Introduction

As we kick off 2024, for the first time in eight years, we are cautiously optimistic about the outlook for the US economy. As we explore in this report, households and businesses have weathered the interest rate rise environment markedly well, and are in relatively good shape, indicating that the elusive soft landing has been achieved. Despite a mini trade recession throughout 2022–2023, certain emerging market developing economies (including India and Vietnam) remain bright spots for investing and growth, while our look for the Eurozone is more dour.

As this ‘jobs-rich recovery’[1] continues to roll on across geographies, there is a very real potential that geopolitics can upend the base case. Any escalation of the conflict between Israel and Hamas that could result in congestion in the Strait of Hormuz can potentially drive oil prices north of US$100 per barrel (and the rest of the commodity basket with it). Already, the disruption in the Bab al-Mandab Strait is pushing up shipping prices through the Red Sea and can potentially disrupt LNG trade to Europe. Additionally, on the geopolitical landscape, as 4.1 billion people head to the polls in 64 countries, certain domestic factors—such as record house prices in many geographies—have the real potential to disrupt the status quo in many jurisdictions, arguably more than certain foreign policy issues.

Emerging pockets of financial instability can also disrupt the economic recovery. Risks lurking within non-bank financial institutions (NBFIs; in India, non-banking financial companies, or NBFCs[2])—and, specifically, within private credit markets—can spur a crisis, potentially in 2025. Accordingly, we diagnose how these risks have been built up over time and what regulators are doing (or poised to do) to address imbalances within elements of the financial system to help restore greater resilience within credit markets.

Lastly, our key investing theme for the year focuses on longevity: that is, investing in longer life spans. As we explore, this means different things in different geographies. While the US is further down the longevity trajectory (with windows for capital allocation into the venture capital, biotech, and consumer sectors), Europe also offers emerging opportunities in the medical tourism space. This element of the ‘consumerisation of healthcare’ trend also offers bright spots within Asia, including dairy farms in emerging Asia. One key aspect of investing in longevity relates to the sheer size and growth of the asset and wealth management industry. As we highlight, while the US market continues to present opportunities for greater consolidation, Japan also offers prospective investors a significant opportunity for long-term capital allocation.

Outlook for Economic Growth

US: A Rolling Recovery

We are moderately optimistic in the outlook for the trajectory of economic growth in the US economy for 2024. As we consider the shape and drivers of growth in the post-post-pandemic world, it is evident that we are amidst a rotation back into services-oriented activity driving the bulk of GDP growth, wage gains, labour creation, and consumption. For our base case—and also noting a probable spending cap in the US[3] creating a fiscal drag—we forecast a ‘rolling’ recovery, with annual GDP growth of 1.2 percent, and modest growth of 1.4 percent for 2025.

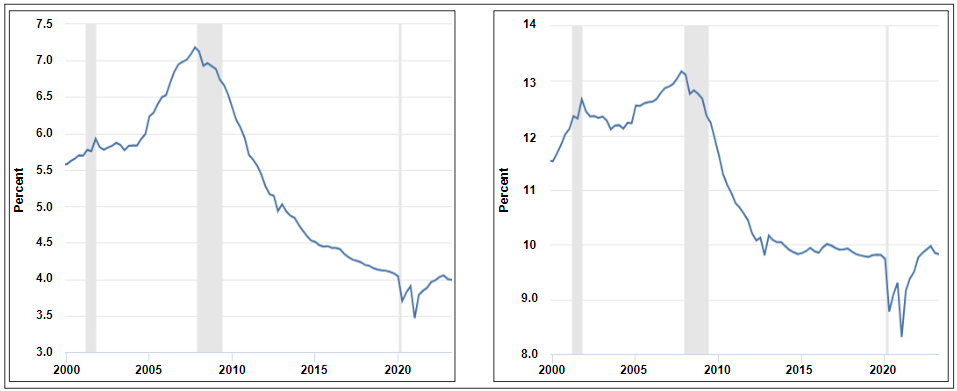

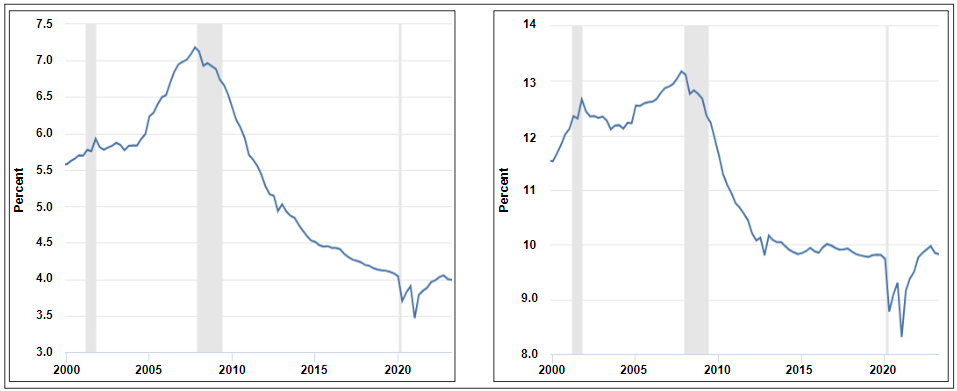

The US consumer is in relatively healthy shape: as inflation subsides, household savings rates are steadily increasing.[4] And, as shown in Figure 1, even though debt service costs have risen amidst a higher interest rate (and higher mortgage rate) environment, these costs remain relatively modest in contrast with historical standards.

| Figure 1a: US mortgage debt service payments as a percentage of disposable income (2000–2023) |

Figure 1b: US household debt service payment as a percentage of disposable income (2000–2023) |

|

| Source: St. Louis Federal Reserve[5] |

Source: St. Louis Federal Reserve[6] |

Even though consumers have cited an intention of conservatism and value-seeking, retail sales in the US over the holiday period were in line with retailers’ expectations, expanding by 3.1 percent year-on-year.[7]

Labour markets have held up well throughout sustained rate increases, and the labour force participation rate in the US for prime-age workers hovers near multi-decade highs,[8] indicating that the Federal Reserve (Fed) might have achieved its target of a soft landing. Business investment has increased,[9] as companies emerge from the economic uncertainty ushered in by the pandemic, the Russia-Ukraine conflict, and the subsequent shocks to price stability resulting from the war. Even the housing market has weathered the ‘higher for longer’ period: house prices continue to hit historic highs, and US single family housing starts have risen to an 18-month high at the end of 2023.[10]

Gifting from the Fed?

Equity markets have enjoyed a significant rally, and are likely to continue to post gains, after the hint of 75 bps interest rate cuts in 2024, issued during the 11-12 December Federal Open Market Committee (FOMC) meeting. Notwithstanding, markets might be a bit exuberant as to the timing and scale of these cuts: the Fed’s credibility is still on the line to restore price stability for a sustained period, and FOMC members may need to see core inflation come closer in line with the 2 percent target before a first cut, likely at the end of Q2 2024.

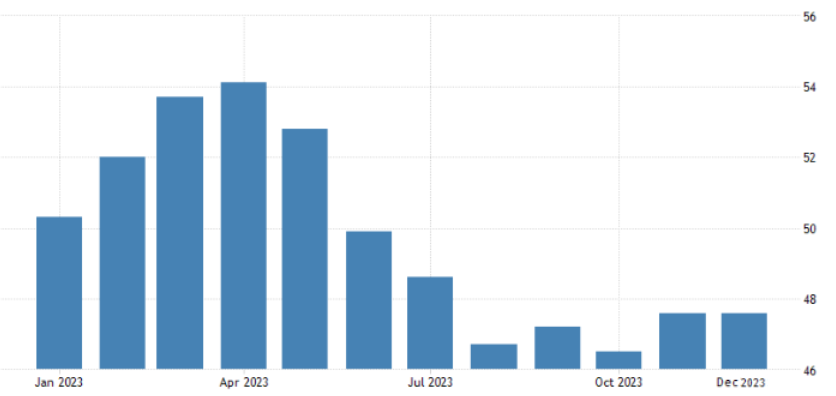

Eurozone

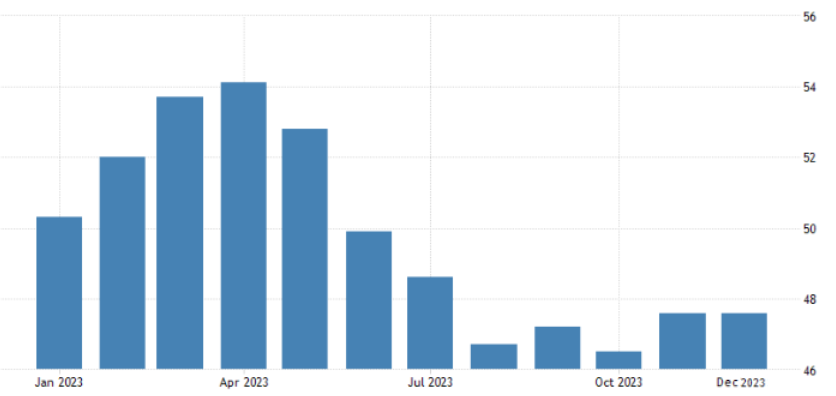

We forecast a comparatively bleaker outlook for growth in the eurozone in 2024. The sustained inflation shocks resulting from the energy crisis continue to weigh on households and corporations, and, given Europe’s proximity to the Russia-Ukraine conflict, the energy crisis has hit the continent harder, relative to the US. Our outlook is for 0.3 percent growth across the eurozone in 2024, with the potential for a technical recession heading into Q1 2024. Industrial production in Germany (Europe’s largest economy) significantly contracted in the second half of 2023,[11] and this slowdown in manufacturing activity compounded an already etiolated business activity environment throughout much of 2023 (see Figure 2).[12]

Figure 2: Euro Area Composite PMI (2023)

Source: Trading Economics[13]

Although private investment within the eurozone has held up relatively well,[14] we can expect a pullback of government spending in 2024,[15] and with this fiscal drag, a potential slowdown in government support of the private sector as well.

Households have also navigated the energy price shocks relatively well, and savings rates have moderately recovered since 2022.[16] Although there is some debate as to the extent to which households across geographies have depleted the ‘excess savings’ accumulated during the pandemic economy years,[17] European households have historically been somewhat conservative with savings rates (in contrast with the US), and likely still hold buffers from the estimated US$1 trillion of ‘excess’ savings during the pandemic economy years.[18] Data shows that welfare losses for households resulting from the spikes in inflation between 2021–2022 were unevenly distributed across the eurozone, with Italy bearing the brunt of the losses, at about 8 percent of disposable income.[19]

Europe’s proximity to the energy price shocks resulting from the Russia-Ukraine conflict means that inflation is unlikely to come within close range of the European Central Bank (ECB)’s target of 2 percent in 2024. Hence, markets are likely exuberantly pricing in the potential for more interest rate cuts than what might actually be implemented by the ECB. Additionally, the high cost of housing continues to complicate the return to price stability: France, Germany, and Portugal continue to face a housing crisis, and higher interest rates have also curtailed new supply. This crisis of affordability in housing is also likely to disrupt the political landscape in 2024. As citizens in over 50 countries head to the polls, the persistence of high shelter costs is likely to be a major driving force for change on behalf of electorates within advanced and emerging market/developing economies (EMDEs).

China

While many policymakers confront record high house prices, policy officials in China continue to contend with a housing slump, which is contributing to a deflationary environment in the mainland. Efforts by provincial and municipal authorities to stimulate demand in the residential property sector (including reducing minimum down payments and reducing rates of lending) have had little impact on stoking activity in the market. The housing downturn has also weighed on consumer sentiment, as sustained price declines have led to feelings of negative wealth for Chinese households. However, as this author has highlighted in the past, the risk of a systemic ‘Minsky moment’ or bubble bursting within the property sector remains limited. On a global basis, China has more money supply defined in terms of M2 than even the US, indicating that there is likely enough cash in the system to cover existing covenants.

As manufacturing and services activity continues to slump and hover in contraction territory,[20] it may be difficult for the government to meet its 5 percent GDP growth target for 2024. Nevertheless, while the short to medium term outlook might be challenging, Beijing’s emphasis on supporting the clean tech and green energy industry—and to exporting its prowess—and to focus on advanced manufacturing are both domains in which China supremely excels. An unwavering focus on these two sectors will likely provide China with levers for sustainable economic growth in current and future demand patterns. As to how Beijing chooses to buttress against the downturn in the property market, and make policy choices designed to address deeper secular and structural issues (such as demographics), all eyes will be on the outcome of the eventual plenum, a crucial economic development meeting, that has been postponed since autumn 2023.[21]

Japan

Looking to the rest of Asia, and with a spotlight on Japan, many prognosticate whether 2024 will be the year the Bank of Japan (BoJ)—with the recently anointed Kazuo Ueda at the helm—will eventually chart a path to policy normalisation. Such a ‘QExit’ might include retiring the policy tool of yield curve control and exiting negative interest rate policy. While an unprecedented number of central banks have been hiking rates across the globe, the BoJ has been bucking the trend, keeping short-term interest rates in negative territory. There is certainly cause for normalisation: the yen hit a 33-year low in autumn 2023,[22] and has been the worst performing G10 currency for three consecutive years. This has, however, been a boon to Japanese exporters and has given a serious boost to automotive exports to markets, including China and the US.[23]

In considering the outlook for growth, ‘Japan outbound inc.’[24] continues to be a promising story. Japanese Prime Minister Fumio Kishida has also been engaged in rich shuttle diplomacy, building rapport with Mohammed bin Salman in Saudi Arabia,[25] and also courting inbound investment from the UAE into Japan’s semiconductor chip industry and battery and clean tech sectors.[26] Additionally, Japan’s property market has been running hot, with increased tourism, foreign capital, and industrial redevelopment supporting investment flows into Tokyo, Osaka, and Nagoya.[27] Accordingly, house prices in major metropolitan areas continue to surge, with foreign capital pushing out prospective younger buyers within the Tokyo market.[28] The sharp rise in the cost of housing—although a positive sign of activity, and a welcome emanation from years of a deflationary environment—might also give cause for the BoJ to work toward its version of QExit in 2024.

India and Emerging Asia

Looking beyond rich-income Asia, the probable exit from a mini ‘trade recession’ that has prevailed over the last few years is likely to provide a boon for growth for emerging Asian countries, including India and Vietnam. Off the back of strong services exports, India is forecasted to be one of the fastest growing economies in the world in 2024 and 2025.[29] As the world’s most populous country heads to the polls this year, there will be a focus on the extent to which eventual policy reforms might stimulate private investment flows to support sustainable economic growth,[30] thus taking on some of the burden from the public sector.[31]

Stronger trade winds are also likely to propel growth in Vietnam: the export powerhouse is likely to be Southeast Asia’s fastest-growing economy in 2024 and 2025. In addition to manufacturing activity, Vietnam’s Just Energy Transition Partnership resource mobilisation plan (JETP), announced during COP28, is likely to spur growth in the country’s green energy sector. With potentially US$15.5 billion of public and private investment, Vietnam’s JETP might revolutionise the country’s power sector, and reduce its reliance on coal.[32] Additionally, commensurate with its status as one of the fastest growing economies in the world, the wealth creation and consumption firepower associated with the rise in income also creates significant opportunities for catering toward the strong domestic market and, as we explore below, Vietnam’s budding food market.

Geopolitics: Upending the Base Case?

Hormuz and the Bab al-Mandab Straits

In surveying the geopolitical landscape for 2024, potential flares and chokepoints can actually upend our cautiously optimistic forecast for the economy. Firstly, as the war between Israel and Hamas might have spillover effects into neighbouring jurisdictions, any escalation of the conflict could potentially thwart a stable trajectory of economic growth in some geographies (such as the US and India) and possibly disrupt a tepid outlook for others (namely, Europe).

Already at the end of December 2023, some of the world’s major shipping companies have temporarily ceased operating in the Red Sea, given armed attacks in the Bab al-Mandab Strait.[33] It is important to note that 17 percent of sea cargo moves through both the Suez and the Panama Canals,[34] and, as climate change-related dryness has reduced flows through the Panama Canal, any congestion within the Suez position is concerning. While the price increases have so far been limited to a rise in shipping costs from Asia to Europe, one should also consider the increasing geostrategic importance for LNG cargoes to flow through from West Asia to European importing countries, which have replaced the supply of Russian pipeline gas.

Moreover, should any escalation of the conflict generate a disruption of oil flows within the Gulf Cooperation Council, we can see how quickly the price of oil can move north of US$100 per barrel, thus upending central bankers’ concerted efforts to restore price stability and to bring inflation under control. Europe’s proximity to such a disruption renders it more exposed on relative terms than the US, not only because, on the demand side, Europe has borne the brunt of the rewriting of the global energy map resulting from the Russia-Ukraine conflict, but also because a seemingly endless and record supply of oil continues to come from Texas’ Permian basin in the US. For certain EMDEs, specifically the energy importers or ‘price takers’, a sustained rise in WTI prices north of US$100 per barrel has the potential not only to cause a spike in inflation, but also to weigh on sovereign borrowing costs, thus also exacerbating fiscal deficits and upending trade balances. As such, if non-state and even additional state actors become increasingly embroiled in the Israel-Hamas conflict, there could be a material risk that a sustained escalation can upend our baseline economic scenarios for 2024.

A bumper election year

Looking beyond the potential for deepening geopolitical tensions in West Asia, 2024 is a bumper election year. A world record of 4.1 billion people will head to the polls to vote, as municipal, provincial, legislative, and presidential elections are set to take place in 68 countries.[35] From India to Mexico, and from the US to the European parliament, electorates in some jurisdictions are likely to be motivated not necessarily by foreign policy factors, but by something closer to home—house prices.

Even while inflation retreats closer to the magical 2 percent target set by many central banks around the world, the cost of shelter continues to hit historic highs in many geographies.[36] In fact, prior to the inflation shocks of 2021–2022, the cost of housing was often an outlier in an otherwise disinflationary environment within some advanced economies. Due to continued demand from housing formation, foreign capital flows, and retail investors directing capital toward residential real estate, demand continues to remain robust, and set against the backdrop of a high interest rate environment, supply is not keeping pace with demand. Many households continue to remain overburdened; in OECD terminology, this amounts to spending more than 40 percent of one’s income on housing costs.[37]

Thus, the affordability of housing is likely to feature strongly in national debates and elections. For example, in Taiwan, Taipei’s house price to income ratio has reached 16.2, rendering it more expensive than Vancouver and Toronto (Canada), Sydney (Australia), London (UK), and New York (US).[38] In the US, where mortgage rates have more than doubled in recent years, house prices continue to hit historic highs. And in pockets of Europe, housing continues to contribute to a cost of living crisis in countries such as Germany, France, and Portugal.[39] The moral of the story here is that while many executives, investors, and policymakers consider the global landscape and geopolitical issues such as funding for Ukraine or tensions with China as motivating factors for political change, these might be considered as elite issues, as electorates are likely to focus on things closer to home—with housing out of reach for the voter base in many advanced economies and EMDEs.

It is also worth pointing out that a persistent crisis in the affordability of housing has the potential to create a drag on the GDP of cities. In Sydney, one of the least affordable cities in the world, research shows that the shelter affordability crisis is costing the city US$2.9 billion per year.[40] The loss of productivity resulting from inefficient commutes (when people cannot live near the workplace) and the loss of start-up capital (if employees and founders of new companies are priced out of tech ecosystems within thriving cities) has the potential to weigh on the outlook for sustainable economic growth, especially in services-oriented economies.

Outlook for Financial Stability: Risks Lurking within NBFIs (NBFCs) and the US$1.6 trillion Private Credit Market

(with contribution from Pete Driscoll)

In addition to the prospect for geopolitics to upend our baseline scenario for the economy, there is also significant potential for certain aspects of the financial system to upend economic growth in the longer term. To understand these financial stability risks, it is helpful to look back to the last crisis.

In the wake of the global financial crisis (GFC), as traditional banks remained squarely in the crosshairs of regulators, the banks’ share of global assets under management declined, and yielded to the increasing share held by NBFIs and NBFCs. In fact, by 2019, NBFIs share of global AUM hovered at over 50 percent, and by 2021, reached a zenith of total value of over US$230 trillion.[41] The share and value has since posted a modest decline, given the impact of the high interest rate environment on asset valuations.[42] As this author and many others have highlighted in the past, material risks to financial stability arise from NBFIs, and relate to subsets within NBFIs/NBFCs, including money market funds, open-ended funds, and the potential for liquidity mismatches[43] and ‘run on the bank’ scenarios from such funds.

One subset that has raised alarm bells for regulators, banks, and some asset managers[44] is the proliferation of private credit funds. Alongside the reduction of the traditional banks’ share of global AUM—precipitated by regulation implemented after the GFC—certain types of lending have also been regulated out of the banks, and riskier lending has found its way like liquid mercury into other (often newly created) financial institutions. On the demand side, yield-hungry institutional investors (including pension funds) have stepped up allocation to the space: as the total private credit market has swelled to US$1.6 trillion globally,[45] pension funds have channelled US$100 billion worth of investments to the burgeoning asset class,[46] which can offer tantalising yields amidst sky-high equity valuations, and a dearth of negative-yielding fixed income assets in the years following the GFC.

Looking beyond creditors, and to the borrower landscape, there is no shortage of demand for private credit amidst our higher for longer interest rate environment, the pullback of banks from certain types of lending, and a dissipation of activity in capital markets, related to a prolonged period of economic and geopolitical uncertainty. Venture capital groups and companies from across sectors—in the US, Europe, and, increasingly, within Asia[47]--have found refuge in borrowing from private creditors to fund acquisitions and growth amidst a higher rate environment.

In the US market specifically, the bank wobbles of community banks in March 2023, and the nexus with the commercial real estate market, has also created fertile ground for private credit creation. As many investors doubt the long-term viability of office and office-anchored retail assets in the US, the rest of the real estate investment ‘baby’ has been tarnished with the office brush. Capital to fund new investments and development has been hard to come by (as even multi-family is wrapped up within the commercial real estate umbrella). The pullback from real estate lending and the risk-off sentiment has also been amplified by the bank failures in March: small to medium lenders have a significant exposure to office and office-anchored retail assets in the US.[48] Accordingly, real estate developers have found solace in private credit markets, and this is the case not only in the US[49] but also in other pockets of distress across the globe.[50]

So what could happen?

As the late economist Hyman Minsky shrewdly pointed out, strong medicine has strong effects. And, one of the strong side effects of the medicine from the GFC, including a decade-plus of low to negative interest rates and the implementation of regulation in the traditional banking sphere – has been the explosive growth of supply and demand for NBFIs/NBFCs and private credit. Regulators and central banks continually highlight the lack of transparency into the balance sheets of these institutions, and a lack of data which would provide insight on how best to close ‘supervisory gaps.’[51] Accordingly, the increasing allocation of pension funds to the asset class may present a moral hazard, should any kind of bubble burst within the private credit sphere. Worryingly, any kind of credit event might carry with it corollary, knock-on effects into the traditional banking sector, as some banks are deepening exposure to private credit markets by acting as intermediaries and also by building up their own private credit wings.[52] While it might take a bubble bursting to usher in new waves of regulation, the Financial Stability Board has pointed to the end of 2024-early 2025 as a targeted time frame to make ‘recommendations’ for building resilience within the NBFI and private credit space.[53]

Current safeguarding regulations in the private fund sector, including credit, are generally limited to rules promulgated by the US Securities and Exchange Commission (SEC) along with the Commodity Futures Trading Commission (CFTC). While the banking regulators are typically focused on the safety and soundness of financial institutions and have very active and present approaches to supervision, the SEC and CFTC take a different risk-based approach focused primarily on protecting investors, even those seen as sophisticated and/or institutional invested private funds, such as credit funds.

Under Chair Gary Gensler’s recent priority-setting, the SEC has particularly focused on reforming the private fund industry in two recent 2023 final rulemaking packages impacting over seven rules, five of which are new.[54] These rulemakings are designed as putting parity in disclosures between public and private markets, i.e., Gensler’s approach to cast a bright light on potential risks of investing in the private fund space. These rulemakings are likely to impact private credit funds on many levels, pushing more granular expense and conflicts of interest disclosures, uniformity among the risk information and fund performance presented, and restricting and prohibiting certain activity. These rulemakings were not met well by the industry, with several key private fund adviser trade associations joining together to sue the SEC.[55]

Not to be outdone by rulemaking, the SEC is also prioritising the private fund space through its Division of Examinations’ Private Fund Unit, a team of over 20 examiners focused only on inspecting private fund advisers, including credit, for many areas of potential abuse, including disclosures concerning risks to investors and conflicts of interest.[56] The SEC’s Division of Enforcement also continues to bring many cases against private fund advisers on a range of issues, many of which include fraudulent alleged activity often resulting in losses to investors.

This significant focus on the private fund space by the SEC is likely indicative of concerns around risks involving this space, particularly with trends like the movement of lending from traditional banking to the less regulated private fund sector. The SEC and CFTC are concerned about potential losses to investors that normally would not be borne if the credit markets were limited to the well-regulated banking industry, so the SEC and CFTC continue to increase its presence and surveillance of the space. The imbalances that are being created continue to hold our attention, guiding and informing the outlook for 2024 and beyond.

Conclusion: Investing in Longevity

In purely macroeconomic terms, longer life expectancy usually conjures negative notions. Aging populations are a contributing factor to ‘secular stagnation’; with lackluster immigration policies, many countries are locked in for a trajectory of lower, slower growth. As gross national income declines and spending on entitlements (such as healthcare) rises, many governments have lost sight of a fiscal balance. In fact, rampant fiscal deficits worryingly seem to be of little concern for many policymakers, on both sides of the party bench. Also, deepening and widening wealth inequality can also be a feature of aging populations: in the case of the US, and set against the backdrop of the ‘gig economy’, the salaries of those retiring from the workforce are not necessarily matched by those of new entrants to the labour market.

However, there is a bright side to aging, which is investing in longevity. This means different things in different geographies. In the US, which is arguably more advanced on the longevity spectrum, the craze for ‘biohacking’ (whereby a person chooses to optimise their health via DIY biology) has created opportunities for investing in consumer healthcare, as well as in biotech and venture capital.[57] This is a facet of another key investing trend, the ‘consumerisation of healthcare’. In the US, the complementary and alternative medicine market is poised to be worth US$411.4 billion by 2030[58] (given a cumbersome and exorbitant healthcare system, many consumers take matters into their own hands).

In Europe, which is a bit further behind the US in the wellness craze, the prospects for medical tourism offer potential for long-term investment. The market is heavily fragmented and can benefit from consolidation and perhaps collaboration from leading hospitality companies as well as health and beauty brands. The prospect of rolling out ‘medispas’ in France is a case in point; while the country is the most visited in the world, and is (rightfully) associated with beauty, the medispa market is as yet underdeveloped, and is garnering attention from global investors.[59]

Certain aspects of the food system are also closely interrelated with the investing in longevity theme. In EMDEs such as Vietnam, wealth creation is spurring changing tastes in food and (as was the case in China) increased dairy consumption. Accordingly, some of the world’s largest private equity houses are deploying capital to Vietnam’s budding domestic dairy market, alongside seed capital from multilateral development banks (MDBs).[60] Growing at 8 percent per annum, Vietnam’s total food market is one of the fastest growing in the world.[61] And, investing in the country’s growing food distribution network has attracted Japanese investment.[62] Also, in a green shade, one MDB has invested in an aquaculture initiative in Vietnam, with a focus on reducing methane emissions in cattle feed.[63] If successful, such an investment can be proliferated across Asia where increased dairy consumption coincides with greater climate and environmental action.

Lastly, in considering the investing theme of longevity, one clear opportunity arises, which is deploying capital to the asset wealth management (AWM) industry. Again, this means different things in different geographies. In the US, the sheer size of the market is forecasted to expand by 4.5 percent CAGR, to reach US$72.5 trillion in 2027.[64] The AWM industry in the US has been rife with consolidation in recent years, and groups have become investment targets for private equity, family office, and multifamily office investors. The decline in asset valuations resulting from a higher interest rate environment is also likely to contribute to swifter consolidation. Within the next three years, 16 percent of AWM groups are forecasted to vanish or to be acquired.[65]

Looking to Asia—and with an eye on expansion—the total growth AUM in wealth management within Asia Pacific is forecasted to rapidly expand within the next four years, with growth rates estimated to be 50 percent higher than that in the US.[66] Although China has been a critical market for many global wealth managers, Japan is also a promising market. As a facet of the BoJ’s ultra loose monetary policy, the yield on Japanese bonds is not entirely lucrative; in fact, according to data from the BoJ, Japanese households maintained over 2000 trillion yen (roughly US$13 trillion) in financial assets, but over half of this is at close to negative yielding rates.[67]

Accordingly, some local entities in Japan are piloting the launch of digital securities, to be able to offer higher yields in the form of security tokens to Japanese households in 2024. Additionally, in the offering of real assets, some of the world’s most sophisticated alternative investment groups are focusing on providing Japan’s wealthy households access to real estate, private equity, and infrastructure investing products, via both private as well as public markets.[68]

Endnotes

[1] BIS Quarterly Review: International Banking and Financial Market Developments, BIS, December 2023, https://www.bis.org/publ/qtrpdf/r_qt2312.pdf

[2] “All You Wanted to Know About NBFCs,” Reserve Bank of India, January 10, 2017, https://www.rbi.org.in/commonperson/English/Scripts/FAQs.aspx?Id=1167

[3] Andy Sullivan and Moira Warburton, “Republican Debt-Limit Plan Would Cut US Jobs, Slow Growth, Economist Tells Senate Panel,” Reuters, May 5, 2023, https://www.reuters.com/world/us/amid-us-debt-ceiling-standoff-senate-democrats-dissect-republican-plan-2023-05-04/

[4] U.S. Bureau of Economic Analysis, “United States Personal Savings Rate,” Trading Economics, https://tradingeconomics.com/united-states/personal-savings

[5] “Mortgage Debt Service Payments as a Percent of Disposable Personal Income (MDSP),” FRED Economic Data, https://fred.stlouisfed.org/series/MDSP

[6] “Household Debt Service Payments as a Percent of Disposable Personal Income (TDS),” FRED Economic Data, https://fred.stlouisfed.org/series/TDSP#0

[7] “Mastercard SpendingPulse: U.S. Retail Sales Grew +3.1%* This Holiday Season,” Mastercard, December 26, 2023, https://www.mastercard.com/news/press/2023/december/mastercard-spendingpulse-u-s-retail-sales-grew-3-1-this-holiday-season/

[8] “Labor Force Participation Rate - 25-54 Yrs.,” FRED Economic Data, https://fred.stlouisfed.org/series/LNS11300060#0

[9] “Gross Private Domestic Investment (GDPI),” FRED Economic Data, https://fred.stlouisfed.org/series/GPDI

[10] “New Privately-Owned Housing Units Started: Total Units (HOUST),” FRED Economic Data, https://fred.stlouisfed.org/series/HOUST

[11] Federal Statistical Office, “Germany Industrial Production,” Trading Economics, https://tradingeconomics.com/germany/industrial-production

[12] S&P Global, “Euro Area Composite PMI,” Trading Economics, https://tradingeconomics.com/euro-area/composite-pmi

[13] S&P Global, “Euro Area Composite PMI”

[14] Macroeconomic Projections, European Central Bank, https://www.ecb.europa.eu/pub/projections/html/ecb.projections202309_ecbstaff~4eb3c5960e.en.html; EUROSTAT, “Euro Area Gross Fixed Capital Formation,” Trading Economics, https://tradingeconomics.com/euro-area/gross-fixed-capital-formation

[15] “Assessment of the Fiscal Stance Appropriate for the Euro Area in 2024,” European Fiscal Board, June 28, 2023, https://www.consilium.europa.eu/media/65609/2023-06-21-efb-assessment-of-euro-area-fiscal-stance-final_0.pdf

[16] EUROSTAT, “Euro Area Gross Household Saving Rate,” Trading Economics, https://tradingeconomics.com/euro-area/personal-savings

[17] Thomas Klitgaard and Matthew Higgins, “Spending Down Pandemic Savings is an “Only-in-the-U.S.” Phenomenon,” Liberty Street Economics, Federal Reserve Bank of New York, October 11, 2023, https://libertystreeteconomics.newyorkfed.org/2023/10/spending-down-pandemic-savings-is-an-only-in-the-u-s-phenomenon/; Omar Barbiero and Dhiren Patki, “Have US Households Depleted All the Excess Savings They Accumulated During the Pandemic?” Federal Reserve Bank of Boston, November 7, 2023, https://www.bostonfed.org/publications/current-policy-perspectives/2023/have-us-households-depleted-all-the-excess-savings-they-accumulated-during-the-pandemic.aspx

[18] “Excess Savings: To Spend or not to Spend,” The ECB Blog, November 2, 2023, https://www.ecb.europa.eu/press/blog/date/2023/html/ecb.blog231102~66a04caa1e.en.html#

[19] Filippo Pallotti et al., “Who Bears the Cost of Inflation? Euro Area Households and the 2021–2022 Shock,” NBER Working Paper Series, https://www.nber.org/system/files/working_papers/w31896/w31896.pdf

[20] “China Factory Activity Posts Worst Contraction in Six Months,” Bloomberg, December 31, 2023, https://www.bloomberg.com/news/articles/2023-12-31/china-factory-activity-contracts-more-than-expected-in-december?srnd=premium-europe

[21] “China’s Communist Party Signals Further Delay to Third Plenum, a Key Economic Session,” SCMP, 27 November, 2023, https://www.scmp.com/business/china-business/article/3242911/chinas-president-xi-jinping-visit-shanghai-tuesday-his-first-trip-nations-commercial-hub-2021

[22] Sumit Roy, “Currency-Hedged ETFs Soar as Yen Hits 33-Year Low,” Yahoo Finance, November 22, 2023, https://finance.yahoo.com/news/currency-hedged-etfs-massively-outperform-222000352.html

[23] Chihiro Ishikawa, “Japan’s U.S.-Bound Exports Hit Record High on Weak Yen,” Nikkei Asia, November 16, 2023, https://asia.nikkei.com/Economy/Japan-s-U.S.-bound-exports-hit-record-high-on-weak-yen; Mary Hui, “A Weak Yen is Throwing a Lifeline to Japanese Carmakers Struggling in China,” QZ, August 15, 2023, https://qz.com/a-weak-yen-is-throwing-a-lifeline-to-japanese-carmakers-1850737260

[24] Alexis Crow, “Japan Outbound, Inc.: What Policymakers, Companies, and Investors Can Learn from Japan in the Reiwa Era,” Atlantic Council, August 1, 2019, https://www.atlanticcouncil.org/blogs/new-atlanticist/japan-outbound-inc-what-policymakers-companies-and-investors-can-learn-from-japan-in-the-reiwa-era/

[25] Shiko Ueda, “Japan and Saudi Arabia Agree to Launch Regular Diplomatic Dialogue,” Nikkei Asia, July 17, 2023, https://asia.nikkei.com/Politics/International-relations/Japan-and-Saudi-Arabia-agree-to-launch-regular-diplomatic-dialogue

[26] Shiko Ueda, “Japan Seeks UAE Investments in Chips, Batteries via New Framework,” Nikkei Asia, July 18, 2023, https://asia.nikkei.com/Politics/International-relations/Japan-seeks-UAE-investments-in-chips-batteries-via-new-framework

[27] Satsuki Kaneko, “Japan Land Values Rise Beyond Big Cities on Flood of Overseas Money,” Nikkei Asia, September 20, 2023, https://asia.nikkei.com/Business/Markets/Property/Japan-land-values-rise-beyond-big-cities-on-flood-of-overseas-money

[28] Lisa Du, “Tokyo’s New Condo Prices Surge 60% to a Record in First Half of Year,” Japan Times, July 21, 2023, https://www.japantimes.co.jp/news/2023/07/21/business/condo-prices-surge/; Mariko Katsumura and Rocky Swift, “Surging Tokyo Property Prices Squeeze Out Young Professionals,” Reuters, October 4, 2023, https://www.reuters.com/markets/asia/surging-tokyo-property-prices-squeeze-out-young-professionals-2023-10-04/

[29] “Economic Outlook: A Mild Slowdown in 2024 and Slightly Improved Growth in 2025,” OECD, November 29, 2023, https://www.oecd.org/newsroom/economic-outlook-a-mild-slowdown-in-2024-and-slightly-improved-growth-in-2025.htm

[30] “India’s Growth to Remain Resilient Despite Global Challenges,” World Bank, October 3, 2023,

https://www.worldbank.org/en/news/press-release/2023/10/03/india-s-growth-to-remain-resilient-despite-global-challenges

[31] Alex Travelli, “India is Chasing China’s Economy. But Something is Holding it Back,” New York Times, January 2, 2024, https://www.nytimes.com/2024/01/02/business/india-economy-foreign-direct-investment.html

[32] Mark Barnes, “Vietnam’s Just Energy Transition Partnership Resource Mobilization Plan: Unpacked,” Vietnam Briefing, December 5, 2023, https://www.vietnam-briefing.com/news/vietnams-just-energy-transition-partnership-resource-mobilization-plan-unpacked.html/

[33] Sam Dagher, Mohammed Hatem, and Christian Wienberg, “Maersk Halts Red Sea Shipping as US Navy Sinks Houthi Boats,” Bloomberg, December 31, 2023, https://www.bloomberg.com/news/articles/2023-12-31/us-shoots-down-anti-ship-missiles-launched-by-houthi-targeting-maersk-vessel

[34] Jean-Michel Bezat, “Alimenté par une économie à flux tendu, le transport maritime reste fragile,” Le Monde, December 18, 2023, https://www.lemonde.fr/idees/article/2023/12/18/alimente-par-une-economie-a-flux-tendus-le-transport-maritime-reste-fragile_6206429_3232.html

[35] Marie Jego, “2024, année électorale record,” Le Monde, January 8, 2024, https://www.lemonde.fr/international/article/2024/01/06/2024-annee-electorale-record_6209359_3210.html?lmd_medium=al&lmd_campaign=envoye-par-appli&lmd_creation=ios&lmd_source=default

[36] Nassira Abbas and Corrado Macchiarelli, “Housing Affordability Remains Stretched Amid Higher Interest Rate Environment,” IMF Blog, January 11, 2024, https://www.imf.org/en/Blogs/Articles/2024/01/11/housing-affordability-remains-stretched-amid-higher-interest-rate-environment

[37] Nina Biljanovska, Chenxu Fu, and Deniz O. Igan, “Housing Affordability: A New Dataset,” IMF Working Papers 2023, no. 247 (2023), https://www.elibrary.imf.org/view/journals/001/2023/247/001.2023.issue-247-en.xml

[38] Lalaine C. Delmendo, “Taiwan’s Housing Market is Losing Steam,” Global Property Guide, December 21, 2023, https://www.globalpropertyguide.com/asia/taiwan/price-history

[39] Laura Malsch and Niclas Rolander, “Europe’s Great Housing Crisis is Only Getting Started,” November 2, 2023, https://www.bloomberg.com/news/features/2023-11-02/eu-housing-crisis-is-intensifying-across-germany-france-and-sweden

[40] Tamsin Rose, “Only Five Cities Worldwide are More Unaffordable Than Sydney for Housing, Thinktank Says,” The Guardian, September 6, 2023, https://www.theguardian.com/australia-news/2023/sep/07/only-five-cities-worldwide-are-more-unaffordable-than-sydney-for-housing-thinktank-says

[41] Global Monitoring Report on Non-Bank Financial Intermediation 2023, FSB, December 18, 2023, https://www.fsb.org/2023/12/global-monitoring-report-on-non-bank-financial-intermediation-2023/

[42] “Global Monitoring Report on Non-Bank Financial Intermediation 2023”

[43] Enhancing the Resilience of Non-Bank Financial Intermediation: Progress Report, FSB, September 6, 2023, https://www.fsb.org/wp-content/uploads/P060923-1.pdf

[44] Myriam Balezou and Laura Benitez, “UBS Chair Kelleher Warns Bubble is Forming in Private Credit,” Bloomberg, November 28, 2023, https://www.bloomberg.com/news/articles/2023-11-28/ubs-chair-kelleher-warns-bubble-is-forming-in-private-credit; Laura Benitez, “Pimco Sounds Alarm on Under-Regulated Private Credit Markets,” Bloomberg, November 2, 2023, https://www.bloomberg.com/news/articles/2023-11-02/pimco-sounds-alarm-on-under-regulated-private-credit-markets; Nicholas Comfort, “FSB Turns to Hedge Funds, Private Credit as Risk Scrutiny Widens,” Bloomberg, December 21, 2023, https://www.bloomberg.com/news/articles/2023-12-21/fsb-turns-to-hedge-funds-private-credit-as-risk-scrutiny-widens

[45] Bloomberg, “Private Credit Attracts Billions from U.S. Pension Funds,” Pensions&Investments, December 18, 2023, https://www.pionline.com/alternatives/private-credit-attracts-billions-us-pension-funds

[46] Bloomberg, “Private Credit Attracts Billions from U.S. Pension Funds”

[47] Echo Wong, “Private Credit Catches on in Asia as High Rates Squeeze Other Funding Routes,” Nikkei Asia, November 1, 2023, https://asia.nikkei.com/Business/Finance/Private-credit-catches-on-in-Asia-as-high-rates-squeeze-other-funding-routes

[48] Alexis Crow and Byron Carlock, “Guest View: What’s the Trouble with Offices?” IPE Real Assets, June 23, 2023, https://realassets.ipe.com/real-estate/guest-view-whats-the-trouble-with-offices/10067355.article

[49] “Private Credit Funds Find Opportunity in Real Estate,” The Real Deal, August 3, 2023, https://therealdeal.com/national/2023/08/03/private-credit-funds-find-opportunity-in-real-estate/

[50] Lorretta Chen and Pearl Liu, “Hong Kong’s Stressed Developers Lure Private Credit as Funding Gap Looms,” Bloomberg, November 27, 2023, https://www.bloomberg.com/news/articles/2023-11-27/hong-kong-s-stressed-developers-start-to-turn-to-private-credit

[51] Comfort, “FSB Turns to Hedge Funds, Private Credit as Risk Scrutiny Widens”

[52] Carleton English, “Wells Fargo and Other Big Banks Aren’t Fighting Private Credit—They’re Enabling It,” Barron’s, December 30, 2023, https://www.barrons.com/articles/wells-fargo-jpmorgan-private-credit-banks-9f6ac4ed; Jonathan Kandell, “As Private Credit Surges, Banks and Alternative Asset Managers Turn Frenemies Rather Than Foes,” Institutional Investor, December 4, 2023, https://www.institutionalinvestor.com/article/2ciy5fv74kddt9eoq1m2o/corner-office/as-private-credit-surges-banks-and-alternative-asset-managers-turn-frenemies-rather-than-foes

[53] Comfort, “FSB Turns to Hedge Funds, Private Credit as Risk Scrutiny Widens”

[54] “Private Fund Advisers; Documentation of Registered Investment Adviser Compliance Reviews,” U.S. Securities and Exchange Commission, https://www.sec.gov/rules/2022/05/private-fund-advisers-documentation-registered-investment-adviser-compliance-reviews#IA-6383; “Conformed: Form PF; Event Reporting for Large Hedge Fund Advisers and Private Equity Fund Advisers; Requirements for Large Private Equity Fund Adviser Reporting,” U.S. Securities and Exchange Commission, https://www.sec.gov/rules/2022/01/amendments-form-pf-require-current-reporting-and-amend-reporting-requirements-large#IA-6297

[55] “MFA Files Lawsuit Against SEC to Prevent Adoption of Private Fund Adviser Rule,” MFA, September 1, 2023, https://www.managedfunds.org/press-releases/mfa-files-lawsuit-against-sec-to-prevent-adoption-of-private-fund-adviser-rules/

[56] 2024 Examination Priorities, U.S. Securities and Exchange Commission, https://www.sec.gov/files/2024-exam-priorities.pdf

[57] iSelect Fund, “Biohacking: Revolutionizing Health and Redefining the Future,” https://www.iselectfund.com/deep-dive/biohacking/; Josipa Majic Predin, “Venture Capital Giants In The Billion-Dollar Quest For Longevity Breakthroughs,” Forbes, November 9, 2023, https://www.forbes.com/sites/josipamajic/2023/11/09/venture-capital-giants-in-the-billion-dollar-quest-for-longevity-breakthroughs/?sh=778e02011265

[58] BioSpace, “Complementary and Alternative Medicine Market Poised to Grow at a CAGR of 18% by 2030,” April 27, 2022, https://www.biospace.com/article/complementary-and-alternative-medicine-market-poised-to-grow-at-a-cagr-of-18-percent-by-2030/

[59] Jennifer Weil, “EXCLUSIVE: Innerskin Aesthetic Clinic Raises 5 Million Euros,” BeautyInc, November 17, 2023, https://wwd.com/beauty-industry-news/beauty-features/exclusive-innerskin-aesthetic-clinic-raises-5-million-euros-funding-1235931239/

[60] Nguyen Thi Bich Ngoc, “Southeast Asia's dairy industry attracts big private equity deals,” Nikkei Asia, October 17, 2023, https://asia.nikkei.com/Spotlight/DealStreetAsia/Southeast-Asia-s-dairy-industry-attracts-big-private-equity-deals

[61] Nguyen Thi Bich Ngoc, “Marubeni Growth Capital Asia Invests in Vietnam Food Firm AIG,” Nikkei Asia, November 8, 2023, https://asia.nikkei.com/Spotlight/DealStreetAsia/Marubeni-Growth-Capital-Asia-invests-in-Vietnam-food-firm-AIG

[62] Yuji Nitta, “Japan’s Sojitz Buys Vietnam Food Wholesaler Amid Modernization Push,” Nikkei Asia, November 24, 2023, https://asia.nikkei.com/Business/Business-deals/Japan-s-Sojitz-buys-Vietnam-food-wholesaler-amid-modernization-push

[63] Asian Development Bank, “ADB Invests in Ocean-Based Aquaculture in Viet Nam,” June 30, 2023, https://www.adb.org/news/adb-invests-ocean-based-aquaculture-viet-nam

[64] Research from Dr Osama al-Sabbagh, PwC Luxembourg.

[65] PwC, “Asset and Wealth Management Revolution 2023: The New Context,” July 7, 2023, https://www.pwc.com/gx/en/industries/financial-services/asset-management/publications/asset-and-wealth-management-revolution-2023.html

[66] PwC, “Asset and Wealth Management Revolution 2023: The New Context”

[67] Takahiko Hyuga, “Japan to Start Digital Securities Trading From Next Month,” Bloomberg, November 20, 2023, https://www.bloomberg.com/news/articles/2023-11-20/japan-s-first-digital-securities-trading-to-begin-on-dec-25?srnd=markets-vp

[68] Taizo Wada, “Brookfield Joins Blackstone and KKR in Race for Japan’s Wealthy,” Nikkei Asia, December 6, 2023, https://asia.nikkei.com/Business/Finance/Brookfield-joins-Blackstone-and-KKR-in-race-for-Japan-s-wealthy

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

PREV

PREV