-

CENTRES

Progammes & Centres

Location

An increase in temperature not only increases electricity demand but also increases carbon emissions, posing a challenge to India’s energy transition

This article is part of the series Comprehensive Energy Monitor: India and the World

The Ministry of Power (MoP) had projected a peak of 229 GW (gigawatt) during the summer of 2023. Though peak demand exceeded projections, it occurred much later than expected. Speaking at a meeting in October 2023, the Minister for Power observed that power demand had increased by 20 percent in August, September, and October 2023 compared to demand in the same months in 2022. The minister attributed the surge in power demand mostly to a increase in economic activity but demand is highly corelated with summer temperature. An increase in temperature not only increases electricity demand but also increases carbon emissions, posing a challenge to India’s energy transition.

In September 2023, coal with an installed capacity of 214,254 megawatt (MW) accounted for just over 50 percent of total power generation capacity of 425,406 MW in India followed by renewable energy (RE) with 131,783 MW that accounted for about 31 percent of installed capacity. 46,850 MW of installed capacity for hydro accounted for about 11 percent of total power generation capacity while natural gas with installed capacity of 25,038 MW accounted for about 6 percent. Nuclear power with installed capacity of 7480 MW accounted for just under 2 percent of total installed capacity.

Source: Central Electricity Authority

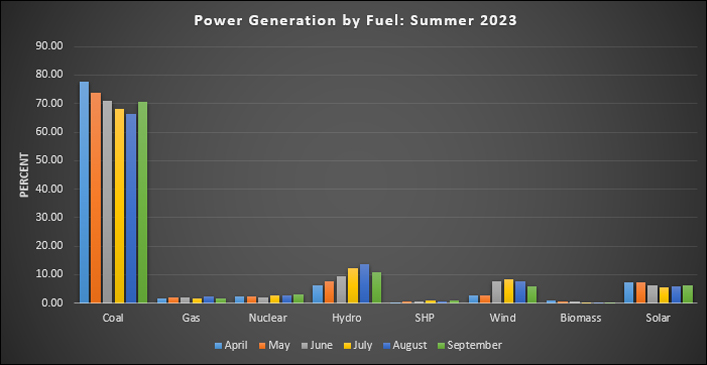

Coal continued to dominate power generation in 2023 contributing 71 percent of electricity generation from April to September 2023. Hydro made the second largest contribution with over 10 percent of generation in the 6-month period. Solar power generation contributed 6.45 percent followed by wind that contributed 5.92 percent of generation. Nuclear contributed about 2.58 percent of generation and natural gas about 1.87 percent. Renewables like biomass and small hydro power (SHP) contributed less than 1 percent each.

In the same period in 2022 (April-September 2022) the fuel shares were roughly the same with coal accounting for about 70.54 percent of generation followed by hydro with 12.34 percent. The third largest contribution came from wind with about 5.87 percent closely followed by solar with about 5.71 percent of electricity generation. The contribution of nuclear power was 2.57 percent closely followed by natural gas-based generation that contributed 1.67 percent of generation. Renewables like biomass and SHP contributed less than 1 percent each.

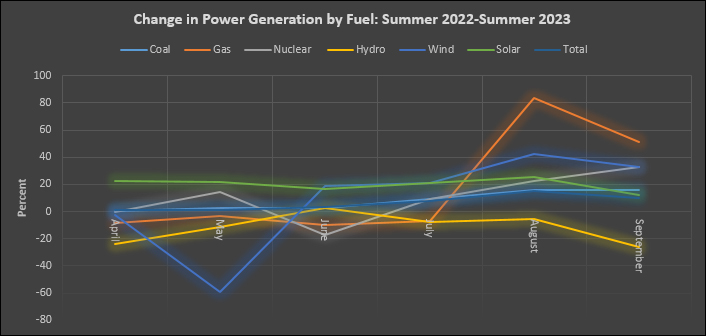

Peak energy generation was in May 2022 with a generation of 145.79-terawatt hour (TWh) while peak energy generation occurred in August 2023 with a generation of 159.97 TWh, an increase of over 9.7 percent over peak generation in 2022. The increase in monthly generation in 2023 compared to monthly generation in 2022 was 1.5 percent in April, 0.95 percent in May. In June 2023, generation increased by over 3.4 percent compared to generation in June 2022. The increase was 7.89 percent in July, 15.3 percent in August and 10.34 percent in September. The overall increase in generation in 2023 summer over 2022 summer was about 6.56 percent.

In terms of generation growth, solar led with an average growth of over 20 percent in April-September 2023 compared to generation in the same period in 2022 followed by natural gas that demonstrated an increase of 17.76 percent. Nuclear ramped up by 10.23 percent while wind generation increased by 9.05 percent but generation from hydro fell by 11 percent. During August and September 2023 when electricity generation touched new highs, generation from natural gas increased by over 83 percent in August and 51 percent in September compared to generation in the same months in 2022. Overall, coal provided7.29 TWh of additional electricity generation, the largest during the summer of 2023 compared to generation in the summer of 2022.

The summer surge in electricity demand poses challenges to India’s energy transition. It favours generation that can be ramped up quickly in response to demand. This invariably means fossil fuel-based generation which increases carbon emissions. In the context of summer electricity demand, the power minister said that thermal generators were asked to run at full capacity and opt for 6 percent blending with imported coal to make up for any shortfall in domestic coal availability. He also said that phasing out coal was not an option for India and that capacity of coal-based power generation under construction would have to be increased by 80 GW to meet the surge in power demand in the future. India had also sought additional volumes of natural gas to meet summer demand and had asked utilities to expedite completion of gas-based power plant maintenance, as part of emergency steps to stop electricity outages in summer.

According to research by the International Energy Agency (IEA), extreme heat drives higher air conditioner demand, with sustained average daily temperatures of 30°C typically boosting weekly sales by around 16 percent. Demand is found to be rising fastest in emerging and developing economies where fewer households own air conditioners. In the United States and Japan, more than 90 percent of households have an air conditioner, while in Southeast Asia, only 15 percent do. That number drops to 5 percent in India and Africa.

While the need for cooling is growing, greater usage of air conditioners is straining the grid. Cooling represents around 10 percent of global electricity demand. In hotter countries, such as India cooling can drive a rise in electricity demand of more than 50 percent in summer. In the hottest regions, the capacity of the grid needs to cover a doubling of electricity demand compared with milder months and cooling can account for over 70 percent of electricity peak demand. In Texas, USA for example, every 1°C increase in the average daily temperature above 24°C drives a rise of about 4 percent in electricity demand. In India, where air conditioner ownership is lower, the same temperature increase drives a 2 percent rise. Swings in demand as a result of changing cooling needs mean grid operators need to ramp up fossil fuel-based firm (dispatchable) electricity supply. One power plant in China is recorded to have burnt around 800 tonnes of coal in just one hour in June 2023 to help keep Shanghai residents cool.

In many markets short term peak demand which is expensive to serve is reduced through financial and other incentives. For example, in Texas, when electricity demand hit an all-time high in June 2023, the operator provided financial incentives to energy consumers to reduce demand during times of electricity grid stress or shift consumption to times of day when grid pressures and power prices are lower. Demand response payments in Texas were 20 times higher in 2023. Korea launched a new pilot programme in December 2022 in which intelligent appliances automatically respond to demand reduction requests based on grid conditions instead of relying on consumers’ manual adjustments to controls, resulting in a 24 percent improvement in electricity savings.

Given the stress on power grids during summer, distribution companies in India need to adopt similar demand response mechanisms to reduce peak demand. Households, industries and other consumers should be offered the option of reducing the use of electrical equipment based on real-time electricity demand, helping to balance the grid during periods of peak demand. Distribution companies must offer financial compensation to consumers for this service. This is likely to benefit financially stressed distribution companies as paying consumers to reduce demand will be far cheaper than investment in peaking capacity.

Source: Central Electricity Authority

Lydia Powell is a Distinguished Fellow at the Observer Research Foundation.

Akhilesh Sati is a Program Manager at the Observer Research Foundation.

Vinod Kumar Tomar is a Assistant Manager at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Ms Powell has been with the ORF Centre for Resources Management for over eight years working on policy issues in Energy and Climate Change. Her ...

Read More +

Akhilesh Sati is a Programme Manager working under ORFs Energy Initiative for more than fifteen years. With Statistics as academic background his core area of ...

Read More +

Vinod Kumar, Assistant Manager, Energy and Climate Change Content Development of the Energy News Monitor Energy and Climate Change. Member of the Energy News Monitor production ...

Read More +