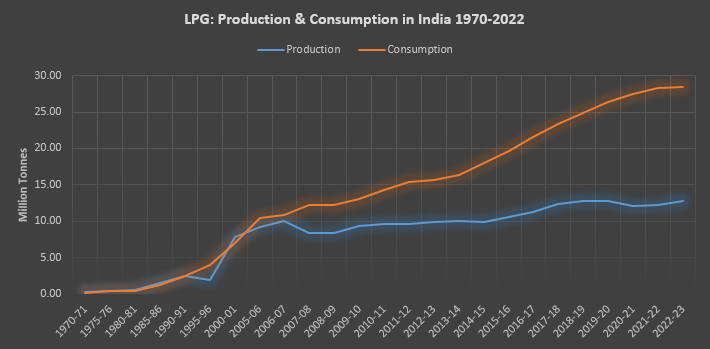

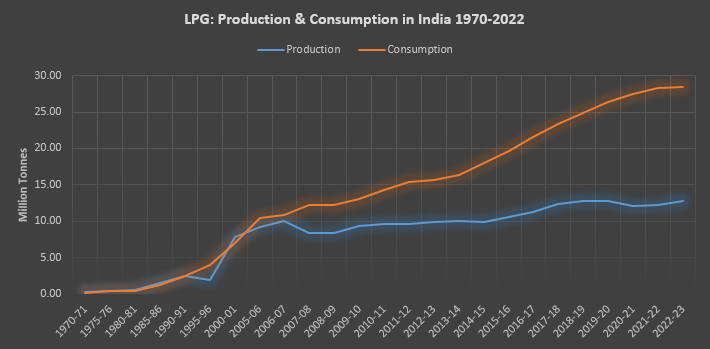

Production of liquefied petroleum gas (LPG) was initiated by Burmah-Shell and Stanvac, international oil companies operating in India in the 1940s and 50s. Burmah Shell started marketing operations for LPG in 1955 in Mumbai but it took another ten years for the release of the first LPG connection in Kolkata under the brand name Indane by the Indian oil corporation (IOC) which had by then taken over nationalised refineries of Burmah Shell. In the early 1970s, concerns over the safety of LPG use inhibited its adoption by households. For example, in 1970, IOC’s Indane LPG had only 235,000 registrations. It took almost three decades, a well-orchestrated media campaign and subsidies to increase registrations to 14.8 million. In the 1980s, domestic production of LPG was insufficient to cover the demand and extraction of propane and butane from large quantities of 'associated gas' and much larger quantities of 'free gas' from the Bombay and South Bassien fields were initiated. Specific budgetary provisions were made for setting up LPG extraction and bottling plants and also for marketing of LPG as fuel for cooking. Between 1970-71 and 2010-11, LPG production grew at an annual average rate of over 9.91 percent while consumption grew at 11.33 percent, the fastest growth rates among all petroleum derivatives including petrol and diesel. In 2010-11, imports met roughly 47.3 percent of the demand for LPG which has increased to over 64.2 percent in 2022-23. LPG imports accounted for the largest share of over 41.1 percent of petroleum product imports in 2022-23. Growth in demand for LPG is slowing down and supply challenges could add to the pressure on demand for LPG in India.

Production of LPG

In 1970-71, domestic production of LPG amounted to 0.17 million tonnes (MT). Production of LPG grew by an annual average of over 13.3 percent in 1970-71 to 1980-85. In 1980-81 to 1985-86, production grew by an annual average of about 22.8 percent because in this period additional refining capacity came onstream, new cracking units were commissioned and LPG production from natural gas increased. Annual average growth in LPG production slowed down to about 3.11 percent between 1985-86 to 1995-96 but it increased to over 31.34 percent in 1995-96 to 2000-01 when the private sector refinery in Jamnagar came onstream. From 2000-01 to 2010-2011, LPG production grew by an annual average of just 2.1 percent and in 2010-2020 growth marginally increased to 2.2 percent. In 2020-21 to 2022-23, LPG production grew by an annual average of 3.1 percent. LPG accounted for about 5 percent of crude oil processing capacity in 2010-11 and in 2022-23 it fell to about 4.2 percent of processing capacity. Despite rising consumption, Indian refiners have not ramped up LPG production capability meaningfully. Indian refineries are more optimally designed to produce petrol and diesel and have lower LPG yields, which in turn limits domestic LPG production. With abundant LPG availability in international markets, thanks to increased production from the US, Indian oil companies are unlikely to dramatically increase LPG production in the future.

Source: Petroleum Planning & Analysis Cell

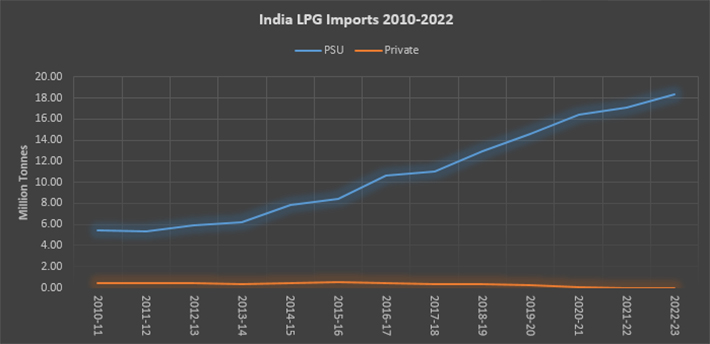

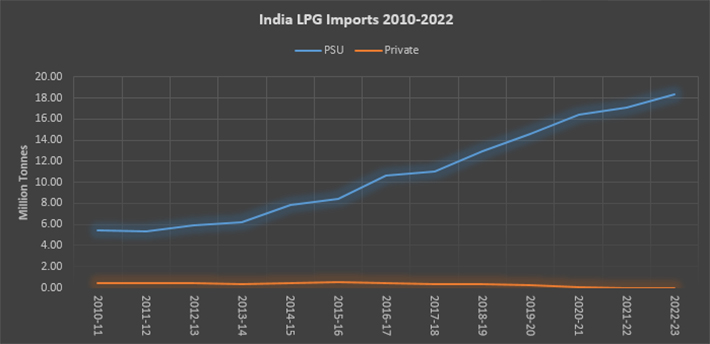

Imports

As domestic production of LPG is stagnant, imports have increased substantially to meet growth in demand. Import dependency for LPG has increased from over 41 percent in 2010-11 to over 64 percent in 2022-23. Private sector imports that accounted for roughly 7.8 percent of LPG imports in 2010-11 have fallen to zero in 2022-23. In 2012-13, countries in the Middle East accounted for over 99 percent of India’s LPG imports. In 2022-23, the share of the Middle East in India’s LPG imports fell to about 92 percent. Qatar, Saudi Arabia and United Arab Emirates (UAE) have remained the top three LPG import sources for India since 2012-13. In 2012-13, Qatar was the largest source of LPG imports to India but its share fell from 32 percent in 2012-13 to 27 percent in 2022-23 but it continues to be India’s top LPG supplier. Saudi Arabia was the second largest supplier of LPG to India in 2012-13 accounting for 25 percent of total imports but it fell to the third spot in 2022-23 with a share of 19 percent. UAE which was the third largest supplier in 2012-23 with a share of 21 percent has moved up to the second spot in 2022-23 increasing its share to 26 percent. In 2022-23, India imported 18.3 MT of LPG of value US$13.8 billion. LPG imports accounted for 41 percent of total petroleum product imports in terms of volume and 51 percent of total product imports in terms of value. Petroleum product imports account for about 24 percent of gross imports of India.

Issues

LPG is essentially a fossil fuel. Scope 1 emissions (direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by the producer of LPG) and scope 2 emissions of LPG (indirect GHG emissions associated with the purchase of imported energy and external energy inputs used by producer of LPG) are quite high as it is for most fossil fuels. Scope 3 emissions of LPG (emissions across the value chain starting with the procurement of the raw materials, through manufacturing, distribution and finally the customer use of the end product) are relatively low at the point of use compared to petrol and diesel. Scope 3 is where the largest percentage of emissions lie for oil & gas producers and typically are the hardest for producers to accurately quantify and track. Increase in import dependency for LPG can magnify the emissions challenge and undermine the goal of energy security. Energy security and emission challenges embedded in LPG supply and consumption in India can compromise achievement of sustainable development goal 7 (SDG 7) that aims to increase access to clean cooking fuels to all.

Most of the public sector producers and importers of LPG (ONGC, IOC, HPCL, BPCL and others) have committed to phase out scope 1 & 2 emissions by 2040-50. This will substantially improve the environmental credentials of LPG in the medium term but this may limit import of LPG from sources that have also committed to phase out scope 1 & 2 emissions. In the longer term, producers of LPG will have to invest in the production of renewable LPG (rLPG) using feedstock that include agricultural residues, energy plants, forest residues, mixed waste, algae, bio-oils, and ethanol. Globally small quantities of rLPG are being produced currently. However strong policy push and incentives will be required for replacing even a small fraction of energy derived from LPG with energy derived from rLPG.

Source: Petroleum Planning & Analysis Cell (PPAC)

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV