONGC’s overseas arm OVL (ONGC Videsh Ltd) too had a lower capital spending of INR 53.51 billion in 2020-21 fiscal as compared to the targeted INR 72.35 billion. Other downstream companies exceeded their capital spending targets by a wide margin. The government had banked on capital spending of the public sector companies for economic recovery post disruptions caused by the pandemic. Such spending drives economic activity by creating demand for different sectors such as steel and creating employment.

BPCL (Bharat Petroleum Corp Ltd) has "re-routed" its critical 252-km-long 18-inch diameter oil pipeline connecting Mumbai and Nashik. Constructed over two decades ago, the pipeline was linked with Nashik's important railway junction Manmad, joining the BPCL Fuel Installation facility there with the BPCL Refinery in Mumbai. It was the veritable 'oil lifeline' for BPCL as more than 80 percent of the diesel and petrol produced at the Mumbai refinery was evacuated through the pipeline. However, since then, lot of infrastructural developments, residential or other buildings have sprung up around its route, making it inaccessible for repairs or maintenance and posing risks to people in the vicinity. Later, the Mumbai-Manmad Pipeline was extended till Delhi, passing through Maharashtra, Madhya Pradesh, Rajasthan, Uttar Pradesh, Haryana to supply petrol, diesel, kerosene, etc. to the interiors of the country.

Oil prices added to overnight gains, buoyed as more United States (US) states eased lockdowns and the European Union (EU) sought to attract more travellers, which would help offset weakened fuel demand in India as COVID-19 cases soar. Prices are being supported by the prospect of a pick-up in fuel demand in the US and Europe, as New York state, New Jersey, and Connecticut were set to ease pandemic curbs and the EU planned to open up to more foreign visitors who have been vaccinated. For further signs of rising US oil demand, traders will be watching out for reports on crude and product stockpiles from the American Petroleum Institute and the US Energy Information Administration. Oil prices recovered after a 1 percent on buoyant economic data from China and the US even as the surging pandemic in India capped prices. Brent crude futures for July were at US $68.47/barrel, up 38 cents, or 0.6 percent, while US WTI (West Texas Intermediate) crude for June rose 38 cents, or 0.6 percent, to US $65.09. Both Brent and WTI are on track for a second weekly gain as easing restrictions on movement in the US and Europe, recovering factory operations and coronavirus vaccinations pave the way for a revival in fuel demand, while pent-up summer travel is likely to give gasoline and jet fuel consumption a further boost. In the US, the world’s largest oil consumer, jobless claims have dropped, signalling the labour market recovery had entered a new phase amid a booming economy.

The rapid adoption of Electric Vehicles (EV) around the world will probably cause global oil demand to peak two years earlier than previously expected, according to Norway’s biggest independent energy consultancy Rystad. World demand is now seen peaking at 101.6 million bpd in 2026, down from a forecast made in November of a peak in 2028 at 102.2 million bpd. Before the outbreak of the COVID-19 pandemic in early 2020, Rystad had anticipated that peak oil demand would be reached in 2030 at 106 million bpd.

Saudi Arabia, the world’s top crude oil exporter, will supply full volumes of crude to most Asian refiners in June. The OPEC (Organisation of the Petroleum Exporting Countries) kingpin started easing supply cuts to buyers in May as OPEC, Russia and their allies, a group known as OPEC+, stuck to plans for a phased roll-back of oil production restrictions from May to July. Most Asian refiners received their allocations while Saudi Aramco has cut supplies to Europe. Despite Saudi Aramco cutting prices for its Asian supplies in June for the first time in six months, some buyers had requested lower volumes as the price of flagship Arab Light crude was relatively higher than similar grades in the spot market such as Upper Zakum from Abu Dhabi.

Top oil exporter Saudi Arabia is expected to cut its official selling prices (OSPs) for Asia in June, tracking weakness in Middle East benchmark Dubai and demand uncertainty amid a new wave of regional COVID-19 outbreaks. Sources at five Asian refiners expected the June OSP for flagship Arab Light crude to decrease by an average of 28 cents a barrel, which would become the producer's first price reduction since December last year. A resurgence in COVID-19 infections in India has hit local fuel demand and dampened market sentiment, causing refineries there to reduce run rates and slow crude purchases in the spot market. Asia’s refining margins for gasoline, gasoil, jet fuel and 0.5 percent very low-sulphur fuel oil (VLSFO) strengthened in April, while the naphtha crack weakened. Saudi crude OSPs are usually released around the fifth of each month, and set the trend for Iranian, Kuwaiti, and Iraqi prices, affecting more than 12 million bpd of crude bound for Asia. State oil giant Saudi Aramco sets its crude prices based on recommendations from customers and after calculating the change in the value of its oil over the past month, based on yields and product prices.

The OPEC+ joint technical committee (JTC) has kept its forecast for growth in global oil demand this year, but is concerned about surging COVID-19 cases in India and elsewhere. In its most recent monthly oil market report, the OPEC raised its forecast for global oil demand growth by 70,000 bpd to 5.95 million bpd. The JTC usually reviews market fundamentals and monitors compliance with the group’s oil production cuts.

Russian oil and gas condensate output rose 2 percent to 10.46 million bpd in April, from 10.25 million bpd in March, according to the energy ministry data. Under a deal agreed by the OPEC+ group of leading oil producers in March, Russia’s production quota was allowed to increase by 130,000 bpd from 1 April to 9.379 million bpd, excluding the output of gas condensate, a light oil. Russia’s oil and gas condensate production totalled 42.81 mt in April, in comparison with 43.34 mt in March, which was a day longer. The ministry has not revealed production of crude oil alone. Russia typically produces around 700,000 bpd-800,000 bpd of gas condensate. Russian crude oil exports fell 20.5 percent in January-April from a year earlier to 66.65 mt. The OPEC+ group, the alliance of the OPEC and other leading oil producers including Russia, decided to stick to its previously approved action plan to ease output curbs further from May. OPEC oil output rose in April as higher supply from Iran countered involuntary cuts and agreed reductions by other members under the pact with allies adding to signs of a 2021 recovery in Iran’s exports.

Exxon Mobil’s Guyana unit has reduced crude output at its offshore Liza-1 project to 30,000 bpd down from 120,000 bpd, due to a mechanical problem with the offshore platform's gas compressor. According to Exxon the problem with the compressor's discharge silencer prompted it to reduce output to maintain gas injection and power supply and minimise gas flaring. A team from Exxon, equipment manufacturer MAN Energy Solutions and vessel operator SBM were assessing repairs. The incident marks the third time Exxon has reduced crude output on the Liza Destiny floating production, storage and offloading (FPSO) vessel due to gas compressor problems since output began in December 2019. Exxon, which operates the Stabroek block where Liza is located as part of a consortium with Hess Corp and China's CNOOC Ltd, has discovered more than 8 billion barrels of recoverable oil and gas off Guyana's shores, making the South American country the world's newest energy hotspot.

Canada's Imperial Oil Ltd posted a first-quarter profit and raised its quarterly dividend, bolstered by higher crude prices, as well as improved refining and chemical margins. Calgary-based Imperial, which is majority-owned by Exxon Mobil Corp, is benefiting from higher global oil prices as fuel usage picks up from last year, when lockdowns intended to stop the spread of COVID-19 decimated demand. Upstream production averaged 432,000 gross oil-equivalent bpd, the highest first quarter production in 30 years. Total gross production at Kearl, Imperial’s huge oil sands mine in northern Alberta, averaged 251,000 bpd.

Venezuela’s April oil exports were flat at about 700,000 bpd for the third month in a row, with three-quarters of its shipments headed to Asia and the Middle East, according to tanker tracking data and documents from Petroleos de Venezuela (PDVSA). PDVSA’s exports have stabilized in recent months following a sharp decline between late 2020 and early 2021 caused by US orders to halt oil swaps that had allowed the exchange of Venezuelan crude for imported fuel. A total of 25 cargoes set sail from Venezuelan waters last month, carrying 688,533 bpd of crude and fuel mainly to China, Malaysia, and the United Arab Emirates. Exports to Europe fell to a single cargo of 110,000 barrels from two to three cargoes in previous months, the data and documents showed. After exhausting most stocks of Merey and upgraded crude grades in April, PDVSA is preparing to restart two of its four upgraders, which in total are capable of converting over 600,000 bpd of extra heavy crude from the Orinoco belt into exportable grades. The restarts could allow PDVSA to boost output from the Orinoco, the country’s main producing region, while supplying more of its lightest grades to domestic refineries for motor fuel production. The lack of lighter oils has led to shortages of gasoline and diesel. Among the exported cargoes this month, PDVSA sold a 991,000-barrel cargo of Corocoro crude, oil that had remained stored for over a year at the Nabarima floating facility, operated by the state firm and Italy’s ENI. PDVSA also exported about 55,000 bpd of crude and fuel to its political ally Cuba. Venezuela maintained imports within the range of previous months, of about 30,000 bpd.

Argentina’s labour ministry called for a mandatory 15-day period of fresh talks between oil sector workers and the country’s largest oil producing companies, requiring workers union to call off a strike announced hours earlier over a wage hike. Workers and the companies, including those that operate in Argentina’s sprawling Vaca Muerta region, one of the world's largest shale-oil reserves wanted to walk off the job for 24 hours after failing to reach agreement in negotiations.

Mexico's lower house of Congress approved changes to existing legislation that could allow the government to revoke private oil companies' permits to import gasoline and other fuels. One of the much-debated parts of the legislation would change Mexico’s hydrocarbons law to allow the suspension of permits to import and sell gasoline and other fuels under certain circumstances, including threats to the economy and national security.

China’s crude oil imports in April fell 0.2 percent from a year earlier as refiners curbed production to relieve a squeeze in profit margins brought about by rising crude oil prices and bulging inventories. The world’s biggest crude oil buyer brought in 40.36 mt of crude oil in April, or 9.82 million bpd data from the General Administration of Customs showed. That was the lowest since December and was down from 11.69 million bpd of imports in March. Data showed China’s refined fuel exports fell 14.8 percent over April 2020 to 6.82 mt, despite the bulging inventory at dominant state refiners.

China’s fuel exports are likely to expand by nearly a third this year as the world’s second-largest oil consumer adds new refineries that will exacerbate a supply overhang according to top oil and gas group China National Petroleum Company (CNPC). An estimated 14.74 MTPA or 295,000 bpd of crude run capacity, will be added this year, bringing the country’s total to 18 million bpd according to CNPC’s Economics and Technology Research Institute (ETRI). That could result in fuel exports surging 31.7 percent to a record 54.7 mt. The group also forecast China's net crude oil imports to grow 3.4 percent this year to a record of about 559 mt, or 11.2 million bpd. Domestic fuel demand is expected to continue its recovery from the coronavirus pandemic. The company pegs gasoline use to grow 0.8 percent this year and aviation fuel to rise 13 percent, though diesel will ease 0.8 percent.

China's national offshore oil and gas producer CNOOC Ltd reported its first quarter (Q1) revenue surged 21 percent on year on recovering oil and gas prices and higher sales. Realised oil prices rose 20.5 percent to US $59.07/b (barrel0, while gas prices were up 5 percent on year at US $6.71 per thousand cubic feet. Total net production during the period reached 137.7 million barrels of oil equivalent (boe), up 4.7 percent from the same period last year, with domestic output nearly 9 percent higher than a year earlier. Production from overseas oilfields dropped 3.2 percent over the period, owing to lower output at the Egina project in Nigeria, Eagle Ford in the US and Buzzard in Britain. The firm estimated a loss of up to 600,000 barrels of output, representing 0.1 percent of annual production scheduled in 2021. CNOOC aims to raise production to 545-555 million boe this year from 528 million boe in 2020.

According to Norway’s Petroleum Safety Authority (PSA) there had been an oil spill from Equinor’s Gullfaks C platform in the North Sea on 26 April, and the incident will be investigated. This discharge is understood to have occurred in connection with starting up production from the Tordis field, which is tied back to Gullfaks C. Oil was observed on the sea after production had got under way. Gullfaks operator Equinor has estimated the size of the spill at 17.5 cubic metres (110.1 barrels) of oil.

18 May: Voices of dissent have started growing louder among different sections of the society as price of petrol crossed the INR 100-mark in parts of Marathwada. With the recent rise in prices of fuel, petrol is being sold for INR 100.17 per litre, while diesel costs INR 91.96 per litre in Aurangabad. On the political front, the local wing of Nationalist Congress Party (NCP) criticised the central government for the hike in fuel prices.

Source: The Economic Times

18 May: Rising fuel prices have crowded out discretionary household spending on items like health, grocery and utility services, State Bank of India (SBI) Research said in a report, calling for an urgent cut in oil prices through tax rationalisation. Consumers will feel the double pain of rising health expenditure and lower incomes in this financial year as the second wave of COVID-19 spreads across India, it said. The cost of petrol was close to INR 100 in Mumbai, New Delhi and Chennai for the second time this year.

Source: The Economic Times

15 May: S&P Global Platts has cut India’s demand for oil and gas amid the second wave of COVID cases that have triggered lockdowns across key states since the past few weeks. For 2021, it now pegs the oil demand growth at 350,000 barrels per day (bpd), down from a forecast of 485,000 bpd made in February—translating into a fall of nearly 28 percent. India's city gas demand, Platts said, could drop by 25–30 percent in the coming months. However, once the lockdowns are lifted, Platts expects the pent-up demand to get released, which in turn will act as a catalyst for economic growth and trigger a demand uptick for oil and gas in the country. Besides India, the demand forecast for 2021 has been revised down for Western Europe and Latin America due to more restrictions stemming from second and third waves of COVID. Brent oil prices, WU said, will peak in mid-2021 at over US $70 per barrel. At the global level, Platts expects global oil demand growth at 5.5 million bpd in 2021. However for 2022, Platts has pegged the global oil demand at 4.4 million bpd, 20 percent lower compared to 2021.

Source: Business Standard

14 May: The Shiv Sena criticised the Centre for hike in fuel prices after the recent Assembly polls in some states, saying the "present day rulers" can go to any extent for elections. An editorial in the Sena mouthpiece 'Saamana' said the fuel prices, which were always on the upswing, were suddenly reduced during the period of elections in four states (Assam, West Bengal, Kerala, Tamil Nadu) and a Union Territory (Puducherry). It said petrol and diesel rates have touched record highs after state-run oil marketing companies hiked prices "five times in a row". The results of elections were declared on 2 May and there has been a hike in fuel prices since 4 May, it said. Earlier, during the Bihar Assembly elections, the fuel prices were stable and after the results, there was hike in prices 15 times in 18 days, it claimed. During the Delhi Assembly polls, there was a "miracle" of fuel prices being stable, the Sena said sarcastically. Three years ago, during the Karnataka Assembly polls, despite the international crude prices seeing a rise, the fuel prices in India were "stable", it said.

Source: The Economic Times

12 May: Cairn Oil & Gas, India’s largest private oil and gas exploration and production company, has achieved a significant milestone by starting production from its NA #01 facility in Aishwariya Barmer Hills in Rajasthan. The project is a first in Cairn's tight oil portfolio with a growth potential to contribute 20 percent to the company’s vision production. The project has been executed in collaboration with global oilfields services company, Schlumberger. The ABH development uses some of the most advanced technologies for its operations. It is the largest horizontal well with multi-frac development campaign of 37 wells in the Indian subcontinent which is the key enabler to unlock tight oil.

Source: The Economic Times

12 May: India’s fuel demand slumped 9.4 percent in April when compared to the preceding month as lockdowns clamped in several states to curb the second wave of coronavirus sweeping the nation pummelled demand. Fuel consumption fell 9.38 percent to 17.01 million tonnes (mt) in April from 18.77 mt in March, data from oil ministry’s Petroleum Planning and Analysis Cell (PPAC) showed. India was under one of the world’s severest lockdowns in April 2020, bringing to a halt almost all economic activity. Fuel sales had halved that month, plunging to the lowest since 2006. Comparing on a yearly basis, fuel demand surged 81.5 percent from April 2020 lows. Sales of petrol—used in cars and motorcycles—fell to 2.38 mt in April, the lowest since August. Petrol sales in April were 13 percent lower than March 2021 and 3 percent lower than April 2019. Petrol sales in April 2020 were 972,000 tonnes. Demand for diesel—the most used fuel in the country— fell to 6.67 mt in April 2021, down 7.5 percent from the previous month and 9 percent from April 2019. Diesel sales in April 2020 were 3.25 mt.

Source: The Economic Times

18 May: India lost the ONGC Videsh Ltd-discovered Farzad-B gas field in the Persian Gulf after Iran awarded a contract for developing the giant gas field to a local company. The field holds 23 trillion cubic feet of in-place gas reserves, of which about 60 percent is recoverable. It also holds gas condensates of about 5,000 barrels per billion cubic feet of gas. The buyback contract signed envisages daily production of 28 million cubic meters of sour gas over five years. OVL, the overseas investment arm of Oil and Natural Gas Corp (ONGC), had in 2008 discovered a giant gas field in the Farsi offshore exploration block.

Source: The Economic Times

13 May: Oil and Natural Gas Corp (ONGC) has agreed to do away with charging users a marketing margin on the gas it plans to produce from its KG basin field but refused to lower the minimum rate, according to tender documents. ONGC sought bids for sale of initial 2 million metric standard cubic metre per day (mmscmd) of gas from its KG-DWN-98/2 block (KG-D5). The company asked bidders to quote a rate linked to prevailing Brent crude oil prices. It fixed the floor or minimum rate at 10.5 per cent of the three-month average Brent crude oil price. On top of it, the firm sought US $0.20 per million metric British thermal units (mmBtu). Potential bidders however opposed the levy of the marketing margin as well as the "high" floor price. At the current Brent crude oil price of close to US $70, the minimum price comes to US $7.3 per mmBtu. This price, however, will be subject to the ceiling or cap fixed by the government for deepsea fields every six months. The cap for six months beginning 1 April is US $3.62 per mmBtu. ONGC in the tender offered to sell 2 mmscmd of gas for a duration of 3 to 5 years at Odalarevu in East Godavari district of Andhra Pradesh, which is connected to state gas utility GAIL's KG basin pipeline network as well as PIL’s East West Pipeline which is connected to KG basin network and further to Gujarat gas grid. Bid prices starting from 10.5 percent of dated Brent price must be revised downwards so as to account for cheaper alternatives available from other LNG (liquefied natural gas) terminals, according to a bidder query posted on the ONGC tender document. In the bid document, ONGC said the marketing margin was to cover the cost of marketing and it does not form a part of the ceiling gas price. Gas supplies from the block, which sits next to Reliance Industries Ltd (RIL)’s KG-D6 block in Bay of Bengal, is to start from end-June. RIL and its partner BP Plc of UK sold 5.5 mmscmd of additional natural gas from KG-D6 at a rate linked to Platts JKM (Japan Korea marker)—the LNG benchmark price assessment for spot physical cargoes. ONGC’s KG-DWN-98/2 or KG-D5 block is expected to have a peak production rate of 15.25 mmscmd of natural gas and 80,000 barrels per day of oil. The company is likely to come out with another tender later this year for the sale of 5 mmscmd of gas from next year.

Source: The Economic Times

14 May: Coal India arm Central Coalfields Ltd (CCL) said it has recorded 112 percent increase in production at 4.84 million tonnes (mt) in April. The Jharkhand-based subsidiary had recorded 2.28 mt coal output in April 2020, it said. As far as coal offtake was concerned, the arm said it recorded a 122 percent increase in April 2021 to 6.56 mt against 2.96 mt in the corresponding month of the previous fiscal. CCL has mining operations in Chatra, Latehar, Ramgarh, Hazaribag, Bokaro, Ranchi, Giridih, and Palamu districts of Jharkhand.

Source: The Economic Times

18 May: India's electricity use fell 6.2 percent during the first half of May compared with the second half of April, government data showed, as coronavirus lockdowns imposed by states across the country stifled power demand. Total daily average electricity supply to states fell to 3,666 billion units during the first sixteen days of May, compared with 3,910 billion units during the second half of April, data from federal grid regulator POSOCO showed. Industries and offices account for half the country’s annual electricity consumption. Power generation in India generally starts rising from April and peaks in May due to a higher air-conditioning load. Power use in May has been higher than the same time the previous year except in two southern states and two Northeastern states, the data showed, indicating curbs have been less strict than last year despite surging deaths due to the pandemic. Power use rose in the northern states of Rajasthan, Uttar Pradesh, Haryana, Punjab, and Delhi—among the regions worst affected by the coronavirus, even as overall power generation fell 6.3 percent compared with the second half of April. Power supplied to Maharashtra, Tamil Nadu, and Gujarat—India's richest and most industrial states which together account for nearly a third of the total electricity consumption—fell by over 5 percent each.

Source: The Economic Times

17 May: Power consumption in the country grew by around 19 percent in the first fortnight of May to 51.67 billion units over the same period last year, showing recovery in industrial and commercial demand of electricity, according to the power ministry data. Power consumption in the first fortnight of May 2020 was 43.55 billion units. The power consumption in the entire month of May last year was 102.08 billion units. The power consumption in April grew nearly 40 percent to 118.08 billion units. Power consumption in April 2020 had dropped to 84.55 billion units from 110.11 billion units in the same month in 2019, mainly because of fewer economic activities following the imposition of lockdown by the government in the last week of March 2020 to contain the spread of deadly COVID-19. The power consumption also fell in May 2020 to 102.08 billion units from 120.02 billion units in May 2019. Similarly, peak power demand met or the highest power supply in a day also slumped to 132.73 GW in April last year from 176.81 GW in the same month in 2019, showing the impact of lockdown on economic activities. The fewer economic activities also resulted in a fall of peak power demand in May 2020 to 166.22 GW from 182.53 GW in May 2019.

Source: The Economic Times

14 May: Notwithstanding the fact that a large number of its staff and their family members got infected with coronavirus, the NTPC Kahalgaon project ensured uninterrupted generation of electricity in all seven units of the plant. Despite large number of employee falling prey to the virus, the staff have not lowered their guard and ensured that the project generates electricity to its full strength. All the seven units of the plant are working at 96.78 percent plant load factor to generate 2264.60 MW of electricity.

Source: The Economic Times

13 May: Power regulator Central Electricity Regulatory Commission (CERC) has approved registration to PTC, BSE and ICICI Bank-led Pranurja Solution Ltd to start the country’s third power exchange. The company said the exchange is likely to be operationalised by this year-end. The other two power exchanges are Indian Energy Exchange and Power Exchange of India Ltd. The commencement of operation of the power exchange is subject to approval of the bye-laws, rules, and business rules and the technology including trading software in accordance with various provisions of the Power Market Regulations (PMR) 2010. Pranurja Solutions had submitted the draft rules and bye-laws at the time of filing the petition, according to the CERC order issued. On complying with the conditions, the registration of the power exchange will be in force for 25 years from date of commencement of operation, it said.

Source: The Economic Times

12 May: The Goa electricity department has stated that there will be no tariff hike for the current financial year. Chief electrical engineer Raghuvir Keni said that the tariff has remained the same since the financial year 2019-20 despite the joint electricity regulatory Commission (JERC) recommending a hike in tariff. He said that the fuel power purchase cost adjustment (FPPCA) for this quarter, has been notified. Although JERC recommended a power tariff hike, the government has not enforced this during the pandemic, he said.

Source: The Economic Times

18 May: ReNew Power said it plans to develop a solar cell and module manufacturing facility with 2 GW annual capacity in Dholera Special Industrial Region, Gujarat. The facility will manufacture solar cells and modules using state-of-the-art monocrystalline PERC (Passivated Emitter & Rear Contact) and large wafer technology and will implement best practices in line with Industry 4.0 manufacturing standards, it said. The plant is expected to be vertically integrated in terms of processes and infrastructure for the manufacturing of solar cells and modules and is anticipated to commence operations from fiscal year 2022-23. Gujarat has been one of the pioneers in promoting renewable energy and ReNew’s first power project, a 25.2 MW wind farm, was also commissioned in Jasdan, Gujarat.

Source: The Economic Times

18 May: Private solar power companies have sought the intervention of Uttar Pradesh (UP) Chief Minister Yogi Adityanath in securing the award of contracts they won in February last year. NV Vogt Singapore Private Limited, Al-Jomaih-Jakson Power Private Limited, Vijay Printing Press Private Limited, and Talettutayi Solar Projects Eight have been waiting to sign the contracts after they emerged as lowest bidders for supplying about 184 MW solar capacity in reverse auctions held February last year. As per bid documents, the letters of intent (LOI) was expected to be issued within 94 days of the e-reverse result but the companies have been thrice asked to extend the validity of bank guarantee.

Source: The Economic Times

17 May: The Yogi Adityanath government in Uttar Pradesh (UP) has launched a project to manufacture solar lamps and distribute them to children in rural areas of the state at a reasonably low cost. With the help of the government and the CSR Fund, women of self-help groups are creating these solar lamps, which are being made available to the school children by the government for INR 100 per piece against their market rate of a whopping INR 500 per piece. Earlier, the Yogi Adityanath government had distributed 28 lakh solar lamps made by 4,000 women to school children in 75 blocks spread over 30 districts of UP. In the first phase of the Prerna Ojas programme, 35 women from 18 groups were selected to receive training in manufacturing cheaper solar lamps and selling them while a unit was set up at Paraunkh village of President Ram Nath Kovind.

Source: The Economic Times

13 May: Vikram Solar announced the commissioning of an 85 MW solar plant for state-run power giant NTPC at Bilhaur, in Uttar Pradesh. Combining the latest 85 MW project at Bilhaur with Vikram Solar's recently commissioned 140 MW project for NTPC at the same location amounts to 225 MW capacity project and became the largest solar project in a single location in the state of Uttar Pradesh, it said. The 85 MW solar project is spread across 400 acres. The expected energy yield of this project in Uttar Pradesh is 200 million units. The plant is expected to reduce 4.57 tonnes of CO2 and can power 88,905 houses per year. Vikram Solar’s annual PV module production capacity stands at 1.2 GW and the company has shipped over 3.1 GW PV modules globally.

Source: The Economic Times

12 May: The Ministry of New and Renewable Energy (MNRE) announced a timeline extension in the scheduled commissioning date (SCD) of renewable energy projects considering disruption due to the second wave of COVID-19 cases. The ministry in its order said that RE projects being implemented through implementing agencies designated by the MNRE having their SCD on or after 1 April 2021 would be eligible to claim time-extension for completion of their project activities.

Source: The Economic Times

12 May: Gujarat continues to be the preferred destination for setting up wind power projects in India. Despite the challenges posed by the COVID-19 pandemic, Gujarat witnessed the highest addition of wind power generation capacity in the country in 2020-21. Wind power projects with the cumulative generation capacity of 1,020.3 MW were installed and commissioned in Gujarat from April 2020 to March 2021. That was the highest capacity addition by any state in India during the period, shows data compiled by Indian Wind Turbine Manufacturers Association (IWTMA). Gujarat was followed by Tamil Nadu (303.7 MW) and Karnataka (148 MW). About 1,503.3 MW of new wind power generation capacity was installed in India in fiscal 2021, IWTMA data shows. With these new installations, Gujarat’s current operational capacity for generation of power from wind energy sources stands at 8,561.8 MW as against 7541.5 MW in 2019-20. At 1,468.4 MW, Gujarat created the highest wind power capacity in the previous fiscal as well. Renewable energy companies such as Adani Green and ReNew Power were among the prominent players that commissioned their power projects. Adani Green and ReNew Power commissioned 100 MW and 300 MW wind power projects in Kutch in March 2021. The state government sources, however, pegged the capacity of new wind projects commissioned in Gujarat at 890 MW for the fiscal 2021. Gujarat currently stands second after Tamil Nadu in terms of the total installed wind power generation capacity in the country.

Source: The Economic Times

18 May: US (United States) oil output from seven major shale formations is expected to climb by 26,000 barrels per day (bpd) in June to 7.73 million bpd, the first rise in three months, the US Energy Information Administration (EIA) said. The biggest increase is set to come from the Permian, the top producing basin in the country, where output is expected to rise by 54,000 bpd to about 4.59 million bpd, the highest since March 2020. Output in nearly every other large basin such as the Bakken in North Dakota and Montana, as well as the Eagle Ford in South Texas is expected to decline. In the Bakken, production is expected to drop by about 7,000 bpd to 1.1 million bpd, the lowest since July 2020. EIA said producers drilled 513 wells and completed 754 in the biggest shale basins in April. That left total drilled but uncompleted (DUC) wells down 241 to 6,857, their lowest since October 2018.

Source: The Economic Times

12 May: The United Arab Emirates (UAE) has committed to supplying Sudan’s full requirements of petroleum products through a contract by the UAE’s state oil producer ADNOC, Sudan’s Cabinet Affairs Minister Khalid Omer Yousif said. Sudan has had frequent troubles securing a stable supply of petrol, diesel, fuel oil, and cooking gas, which have resulted in frequent lines at gas stations, power cuts, and protests. Yousif said Sudan received very favourable financial terms. Financing imports has frequently been an issue as the country has chronically low foreign reserves. The country’s transitional government has removed subsidies on petrol and diesel, part of a raft of reforms designed to attract foreign financing and pull the country out of a protracted economic crisis. Fuel oil and cooking gas remain subsidised. A delegation from Sudan’s energy ministry will visit the UAE to discuss the details of the agreement, Yousif said.

Source: The Economic Times

12 May: Ukraine has imposed control on retail petrol and diesel fuel prices in an attempt to halt rising inflation, the government said. The oil products were added to the list of socially important goods and retailers must now declare plans to increase prices by 1 percent and more to the state consumer market watchdog 20 days in advance. The government earlier this year imposed a price cap on natural gas and electricity for households, and the central bank raised its key rate twice— to 7.5 percent from 6.0 percent—to fight inflation, which jumped to 8.5 percent in March and 8.4 percent in April from 5.0 percent in December. Consulting firm A-95 said that retail petrol prices had increased about 1 percent, but analysts expect a further rise following the dynamic on European markets. The Ukrainian Oil & Gas Association said the government decision violated the principles of market competition because it is not possible to set up prices 20 days ahead.

Source: The Economic Times

15 May: Exxon Mobil Corp said it will reinstall a gas compressor at its Liza Destiny platform off Guyana’s coast in June, after an equipment failure last month prompted the company to slash output. The company said in a statement that its Liza-1 project was currently producing between 100,000-110,000 barrels per day (bpd) while flaring less than 15,000 standard cubic feet per day. The compressor failure prevented Exxon from producing at full capacity without flaring in excess of Guyana's government guidance. The company, which operates the project in a consortium with New York-based Hess Corp and China's CNOOC Ltd, initially slashed production to 30,000 bpd after the outage down from nameplate capacity of 120,000 bpd. Gas flaring emits significant amounts of planet-warming carbon dioxide and has been a source of tension between Exxon and Guyana's government since Liza-1 began production in December 2019, making the impoverished South American country the world's newest energy hotspot.

Source: The Economic Times

13 May: The national average gas prices in the US (United States) have increased above US $3 a gallon for the first time since 2014 amid the six-day shutdown of a major fuel pipeline following a cybersecurity attack. On an average, Americans paid US $3.008 for a gallon of gas, up from US $2.985 the previous day and US $2.927 one week ago, the American Automobile Association (AAA) said. The US auto club had forecasted gas prices to climb this week in reaction to the shutdown of the Colonial Pipeline, which delivers approximately 45 percent of all fuel to the East Coast. However, a growing number of gas stations along the East Coast are without fuel as the panic-buying continued amid concerns over the shortage of gas. 28.2 percent of all gas stations in North Carolina, 17.45 percent in Georgia and 17.09 percent in Virginia were without gasoline, according to the latest data from GasBuddy, which tracks fuel demand, prices, and outages.

Source: The Economic Times

12 May: Pakistan’s Khyber Pakhtunkhwa (KP) and Sindh provinces have rejected monopoly to centralise transmission lines of gas companies in the country terming it as a violation of the 18th constitutional amendment and warned of approaching the court against the Imran Khan government in this connection. According to The News International, both the provinces have rejected the monopoly to centralise the transmission line of Sui Southern Gas Pipe Lines and Sui Northern Gas Pipe Lines by the federal government and termed it as a violation of the 18th constitutional amendment of Pakistan.

Source: The Economic Times

17 May: China’s coal production slowed in April to the lowest level since July 2020, curbed by ongoing safety inspections at major coal mines following several accidents across the country. China churned out 322.22 million tonnes (mt) of coal last month, down 1.8 percent from the same period a year ago, data from the National Bureau of Statistics showed. Output over the first four months of the year reached 1.29 billion tonnes, up 11.1 percent on year. Physical thermal coal prices had soared by 20 percent over the month to 10 May, prompting at least three leading Chinese coal pricing indexes to suspend daily price assessments to try to stabilise the market. The jump followed worries over increasing demand for coal for power generation and industrial activity amid tepid domestic output and stringent imports restrictions for Australian coal. China’s April power consumption rose 13.2 percent from the same period last year to 636.1 billion kilowatt hours. The Statistic Bureau said production of coke used in steelmaking rose 2.4 percent in April to 39.34 mt, with year-to-date output rising 7.4 percent to 158.62 mt.

Source: The Economic Times

14 May: Britain wants to broker a global agreement to stop the cross-border financing of coal projects when it hosts a major climate conference in November, Alok Sharma, the Minister in charge of preparations for the United Nations COP26 summit in Glasgow, said. Hesaid that significant action was needed to limit global warming to 1.5 degrees Celsius above pre-industrial levels, a threshold scientists say can prevent the worst impacts of climate change. Britain currently generates 2 percent of its electricity from coal, down from 40 percent in 2020, and it plans to completely phase out coal as a power source by 2024. But environmental campaigners said British financial institutions play a major role in funding coal mines and coal-fired power stations elsewhere in the world. Coal remains widely used for electricity and other industrial purposes in China, where President Xi Jinping has said he expects carbon emissions to continue rising until 2030.

Source: The Economic Times

18 May: The European Energy Exchange (EEX) could double the number of participants in its Japanese power futures market from around 20 players in 2021, having traded over 3 terawatt hours (TWh) in its first 12 months. Interest in wholesale trading was boosted by extremely cold weather, which left Japanese retail suppliers undercovered, the EEX said. The 3 TWh EEX futures traded in Japan since 18 May 2020 are equivalent to supplying electricity to a city of 350,0000 inhabitants for a year. While that is still small compared to Japan's power consumption of 1,000 TWh a year, it shows the huge size of trading potential in a country that has twice Germany’s power usage. In its European core futures markets, EEX traded 4.7 TWh in 2020, up 19 percent from 2019. EEX offers weekly, monthly, quarterly, seasonal, and annual delivery periods up to six years in advance, based on the index set by local spot power bourse JEPX.

Source: The Economic Times

18 May: Taiwan President Tsai Ing-wen pledged to look into the tech powerhouse's electricity management after two major blackouts hit homes and businesses in less than a week, triggering criticism of the government's power policy. Taiwan, which hosts major chip makers such as Taiwan Semiconductor Manufacturing Co Ltd, imposed power cuts following a spike in demand amid a heatwave and drought and failure at a power plant, in the second such outage in a week. In a live broadcast online, Tsai offered her apology for the two outages and promised to re-examine the island’s power management amid heated debate over the electricity policy. Tsai said she had instructed the economy ministry and state-run electricity provider Taipower to re-examine their management planning. Taipower said the drought meant electricity generated by hydropower plants was insufficient to meet the unexpected demand during a heatwave, a record high for May.

Source: Reuters

17 May: South Africa’s Eskom will implement nationwide scheduled power cuts from 1700 local time due to breakdowns at seven of its power plants in the last 24 hours, the struggling state utility said. Eskom said the breakdowns at the seven plants represented a "total loss of 6,044 MW, bringing the total unplanned capacity lost to 16,118 MW." It said stage 2 "loadshedding", which will see up to 2,000 MW shaved from the national grid, would be in place 2200 local time.

Source: The Economic Times

12 May: Brazil’s worst drought in two decades will force the country to depend more heavily on costly thermal power plants to compensate for reduced hydroelectric generation, the National Electric Grid Operator said. Around three-quarters of Brazil’s electricity is generated by plants driven by flowing water, one of the largest proportions for any country. President Jair Bolsonaro said that Brazil is experiencing the worst water crisis in its history, warning that it poses major problems for electricity generation.

Source: The Economic Times

12 May: US (United States) power consumption will rise 2.2 percent this year as state and local governments ease coronavirus lockdowns, the US Energy Information Administration (EIA) said in its Short Term Energy Outlook (STEO). The EIA projected power demand will rise to 3,887 billion kilowatt hours (kWh) in 2021 and 3,925 billion kWh in 2022 from a coronavirus-depressed 11-year low of 3,802 billion kWh in 2020. That compares with an all-time high of 4,003 billion kWh in 2018. The EIA projected 2021 power sales would rise to 1,504 billion kWh for residential consumers, which would be a record as continuing lockdowns cause more people to work from home, 1,293 billion kWh to commercial customers and 950 billion kWh to industrials. That compares with all-time highs of 1,469 billion kWh in 2018 for residential consumers, 1,382 billion kWh in 2018 for commercial customers and 1,064 billion kWh in 2000 for industrials.

Source: The Economic Times

18 May: All future fossil fuel projects must be scrapped if the world is to reach net-zero carbon emissions by 2050 and to stand any chance of limiting warming to 1.5C, the International Energy Agency (IEA) said. It called for a rapid and vast ramping up of renewable energy investment and capacity, which bring gains in development, wealth and human health. IEA Executive Director Fatih Birol said the roadmap outlined in the report showed that the path to global net-zero by 2050 was "narrow but still achievable". With annual additions of solar and wind power reaching 630 and 390 GW respectively by 2030, the IEA said that investment in renewables could put global GDP four percent higher by 2050 than it would be based on current trends. By 2050, it said that renewables capacity and greater efficiency would see global energy demand drop about eight percent, even as 2 billion more people gained access to electricity. The IEA said that clean energy and access to clean cooking solutions could cut the number of premature deaths by 2.5 million a year by 2050.

Source: The Economic Times

18 May: Russian gas giant Gazprom expects demand for natural gas to grow in the coming decades and for it to play a bigger role in energy consumption than renewable Sources and hydrogen, the company said. The forecasts runs counter to a global trend for an energy transition from fossil fuels to the use of environment-friendly renewable Sources of energy, such as solar and wind power, to slow climate change.

Source: Reuters

18 May: Brazilian fund manager Perfin has created a new company focused on renewable energy generation, especially solar, with expected investment totaling 5.5 billion reais (US $1 billion) by 2025, the company said. The new company Mercury Renew, which has an operational partnership with energy generator Servtec, is Perfin’s latest venture into energy and highlights investor interest in Brazil’s electricity sector and potential in renewables. Mercury Renew will focus on solar projects, especially in the Southeast and Centre-West of the country. It will look to sell power directly to companies that usually buy on the free market, mainly large industries and businesses. The company aims to reach 2 GW of generating capacity by 2025. Perfin’s strategy comes as investors in generation projects in Brazil are increasingly turning to the free market, where rising demand from companies for clean energy has helped to spur activity and the construction of several generation plants.

Source: The Economic Times

15 May: Italian energy group Eni has picked Goldman Sachs and Mediobanca to work on the planned spinoff of its new retail and renewable business. In April, Eni approved the launch of a strategic project to list or sell a minority stake in the unit as part of the company's energy transition strategy. The business, which includes renewable power generation and energy sales to customers, could be worth in the region of 10 billion euros (US $12 billion).

Source: The Economic Times

14 May: The Biden administration is considering sanctions over China's use of forced labour in the production of solar panels, United States (US) Special Envoy on Climate John Kerry said. Kerry acknowledged that importing solar panel from Xinjiang is a problem due to forced labour by Uyghurs in the region. Much of the world’s polysilicon, used in photovoltaic cells for solar panels, comes through China's Xinjiang province, where the Chinese government has been accused of committing genocide against Muslim minorities including Uyghurs. Although Kerry didn't commit to precluding those panels, he indicated that the Biden administration was moving toward doing so with sanctions.

Source: The Economic Times

14 May: Spain’s parliament approved a clean energy bill aimed at achieving carbon neutrality by 2050 in line with EU (European Union) targets, while also banning the sale of fossil fuel vehicles by 2040. As part of Spain’s efforts to meet its carbon emissions target, the legislation outlaws the sale of vehicles that emit carbon dioxide by 2040, and their circulation by 2050. The overall aim is to implement measures that will enable Spain to meet the EU’s target of achieving carbon neutrality by 2050. It also sets a national 2030 target for reducing its greenhouse gas emissions by at least 23 percent compared with 1990 levels. The EU had set a 2030 target of cutting emissions by 40 percent compared with 1990 but in November, member states agreed to increase this to 55 percent.

Source: The Economic Times

12 May: Suncor Energy will develop a clean hydrogen project near Fort Saskatchewan, Alberta, in one of the most significant steps taken by an oil sands producer to cut greenhouse gas emissions and tackle climate change. Canada’s cash-rich oil sands firms have been facing mounting pressure to spend on energy transition at a time when Prime Minister Justin Trudeau has set a goal of net-zero emissions for the country by 2050. The project, with ATCO Ltd, would produce more than 300,000 tonnes per year of clean hydrogen, reducing Alberta's carbon dioxide emissions by more than 2 million tonnes (mt) per year. About 65 percent of the produced hydrogen would be used in refining processes at the Suncor Edmonton refinery in Alberta, while another 20 percent of it could be used in the Alberta natural gas grid, the companies said. The hydrogen production facility could be operational as early as 2028, while a sanctioning decision is expected in 2024. Suncor will construct and operate the hydrogen production and carbon dioxide sequestration facilities, while ATCO will construct and operate associated pipeline and hydrogen storage facilities.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.