-

CENTRES

Progammes & Centres

Location

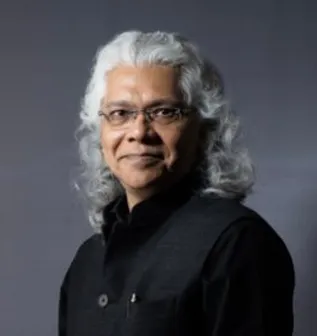

Image Source: Arun Jaitley/Twitter

Finance Minister Jailey at a GST Council meeting in Srinagar

Like demonetisation, whose evidence of success or failure must go beyond the anecdotal, the real impact of GST (goods and services tax) will not be judged by the policy archer’s target practice but by actual data and empirical observations. These will be visible in about six to eight quarters to quantify. But even before the GST rollout, we have one success metric: politics. In the field of federalism, the Srinagar Consensus saw the combined efforts by the Centre and the States through the institution of the GST Council usher in a transformative tax system, and take a gamble on economic growth. This is a landmark in India’s democratic policymaking.

While we wait to strengthen and consolidate its successes, and take course correction and modifications on its failures, we need to be clear about how we go about evaluating this approach to taxation. We need to move away from the boom-and-gloom scenarios and predictions. Optimists see the GST as a silver bullet that can cure all of India’s economic problems, from poverty to growth, inflation to doing business. Pessimists say too many objectives are being loaded on the GST, and there will be no accountability in the system. The truth lies somewhere in the middle. How should we think about evaluating the rollout of GST? There are five windows through which we can view this process and come to dependable conclusions --- consumption, production, inflationary pressures, compliances, and tax buoyancy.

First, consumption. Taxes impact the aggregate consumption in the economy and nudges its constituents --- households, firms, governments --- as well as the rest of the world through exports, towards making economic choices. Ceteris paribus, a higher rate of GST on one commodity would shift consumer preference towards alternatives with a lower taxes or lead to its non-consumption on the margins. Not all decisions are rational, as neoclassical economists would have us believe, but in the aggregate, the logic of lower prices leading to greater consumption and vice versa stand. We have seen this work through monetary policy in the past, when increased interest rates led to a fall in consumption and through it the inflation rate. On the fiscal side, the GST will achieve the same result by making the prices of goods and services cheaper or steeper and through them impact consumption.

The question is: by how much? If the rates are optimal, aggregate consumption will not change; if low, it could lead to a rise in consumption; if high, a fall. And accordingly, we can judge the impact of the GST.

Second, production. For an entrepreneur, the GST is a clean pass-through --- whatever the tax, it gets priced into the product and the burden is transferred to the consumer. But if the price of a product or service increases to the point that consumption falls, the entrepreneur has only two choices. She can either take a cut in her margins or close the business if it doesn’t make financial sense. A good tax policy will nudge the production within an economy towards the goals of a nation --- a luxury product, for instance, would cost more than a necessity, a poor but populated country like India would nudge towards thin margins on large turnovers for affordability. On the other hand, if the tax on luxury goods gets too high, there is a danger of entrepreneurs exiting that business and redeploying resources towards some other good. And consumption would shift to imports. A related indicator to track here would be employment, except that it’s not captured accurately.

Third, inflationary pressures. The price tolerance in India is very low. That’s why inflation is more a political issue than an economic one. While Union Finance Minister Arun Jaitley as well as State finance ministers have repeatedly emphasised that the GST will not be inflationary, we need to wait for data for its confirmation. The first two quarters will go in stabilising the new tax regime. It will be from the third quarter and beyond of implementation that we will clearly know if and how inflationary pressures are working themselves out. But let us not lose sight of the big picture here --- tax buoyancy has to be maintained, and for which the GST Council has said it will increase taxes by increasing cess on various goods and services. Which means, if tax revenues don’t match up, they will be increased. And since all taxes are a pass-throughs, the result could be an increase in inflation. It seems the GST Council is trying to begin the implementation with low inflation impact, while keeping the cess option open it if revenues don’t add up.

Fourth, compliances. The GST is a high-compliance tax system. It is an exceptionally high-digital system as well, from infrastructure and processes to filing and receiving credits. The strain on existing entrepreneurs will increase and those planning to expand capacities or open new outlets may not do so until the system stabilises. New entrepreneurs may hold their investments until the field is clear and visible. Why invest when there is implementation uncertainty? Of course, any new system will have these problems. The difference is the zeal with which the GST Council has outsourced rules and provisions to bureaucrats and put the weight of ensuring downstream compliance on entrepreneurs, effectively creating a Big Brother society. There will be good business for chartered accountants and lawyers in the short to medium term, possibly longer. But as a nation, we will take several steps back if compliance burden gets the better of our enterprises. The first few quarters of implementation will force the Council to change rules and fine-tune them such that ease of doing business rises rather than falls.

Fifth, tax buoyancy. The final --- and permanent --- test of whether the GST works or not would be if tax revenues stay constant in the short term (two years) and increase in the medium (three to five years) to long term (five years and beyond). A statistic to follow here would be tax buoyancy, that is, the propensity of the system to increase tax revenues by more than 1% for every 1% increase in GDP. A second related statistic that will provide a direction to the success or failure of GST is the derivative of tax buoyancy, the tax-GDP ratio --- if it increases, the tax is efficient, else not. A third statistic that will support these two is an increase or decrease in the number of taxpayers.

The three indicators are related and interwoven with one another. We must also keep in mind that there will be no direct causality here, as there are several economic policy themes playing out simultaneously and impacting taxes.

The performance of the GST Council needs to be evaluated on these five parameters. There is danger of the Council getting lost in the maze of accountability. What if inflation rate remains low but not due to tax efficiency but because of a cut in consumption? Or, consumption remains constant but profits of corporations fall and impact tax revenues through reduced direct taxes? Or the weight of compliance forces the entrepreneurs towards evasion, non-reporting, or plain bribery of the dreaded Licence Raj of the past? These are questions the Council needs to think about.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Gautam Chikermane is Vice President at Observer Research Foundation, New Delhi. His areas of research are grand strategy, economics, and foreign policy. He speaks to ...

Read More +