This is the 123rd article in the series –

This is the 123rd article in the series – The China Chronicles.

Read the articles here.

Buried under a huge US $305 billion debt and almost on the brink of collapse, China’s real estate giant Evergrande Group

defaulted twice on payments to offshore bondholders in September 2021. More damning is the fact that the group is yet to announce any plan to repay those investors.

This has sent shockwaves through financial markets across the globe.

China has been the principal driver of the post-pandemic global recovery. It is the first country returning back to the pre-pandemic output level. In the process, China became the single-most important factor in the global commodities market upturn.

China’s extended boom run in the property sector started in the mid-1990s and continued unabated. As a result, almost three-fourth of the country’s household wealth is now

engaged in housing. With large offshore investments in Chinese high-yield (HY) real estate bonds, financial markets in other countries now are exposed to substantial risk of contagion.

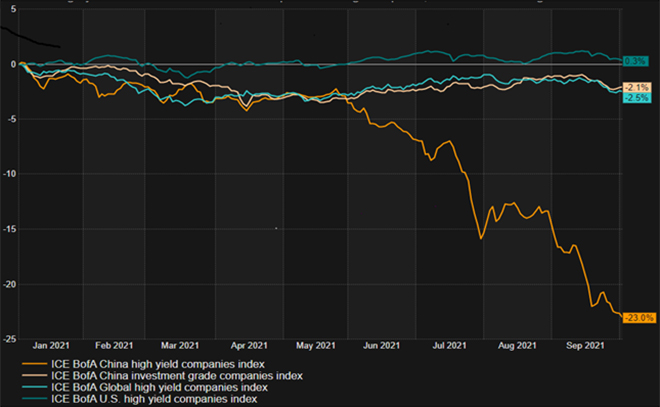

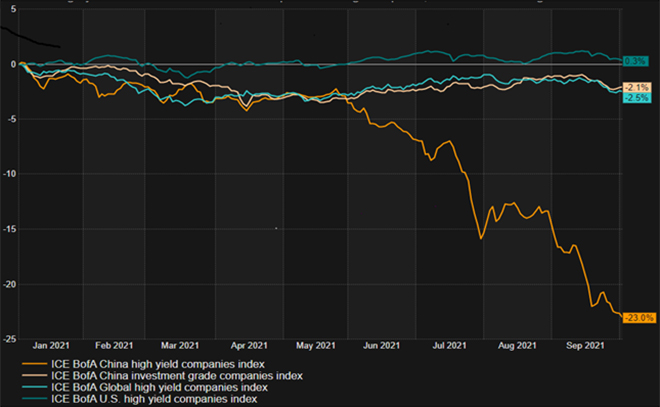

It is no wonder that China HY bonds index tumbled in the aftermath (

Figure 1). Foreign investors

have taken out US $8.1 billion out of the Chinese debt portfolio in September—the largest outflow in the last six months.

| FIGURE 1: Evergrande Crisis Pulls Down China High Yield (HY) Bonds |

|

|

* ICE Data Indices is a leading indices provider across all major classes.

Source: Reuter |

The empire of

Evergrande Group s over 1,300 housing projects in nearly 300 cities, a football team (Guangzhou FC), an island holiday resort with 58 hotels and 15 under-construction Chinese Disneyland-like theme parks. This empire is erected mostly by borrowed money from domestic and international markets.

Currently, it has 800 unfinished residential buildings, numerous unpaid suppliers, and over a million home buyers who have partially paid for their properties.

The group is also in wealth management products, and those are mostly sold to its own employees. Under the current circumstances, the group would be unable to discharge the guarantees on many of these products. For obvious reasons, insider selling has started, if grapevines are to be believed.

Evergrande used to bid for land at prices significantly higher than market prices. Apparently, this is a common practice amongst Chinese companies. Evergrande excelled at that on its way up to becoming the property giant selling home-ownership dreams to the Chinese middle class. Earlier this overinflating price did not affect the property developers as the risks were finally transferred to the flat buyers and the banks that financed those purchases.

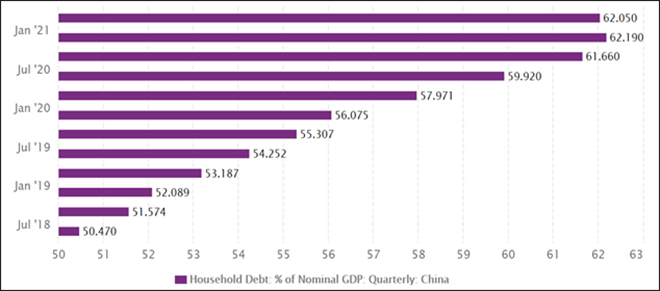

This model has worked fine for households, real estate developers, banks, and local governments up until now because housing prices were soaring up. Rising residential property prices took care of artificial overinflating of land prices. However, this was bound to affect affordability of home and household debt at some point. And it did this time.

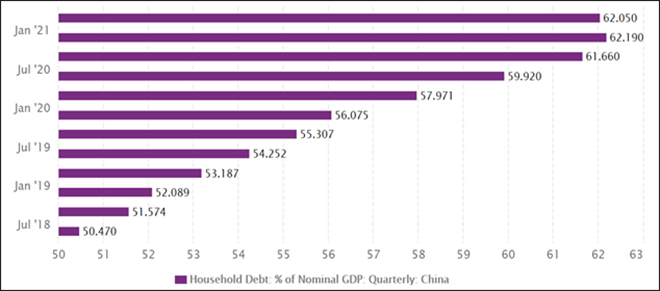

The shock of the COVID-19 pandemic triggered further increase in household debt. Now, household debt burden is probably close to the snapping threshold or has exceeded it (

Figure 2).

| FIGURE 2: Upward Moving Household Debt of China (as % of GDP) |

|

| Source: CEIC Data |

This all started in 2020, when the People’s Bank of China (PBC) and the Ministry of Housing announced new financing rules for real estate companies, often called as the “

three red lines”. Those were –

- a 70 percent ceiling on liabilities to asset ratio, excluding advance proceeds from projects sold on contract,

- a 100 percent cap on net debt to equity, and

- a cash to short-term borrowing ratio of at least 1.

The objective of imposing these borrowing restrictions primarily was to prevent a housing bubble and a subsequent disastrous bust. China was eager not to repeat

Japan’s mistake of not controlling excessive credit in the 1990s and not shutting down insolvent borrowers quickly. Those mistakes caused long-term damage to Japanese growth.

However, Evergrande’s illiquid portfolio of property projects are financed by more than US $300 billion of domestic and international liabilities, and 80 percent of these are short-term. The group has a huge liquidity mismatch. Apparently, the cash flow plays a vital part in the growth of these Chinese real estate companies that almost operate like a credit-driven Ponzi scheme. So, like other companies in the sector, Evergrande also struggled to abide by those new “three red lines”. Even in September 2020, there had been reports of a

possible cash crunch at Evergrande, leading to a brief liquidity scare.

In the Chinese property sector, therefore, symptoms of stress were bound to appear. Fantasia Holdings has

defaulted on a US $206 million bond payment in the beginning of October 2021. Sinic Holdings, another developer, now has to undergo a rating downgrade after some of its units missed interest payments on onshore financing arrangements.

If trends in commodity markets are observed, there are definitive initial stress signs—steel being the prime one. However, this is not just only related to the commodities markets—due to linkages to real estate. China’s consumers are also highly leveraged (

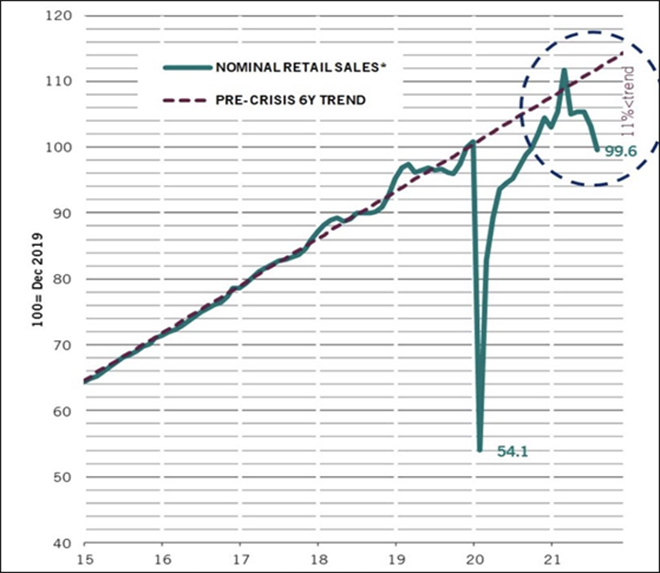

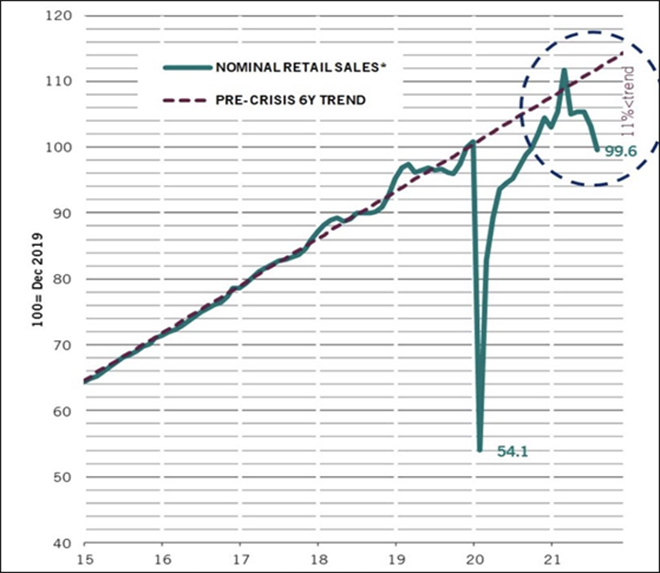

Figure 2). Though output reached pre-pandemic level, consumers are clearly unable to keep up with that pace. Nominal retail sales remained way below the six-year trend through most of 2020 and suffered a 11 percent drop in recent times (

Figure 3). Domestic consumer demand is clearly down in China. Till now, the exports have compensated for that.

| FIGURE 3: Nominal Retail Sale of China Has Plunged |

|

|

* Monthly trends in China’s nominal retail sales are shown taking December 2019 = 100

Data Source: Pictet Asset Management, CEIC, Refinitiv |

Critics always pointed out the opacity and command-driven nature of the Chinese financial market. One major criticism has been misallocation of capital in the system. China’s high-tech sectors are relatively starved of capital, compared to real estate. PBC probably tried to address that issue also while creating those “three red lines”. In the process, it has practically magnified and compounded inherent systemic errors in the real estate sector.

If anybody tries to find initial symptoms of contagion in the funding stress at the housing markets, then probably it will be a mistake. In the Chinese structure, the government is likely to keep the funding pipeline operating smoothly, at least in the short run. In all probability, China would try its best to prevent housing prices from also falling. Therefore, those places may look all right for the time being. The international commodity markets and domestic consumption markets are the most crucial places to follow right now. If the contagion starts, then these are the ones which will show clearer signs.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This is the 123rd article in the series – The China Chronicles.

Read the articles

This is the 123rd article in the series – The China Chronicles.

Read the articles

PREV

PREV