Background

Russia is the largest net exporter of fossil fuels (coal, oil, and gas). It is the world’s largest oil (crude and products) exporter shipping 8 million barrels per day (b/d) into global markets and the world’s largest natural gas exporter with 210 BCM (billion cubic meters) of exports through pipeline alone. Russia is also amongst the top ten coal producers in the world accounting for over 5 percent of global output. The partial removal of Russian oil, gas, and coal from international markets has price and volume implications for the Indian energy sector.

Crude Oil

Oil price risk is the biggest threat to the Indian economy as supply losses even in the worst cases are not likely to result in significant volume risk. Analysis shows that production losses from Russia of up to 1 mb/d (million barrels per day) will be manageable in the short term, but a more severe supply shock will need a collective response from the supply side, but this is very difficult to achieve. The worst-case estimate for the loss of supply from Russia put it at around 4 mb/d. OPEC (oil-producing and exporting countries) production increases can make up less than 40 percent of this loss. US shale production increases are constrained by capital discipline in the industry and supply increases from Iran are subject to reaching a nuclear deal. Most analysis suggests that the oil sector is likely to remain in deficit in 2022 with the supply deficit in the worst case put at about 1.3 mb/d. Crude prices are expected to remain volatile ranging from US$100/b to US$130/b.

The worst-case estimate for the loss of supply from Russia put it at around 4 mb/d. OPEC (oil-producing and exporting countries) production increases can make up less than 40 percent of this loss.

The self-sufficiency ratio for petroleum products in India was 15.6 percent in 2020-21 which means India is dependent on imports for meeting about 85 percent of its petroleum product needs. Given the substantial impact of energy on the trade balance, India’s energy policy is closely tied to managing the impacts on the balance of trade, specifically its energy import bill. Every US$10/b increase in crude prices results in an increase of over US$15 billion in India’s net oil import bill. This will increase India’s current account deficit (CAD) by about 0.4-0.6 percent of GDP and reduce fiscal headroom with additional subsidy outgo of over US$1.9 billion. Most of the oil demand adjustment globally and in India is expected from fuels for industrial use as high input costs restrict industrial activity and manufacturing, followed by the demand for transport fuels particularly road and aviation fuels. This reduction will have significant economic consequences.

Natural Gas

In the case of natural gas, India is likely to be exposed to both price and volume risk, especially in the case of its spot gas imports. India’s self-sufficiency ratio for natural gas in 2021-22 was 50.9 percent. Of the roughly 50 percent of imported gas LNG (liquefied natural gas) about 75-80 percent is sourced through long-term contracts and the rest through spot purchases. GAIL (India) Limited signed a purchase agreement with Cheniere Energy in 2011 for 3.5 million metric tons per annum (mtpa) from the Sabine Pass LNG facility in Louisiana. The 20-year contract term commenced in 2018. India’s Petronet has two-term supply contracts with Rasgas of Qatar for 7.5mtpa and 1 mtpa. Petronet’s contract with RasGas slated for a review in 2023, will expire in 2028. Petronet also imports 1.44 mtpa from Exxon's Gorgon project in Australia under a term deal. Prices average around US$12/mmBtu (metric million British thermal units) for Petronet LNG's Qatari supplies, less than half of spot LNG levels. However, any sustained increase in gas and oil prices in the international market could lead to an upward price shift in negotiations for long-term contracts. Oil-linked contracts were signed with a 10 percent slope (that defines the relationship between the oil and gas prices and multiplied by the Japanese crude cocktail prices) of Brent crude futures in 2020 when crude prices were low. Exporters are likely to demand a higher slope in their revised contracts. Germany has signed an agreement with Qatar for LNG supplies recently. Competition from Europe (which will probably buy gas at any price) for middle eastern LNG could reduce space for favourable price negotiations by India.

Oil-linked contracts were signed with a 10 percent slope (that defines the relationship between the oil and gas prices and multiplied by the Japanese crude cocktail prices) of Brent crude futures in 2020 when crude prices were low.

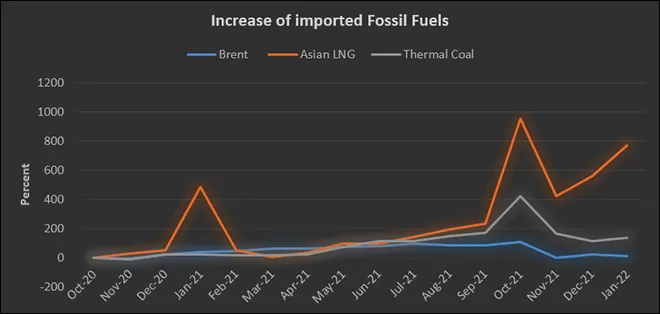

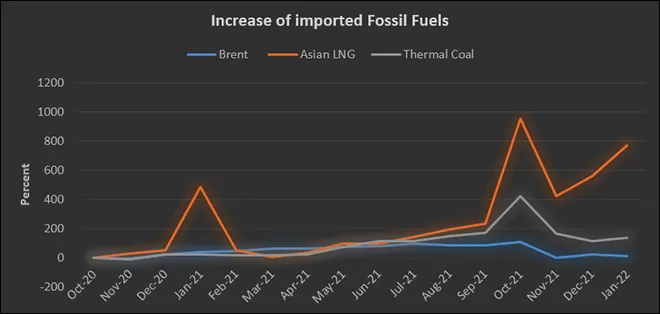

Import of LNG on the spot market means dealing with wild volatility in pricing. During the pandemic when the Japan Korea Marker (JKM) price for LNG, the benchmark for Asian spot LNG imports swung to US$18/mmBtu in February 2021 demand for spot gas from India dried up. Indian companies rescheduled or deferred LNG cargoes to avoid the current prevailing high spot prices. The JKM fell to about US$2/mmBtu in April 2020 on account of the pandemic-influenced economic slowdown but increased to over US$35/mmBtu in March 2022, an increase of over 1650 percent following the crisis in Ukraine and the related natural gas supply risks.

Indian industrial customers prefer US$5-6/mmBtu to use gas over coal with some segments such as fertiliser and city gas distribution (CGD) accepting prices of around US$10/mmBtu. Beyond this price India’s spot market purchase prospects are limited. The likelihood of higher gas prices for Asian importers will increase as Europe approaches winter. Under a scenario where Russian flows on Nord Stream 1, the Yamal-Europe pipeline, and the Ukraine routes are curtailed between April 2022 and March 2023, the ability of Europe to refill its storage is expected to be severely compromised and lead to global price increases. In this context, Indian industrial gas users are likely to substitute gas with alternative fossil fuels primarily coal and pet coke. Segments such as city gas distribution (CGD) will not be able to do so and some pass-through of a global price increase to the retail consumer is inevitable. In the long run, higher gas prices will compromise India’s goal of increasing the share of gas in its primary energy basket from 6 percent to 15 percent which will mean higher carbon emissions.

Coal

Out of the 204.9 GW (gigawatt) of installed coal-fired power generation capacity in India, around 17.6 GW is designed specifically to run on imported coal. Other power plants import the fuel for blending with domestic coal. Imported coal has unexpectedly become the fallback fuel for power generation following a combination of an unprecedented heat wave, the consequent increase in power demand, a coal stock shortage at thermal power plants and a reduction in power generation by thermal plants dependent on imported coal. The result is that the government is directing thermal plants to increase imports of coal to tide over the coal crisis comes at a time when international coal prices are at unprecedented highs following the crisis in Ukraine. The price of Indonesian 4,200 kcal/kg (kilocalories per kilogram) coal increased from US$79.05/tonne (t) in February 2021 to US$91.95/t in May 2022. In the same period, the price of South African 5,500 kcal/kg coal increased from US$231.9/t FOB to US$269.5/t, whilst Australian 5,500 kcal/kg coal price increased from US$159.25/t to US$196.95/t. This will add to the pressure on India’s energy import bill which in turn will add to India’s current account deficit. The government’s decision to push power generators to import coal is sending confusing signals to lenders. Government-owned banks that had taken the signal from the Reserve Bank of India (RBI), and decided not to fund the working capital requirements of 13 imported coal-fired power plants have now agreed to finance working capital loans to buy imported coal as directed by the government. In the long term, this contradiction is likely to worsen the owes of the power sector.

The Government has projected that the overall coal demand will outstrip the domestic supply in the current financial year. Whilst the overall coal demand in 2022-23 is expected to be 1,029 million tonnes (MT), the domestic supply is estimated to be 974 MT, according to the latest medium-term projections of dry fuel by the coal ministry. In the longer term, thermal coal requirement is expected to increase to 1,500 MT in the next 18 years. Increasing domestic production of coal as planned and removing logistical constraints for coal transport could potentially reduce exposure to an increase in seaborne thermal coal prices.

Source: International Energy Agency

Source: International Energy Agency

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV