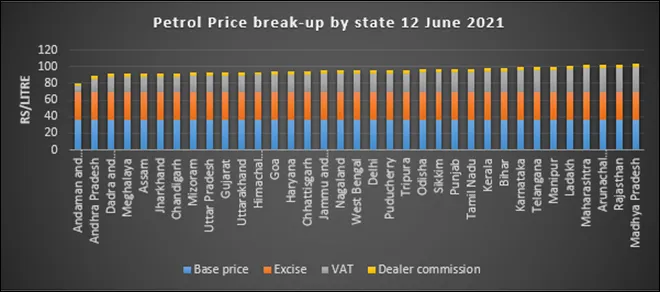

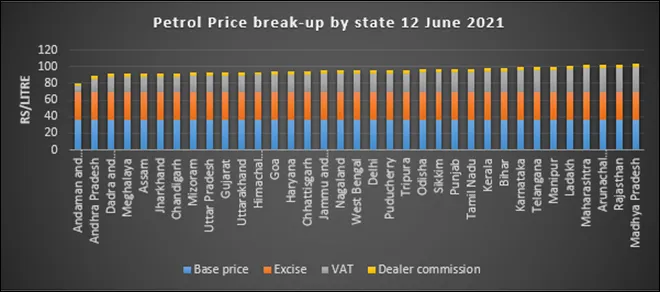

As of 12 June 2021, the retail price of petrol was highest in Madhya Pradesh (MP) (amongst states excluding union territories) at INR 104.01 per litre (l) and lowest in Andhra Pradesh (AP) at INR 88/l. The difference in retail price is on account of state taxes (value added tax or VAT) which in MP was INR 31.3/l or 31 percent of the retail price, while it was INR 16.8/l or 18 percent of the retail prices in AP. Central (excise) and state taxes constituted 61 percent of the retail price of petrol in MP and 55 percent of the retail price of petrol in AP while central tax alone accounted for 31 percent of the retail price in MP and 36 percent of the retail price in AP.

Source: Estimates based on data from PPAC and IOC

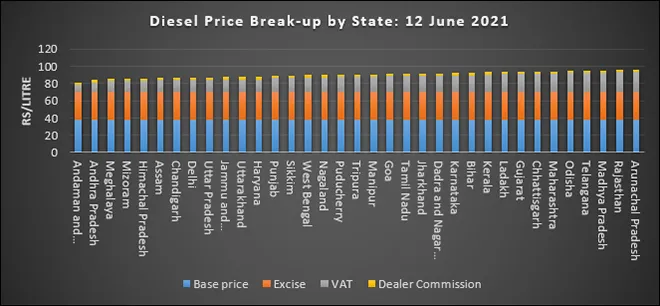

Source: Estimates based on data from PPAC and IOC

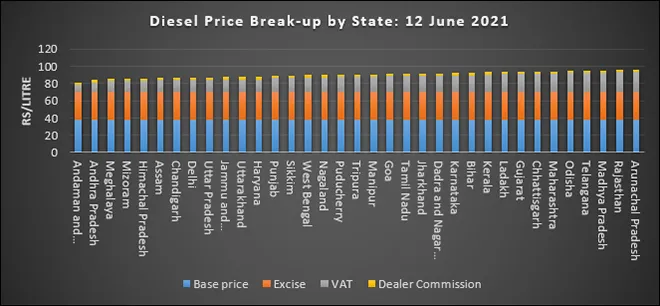

The retail price of diesel was highest in Arunachal Pradesh at INR 96.43/l and lowest in Andhra Pradesh at INR 83.81/l. VAT at INR 8.08/l in AP was only a third of the VAT in Arunachal Pradesh (INR 23.55/l). Excise accounted for 33 percent of the retail price of diesel in Arunachal Pradesh and VAT about 24 percent. In AP, excise accounted for roughly 38 percent of the retail price, but VAT only accounted for about 9 percent. Amongst metro cities, petrol was most expensive in Mumbai at INR 102.04/l on 12 June 2021 and least expensive in Kolkata at INR 95.8/l, closely followed by Delhi at INR 95.85/l.

On 12 June 2012, sellers took about 38 percent (INR 35.99) of the retail price of a litre of petrol in Delhi, the centre took 34 percent (INR 32.9), the state took about 24 percent (INR23.17) and dealers took about 4 percent (INR 3.79). Sellers took about 44 percent (INR 38.49) of the retail price of a litre of diesel in Delhi, the centre took 37 percent (INR 31.8), the state took about 16 percent (INR 13.87) and dealers took about 3 percent (INR 2.59). Overall, the tax-take on a litre of petrol and diesel is more than what sellers get for the petroleum products. India is not unique in taxing petroleum products. Most European countries tax petroleum products heavily partly to discourage the use of oil to curb pollution and partly to maintain infrastructure for petroleum-based transport.

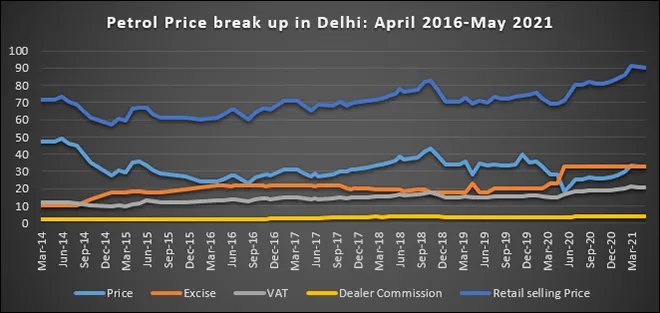

Source: Estimates based on data from PPAC and IOC

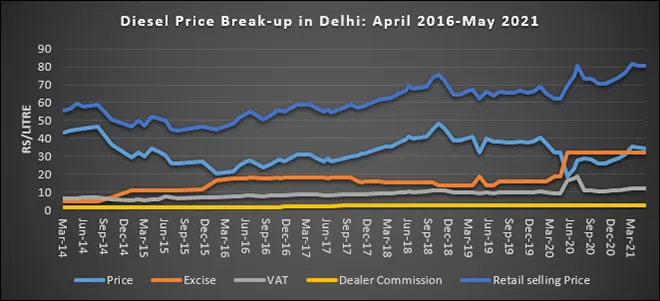

Source: Estimates based on data from PPAC and IOC

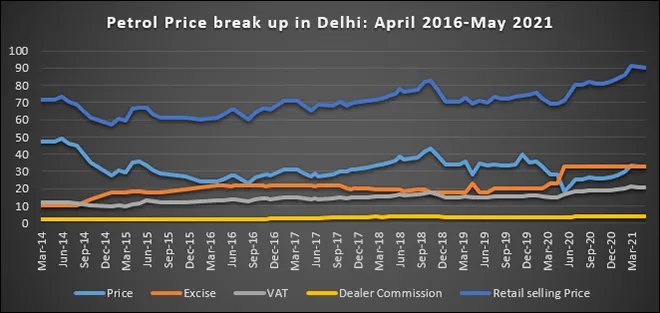

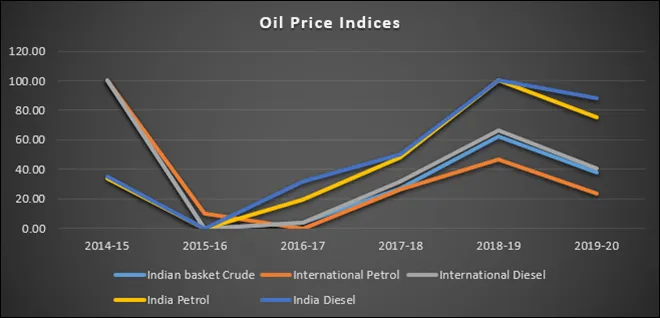

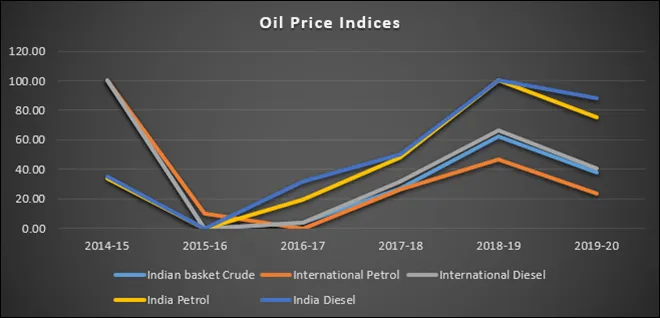

Since 2015, the reduction in international crude prices were compensated with increase in taxes that have effectively kept the retail prices of petrol and diesel relatively high. If the fall in global crude oil prices in the last five years were fully passed through to consumers, the retail price of refined products would have been lower by INR 0.50/l for every US $1/barrel (b) reduction in crude prices. In other words, every US $1/b reduction in crude price is an opportunity to increase taxes by INR 0.50/l.

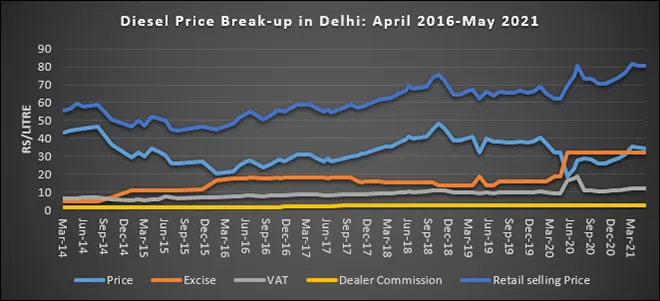

Since 2015, the reduction in international crude prices were compensated with increase in taxes that have effectively kept the retail prices of petrol and diesel relatively high. If the fall in global crude oil prices in the last five years were fully passed through to consumers, the retail price of refined products would have been lower by INR 0.50/l for every US $1/barrel (b) reduction in crude price

Source: PPAC, Various Reports

Source: PPAC, Various Reports

The burden of tax increase has so far has fallen more on diesel than on petrol. In March 2014, a litre of diesel was cheaper than petrol by about INR 15/l on average across the country. Taxes accounted for 31 percent of the retail price of petrol and about 19 percent of the retail price of diesel respectively. In June 2020, the tax component on petrol and diesel was at 69 percent and 58 percent respectively.

The burden of tax increase has so far has fallen more on diesel than on petrol. In March 2014, a litre of diesel was cheaper than petrol by about INR 15/l on average across the country. Taxes accounted for 31 percent of the retail price of petrol and about 19 percent of the retail price of diesel respectively

Source: PPAC, Various Reports

Source: PPAC, Various Reports

The retail price of diesel exceeded the retail price of petrol in Delhi briefly last year and the discount on the price of diesel was less than a rupee or two compared to the retail price of petrol across the country. Excise on petrol increased by over 200 percent, from about INR10.38/l in March 2014 to INR 32.98/l in September 2020. For diesel, the increase was a more dramatic, 600 percent in the same period from INR 4.58/l to INR31.83/l. Increase in VAT was far less steep in most states. For petrol, VAT increased by roughly 60 percent from INR 11.9/l to about INR 18.94/l and for diesel VAT increased by about 68 percent from INR 6.41/l to INR 10.8/l in the same period in Delhi. The fall in the price of crude (Indian basket) was a modest 28 percent from US $84.16/b in 2014-15 to US $60.47/b in 2019-20.

Source: Calculated from PPAC data

Source: Calculated from PPAC data

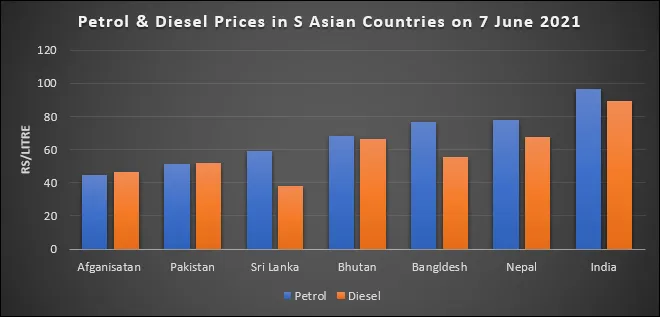

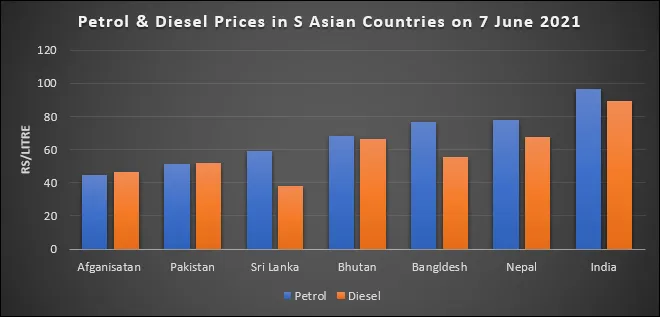

In the last few months, the price of crude has increased with hopes of economic revival following the successful vaccination campaigns in China, the USA, Europe, and some other regions of the world. The price of crude (Indian basket) was US $44.19/b in September 2020 and in May 2021, it was US $64.73/b, an increase of over 46 percent. In this period, the excise on petrol and diesel have not increased, while the VAT on petrol has increased by 10 percent (in Delhi) and VAT on diesel has increased by 14 percent (Delhi). High taxes on petrol and diesel in India have cushioned the impact of increase in crude price which has not been passed through to retail prices. Despite this, the average price of petrol and diesel in India remain amongst the highest in South Asian countries (in both rupees and dollars).

Source: www.globalpetrolprices.com

Source: www.globalpetrolprices.com

Growth in tax revenue

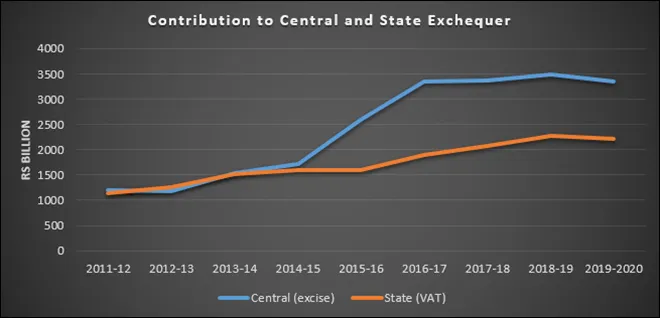

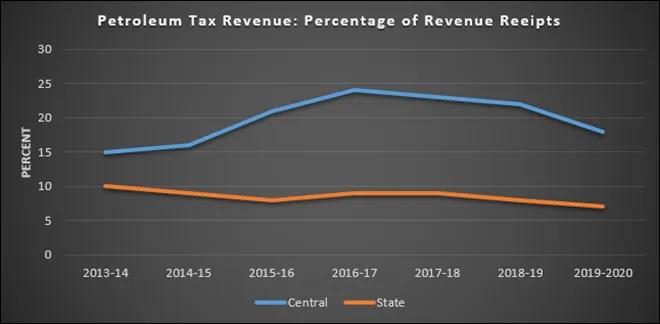

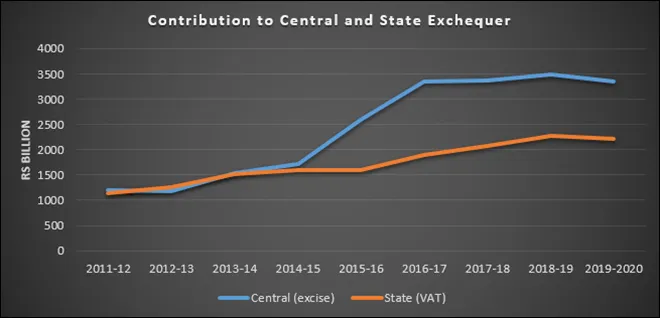

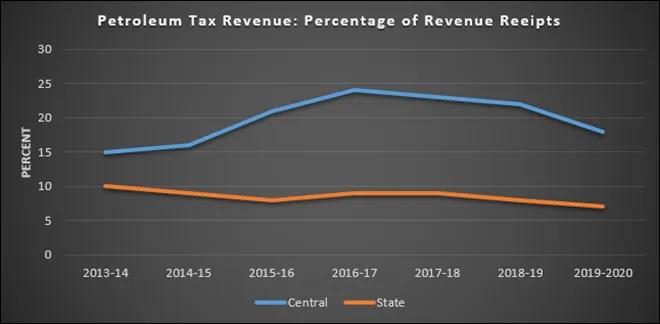

The importance of tax revenue from the petroleum sector in India has substantially increased after the introduction of the goods and services tax (GST). On average, petroleum taxes contributed over 2 percent of GDP during the last decade.

The importance of tax revenue from the petroleum sector in India has substantially increased after the introduction of the goods and services tax (GST). On average, petroleum taxes contributed over 2 percent of GDP during the last decade.

Source: PPAC, Various Reports

Source: PPAC, Various Reports

Excise duty from petroleum products alone now contributes 85-90 percent of all excise collected by the Union government accounting for roughly 24 percent of indirect tax revenue in 2018-19. Excise revenue from petrol and diesel increased by over 94 percent from about INR 1,720 billion to about INR 3,343 billion from 2014-15 to 2019-2020 for the Union government. For the State governments, the increase in VAT revenue was about 37 percent from INR 1,605 billion to INR 2,210 billion.

Source: PPAC, Various Reports

Source: PPAC, Various Reports

Economic Impact

In India, growth in demand for diesel has closely tracked growth in the index of industrial production (IIP). When excise on refined petroleum products was reduced as part of the stimulus package after the financial crisis in 2008-09, economic growth picked up along with IIP which translated into growth in demand for diesel. In 2014-15 to 2017-18 when the retail price of diesel averaged about INR 54/l, demand grew at about 9 percent per year closely tracking IIP whereas demand for petrol grew at about 3.5 percent.

Not surprisingly, diesel demand is expected to slow down during the current financial year (2020-21) on account of the nationwide lockdown and slow economic recovery. In fact, diesel demand growth started faltering before the lockdown on account of the increase in retail prices. In 2019-20, diesel demand fell by 1 percent compared to the previous year while petrol demand continued to grow by over 5 percent. The fall in demand for diesel was consistent with the 0.7 percent fall in IIP for 2019-20. Given the strong correlation between IIP and diesel demand, higher retail prices is likely to further dampen demand for diesel. As in the case of electricity, the fall in demand for diesel is likely to be greater in industrialised states than in less industrialised states as studies have indicated.

Diesel demand is expected to slow down during the current financial year (2020-21) on account of the nationwide lockdown and slow economic recovery. In fact, diesel demand growth started faltering before the lockdown on account of the increase in retail prices

Studies have shown that small tax increases on petrol and diesel can substantially improve the environment because of reduced consumption but as with other public interventions, energy price increases can undermine equity objectives, posing an equity-efficiency trade-off familiar to economists. Though the equity or distributional impact is estimated to vary between and within countries depending on social, geographic, climatic, economic conditions as well as the pattern of energy use in households, there is consensus that poor households suffer more from energy price increases as they tend to spend a larger share of their income to buy energy and energy services. Marrying a regressive tax on petrol and diesel with progressive redistribution of revenues amongst poor households is the recommended policy intervention to correct this trade-off.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV