-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Introduction

The Bay of Bengal region continues to rise as an economic and strategic hub. Parallel to such growth is an increase in the attention being given to the role of a subregional grouping such as the Bay of Bengal Initiative for Multi-Sectorial and Technical Cooperation (BIMSTEC) in promoting development and stability in the region. BIMSTEC was formed in 1997, [ii] and its member-states are at varied stages of development. Four of the seven countries are LDCs (least developing countries)—Bangladesh, Bhutan, Myanmar and Nepal—while the rest are not (India, Thailand and Sri Lanka). Overall, 2016 statistics from the International Monetary Fund (IMF) estimated that BIMSTEC is likely to grow by 6.9 percent (with even some of the smaller BIMSTEC countries such as Myanmar, expanding more rapidly at 8.1 percent), while the world economy keeps a sluggish pace of 3.1 percent. [iii] It is also worth noting that in 2016, BIMSTEC reported a Gross Domestic Product (GDP) of US$3 trillion or four percent of global GDP. [iv]

The region is home to more than 1.5 billion people, or one-fifth of the world’s population. It also has another unique characteristic of geographic contiguity between the states. As the South Asian Association for Regional Cooperation (SAARC) continues to be marred by internal divisions—predominant of which is India-Pakistan tensions—BIMSTEC could be an effective subregional institution. [v]

Twenty years since its inception, BIMSTEC is showing vigour in seeking a new regionalism through greater integration and exposure to financial investments for the region. This enthusiasm can be seen through initiatives such as the BRICS-BIMSTEC Outreach Summit held in October 2016. [vi] Hosted in India, it was the first joint summit engagement of the organisation. It reiterated the challenges that continue to hamper BIMSTEC’s pursuit of inter-regional growth and development.

For one, BIMSTEC currently lacks a partner that is not only economically and technologically advanced, but is also a key capital exporter and can provide significant amounts of official development assistance. [vii] Further, in the crucial fields of energy and transport infrastructure, BIMSTEC could use a catalyst to boost the implementation of projects and raise their quality. Finally, as most recently pointed out by officials of Nepal that is the current BIMSTEC chair, the pace of cooperation among member countries is far from satisfactory and a clarity on the grouping’s vision is still missing.[viii]

The first section of this brief argues that given Japan’s long-standing relationship with BIMSTEC members, increased Japan–BIMSTEC cooperation is mutually beneficial if both can broaden and deepen engagements in various areas. This essay pivots on Japan’s strong relationship with India; and India’s key role in BIMSTEC — owing not only to its geographical location but also its capabilities. [ix] It focuses on three BIMSTEC priority sectors: trade and investment; transportation and infrastructure; and energy. It makes the case for Japan to join BIMSTEC, initially as an “observer state”, progressing to a “dialogue partner”, and aiming to eventually become a key member of the grouping.

Why Japan — BIMSTEC cooperation can be mutually beneficial

Extant literature points to the period between 2006 and 2008 as one where dialogue, studies and research on the scope of deepening Japan–BIMSTEC cooperation were strongly pursued. [x] Since then, however, there has been sparse scholarly attention to the potential of Japan-BIMSTEC cooperation. Drawing from this literature, the arguments for win-win cooperation between Japan and BIMSTEC are many.

For both entities, the benefits range from infrastructure and connectivity projects, energy security, science and technology, disaster management, maritime security, and tourism and risk management. Further, and importantly, a Free Trade Agreement (FTA) between BIMSTEC and Japan would be another mutually beneficial area for both. [xi]

For Japan, the biggest benefits will be the widening of its economic space, and greater leverage in the subcontinent. To begin with, Japan already has good relations with BIMSTEC countries and has been an important partner in the region in various respects as a trading partner, investor, and donor. Finally, demographic complementarities between BIMSTEC and Japan would also be important. [xii] After all, Japan’s shrinking population and increasing labour deficit [xiii] can be complemented by BIMSTEC’s vast and young labor force [xiv] –six out of 10 in the BIMSTEC region are aged 18–55 years. [xv]

That said, some BIMSTEC states have reservations about granting Japan “observer status”. These doubts can be attributed to the great-power rivalry playing out in the Bay of Bengal. Strategic manoeuvring by big powers such as China, Japan, the US, and India, is getting manifested in an increasingly large number of projects in BIMSTEC countries in the areas of energy, infrastructure and connectivity. These are giving rise to apprehensions, especially amongst the smaller BIMSTEC states, of becoming overly dependent on one or the other major power. In turn, being too closely associated with one power may limit their ability to garner benefits from the others.

As a result, many of these states are adopting hedging strategies to minimise risks and maximise options. With regards to bandwagoning, while it may be difficult to pinpoint a BIMSTEC country that adopts this strategy, Sri Lanka comes the closest. Still, studies have shown that bandwagoning alliance theories themselves do not adequately describe Sri Lanka’s policy with regional powers, [xvi] and it is plausible that both bandwagoning and balancing policies have helped Sri Lanka derive specific advantages and protect its national interests. [xvii] Either way, the smaller BIMSTEC states remain hesitant.

Japan’s entry into BIMSTEC: Implications

There is hardly any doubt that benefits can accrue from increased cooperation between BIMSTEC states and Japan. However, the earlier section of this brief has also raised a number of pertinent questions about the potential implications of Japan’s entry into BIMSTEC. This section examines these implications on India, the smaller BIMSTEC states, and the wider region.

BIMSTEC is a key tool in India’s ‘Act East’ policy, and the country can gain benefits from Japan’s entry into the grouping. The India-Japan partnership in BIMSTEC carries with it not only the economic potential to provide other group members with sustained economic opportunities and risk diversification, but also strategic benefits, especially when dealing with China. Further, the absence of Pakistan enhances India’s ability to lead, build trust, and enable BIMSTEC to achieve its goal of subregional integration.

China is working to enlarge its footprint in the Bay of Bengal, pumping in billions of dollars to a large number of infrastructure projects in the region. Many of these projects have often been criticised for their lack of transparency, and the fact that these Chinese investments serve as a “debt trap” to the supposed beneficiaries. [xviii] As India, on its own, does not have enough economic or technological bandwidth to compete with the fast-paced Chinese investments and projects, partnering and cooperating with Japan within BIMSTEC projects, would enable India to give its members an alternative to China’s Belt and Road Initiative (BRI) within the region. [xix] Japan, a long-time ODA donor to the region, enjoys a reputation amongst recipient countries for its transparent initiatives and low-interest loans. Through the Japan International Cooperation Agency (JICA) and the Asian Development Bank (ADB), Japan has been investing in a large number of important projects in the Bay of Bengal.

Further, increasing Japan-BIMSTEC cooperation also enables India to counter-balance China, whose dramatic rise to power has raised security concerns for India in the region, along with its increased defense spending and growing bonhomie with Pakistan. The 2017 Doklam border dispute with China also deepened existing tensions between India and China, and such incidents can have a serious destabilising effect on the region as a whole. Acknowledging this, Japan came out in support of both Bhutan and India, issuing key statements condemning any “unilateral attempts to change the status quo by force”.[xx] Thus, engaging a like-minded democracy, and drawing from its expertise will help BIMSTEC achieve its goals.

Smaller BIMSTEC states are anxious regarding which strategy to adopt to garner the maximum benefits from great-power investments in the Bay of Bengal region. While there is merit to these apprehensions, drawing Japan into the grouping will not likely result in these smaller states having to choose one great power over another.

Indeed, bringing Japan into BIMSTEC progressively and steadily, and by focusing on the three key areas of cooperation identified in this brief gives these great powers in the Bay of Bengal the space to continue to manoeuvre competitively. At the same time, Japan’s entry enables BIMSTEC states to bring to the table a country that can positively contribute to increased research, discussion, and projects in the region. After all, these three sectors—trade and investment; infrastructure and connectivity; and energy— are not zero-sum games but positive-sum games. Further, such competition will allow for BIMSTEC states to focus on their goals of “shared and accelerated growth through mutual cooperation” [xxi] while also ensuring that China does not dominate the region.

SAARC has been hobbled by internal divisions, and BIMSTEC is seen as the obvious choice for strengthening integration between South Asia and Southeast Asia. [xxii] However, this also opens up room for other questions: Is it the right time to discuss BIMSTEC’s expansion for membership or observers? If so, should membership be extended to other key states such as Vietnam, Indonesia or Singapore?

Along these lines, while the entry of other ASEAN states can be considered eventually, these other potential bids for membership should be stalled for the next few years in order to concentrate on consolidation. These new entrants must wait until some gains from integration become more visible. [xxiii]

Japan, on the other hand, must be viewed differently, as its entry into BIMSTEC carries potential gains for all stakeholders. It is an apt time to bring in a country such as Japan into BIMSTEC—first as an “observer state” for the next couple of years. BIMSTEC could then work towards transitioning Japan into a “dialogue partner”, and then finally, a permanent member. These rational, first steps, also help narrow the possibility of provoking China, which is another great power that is competitively investing in the region.

Japan was instrumental in pushing for India’s entry into the East Asia Summit (EAS); India can reciprocate by initiating Japan’s entry into BIMSTEC. It was in 2005 that Japan’s participation in SAARC as an observer was formally approved. Thirteen years since, this may be Japan’s starting point into BIMSTEC as well.

Japan – BIMSTEC engagement: Three priority areas

BIMSTEC has 14 identified priority sectors of engagement. While Japan’s cooperation can result in benefits in most, if not all sectors, this section makes the case for three: trade and investment; infrastructure and connectivity; and energy.

South Asia’s cross-border supply chains remain underdeveloped and stand to gain from linkages with already established supply chains in Southeast Asia [xxiv] and East Asia. Thus, trade is a top priority for BIMSTEC countries. Though trade accounts for over 60 percent of the grouping’s combined GDP, member countries constitute only 3.8 percent of world trade in 2016. While tariffs are no longer the major barrier to intra-regional trade, cost and time to trade remain relatively high. At the same time, BIMSTEC countries face a huge trade burden due to a wide variety of non-tariff measures (NTMs). [xxv] Intra-regional investments too have been small despite the potential for market and efficiency seeking investments in the region. [xxvi] Currently, intra-BIMSTEC trade makes up less than five percent of trade among the countries in the region, with exports comprising approximately four percent and imports constituting three percent. [xxvii]

A number of comprehensive studies—such as those done by the Centre for Studies in International Relations and Development (CSIRD), Asia Forum Japan (AFJ) and Sasakawa Peace Foundation (SPF) — [xxviii] indicate that Japan can be considered a valuable partner for BIMSTEC given its potential to contribute to sustainable economic growth and cooperation, as well as poverty reduction goals in the region. Further, Foreign Direct Investments (FDI) by Japan can also foster greater integration in the grouping. Japan too will gain from partnering with the BIMSTEC states by diversifying its economic partners and securing access to the huge markets of South Asia and South East Asia. Japanese businesses are also upbeat regarding the prospects of investing in some BIMSTEC countries such as Bangladesh, as its production costs are half of those in Japan. [xxix]

Studies on Japan – BIMSTEC relations show conclusive data on the economic benefits of cooperation. An empirical quantitative study by Bhattacharya and Bhattacharya, using a Gravity Model, conducts an examination of whether BIMSTEC-Japan economic cooperation will increase intraregional trade. While acknowledging some obstacles, the study concludes that Japan-BIMSTEC cooperation will increase intraregional trade. [xxx]

Further, regarding a Japan-BIMSTEC FTA, another study used Computable General Equilibrium (CGE) models and found that an FTA between Japan and BIMSTEC would have an impact, albeit a modest one; Thailand was projected as the primary beneficiary. [xxxi] Developing BIMSTEC partners would also gain from market access, which as of now is often constrained by trade and non-trade distortions. Importantly, a BIMSTEC-Japan FTA would also make a positive impact on the reduction of poverty: in the case of a Japan-BIMSTEC agreement, a modest estimate showed that about one million people in the region could be lifted from extreme poverty. [xxxii] Finally, another study has suggested that if the BIMSTEC FTA is extended to include Japan, significant gains were likely for both the BIMSTEC region as a whole and for Japan as well. [xxxiii]

A caveat is in order. First, two of the above studies have highlighted that although trade will increase, the growth will be uneven across the BIMSTEC countries; in fact, there will be potential losses on trade for some. Results of this would generally depend upon the exact form of the liberalisation, including the timing of reforms, the use of sensitive product categories, and special treatment for countries categorised as Least Developed Countries. [xxxiv]

Yet these potential losses in trade for some countries, could be compensated by gains in other areas—including stepped up resource transfer, foreign direct investment flows, technology transfer, and market access to services. [xxxv] Further, as most of the BIMSTEC member countries have benefited from Japanese ODA and FDI flows in the past, [xxxvi] it is possible that additional assistance to poorer countries can compensate for the asymmetries arising from trade liberalisation—this can be provided for by Japan. [xxxvii]

Second, given the many issues that have hampered the South Asian Free Trade Agreement (SAFTA) since 2016, it is imperative that BIMSTEC states conclude their FTA negotiations, which were initiated as early as in 2004, [xxxviii] before BIMSTEC pushes for another agreement with a non-member such as Japan.

Closer economic engagement between BIMSTEC and Japan should be a more natural phenomenon. However, such deepening of economic links requires a fuller evolution and maturing of BIMSTEC with a distinct regional economic identity. This makes it important to build awareness within the BIMSTEC countries about the gains that can be realised by a fusion of individual initiatives into a regional effort. [xxxix] Granting Japan “observer” status, as well as increased cooperation with Japan, may ease the ability to do this, while pushing growth and progress for BIMSTEC states and Japan as well.

Transport and Communication was one of the first six priority sectors identified by BIMSTEC when it was established in 1997, and it is led by India. [xl] Connectivity is key to the success of any regional integration scheme and BIMSTEC most urgently needs to makes efforts to address this and several agreements. [xli] Despite some progress, there is still a long way to go in establishing satisfactory intraregional transport connectivity. The BIMSTEC Transport Infrastructure and Logistics Study (BTILS), conducted in the mid-2000s and funded by the ADB, identified 166 projects to boost connectivity, of which 65 were to be prioritised. [xlii]

Table 1. BIMSTEC Priority Projects [ 2014-2020] [xliii]

| Country | Projects |

| Bangladesh | 16 |

| Bhutan | 4 |

| India | 17 |

| Myanmar | 9 |

| Nepal | 6 |

| Sri Lanka | 5 |

| Thailand | 8 |

So far, only a few of these projects have been implemented. BIMSTEC has only three major connectivity projects that, when finished, can ease the movement of goods and vehicles through the countries in the grouping. The first is the Kaladan Multimodal project that seeks to link India and Myanmar. The second is the Trilateral Highway, connecting India and Thailand through Myanmar, which after a number of delays is now set to be operational by December 2019. [xliv] Third, there is the Bangladesh, Bhutan, India and Nepal (BBIN) Motor Vehicles Agreement (MVA) that was signed last year but is still awaiting the clearance of some of the members.

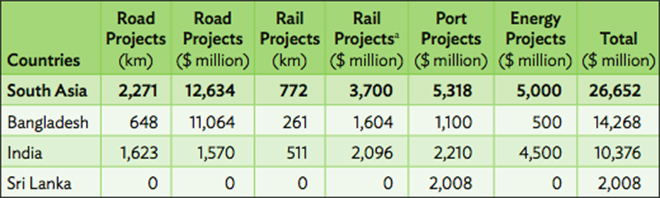

Another issue is that road transport, which accounts for at least 65–70 percent of the freight movement in South Asia, dominates the overall regional transport system. [xlv] While this system of transportation is obviously important, it should be noted that South Asia also has one of the largest railway networks in the world—with systems in India, Bangladesh, and Sri Lanka—which have been losing their market share to road transport. As can be seen in Table 2, in some BIMSTEC states, the difference in rail and road projects is still large. However, one way that this trend could be reversed is by huge investments in railway development plans, not only in India and Bangladesh, but also between Thailand and Myanmar. [xlvi]

Table 2.

Further, besides intraregional cross-border connectivity, it is crucial that BIMSTEC countries simultaneously develop their own internal infrastructure – feeder road connectivity, which would form a major part of the supply chain –to fully benefit from the fruits of trade liberalisation. [xlviii]

With regards to these challenges, Japanese ODA can play a significant role. Indeed, financing by the Japanese government for some of the biggest infrastructural development projects in this region already come from ADB and JICA, with private funding also now being supported by the Japan Bank for International Cooperation (JBIC), Japan Overseas Infrastructure Investment Corporation for Transport & Urban Development (JOIN), and Nippon Export and Investment Insurance (NEXI). [xlix]

The entry of Japan would also boost competition in the region and act as a catalyst for upgrading quality and standards of production and service supply in the region. Moreover, Japan—with its high standards in governance—can help mitigate the problems that are usually associated with large-scale infrastructure projects, including corruption, environmental damage, and cronyism. [l]

Despite a compelling techno-economic rationale for BIMSTEC nations, regional cooperation in the field of energy has not moved beyond the drawing board. [li] The energy situation in BIMSTEC is characterised by low per-capita consumption and fast-growing demand, limited supply of non-renewable energy, and heavy reliance by a large part of the population in most member countries on traditional energy. As a result, BIMSTEC countries are largely dependent on imports of non-renewable energy, particularly oil. However, some countries in BIMSTEC have considerable reserves of hydrocarbon including natural gas, coal and oil. [lii] As the demand for energy in the BIMSTEC region is increasing at an exponential rate, all member countries, with the exception of Bhutan and Myanmar, are still heavily energy-deficient.

A large section of the literature on why regional energy cooperation remains elusive in Asia—invariably originating from international funding agencies—highlights the lack of investment in hard infrastructure such as transborder electricity transmission lines and natural gas pipelines. They also point to the lack of soft infrastructure such as common governance and operational guidelines as a reason for the slow progress in regional energy cooperation. Various scholars have also highlighted the lack of mutual trust, and political will, as impediments to stronger cooperation in the area of energy. [liii]

Japan’s know-how in the area of renewable energy, apart from its technical and investment assistance, would benefit the BIMSTEC countries. [liv] Japan is already investing in a number of energy projects in some BIMSTEC states, and it can complement these projects. Finally, the BIMSTEC region has vast amounts of untapped natural and water resources—such as the hydropower potential in the Himalayan basin. Partnering with Japan to tap these resources can be extremely beneficial.

Conclusion

Twenty years since its inception, BIMSTEC still faces a number of challenges despite a renewed vigour for new regionalism. While many of these issues require deeper integration amongst BIMSTEC members themselves, there are a number of external interactions that could enable BIMSTEC to overcome them. One, for example, is continued dialogues such as the BRICS-BIMSTEC Outreach Summit in 2016.

Another strategy is to bring to the table a trustworthy partner, such as Japan, that would create opportunities and provide technical and logistical support and low-cost loans. Pivoting on Japan’s strong ties with a leading BIMSTEC country, India, this brief made the case for Japan’s entry into BIMSTEC, initially as an “observer” state, progressing into a “dialogue partner” and then finally a full member.

This brief demonstrated that this was a realistic and rational step, as not only Japan, India, or the smaller BIMSTEC states are set to gain, but the entire region as well. Further, due to the steady, progressive nature in implementing this move, it will encourage healthy competition amongst the great powers present in the Bay of Bengal—as such, the smaller BIMSTEC states will not have to choose between loyalty to one over another. Finally, and most importantly, granting Japan “observer” status first, and then progressing slowly to full membership, while initially focusing on the three key priority sectors, also provides ample competitive space and time such that China—who is engaged in a large number of projects in the region—is not provoked or threatened.

The initial focus of any Japan-BIMSTEC cooperation should be on three key areas that do not play out as zero-sum games: trade and investment, infrastructure and connectivity, and energy cooperation. With this as a starting point, BIMSTEC-Japan cooperation has huge potential to create gains in other key areas such as education, research and development, quality infrastructure, disaster management, and maritime security. These opportunities should be explored.

[i] K. Yhome, “BIMSTEC: Rediscovering Old Routes to Connectivity”, Observer Research Foundation, Issue Brief No. 213, December 2017.

[iii] N Chandra Mohan, “BIMSTEC: An Idea Whose Time Has Come?”, Observer Research Foundation, November 2016.

[iv] Ibid 3

[v] Rajiv Bhatia, “Building consensus for BIMSTEC”, Gateway House. 27 October 2017.

[vi] Kamal Madishetty, “Goa Summit Could Be the Turning Point for BIMSTEC”, The Diplomat, 2 November 2016.

[vii] Mukul G. Asher and Rahul Sen, “Role of Japan in BIMSTEC”, eSS Working Paper, February 2006.

[viii] “BIMSTEC cooperation not satisfactory, need charter: Nepal”, The New Indian Express, 18 January 2018.

[ix] K. Yhome, “BIMSTEC: Rediscovering Old Routes to Connectivity”, Observer Research Foundation, Issue Brief No. 213, December 2017.

[x] Research studies undertaken by CSIRD between 2005-2007, and international conferences jointly hosted by Sasakawa Peace Foundation, Asian Forum Japan, and CSIRD (Kolkata, India) disseminated comprehensive studies regarding the possibilities and benefits of Japan- BIMSTEC relations.

[xi] “Tokyo Consensus 2007, Third International Conference on Building a New BIMSTEC – Japan Comprehensive Economic Cooperation”, 3 December 2007.

[xii] Mukul G. Asher and Rahul Sen, “BIMSTEC – Japan Economic Partnership: Opportunities and Challenges”, Centre for Studies in International Relations and Development (CSIRD), 2006.

[xiii] “Japan’s labour shortage hits new extreme”, Financial Times, 28 July 2017. Available at:

[xiv] If Japan is to tackle the issue of its labour shortage it has to increase foreign labour from 0.7 million to 3 million by 2030. Thus, Japan needs approximately 3 million foreign labour. Additionally, it should be noted that Japan is now competing with its neighbors: China and South Korea, for foreign labour from Southeast Asia, and thus BIMSTEC states, can make for a better alternative from Southeast Asia to alleviate Japan’s demographic deficit and labour shortage.

[xv] Prabir De, “Big ideas to shape BIMSTEC’s future”, East Asia Forum, 15 September 2017.

[xvi] Polly Diven, “Superpowers and Small States: U.S., China, and India Vie for Influence in Sri Lanka”. Paper prepared for the Annual Meeting of the European Consortium on Political Research.

[xvii] Sandya Nishanthi Gunasekara, “Bandwagoning, Balancing, and Small States: A Case of Sri Lanka”, Asian Social Science, Volume 11, No. 28, 2015.

[xviii] Brahma Chellaney, “China’s creditor imperialism”, The Japan Times, 21 December 2017.

[xix] “Challenges facing BIMSTEC in integrating Bay of Bengal”, Newsin.Asia, 29 January 2018.

[xx] “On Doklam, Japan Backs India, Says ‘Must Not Change Status Quo By Force’”, NDTV, 18 August 2017.

[xxii] Prabir De, “Big ideas to shape BIMSTEC’s future”, East Asia Forum, 15 September 2017.

[xxiii] “Future Directions of BIMST-EC: Towards A Bay of Bengal Economic Community (BoBEC)”, Research and Information System for Developing Countries (RIS), Policy Brief Number 12, February 2004.

[xxiv] “Connecting South Asia and Southeast Asia”, Asian Development Bank Institute, 2015.

[xxv] Ibid 20

[xxvi] Janaka Wijayasiri and Deshal De Mel, “BIMSTEC -Japan Cooperation in Trade and Investment: A Sri Lankan Perspective”, Centre for Studies in International Relations and Development (CSIRD) Discussion Paper #38,

May 2008.

[xxvii] Shoumik Hassin, “BIMSTEC free trade deal must go above and beyond to reap benefits: Economist”, bdnews24, 28 May 2017.

[xxviii] Research studies undertaken by CSIRD between 2005-2007, and international conferences jointly hosted by Sasakawa Peace Foundation, Asian Forum Japan, and CSIRD (Kolkata, India) disseminated comprehensive studies regarding the possibilities and benefits of Japan- BIMSTEC relations.

[xxix] “Bangladesh most attractive investment destination”, The Independent, 22 August, 2016.

[xxx] Swapan K. Bhattacharya and Biswa N. Bhattacharya, “Prospects of Regional Cooperation in Trade, Invetsment and Finance in Asia: An Empirical Analysis on BIMSTEC countries and Japan”, CESIFO Working Paper No. 1725 Category 7: Trade Policy, May 2006.

[xxxi] “Tokyo Consensus 2007, Third International Conference on Building a New BIMSTEC – Japan Comprehensive Economic Cooperation”, 3 December 2007.

[xxxii] John Gilbert, “BIMSTEC-Japan Trade Cooperation and Poverty in Asia”, Working Papers from Utah State University, No 200803, Department of Economics and Finance, 2008.

[xxxiii] Anna Strutt, “Dynamic Analysis of a BIMSTEC-Japan Free Trade Area”, Eleventh Annual Conference in Global Trade Analysis, Helsinki, June, 2008.

[xxxiv] Ibid 30

[xxxv] Ibid 27

[xxxvi] T Nirmala Devi, “BIMSTEC – Japan Economic Cooperation: Trends and Prospects”, Centre for Studies in International Relations and Development (CSIRD), Discussion Paper, November 2005.

[xxxvii] Ibid 27

[xxxviii] Jayshree Sengupta, “BIMSTEC-FTA: A New Hope for Enhanced Regional Trade”, Observer Research Foundation, September 2017.

[xxxix] “Need for closer BIMSTEC-Japan economic engagement, Tokyo Consensus 2007”, CSIRD.

[xl]BIMSTEC Website.

[xli] “Harmonious relations with both neighbours”, The Himalayan Times, 19 December 2017.

[xlii] Technical Assistance Consultant’s Report, “Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) Transport Infrastructure and Logistics Study (BTILS)”, Asian Development Bank, January 2008.

[xliii] Md. Shafiqur Rahman, “Promoting Transport Connectivity in Southern Asia: A BIMSTEC Perspective”, United Nations Economic and Social Commission for Asia and the Pacific, 20 November 2014.

[xliv] “India-Myanmar-Thailand Trilateral Highway by 2019: Nitin Gadkari”, Live Mint, 23 January 2018.

Available at,

[xlv] “Technical Assistance Report, Regional Transport Development in South Asia”, Asian Development Bank”, October 2010.

[xlvi] Ibid 42

[xlvii] “Connecting South Asia and Southeast Asia”, Asian Development Bank Institute, 2015.

[xlviii] Kamal Madishetty, “Goa Summit Could Be the Turning Point for BIMSTEC”, The Diplomat, 2 November 2016.

[xlix] Vindu Mai Chotani, “Japan Could Benefit from China’s One Belt One Road Plan”, The National Interest, 1 August 2017.

[l] Janaka Wijayasiri and Deshal De Mel, “BIMSTEC -Japan Cooperation in Trade and Investment: A Sri Lankan Perspective”, Centre for Studies in International Relations and Development (CSIRD) Discussion Paper #38, May 2008.

[li] Lydia Powell, “Energy Cooperation Under BIMSTEC: Are Techno-Economic Rationales Sufficient?”, The Observer Research Foundation, Issue Brief No. 206, November 2017.

[lii] Myat Thein and Myoe Myint, “BIMSTEC-Japan Cooperation in Energy Sector:

Myanmar Perspective”, Centre for Studies in International Relations and Development (CSIRD), Discussion Paper #39, May 2008.

[liii] Ibid 51

[liv] Ibid 52

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Vindu Mai Chotani is a PhD scholar at the Graduate School of Public Policy University of Tokyo. She is also a teaching fellow for the ...

Read More +