Pricing formula for domestic natural gas could not have been more wrong and other weekly energy roundups

Gas News Commentary: September – October 2016

India

The pricing formula for domestic natural gas that appeared to be a one way bet on the upside just a year or two ago could not have been more wrong. Every single international price component that was included in the price formula has gone down since the formula was conceived. Domestic gas producers are reporting loss on natural gas production as the price is now lower than the cost of production. Price of domestic natural gas was cut by 18 percent to $2.5 per mmBtu based on its gross heat value for six month period from October. Average cost of production for ONGC was reported to be about $5.14 per mmBtu. The price of domestic natural gas is revised every six months in the financial year starting in April. The current formula for price includes weighted average price of gas exporting countries such as USA, Mexico, Canada and Russia. But bad news for producers is always good news for consumers as they can expect CNG for their vehicles and PNG for their cook stoves to be cheaper.

Meanwhile, the MEA announced that India and Russia had agreed that an industry level working group led by Gazprom will work to create an ‘energy bridge’, essentially pipelines, for potential Russian gas supplies to be transported to India during the recent India-Russia talks on the side-lines of the BRICS summit. About a decade ago, we had said in one of our reports on transporting Central Asian gas to India that it was in Russia’s interest to facilitate the flow of Central and West Asian gas towards the South Asian market to reduce the threat of competition in its lucrative markets of Western Europe and potentially also the USA. Now that these markets are looking less lucrative, it is probably in Russia’s interest to facilitate the flow of natural gas to the relatively more lucrative South Asian and Indian markets.

Rest of the World

On the international front the most intriguing news was that Turkey and Russia would work to start the construction of the second pipeline on the Turkish Stream project provided there is sufficient demand from European markets. Turkey and Russia signed a bilateral agreement to build the Turkish Stream undersea gas pipeline, which will allow Moscow to strengthen its position in the European gas market and cut energy supplies via Ukraine. The Turkish Stream project was conceived in 2014 in response to the EU’s objection to the South Stream pipeline which was supposed to be laid on the bottom of the Black Sea from Russia into Turkey and Germany. Following the shooting down of a Russian bomber in Syria by Turkey, the project was frozen. Russian gas meets approximately 60 percent of the Turkish gas market needs. The Turkish Stream infrastructure is ready on the Russian side for the supply of gas into the line going to Turkey. In its current form, each of the two lines have a capacity of 15.75 BCM per year.

Another interesting development in the gas market was that the Asian LNG price had risen on account of increased demand from India and South Korea. Prices for November delivery traded at $5.75 per mmBtu helped by a surge in gas prices at Britain's benchmark gas market which is seen to influence Asian LNG markets. GAIL (India) Ltd is reportedly negotiating delivery of five cargoes for October-December delivery. According to experts, price sensitive Indian importers were nearing their cut-off points, potentially resulting in tenders going un-awarded which may dampen prices. South Korean import of LNG has risen on account of shut down of four nuclear reactors with a total capacity of over 2 GW following an earthquake.

Staying on earthquakes, the government of Netherlands has reportedly limited extraction of natural gas from Groningen, the EU’s largest gas deposit, over threat of earthquakes. Netherlands is struggling to contain tremors linked to gas production by a joint venture of Exxon and Shell that has reportedly damaged thousands of homes. Groningen’s decline may have broader implications for the European gas market, which would have to rely more on imports from outside the EU. The Netherlands produced 3.85 TCM of gas since the discovery of the Groningen deposit in 1959, more than total global production last year. Output fell to 52 BCM in 2014 the lowest level since the early 1970s compared to 84 BCM in 2013.

The TAPI pipeline appeared to gather momentum with Turkmenistan signing a $700 million loan agreement with Islamic Development Bank to finance the TAPI gas pipeline project.

SEALNG, the cross-industry coalition established to promote the use of LNG as a marine fuel, said that the LNG sector was ready for the future emissions constraints on the shipping industry and that it supported the implementation of the MARPOL Annex VI for the prevention of air pollution by ships. LNG emits zero SOx and virtually zero particulate matter. Compared to existing heavy marine fuel oils, LNG can, depending on the technology used, emit 90 percent less NOx and 20-25 percent less CO

2. The coalition believes that LNG will become a fuel of choice for vessels operating in global trade lanes, as well as in ECA zones, where LNG is already gaining a foothold. According to SEALNG, there are currently 86 LNG-fuelled ships in operation worldwide (excluding LNG carriers) and a further 95 on order.

There was also news on the intriguing geo-political and geo-economic contest between Russia and the USA two of the World’s largest energy producers and exporters. Gazprom, that generates more than a half of its revenue in Europe, reportedly observed that in the European market ‘US LNG was losing’ against Gazprom’s pipeline gas deliveries. Gazprom is said to believe that Latin America would become one of the main markets for US LNG in the medium and long term.

So far three US LNG cargoes were delivered to European including one to Turkey. Gazprom operates Russia’s only LNG plant, built within the Sakhalin II project, which currently has an annual production capacity of 9.6 MT. Gazprom is reportedly interested in increasing the LNG share in Gazprom’s portfolio with the purpose of expanding sales geography and boosting gas exports.

NATIONAL: OIL

Delhi HC rejects Cairn's plea to export surplus crude oil

October 18: The Delhi High Court (HC) refused to allow Cairn India Ltd to export surplus crude oil from its Barmer oil fields in Rajasthan. The court had earlier reserved its verdict on a petition filed by Cairn seeking to export the surplus crude, produced under a production sharing contract (PSC) with Oil and Natural Gas Corp (ONGC), as benchmark prices offered in India were far lower than the prevailing global rates.

Source: Business Standard

RIL plans shutdown of FCCU in DTA unit of Jamnagar refinery for maintenance

October 18: Reliance Industries Ltd (RIL) informed that it was planning to shut down the fluidized catalytic cracking unit (FCCU) in the DTA unit of its Jamnagar refinery for "routine maintenance & inspection activities". The shutdown is being planned from second week of November 2016 for about five weeks.

Source: Business Standard

Pakistani agents making calls to executives at oil installations to extract key details

October 18: Indian oil installations are on Pakistan's radar. The Intelligence Bureau (IB) has advised the oil ministry to step up safety and information shield at important energy installations after it intercepted a conversation in which a Pakistani spy was heard extracting information from an oil industry executive. IB recently intercepted a conversation in which a Pakistani operative, posing as an officer of India's external intelligence agency, the Research & Analysis Wing, engaged on phone an executive managing a sensitive hydrocarbon pipeline in Rajasthan and sought finer details about the facility. IB has warned that several Pakistani spies are making pseudonymous calls from across the border as well as within India to executives at oil installations to extract details. It suggested that oil industry executives be sensitised so they do not end up sharing vital information. The oil ministry said the home ministry handles internal security matters and will take appropriate action. Indian Oil Corp (IOC) said the country's largest refiner has sensitised its officials and security personnel at refineries in North India in this regard.

Source: The Times of India

Petrol pumps to go on blackout in Rajasthan

October 18: Rajasthan Petroleum Dealers Association (RPDA) will join the countrywide protest of Petrol Pump Dealers against the meagre hike in Dealer Margin given by Oil Marketing Companies, Indian Oil Corp, Bharat Petroleum Corp and Hindustan Petroleum Corp. In accordance with the nationwide agitation, a blackout will be observed by all petrol pumps in entire Rajasthan on October 19 from 7:00 pm to 7:15 pm. In case the demands are still not met there will be another blackout on October 26, during same time for same duration. However, the demands still remain unanswered then claim that there will be no purchase of fuel on November 3, 2016 from the oil companies followed by a complete closure of petrol pumps on November 15.

Source: The Times of India

India discussing $15 bn petroleum investments with Nigeria

October 17: India is discussing a mega investment opportunity worth around $15 billion with Nigeria focusing on a range of petroleum sector initiatives including crude purchase, refining partnerships and exploration and production in the African nation. The proposals were discussed in a meeting between Oil Minister Dharmendra Pradhan and his Nigerian Counterpart Emmanuel Ibe Kachikwu. The investment proposal may also cover opportunities for long-term contracts for supply of crude to Indian PSU companies from Nigeria and also possibilities of executing city gas distribution and liquefied petroleum gas infrastructure projects by Indian PSU companies in Nigeria. During the meeting, both the sides agreed to strengthen the existing cooperation in the oil and gas sector, particularly to explore investment opportunities for Indian public and private sector companies in Nigeria. The ministers agreed to sign a Memorandum of Understanding in December to firm up the initial talks.

Source: The Economic Times

Govt grants BP licence to set up petrol pumps in India

October 16: Government has formally granted a licence to BP Plc, Europe's third-biggest oil company, to set up 3,500 petrol pumps in India, making it the 10

th company to enter the lucrative fuel retailing sector. The company was granted a formal licence on October 14. The UK-based firm, as also Haldia Petrochemicals Ltd, was given approval by the Oil Ministry to retail petrol and diesel. The company had in January this year won in-principle approval to retail aviation turbine fuel (ATF) to airlines in India.

Source: Business Standard

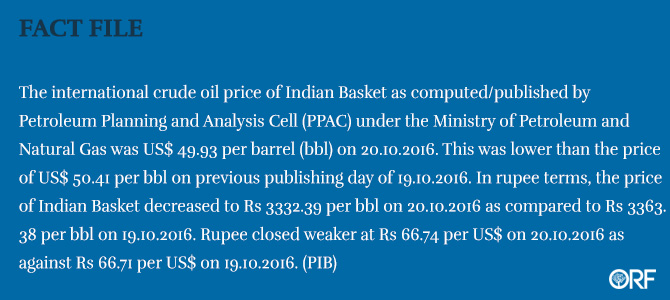

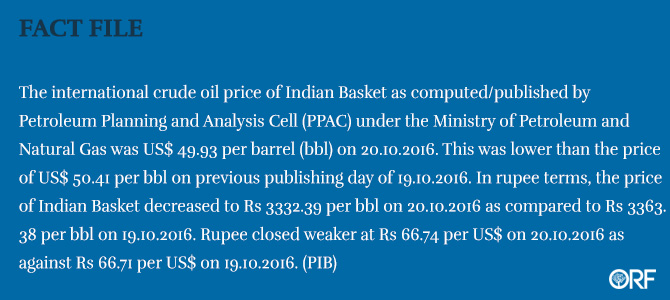

No alarming situation due to rising oil prices in global market: Oil Minister

October 15: Oil Minister Dharmendra Pradhan said there is no alarming situation in India following rising oil prices in the international market, which has crossed the psychological barrier of $50 per barrel. Market watchers fear that the rising oil prices, which had crossed $50 per barrel, would adversely affect the India market. He said government has taken steps to link the oil price to the market and hence there was no such alarming situation.

Source: The Economic Times

Rosneft-led group to buy India refiner Essar for $12-$13 bn

October 14: A group led by Russian oil major Rosneft will acquire India's Essar Oil in a $12 to $13 billion deal including debt, strengthening the ties between the world's largest oil producer and the world's fastest growing fuel consumer. The deal helps Russia to deepen economic ties that stretch back to the Soviet era. Rosneft will get a 49 percent stake in Essar and the two investors -- European trader Trafigura and a Russian fund UCP -- will hold another 49 percent in equal parts, the sources said, adding that the valuation included about $4.5 billion in assumed debt. Essar Oil operates a 400,000 barrel per day oil refinery in Vadinar on India's west coast and sells fuels through its 2,470 filling stations in India. The two oil traders have a combined experience of more than 20 years with the Indian refiners. Rosneft and Trafigura are the latest international oil companies after Royal Dutch Shell and BP to enter the Indian fuel retailing market.

Source: Reuters

Kerosene subsidy likely to decline 25 percent this fiscal year

October 13: India's kerosene subsidy is poised to fall sharply as higher supply of cooking gas and rural electrification have encouraged the government to cut supply of the inefficient and polluting fuel that is often diverted to adulterate diesel. The Centre is reducing kerosene supply by 5% a quarter which, along with additional voluntary cuts by some states, small increases in retail prices, and roll out of direct cash transfer for beneficiaries, is estimated to reduce sales and subsidy by 25% by the end of this fiscal year. The oil ministry said the decline in kerosene consumption this year would be the steepest ever. Consumption has been shrinking in lower single digits annually for a decade. Sale of subsidised Kerosene, meant for lighting and cooking for the poor, fell 4.2% to 6.8 million metric tonnes in 2015-16. But this year until August, the fall has been much sharper at 10%. In August, the consumption fell 17%. State oil companies have added about 1.4 crore new cooking gas subscribers so far this year. The oil ministry expect an additional 5% reduction in kerosene consumption with some states taking voluntary cuts and the launch of direct transfer of kerosene subsidy helping reduce diversion.

Source: The Economic Times

India gets first Iranian oil parcel for emergency reserves

October 13: India has received the first parcel of Iranian oil to partly fill its strategic storage in southern India, Mangalore Refinery and Petrochemicals Ltd, which imported the very large crude carrier (VLCC), said. MRPL shipped in 2 million barrels of Iranian oil in the VLCC Dino. India will fill half of the storage with 6 million barrels of Iranian oil while continuing talks with United Arab Emirates and Saudi Arabia for the remainder. A second parcel to be procured by Bharat Petroleum Corp is scheduled to arrive around October 25. India is building emergency storage in vast underground caverns at three locations in southern India to hold a total of 36.87 million barrels of crude, enough crude to cover almost two weeks of demand.

Source: The Hindu

NATIONAL: GAS

India gets a brand new O&G basin, Kutch Offshore, after 31 yrs

October 18: Nearly 31 years later, India is expecting to get oil and gas (O&G) production from a new basin — Kutch Offshore — starting 2017-18. Till now, only seven out of 26 sedimentary basins in India are under production. Cauvery basin was the last to come on stream in 1985. ONGC is carrying out exploratory work in the Kutch Offshore basin and has so far discovered one trillion cubic feet of natural gas. The Kutch Offshore is a shallow water acreage where ONGC has reached the appraisal stage. In the Kutch Offshore sedimentary basin, ONGC has four blocks bagged under the New Exploration Licensing Policy (NELP) auction regime, while another 700-800 square kilometre of nominated area is available for exploration and production activities. Currently, seven out of 26 sedimentary basins are under production. Oil Minister Dharmendra Pradhan said that India has suffered because exploration surveys have stopped since the past more than two decades. The NDA government has now launched the National Seismic Programme, which includes survey of virgin areas and reassessment of hydrocarbons, and bringing all kind of data to National Data Repository. ONGC produced 22.368 million tonnes (MT) of crude oil in FY16 against 22.264 MT in FY15. However, the gas production scenario continues to be grim with output falling to 21.2 billion cubic metres (bcm) in FY16 from 22.02 bcm in FY15.

Source: The Financial Express

Gazprom sees new LNG deal with GAIL in six months

October 15: Russia's Gazprom chief executive officer (CEO) Alexei Miller said he hoped to renegotiate a deal to supply liquefied natural gas (LNG) to India's GAIL (India) Ltd within the next six months. The two companies are discussing a change to the period in which Gail has to increase its off-take to 2.5 million tonnes of LNG per a year, as agreed under a previous contract, Miller said.

Source: Reuters

India to double LNG import capacity to 50 MT a year: Oil Minister

October 13: India plans to more than double its liquefied natural gas (LNG) import capacity to 50 million tonnes (MT) a year, Oil Minister Dharmendra Pradhan said. It has a capacity to import 21 million tonnes of the super-cooled fuel currently. As the nation moves to a gas-based economy, India wants to increase the share of natural gas in its energy mix to 15 percent in the next three-to-four years from 6.5 percent now, Pradhan said.

Source: Reuters

ONGC, United Energy said to vie for $2 bn Chevron asset

October 13: Oil & Natural Gas Corp (ONGC) and Hong Kong-listed United Energy Group Ltd are among bidders for Bangladesh natural gas assets being sold by Chevron Corp. United Energy submitted a joint offer with Chinese conglomerate Orient Group Inc. The gas fields, which could fetch as much as $2 billion, have also drawn interest from Brightoil Petroleum Holdings Ltd.

Source: Bloomberg

NATIONAL: COAL

US college to study coal movement of Chhattisgarh district

October 18: A unique 'Coal agitation' by a group of villagers in Chhattisgarh demanding that the local community be given mining rights on natural resources has caught the attention of an American college, which plans to take up a study on the social movement. Started about five years ago on Gandhi Jayanti, more than 1000 villagers of Gare, Saramal and Khamharia of Tamnar block in Raigarh district broke the coal law like Mahatma Gandhi led the movement against British Raj's salt law. Every year by breaking the coal act, people of village Gare emphasize their stand that they have the right over coal of their land.

Source: The Economic Times

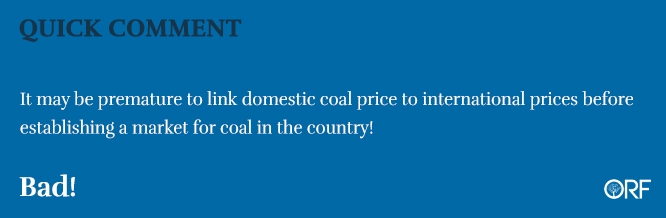

Coal ministry opposes NITI Aayog’s draft Energy Policy

October 18: The coal ministry has raised reservations over the draft National Energy Policy, which favours aligning domestic coal prices with international rates. The ministry is scared of this forward-looking policy because it would lose control over coal prices and would no longer be able to maximise profit for Coal India Ltd (CIL). NITI Aayog’s National Energy Policy is aimed at curbing imports by increasing production of renewable energy in the country fivefold to 300 billion units by 2019 and tripling coal production to 1.5 billion tonnes. Coal imports are envisaged to come down by 10% by 2022 and by 50% by 2030. According to NITI Aayog, once inputs have been provided by everyone, it is not necessary to reach a consensus on all issues.

Source: The Economic Times

Coal import declines 6 percent to 16 MT in September

October 16: Coal imports fell six percent to 16.1 million tonnes (MT) in September over the same month last year owing to higher prices of the fossil fuel in the international market. The demand for coal in India is not rising as per expectation as overall economy is not growing in the way it was expected to grow, leading to lower-than-expected demand for steel and cement, consequently the lower demand for power and coal, the mjunction services said.

Source: Business Standard

CIL to go totally digital by December end

October 14: Coal India Ltd (CIL) will go totally digital by the end of December. This follows the coal ministry earlier announcing that it has decided to move all papers and documents to digital format November 1 onwards.

Source: The Indian Express

India's coal output to miss govt target of self sufficiency

October 13: India's coal output will miss government's ambitious target of self-sufficiency on the back of delays in opening up of commercial mining to private sectors and slow approvals for new state miners, a report said. The country is eyeing 1.5 billion tonnes of coal production by 2020, of which 1 billion tonnes would come from Coal India Ltd (CIL). According to a report by BMI Research, the country will remain in coal deficit up to 2020, although the deficit will narrow from 191 million tonnes (MT) in 2016 to 163 million tonnes by 2020. However, India will surpass the US as the world's second largest producer of coal during 2016-20, increasing the market share from 9.8 percent in 2016 to 12.7 percent by 2020 as CIL ramps up output to meet the domestic power demand of the country, the report said.

Source: The Economic Times

National: Power

Indian Energy Exchange sets record

October 18: The Indian Energy Exchange set a record in September by trading a total of 3,630 million units of electricity. This is the highest since its inception of the exchange in 2008. On a daily average basis, 121 million units were traded in September. Around 60% of the power purchasers were open access consumers while the rest were distribution companies. Power was on an average available at ` 2.43 per unit, much below all sources of power generation. Southern and northern states were the net buyer of electricity while the other regions were the net sellers. The tariff on the exchange varied from ` 2.35 to ` 2.73 per unit across regions in September. Even at ` 5 per unit, the cost of power will be cheaper for industries and commercial establishments as the power sourced from a government-owned distribution company will be higher as it will also include cross-subsidy.

Source: The Indian Express

No electricity, 500 SP men join BJP

October 18: Nearly 500 Samajwadi Party (SP) workers and many villagers of Guvariya, Mainpuri, joined Bharatiya Janta Party (BJP). They left the party as the local MLA, Brijesh Katheriya, failed to provide electricity to their village. There are over 2,500 small villages in Mainpuri that have been living without electricity since independence. The villagers and party workers told media that they have been demanding basic amenities for long but to no avail.

Source: The Economic Times

Indo-Bangla forum writes to PM against proposed power plant

October 18: A joint Indo-Bangla forum wrote to Prime Minister (PM) Narendra Modi demanding that the proposed Rampal power plant in Bangladesh be scrapped due to its potential to cause "irreparable damage" to Sundarbans, the world's largest mangrove forest. The National Oil, Gas, Mineral Resource, Power and Port Protection Committee, which is spearheading the movement against the 1320 MW coal-based plant in Bangladesh, submitted a memorandum in this regard to the Indian High Commissioner in Dhaka. In New Delhi, a coalition of groups including the All India Union of Forest Working People and National Alliance of People's Movements (NAPM) wrote to the PM claiming that the project will adversely affect India as well. A 250-km 'Long March' was held in March against the plant, for which a deal was signed between the two countries in 2010.

Source: Business Standard

Power engineers to strike work in Punjab

October 17: Power Engineers Association working in PSPCL and Punjab State Transmission Corp Ltd (PSTCL) have decided to proceed on mass casual leave on October 20. They are protesting against denial of initial start of scale to the assistant engineers. Association said all other categories of employees whether recruited before or after 2010 in PSPCL and PSTCL are being paid the same pay except the assistant engineers.

Source: The Economic Times

Soon, pay power bills at fair price shops

October 16: The Haryana government plans to make better use of thousands of fair price shops across the state by adding facilities for paying electricity bill and collecting social security pension. The food and supplies department has already moved a proposal to this effect. Haryana's minister of state for food and supplies Karan Dev Kamboj said the chief minister's office (CMO) has been informed about the move. Power commissioner Anurag Rastogi said that since there were 9,275 fair price shops in Haryana, including over 6,000 in rural areas, the network is nearly exhaustive. At present, the shops are used for distribution of subsidies grains and kerosene oil under PDS schemes. Since the government has already announced to make Haryana a kerosene-free state, the food and supplies department is exploring the ways to increase the income of depot holders to help them survive.

Source: The Times of India

J&K govt approves construction of Srinagar-Leh power line

October 15: Jammu and Kashmir (J&K) government has given the go-ahead for the construction of a 332 km-long, 220 KV transmission line from summer capital Srinagar to Leh in the frontier Ladakh region that is suffering energy shortage. The approval to the State Power Development Department to sign an MoU with the Power Grid Corp of India Ltd (PGCIL) in this regard, was given by the state cabinet which met under Chief Minister Mehbooba Mufti. The sanctioned cost of the project is ` 1,788 crore and the cost of the project will be borne by the Centre and state in the ratio of 95:5. The electricity supply system of Ladakh region is currently isolated from the Northern Grid and fed through local small hydro generation and diesel generator sets. The region is experiencing energy shortage and to overcome this, the 220 KV transmission line has been planned to improve reliability of power supply through interconnection with the Northern Grid.

Source: Business Standard

50 pc relief in power tariff for domestic power consumers in Pondi

October 15: Puducherry government introduced a relief of 50 percent in power tariff for domestic power consumers in the Union Territory. An order of the Department of the Industrial Development (Power) said domestic consumers consuming upto 100 units per month would be granted 50 percent relief on actual power consumption charges.

Source: The Economic Times

Fitch affirms 'BBB-' ratings to PGCIL

October 14: Fitch has affirmed investment grade rating with 'stable' outlook on Power Grid Corp of India Ltd (PGCIL). BBB' ratings indicate low default risk. The capacity for payment of financial commitments under this is considered adequate although adverse business or economic conditions are more likely to impair this capacity.

Source: Business Standard

Transmission project worth ` 500 bn to go under hammer in FY’17

October 14: Transmission projects worth more than ` 50,000 crore would be up for bidding during the current fiscal to increase power evacuation capacity in the country, Power Secretary P K Pujari said. There has been healthy growth of the transmission sector during the 12

th Plan (2012-17). After April 2012, India has added 90,000 circuit kilometres of transmission lines and 2.72 lakh MVA of transmission capacity. The Power System Development Fund (PSDF) scheme was sanctioned for two financial year till March 31, 2017, to revive stranded as well as other domestic power plants running at sub optimal levels (capacities).

Source: The Financial Express

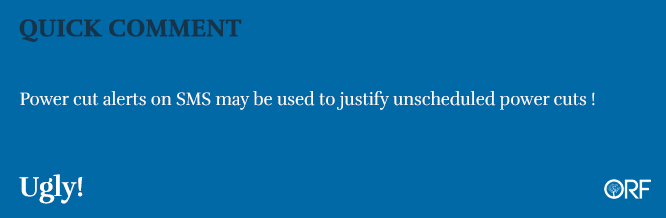

Soon, power cut alerts on SMS

October 12: Complaints about power cuts taking consumers by surprise will soon be a thing of the past with the Kerala State Electricity Board (KSEB) planning to inform citizens about such shut downs in advance through a short messaging service (SMS) facility. Power Minister Kadakampally Surendran said that his department plans to provide more information technology-based services to KSEB consumers as part of efforts to improve efficiency. He said that there are complaints that section officers do not respond to phone calls regarding power failure. To tackle this, the board has come up with a toll-free number -- 1912 -- where such complaints can be registered. In addition, the consumers can also send complaints to the KSEB's WhatsApp number, 9496018367. The minister said that the board will provide the option to access the electricity bills through emails and SMS.

Source: The Times of India

NATIONAL: NON-FOSSIL FUELS/CLIMATE CHANGE TRENDS

India witnessed $16 bn shortfall in renewable energy investments in 2015: IEEFA

October 18: India needs a total annual investment $26 billion to achieve its targeted renewable capacities and meet committed reduction in emissions. In comparison, the investment made into the renewable sector in the country was $10 billion in 2015 – a shortfall of $16 billion. According to data compiled by the Institute of Energy Economics and Financial Analysis (IEEFA), India’s electricity generation from renewable sources is estimated to be 17 percent and is projected to rise to 25 percent by 2022, and an impressive 40 percent by 2030. As part of its targets, India aims to reduce its emissions intensity by 33-35 percent over the 2005 levels, by 2030.

Source: The Economic Times

PM Modi dedicates 3 HEPs to nation in Himachal Pradesh

October 18: Prime Minister (PM) Narendra Modi dedicated to the nation three hydro-electric projects (HEPs) with a generating capacity of 1,732 MW in Himachal Pradesh. All the three power projects — Koldam HEP (4×200 MW) of NTPC, Parbati HEP Stage-III (4×130 MW) of NHPC and Rampur HEP (6×68.67 MW) of SJVN — are equipped with generating equipment supplied and commissioned by Bharat Heavy Electricals Ltd (BHEL), BHEL said. BHEL has a vast experience in hydro-electric projects having contracted more than 500 hydro generating sets with a cumulative capacity of more than 29,000 MW of various ratings in India and abroad. BHEL’s hydro installations are in operation in India and across the world in Azerbaijan, Bhutan, Malaysia, Nepal, Taiwan, Tajikistan, Rwanda and Vietnam. The company is executing HEPs of around 3,300 MW in the country, which are at various stages of implementation, in addition to major hydropower projects in DR Congo and Bhutan. The government is contemplating inclusion of large hydro projects in the fold of renewable energy to provide an impetus to these projects.

Source: The Financial Express

India, Germany join hands for wind energy

October 18: India and Germany signed an MoU (Memorandum of Understanding) to further their cooperation in the wind energy sector. Germany, which is a pioneer in wind energy, both off shore and on shore, expressed its willingness to share technology to promote green energy to combat greenhouse gases. Robert Habeck, a Green Party minister of energy, agriculture, environment and rural areas from the state of Schleswig Holstein announced that the country is ready to share expertise in renewable energy to assuage the ill effects of fossil fuel which Germany as well as other European countries promoted since 1970s. The MoU was signed between the Indian Wind Turbine Manufacturers Association and Messe Husum in Chennai.

Source: The Economic Times

India's new HFC target will eliminate one-sixth of coal-powered CO2 emissions

October 18: According to an IndiaSpend calculation based on carbon-dioxide (CO

2) equivalent emissions from thermal power stations in 2012, India’s participation in a global agreement on climate change will reduce India’s greenhouse gases equal to closing one-sixth of India’s thermal power stations over the next 35 years. As many as 197 countries reached a legally binding agreement in Rwanda on 15 October to phase down the production and consumption of hydrofluorocarbons (HFCs) – gases that can have global warming potential up to 12,000 times more than CO

2. The agreement will come into force on 1 January, 2019, and avoid an emission of 70 billion tonnes of CO

2 equivalent globally – the same as stopping more than half of tropical deforestation.

Source: Firstpost

PM Modi said to plan $3.1 bn boost for India’s solar factories

October 18: Prime Minister (PM) Narendra Modi’s government is planning a ` 210 billion ($3.1 billion) package of state aid for India’s solar panel manufacturing industry. The so-called Prayas initiative, short for “Pradhan Mantri Yojana for Augmenting Solar Manufacturing,” a central-government plan designed to lift India’s installed photovoltaic capacity as well as to create an export industry. Modi wants to raise renewable capacity to 175 GW by 2022 from 45 GW at present. The Prayas program, part of Modi’s “make in India” campaign, is intended to create 5 GW of photovoltaic manufacturing capacity from 2019 and build 20 GW of projects in the country by 2026. Power, Coal, New and Renewable Energy and Mines Minister Piyush Goyal said that a policy to encourage domestic manufacturing of solar equipment is in works. India has become one of the biggest clients of Chinese photovoltaic manufacturers and in the absence of its own domestic capacity, that reliance could potentially grow.

Source: Bloomberg

Kudankulam is still the cheapest of all foreign-built nuclear plants

October 17: Kudankulam Nuclear Power Plant’s unit 3 and 4, for which Prime Minister Narendra Modi and Russian President Vladimir Putin laid the foundation through video-conferencing, are expected to sell electricity at ₹ 3.90 a kilowatt hour (kWh), according to World Association of Nuclear Operators. KKNP 3 and 4, with a net capacity of 917 MW each, will cost ₹ 39,849 crore ($6.5 billion) to build. The first two units, the second of which was connected to the grid only in August 2016, cost ₹ 17,270 crore, but the cost is under revision to ₹ 22,462 crore. The Kudankulam plant’s equipment and fuel are supplied by Russia’s State Atomic Energy Corp. Despite costing twice as much as the first two units, 3 and 4 will still sell their electricity at the same price. The price of the second set of units nearly doubled from the first two because of India’s Nuclear Liability Act. The 2010 vendor liability law gives the operator of the plant the natural right to sue the equipment supplier for damages in case of a nuclear mishap due to a defect in the equipment or services. India’s nuclear power capacity stands at 5,780 MW (5,308 MW net), compared with the US’ 1,00,350 MW, France’s 63,130 MW, Japan’s 40,290 MW, China’s 30,402 MW and Pakistan’s 690 MW.

Source: The Hindu Business Line

PM Modi thanks Brazil for support to India’s NSG bid

October 17: Prime Minister (PM) Narendra Modi thanked Brazilian President Michel Temer for his country’s support for “understanding India’s aspiration” for membership of the Nuclear Suppliers’ Group (NSG) as the two countries inked four MoUs, including on investment cooperation.

Source: Hindustan Times

Ashok Leyland launches first India-made electric bus

October 17: After electric cars it is the turn of bigger vehicles coming in full electric format for mass transportation. The Hinduja flagship Ashok Leyland has launched its first locally designed, engineered and produced battery electric bus series Circuit. The company has developed the circuit series electric bus, a zero-emission product, with some technology inputs sourced from its UK subsidiary Optare, which is a pioneer of electric buses. Battery for these buses will be imported from US and is expected to last five to seven years. Meanwhile, some states such as Himachal Pradesh and Maharashtra have been adopting such green vehicles and Ashok Leyland is in active discussion with them. It is hoping to clinch a deal soon.

Source: The Hindu Business Line

Govt keen on solar park in region: Goyal

October 17: The Centre is keen to set up a solar power park in Marathwada if the state government provides land for it, Power, Coal, New and Renewable Energy and Mines Minister Piyush Goyal said. Goyal, who commissioned the 47.6 MW wind power project installed by public sector undertaking Satluj Jal Vidyut Nigam (SJVN) at Khirvire in Akole taluka, appealed to SJVN authorities to take the lead in setting up a solar power park in Marathwada. The minister said the government has plans to carry out competitive bidding of wind power on the lines of solar power. Fly ash, which is a byproduct of power generation with coal, has been aptly used by NTPC at Dadri in Uttar Pradesh for afforestation, the minister said.

Source: The Times of India

2 GW Mandvi power plant gets green nod

October 17: Infrastructure Leasing and Financial Services Ltd (IL&FS) group has received environmental clearance for its proposed 2000 MW gas-based power project in Mandvi taluka of Kutch district. The gas-fired power project will be developed within a multi-product special economic zone (SEZ) by IL&FS group at Mandvi.

Source: The Times of India

Jharkhand loses steam for solar PPAs

October 17: Developers who won an auction of solar project contracts in Jharkhand are still waiting for the state’s government-run electricity distributor to sign power purchase agreements (PPAs), six months after they emerged the successful bidders. The March auction, with contracts for 1,200 MW of projects in 45 places up for grabs, was one of the largest single auctions to have ever been held in the country.

Source: The Economic Times

Govt to provide solar panels at subsidized rate

October 16: In order to motivate people to install solar panels in their homes, the state government has come up with a scheme of subsidies. People, who will apply for solar panel producing two kilowatt solar energy, will be provided a subsidy of ` 45,000. The actual cost of the panel is ` 1.5 lakh. Solar panels can save ` 15,000 to ` 17,000 invested on electricity in a year. Experts said that installation of solar panel would not be a costly affair since a household would be able to save the amount invested in around five years. To ease the process of subsidy, the government has authorized some companies to provide the subsided solar panels.

Source: The Times of India

Inox Wind bags orders for 40 MW projects from Gujarat’s Malpani Group

October 13: Indian wind energy service provider, Inox Wind said that the company has bagged two repeat orders for two 20 MW projects from Malpani Group in Gujarat. The orders involve supply and installation of 20 units of Inox Wind's latest offering, the 113 meter rotor dia Wind Turbine Generator. The company said that the two orders will be executed on turnkey basis and are expected to be commissioned by March 2017.

Source: ZeeBiz

Solar power to make Noida Metro India’s greenest

October 12: The 29.7 km Noida Metro corridor will be India’s greenest when it becomes operational a little over a year from now with a capacity to generate enough solar power to run not only all 21 stations but also its offices and train depot. The practices being followed are similar to those Delhi Metro is employing in Phase-3 and some of its existing stations, but Noida Metro will stand out as India’s most environment-friendly Metro project because the entire corridor will homogenously use solar power, right from its head office to parking lots and footbridges. Noida Metro has set a target of generating 12 MW of solar power daily. For that yield, it is installing solar panels on the rooftops of all stations, footbridges, its main office building, the depot and parking lot boundary walls. Noida Metro Railway Corp’s headquarters in Sector 29 will be the first building in the NCR city to fully generate its own solar power. The project’s environmental initiatives have been taken up under the terms of reference issued by the State-level Environment Impact Assessment Authority, which it approached after a direction from the National Green Tribunal to obtain environmental clearance. Under those guidelines, Noida Metro must also build sound barriers along the entire line, 576 rainwater harvesting pits and plant nearly 18,000 trees to compensate for the loss of greenery because of construction.

Source: The Economic Times

International: Oil

Abu Dhabi to merge shipping units after offshore energy combined

October 18: Abu Dhabi National Oil Co. (ADNOC) will combine three shipping and ports units less than a month after consolidating two offshore oil and gas businesses. Abu Dhabi National Tanker Co., Petroleum Services Co. and Abu Dhabi Petroleum Ports Operating Co. will be combined, effective by the end of 2017, ADNOC said. ADNOC said it expects the consolidation to lead to improved efficiency and savings, which it didn’t specify. Abu Dhabi, holder of about 6 percent of global oil reserves, is reining in spending as a drop in oil prices to about half of 2014 levels slows economic growth. The Gulf emirate plans to cut costs by combining its two biggest banks and unifying two of its largest sovereign investment funds, International Petroleum Investment Co. and Mubadala Development Company PJSC. It’s also consolidating offshore energy businesses Abu Dhabi Marine Operating Co. and Zakum Development Co. The new shipping company will operate more than 165 vessels, including vessels to carry liquefied natural gas, chemicals and bulk cargo, ADNOC said.

Source: Bloomberg

BP says will break even with oil at $55 per barrel in 2017

October 18: BP chief executive officer (CEO) Bob Dudley expects oil to trade at $50-$60 a barrel next year, he said, adding that his company would break even at prices slightly below $55. He also said he does not see production rising fast in Iraq next year and that there is still no clarity on new contracts in Iran.

Source: Reuters

Petrobras agrees to sell closed Okinawa refinery to Taiyo Oil

October 17: Brazil's state-controlled oil company Petroleo Brasileiro SA (Petrobras) said it had agreed to sell its mothballed Okinawa refinery and related assets to Japan's Taiyo Oil Co. for $129.3 million. Known as Nansei Seikyu, the Okinawa refinery company supplies about half the fuel needs for the Japanese island, has a capacity to produce 100,000 barrels a day, is home to 36 storage tanks that can hold 9.5 million barrels of petroleum and derivatives, and port facilities, Petrobras said.

Source: Reuters

Iran calls OPEC's decision to limit output 'baby step in right direction'

October 17: Iran's Deputy Oil Minister Amir Hossein Zamaninia said that the OPEC's primary agreement in Algeria to limit oil output at 32.5 million barrels per day (bpd) was a small step but in right direction. Iran's current oil output is 3.85 million bpd, and its exports more than 2.2 million bpd. Zamaninia said the exact levels of production by each country would be negotiated at OPEC next formal meeting in November.

Source: Reuters

Kazakhstan resumes production at Kashagan giant O&G field

October 17: Kazakhstan energy ministry has announced that production had resumed at the giant Kashagan giant oil and gas (O&G) field, with four wells already producing 90,000 barrel (bbl) per day of crude oil. Commercial flows of oil are expected by the end of October 2016. The operating consortium now expects production to reach 230,000 bbl per day by the end of 2016 and up to 370,000 bbl per day by mid-2017.

Source: Enerdata

Oil prices fall on rise in US drilling, strong dollar

October 17: Oil prices fell, pulled down by a rising rig count in the United States, a strong dollar and record OPEC-output which comes amid slowing global economic growth that could erode fuel demand. United States (US) West Texas Intermediate (WTI) crude oil futures were trading at $50.20 per barrel at 0710 GMT, down 15 cents from their last settlement. Traders said that WTI was pulled down by another rise in US oil drilling activity. OPEC is scheduled to meet on November 30 to discuss a production cut of around 1 million barrels per day. The producer cartel hopes non-OPEC members, particularly Russia, will join a potential cut.

Source: Reuters

Brazil oil regulator says it will cut 350 rules in 2016

October 17: Brazil's oil regulator ANP will extinguish about 350 rules in 2016 as part of efforts to attract investment to Brazil by simplifying regulations after a fall in world oil prices, the agency's outgoing chief Magda Chambriard said. She also said the planned sale of the unleased portion of the giant Carcara oil discovery will occur in 2017.

Source: Reuters

US shale output drop seen for 12th straight month in November: EIA

October 17: United States (US) shale oil production was expected to fall for a 12

th consecutive month in November, according to a US government forecast released, on the back of a two-year global rout in oil markets. November oil production was expected to fall by 30,000 barrels per day (bpd) to 4.43 million bpd, according to the U.S. Energy Information Administration (EIA)'s drilling productivity report, the lowest output since March 2014. The biggest decline was in the Eagle Ford in Texas, which was set to drop by 35,000 bpd to 947,000 bpd. In North Dakota, oil production in the Bakken was set to drop by 21,000 bpd to 946,000 bpd.

Source: Reuters

Kuwait's acting Oil Minister expects output 'understanding' at November OPEC meeting

October 17: Kuwait's Finance Minister and acting Oil Minister, Anas al-Saleh, said he was optimistic that an understanding on production "at least" would be reached between producers at an OPEC meeting in November. He said expectations that oil prices would be between $50 and $60 over the next 10 to 15 months were "logical and acceptable". He said that current prices were unsustainable but that he believed the cancellation of oil investments globally would help to balance supply and demand so as to arrive at an acceptable price.

Source: Reuters

Nigeria expects 22 percent jump in oil output by end-December

October 17: OPEC member Nigeria expects its oil production rate to jump by 22 percent by the year-end to 2.2 million barrels per day (bpd) from current levels, its Oil Minister Emmanuel Ibe Kachikwu said. He hoped a force majeure on all its oil fields would be lifted by December or January. Kachikwu, on a visit to New Delhi, said Nigeria was likely to sign a cash-raising oil deal with India for $15 billion by the end of this year. India's oil ministry said that Nigeria, whose economy has been hit hard by low oil prices and militancy, had requested an upfront payment. He said the OPEC, which has agreed to cut world output to rescue prices, has however allowed a production window of 1.8 million bpd to 2.2 million bpd for recession-hit Nigeria. Apart from the impact of low oil prices, whose sales account for 70 percent of the Nigerian government's revenue, the country's energy facilities have been crippled by attacks by militants calling for a greater share of the country's oil wealth. Kachikwu met Indian oil minister Dharmendra Pradhan to discuss expanding energy ties between the two countries. In the last fiscal year ended March 31 Nigeria accounted for nearly 12 percent of all crude oil imports by India, one of the fastest growing economies and energy markets in the world.

Source: Reuters

Colonial Pipeline to cut volumes on gasoline line after Alabama leak

October 17: Colonial Pipeline said it would cut shipping volumes while it works to restart the section of its main gasoline conduit that was damaged after its biggest gasoline leak in nearly two decades in Alabama last month. The company expects to fully restart the damaged part of artery by mid-November. The damaged section of the 1.3 million barrel a day line that connects the refining hub of the Gulf Coast to the East Coast was shut for more than 12 days after a leak was discovered on September 9. A bypass line was constructed to restart operations while the company repaired the main conduit. Allocations on Line 1 - the main gasoline line on the biggest refined products system in the United States- will be reduced by about 20 percent for 10 days. U.S. gasoline crack spreads, a key metric for margins for U.S. refiners, jumped by 5.3 percent to $13.32 a barrel on news of the reduced allocations. New York Harbor gasoline for prompt delivery were also said to be offered higher. The U.S. Department of Transportation Pipeline and Hazardous Materials Safety Administration said that Colonial must cut pressure on the line by 20 percent until it can ensure the line can safely operate at full capacity.

Source: Reuters

Iran boosting oil production in possible hitch to OPEC deal

October 17: Iran, OPEC’s third-biggest member, plans to boost its oil output to 4 million barrels a day this year, potentially complicating the producer group’s plan to cut supply in an effort to prop up prices. Oil Minister Bijan Namdar Zanganeh said he hopes the OPEC will agree next month at a meeting in Vienna to limit output. Iran is seeking about $200 billion of investment in its oil, natural gas and petrochemicals industries to raise production and sales, according to Zanganeh. The country is targeting an average daily output of 4.28 million barrels of crude and 1 million barrels of condensate within four years, he said. OPEC members will meet next month to seek agreement on how to put into effect a planned cut in the group’s output. OPEC decided in Algeria to reduce its collective production to between 32.5 million and 33 million barrels a day to rein in a global glut and support prices, though it may exempt Iran from any cuts. Iran lost its position as OPEC’s second-biggest producer after international sanctions were tightened in 2012 and has defended its steps to ramp up output to return to prior levels. Iran aims to raise production from 3.89 million barrels a day currently, National Iranian Oil Co (NIOC) said at the conference in Tehran. Iran pumped 3.63 million barrels of oil a day in September, data show. The country is producing at full capacity and aims to raise exports to 2.5 million barrels a day by March, NIOC said. Iran currently exports more than 2.2 million barrels a day, Zamaninia said. The country may tender the first field, the South Azadegan deposit, to international companies as early as November, NIOC said.

Source: Bloomberg

No tax increase after cut in fuel price: Brazil President

October 15: Brazilian President Michel Temer said the government has no plans to increase fuel taxes, a day after Petroleo Brasileiro SA (Petrobras) announced a drop in fuel prices. Temer said any tax increase at present goes counter to efforts by the new government to rein in public spending, particularly through a proposed constitutional amendment that would cap expenditures. Despite the drop in oil prices worldwide in recent years, Petrobras' cut was the first downward change in Brazilian fuel prices since 2009. The new cut reduced prices for diesel by 2.7 percent and gasoline by 3.2 percent.

Source: Reuters

Mexico's Pemex risks compensation bust from lost oil fields

October 14: Mexican state oil company Pemex risks getting little or no compensation for the billions it invested in fields now set aside for private competitors in a landmark energy reform, according to an energy ministry document. Already struggling with low oil prices and mounting debt, Pemex faces a bruising battle to recoup money from the government for its investments due to strained public finances. The ministry document showed that Pemex might be denied any compensation at all if the government finds the company is liable for "environmental, social or infrastructure" damage from its work in those fields.

Source: Reuters

VTTI looking to invest in oil storage in Southeast Asia

October 14: VTTI, the storage arm of the world's largest independent oil trader Vitol, is scouting for investment opportunities in Southeast Asia to cater to the region's rising demand for tank space, Aernout Boot, general manager of VTTI Asia said. The oil industry has absorbed at least 2 million cubic meters, about 12.6 million barrels, of storage in the past 18 months in Singapore, Malaysia and Indonesia following record fuel exports from China and a build-up in diesel supplies, according to Boot. While Southeast Asian countries are in general showing growth, they each have different regulations and their own state-run and domestic companies, Boot said. Oil volume through the Tanjung Bin terminal in Johor, Malaysia, which has a total storage capacity of 1.155 million cubic meters, has grown by 10 percent a year since 2014, according to Boot. VTTI is now looking to add berths that will allow traders to increase the turnover of oil in storage tanks, Boot said. Strong growth in India's liquefied petroleum gas (LPG) import demand also points to a "huge opportunity", although the company has no firm plans to enter the market, he said.

Source: Reuters

Mercuria sees oil sector going digital with blockchain

October 13: The traditionally old-fashioned oil and gas industry could start adopting the technology behind the bitcoin electronic currency within the next year, Marco Dunand, chief executive of Swiss-based Mercuria said. He believes a key part of the Brent market that helps to set the global benchmark price for oil could be making regular use of blockchain payment technology, provided enough participants agree to employ it. The Brent crude derivative, or paper, market, is underpinned by four physical crude oils - Brent itself, Forties, Ekofisk and Oseberg (BFOE) - and could be an ideal early adopter of blockchain, he said. Dunand's company often helps to bridge the gap between the so-called physical markets, where real barrels of oil change hands, and the paper markets, where futures, options and other derivatives trade. Dunand said some parts of the physical energy markets would remain stuck in their ways for some time to come.

Source: Reuters

International: GAS

O&G discovery made in Norwegian Sea: Faroe Petroleum

October 18: An oil and gas discovery has been made at the Njord North Flank in the Norwegian Sea, says independent oil and gas company Faroe Petroleum. The NF-2 exploration well 6407/7-9 S, which was drilled to a total depth of 13,467 feet below sea level, encountered 334 feet of gross oil-bearing reservoir in Middle and Lower Jurassic sandstones of the Ile and 515 feet of gross gas condensate-bearing column in Lower Jurassic sandstones in the Tilje formation.

Source: Rigzone

Total E&P Norge makes gas discovery offshore Norway

October 17: Total E&P Norge, operator of production license 043, has made a gas/condensate discovery through wildcat well 30/4-3 S, located offshore Norway. Drilled in the northeast part of the Martin Linge field, the objective of the well was to prove petroleum in Middle Jurassic reservoir rocks (Brent group). The well encountered gas and condensate in the Tarbert, Ness and Etive formations in the Brent group and reservoir quality was reported by the Norwegian Petroleum Directorate as being good. Preliminary estimations of the size of the discovery are between 2 and 11 million standard cubic metres of recoverable oil equivalents.

Source: Rigzone

US natural gas prices surge amid supply fears

October 17: United States (US) natural gas prices have surged to the highest level for more than 18 months as stocks continue to build more slowly than normal despite the warm weather. The price for gas delivered to Henry Hub in March 2017 has risen by 11 percent since the end of September and is up by almost 44 percent since hitting a low back in February. Gas stocks typically rise between April and October and then draw down between November and March. But stocks have increased much more slowly than usual this year. Stocks have risen by less than the five-year average every week since the start of May, a total of 23 consecutive weeks, according to data from the U.S. Energy Information Administration. The result is that the gas market has swung from a huge surplus at the end of the first quarter close to balance by the end of the third quarter and is on track for a deficit in 2017. Stocks were 1,014 billion cubic feet above prior-year levels in late March but by the end of the first week in October the surplus had shrunk to just 28 billion cubic feet. Gas production has been falling since April as low prices forced many gas companies to scale back drilling programs.

Source: Reuters

UK gas on longest winning streak in nine years on absent LNG

October 17: Britain’s heating season has started with a bang, as natural gas contracts reverse a two-year slump. Gas for next-day delivery in the United Kingdom (UK) is on its longest rising streak since at least 2007, when records of broker data compiled began. The contract has added 23 percent this month, after rising 52 percent in September in the largest monthly gain in at least nine years. Prices for the heating fuel have gained amid cold weather and the longest dry spell for liquefied natural gas imports in two years. The UK didn’t receive any LNG cargoes in the first half of October as tankers instead sailed to markets where they could fetch higher prices, leaving less supply for Britons turning on their heaters for the first time since last winter. The UK entered the heating season, which starts in October and ends in March, with less gas in long-term stockpiles than normal. An unexpected outage at the Rough gas storage facility, the largest in the country, to test the integrity of its wells in June caused it to start the winter with 1.3 billion cubic meters (46 billion cubic feet) of gas, a 54 percent reduction from last year.

Source: Bloomberg

US natural gas production to decline for first year since 2005: EIA STEO

October 13: The United States (US) Energy Information Administration projected year-over-year dry natural gas production in 2016 would fall for the first time since 2005 as low energy prices reduced drilling activity, according to its Short Term Energy Outlook (STEO). EIA reduced its output projection for 2016 to 72.49 billion cubic feet per day (bcfd) in its October outlook from 74.06 bcfd in September. That compared with an all-time high of 74.14 bcfd in 2015. EIA forecast dry gas production would return to a record high in 2017, rising to 76.23 bcfd.

Source: Reuters

UAE gets second deal securing natural gas supplies

October 12: Sharjah National Oil Co. signed the second deal this month aimed at securing natural gas supplies for the United Arab Emirates (UAE). The Persian Gulf emirate’s state oil company signed a Memorandum of Understanding with Uniper SE, of Germany, to import liquefied natural gas through the Port of Hamriyah, in Sharjah. Sharjah Electricity & Water Authority will receive set quantities of gas via pipeline from Qatar under an accord signed, the utility said. Most of the oil in the UAE is in Abu Dhabi.

Source: Bloomberg

Japan protests over signs of renewed Chinese gas exploration

October 12: Japan has protested to China over signs it is pressing ahead with maritime gas exploration in the East China Sea despite Tokyo's repeated requests to stop. The exploration platforms are on the Chinese side of the median line between the two countries, but Japan accuses China of ignoring a 2008 agreement to maintain cooperation on resources development in an area where no official border has been drawn.

Source: Reuters

International: Coal

Glencore’s coal hedge gets more painful as prices rally

October 17: The rally in thermal coal is taking a bigger bite out of Glencore Plc’s profits after the world’s biggest exporter of the fuel locked in prices prior to the surge. Coal prices kept climbing -- meaning Glencore is forgoing even more potential profits -- and Liberum Capital Ltd analysts estimated in a report that loss on the hedge could be as much as $1.2 billion. A benchmark for prices in Asia has risen 53 percent since the end of June and traded at the highest in more than three years. Prices for the fuel have surged this year after a surprise change in Chinese government policy that lowered domestic production. As a result, steel mills and power plants in China increased coal imports since April, boosting prices. Glencore has been working to slash its debt load after its share price collapsed last year. The move to hedge about 55 million metric tons of output was a “corporate risk-management” decision, the company said. It produced 59 million tons of coal in the first half from mines in Australia, Colombia and South Africa.

Source: Bloomberg

Anglo close to selling Australian coal assets to Apollo consortium

October 13: Anglo American is expected to finalize a $1 billion-plus sale of its Australian coal assets to a group headed by private equity group Apollo Global Management in the coming weeks. Major mining firms BHP Billiton and Glencore as well as suitors from China, Japan and India were looking at the assets. Anglo American said that discussions were under way to divest its Moranbah and Grosvenor coal mines in Queensland state as part of its plans to sell $3-4 billion of assets this year.

Source: Reuters

China September coal imports surge again as domestic cuts bite

October 13: China imported 24.26 million tonnes (MT) of coal in September, up more than a third from a year ago, customs data showed. For the year to date, imports increased 15.2 percent to 180 MT. The monthly total was up from 17.7 MT last year but down from August's total of more than 26 MT, which was the highest in nearly two years. The pace of buying may not continue into October after Beijing allowed domestic mines to ramp up output after inventories fell to critically low levels and prices spiked.

Source: Reuters

International: Power

Sri Lanka announces power-cut following power plant breakdown

October 17: Sri Lanka announced nation-wide power cuts following a breakdown in the island’s only coal-fired power plant. The power and energy ministry said the power-cut will be imposed across the country, but not in capital Colombo. The electricity will be cut for 2.5 hours in the morning from 8 a.m. and for one hour in the evening from 6 p.m. However the ministry said that electricity will not be cut in hospitals. Sri Lanka was forced to impose power cuts after the coal power plant broke down. The Norochcholai coal power plant contributes to a major portion of Sri Lanka’s electricity demand. The power plant had malfunctioned several times in the past as well resulting in similar power cuts.

Source: The Indian Express

Indonesia's Adaro Energy says power plant on track

October 12: Adaro Energy's power generation project in the Indonesian province of Central Java is on track after securing necessary financing and regulatory approvals, the company said. The 2,000 MW coal-fired plant, the first by the coal producer, was delayed for more than four years due to land acquisition issues. The project is part of the ambitious plan by Indonesian President Joko Widodo's government to construct 35,000 MW of generating capacity by 2019.

Source: Nikkei Asian Review

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

UK botched its renewable energy programs

October 18: The U.K. government miscalculated the costs of renewable-energy support and is likely to overshoot its 7.6 billion pound ($9.2 billion) annual budget by about a fifth in 2020 and 2021, according to auditors. The “government’s forecasting, allocation of the budget and approach to dealing with uncertainty has been poor, and so has not supported value for money, the National Audit Office said. The U.K.’s generous subsidies for renewables resulted in a rapid build-out of solar and wind farms. The overcast northern European country has 9.2 GW of solar farms installed. The government reduced those programs in 2015 and ended one for onshore wind a year early. Most of the allocated government funds have been spent and there is little left over to fund new projects between now and 2021.

Source: Bloomberg

OPG starts refurbishing the Darlington nuclear plant in Canada

October 18: Canadian energy utility Ontario Power Generation (OPG) has started refurbishing its 3,512 MW Darlington nuclear power plant in Ontario (Canada), which supplies around 20% of the province's electricity consumption. The operating license for the plant was to expire on 31 December 2014 and has been extended until 31 December 2015. The refurbishment programme, estimated at C$12.8 bn (US$9.9 bn), is expected to extend the lifetime of the units, initially due to stop operations around 2020, to 2055. During works, OPG will continue to operate the 3,100 MW Pickering nuclear power plant until 2024, as approved by the Ontario province.

Source: Enerdata

Tesla says it hopes to work with Panasonic on solar energy tech

October 18: United States electric car maker Tesla says it plans to start working with Japanese electronics company Panasonic Corp on solar energy. Tesla's said that the companies have signed a non-binding letter of intent to begin collaborating on Panasonic's production of photovoltaic cells and modules at a facility under construction by San Mateo, California-based solar-panel company SolarCity Corp in Buffalo, New York. The deal requires shareholders' approval of Tesla's planned acquisition of SolarCity. Tesla said SolarCity's installation network and Tesla's global energy storage could provide customers a one-stop shop for sustainable energy and transportation.

Source: China Post

Enel begins construction of $500 mn wind project in Missouri, US

October 18: Enel Green Power North America (EGPNA), a renewable energy subsidiary of Enel, has commenced construction of the 300 MW Rock Creek wind farm in Missouri, United States. Upon commissioning by the end of 2017, the plant, which will be owned by EGPNA subsidiary Rock Creek Wind Project, is expected to avoid CO

2 emissions of about 900,000 tons each year.

Source: Energy Business Review

Wind power could fuel 20 percent of power demand by 2030: GWEC

October 18: Wind power could fuel 20 percent of global electricity by 2030, the Global Wind Energy Council (GWEC) has estimated in its biennial Global Wind Energy Outlook. By 2030 wind power could reach 2,110 GW, and supply up to 20 percent of global electricity, creating 2.4 million new jobs and reducing CO

2 emissions by more than 3.3 billion tonnes per year, and attracting annual investment of about €200 billion. According to GWEC, decarbonising the global energy system includes the transport sector as a major emitter of carbon. Global wind energy installations totalled 433 GW as of the end of 2015, and the industry is set to grow by another 60 GW in 2015.

Source: The Economic Times

Rich nations say on track for promised $100 bn climate finance

October 17: Rich countries said they were on track to keep a promise to provide developing nations with $100 billion a year to tackle climate change by 2020, up from an estimated $62 billion in 2014. The pledge of fast-rising funds, first made in 2009 to help the poor rein in greenhouse gas emissions and adapt to rising temperatures, was a key to ensuring all governments signed up for the 2015 Paris Agreement to combat global warming. The Paris Agreement will enter into force on November 4 after winning backing from major emitters led by China and the United States.

Source: Reuters

Sweden floats options to strengthen EU’s ailing carbon market

October 17: The European Union (EU) debate on a post-2020 overhaul of the bloc’s carbon market is set to intensify after Sweden outlined options to boost the cap-and-trade system tainted by a persistent oversupply of permits. Isabella Loevin, Swedish minister for international development cooperation and climate, said she presented a discussion paper on the Emissions Trading System to a group of environment ministers from 14 EU countries supporting ambitious climate policies, including Germany, France and the United Kingdom.

Source: Bloomberg

Axpo, Alpiq and BKW withdraw nuclear permit applications

October 17: Swiss energy group Axpo, Alpiq and BKW have jointly agreed to withdraw the framework permit applications for replacement nuclear power plants, which were submitted in the year 2008 and postponed in 2011. Indeed, Switzerland has since then decide to exit nuclear and to phase out the existing five nuclear reactors, which will be progressively shut down between 2019 and 2031.

Source: Enerdata

ACWA Power plans to build a 340 MW wind power project in Turkey

October 17: Saudi Arabia's energy project developer ACWA Power International plans to build a 340 MW wind power project in Turkey, as part of its expansion plans in the dynamic Turkish market. ACWA Power is already building a 950 MW CCGT power plant in Kirikkale, expected to be commissioned in the second quarter of 2017.

Source: Enerdata

China trade environment to remain weak for remainder of 2016

October 17: China trade environment will remain weak for remainder of 2016, the commerce ministry said. China will actively support Chinese steel firms facing anti-dumping accusations, the commerce ministry said.

Source: Reuters

Global deal reached to limit powerful greenhouse gases

October 15: Nearly 200 nations have reached a deal to limit the use of greenhouse gases far more powerful than carbon dioxide in a major effort to fight climate change. The talks on hydrofluorocarbons (HFCs) were called the first test of global will since the historic Paris Agreement to cut carbon emissions was reached last year. HFCs are described as the world's fastest-growing climate pollutant and are used in air conditioners and refrigerators. Experts say cutting them is the fastest way to reduce global warming. The new agreement, unlike the broader Paris one, is legally binding. It caps and reduces the use of HFCs in a gradual process beginning by 2019 with action by developed countries including the United States, the world's second-worst polluter. More than 100 developing countries, including China, the world's top carbon emitter, will start taking action by 2024, when HFC consumption levels should peak. Environmental groups had hoped that the deal could reduce global warming by a half-degree Celsius by the end of this century.

Source: Bloomberg

UK urged by adviser to devise strategy to suck carbon from air

October 13: The United Kingdom (UK) should develop strategies for removing carbon dioxide from the atmosphere in order to meet its obligations under the first internationally binding agreement to fight global warming, the government’s climate change adviser said. Britain’s vote to leave the European Union doesn’t affect its climate targets, which are enshrined in national law, the Committee on Climate Change said in a set of three reports laying out action the government should take. Without new policies to cut greenhouse gases from cars and buildings, the government will only deliver half the emissions cuts needed to meet its fifth “carbon budget,” limiting emissions from 2028 through 2032, it said. Britain aims to reduce greenhouse gases by 57 percent in the four decades through to 2030 under the fifth carbon budget. Emissions are already more than 35 percent down since 1990, but existing policies will only get halfway to the 2030 target from current levels, according to the committee.

Source: Bloomberg

Shell oil bids $26 mn for Abengoa's advanced biofuel plant

October 13: Royal Dutch Shell Plc's US arm has offered more than $26 million to buy Abengoa SA's cellulosic ethanol plant in Kansas. Shell's initial bid on Abengoa's bankrupt biofuels asset marks the oil major's latest push into renewable fuels as the US government is getting its over decade-old biofuels policy back on track following years of regulatory delays. For Abengoa, the potential sale is the latest step to shed its U.S. renewables assets as the company pushes on with efforts to avoid becoming Spain's biggest bankruptcy after more than a decade of heavy borrowing to fuel an expansion into clean energy. Abengoa has already auctioned off several of its conventional ethanol assets. Its 25-million-gallon cellulosic plant near Hugoton, Kansas, can turn plant waste into an advanced biofuel that qualifies for the country's Renewable Fuel Standard program. Shell also has a sugar-ethanol joint venture with Brazil's Cosan SA Industria e Comercio and said earlier this year it wants renewables including biofuels and wind to become "essential" for the company.

Source: Reuters

A gas line has two US agencies in a climate change dustup

October 12: The United States (US) Environmental Protection Agency said the Federal Energy Regulatory Commission failed to undertake a “proper” analysis of climate change in its final environmental impact statement for the 160 mile (257 kilometer) Leach Xpress pipeline. The rift exposes divisions at the federal level over the approval process for pipelines when climate change is taken into account at a time when the U.S. gas network is undergoing a massive expansion driven by booming production.

Source: Bloomberg

US biodiesel executives plead guilty to over $60 mn fraud scheme

October 12: Two men pleaded guilty in a United States (US) court to conspiracy, fraud and making false statements related to the U.S. government's controversial policy designed to boost use of renewable fuels, according to court documents. The case comes in the last four weeks of a contentious U.S. presidential election campaign as the petroleum industry presses for reform or repeal of a program that has drawn criticism from Big Oil and environmentalists alike. The U.S. government is due to finalize next year's biofuel mandates by end-November. Fred Witmer and Gary Jury co-owners of Indiana biodiesel plant Triton Energy LLC, pleaded guilty in an Indiana court to defrauding the U.S. government's renewable fuel support program and a tax credit program, the US Department of Justice said. Witmer and Jury together owe more than $64 million for wire fraud and conspiracy in a scheme to fraudulently produce biofuels credits used to comply with the U.S. Renewable Fuel Standard from 2012 to 2015, according to court documents.

Source: Reuters

DATA INSIGHT

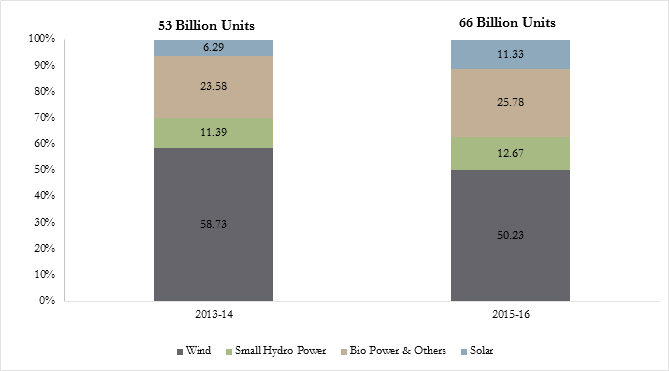

Renewables in India: Installed Generation Capacity and Electricity Generation

A) Installed Generation Capacity

| Type |

As on March 31, 2014 |

As on June 31, 2016 |

| Installed Capacity (MW) |

% Share in Total |

Installed Capacity (MW) |

% Share in Total |

| Small Hydro Power |

3803.68 |

12.0 |

4304.27 |

9.7 |

| Wind Power |

21136.4 |

66.7 |

27151.4 |

61.4 |

| Bio Power/Cogeneration |

4013.55 |

12.7 |

4860.83 |

11.0 |

| Waste to Energy |

106.58 |

0.3 |

115.08 |

0.3 |

| Solar Power |

2631.93 |

8.3 |

7805.34 |

17.6 |

| Total |

31692.14 |

100 |

44236.92 |

100 |

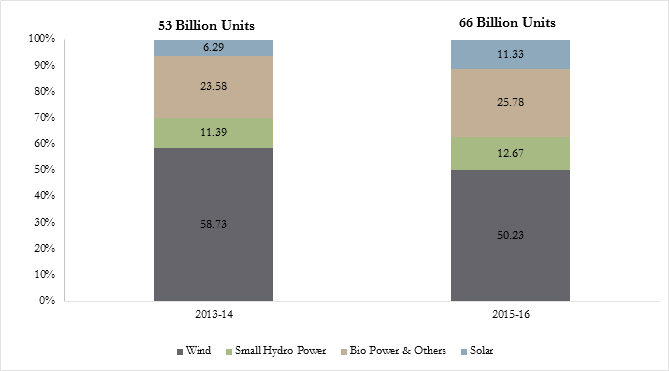

B) Electricity Generation

Source: Compiled from Questions of Rajya Sabha

Source: Compiled from Questions of Rajya Sabha

Publisher:

Publisher: Baljit Kapoor

Editorial adviser: Lydia Powell

Editor: Akhilesh Sati

Content development: Vinod Kumar Tomar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV