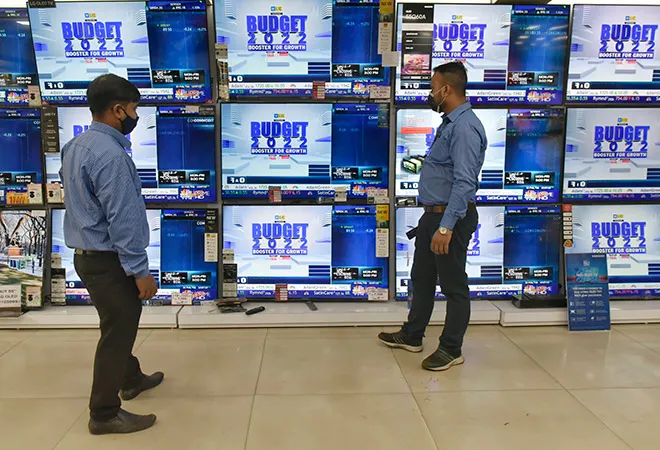

This brief is a part of the Budget 2022: Numbers and Beyond series.

The Union Budget FY 2022–2023 of the Government of India has not only brought focus on digitalising finance and the finance sector, but has also taken the public sphere by storm. The budget has used “Digital India” as a pillar to bring in inclusion and to build a robust economy in the long term. Some of the key highlights that cut into the finance and digital-finance space include:

CBDC—Digital Rupee

The budget proposal mentions that the digital rupee will be introduced by the Reserve Bank of India (RBI) in FY 2022-23.

“

Introduction of Central Bank Digital Currency (CBDC) will give a big boost to the digital economy. Digital currency will also lead to a more efficient and cheaper currency management system. It is, therefore, proposed to introduce Digital Rupee, using blockchain and other technologies, to be issued by the Reserve Bank of India starting 2022-23”, Finance Minister Sitharaman said.

Digital Rupee can have many uses, such as in programmable payments for subsidies and by financial institutions for quicker lending and payments.

In a blockchain, the transaction records cannot be changed at all, and the ledger is transparent and authentic. The CBDC is a digital form of fiat currency, which can be transacted using wallets backed by blockchain and is regulated by the central bank. It enables the user to conduct both domestic and cross-border transactions, which do not require a third party or a bank. Digital Rupee can have many uses, such as in programmable payments for subsidies and by financial institutions for quicker lending and payments. With interoperability and increased usage, Digital Rupee could also positively impact faster real-time cross-border remittances.

Cryptos as assets?

Meanwhile, the government has also announced that any income from transfer of

digital assets will be taxed at the rate of 30 percent. This will impact all profits from trading in cryptocurrency and Non-Fungible Tokens (NFTs). “No deduction in respect of any expenditure or allowance shall be allowed while computing such income except cost of acquisition. Further, loss from transfer of virtual digital asset cannot be set off against any other income

,” she added. To capture the transaction details, the government has also provided for TDS on payment made in relation to transfer of virtual digital assets at the rate of 1 percent of such consideration. Gifting of virtual digital assets is also proposed to be taxed in the hands of the recipient.

The Supreme Court in its judgment in March 2020 overturned the RBI’s 2018 circular, mentioning that in the absence of any legislative ban on the buying or selling of cryptocurrencies, the RBI cannot impose disproportionate restrictions on trading in these currencies.

The move comes amidst the government’s plans to introduce a bill on cryptocurrencies that seeks to prohibit “all private cryptocurrencies in India” with “certain exceptions”. The bill has been in the making since January 2021, and the stakeholders (RBI, crypto exchanges, banks, investors) have been on tenterhooks as well as being warring factions over the past few years. Until this bill is passed, crypto’s legality is still iffy. Earlier in 2017, an inter-disciplinary committee set up by the Centre had recommended a ban on the trading and possession of cryptocurrencies. In April 2018, the RBI issued a circular instructing banks to deny banking services access to those customers dealing in cryptocurrencies. The Supreme Court in its judgment in March 2020 overturned the RBI’s 2018 circular, mentioning that in the absence of any legislative ban on the buying or selling of cryptocurrencies, the RBI cannot impose disproportionate restrictions on trading in these currencies.

Post offices on core-banking system

All the 1.5 lakh post offices in India are set to be connected to the core banking system in the FY 2022-23. This will enable financial inclusion and access to post office accounts through net banking, mobile banking, ATMs, and also provide online transfer of funds between post office accounts and bank accounts. It is worthy to mention that this proposal has its ideological genesis in the

National Mission for Financial Inclusion (NMFI) of August 2014, which seeks to provide universal banking services for every unbanked household, based on the guiding principles of “banking the unbanked, securing the unsecured, funding the unfunded, and serving unserved and underserved areas”.

‘Digital banking Units’ in 75 districts by SCBs

To mark 75 years of Indian Independence, 75 Digital banking units will be set up in 75 districts of the country by the Scheduled Commercial Banks (SCBs). This would push ahead financial inclusion, and the banks might see improved access to liabilities pools from newer consumer sources in those geographies. A

2017 RBI Report of the Working Group on FinTech and Digital Banking had noted that customers were rapidly adopting technology in their daily lives, driven by the growth in internet and mobile penetration, availability of low-cost data plans, and shift from offline to online commerce. In this report, it was observed, “The form of retail financial services is completely dictated by consumers and as they evolve so will retail financial services. Hence innovation is not a luxury anymore, it's a necessity. More importantly we are also seeing the advent of nimble startups, which are slowly and steadily changing how retail financial services are delivered to the consumers and hence putting pressure on traditional banks to take notice and align their functioning accordingly. It is, therefore, extremely important for banks to innovate in the retail financial services space in tune with the changing times or else there is a grave risk of their becoming less relevant to existing customers

.”

A 2017 RBI Report of the Working Group on FinTech and Digital Banking had noted that customers were rapidly adopting technology in their daily lives, driven by the growth in internet and mobile penetration, availability of low-cost data plans, and shift from offline to online commerce.

The larger question to answer is, if this can be the precursor to the idea of the digital-bank mooted by the

discussion paper proposed by Niti Aayog, and the

purported RBI’s lack of evident interest for this idea. With the Finance Minister proposing the digital banking units idea, the details of how it would be shaped will be keenly watched by the FinTechs, who can potentially morph into digital banks.

Tax holiday extension for startups

Eligible start-ups established before 31 March 2022 had been provided a tax incentive for three consecutive years out of 10 years from incorporation. Now that eligibility has been extended to those eligible startups established before 31 March 2023. The Finance Minister in her Budget speech mentioned that startups have emerged as “

drivers of growth for India's economy and that over the past few years, the country has seen a manifold increase in successful startups.”

Gift City: India’s first and only financial services centre

Gift–IFSC has an entirely separate financial jurisdiction with the International Financial Services Centre Authority (IFSCA) as the unified financial services regulator. The IFSCA has been empowered under 14 separate Central Acts. An international arbitration centre will be set up in GIFT city with the aim to provide faster and cheaper dispute resolution, on the lines of the Singapore International Arbitration Centre or London Commercial Arbitration Centre.

Interlinkages for better credit access to MSMEs

MSME portals such as Udyam, e-shram, NCS, and Aseem will be interlinked, widening their scope of usage. They will work as portals with live databases providing G-C, B-C & B-B services such as credit facilitation. With improved credit facilitation, the MSME sector would benefit by addressing the working capital needs, which have been plaguing them for long.

Green Bonds

The government will float a sovereign green bond, the proceeds of which will be deployed in public sector projects that reduce carbon footprint. Green bonds, or climate bonds, are debt instruments that are used to raise money to fund projects that have a positive impact on the environment and climate, amongst other things.

India had issued over US $6 billion in green bonds in CY 2021, according to the UK-based green bond tracking agency, Climate Bonds Initiative.

An international arbitration centre will be set up in GIFT city with the aim to provide faster and cheaper dispute resolution, on the lines of the Singapore International Arbitration Centre or London Commercial Arbitration Centre.

Green bonds have been fast gaining popularity, with

Climate Bonds Market Intelligence pegging the green bond market size at an all-time high of US $517 billion in 2021. India is at a distant 17th position amongst green bond issuing nations in 2021, where the United States, Germany, China, France, and the United Kingdom dominate. According to S&P,

corporate and bank issuers in India are likely to tap the climate-related debt market more actively as the world's third-largest emitter of carbon dioxide will need as much as US $10 trillion to be carbon-neutral by 2070. Though the details of these green bonds will be announced in due course, tapping into the savings base of domestic retail investors by allowing them to invest in it can be an important source of funds.

Conclusion

Over the past few years, many digital enablers have been put into motion. The larger context that could leapfrog India as a digital finance leader-nation would be the ecosystem combination of ‘Open Network for Digital Commerce’ (ONDC—an open-source e-commerce platform that all online retailers can use), Open Credit Enablement Network (OCEN), blockchain-enabled financial system, Digital Rupee, UPI, the powerful JAM trinity, and the move towards the green-transition. This could make India a true digital finance state, and hopefully, without any digital divides that could marginalise anyone from participating in the citizenry benefits that such a state can provide.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV