This article is part of the series Comprehensive Energy Monitor: India and the World

This article is part of the series Comprehensive Energy Monitor: India and the World

Domestic Gas Price Revisions

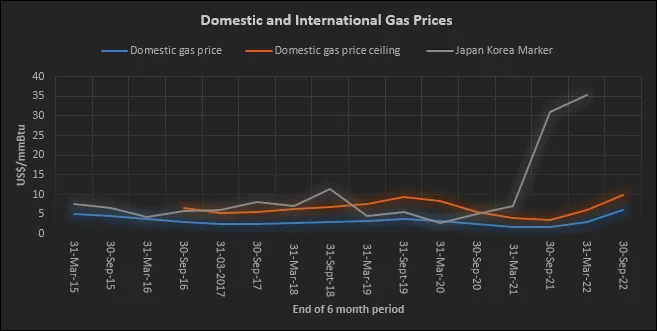

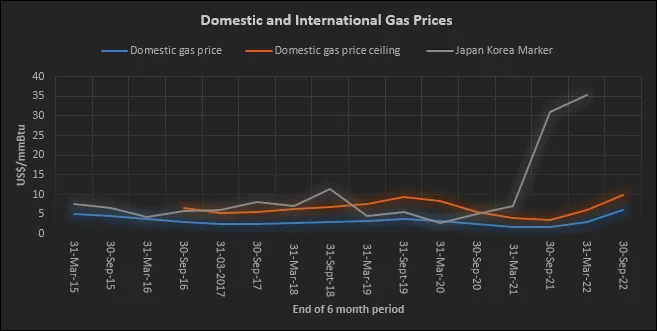

On 31 March 2022, the Indian government increased the price of domestic gas from US$2.9/mmBtu (metric million British thermal units) to US$6.10/mmBtu, an increase of over 110 percent. The government also increased the price ceiling for deep water, ultradeep water, high temperature, and high-pressure gas to US$9.92/mmBtu from US$6.13/mmBtu, an increase of over 61 percent. Commentary on the upward revision of prices ranges from its impact on the profitability of domestic producers to using higher gas prices as motivation for shifting to non-fossil fuels. The broader policy implications are an increase in energy security and a possible increase in consumption that could contribute toward the policy goal of making India a gas-based economy by increasing the share of natural gas in India’s primary energy basket to 15 percent by 2030.

Production & Imports

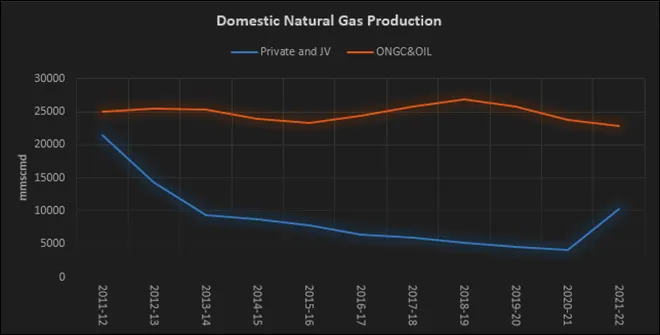

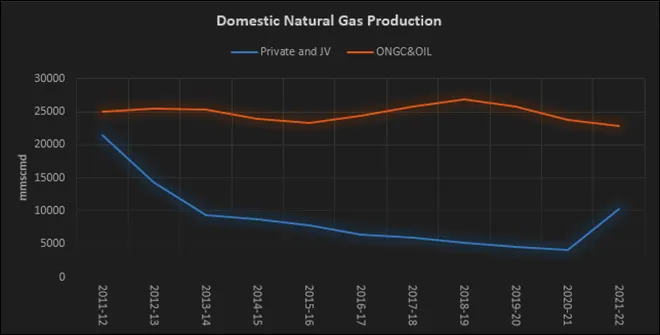

Source: PPAC

Source: PPAC

Domestic production of natural gas particularly production by private and joint venture (JV) companies increased substantially even before the announcement of price revisions. Though net domestic natural gas production fell from 46,453 mmscmd (metric million standard cubic meters per day) in 2011-12 to 33,131 mmscmd in 2021-22, it is roughly 10 percent more than the pre-pandemic production of 30,257 mmscmd. Whilst production from state owned companies fell from 25,726 mmscmd in 2019-20 to 22,774 mmscmd in 2021-22, production from private and JV companies increased by more than 128 percent from 4531 mmscmd in 2019-20 to 10,357 mmscmd in 2021-22. LNG (liquefied natural gas) imports increased from 17,997 mmscmd in 2011-12 to 31,906 mmscmd in 2021-22.

Import of LNG has meant dealing with wild volatility in pricing. The Japan-Korea marker price for LNG, the benchmark for Asian spot LNG imports fell to about US$2/mmBtu in April 2020 on account of pandemic influenced economic slowdown, but increased to over US$35/mmBtu in March 2022, an increase of over 1650 percent following the crisis in Ukraine and the related natural gas supply risks. If India sourced 25 percent of LNG at a spot price of over US$35/mmBtu, it would cost more than US$9.8 billion. However, if this demand is met with domestic gas, even if from complex deep-water fields, the cost would be less than a third. The other side of the argument is that domestic producers have effectively subsidised imports through lower production which has not only meant substantial revenue loss, but also loss in domestic job creation.

Hydrocarbons beneath the ground are depleting resources and therefore the marginal cost of bringing additional supplies into the market almost always exceeds the average costs.

Impact on Production

Price control on natural gas in India has been equivalent to rent control and the effect has been no different from urban rental housing - shortages. It simulated demand without helping supply. Exploration for oil & gas does not follow a utility function in the sense that an increase in investment does not necessarily mean an increase in supply as it is in other industries. Exploration for gas is a game of chance and probability that requires a large appetite for risk. Hydrocarbons beneath the ground are depleting resources and therefore the marginal cost of bringing additional supplies into the market almost always exceeds the average costs. The current approach that does not consider the marginal cost of bringing in additional supply has stifled risk taking and discovery. Under the controlled price regime, the gap between revenues and replacement costs has widened over time and has become a disincentive for producers to commit new reserves to purchase contracts for fear of getting locked into an ‘old’ price. Even if regulated prices are set at a high level and allowed a wide margin for flexibility, it cannot approximate marginal prices nor can it provide investments in marginal areas where higher risks are involved.

Impact on Consumption

Coal, oil, and, natural gas industries were all born vulnerable to market instability and thus were subject to regulation world-wide. Whilst interventions in the coal industry were originally demanded by coal workers and that in the oil industry demanded by the oil industry, interventions in the natural gas sector were always demanded by consumers of natural gas, given its status as a natural monopoly at the point of sale. India is not an exception to this rule. Since production of natural gas began almost three decades ago, the industry has been subject to continuous compensatory regulation skewed in favour of consumers. As a result, a host of unproductive distortions in resource allocation have been created within and outside the sector.

Regulation in the natural gas sector has consisted mostly of incremental decisions influenced heavily by existing patterns of gas consumption. Those industries that have preferential access to natural gas have used it in a manner that is economically inefficient because the price signals they have received is misleading. Those industries without access to gas, but willing to pay higher prices use other fuels instead thereby distorting the market for products produced with them. In the short run, those with access have benefitted, but in the long run all consumers have suffered because of the reluctance of prospective suppliers to bring gas to the market and because the bargaining process created by regulation has resulted in expectation of higher prices for new gas rather than what would have been required under competitive conditions.

In the context of reforming the energy sector, the former Prime Minister of India Manmohan Singh commented that it is difficult to implement policies that are ‘manifestly obvious’ because of ‘competitive politics’ and ‘fractured mandates’. Competitive politics and fractured mandates have meant that ‘policies’ that govern the energy sector today are merely a set of incremental decisions, some taken by the government, some by the players in the industry, but all heavily influenced by the existing patterns of energy supply and consumption.

Unlike subsidies that disappear from public minds and require no ongoing political process, control of prices and access to natural gas must be done again and again, and thus more visible and more accessible to political interests. In such a regime, business entities have been placed in an uncomfortable position of fighting for a position of preference with the government rather than competing with others to bring additional supplies at the lowest possible prices. In the long run, this has reduced the country’s very capacity to attain the very goals on behalf of which the system is established, to assure plentiful supplies of energy at the lowest possible cost over the longest possible time.

Source: PPAC for domestic Price, BP for JK Marker

Source: PPAC for domestic Price, BP for JK Marker

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This article is part of the series

This article is part of the series

PREV

PREV