-

CENTRES

Progammes & Centres

Location

Cautious support for renewable energy in the budget and survey emphasizes complex trade-offs

The budget (2024-25) and the economic survey (2023-24) cautiously support renewable energy (RE) sources, acknowledging climate change and the need for an energy transition. The economic survey, in particular, highlighted the trade-offs involved in increasing the share of RE. Under the fitting caption “successful energy transition is an orchestra”, the economic survey listed various challenges (i) resource dependence on hostile nations for critical minerals, (ii) technological challenges such as intermittency of power generation & ensuring grid stability, (iii) the opportunity cost of tying up land in a land-scarce country, (iv) fiscal implications of additional expenditures for subsidising RE generation and for e-mobility along with the loss of tax and freight revenue from fossil fuels, (v) impairment to bank balance sheets from ‘stranded assets’ and, (vi) examination of the merits of alternative mobility solutions such as public transportation and “many more” challenges that need to be overcome. Reading between the lines of both the budget documents and the economic survey, what India seems to be saying is that it will continue with investments in RE but it is sceptical of the romantic rhetoric that promote RE, as the cheapest source of energy that does not involve expensive trade-offs.

Among the many trade-offs identified by the survey is the cost of managing RE’s intermittency challenge. The survey notes that RE is intermittent and discontinuous, impacting grid stability in the absence of battery storage. It further states that increase in RE capacity may lead to a decline in base load efficiency as the supply composition changes, and that large-scale phasing-in of RE poses several risks associated with intermittency and dispatchability in the energy system. In a footnote, the survey clarifies that risk reflects the potential inability of the energy system to deliver on its essential function – a reliable, stable, and sustainable supply of energy at affordable prices and social costs. The survey then unravels the concept of levelized cost of electricity (LCOE) of RE. Contesting the widely quoted view that solar energy is now cheaper (based on the LCOE metric) in many countries compared to fossil fuel-based alternatives, the survey observes that the LCOE metric may be useful for investors who have the narrow focus on return on investment but not necessarily for policy makers as they have to worry about total costs including social costs. LCOE represents the total cost of building and operating an RE generation asset per unit of electricity generated over an assumed lifetime. Investing in the project is viable if the LCOE is lower than the electricity tariff. But, LCOE ignores the cost of back up that is required to manage intermittency and dispatchability of RE systems. If the producer is not mandated to make the power dispatchable, then energy procurement at LCOE reflects an implicit subsidy for the producer. The survey proposes the use of round-the-clock (RTC) RE supply contracts that internalise risks related to intermittency and dispatchability.

LCOE represents the total cost of building and operating an RE generation asset per unit of electricity generated over an assumed lifetime. Investing in the project is viable if the LCOE is lower than the electricity tariff.

With the use of backup, RTC-RE supply could potentially match the buyers’ energy demand curve. As pointed out by the survey, the tariff for RTC-RE is not necessarily lower than that of fossil fuel-based conventional power. Wind-solar systems connected to the interstate transmission system (ISTS), with assured peak power supply contracts signed by the solar energy corporation of India (SECI), were in the range of INR4.64/ kilowatt hour(kWh) to INR5.96/kWh. The survey notes that, in theory, combining wind and solar projects across space could produce dispatchable power, but this would mean navigating complex transaction costs, that include but not limited to long term power purchase agreements (PPAs) with many generators across states, availability of transmission, real time control of supply. The allocation for the solar sector has doubled from about INR73 billion to about INR163 billion, but roughly (about INR 62 billion) is allocated to the surya ghar programme that has to overcome significant financial, technological, and bureaucratic hurdles to succeed.

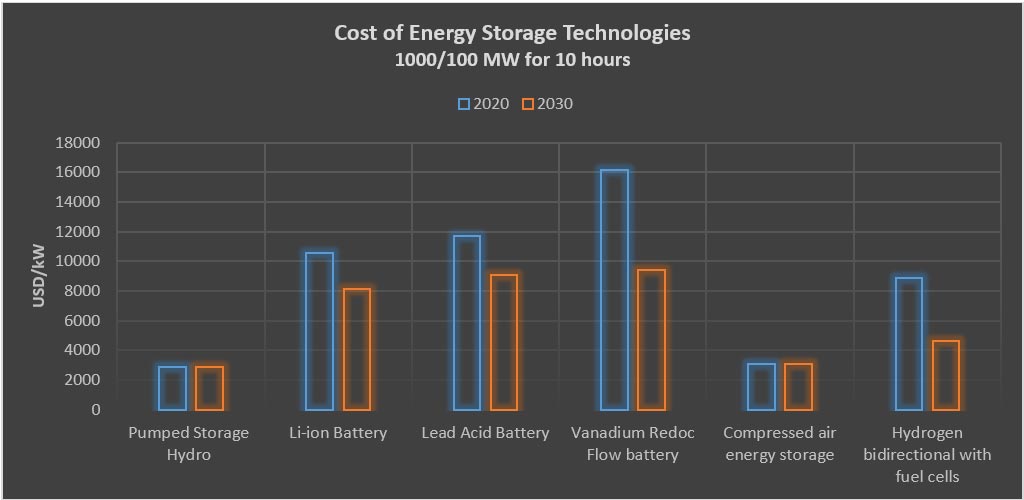

The sobering conclusion of the survey in investing in battery storage is that higher upfront costs, technology risks, longer payback periods, and limited access to critical and rare earth minerals required for battery storage technology pose serious challenges. The survey, therefore, recommends pumped storage-based energy storage solutions to reduce system costs and, in addition, have longer life than batteries. Resonating this sentiment, the budget speech stated that a policy for promoting pumped storage projects would be brought out for electricity storage, that would facilitate smooth integration of the growing share of RE, notwithstanding inherent limitations of intermittency and variability. The viability gap funding (VGF) for battery storage in 2024-25, of about INR160 billion, was roughly the same as that in 2023-24.

Many recent papers concur with the view expressed by the economic survey. An insightful analysis on the power outages experienced in the summer of 2024 shows that expansion of RE-based power at the expense of conventional thermal power generation increased peak shortages, as RE power could not meet peak demand that occurred after sunset. Another recent (2024) paper on tariff shocks arising from the increase in RE generation cites examples from Germany, the Netherlands, and Spain where the cost of grid integration of RE, that runs into several billion Euros, was passed on to retail consumers. The paper also shows that as the share of RE rises in the Indian grid, thermal plant load factors (PLFs) will fall, and fixed costs for each plant will be spread over fewer kWhs of power generation increasing the per kWh cost. With the increase in fixed costs, distribution companies (discoms) will be forced to source fewer kWhs of electricity for the same outlay for power purchases. The counter-argument made is that discoms can purchase cheaper kWhs from RE generators. Howerver, the problem is that the weighted (time and space or when and where) average variable cost of RE is not necessarily equal or lower than the weighted average variable cost of thermal power. Based on tariff orders for Andra Pradesh, Uttar Pradesh and Maharashtra, the paper shows that the variable cost of RE purchase is higher. At an all-India level, the paper estimates that additional cost of RE purchase ranges from a minimum of INR 0.80/kWh to a maximum of INR2.34/kWh. The paper lists integration costs that include (i) additional cost liabilities due to power purchase from RE sources to replace PPAs for coal-based power, (ii) greater cost of thermal flexibility and cycling, (iii) retrofit cost of grid integration such as deviation settlement mechanism and standby power, (iv) costs of additional transmission infrastructure for RE power evacuation, (v) cost of stranded assets. Overall, the conclusion of the paper, co-authored by members of state electricity regulatory commissions (SERCs), are in line with the conclusions of a 2015 paper that theoretically estimated integration costs based on the market value of electricity for balancing, flexible operation of thermal plants, and reduced use of capital stock in infrastructure, are too high to be ignored at high RE penetration levels.

An insightful analysis on the power outages experienced in the summer of 2024 shows that expansion of RE-based power at the expense of conventional thermal power generation increased peak shortages, as RE power could not meet peak demand that occurred after sunset.

Another trade-off discussed in the survey is the competition for land and water for energy production and food production. It observes that land requirement is highest for RE and quotes figures of 1-1.5 hectares of land per megawatt (MW) of solar photovoltaic (PV) capacity. Given that land availability per person is lowest in India among G20 countries, access to land for food security and energy security will be contested.

Other risks discussed in the survey include the growth in import of critical minerals, China’s control over critical mineral processing, and access to finance. In the context of import dependence, it is hard to disagree with the conclusion that when India’s high dependency on imports for petroleum shifts to high import dependency for Solar PV panels and critical minerals, the risks to supply chain disruption and geopolitics may be even trickier.

The survey quotes the study by Indian Institute of Management Ahmedabad (IIMA), with support from the Nuclear Power Corporation of India Limited (NPCIL) and the Office of the Principal Scientific Advisor to the Government of India, that coal phase-down in India, will be heavily dependent on the import of critical minerals required for RE and battery storage unless the country invests in the development of technologies based on domestically available mineral resources and those that enable the reuse, recovery, and recycling of critical minerals. The implicit suggestion is probably that a stronger focus on nuclear power would offer greater energy security and lower carbon emissions.

The war over Ukraine, which brought energy security to the forefront, the summer peak electricity demand that called for increasing coal and gas-based electricity generation despite dramatic RE capacity additions, the rhetorical flourish on RE affordability and technological simplicity that appears to be far removed from reality, the material challenge of the energy transition that imposes import dependence for critical minerals, the geopolitics of new energy supply chains, the set back for carbon emission reduction mandates in Europe, and the overall political backlash over top-down mandates for carbon reduction in many affluent countries do justify a review of carbon reduction policies that have taken precedence over development priorities. However, among the key drivers of change – policy driven incentives and disincentives, demographic change, consumer choice or behaviour and technology – technology is likely to make the fastest progress in both reducing costs and in reducing complexities as history has shown. It is wise to keep in mind that policies that appear to be the right thing to do today may appear inadequate or irrational tAFomorrow.

Source: Pumped Storage Hydropower Capabilities and Costs Capabilities, Pumped Storage Hydropower International Forum, 2021

Lydia Powell is a Distinguished Fellow at the Observer Research Foundation.

Akhilesh Sati is a Program Manager at the Observer Research Foundation.

Vinod Kumar Tomar is a Assistant Manager at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Ms Powell has been with the ORF Centre for Resources Management for over eight years working on policy issues in Energy and Climate Change. Her ...

Read More +

Akhilesh Sati is a Programme Manager working under ORFs Energy Initiative for more than fifteen years. With Statistics as academic background his core area of ...

Read More +

Vinod Kumar, Assistant Manager, Energy and Climate Change Content Development of the Energy News Monitor Energy and Climate Change. Member of the Energy News Monitor production ...

Read More +