-

CENTRES

Progammes & Centres

Location

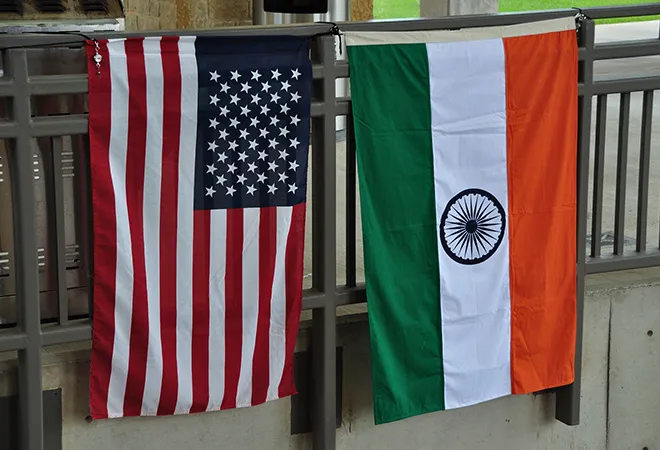

Can India jumpstart its economy by expanding bilateral trade relations with the US to reverse negative economic trends?

The Modi 2.0 government’s aims of increasing the share of India’s manufacturing sector to 25% of GDP by 2022, ambitious ‘Make in India’ flagship programme need kickstarting with the impact of COVID-19 on the economy. Despite India’s efforts over many years now, its manufacturing share refuses to go beyond the 20% level and has remained below it. As India continues to reel under different iterations of a nationwide lockdown, can India jumpstart its economy by expanding bilateral trade relations with the US, to reverse these negative economic trends?

The government has faltered in boosting it local demand. Despite the government’s rhetoric to promote domestic production, consumption demand plummeted even before COVID-19 in all segments, including import demand — both industrial and private. The overestimations of the Indian market were largely due to the inadequacies in producing goods which would cater to the masses. The targeted production, in fact, remained for the higher-income, albeit smaller segment of local consumers. Recognising the need to tap Indian masses as potential consumers, speeches of PM Modi resounded the ‘Made in India’ sentiments and urged people to procure domestic products. Where ‘Make in India’ was focused on commodity production — ‘Made in India’ is a nudge by the government to increase the consumption of these locally manufactured goods. New Delhi needs to also acknowledge that to boost consumer demands, the goods manufactured must be at a break-even with the consumers’ willingness to pay.

There exists a lack of purchasing power in most people’s hands and raising it and generating demand will key to driving economic growth and absorbing an increase in production in India.

The move to establish India as a global manufacturing hub, in parallel with the Skill India campaign and the digitalisation of the economy, has not been enough. None have been able to generate the desired levels of jobs or attract greater foreign investments. The flow of FDIs is crucial for enduring growth of the manufacturing sector, which alarmingly slumped in the past quarters. According to reports, the annual growth in gross Foreign Direct Investment (FDI) and FDI equity inflows have fallen significantly into single digits since 2016-17 with the latter registering a negative growth in 2018-19.

The Ministry of Finance has undertaken several measures to encourage exports. Drastic interventions by the government of slashing corporate taxes, deductions in importer privileges, incentivising the real-estate sector, and to make automobile loans cheaper contributed to the Indian stock market skyrocketing. These announcements were perceived as definitive steps in promoting local manufacturing and Foreign Direct Investment. However data from the Department for Promotion of Industry & Internal Trade for the last two quarters of 2019 indicates FDI equity inflows stood at $23 billion, while the quarters before the corporate tax rate cut was $26.1 billion. Indicating the measure has not let to any increase in FDI.

However, since 2018, India has also faced collateral trade damages in the US-China tariff war. While Washington withdrew India’s special trade privileges, the country reacted by imposing higher import duties on American products. The frictions in bilateral trade with the US has been consequential for India as the country continues to face economic slowdown, and an uncertain business environment.

Both countries still lack a Free Trade Agreement (FTA), which hinders the free movement of goods and limits trade potential. The bilateral good and services trade figures between the two countries was $142.6 billion in 2018-19, significantly shy of the publicly-stated goal of $500 billion. India and the United States also lack a bilateral investment treaty (BIT), which is considered essential for securing stable investment flows and boosting growth in services. There is a pressing need for both the countries to further engage on issues like FTAs and regional pacts. India’s decision to opt out of the Regional Comprehensive Economic Partnership (RCEP), which includes China, reinforced this government’s decision to focus on domestic manufacturing.

There was optimism in the political discourses, with Modi’s visit to the US, and President Trump joining his Indian counterpart in the mega Howdy Modi event. Outlining his vision of ‘Start-up India, Stand-up India’ in a meeting with the Fortune 500 CEOS, the PM further projected India as a preferred destination for business.

In the midst of scepticisms of bilateral trade potentials, President Trump made his first visit to India in February 2020. The visit was reflective of the growing strategic cooperation between the two nations, the leaders also used this opportunity to mutually benefit from their defence manufacturers, by signing two arms deals. The significant upswing in the compartmentalised defence cooperation has been driven by convergences, especially in view of China’s rise.

But with the onset of the COVID-19, there is a need for the Indian government to revisit its economic priorities. Not only does the pandemic raises concerns on sustaining livelihoods globally, the long-term effects on wealth-creators and trade in general, remains unaccounted for. In the post-COVID-19 world order, developing countries like India are likely to see fluctuations in low-cost manufacturing-driven growth models. With such disruptions in the global economy, countries will seek to correct domestic production in key sectors to reduce dependencies.

India will need to react to specific needs of the post-pandemic economic landscape. Developing a land pool of 461,589 hectares for special economic zones to attract manufacturers relocating businesses from China is a positive step, as are corporate tax cuts.

Contradicting this is Trump’s open criticism of China for mishandling the pandemic. Several other companies and governments are restructuring their supply chains to reduce the dependence on China, which coincides with India’s efforts to grow its bilateral trade relations. New Delhi is already making attempts to lure businesses to invest in India, and incentivised global companies to move their manufacturing out of China.

It has been reported that the government in the month of April has already reached out to more than 1,000 US-based companies through its overseas missions to incentivise manufacturers seeking to move their businesses out of China.

While India may be keen to deepen its ties with the US to attract potential investors to kickstart the faltering economy, India’s protectionist trade policies and the lack of political will, with Trump’s transaction approach on the American side, are factors that will continue to contribute to the slow progress in Indo-US trade.

The post-pandemic geo-economic landscape presents an opportunity in strengthening India-US ties pushing through long pending trade, land, labour and tax reforms will be instrumental in Modi’s economic playbook. However, India’s historically volatile foreign investment rules and regulatory environment will continue to be a hindrance as it seeks to carve out a slice of the global supply chains.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Rashi Sharma was Junior Fellow with ORF. Her research interests include comparative government policy analysis.

Read More +