-

CENTRES

Progammes & Centres

Location

As the price of crude oil continues to rise, there will be drastic repercussions if the centre increases excise taxes without sharing the revenue with the states.

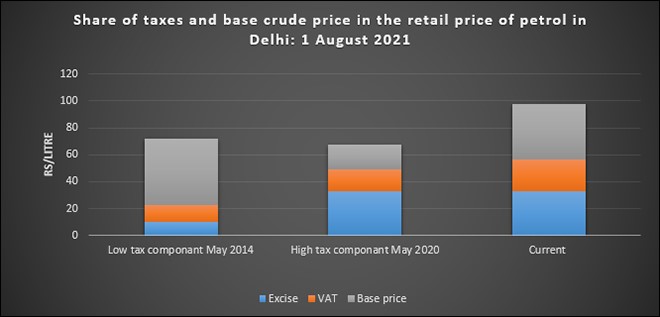

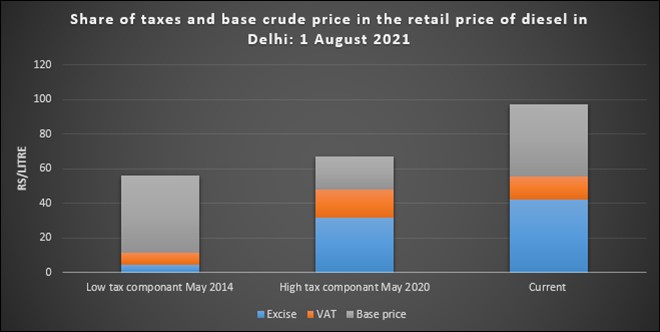

This article is part of the series Comprehensive Energy Monitor : India and the World

The retail price of petrol was INR 101.84/litre (l) and diesel INR 89.97/l in Delhi on 1 August 2021. For petrol, the base price was INR 41.24/I or about 40.4 percent of the prices, central excise was INR 32.90/l or 32.3 percent of the retail price and state value added tax (VAT) was INR 23.50/l or about 23 percent of the price. Freight and dealer commission at INR4.2/l was about 4.1 percent of the retail price. Overall central and state taxes accounted for about 55.3 percent of the retail price of petrol in Delhi. For diesel the base price was INR 42/l or 46.7 percent of the retail prices, central excise at INR42.33/l was about 47 percent of the taxes, state VAT at INR 13.14/l was about 14.6 percent of the retail prices. Fright and dealer commission was INR 2.93/l or 3.2 percent of the retail price. Overall central and state taxes accounted for about 50 percent of the retail price of diesel in Delhi.

Source: Petroleum Planning & Analysis Cell (PPAC) & Indian Oil Corporation

Source: Petroleum Planning & Analysis Cell (PPAC) & Indian Oil CorporationThe share of taxes in the retail price of petrol in Delhi since March 2014 was lowest in June 2014 at 30.8 percent and highest at 69.35 percent in May 2020. Between May 2014 June 2020, central excise on petrol increased by over 216 percent but since then excise decreased marginally by 0.24 percent. VAT on petrol in Delhi increased by over 33 percent between May 2014 and May 2020 and by over 42 percent since then.

The share of taxes in the retail price of diesel in Delhi was lowest in May 2014 at 18.7 percent in May 2014 and highest in May 2020 at 69.3 percent. Central excise increased by over 600 percent between May 2014 and May 2020 and by over 3 percent since then. VAT in Delhi increased by over 144 percent between May 2014 and May 2020 and by over 44 percent. Though VAT has increased more since May 2020 in Delhi, the increase in excise between 2014 and 2020 is much greater.

The centre shares only the revenue from basic excise duty on petrol and diesel with the states. Of the current basic excise on petrol of INR 1.4/l, only 42 percent or INR 0.58/l out of the total excise of INR 32.9/l is shared with the states. For diesel only about INR 0.75/l out of the total excise of INR 42.33/l is shared with the states.

Source: Petroleum Planning & Analysis Cell (PPAC) & Indian Oil Corporation

Source: Petroleum Planning & Analysis Cell (PPAC) & Indian Oil CorporationIn May 2014, when the share of taxes in the retail price of petrol was the lowest, the base price of crude in a litre of petrol was INR 47.12/l or 66 percent of the retail price of petrol. In May-June 2020, when the share of taxes in the retail price of petrol and diesel were the highest, the base price of crude in a litre of petrol was INR 18.28/l or 25.6 percent of the retail price of petrol. Today the base price of crude in a litre of petrol is INR 41.24/l or over 40 percent of the retail price of petrol. The base price of crude fell by over 61 percent between May 2014 and May 2020, but it has increased by over 125 percent since then.

The centre shares only the revenue from basic excise duty on petrol and diesel with the states. Of the current basic excise on petrol of INR 1.4/l, only 42 percent or INR 0.58/l out of the total excise of INR 32.9/l is shared with the states. For diesel only about INR 0.75/l out of the total excise of INR 42.33/l is shared with the states.

The base price of crude in a litre of diesel was INR 44.98/l or over 75 percent of the retail price of diesel in May 2014 (when share of taxes was lowest since 2014) and the base price of crude in a litre of diesel in May 2020 when the share of taxes was the highest was INR 18.78/l or just over 27 percent of the retail price. Today, the base price of crude in a litre of diesel is INR 42/l or 47 percent of the retail price of diesel. The base price of crude in diesel fell by over 58 percent between May 2014 and May 2020 but increased by over 123 percent since then.

At present the price of crude accounts for almost as much as the central excise in a litre of petrol and diesel.

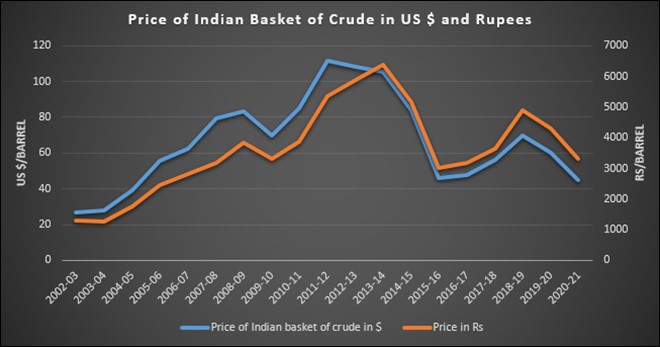

The value of the rupee fell by 22 percent between 2013-14 and 2020-21. In this period, the price of crude (Indian basket) in dollars (and rupees) fell by just over 47 percent from US $105.52/b to US $44.82/b. Since April 2021, the price of crude (Indian basket) has increased from US $63.40/barrel (b) to US $73.54/b, an increase of over 15 percent and the value of the Indian rupee fell marginally by just over 1 percent. Overall, the fall in the value of the rupee since 2014 only had a marginal effect on the retail price of petrol and diesel in India.

Source: Petroleum Planning & Analysis Cell (PPAC) & Reserve Bank of India

Source: Petroleum Planning & Analysis Cell (PPAC) & Reserve Bank of IndiaSince 2014, the largest beneficiary, in terms of revenue take from the increase in taxes on petrol and diesel accommodated by fall in crude prices was the centre. The steep increase in central excise since 2014 accounted for most of the increase in the retail price of petrol and diesel followed by the increase in VAT. The dramatic fall in crude prices, initially on account of global economic slowdown but later on account of the pandemic opened the space for an increase in taxes. Since April 2021, this space is being retaken by the increase in the price of crude. The centre’s crude calculations in increasing the component of excise taxes on petrol and diesel that is not shared with the states may backfire if the increase in crude oil prices continues.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Akhilesh Sati is a Programme Manager working under ORFs Energy Initiative for more than fifteen years. With Statistics as academic background his core area of ...

Read More +

Ms Powell has been with the ORF Centre for Resources Management for over eight years working on policy issues in Energy and Climate Change. Her ...

Read More +

Vinod Kumar, Assistant Manager, Energy and Climate Change Content Development of the Energy News Monitor Energy and Climate Change. Member of the Energy News Monitor production ...

Read More +