-

CENTRES

Progammes & Centres

Location

Cooperative federalism must be maintained as an immutable Indian agenda.

The tussle over how financial resources have been distributed throughout our country dates back to centuries-old policies laid out in British India.

Historically, even prior to the Charter Act of 1833, the revenue surplus of the Presidency of Bengal was used to finance the deficit in the Presidencies of Madras and Bombay. It leads us through the centuries to the contemporary divide between the southern and northern states in the context of equitable fiscal measures on one hand versus economic convergence on the other.

The controversies surrounding the 15th Finance Commission over the last year are extremely crucial in the purview of this topic. The commission was set up in 2017 to give its recommendations for the five fiscal years from 2020 to 2025, the agenda being “to strengthen cooperative federalism, improve the quality of public spending and help protect fiscal stability”.

The commission’s approach seemed to be strictly at par with ‘conditional beta convergence’ in economic theory, which outlines that poorer regions tend to grow at a faster rate than the richer ones. This, however, is conditional on the trade-off between population growth and investment rates in the corresponding regions.

Based on this theory, the underdeveloped and overpopulated northern regions would require a higher investment push from the Centre in order to attain economic convergence between the Indian states in the long run.

Speculations were on the rise that whether the commission’s Terms of Reference (ToR) would not only result in a ‘penalty’ to the southern states for performing well over the decades, but would also mean that the south will be ‘subsidising’ the north. On top of this, the commission’s recent plan to bailout Punjab’s food account debt of approximately Rs 31,000 crore has further added to the woes of southern politics.

However, counter arguments have suggested that the northern states need more support at the moment owing to the faulty policies applied to them in the past and so they are rightfully entitled to more funds.

What needs to be seen here is that whether the speculated lack of government spending in southern states can be balanced by the high foreign investment in that region.

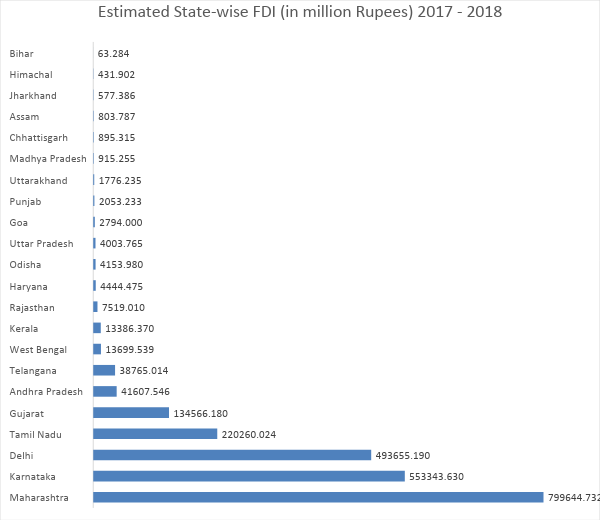

The trend of high Foreign Direct Investment (FDI) inflows in the Southern states is established by the following chart (estimated FDI values of states in accordance with state-wise ratio of Gross Capital Formation) where Maharashtra and Karnataka top the chart while Bihar and Himachal Pradesh rank lowest.

Source: Bhowmick S. and Roshan Saha (2019) Competitive Federalism and FDI Inflow: Disparity within Indian States. Kolkata: Observer Research Foundation Working Paper; Data from RBI Handbook of Indian Statistics (MOCI) and Annual Survey of Industries (MoSPI).

Source: Bhowmick S. and Roshan Saha (2019) Competitive Federalism and FDI Inflow: Disparity within Indian States. Kolkata: Observer Research Foundation Working Paper; Data from RBI Handbook of Indian Statistics (MOCI) and Annual Survey of Industries (MoSPI).FDI inflows are quite beneficial in terms of market access, improving economies of scale, access to resources and betterment of labor markets and opportunities. Such regional trends in foreign investment have a high tendency of aggravating inequality amongst regions.

Hence, appropriate fiscal measures tilting towards favoring the northern states are of utmost importance to ameliorate dispersions in terms of growth and development. The economic convergence issue is extremely relevant for India, where robust growth over the last several decades has left an increasingly wide gap between its richest and poorest states.

The lack of convergence and huge regional disparities has stalled the development process in India. In spite of this, the objective of the 15th Finance Commission debate was failed to be seen in the light of a sustainable developmental framework that would ensure intra-generational as well as inter-regional equity.

Evidence of regional divides in a country is not a new phenomenon in the global scenario with Italy being one of the stark examples in Europe alongside Britain. The northern and southern provinces in Italy show a similar split owing to cultural and economic differences with the north of Italy depicting higher standards of living and significantly higher GDP per capita compared to the south.

The big question now is how the 15th Finance Commission will balance the assignment of weightage to factors such as population vis-à-vis factors such as FDI, literacy, human development and others while allocating funds to the states in India.

It also has to keep in mind how the regional macroeconomic parameters such as private investment, market competitiveness and trade has been influential over the years. The commission will have to find a middle point between the economic centre of gravity in the south and the political centre of gravity in the north in order to maintain ‘unified’ India as a non-negotiable agenda.

This commentary originally appeared in The Wire.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Soumya Bhowmick is a Fellow and Lead, World Economies and Sustainability at the Centre for New Economic Diplomacy (CNED) at Observer Research Foundation (ORF). He ...

Read More +