Quick Notes

Green growth: A review

Basics

The precise origin of the idea of a green economy is unknown but it is often seen as an ‘imaginative extension of the idea of the knowledge-based economy’ that was born in the 1980s. In a ‘knowledge-based economy’, knowledge and technology are treated as factors that directly affect production rather than merely playing an external role influencing production. Unlike capital, labour, land, and materials which are subject to fundamental economic principles such as scarcity and the law of diminishing returns, knowledge is abundant and therefore, return to investment in knowledge is unlimited. This meant that the ecological ‘limits to growth’ is overcome by the careful application of knowledge and technology.

The concept of a ‘green economy’ was first introduced officially in the 1989 report ‘Blueprint for a Green Economy’ which argued that the economy could be ‘greened’ when the right taxes are imposed on environmental pollution. Paul Ekins later used the term ‘green growth’ in his book on the economics of environmental sustainability first published in 2000 to argue that the right technological changes driven by right policies could lead to economically and ecologically sustainable ‘green growth’.

Like most policy paradigms, ‘green growth’ has become less sophisticated as it climbed the policy ladder and has lost much of its intellectual underpinnings. Policy advisors have screened out ambiguities and blurred the fine distinctions which are typical of theoretical paradigms. The concept is now convenient enough to be widely used by policymakers and politicians in the context of sustainable development and poverty eradication.

Green Growth in Multilateral Policy Platforms

The phrase ‘green growth’ and its variations such as ‘green economy’ have since percolated into national, bilateral, and multilateral policy platforms, thanks mainly to the United Nations (UN) especially the United Nations Environmental Programme (UNEP). The first official use of the term ‘green growth’ within the UN is traced to the fifth Ministerial Conference of the United Nations on Environment and Development in Asia and the Pacific in 2005. The UN Secretary General’s report to the second Preparatory Committee of the United Nations Conference on Sustainable Development in 2010 stated that ‘the concept of green economy focuses primarily on the intersection between the environment and the economy’. In 2011, a report by UNEP concluded that the concept of green growth reflected the ‘growing recognition that achieving sustainability rested almost entirely on getting the economy right.’ It emphasised the crucial point that economic growth and environmental stewardship could be complementary strategies, thus, countering the view that there are strong trade-offs between the two objectives.

The Organisation for Economic Cooperation and Development (OECD) and EU policy documents readily adopted the idea of green growth which offered a solution to the many issues confronting them. For the EU, it offered the means to moral and industrial superiority through leadership in green technologies. For the rich nations of OECD countries, it emphasised their crucial point that economic growth and environmental stewardship can be complementary strategies, thus, countering the view that there are strong trade-offs between the two objectives. In 2012, ‘green growth’ was put on the agenda of the Los Cabos G20 summit.

South Korea’s Experiment with Green Growth

Following a decade of slow growth, shrinking middle class and growing income inequality, South Korea embraced the idea of green growth in the late 2000s to invigorate its economy. The 2010 Seoul G20 summit at which the concept of green growth was first introduced formally, knowledge and innovation in clean, low-carbon technologies were promoted to accelerate growth, create new competencies, and simulate job creation without imposing compromises on the environment. Under the green growth initiative, aggressive targets were set for reducing energy intensity, reducing the share of nuclear energy, increasing the share of renewable energy, reducing oil dependence, decreasing energy poverty, and increasing green jobs by 2030.

An analysis of the trajectory of green growth policy outcomes in 2016 showed a wide departure from the trajectory required to achieve the goals set for 2030 under the green growth plan. Despite substantial investment in sectors selected for green growth, only marginal improvement was achieved in areas such as energy intensity, utility scale solar photo voltaics (PV), share of low carbon renewables (RE), oil dependency, and green jobs compared to the levels in 2006. Moreover, energy poverty rates increased from about 7 percent in 2006 to percent to about 10 percent in 2016.

Amongst the reasons identified by empirical studies on the ‘failed dream’ of South Korea’s ‘green growth’ initiative are: (1) ‘more is better’ ideology on energy consumption and (2) technological optimism of large-scale system managed by experts. Both the issues are relevant for India as it embraces clean energy for greener growth.

India’s Evolving Perspective

The G77 nations which includes India, conveyed concerns over the interpretations of the ‘green economy’ in their statement presented at the preparatory meeting in New York ahead of the Rio+20 summit. The G77 (plus China) nations cautioned against replicating the discussion on the interrelationship between the environment, economy, and the society and the uniform application of the green economy concept overlooking economic, social, and ecological differences between countries. The nations endorsed the call for developing the green economy concept in accordance with the principles contained in Agenda 21 of the Rio Declaration.

India’s 12

th plan document reflects a more accommodating stand on green growth. The document observes that an environment must be created whereby being ‘green’ is not seen as an obligatory expectation of the country but becomes its primary focus. The plan document calls for the creation of a green technology fund and the promotion of green products. Green energy, green buildings, green townships, green cities, green Information Technology (IT), and the greening of rural development are all discussed with great enthusiasm. Green growth is presented as Indian capitalism’s best hope to create jobs, restore growth, address inequality and tackle climate change.

The 12

th plan document cautiously observes that ‘there is an impression that India is consuming more than what its ecosystem can sustain’. It responds to this accusation by listing all the national strategies and policies in which the principle of sustainability has already been put in place. According to the Planning Commission (Now NITI Aayog), the National Environmental Policy 2006 is designed to facilitate only those developments that respect ecological constraints; the National Agricultural Policy is intended to promote only technically and economically sustainable agriculture; the National Electricity Policy is designed to facilitate renewable energy sources; the National Urban Sanitation Policy will promote countrywide sanitation and cleanliness and so on. The 12

th plan document also admits that measuring gross domestic product (GDP) in terms of production does not consider environmental damage caused by the production of goods and services and that GDP must be adjusted for environmental costs after which it can be treated as a measure of production.

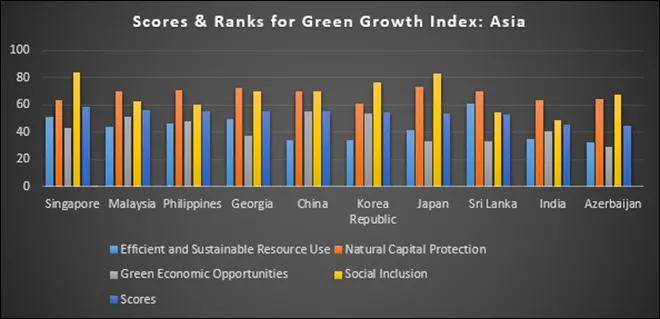

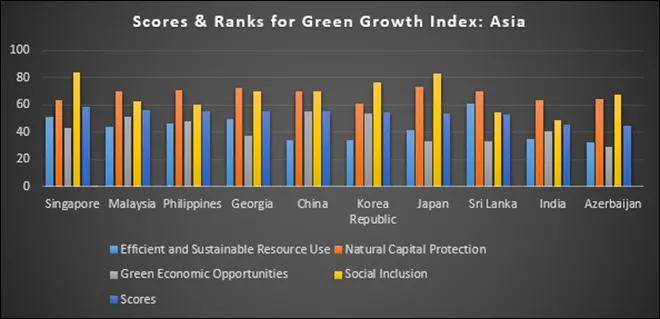

According to the Green Growth Index by the Global Green Growth Institute, India ranks within the top 10 amongst Asian countries, most of which fall in the category labelled ‘moderate’. All the countries in the category ‘high’ in the Green Growth Index are European. India’s scores are low in ‘efficient and sustainable resource use’ and in ‘social inclusion’ which pull India’s ranking below that of China and Sri Lanka. The key challenges for India in quest for green growth are efficiency in the technology context and equity in the social context.

Source: Global Green Growth Institute

Source: Global Green Growth Institute

Monthly News Commentary: Power

Second Wave Dents Power Demand

India

Demand Growth

India’s average daily electricity use in May fell 10.4 percent from April, analysis of government data showed, as states-imposed lockdowns to rein in a devastating second wave of coronavirus infections. Average power generation fell to 3,664 billion units in May from 4,074 billion in April, the analysis of data from federal grid regulator POSOCO showed, with output beginning to increase in the last week of the month. Electricity use in India generally peaks in May, as more people turn to air-conditioning amid sweltering temperatures at the height of the summer season and industrial activity rises. According to the government, recovery in power demand in late 2020 was a sign the economy was beginning to recover from its worst slump in decades. Industries and offices account for half of India's annual electricity consumption. More than three-quarters of states reported lower electricity use in May than April, the data showed. India’s power use rose more than 7.2 percent in May over last year, when a nationwide lockdown was imposed. Strict lockdowns in the southern states of Kerala and Karnataka, the northern state of Rajasthan, city state Delhi and Sikkim in the northeast pushed electricity use to levels lower than the corresponding period last year, the data showed. But power consumption in the country witnessed an 8.2 percent year-on-year growth in May at 110.47 billion units, indicating slow recovery in commercial and industrial demand of electricity, according to power ministry data. Moreover, the two cyclones that hit the east and west coast of the country in May resulted in power outages and lesser consumption due to rains in different areas of the country during peak summer season. The power consumption in the entire month of May last year was 102.08 billion units due to the impact of the lockdown imposed to curb the COVID-19 and had witnessed a year-on-year fall of nearly 15 percent in May 2020. Power consumption was 120.02 billion units in May, 2019. Therefore, power consumption in May this year has not recovered as fast as it should have been, in view of lower base in 2020. Last year, the government had imposed a lockdown on 25 March 2020 to contain the spread of coronavirus. The lockdown was eased later in a phased manner but had hit the economic and commercial activities and resulted in lower commercial and industrial demand for electricity in the country. Power consumption in April 2021, saw year-on-year growth of nearly 40 percent to 118.08 billion units. Power consumption in April 2020, had dropped to 84.55 billion units from 110.11 billion units over the same month in 2019, mainly due to fewer economic activities following the imposition of lockdown by the government in the last week of March, 2020, to contain the spread of deadly COVID-19. Similarly, peak power demand met or the highest power supply in a day also slumped to 132.73 GW in April last year from 176.81 GW in the same month in 2019, showing the impact of lockdown on economic activities.

The sustained pace of recovery in India’s energy demand growth witnessed over the past many months is set to be disrupted in the ongoing quarter ending June 2021 while the demand during the three-month period will still be higher as compared to the same period last year on account of low base effect according to India Ratings and Research. In March 2021, the all-India energy demand was higher by 22.8 percent year-on-year at 122 billion units. The early onset of summer season also contributed to the higher demand.

Discom Reform

All India Power Engineers' Federation (AIPEF) demanded scrapping of ongoing bidding for discoms (distribution companies) in Union Territories (UTs) citing serious flaws. The Federation has particularly mentioned the ongoing bidding of discoms in Chandigarh and Dadra Nagar Haveli Daman Diu. AIPEF claimed that the government is exploiting the crisis of the pandemic to put forth its policy of privatisation of the power sector, and the draft National Electricity Policy 2021 that conflicts with the Electricity Act 2003 should be withdrawn. In the case of UTs, no guidelines are issued by Government of India for competitive bidding under Section 63 of the Electricity Act 2003 for a discom. The Centre is pushing the competitive bidding of privatisation of electricity wing of Chandigarh and Dadra Nagar Haveli Daman Diu. Privatisation of discoms is not allowed by competitive bidding when the competitive bidding guidelines are non-existent and have not been issued. The decision of the central government last year that the distribution function in all the UTs should be privatised is an executive decision of the home ministry and this should not overrule the provision of Electricity Act 2003 in a matter relating to the privatisation of electricity. In Chandigarh, the commercial and domestic consumers are the main source of earnings for discoms as the agriculture load is less than 1 percent, AIPEF noted adding that in both cases, it is high revenue, low loss system with financial surplus utilities.

The power ministry has written to 18 states and union territories, asking them to issue electricity tariff orders for the current year in line with provisions under the Electricity Act immediately. The Centre had asked state regulatory commissions to issue tariff orders of all distribution licensees before 1 April of the tariff year and report compliance to the union power ministry by 31 May every year. Nearly 14 states have issued tariff orders in March while some others are in the process. Uttar Pradesh, Tamil Nadu, Jharkhand, Uttarakhand, Delhi, Rajasthan and Punjab, West Bengal, Tripura, Madhya Pradesh, Karnataka, Chhattisgarh, Arunachal Pradesh and UTs of Jammu & Kashmir and Ladakh are amongst states that have received the letter. The move is aimed at correcting the financial position of power distribution utilities in the country. Nearly 14 states have issued tariff orders in March this year, while some are in the process. The Central government has recently asked regulatory commissions to issue tariff orders of all distribution licensees before 1 April of the tariff year and report compliance to the Union power ministry by 31 May every year. In a communication to chairpersons of central and all state power regulatory bodies, the power ministry has sought compliance of legal provisions in the Electricity Act 2003 and the Tariff Policy 2016, which mandate timely determination of the adequate power tariffs by the electricity commissions.

Regulation and Governance

Punjab State Power Corp Ltd (PSPCL), in reply to a letter sent by the state government, has claimed that termination of PPAs with independent power purchasers (IPPs) will lead to a power crisis in the state. PPAs have been blamed for high electricity tariffs in the state. Now, the view of the Punjab’s sole power of distribution company could trigger a fresh round criticism for the government. The rise in demand for power was nearly four times the increase in transmission capacity in the last six to seven years in the state.

Three review petitions have been filed with the Odisha Electricity Regulatory Commission (OERC) regarding the proceedings to determine the average cost of supply (ACoS) of electricity for the 2021-22 financial year. An NGO working for the rights of power consumers, has filed the review petitions on April 26 against the retail supply tariff (RST) order of the four discoms bulk supply price (BSP) order of Gridco and transmission tariff (TT) order of Odisha Power Transmission Corporation Limited (OPTCL) issued by the OERC on 26 March seeking review of the increased RST by INR 0.30/kWh (kilowatt hour), BSP by INR 0.08/kWh and TT by INR 0.03/unit for the ongoing fiscal. For the first time, a respondent has filed three review petitions on behalf of the state and consumers at large for review of the commission’s order. People of the state have shown displeasure over the power tariff hike by INR0.30/kWh on 26 March. The petitioner has pointed out 10 mistakes in the RST order, five mistakes in BSP order and three mistakes in TT order passed by OERC. The petitioner has prayed at the end of the petitions to keep the increased tariff order in abeyance till the disposal of the review petitions by the commission. Revised power tariff had come into effect from 4 April.

The Chandigarh administration has written to the police department for providing security to the electricity department staff while installing smart electricity meters in Raipur Khurd and Makhan Majra villages. Recently, some residents of these villages had opposed installation of smart meters. Apprehending threat to the lives of their staff, the electricity department through the administration has asked for police protection. The Joint Electricity Regulatory Commission (JERC) had directed the administration to ensure faulty meters are replaced in a timely manner. The department has already started work on smart grid project. In the first phase, the department has allotted a work to a firm for replacing 30,000 existing power meters into smart meters in sectors 29, 31, 47, and 48 and Industrial Area, phases 1 and 2, and Faida, Ram Darbar, Hallomajra, Raipur Kalan, Makhan Majra and Daria villages. The JERC in its latest order had reduced power tariff by 9.58 percent and ordered to stop recovery of fuel and power purchase cost adjustment (FPPCA) from 1 April. The electricity department caters to 247,000 consumers divided into nine different categories.

Electricity Trade

CERC (Central Electricity Regulatory Commission) has approved registration to PTC, BSE and ICICI Bank-led Pranurja Solution Ltd to start the country’s third power exchange. The exchange is likely to be operationalised by this year-end. The other two power exchanges are Indian Energy Exchange and Power Exchange of India Ltd. The commencement of operation of the power exchange is subject to approval of the byelaws, rules, and business rules and the technology including trading software in accordance with various provisions of the Power Market Regulations (PMR) 2010. Pranurja Solutions had submitted the draft rules and byelaws at the time of filing the petition, according to the CERC order issued. On complying with the conditions, the registration of the power exchange will be in force for 25 years from date of commencement of operation.

Andhra Pradesh has saved around INR 23.5 billion by purchasing electricity in spot markets at cost effective prices in the last two years, i.e., 2019–20 and 2020–21. The power utilities procured 3,393 million units in 2019-20 and 8,890 million units in 2020-21 from the open market at cheaper prices. The average cost of procurement, including transmission charges, was INR 3.12/kWh against the approved weighted average procurement cost of INR 4.55/kWh. Apart from depending on power purchases in the spot market, for the first time in India, the state power utilities deployed day-ahead electricity forecasting model using artificial intelligence and machine learning. This could forecast the next day’s electricity consumption on every 15-minute basis. This would in turn enable taking right decisions on electricity demand and supply, grid management, and minimising power purchase cost. Cost-effective power would benefit every consumer in the state and boost industrial and economic development.

Subsidies

The Andhra Pradesh state government has decided to continue to provide free power for agriculture for the next 30 years. The power utilities of Andhra Pradesh are currently supplying free power to more than 1.8 million agricultural services. The state government is developing necessary power infrastructure to continue the scheme for the next 30 years. As part of this, the government will exclusively set up a 10,000 MW solar power plant for making the free power scheme a permanent one. The state government already spent about INR 17 billion on upgrading agriculture feeders to supply nine-hour free power in two spells during day.

The Goa Electricity Department has stated that there will be no tariff hike for the current financial year. The tariff has remained the same since the financial year 2019-20 despite the JERC recommending a hike in tariff. The fuel power purchase cost adjustment (FPPCA) for this quarter, has been notified. Although JERC recommended a power tariff hike, the government has not enforced this during the pandemic.

Transmission

Moody’s Investors Service affirmed an investment grade rating of Baa3 with negative outlook on senior secured bonds of Adani Transmission Ltd (ATL). According to Moody’s global rating scale, obligations rated Baa are subject to moderate credit risk. They are considered medium-grade and as such may possess speculative characteristics. Thus, Baa3 is an investment grade rating, and a negative outlook indicates downward pressure on the issuer. The servicing of ATL’s bonds is supported by an obligor group that includes ATL and two of its fully owned subsidiaries, Maharashtra Eastern Grid Power Transmission Company and Adani Transmission (India) Ltd which operate four transmission lines of more than 5,000 circuit kilometres (km). The negative outlook on the senior secured bond ratings reflects the likely weakening in ATL's financial metrics because of the incremental debt it would require completing its substantial capital expenditure programme over the next four to five years.

Rest of the World

Asia Pacific

Taiwan pledged to investigate the tech powerhouse's electricity management after two major blackouts hit homes and businesses in less than a week, triggering criticism of the government's power policy. Taiwan, which hosts major chip makers such as Taiwan Semiconductor Manufacturing Co Ltd, imposed power cuts following a spike in demand amid a heatwave and drought and failure at a power plant, in the second such outage in a week. The government promised to re-examine the island’s power management amid heated debate over the electricity policy. The economy ministry and state-run electricity provider Taipower will re-examine their management planning. According to Taipower, the drought meant electricity generated by hydropower plants was insufficient to meet the unexpected demand during a heatwave, a record high for May.

Australia’s New South Wales (NSW) state has awarded a Australian $3.2 billion (US $2.5 billion) 10-year power supply contract to Royal Dutch Shell PLC, which includes supplying battery back-up power for wind and solar energy. A 100 MW two-hour battery will be built and run by privately owned partner Edify Energy. The battery is slated to be switched on by early 2023 and will help fill a supply gap when AGL Energy Ltd's coal-fired Liddell power station closes in the same year. Under a deal with Edify, Shell has contracted to take 60 percent of the battery’s power. The decision comes just days after the federal government decided to build a taxpayer-funded Australian $600 million gas-fired power plant in NSW to offset a looming power shortfall once the Liddell power station shuts in 2023. The new power contract would begin in July 2022, when its existing contract with Shell expires, and run for 10 years. Shell won the deal to supply the state government, the second-largest power consumer in New South Wales, through its Shell Energy arm, the former ERM Power business, which the oil major bought in 2019.

Iran has banned the energy-intensive mining of cryptocurrencies such as Bitcoin for nearly four months as the country faces major power blackouts in many cities. The blackouts have been widely criticised by Iranians. The government has blamed the power cuts on cryptocurrency mining, drought, and surging electricity demand in summer. Iran has accepted crypto mining in recent years, offering cheap power and requiring miners to sell their bitcoins to the central bank. The prospect of cheap power has attracted miners to Iran, particularly from China.

Myanmar's military rulers have approved new investment in projects worth nearly US $2.8 billion, including an LNG power plant that will cost US $2.5 billion. Approvals for 15 projects were given by the Myanmar Investment Commission, according to a statement on the website of the Directorate of Investment and Company Administration. The announcement comes with much of Myanmar's economy paralysed by protests and strikes since the army seized power on 1 February. International credit rating agency Fitch Solutions has forecast the economy will contract by 20 percent this year. In addition to the plant to generate power for local needs, other projects approved included for livestock, manufacturing and services sectors. Most of Myanmar’s electric power is currently generated from hydroelectric projects, but LNG has been seen as increasingly important for a country whose economy had boomed during a decade of democratic reforms, leading to erratic electricity supplies.

Pakistan’s flagship CPEC power projects are hit by the circular debt and the government has failed to clear PKR 188 billion due payments in breach of an energy framework agreement with China. Meanwhile, Pakistan’s energy ministry has submitted a comprehensive circular debt management plan to a cabinet, recommending clearing PKR 435 billion worth principal loan of power plants under CPEC in the next 13 years instead of making immediate payments. Aside from this, Islamabad is set to seek debt restructuring of US $3 billion for the CPEC energy projects and requests China to consider restructuring of the repayments for 10 to 12 years in a bid to eliminate the need for increasing power tariff in the country. China has set up two dozen power plants under the CPEC and the repayments of the Chinese debt are included in the electricity tariffs.

Africa

South Africa’s Eskom will implement nationwide scheduled power cuts from 1700 local time due to breakdowns at seven of its power plants in the last 24 hours. According to Eskom, breakdowns at the seven plants represented a total loss of 6,044 MW, bringing the total unplanned capacity lost to 16,118 MW. The stage 2 "loadshedding", which will see up to 2,000 MW shaved from the national grid, would be in place 2200 local time.

A drop in electricity generation in Ivory Coast and Ghana has left households and businesses fuming as well as cutting power supplies to neighbouring West African countries Mali and Burkina Faso. A prolonged dry season has reduced water levels at hydropower dams in both countries that in some cases could take months to resolve, hampering productivity, raising costs and hitting the economies of the world's biggest cocoa producers. In Ivory Coast, which exports power to six countries, the national power company faces a generation deficit of about 200 MW, or nearly 10 percent of its 2,230 MW capacity. Most power companies in the country were producing at reduced capacity. Electricity imports from Ivory Coast had fallen 30 percent, causing repeated outages, and leading to a 100 MW generation deficit. Burkina Faso's utility blamed its power shortages and cuts on generation constraints in Ghana and Ivory Coast. In Ghana, which exports to Burkina Faso, the national utility is carrying out rolling outages until 17 May. The power regulator blamed the problem on several issues including work on transmission lines and a lack of rain that has left reservoirs depleted in the north of the country.

Mozambique began construction of gas-to-power plant and transmission line projects worth US $1 billion in the southern province of Inhambane as the government aims to boost energy supply. Upon completion, the gas-to-power Temane Thermal Power Plant will have a capacity of 450 MW.

South America

Brazil’s worst drought in two decades will force the country to depend more heavily on costly thermal power plants to compensate for reduced hydroelectric generation according to the National Electric Grid Operator. Around three-quarters of Brazil’s electricity is generated by plants driven by flowing water, one of the largest proportions for any country. Brazil is experiencing the worst water crisis in its history, warning that it poses major problems for electricity generation.

Europe and the UK

The European Energy Exchange (EEX) could double the number of participants in its Japanese power futures market from around 20 players in 2021, having traded over 3 TWh (terawatt hour) in its first 12 months. Interest in wholesale trading was boosted by extremely cold weather, which left Japanese retail suppliers under covered. The 3 TWh EEX futures traded in Japan since 18 May 2020 are equivalent to supplying electricity to a city of 350,0000 inhabitants for a year. While that is still small compared to Japan's power consumption of 1,000 TWh a year, it shows the huge size of trading potential in a country that has twice Germany’s power usage. In its European core futures markets, EEX traded 4.7 TWh in 2020, up 19 percent from 2019. EEX offers weekly, monthly, quarterly, seasonal and annual delivery periods up to six years in advance, based on the index set by local spot power bourse JEPX.

According to Germany’s energy regulator planning for the country’s power, transmission networks was keeping up with the need for new lines to send increasing amounts of renewable power to centres of consumption. Network infrastructure is becoming crucial for keeping the lights on, for example to transport offshore wind power to the industrial south and to integrate hundreds of thousands of fragmented solar photovoltaics plants. The network authority recorded a total planning volume of 7,783 km of electricity grid expansions at the end of 2020, of which 3,500 km are at final planning stage. Some 1,600 km are completed, 734 km have been approved and the remainder is at earlier planning stages. Transmission grid firms have presented plans to the regulator to invest up to 102 billion euros up to 2030, of which 55 billion will go into high-voltage networks and 47 billion into local distribution grids. Costs to refinance their spending are shared as part of energy customers' final bills under the regulator’s oversight.

Spain’s government is expected to approve draft legislation to limit the windfall profits hydro and nuclear plants make as rising C0

2 (carbon dioxide) prices drive up electricity bills. The preliminary bill is part of a wider pledge by the ruling Socialists and left-wing party Unidas Podemos to curb energy prices to protect end-consumers. The government estimated the measures cost utilities between 800 million euros and 1 billion euros in lost income, but would reduce consumers' electricity bills by around 5 percent, depending on CO

2 prices. The energy pool price has surged since the beginning of the year, reaching an average of €52/MWh (megawatt hour) roughly a 90 percent rise year-on-year as CO

2 prices have risen 40 percent. Shares in Spain’s utilities or companies with the highest exposure to hydro and nuclear power fell on reports of the plan, which coincides with the implementation of a new power tariff scheme from next month. The new system, unusual in Europe, splits retail power prices into time bands, which the government hopes will reduce annual bills, but consumer associations say would be confusing for households.

USA

US (United States) power consumption will rise 2.2 percent this year as state and local governments ease coronavirus lockdowns according to the EIA (Energy Information Administration). The EIA projected power demand will rise to 3,887 billion kWh in 2021 and 3,925 billion kWh in 2022 from a coronavirus-depressed 11-year low of 3,802 billion kWh in 2020. That compares with an all-time high of 4,003 billion kWh in 2018. The EIA projected 2021 power sales would rise to 1,504 billion kWh for residential consumers, which would be a record as continuing lockdowns cause more people to work from home, 1,293 billion kWh to commercial customers and 950 billion kWh to industrials. That compares with all-time highs of 1,469 billion kWh in 2018 for residential consumers, 1,382 billion kWh in 2018 for commercial customers and 1,064 billion kWh in 2000 for industrials.

News Highlights: 2 – 8 June 2021

National: Oil

Petrol selling at INR 101.52 in Mumbai after another hike

7 June: Petrol is retailing at INR 101.52 in Mumbai while diesel is selling for INR 93.58 a litre after Oil Marketing Companies (OMCs) hiked fuel prices by up to 28 paise. In the national capital, petrol was selling at INR 95.31 and diesel at INR 86.22. This is the 21

st hike since 4 May when the OMCs began increasing the price after an 18-day pause. The continuous spike in fuel prices is on the back of firming up of crude oil prices as the global economy is expected to witness a resurgence of demand and as the oil glut dwindles. Rajasthan levies the highest VAT (Value Added Tax) on petrol and diesel in the country, followed by Madhya Pradesh, Maharashtra, Andhra Pradesh, and Telangana. Mumbai on 29 May became the first metro in the country where petrol was being sold at over INR 100-a-litre mark. Petrol now costs INR 101.3 per litre in the city and diesel comes for INR 93.35.

Source: The Economic Times

Options being explored to further sweeten BPCL privatisation deal

7 June: The Central government proposes to further sugar-coat the BPCL (Bharat Petroleum Corp Ltd) strategic sale deal for the interested investors by giving few more clarifications through a new set of frequently asked questions (FAQ). The Department of Promotion of Investment and Internal Trade (DPIIT) may soon issue a clarification that the BPCL under new private sector owners would be free to bring in foreign direct investments (FDIs) to the tune of the entire 100 percent equity of the company without conditions. Also, after privatisation, BPCL would be free to exercise its right to stay or come out of the joint venture company that plans to build the world’s largest 60 million tonnes (mt) integrated refinery-cum-petrochemicals complex in Maharashtra’s Ratnagiri district at an estimated cost of INR 3k billion. Moreover, the government is also looking to allow BPCL to sell its stake in Petronet LNG and Indraprastha Gas Ltd, where the oil refiner is one of the promoters, before its own strategic sale. BPCL operates four refineries in Mumbai, Kochi, Bina (Madhya Pradesh) and Numaligarh (Assam), but the facility in Assam has been hived off. The company accounts for 15 percent of India’s refining capacity of close to 250 mt. BPCL distributes 21 percent of the petroleum products consumed in the country and owns a fifth of the 250 aviation fuel stations in India.

Source: The Economic Times

India brings forward target of 20 percent ethanol-blending in petrol to 2025

6 June: In order to cut pollution and import dependence, Prime Minister (PM) Narendra Modi said that the target for mixing 20 percent ethanol in petrol has been brought forward from 2030 to 2025, on the occasion of World Environment Day. India is now a proponent of climate change resolution and is amongst the top 10 nations on the Climate Change Performance Index, PM said. Ethanol extracted from sugarcane as well as damaged food grains such as wheat and broken rice and agriculture waste has two positives on environment—it is less polluting and its use also provides farmers with an alternate source of income. The government last year, had set a target for blending 10 percent ethanol in petrol by 2022, and 20 percent by 2030. Currently, about 8.5 percent ethanol is mixed with petrol as against 1-1.5 percent in 2014.

Source: The Economic Times

Doorstep diesel delivery picks up pace in Rajasthan

5 June: Doorstep diesel delivery is a new revolution in the field of energy distribution in Rajasthan which is easing the lives of the end-consumers without the hassles of diesel procurement. Four fuel entrepreneurs are bringing change in the fuel industry in Rajasthan with this door-to-door delivery model which includes Bikaner-based Hiralal Bhattar Petroleum. It has started the facility of doorstep diesel delivery through their mobile petrol pumps. Barmer-based Shree Mahadev Petroleum has also started the facility of doorstep diesel delivery. Pali-based Manish Kishan Filling Station has also started the facility of doorstep diesel delivery. M/s Sirohi Petroleum has started the facility of doorstep diesel delivery through their mobile petrol pumps in Nagaur. Doorstep diesel delivery is approved by the government and is a new-age concept of effective distribution of diesel. It allows fuel startups to maintain quality and create availability of fuel for the consumers. It will hugely benefit the agricultural sector, hospitals, housing societies, heavy machinery facilities, mobile towers, etc. Earlier, the bulk consumers of diesel had to procure it from retail outlets in barrels which used to cause a lot of spillage and dead mileage in energy procurement. Efficient energy distribution infrastructure was lacking. Doorstep diesel delivery will solve many such problems and will provide diesel to bulk consumers in a legal manner.

Source: The Economic Times

Oil companies’ expansion plan creates problem of plenty due to COVID

5 June: Oil companies’ mega expansion plan has collided with the pandemic, creating for petrol pumps a double whammy of increased competition and collapsing fuel demand. In two years, companies have added around 12,500 pumps, increasing the country’s fuel retail network by nearly 20 percent to 77,200, even as the combined sales of petrol and diesel have plunged about 30 percent in May. The devastating pandemic cut petrol and diesel demand by 7 percent and 12 percent, respectively, during 2020-21 over the previous year. This was the second straight year of decline for diesel. Even as sales of petrol were normalising as the first COVID wave tapered off, the resurgence of the virus prompted states to impose fresh lockdowns. The pandemic slowed but didn’t stop setting up of new pumps. Two-and-a-half years ago, three state-run oil companies—IOC, HPCL, and BPCL—set off the process to appoint dealers at nearly 80,000 locations across the country, which could have more than doubled their then network of 57,000 pumps. They received applications for 95 percent of locations and have since appointed 12,500 dealers.

Source: The Economic Times

National: Coal

Coal India’s e-auction sales up 53 percent in April-May

7 June: Coal India Ltd (CIL) said its e-auction sales registered a growth of 52.5 percent at 21.5 million tonne (mt) in the first two months of the ongoing fiscal year. CIL’s total allocated quantity under the five auction windows was at 14.1 mt in April-May 2019-20. The company's total allocated quantity this fiscal year till May 2021 moved up to 21.5 mt, under the five auction windows. With the demand for coal gathering steam, CIL could garner 16 percent add-on over the notified price during April-May compared to seven percent of same period last financial year. To encourage coal consumers lift additional coal quantities, reserve price under all e-auction windows was kept at par with notified price during the first six months of the last fiscal year. CIL scripted an all-time high of 124 mt in e-auction sales in 2020-21 posting 88 percent growth over the preceding year.

Source: The Economic Times

New coal-fired power plants in India likely to end up stranded: IEEFA

5 June: Much of India’s 33 GW of coal-fired power capacity currently under construction and another 29 GW in the pre-construction stage will end up stranded due to competition from renewables, according to the Institute for Energy Economics and Financial Analysis (IEEFA). IEEFA Research Analyst, Kashish Shah said that in the past 12 months no new coal-fired power plants have been announced, and there has been no movement in the 29 GW of pre-construction capacity. Despite these headwinds, the Central Electricity Authority had projected that India would reach 267 GW of coal-fired capacity by 2030 which would require adding 58 GW of net new capacity additions—about 6.4 GW annually. IEEFA expects coal-fired capacity in India to peak at 220-230 GW by 2025 and with additions of 2-3 GW of net new coal-fired capacity annually in this five-year window—and only then if financing can be found amid the accelerating global retreat from coal.

Source: The Economic Times

Government allows flexible use of domestic coal

5 June: The power ministry has allowed flexibility in utilisation of domestic coal for reducing the cost of power generation. According to the power ministry, states can use their linkage domestic coal, under flexible utilisation of coal, in the Case-2 Scenario-4 power plants leading to reduction in cost of power. The Case-2 Scenario-4 power plants are those power plants which have been bid based on the Net Heat Rate and the power generated from such power plants is supplied to the state itself. Entire savings shall be passed on to the electricity consumers, it said. At present, consumers in Punjab, Haryana and Uttar Pradesh will benefit from this. The expected savings in Punjab alone is going to be INR 3 billion per annum, it said. This will also help reduce import of coal and is aligned to the Aatmanirbhar Bharat initiative. It will also reduce the carbon emission as the coal will be used in the more efficient power plants with lower Station Heat Rate. Under the flexibility in utilisation of domestic coal, states can also use their aggregated linkage coal i.e. Aggregated Annual Contract Quantity (AACQ) in the power plants which have been established through competitive bidding under Case-2 Scenario-4. The Case-2 Scenario-4 power plants have been established through a bidding process under the guidelines issued by Ministry of Power under Section 63 of the Electricity Act 2003. While transferring the linkage coal by the state, it may be ensured that these plants are more cost efficient

vis-à-vis the state owned plants leading to savings in the cost of power purchase. The entire savings due to the use of such linkage domestic coal of the state will automatically be passed to the discoms (distribution companies) and ultimately to the consumers. These power plants will utilise the transferred coal only for generation of electricity for supply to the state.

Source: The Economic Times

National: Power

Scrap privatisation process of electricity distribution in Chandigarh: AIPEF to Government

8 June: The All India Power Engineers' Federation (AIPEF) urged the government to scrap the bidding for privatisation of electricity distribution in Chandigarh. AIPEF said that it is highly regrettable that the UT (Union Territory) administration, as well as the Ministry of Power, is going ahead with the privatisation against the principle laid down by the court and this would be a clear case of deliberate contempt of court. The AIPEF has written to the power ministry about alleged gross irregularity in the bidding process as "Transaction Adviser" of Chandigarh administration is also the chartered accountant of one of the bidders. This is a case of "conflict of interest" and should be referred to the "High-Level Steering Committee" and nothing has been done to safeguard the interest of employees of UT Chandigarh under the provisions of section 133 of the Electricity Act 2003. Further, the ministry has proposed that the assets of UT Chandigarh may be transferred to the private party at a nominal cost of Re one where the cost data is not available in the asset register against section 131 of the Electricity Act 2003.

Source: The Economic Times

Power market trades 6.5k million units in May amid lockdowns

7 June: Indian Energy Exchange (IEX) traded 6,540 million units of electricity volume in May, achieving 9 percent year-on-year growth amid continuation of COVID-19 lockdowns as well the cyclonic disturbances which affected overall power demand in the country. The national peak demand at 169 GW recorded a 2 percent growth while the energy consumption at 111 billion units saw 8 percent growth on the weak base, IEX said. The day-ahead market traded 4,364 million units volume in May with average monthly price at INR 2.83 per unit. The market clearing price saw a steep decline of 24 percent on month-on-month basis since average monthly price was INR 3.70 in April. The real-time electricity market witnessed a monthly volume of 1,436 million units with average monthly price at INR 2.53 per unit seeing 28 percent month-on-month decline. With sell-side bids at 2.6X of cleared volume, the market continued to have ample availability of power and competitive price discovery. The term-ahead market comprising intra-day, contingency, daily and weekly contracts traded 383 million units during the month. A total of 43 participants participated with distribution utilities from West Bengal, Bihar, Haryana, Telangana, Karnataka, Uttar Pradesh, Goa, and Gujarat as key participants. The recently-launched cross border electricity trade achieved 119 million units volume, IEX said.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

Climate change action plan launched by Gujarat CM

7 June: On the World Environment Day, the Gujarat government unveiled its ‘State Action Plan on Climate Change’ with the aim to build a sustainable and climate-resilient future. Coordinated climate adaption and mitigation planning is envisaged by 2030. Announcing the plan in Gandhinagar, Chief Minister (CM) Vijay Rupani said that Gujarat had become the first state in the country to implement a long-term action programme to address the challenges of climate change. The plan, prepared by the state’s climate change department in collaboration with experts from IIM-A and IIT-Gn, covers aspects such as renewable energy, energy conservation, forestry, coastal areas, tribal areas, animal husbandry, agriculture, and health. The state’s action plan aims to build a sustainable and climate-resilient future for its people in line with the UN’s Sustainable Development Goals. In the coming days, the CM said, Gujarat will be a leader in this field by producing 30 GW of solar and wind energy. He said that his government was also promoting CNG and electric vehicles for pollution-free transportation.

Source: The Economic Times

IndusInd Bank to raise climate financing to 3.5 percent in two years

7 June: Private sector IndusInd Bank said it will reduce carbon emissions to 50 percent in next four years and raise climate financing to 3.5 percent in two years. The bank will be increasing the allocation of capital towards climate finance to 3.5 percent of its loan book over the next two years, which is currently at 2.7 percent, IndusInd Bank said on the occasion of the World Environment Day. The bank has also committed to reducing its specific carbon emission by 50 percent over the next four years, it said. The bank promoted by the Hinduja group also said it has made it to the Carbon Disclosure Project (CDP) list for the sixth consecutive time, making it the only Indian bank to get featured in this prestigious list. The bank is also supporting tree plantation drive under which 50,000 trees will be planted in cities with high pollution index. It has also launched an employee awareness drive, helped install solar solutions of 675 kW capacity which has reduced carbon emission worth 8,278 tonnes and created water harvesting capacity of about 70 million cubic meters and also restored 15 lakes and two drainage systems.

Source: The Economic Times

Ladakh signs pact with CESL for 5 MW solar power project

6 June: The Union Territory of Ladakh signed a Memorandum of Understanding (MoU) with Convergence Energy Services Ltd (CESL) for setting up of 5 MW Solar Power Plant at Zanskar in Kargil. The signing ceremony coinciding with world environment day was virtually held between Ladakh Autonomous Hill Development Council (LAHDC), Kargil and CESL in the presence of Lt Governor R K Mathur. Mathur shared that this is the first of many such projects in Ladakh's endeavour to achieve carbon neutrality and thanked CESL for taking up the challenge of working in the harsh terrain of Zanskar. The Lt Governor stressed on Ladakh’s potential in renewable energies such as solar, wind, hydro and geothermal and spoke of the projects being conceptualised with the help of the Solar Energy Corporation India (SECI) and expected projects with National Thermal Power Corporation Limited (NTPCL) and other possible projects with CESL.

Source: The Economic Times

Gujarat discoms sign pacts for 3,979 solar projects with 2.5 GW capacity

6 June: Gujarat's four public-owned electricity distribution companies (discoms) have signed power purchase agreements (PPAs) for 3,979 small-scale distributed solar projects with aggregate capacity of 2,500 MW, the government said. These small-scale distributed solar projects, to be commissioned within the next 18 months, will bring in an investment of over INR 100 billion in the state for the development of green energy and allied sectors. State Energy Minister Saurabh Patel said that the development is a major boost towards the state's commitment to promote renewable energy. Gujarat, in 2019, notified the Policy for Development of Small-Scale Distributed Solar Projects, which aims to facilitate development of solar projects with size of 0.5 MW to 4 MW in the state’s distribution network.

Source: The Economic Times

NHPC forms JV with JKSPDCL to set up 850 MW Ratle hydropower project in J&K

5 June: NHPC Ltd said it has incorporated a joint venture (JV) firm Ratle Hydroelectric Power Corp Ltd for implementing 850 MW Ratle project in the union territory of Jammu and Kashmir (J&K). NHPC has incorporated this JV firm with Jammu and Kashmir State Power Development Corp Ltd (JKSPDCL) with equity participation of 51:49 respectively. Under the pact, the parties had decided and agreed to jointly establish a company under the name of 'Ratle Hydroelectric Power Corp Ltd' for the implementation of Ratle hydroelectric project. The project will have an installed capacity of 850 MW in the Chenab river basin and any other project that may be entrusted to the company in the Union Territory of J&K.

Source: The Economic Times

India’s wind energy sector set to register 50 percent growth over next five years: Report

5 June: India, the world’s fourth-largest wind power market, is expected to add nearly 20.2 GW of new wind power capacity between 2021-2025, a growth of 50 percent compared to the country’s current 39.2 GW installed capacity, according to the report titled ‘India Wind Energy Market Outlook 2025’. According to the report, this is a clear signal that the market is beginning to bounce back after a slow-down in recent years. It said that the pace of new installations was likely to double over the next two to three years compared to the average annual installations since 2017 when the market began to slow down. India currently has a pipeline of projects of 10.3 GW in both Central and State tenders, which are expected to drive installations until 2023. It said that over the next five years, 90 percent of new installed wind capacity would come from central tenders, followed by corporate procurements and state markets.

Source: The Economic Times

Adani Electricity launches Green Tariff Initiative to switch to renewable energy

4 June: Adani Electricity Mumbai Ltd (AEML) has decided to offer a Green Tariff Initiative for its consumers in Mumbai suburban area. As per the company, all consumers right from corporates, industrial, commercial, hotels, restaurants, and residential consumers can now switch to green energy. The consumers can opt for Adani Electricity Green Tariff Initiative by paying an additional tariff of INR 0.66 paise per unit, AEML said. The company said its consumers will have the flexibility to decide what should be the percentage of renewable energy in their total energy consumption. AEML has urged its consumers to participate in this innovative initiative for a sustainable future. It said the innovative step will be a significant contribution for consumers to meet their sustainability goals. The company welcomed all members of RE100, a global initiative bringing together the world’s most influential businesses committed to the consumption of renewable energy. AEML said it will issue monthly certificates to such consumers which mention that they have opted for Renewable Energy and the colour of the bill will be green, and added that the program is voluntary for existing AEML as well prospective consumers and has the option to shift both Green Energy Tariff as well normal within next billing cycle.

Source: Livemint

Solar companies seek Centre’s intervention in UP solar bid cancellation

3 June: Private solar power companies have sought the Centre’s intervention in securing solar contracts after the tenders were cancelled by Uttar Pradesh (UP). UP has become the latest state to cancel winning bids for 184 MW discovered through auctions in February last year. The solar companies said bid cancellation and re-negotiation attempts by states affects India’s image among foreign investors. Uttar Pradesh New and Renewable Energy Development Agency (UPNEDA) issued letters informing cancellation to NV Vogt Singapore Private Ltd, Al-Jomaih-Jakson Power Private Ltd, Vijay Printing Press Private Ltd, and Talettutayi Solar Projects Eight saying their bids have become “time-barred and infructuous” since no action was taken by the firms after they consented for extension of the bid period validity till 31 March 2021.

Source: The Economic Times

Tata Power Solar secures INR 6.8 billion orders from NTPC to set up 210 MW projects

2 June: Tata Power Solar, a wholly-owned subsidiary of Tata Power, said it has received a Letter of Award worth INR 6.86 billion from NTPC Ltd to build 210 MW of solar projects in Gujarat. It said that the projects will be commissioned by November, 2022. According to the company, with this addition, the order pipeline of Tata Power Solar has reached 2.8 GW with a value of INR 130 billion. The scope of work includes land, transmission, engineering, procurement, installation and commissioning of the solar projects. The NTPC project site is located in Gujarat. Tata Power Solar has previously executed projects such as the 250 MW Ayana at Andhra Pradesh’s Ananthapur and 105 MW of floating solar at Kayamkulam in Kerala.

Source: The Economic Times

International: Oil

China’s daily crude imports hit year’s low in May on refinery overhauls

7 June: China’s crude oil imports fell 14.6 percent in May from a high base a year earlier, with daily arrivals hitting the lowest level this year, as maintenance at refineries limited consumption of the re

Source. But refinery utilisation rates are expected to rebound in coming months as refineries resume operations, analysts said. May arrivals were 40.97 million tonnes (mt), data released by the General Administration of Customs showed, equivalent to 9.65 million barrels per day (bpd). That compares to 9.82 million bpd in April and 11.3 million bpd in May last year when Chinese buyers snapped up cheap oil amid the spread of the coronavirus. About 1.2 million bpd of China’s refining capacity was offline in May, up from 1 million bpd in April, according to Refinitiv analysts. China’s crude arrivals are expected to reach 11-12 million bpd in the third quarter and refinery runs rise by 0.5 million bpd from the second quarter, Rystad Energy said. The Chinese government has been ramping up scrutiny of the oil industry by imposing taxes on key blending fuels and investigating crude imports at state energy giants and independent refiners. The tax policy is expected to hit demand of bitumen blend, mostly shipped from Malaysia, which analysts say is based on heavy crude from Venezuela and Iran. For refined oil products, customs data also showed exports in May fell to 5.41 mt from 6.82 mt in April, but jumped 38.9 percent higher versus a year earlier.

Source: The Economic Times

OPEC to boost oil output as economies recover, prices rise

3 June: The OPEC (Organisation of the Petroleum Exporting Countries) oil cartel and allied producing countries plan to restore 2.1 million barrels per day (bpd) of crude production, balancing fears that COVID-19 outbreaks in some countries will sap demand against surging energy needs in recovering economies. The cartel decided to stay the course decided at earlier meetings to raise production by 2.1 million bpd from May to July. The group plans to add back 350,000 bpd in June and 440,000 bpd in July. Saudi Arabia is also gradually adding back 1 million barrels in voluntary cuts it made above and beyond its group commitment. The combined OPEC Plus grouping of members led by Saudi Arabia and non-members, chief among them Russia, is facing concerns renewed COVID-19 outbreaks in countries such as India, a major oil consumer, will hurt global demand and weigh on prices. Oil producing countries made drastic cuts to support prices during the worst of the pandemic slowdown in 2020 and must now judge how much additional oil the market needs as producers slowly add more production. But prices have recovered, closing at multi-year highs, and the recoveries in the US (United States), Europe and Asia are expected to drive energy demand higher in the second half of the year as people travel more and use more fuel. Saudi Energy Minister Prince Abdulaziz bin Salman said that the prospect of more Iranian oil coming to market was not discussed at the brief meeting, which he said lasted less than half an hour. Oil prices have risen more than 30 percent since the start of the year. That has meant higher costs for motorists in the US, where crude makes up about half the price of a gallon of gasoline.

Source: The Economic Times

US President Biden’s administration halts oil drilling in Alaska wildlife refuge

2 June: US (United States) President Joe Biden's administration announced it was halting petroleum development activity in Alaska’s Arctic National Wildlife Refuge, reversing a move by former President Donald Trump to allow drilling. The announcement deals a blow to the long-contested quest of oil companies to drill in the sensitive territory. The push for development picked up momentum after Trump announced the leasing plan last November shortly after losing re-election to Biden. At a lease sale in January over some 1.6 million acres, US officials auctioned off 11 oil tracts. Major oil companies sat out the bidding, and nine of the leases went to the Alaska Industrial Development and Export Authority, a state agency, while two went to small companies. But the oil industry has long sought to drill in the area, which is thought to potentially hold billions of barrels in oil. Key Alaska lawmakers such as Republican Senator Lisa Murkowski, have strongly backed development. But the American Petroleum Institute said the oil industry knows how to develop responsibly and that the decision will cost Alaska jobs and tax revenue.

Source: The Economic Times

International: Gas

Norway’s Equinor books capacity at Lithuanian LNG terminal

7 June: Norwegian oil and gas company Equinor booked capacity for the first time to import liquefied natural gas (LNG) to Lithuania’s LNG terminal, its operator Klaipedos Nafta said. Three companies including Equinor booked import capacity totalling 8.9 terrawatt hours (TWh) of LNG during initial bidding for the period of 12 months beginning 1 October, Klaipedos Nafta said. About half of terminal's annual import capacity of 39 TWh was used in 2019 and 2020. The terminal is connected to gas grids of Lithuania, Latvia, Estonia and Finland. A link to Poland is due to open at the end of 2021.

Source: The Economic Times

Germany says Ukraine must remain gas transit country after new pipeline

7 June: Germany said Ukraine should remain a transit country for Russian gas, after President Vladimir Putin said it would depend on the former Soviet republic showing "goodwill" towards Moscow. Putin said that Ukraine's role as a transit country was not assured once the Nord Stream 2 pipeline linking Russia and Germany was complete. Germany expected Russia to adhere to an existing inter-governmental agreement committing it to sending gas via Ukraine. The gas transit treaty expires in 2024, but can be extended.

Source: The Economic Times

Turkey’s Erdogan expected to announce new gas find in Black Sea

5 June: Turkish President Tayyip Erdogan is expected to announce a new gas discovery in the Black Sea. Erdogan said he would announce "good news" about natural gas reserves in the Black Sea during a mosque opening. In one of the world’s biggest finds last year, Turkey said it discovered 405 billion cubic meters (bcm) of natural gas in the Black Sea’s Sakarya field, about 100 nautical miles north of the Turkish coast. Turkey currently has two drill ships working at several boreholes in the Sakarya gas field. If the gas can be commercially extracted, the discovery could transform Turkey’s dependence on Russia, Iran and Azerbaijan for energy imports. Turkey expects the first gas flow from the Sakarya field in 2023. An annual gas flow of 15 bcm was envisaged from 2025.

Source: The Economic Times

Global LNG-Asian prices rise for second week on strong China demand

5 June: Asian spot prices for liquefied natural gas (LNG) rose for a second consecutive week and touched their highest since January, buoyed by higher oil prices and firm demand from China and Europe. The average LNG price for July delivery into Northeast Asia was estimated at about US $10.95 per million metric British thermal units (mmBtu), up 65 cents from the previous week. Demand from China remains robust, with the country importing more than 7 million tonnes (mt) of LNG in May, a record for the month, as industrial activity picked up pace amid strong domestic demand. China’s robust imports are expected to continue in June and July, continuing to boost prices, traders said. China National Offshore Oil Corp (CNOOC) sought 10 LNG cargoes for delivery over July to March in a tender that closes on 4 June. A buy tender by Pakistan LNG received offers in the range of US $10.2937 to US $11.7747 per mmBtu for cargoes to be delivered in July, and US $10.51 to US $10.8312 for cargoes to be delivered in August. ADNOC LNG sold a cargo for 7-16 July loading at US $10.30 per mmBtu on a delivered basis, likely to India, while Oman LNG was offering a cargo for delivery over 7-9 August. Brazil’s Petrobras is seeking four cargoes for delivery over July to August as dry season and low reservoirs at hydroplants is spurring buyers to seek LNG cargoes to complement power generation with thermal plants.

Source: The Economic Times

International: Coal

Indonesia June coal benchmark price up 11.8 percent, highest in over two years

3 June: Indonesia set its coal benchmark price higher in June at US $100.33 per tonne, the country’s energy and minerals ministry said, driven by strong demand from China. This is US $10.59, or 11.8 percent, more than May’s benchmark price for coal and the highest since October 2018, when it stood at US $100.89, Refinitiv data showed.

Source: The Economic Times

International: Power

COVID-19 crisis makes electricity too costly for millions in Africa, Asia

7 June: The economic toll from the COVID-19 pandemic has left more than 25 million people in Africa and Asia unable to afford electricity, threatening a global goal to provide power to everyone by 2030, international agencies warned. Two-thirds of those affected were in sub-Saharan Africa, deepening disparities in the region’s access to electricity, according to an annual global report tracking progress on sustainable energy. Millions struggled to pay for essential electricity services to power lighting, fans, televisions, and mobile phones as the COVID-19 crisis hit jobs and incomes in 2020, the report said. This threatens progress in the last decade, which saw more than a billion people gaining access to electricity since 2010, making 90 percent of the world's population connected in 2019.

Source: The Economic Times

Norway will need to add more power supply as surplus dwindles: PM

5 June: Norway currently has a surplus power supply, but industry plans to develop new energy-intensive ventures will require new capacity to be added in the future, Prime Minister (PM) Erna Solberg said. Norwegian industry lobby group NHO and the country’s biggest labour union LO recently estimated that current energy transition plans could raise electricity demand to 170-190 terawatt hours (TWh) by 2030, up from around 135 TWh at present. Other forecasts are more conservative, with the NVE regulator expecting 154 TWh in 2030. In 2020, Norway produced around 20 TWh more electricity than it consumed, with almost all of its generation based on hydro and wind power.

Source: The Economic Times

International: Non-Fossil Fuels/ Climate Change Trends

US seeks less costly clean hydrogen in fight against climate change

8 June: The Biden administration set a goal of reducing the cost of producing clean hydrogen, a fuel that could reduce dependence on others that emit greenhouse gases that cause climate change. The Department of Energy (DOE) set a goal for hydrogen made with clean power, such as renewables and nuclear energy plants, by 80 percent to US $1 per kilogram in a decade. It was the first of a series of DOE initiatives to accelerate and innovate in clean energy called Energy Earthshots intended to help the economy reach that emissions goal. The DOE issued a request for information on viable hydrogen demonstrations with requests due on 7 July. The United States (US) can generate affordable electricity without producing carbon dioxide emissions by 2035 by deploying hydrogen or carbon capture technology, climate policy think tank report said.

Source: The Economic Times

EU wants to loosen state aid rules for renewable energy projects

8 June: EU (European Union) competition regulators are considering changes in state aid laws to allow EU countries to subsidise up to 100 percent of renewable energy projects, the European Commission said, as the bloc seeks to meet ambitious green targets. The proposed changes are part of the EU executive’s revision of its climate, energy and environmental state aid guidelines (EEAG) which are expected to be adopted by the end of the year. The EU executive said the revised rules would allow EU countries to introduce new aid instruments and projects in clean transport, energy efficiency in buildings and biodiversity could also be fully funded by EU countries. EU countries will have to consult all interested parties on subsidised projects as one of several safeguards to ensure that state aid is effective and limited to what is needed. New investments in natural gas will be covered by the revised rules as long as they are compatible with the bloc’s 2030 and 2050 climate goals. Interested parties have until 2 August to provide feedback before the Commission makes a final decision.

Source: The Economic Times

Asia’s oil giants will be key to global climate fight: S&P

7 June: Asia’s carbon cutting will be critical to the effort to reduce global warming as the region releases more carbon dioxide than rest of the world combined, S&P Global Ratings said. The region does have one big policy advantage: its governments typically control at least one national oil company (NOC). S&P expects the NOCs will set the pace in Asia in slashing carbon emissions even if this undermines their profits and credit standing. Yet the move to carbon neutrality is one of the biggest policy challenges facing any nation. In Asia, much of the burden rests on the shoulders of the NOCs. Many have already committed to targets that outpace the government's carbon goals.

Source: The Economic Times

Germany backs carbon pricing in EU climate policy overhaul

7 June: The German government is backing an extension of EU carbon pricing and an end to free carbon permits for airlines as the bloc prepares new measures to help meet climate change targets. The European Commission will propose a dozen climate policies on 14 July, each designed to slash greenhouse gases faster in line with an EU goal to cut net emissions 55 percent by 2030 from 1990 levels. The package will include reforms to the EU carbon market and a border levy to impose CO

2 costs on imported goods. All the policies will need approval from EU governments and the European Parliament. In a document detailing its position on the package, Germany backed the Commission’s plan to impose CO

2 prices on transport and heating in buildings through a separate system to the EU’s existing carbon market.

Source: The Economic Times

Azerbaijan and BP plan solar power plant in Karabakh

5 June: Azerbaijan and British oil major BP have signed an agreement to cooperate in the evaluation and implementation of a project to build a solar power plant in the Karabakh region, the Azeri energy ministry said. The intention to build the 240 MW solar plant is part of a plan by oil- and gas-rich Azerbaijan to reduce carbon emissions by 35 percent by 2030, as well as BP’s strategy to cut its net emissions to zero by 2050. Azerbaijan said the project was part of plans to develop a green energy zone in Karabakh, the region where it last year won back some territories previously controlled by ethnic Armenians who say the land is theirs.

Source: The Economic Times

BP invests US $220 million in US solar development projects

2 June: Energy major BP Plc boosted its investment in US (United States) renewables with a US $220 million purchase of solar projects from developer 7X Energy. The deal, for assets with a production capacity of 9 GW, marks BP’s first independent investment in solar since buying a stake in Europe’s largest solar developer, Lightsource, in 2017. BP, which adopted a sunburst logo decades ago to convey its ambition in solar energy, said the assets will be developed through its 50-50 joint venture with Lightsource BP. The projects acquired are spread across 12 US states, with the largest portfolios in Texas and the Midwest, BP said. In one of the energy sector’s most ambitious strategies, BP plans to slash its oil output by 40 percent and boost its renewable power business by 20-fold by 2030.

Source: The Economic Times

UAE’s Masdar wins Uzbek Sherabad solar power plant tender

2 June: Abu Dhabi Future Energy Company, also known as Masdar, has won the tender to build a 457 MW photovoltaic solar power plant in the Sherabad district of Uzbekistan's Surkhandarya province, the Central Asian nation’s energy ministry said. Masdar made the lowest bid of US $0.018045/kWh (kilowatt hour) on the Sherabad solar tender, placing it well ahead of four other competitors. The project is part of a wider programme to construct solar plants with total capacity of 1 GW, backed by the Asian Development Bank.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Global Green Growth Institute

Source: Global Green Growth Institute