SIGNS OF PETROLEUM DEMAND REVIVAL

Monthly Oil News Commentary: July 2020

India

Tax on Petroleum Products

Diesel rates in Mumbai, Thane and Navi Mumbai have crossed the ₹80 mark. The price of diesel in Mumbai was ₹80.1/litre while in Thane and Navi Mumbai it was ₹80.2/litre at fuel pumps. As many as 10 districts in Maharashtra have now breached the ₹80 mark for diesel, which has transporters worried about a rise in prices of vegetables, fruits and other essentials. Petrol rate in Mumbai was ₹87.2/litre and in Thane and Navi Mumbai ₹87.3/litre. It was nearing ₹90 in parts of the state, with the rate in Parbhani ₹89.2/litre. Unexpected rise in diesel prices despite slower demand has extended the gain for the transport fuel over petrol in Delhi. With a 17 paise/litre hike in diesel price in New Delhi while petrol prices remaining steady, the gap between the two auto fuels has further widened in the national capital. Diesel prices overtook that of petrol in the national capital, in an unprecedented development. Diesel was priced at ₹81.35/litre in the capital, higher than the previous level of ₹81.18/litre. Petrol prices, however, remain unchanged at ₹80.43/litre the same level as 29 June when it’s pump price rose marginally by 5 paisa/litre over previous days price. With this, diesel is now almost a rupee higher than petrol overturning the advantage of running a vehicle on the fuel. With the price trends in diesel, it may soon catch up with petrol prices in other metros as well. Along with the Capital, diesel prices marginally increased in other metro cities as well but there the price of transportation fuel is still between ₹6-8/litre lower than petrol. With the latest hike in fuel prices, petrol and diesel have become costlier in Andhra Pradesh compared to the other southern states. The state is among the top five with highest fuels prices in the country. The price of petrol reached ₹86.7/litre in the state after the latest hike in VAT and diesel price stands at ₹82.31/litre. While the price of petrol is the fifth-highest in the country, diesel price stands third among all states. The state government has reverted to the tax regime that was in force during 2015 to 2018. VAT on both petrol and diesel has been increased by ₹1.24 and ₹0.93 respectively. The state government is collecting 31 percent + ₹4 as VAT on petrol and 22.25 percent +₹4 on every litre of diesel. While the percentage tax varies with the base price of the fuel, the state government is collecting ₹4/litre on both petrol and diesel as a fixed component irrespective of the base price. Rates vary from state to state depending on the incidence of local sales tax or VAT. While diesel price was last revised on 7 July, petrol rates were last changed on 29 June. In the last five weeks, diesel price has increased on 24 occasions while petrol rates have risen 21 times. The cumulative increase since the oil companies started the cycle totals to ₹9.17/litre for petrol and ₹11.55/litre for diesel. In Mumbai, petrol is priced at ₹87.19 -- unchanged since 29 June, while diesel rate was hiked to ₹79.17/litre from ₹79.05/litre.

The Andhra Pradesh government, which has been claiming credit for implementing welfare schemes despite financial stress, has hiked the value added tax on petrol and diesel. The government on its own resources had dried up and hence, the hike in VAT on fuel. As per a new order issued, amending the VAT Act, the state tax on petrol is increased by ₹1.24/litre and on diesel by 93 paise/litre. The new tax on petrol is 31 per cent plus ₹4/litre and on diesel is 22.25/litre percent plus ₹4/litre. With the latest hike in fuel prices, petrol and diesel have become costlier in Andhra Pradesh compared to the other southern states. The state is among the top five with highest fuels prices in the country. The price of petrol reached ₹86.7/litre in the state after the latest hike in VAT and diesel price stands at ₹82.31/litre. While the price of petrol is the fifth-highest in the country, diesel price stands third among all states. The state government has reverted to the tax regime that was in force during 2015 to 2018. VAT on both petrol and diesel has been increased by ₹1.24 and ₹0.93 respectively. The state government is collecting 31 percent + ₹4 as VAT on petrol and 22.25 percent + ₹4 on every litre of diesel. While the percentage tax varies with the base price of the fuel, the state government is collecting ₹4/litre on both petrol and diesel as a fixed component irrespective of the base price.

Protesting against increased excise duty levied on petrol products in the state, petrol pump dealers across Punjab have gone for a strike by shutting down their pumps for business during certain times. Diesel price in the state has hit ₹73.23/litre while petrol rate has touched ₹79.77/litre. Petrol prices have skyrocketed across the nation. Though prices are high in Punjab, they are not the highest in the country. Mumbai currently sells petrol at ₹87.19/litre. Leader of the Opposition in Delhi urged the Delhi government to reduce the VAT on diesel to 12.5 percent and petrol to 20 percent. Under the previous government, 12.5 percent VAT was being charged on diesel. The VAT on diesel was increased to 30 percent and on petrol from 20 percent to 30 percent currently. Opposition party leaders demanded that the Haryana government lower taxes on petrol and diesel, saying lockdown restrictions have been largely lifted and almost all sources of government revenue have been restored. VAT on diesel was around 9 percent during the previous government's time in the state, which has almost doubled. Farmers of the state have been impacted the hardest by high fuel prices as their input costs have gone up. Farmers in the state were already suffering because of alleged government apathy and high fuel prices were further adding to their woes. Petrol pump owners in the national capital urged Delhi government to reduce VAT on petroleum products, citing lower rates in neighbouring states. The increase in VAT on diesel is resulting in heavy loss of sales at petrol pumps in Delhi and making it unviable to operate them according to the Delhi Petrol Dealers Association, which has around 400 petrol pump owners as members. The Delhi government had increased VAT on petrol to 30 percent from 27 percent on 5 May. For diesel, VAT has been almost doubled to 30 percent from 16.75 percent. Petrol dealers will have to resort to cost cutting for survival if VAT is not lowered. The migration of diesel sales to neighbouring states and its smuggling into the city from these states has led to a massive drop in sales, and thus revenue.

Demand

Consumption of petroleum products was estimated at 11.8 mt in June, which is 88 percent of the level seen a year ago, indicating that economic activity was limping back towards normalcy. In June, petrol consumption is estimated to have reached 85 percent of last year’s level, while diesel was at 82 percent. The sales of petroleum products in India, the world’s third-biggest oil consuming nation, had in April fallen to the lowest since 2007, due to the nationwide lockdown, necessitated to prevent the spread of Covid-19 pandemic. At 11.8 mt of consumption, fuel demand in June was 88 percent of 13.4 mt consumption in June 2019. Petrol consumption of 2 mt in June was 85 percent of last year’s levels, while diesel at 5.5 mt was 82 percent of normal levels. Sales for petrol, diesel, jet fuel and cooking gas rose a combined 16 percent in June from May as the lockdown restrictions eased in the country but were still 14 percent lower than the sales in the same month last year. The demand for diesel, which makes up 40 percent of the country’s total oil demand, was 20 percent higher in June than May, indicating increased long-haul transportation and rising economic activity. The sales, however, were still 17 percent less than in June 2019. Petrol sales soared 36 percent in June from May but were 15 percent lower than the year-ago period. Jump in consumption of petrol, mostly used by cars and bikes for shorter distances, means more people came out of their homes and drove to their workplaces in June. The demand for jet fuel is also returning, albeit slowly, with the resumption of domestic flights. Jet fuel sales in June rose 83 percent over May but were down 67 percent from a year ago. The demand for cooking gas, or the LPG fell 9 percent from May but was up 17 percent from June last year.

Production

Domestic crude oil production contracted 6 percent and natural gas output fell 12 percent in June from a year earlier. Crude oil production fell to 2,527 thousand metric tonnes in June as the Coronavirus pandemic compounded problems for India’s ageing fields whose output have been declining for years. Decline in output from fields operated by ONGC was just 1 percent while for the fields operated by Oil India Ltd and the private sector was almost 10 percent and 16 percent, respectively. Underperformance of wells, delayed oilfield enhancement plans and general disruption caused by the pandemic contributed to a decline in oil production. Refineries processed 13.6 percent less crude in June from a year earlier. State-run refiners processed 9.2 percent less crude than last year while private refiners processed 16 percent less crude.

Imports

At least in the oil sector, the global health emergency caused by coronavirus is coming to India’s advantage. While the severe demand squeeze due to the pandemic helped India save on oil imports, low global crude prices could help it further in reducing sharply the import bill. Declining consistently since April, India’s oil imports fell about 29 percent (year-over-year) to around 13.44 mt in June, the lowest since October 2011. In value terms, the June oil imports stood at $4.93 bn (₹373.41 bn), down 55.29 percent in the dollar terms from $11.03 bn (₹765.86 bn) in June 2019. In April, it fell to 16.55 mt, a 16 percent year-over-year decline, from 17.28 mt reported earlier. In May, crude oil imports fell 22.6 percent, the biggest drop since at least 2005, to 14.61 mt against the year-ago month. If the trend continues, crude oil imports in FY21 may fall to 180 mt, 50 mt lower than 227 mt imported in FY20. At current prices, the value of this 50 mt will be around $20 bn. Moreover, India may further reduce its oil import bill with crude oil prices remaining low or range-bound around $35-45/barrel in FY21. India has already reduced oil import bill by over 60 percent in the first quarter (April-June) of FY21. According to the PPAC of the oil ministry, imports stood at around 227 mt in FY20 against 226.5 mt in FY19. The import bill last year was $101.4 bn against $111.9 bn in FY19. India’s oil imports fell in June, hitting their lowest since October 2011, as refiners curbed purchases due to maintenance turnarounds and weaker fuel demand. India, the world’s third biggest oil consumer and importer, received 3.2 mn bpd oil in June, a decline of 0.4 percent from May and about 28.5 percent from a year ago, the data showed. India did not import oil from Venezuela for the first time since June 2009, data showed. Refiners including IOC, the country’s top refiner, RIL, operator of the world’s biggest refining complex, and BPCL plan to shut units for maintenance. Indian fuel consumption, a proxy for oil demand, typically tapers during the four-month monsoon season from June as rains hit construction and transportation. In the first of half July, India’s fuel demand slowed compared with the previous month due to high retail prices and renewed coronavirus lockdowns in parts of the country. RIL will load its first cargo of Venezuelan crude in three months in exchange for diesel under a swap deal the parties say is permitted under the US sanctions regime on the Latin American country, according to RIL and a shipping document from state oil firm PDVSA. RIL gave the US State Department and the Office of Foreign Assets Control notice of the diesel swap and received word back that the policies that allowed the transaction were still in place. RIL has previously said that its supplies of fuel to PDVSA in exchange for crude were permitted under sanctions. An oil tanker named Commodore would load the cargo of crude in Venezuela and ship it to India. The Commodore is loading a 1.9 mn barrel cargo of crude for RIL at Venezuela’s main oil port of Jose, according to an internal PDVSA cargo schedule. RIL has a swap deal to provide diesel to Venezuela in exchange for fuel, but has not received a cargo of crude since April. Indian refiners planned to wind down their purchases of Venezuelan oil to avoid any problems with supply due to sanctions.

LPG

The price of subsidised cooking gas or LPG rose by an average of just less than ₹10/cylinder per month in the July-June 2019-20 period, taking the price of common man’s fuel closer to market rates. What this has done is to stop consumers receiving any subsidy in their accounts for buying domestic LPG cylinders at market rates for the past three months, believing low oil prices in the market has eliminated the need for the subsidy. But had oil companies refrained from consistently raising the price of subsidised cooking gas as well, from a level of ₹494.35/cylinder in July last year to ₹594 now, a 14.2 kg domestic LPG cylinder price would have been more than ₹100 cheaper, providing relief to consumers during the Covid-19 pandemic. Under the direct benefit transfer scheme (DBT), the government provides subsidy on 12 cylinders a household uses in a year. While consumers buy cooking gas at market rates, the calculated subsidy amount is transferred directly into their accounts. The current price of subsidised LPG cylinder is around ₹594, the same rate as LPG cylinder prices prevailing in the market. According to an analysis done by Emkay Global, oil companies' under-recovery in case of kerosene has come to a naught since March while that for LPG has become zero from May. Due to Covid-19 pandemic, the government is providing three free LPG cylinders to all below poverty line families who are subscribers of cooking gas under Ujjwala scheme. But other customers are now paying full amount for the cylinder without getting any subsidy support from the government. The government has allocated ₹409.15 bn as petroleum subsidy for FY21, a 6 percent increase from ₹385.69 bn allocated for the last fiscal. Out of this, the allocation for LPG subsidy has been increased to ₹372.56 bn for current year. But so far, government had to draw very little from subsidy provisions. The good news is that with the developments in past few months, the government had completely eliminated the oil subsidy and spent the savings on other welfare activities. But this could mean that if there is any spike in LPG prices henceforth, the government may pass a portion of the burden on consumers by raising LPG prices. Over 100 mn free LPG were supplied to poor households under the government’s Covid-19 relief package between April and June by HPCL. As the Covid-19 pandemic is still continuing and normal work is taking time to resume to full capacity, the government has extended the period of availing the free LPG benefits until September. State-run e-governance entity CSC e-Governance Services Ltd launched 2,000 LPG supply centres in rural India in collaboration with BPCL. CSC has exclusively tied up with BPCL for this service where villagers will be able to book new LPG connections.

Refining

Indian refiners are cutting crude processing and shutting units for maintenance as local fuel demand falls and global refining margins are weak. Fuel demand in Asia’s third largest economy had been rising since May from historic lows in April, when a nation-wide lockdown to stem the spread of the novel coronavirus was enforced. In July, however, local demand growth has slowed because of high fuel prices, renewed lockdown in parts of the country and as monsoon rains hit transport, industrial and construction activity. BPCL is operating its three refineries at about 70 percent capacity compared to about 90 percent in early June. India’s August crude processing will decrease further as the country’s top refiner IOC, RIL and BPCL among others are shutting units for maintenance during this low demand period. Indian refineries’ crude throughput fell by an annual 13.6 percent in June compared with a 29 percent decline in April. In contrast China’s daily crude oil throughput in June climbed by 9 percent from a year earlier to a record high. Indian refiners are also reducing run rates as the export market is not attractive and rising fuel exports from China are likely to increase the pressure on Asian refining margins. Refinery runs of IOC’s subsidiary Chennai Petroleum Corp, which is operating at about 50 percent capacity, are matched to product demand, which is fluctuating, and exports are not economically viable. Indian state refiners’ petrol and diesel sales declined in the first half of July from the same period last month as a renewed lockdown in parts of the country and rising retail prices hit demand. Fuel demand growth in India, the world’s third-biggest oil importer and consumer, plunged to historic lows in April when the federal government imposed a country-wide lockdown. State-refiners’ diesel sales, which account for two-fifth of overall refined fuel sales in India, fell by 18 percent to 2.2 mt in the first half of July from the same period in June, and by about 21 percent from a year earlier, according to IOC data. State companies - IOC, HPCL and BPCL - own about 90 percent of India’s retail fuel outlets. Indian fuel demand had gathered pace from May when the lockdown was partly eased. But a spike in cases of coronavirus infection has led to authorities imposing fresh lockdowns and designating new containment zones in several states, including the largely rural Bihar in the east and the southern tech hub Bengaluru. State companies’ sales of petrol fell 6.7 percent to 880,000 tonnes in the first half of July from the same period in June, and by about 12 percent from a year earlier. India’s overall refined fuel demand includes consumption of fuel oil, bitumen and LPG. State retailers sold 6.5 percent more LPG in the first half of July from a year ago, at about 1.075 mt.

IOC, the country’s top refiner, will continue to operate its refineries below capacity in 2020/21 as it sees local and overseas fuel demand remaining subdued. IOC, along with its unit Chennai Petroleum, controls about a third of India’s 5 mbpd refining capacity. Refinery runs have declined to about 75 percent from 93 percent in early July on low fuel demand. The operations are expected to remain at 70-75 percent for the remainder of the fiscal year through March 2021. Indian refiners are cutting crude processing and shutting units for maintenance as local fuel demand falls and global refining margins are weak. IOC has shut its 300,000 bpd Pardip refinery on the east coast for maintenance and has plans to shut some units its 274,000 bpd Koyali refinery in the west for repairs this fiscal year. Indian refiners are also reducing run rates as the export market is not attractive and rising fuel exports from China are likely to increase the pressure on Asian refining margins. To boost revenue IOC would look at maximising petrochemicals production at its refineries. BPCL plans to restart a 200,000 bpd crude unit at its 310,000 bpd Kochi refinery in southern India by end of this month after a three-week maintenance shutdown. The shutdown of the crude unit and some secondary units at Kochi started earlier this month after the company restarted a 156,000 bpd crude unit at its Bina refinery in central India. BPCL had shut the crude unit at the Bina refinery for about three weeks from the second week of June for routine maintenance. Bina has only one crude unit. BPCL’s Bina refinery operated at about 60 percent of its installed capacity in June. BPCL plans to shut a continuous catalytic reformer at its Mumbai refinery in western India for about three weeks from 1 August. RIL operator of the world’s biggest refining complex in western Gujarat, will shut one of its crude refining units at its export-focused plant in the fourth week of July for 3-4 weeks of maintenance. Other Refinery units are expected to operate normally during this period. RIL has two equal-size crude distillation units at the 704,000 bpd export-focused refinery. This refinery at the Jamnagar complex is adjacent to a 660,000 bpd plant that mostly meets local fuel demand.

Retailing

RIL plans to increase its network of aviation fuel stations by 50 percent as it looks to capture greater market share in the business currently controlled by public sector oil retailing firms. RIL recorded double-digit growth observed over 52 consecutive months might have been stalled due to the Covid-19 pandemic, but India continues to be one of the fastest growing aviation markets in the world for the fifth consecutive year. RIL, which operates the world’s largest single location oil refining complex, plans to capture this opportunity through increased presence at airports to refuel airplanes. India currently has 256 aviation fuel stations, with state-owned IOC owning 119 of them. BPCL has 61 and HPCL the remaining 44. RIL is the largest private aviation fuel retailer with 31 stations, according to the latest data from the oil ministry. In comparison, RIL’s auto fuel retailing network is very small. Out of 69,392 petrol pumps in the country, RIL operates 1,398. IOC has the highest number of outlets at 29,208, followed by HPCL with 16,557 and BPCL with 16,309 petrol pumps. RIL registered 9.8 percent growth in retail diesel sales and 14.7 percent in retail petrol volume as compared with 1.5 percent and 6.3 percent for industry, respectively. During financial year 2019-20, RIL registered over 10 percent growth in average outlet sales volume. On bulk diesel, RIL registered a volume growth of 10.8 percent, increasing market share to 8.8 percent, despite expected demand contraction and margin pressure.

Policy & Governance

The Union Cabinet approved extension of Employees’ Provident Fund support for small businesses and workers earning up to ₹15k till August. The decision has been taken to facilitate a higher take-home salary for employees and help employers make the statutory contribution. The extension of the benefit will provide relief to nearly 370,000 establishments and 7.22 mn employees. The Centre has estimated total expenditure of ₹48.60 bn for this. It will pay both the 12 percent employees’ share and the 12 percent employers’ share under EPF. The Centre allowed 74 mn poor women to avail of three free LPG cylinders till September. Earlier, it had allowed them to get this quota between April and June. Cairn Oil & Gas has trimmed its workforce by about 300, nearly a fifth of its employees, primarily by laying off people as low oil prices hit India’s largest private oil producer. Cairn, a unit of mining baron Anil Agarwal’s Vedanta, laid off hundreds of employees in the last week of June, mostly from non-critical functions. This has brought down Cairn’s employees count to 1,400 from 1,700 previously. Cairn, which contributes about a quarter of India’s oil output, is facing a double whammy of declining production and a slump in oil prices. Its oil and gas production fell 14 percent year-on-year in the fourth quarter as it struggles with ageing fields. Oil and gas revenue fell 24 percent year-on-year during the quarter. A dramatic fall in oil prices that began in March has hurt Cairn and other oil producers. Prices had fallen to under $20/barrel in late April but have now recovered to $40 but are still way below $66 at the beginning of the year.

Markets regulator SEBI is looking at permitting futures trading in petrol and diesel, emphasising that there has been no disruption in commodities derivatives trading during the Covid-19 crisis. Currently, futures trading is allowed in crude oil. Petrol and diesel are, among others, the two major refinery products derived from crude oil. Earlier too, there was an industry demand to allow futures trade in these two petroleum products. SEBI had sent the proposal to the petroleum ministry.

Overseas Ventures

IOC has agreed to form an equal joint venture with Bangladesh’s Beximco LPG to set up a terminal to import LPG in Bangladesh. IOC’s Dubai unit IOC Middle East FZE and Beximco’s holding company RR Holdings Ltd, Ras Al Khaimah, UAE have signed an agreement for LPG business in Bangladesh. The joint venture intends to diversify into other downstream oil and gas businesses such as lube blending plant, LNG, petrochemicals, LPG export to north east India through pipeline between two nations and renewable energy.

Rest of the World

Global Price Trends

Oil prices rose, lifted by some supportive economic data, but tensions between the United States and China limited gains. So far, energy companies have been no evacuations of workers or shutdowns of production from offshore platforms in the northern Gulf of Mexico. Oil prices could see a near-term correction if a recovery in fuel demand slows further, especially in the US according to Barclays Commodities Research. Still, the bank lowered its oil market surplus forecast for 2020 to an average of 2.5 mn bpd from 3.5 mn bpd previously. Oil prices offered up a mixed market snapshot, with Brent crude edging higher, supported by tighter supplies, while US benchmark WTI futures dropped on concern that a spike in coronavirus cases could curb oil demand in the US. The implied volatility for Brent crude has dropped to the lowest since prices started collapsing in March as some in the market remain focused on tightening supplies as production by the OPEC fell to its lowest in decades with Russian output dropped to near targeted cuts. OPEC and allies including Russia, collectively known as OPEC+, have pledged to slash production by a record 9.7 mn bpd for a third month in July. After July, the cuts are due to taper to 7.7 mn bpd until December. US production, the world’s largest, is also falling. The number of operating US oil and natural gas rigs fell to an all-time low for a ninth week, although the reductions have slowed as higher oil prices prompt some producers to start drilling again.

Global Demand Trend

Global oil demand will soar by a record 7 mn bpd in 2021 as the global economy recovers from the coronavirus crisis but will remain below 2019 levels, according to OPEC. It was the first report in which OPEC assessed oil markets next year. OPEC forecast assumed no further downside risks materialised in 2021 such as US-China trade tensions, high debt levels or a second wave of coronavirus infections. Oil prices collapsed this year after global demand fell by a third when governments imposed lockdowns to stop the spread of the virus. In 2020 oil demand would drop by 8.95 mn bpd, slightly less than in last month’s report. OPEC expects to cover the lion’s share of the massive projected demand spike in 2021 with demand for its crude rising by 6 mn bpd to reach 29.8 mn bpd. From May 2020, OPEC and allies led by Russia have been cutting output by nearly 10 mn bpd, or a 10th of global demand, to help prop up oil prices. Output in countries such as the US, Norway and Canada has also fallen, although they are not part of the OPEC+ agreement on output cuts. OPEC expected non-OPEC oil supply in 2020 to fall by 3.26 mn bpd and rise by just 0.92 mn bpd in 2021. The Paris-based IEA bumped up its 2020 oil demand forecast but warned that the spread of Covid-19 posed a risk to the outlook. The IEA raised its forecast to 92.1 mn bpd, up 400,000 bpd from its outlook last month. The easing of lockdown measures in many countries caused a strong rebound to fuel deliveries in May, June and likely also July. But oil refining activity in 2020 is set to fall by more than the IEA anticipated and to grow less in 2021. Demand in 2021 will likely be 2.6 mn bpd below 2019 levels, with kerosene and jet fuel due to a drop in air travel accounting for three-quarters of the shortfall.

OPEC

OPEC slashed oil production to the lowest level since the Gulf War in 1991, as it escalated efforts to revive global markets just as a resurgence of the coronavirus is threatening demand again. Saudi Arabia faithfully delivered the extra curbs promised in June, and the laggards, though still trailing in implementing the cuts, stepped up their performance, according to the survey. OPEC and its partners’ record output cuts since May have helped revive the oil market, but a recent surge of Covid-19 infections in countries including the US is highlighting the fragility of the revival. The OPEC cut production by 1.93 mn barrels a day to 22.69 mn a day, according to the survey. That’s the lowest since May 1991, though membership changes since then affect the comparison. The survey is based on information from officials, ship-tracking data and estimates from consultants including Rystad Energy A/S, Rapidan Energy Group, JBC Energy GmbH and Kpler SAS. OPEC member Algeria, facing financial pressure after a fall in energy revenue, will launch a new economic plan to reduce reliance on oil and gas and give the private sector a greater role. The government is committed to reform the oil-reliant economy by developing the non-energy sector and seeking new funding sources. A further drop in oil and gas earnings during the coronavirus pandemic forced the government to cut public spending and delay planned investment projects in sectors including energy. The OPEC and allies, known as OPEC+, began a record supply cut in May to bolster oil prices hammered by the coronavirus crisis. Iraq is cutting output by 1.06 mn bpd under the deal. The July figures imply Iraq is still some way from fulfilling its pledges and is exporting far more than a July loading programme indicated. Iraq had told OPEC+ it would make up for over-production in May and June through larger cuts in later months. The south is the main outlet for Iraq’s crude, so a good part of its OPEC+ cut should show up in lower exports.

USA

US crude oil output from seven major shale formations is expected to decline by about 56,000 bpd in August to about 7.49 mn bpd, the lowest in the two years. The EIA projected the biggest decline would be in the Eagle Ford in Texas where output will slide about 23,000 bpd to 1.1 mn bpd, the lowest since August 2017. Output from the Bakken in North Dakota and Montana is the only region forecast to see increases. Production there plunged by more than many other parts of the country earlier this year as oil prices collapsed after the coronavirus pandemic eroded global fuel demand.

Middle East & Africa

Iran has slashed crude oil production to its lowest level in four decades as storage tanks and vessels are almost completely full due to a fall in exports and refinery run cuts caused by the coronavirus pandemic, industry data showed. Total onshore crude stocks surged to 54 mn barrels in April from 15 mn barrels in January, and swelled further to 63 mn barrels in June, according to FGE Energy. Market intelligence firm Kpler estimated Iranian average onshore crude storage for June to be around 66 million barrels. Iran’s floating storage is also filling up. Iran was estimated to be using in the region of 30 tankers to store oil – most of them supertankers, each of which can carry a maximum of 2 mn barrels of oil. Refinitiv data showed a maximum of 56.4 mn barrels were being held in floating storage by 3 July. Iran’s fleet of crude oil tankers numbers 54 vessels, data from valuations specialist VesselsValue showed. The oil ministry is trying to manage crude stocks by shutting more production. Iran’s total liquid production - including crude oil, condensate and natural gas liquids - fell from 3.1 mn bpd in March to 3 mn bpd in June, according to FGE. The firm predicts the production will fall by another 100,000 bpd in July. Crude production was as low as 1.9 mn bpd in June, according to OPEC survey. That was almost half of Iran’s production in 2018, and the lowest level since 1981, the beginning of Iran’s war with Iraq and attacks on its oil facilities, according to OPEC data. Iranian exports also fell to new lows as an oversupplied market and the coronavirus pandemic made it harder for Tehran to find customers willing to take its sanctions-hit oil. Iran is determined to develop its oil industry in spite of US sanctions imposed on the country. A $294 mn contract is to be signed between the National Iranian Oil Company and Persia Oil & Gas, an Iranian firm, to develop the Yaran oilfield that is shared with neighbouring Iraq’s Majnoon field. The agreement aims to produce 39.5 mn barrels of oil from the Yaran oilfield in Khuzestan province in southwestern Iran. Hit by reimposed US sanctions since Washington exited Iran’s 2015 nuclear deal in 2018, Iran’s oil exports are estimated at 100,000 to 200,000 bpd, down from more than 2.5 mn bpd that Iran shipped in April 2018. The Islamic Republic’s crude production has halved to around 2 mn bpd. Iraq’s crude oil exports have increased so far in July, according to shipping data and industry sources, suggesting OPEC’s second-largest producer is still undershooting its pledge in an OPEC-led supply cut deal. Southern Iraqi exports in the first 20 days of July averaged 2.70 mn bpd, according to the average of figures from Refinitiv Eikon. Saudi Arabia’s state oil producer Aramco has hiked OSPs for its crude to Asia by $1/barrel in August, and raised the OSPs for almost all grades to Europe and the US. Saudi Arabia has set the August price to Asia at plus $1.20/barrel versus the Oman/Dubai average.

China

China’s crude oil imports from Saudi Arabia rose 15 percent in June from a year ago, as refiners ordered record volumes of the fuel in March and April when oil prices tumbled, cementing the kingdom’s position as the top oil supplier to China. Imports from Saudi Arabia rose to 8.88 mt in June, or 2.16 mn bpd, in June, according to data from the General Administration of Customs. The record imports follow a price war between Saudi Arabia and Russia, the world’s top oil exporters, during March and April when the coronavirus pandemic dampened demand and caused a global fuel glut. Shipments from Russia were at 7.98 mt, or 1.95 mn bpd, up around 7 percent from 1.82 mn bpd in May and 1.73 mn bpd in June 2019. Saudi, however, delivered bigger oil cuts from June and raised crude prices as a plunge in oil prices weighed on the kingdom’s budget. China is expected 778to see another record amount of crude imports in July as some May-loading cargoes are still underway while swelling oil inventory at major Chinese ports slows new arrivals. China’s diesel exports in June fell by 50 percent from a year earlier to the lowest since September 2018 as lockdown measures around the world to halt the coronavirus pandemic continued to curb fuel demand. China exported 1.04 mt of diesel, versus 1.45 mt in May and 2.07 mt in June 2019, data from the General Administration of Customs showed. Gasoline exports were 760,000 tonnes last month, up from a 14-month low of 680,000 tonnes in May. China, the world’s second-largest oil user, has slashed refined fuel exports since May as refiners turned to the domestic market, where fuel demand has rapidly recovered because of easing coronavirus restrictions. However, with crude oil refining output rising to a record in June while gasoline and diesel consumption is plateauing, refiners will have a hard time finding markets to absorb excess oil products. The Chinese summer season, which starts in late June and ends in early September, is typically a slack time for diesel demand as construction projects slow amid heatwaves and fishing activities are suspended. China’s jet kerosene exports in June dropped 38 percent from a year earlier to 770,000 tonnes, compared to 560,000 tonnes in May, customs data showed.

S America

Mexico’s state oil company Pemex and a private consortium led by US-based Talos Energy Inc have been instructed to come to an agreement detailing how they will jointly develop a large offshore oil find. The formal instruction from the energy ministry follows a determination that the Zama discovery made in the Talos-operated block in the Gulf of Mexico extends into Pemex’s neighbouring block. Discovered in 2017, Zama is believed to contain nearly 700 mn barrels of oil, making it the biggest new find in Mexico notched by a private company in decades. Prior to a landmark 2013 overhaul of Mexico’s oil sector, which ended Pemex’s longstanding monopoly, only the state-run firm was legally allowed to explore for and develop oil and gas projects in the country. Pemex and Talos Energy have 120 working days to present a unification agreement to jointly develop the Zama reservoir in a way that would maximize its value. Mexico has asked top Wall Street banks to submit quotes for its giant oil hedging program, while trading in crude oil options has increased ahead of the megadeal. Every year, Mexico buys as much as $1 bn in financial contracts, the world’s largest oil hedge program, to protect its oil revenues. Bankers and officials on both sides of the deal expect a smaller hedge this year because the options used to protect oil profits are more expensive than last year. The oil market crashed earlier this year, with the US crude benchmark falling to negative-$40/barrel in April. It was trading around $43.

Canada

Western Canadian oil companies are moving to restore all of the production that they shut in as the novel coronavirus spread, due to improving prices according to Canada’s second-biggest producer Suncor Energy. Alberta, the main oil-producing province, curtailed some 1 mn barrels of crude per day this spring - about 20 percent of Canada’s output - as lockdowns to curb the spread of the virus crushed demand for gasoline and jet fuel.

Russia

Russia’s Gazprom Neft, the oil arm of gas giant Gazprom, has shipped its first cargo with Arctic oil to China via the NSR. Russia is betting on the NSR, an Arctic route requiring icebreakers and special ice-class tankers, to deliver cargoes both to Europe and Asia. Gazprom Neft took 47 days to deliver a cargo with 144,000 tonnes of light Novy Port oil grade to the Chinese port of Yantai on the Bohai Sea from Russia’s north-western city of Murmansk. Before the landmark delivery of Novy Port oil, extracted on the Yamal peninsula in Russia’s Arctic, Gazprom Neft, the country’s third biggest oil company by output, was already using the NSR for exports to Europe. Combined with its second Arctic oil field, Prirazlomnoye in the Pechora Sea, Gazprom Neft has shipped over 40 mt of Arctic oil to Europe since 2013. A new Russian legislation requires companies involved in oil production or handling other hydrocarbons to have adequate resources for a contingency plan in the case of a spill. In late May, a fuel tank at a power station in the Arctic city of Norilsk leaked 21,000 tonnes of diesel into rivers and subsoil, an incident that the environmental campaign Greenpeace compared to the 1989 Exxon Valdez oil spill. According to the Kremlin has the new legislation is aimed at preventing similar spills.

Australia

A coronavirus-driven collapse in fuel demand is threatening Australia’s oil refining industry, just as supply chain disruptions wrought by the pandemic have focused the government on the need to shore up fuel security. Already dependent on imports for more than half its fuel needs after the closure of four refineries since 2003, industry and analysts say at least one of the country’s four remaining refineries could close unless the government steps in. Pandemic lockdowns decimated demand for gasoline, jet fuel, diesel and shipping fuel, hitting refiners that only recently enjoyed a return to profitability after years in the red. As well as seeking proposals to build fuel storage, the government is in talks with the industry on how to shore up the refineries, aiming to “protect Australia’s national sovereignty”.

Oil Majors

Chevron Corp will buy oil and gas producer Noble Energy Inc for about $5 bn in stock, the first big energy deal since the coronavirus crisis crushed global fuel demand and sent crude prices to historic lows. The oil price crash has decimated shares of many energy companies, making them attractive targets for those that have weathered the downturn and have the resources to buy. Chevron ended the first quarter with a cash pile of $8.5 bn after withdrawing a $33 bn bid for Anadarko last year and then being among the first big oil companies to slash spending during the downturn. The deal makes Chevron the first oil major to enter Israel. BP delivered 3 mn barrels of Iraqi oil to the Shanghai International Energy Exchange (INE), becoming the first major global trader to make a physical delivery since China launched the futures market in 2018. BP delivered 3 mn barrels of Iraqi oil Basra Light into an INE storage facility in east China’s Shandong province. BP is set to deliver another 1 mn barrels of Abu Dhabi Upper Zakum crude under an August contract. Mercuria is set to send 1 mn barrels of Upper Zakum crude for August and another 1 mn barrels for September. The INE crude contract is one of a handful Chinese futures products open for direct foreign participation, as the world’s top commodities consumer seeks greater influence over pricing. China’s June crude oil imports jumped by a third from a year earlier, setting a second straight monthly record, as cheap cargoes bought during April’s oil price crash arrived at Chinese ports. Crude delivered into INE storage are also counted as imports.

| VAT: Value Added Tax, mt: million tonnes, LPG: liquefied petroleum gas, ONGC: Oil and Natural Gas Corp, FY: Financial Year, PPAC: Petroleum Planning & Analysis Cell, IOC: Indian Oil Corp, RIL: Reliance Industries Ltd, BPCL: Bharat Petroleum Corp Ltd, US: United States, kg: kilogram, DBT: direct benefit transfer, HPCL: Hindustan Petroleum Corp Ltd, bpd: barrels per day, EPF: Employees’ Provident Fund, UAE: United Arab Emirates, LNG: liquefied natural gas, WTI: West Texas Intermediate, mn: million, bn: billion, OPEC: Organization of the Petroleum Exporting Countries, IEA: International Energy Agency, EIA: Energy Information Administration, OSPs: official selling prices, NSR: Northern Sea Route |

NATIONAL: OIL

BPCL launches GoDigital campaign to popularize online refill booking facilities

10 August. Bharat Petroleum Corp Ltd (BPCL) has launched a major campaign in Andhra Pradesh (AP) and Telangana as part of a nationwide awareness program to popularize its digital initiatives in its fight against the Covid-19 pandemic. The customers can now book a cylinder by giving a missed call on 7710955555. An SMS with payment link will be sent to the phone from which the missed call is given. This facility is aimed at encouraging rural customers to use online refill booking system, according to the company. The company which serves over 52 lakhs consumers in the two Telugu states - 26.83 lakhs in Telangana and 25.77 lakhs in AP - delivering over 40,000 cylinders per day, has launched various online refill booking facilities such as Whatsapp, Bharatgas mobile app, website and ebharatgas.com and payment options through all payment gateways. In addition to various online refill booking methods, the company has recently launched WhatsApp booking and payments through a dedicated number and features like instant price information, LPG (liquefied petroleum gas) delivery tracking, safety awareness video and customer feedback have been added.

Source: The Economic Times

Pachpadra refinery will be built on time: Rajasthan government

10 August. Work on the ₹431.23 bn refinery at Pachpadra may have stalled due to lockdown, but with a little over two years left to meet the deadline for completion of the project, now there is a race to accelerate construction activities. Before the Covid outbreak, 3,800 people were working on the site, but as of now the workforce has gone up to 5,000, the petroleum department after a review meeting of the project said. The department said the joint venture company HPCL Rajasthan Refinery Ltd (HRRL) has fast-tracked development of various projects of the refinery to make up for the lost time. The original deadline of completing the refinery was fixed for October 2022, which now looks within reach, while commercial operation is expected to start from March 2023. A survey for laying 540 kilometre (km) long pipeline from Mandvi port in Gujarat has been completed. As per the plan, HRRL would import 7.5 million tonnes (mt) Arab mix crude oil which will be stored in a tank at Mandvi from which, it will come to the Pachpadra refinery through the pipeline. Additionally, the 9 mt refinery will get 1.5 mt crude oil from Rajasthan, mostly from Cairn.

Source: The Economic Times

NATIONAL: COAL

India’s coal import drops 43 percent in July owing to high stockpile at pitheads, plants

10 August. India’s coal import fell 43.2 percent to 11.13 million tonnes (mt) in July this year on account of high stockpile of the dry fuel at pitheads, plants and ports. The country had imported 19.61 mt of coal in July 2019, according to a provisional compilation, by mjunction services limited, based on monitoring of vessels' positions and data received from shipping companies. During April-July 2020, total coal imports were recorded at 57.27 mt, which is 35.76 percent lower than 89.15 mt imported during April-July 2019, it said. During April-July 2020, non-coking coal imports stood at 38.84 mt as compared to 60.97 mt imported in the corresponding period last year. The government had earlier mandated state-owned Coal India Ltd (CIL), which accounts for over 80 percent of domestic coal output, to replace at least 100 mt of imports with domestically-produced coal in 2020-21. CIL had said that coal production in some of the major mines is still affected due to high stock and less offtake. The Centre had earlier asked power generating companies, including NTPC Ltd, Tata Power and Reliance Power, to reduce import of the dry fuel for blending purposes and replace it with domestic coal. Prime Minister Narendra Modi had also given directions to target thermal coal import substitution, particularly when huge coal stock inventory is available in the country this year. Coal Minister Pralhad Joshi had earlier written to state chief ministers asking them not to import coal and take domestic supply from CIL, which has the fuel in abundance. The country’s coal imports increased marginally by 3.2 percent to 242.97 mt in 2019-20.

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Consumer charter to provide 24x7 power is a welcome development!

< style="color: #ffffff">Good! |

Source: The Economic Times

CIL revises production target for 2020-21 to 650-660 mt

8 August. Coal India Ltd (CIL) has revised its production target to 650-660 million tonnes (mt) for the current fiscal in the wake of the disruptions caused by the Covid-19 pandemic, the company said. The miner had earlier set a production target of 710 mt for the 2020-21 fiscal. The miner is witnessing a 7-8 percent growth in demand in August. The Maharatna PSU (Public Sector Undertaking) had produced 602 mt of coal last year as against a target of 630 mt.

Source: The Economic Times

India’s Adani not interested in domestic coal mine auctions: CFO

6 August. India’s largest coal mining services provider and trader Adani Enterprises Ltd is not interested in participating in the country’s first ever coal mine auctions for the private sector, Chief Financial Officer (CFO) Jugeshinder Singh said. Indian Prime Minister Narendra Modi in June opened up coal mining without end-use restrictions and provided financial incentives to attract investment in India, which has the world’s fourth largest coal reserves. When asked to comment on these coal mining reforms and if Adani would participate in domestic auctions for coal mines, CFO said he would restrict participation to mining services. Adani Group’s position highlights the struggles of the global coal sector, which has been battered by low prices and falling demand. It also highlights challenges India - the world’s second biggest coal market after China - will face in attracting private sector investors into coal as it attempts to become a net exporter.

Source: Reuters

NATIONAL: POWER

Cabinet to okay new Consumer charter to provide 24x7 power

10 August. The Government proposes to bring in regulations that will give rights to the consumer to seek 24x7 electricity supply in their homes and provide them compensation for any deviation from the stated goal. A consumer charter has been introduced in the new tariff policy that has been finalised by the power ministry that clearly mandates role and responsibility for power distribution companies and states the rights of consumers. The new tariff policy with added consumer charter has been placed for approval of the Cabinet by the ministry. Once approved, the subordinate legislation would be placed in Parliament before it becomes operational bringing under its ambit state discoms (distribution companies) over performance of providing 24x7 power to consumers. The new charter would specify interruptions in power supplies due to load shedding. For every load shedding that is unscheduled or stretches beyond a cut off time, consumers would be compensated by the discoms. The compensation would be in the form of a credit that will be made into the consumers account with discoms so that this credit is used when paying the next electricity bill. Government is carrying forward two major reform in the power sector. One that will come through the tariff policy while the other through a new Electricity Act. The aim of both regulations is to create a competitive power market where suppliers, distributors and consumers -- all gain.

Source: The Economic Times

AAP protests power bills in front of Maharashtra Energy Minister’s house

10 August. A large number of activists from the Aam Admi Party (AAP) staged a dharna opposite the residence of Maharashtra Energy Minister Nitin Raut, protesting astronomical summer power bills. The main demands of the activists were waiving power bills up to 200 units per month, and cancelling the power tariff hike imposed by Maharashtra Electricity Regulatory Commission (MERC) from 1 April. The activists said that earnings of most people had reduced drastically due to the lockdown and they were in no position to pay such high bills. The Arvind Kejriwal-led government in Delhi had waived power bills to give relief to common citizens. AAP has collected 10,000 signatures on a petition demanding reduction of power bills and sent it to Maharashtra Chief Minister Uddhav Thackeray.

Source: The Economic Times

NTPC Group achieves 100 bn units power generation mark

9 August. NTPC Ltd said it has achieved 100 bn units of cumulative power generation mark during the ongoing fiscal. NTPC Group has a total installed capacity of 62.9 GW. According to the Central Electricity Authority data, 2600 MW NTPC Korba plant in Chattisgarh has emerged as the top performing thermal power plant with 97.42 percent plant load factor between April 2020 and July 2020, it said. With a total installed capacity of 62.9 GW, NTPC Group has 70 power stations comprising 24 Coal, seven combined cycle gas/liquid fuel, one hydro, 13 renewables along with 25 subsidiary and joint venture power stations.

Source: The Economic Times

Power discoms launch schemes for replacement of ACs in Delhi

8 August. Residents of south, west, east and central Delhi can now exchange their old air-conditioners with new energy-efficient, five-star rated ACs at a discount of up to 64 percent. Consumers can save over 1,000 units annually if they use energy-efficient air-conditioners. Power discoms (distribution companies) BSES Rajdhani Power Limited (BRPL) and BSES Yamuna Power Ltd (BYPL) have re-launched a limited period 'AC replacement schemes' in partnership with leading air conditioner manufacturers. Under the scheme, both window and split ACs of leading brands are on offer on a first-cum-first-serve basis. A domestic consumer will be eligible to buy a maximum of three ACs against a unique CA number.

Source: The Economic Times

Offer rebates to get faster payments: UP to private power plants

6 August. Uttar Pradesh (UP) proposes to conduct unique online auctions among power plants under which companies which propose to offer higher rebates in dues will get faster repayment. The move has come as a surprise to the power industry as this will be the first time the power plants will make bids to get payments for power supplied to the state. The payments are being done through loans being provided by Power Finance Corp and REC Ltd under the Centre’s ₹900 bn liquidity infusion package under Atma Nirbhar scheme. Under the scheme, the payments to power generators are made directly by PFC and REC but state distribution utilities guide the financial institutions.

Source: The Economic Times

Average spot power price down 27 percent to ₹2.47 per unit in July on IEX

5 August. The average spot power price in day ahead market dipped 27 percent to ₹2.47 per unit in July as compared to the year-ago period on the Indian Energy Exchange (IEX). The day ahead market (DAM) traded 4,487 mn units during the month, IEX said. The attractive price continued to ensure significant savings to distribution companies and industries during this time. The electricity market at IEX witnessed a total trade of 5,334 mn units in July 2020. The volume traded in July 2020 registered an increase of 11 percent over the previous month and remained at par with the volume traded in the year-ago period, while the national electricity consumption and peak demand saw 3 percent decline, it said. The distribution utilities from western, southern as well as a few northern states such as Maharashtra, Telangana, Andhra Pradesh and Rajasthan, leveraged the exchange market to optimize their power portfolio and build on the financial liquidity which is so critical at this hour.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Centre’s push to promote local production of solar energy faces hurdles

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">As late entrant in solar equipment production hurdles are inevitable!

< style="color: #ffffff">Bad! |

11 August. The Centre’s plans to impose a basic customs duty on the import of solar cells and modules to promote domestic manufacturing could turn out to be counter productive for local manufacturers as more than 50 percent of the installed capacity is located in special economic zones (SEZs). According to manufacturers, a customs duty in the range of 10-20 percent is being considered with the country importing 90 percent of the solar equipment, mostly from China. This will be in addition to the safeguard duty of around 15 percent on the import of cells and modules that has been extended till July 2021.

Source: The Telegraph

Government looks at mixing biogas with natural gas

11 August. The government is looking at blending biogas with natural gas to boost domestic availability of biofuels and cut reliance on imports, Oil Secretary Tarun Kapoor said. The plan for biogas follows a move to mix ethanol extracted from sugarcane with petrol and doping diesel with biodiesel extracted from non-edible oil. Kapoor said India is an agricultural economy largely and there is a large amount of agricultural residues available, providing good scope of producing biofuels.

Source: The Economic Times

Bharat Electronics BEL sets up solar-powered classrooms in 122 Karnataka schools

9 August. Bharat Electronics Ltd has set up solar-powered smart classrooms in 122 government schools across the backward Yadgir district in north Karnataka. As the district is located in the Deccan plateau across the tropical region, the schools have assured sunlight for nine months in a year to charge photovoltaic cells of the solar panels to power the electronic equipment.

Source: The Economic Times

Government grants ISTS waiver extension for solar, wind projects until June 2023

6 August. The power ministry has extended waiver of inter-state transmission system (ISTS) charges and losses on supply of power generated from solar and wind sources until 30 June 2023. It said that no ISTS charges would be levied for 25 years from the date of commissioning of the power plants for the supply and sale to entities having renewable purchase obligations. According to the ministry Order issued, this would be applicable on power plants using solar and wind sources of energy including solar-wind hybrid power plants with or without storage commissioned till 30 June 2023. It would also apply to solar photovoltaic projects commissioned under the second phase of the Ministry of New and Renewable Energy’s Central Public Sector Undertaking scheme. Apex industry bodies had been pressing for extending the waiver by a period of 12 months to account for the disruptions on account of Covid-19 pandemic.

Source: The Economic Times

India needs to renew pledge to renewable energy: Niti Aayog VC

6 August. India needs to renew its pledge to renewable energy as thermal energy cannot take the country far due to environmental constraints, Niti Aayog vice chairman (VC) Rajiv Kumar said. Kumar said the energy needs of India are enormous, and the country needs all the energy that it can produce including clean and green energy. Kumar said on India the pressure will be enormous not to undertake open coal mining as primary source of energy. Kumar said that India has a comparative advantage in solar power.

Source: The Economic Times

Andhra Pradesh commissions 8.2 GW renewable energy capacity

5 August. Andhra Pradesh, a major renewable energy producer, has an installed renewable energy generation capacity of around 8,203 MW. Of this capacity, commissioned till 31 July 2020, wind energy projects took the largest share with 4,080 MW capacity, followed by solar energy with a capacity of 3,530 MW commissioned, according to the New and Renewable Energy Development Corp of Andhra Pradesh (NREDCAP). It said that the total solar capacity commissioned up to 2019-20 was about 3,522 MW. The renewable energy status update also showed that out of all the segments, only solar projects of 8.75 MW capacity were commissioned during 2020-21. According to Mercom India, Andhra Pradesh has installed solar capacity of about 3.6 GW and a project pipeline of 1.3 GW.

Source: The Economic Times

Indian researchers show how Covid-19 PPE can turn into biofuel

5 August. Plastic from used personal protective equipment (PPE) can and should be transformed into renewable liquid fuels, according to Indian researchers. The study, published in the journal Biofuels, suggested a strategy that could help to mitigate the problem of dumped PPE - currently being disposed of at unprecedented levels due to the current Covid-19 pandemic - becoming a significant threat to the environment. The research from the University of Petroleum and Energy Studies (UPES) in Uttarakhand shows how billions of items of disposable PPE can be converted from its polypropylene (plastic) state into biofuels - which is known to be at par with standard fossil fuels. During the current Covid-19 pandemic specifically, PPE is being designed for single-use followed by disposal. Once these plastic materials are discharged into the environment they end up in landfills or oceans, as their natural degradation is difficult at ambient temperature. They need decades to decompose. The research team reviewed many related research articles as they looked to explore the current policies around PPE disposal, the polypropylene content in PPE, and the feasibility of converting PPE into biofuel. According to the researchers, this process is among the most promising and sustainable methods of recycling compared with incineration and landfill.

Source: The Economic Times

ReNew Power plans 2 GW solar manufacturing unit in Rajasthan

5 August. New Delhi-headquartered ReNew Power has proposed to set up 2000 MW solar cell and module manufacturing plant in Rajasthan with an investment of ₹16 bn. If the state government clinches the deal by offering the incentives the company has sought, this would be a first solar cell manufacturing plant in Rajasthan, which has already become a lucrative destination for power generation. ReNew Power, which builds, owns and operates utility scale wind and solar projects, already has an operational capacity of 740 MW and a firm pipeline of 2,400 MW to be commissioned in the next two years.

Source: The Economic Times

Basic customs duty on Chinese solar imports to be delayed by 15 to 20 days: MNRE

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Customs duty on solar imports will reduce competitiveness of the sector!

< style="color: #ffffff">Ugly! |

5 August. The basic customs duty on solar imports from China, which was supposed to be implemented from 1 August, will be delayed for another two to three weeks, per an industry meeting with the Ministry of New and Renewable Energy (MNRE). The renewable energy ministry has been in talks with the finance ministry over the customs duty for nearly three weeks now. The power purchase agreements (PPAs) which were already signed remain the biggest issue between the ministries, according to people present at the meeting.

Source: The Economic Times

INTERNATIONAL: OIL

Japanese ship that caused Mauritius oil spill passed annual checks

11 August. A Japanese bulk carrier that struck a coral reef off Mauritius and has leaked at least an estimated 1,000 tonnes of oil passed an annual inspection in March without any problems, Japan’s ClassNK inspection body said. The ship, MV Wakashio, owned by Nagashiki Shipping and operated by Mitsui OSK Lines Ltd, ran onto the reef on 25 July, and the resulting oil leak has raised fears of a major ecological crisis the Indian Ocean island. Having already declared a state of emergency, Mauritius Prime Minister Pravind Jugnauth said the ship has now stopped leaking oil, but the island nation must still prepare for a worst case scenario. The company said it has sent six employees to the site was considering sending more, along with transport supplies. The deployed staff were tested for coronavirus before being sent. The International Maritime Organization (IMO) said it had joined international efforts to help Mauritius tackle the oil spill by providing technical advice and coordinating the response. UN (United Nations) agencies and other international organisations were also mobilising environmental and oil spill experts.

Source: Reuters

Saudi Arabia defers to renew pact to supply oil to Pakistan on deferred payments

8 August. World’s biggest oil producer and exporter Saudi Arabia is yet to renew an agreement with Pakistan that allows oil supplies on deferred payments after that pact expired two months back. An agreement between Pakistan and Saudi Arabia for provision of $3.2 bn worth of oil on deferred payments per annum has expired two months ago and decision about its renewal remains pending with Riyadh. The $3.2 bn Saudi oil facility was part of the $6.2 bn Saudi Arabian package announced in November 2018 to ease Pakistan’s external sector woes. The budget estimates suggested that the Pakistan government was hoping to receive minimum $1 bn worth of oil in fiscal year 2020-21, which started from July. The United Arab Emirates (UAE) had announced a $6.2 bn package for Pakistan in December 2018, including $3.2 bn oil facility. But later on, the UAE reduced its financial assistance to $2 bn and also shelved the plan to give $3.2 bn oil facility on deferred payments.

Source: The Economic Times

Libya’s NOC warns of dangers at oil ports

8 August. Libya’s National Oil Corp (NOC) chairman Mustafa Sanalla warned against the risk of a disaster at the country’s oil ports due to a growing military presence with storage tanks held at capacity for months due to a blockade. Eastern forces in the civil war have been stopping energy exports since January, bringing most output to a halt and causing storage tanks to fill. After the latest bout of warfare in June, the NOC said mercenaries had moved into oil fields and ports held by the eastern forces.

Source: Reuters

Russia continues raising fuel oil exports to US

6 August. Russia has continued increasing fuel exports to the United States (US), raising them by 16 percent in July from June, to 1.078 million tonnes (mt), replacing crude oil supplies from Venezuela, Refinitiv Eikon and traders’ data showed. Attractive pricing and lower freight rates have also supported demand for the Russian fuel oil. The US imposed sanctions on Venezuelan oil last year in an effort to squeeze out President Nicolas Maduro. As many US refineries historically process heavy crudes, the US has increased purchases of fuel oil, including from Russia. Supplies by Moscow doubled to 11 mt last year from 2018, according to data. The refineries in the US mostly use Russian fuel oil as feed stock for further refining as well as for marine fuel. Russian fuel oil shipments to the US come mainly from the Baltic Sea port of Ust-Luga, according to data. In January-July, Russia have supplied 6.4 mt of fuel oil to the US, on track to match record-high volumes of 2019, the data showed.

Source: Reuters

INTERNATIONAL: GAS

US energy company Sempra still waiting for Mexican export permit for Costa Azul LNG

5 August. US (United States) energy company Sempra Energy said it continues to work with the Mexican government to get a 20-year export permit for the first phase of its proposed Costa Azul liquefied natural gas (LNG) export plant in Mexico. The company, which made the announcement in its second quarter earnings statement, has said it planned to make a final investment decision (FID) in 2020 to build the plant. Oil and gas companies around the world have pushed back decisions on building new LNG terminals as global demand for energy has collapsed due to the new coronavirus. Investment demand in LNG had been running high for several years due to heavier consumption from mostly Asian countries diversifying their generation mix away from coal. The growth rate for LNG use, however, is slowing now and numerous planned projects have been put on the back burner. Sempra and Infraestructura Energética Nova SAB de CV (IEnova), its Mexican subsidiary, plan to build the export facility at the existing Costa Azul LNG import plant, which entered service in 2008. In addition to the first phase at Costa Azul, Sempra, which owns part of the operating Cameron LNG plant in Louisiana, is developing other LNG export plants, including second phases at Cameron and Costa Azul and Port Arthur in Texas.

Source: Reuters

INTERNATIONAL: COAL

Bangladesh looks to cut future coal use as costs rise

7 August. Bangladesh plans to review the number of coal-based power plants it hopes to build, with an eye to reducing its dependence on coal as costs for the fuel rise and power demand grows more slowly than expected. About 3 percent of the country’s power currently comes from coal, but plans to build 29 new coal-fired power plants in the next two decades would boost that to 35 percent.

Source: Reuters

INTERNATIONAL: POWER

Power restored in New York’s Manhattan after outage affects thousands

7 August. Electricity provider Con Edison said that power was restored to parts of New York’s Manhattan area after an outage left thousands without electricity and caused disruptions to the city’s subway system. The power outage had knocked out not only lights but also cellphone services. Con Edison’s website at one point showed the outage, which began just after 5 am local time, affected more than 40,000 customers. The power loss disrupted the signal system and station lighting on some subway lines and disruptions continued to impact some locations even after power was restored, the city’s subway operator said.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Exxon to buy renewable diesel from Global Clean Energy for 5 years

11 August. US (United States) oil major Exxon Mobil said it has signed an agreement with Global Clean Energy to buy 2.5 mn barrels of renewable diesel per year for five years to help reduce its carbon footprint. Investors in recent years have increased pressure on fossil fuel companies, including Exxon Mobil, to reduce emissions, spend more on low-carbon energy and make disclosures on the impact of fossil fuel production on climate change. The renewable diesel will be sourced from Global Clean Energy’s refinery in Bakersfield, California, starting 2022. The plant is among several traditional oil refineries being converted to manufacture renewable diesel, as demand for the alternative fuel continues to grow. Exxon said it plans to distribute the renewable diesel within California and potentially to other domestic and international markets. In a first, a group of the world’s top oil companies set goals this year to cut their greenhouse gas emissions as a proportion of output, as pressure on the sector’s climate stance grows.

Source: Reuters

Poland’s cabinet to approve nuclear energy plan update in Q3

10 August. Poland's government will approve the country's updated nuclear energy strategy in the third quarter (Q3) as Warsaw sees the need to accelerate its plans to build the first nuclear power station as it seeks to lower carbon emissions. Poland generates most of its electricity from burning coal and sees nuclear energy as a way to help it reduce emissions as required by the European Union (EU). The government said the basic assumptions to build 6-9 GW of capacity in nuclear energy will not change, but elements including the timetable, financing and infrastructure may be updated. Poland had planned to build its first nuclear power plant by 2033, while it has not yet worked out a financing scheme. The government approval of a nuclear energy strategy will be a sign there is unanimity in the cabinet on the issue and that Warsaw plans to move ahead with the plans, after years of delay.

Source: The Economic Times

Belarus begins fuel loading at new Astravets nuclear plant

7 August. Belarus began loading fuel into the first of two reactors at its new Russian-built Astravets nuclear power plant and said it expects to begin using the plant in the fourth quarter. Built by Russian state firm Rosatom and financed by Moscow with a $10 bn loan, the project is opposed by neighbouring Lithuania, whose capital Vilnius is just 50 km away. Vilnius has banned all electricity imports from the plant, citing concerns about safety and national security, and along with Estonia and Latvia is considering slapping a fee on power imports from Russia, as well. Lithuania, Latvia and Estonia are moving towards a full decoupling from their Soviet-era common power system by 2025. Belarus denies that the plant poses a risk and has insisted it meets all safety requirements. Its energy ministry said it plans to add the first 1.2 GW VVER 1200 reactor to the country’s power system in the fourth quarter of 2020. Construction of the second reactor is scheduled for completion in 2022 and will double the plant’s capacity to 2.4 GW.

Source: Reuters

Japan’s climate change efforts hindered by biased business lobby

6 August. Japan’s powerful business lobby Keidanren is dominated by energy-intensive sectors that represent less than 10 percent of the economy, resulting in national policies that favour coal and hindering attempts to combat climate change, a new study said. The influence of the country’s electricity, steel, cement, car and fossil fuel sectors undermines Japan’s attempts to meet its Paris Agreement commitments, according to the report by London-based data analysis company InfluenceMap. Japan later adopted a goal of achieving carbon neutrality as soon as possible in the latter half of this century, rather than an explicit 2050 emissions target.

Source: Reuters

EU eyes sustainable fuel quotas to tackle aviation emissions

5 August. The European Union (EU) is considering quotas to force airlines to use more sustainable fuels as it seeks to clamp down on the climate impact of aviation, the European Commission said. While the coronavirus crisis has slashed emissions from air travel this year, CO2 (carbon dioxide) emissions from flights within Europe had climbed every year from 2013-2019, and the sector is far off track for the EU’s goal to become climate neutral by 2050. To help tackle this, the Commission plans to push airlines towards using lower-carbon fuels - such as liquid advanced biofuels and fuels produced by renewable electricity - instead of fossil kerosene. In a consultation launched, the Commission laid out options to do so, including setting quotas for airlines to use a certain share of sustainable fuels, and an obligation for the fuel industry to produce a minimum share of them. Other options include a European trading system for fuel carbon credits, European tenders for sustainable fuels production, or a new “green airlines” accreditation scheme. The Commission said a kerosene tax is an option, and acknowledged that the lack of such a tax has contributed to the price gap between sustainable jet fuels and fossil kerosene. Countries including the Netherlands, Germany, France, Belgium, and Denmark have called for EU taxes on aviation to tackle the sector’s environmental impact, but the issue would be difficult to implement. EU taxes must be agreed unanimously, meaning a single country can veto them.

Source: Reuters

German automotive supplier Bosch signs solar power supply deals with 3 utilities

5 August. German automotive supplier Bosch published details of three long-term solar power supply deals with utility companies as it switches its electricity sourcing away from fossil fuels to green energy. The contracts were arranged with utilities RWE, Vattenfall and Statkraft. Bosch is expanding green power generation at its locations and will also continue to expand sourcing via such external deals, called power purchase agreements (PPA). PPAs act as an insurance for operators of solar, wind or hydropower installations against falling power prices while locking in a purchase price for consumers, and have long been common in the United States (US), southern Europe and Nordic countries. They are of increasing interest to wholesale markets, consumers and project companies in Germany, which needs to harness PPA expertise to spur more renewables after fixed price support schemes end next year.

Source: Reuters

DATA INSIGHT

All India Energy Supply Scenario

| Year(s) |

Supply |

Requirement |

| |

Million Units |

| 2015-16 |

1090850 |

1114408 |

| 2016-17 |

1135332 |

1142928 |

| 2017-18 |

1204697 |

1213326 |

| 2018-19 |

1267526 |

1274595 |

| 2019-20 |

1284444 |

1291010 |

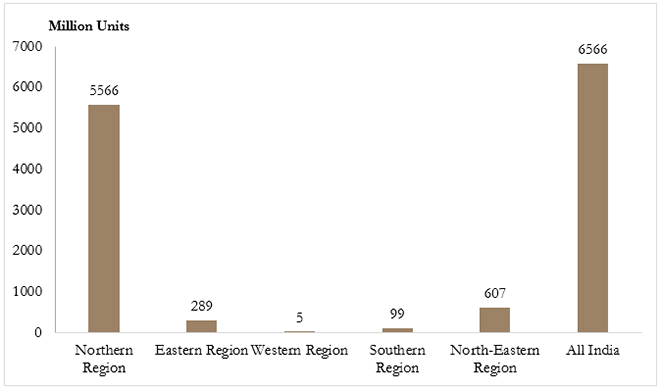

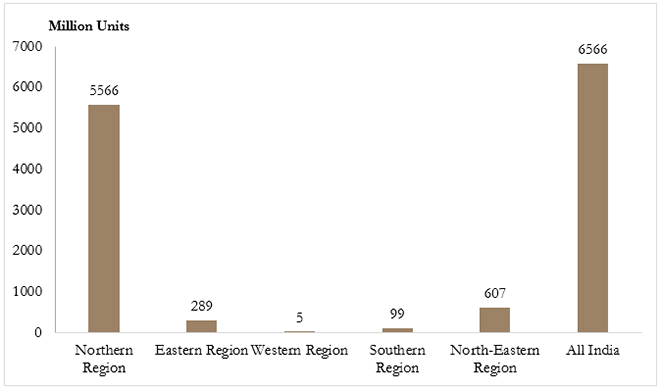

Region-wise Energy Shortage for 2019-20

Source: CEA and Rajya Sabha Questions

Source: CEA and Rajya Sabha Questions

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: CEA and Rajya Sabha Questions

Source: CEA and Rajya Sabha Questions PREV

PREV