Background

State electricity regulatory commissions (SERCs) mandated by the Electricity Act 20023 (EA 2003), imposed renewable purchase obligations (RPOs) on distribution companies (discoms) to purchase a certain percentage of electricity from renewable energy (RE) sources. Following the amendment of the tariff policy in January 2016, SERCs were required to reserve a minimum percentage for the purchase of solar energy to reach 8 percent of the total consumption of energy (excluding hydropower) by March 2022 or as notified by the central government. In July 2018 the central government notified the long-term growth trajectory of RPOs for solar as well as non-solar RE, uniformly for all states and union territories, reaching 21 percent of RPO by 2022 with 10.5 percent for solar-based electricity. Central government-mandated RPO share beyond 2021-22 as per the MOP order dated 22 July 2022 is expected to touch 43 percent of total energy consumption by 2030. For 2022-23 the total central government-mandated RPO target including hydro purchase obligation (HPO) is 24.61 percent. State government RPO targets are lower by at least 30 percent.

Compliance

On compliance of central RPO targets, “hydro-rich” states score better than “RE-rich” states. In 2022-23, Sikkim led the rankings with 88.4 percent RPO compliance followed by Himachal Pradesh at 78.2 percent and Uttarakhand at 60.4 percent. Among “RE-rich” states Karnataka had the highest compliance of 46.7 percent, followed by Kerala at 36.3 percent and Andhra Pradesh at 28.5 percent. Poor RPO compliance and enforcement remain key challenges for RE adoption by distribution companies.

Renewable Energy Certificates

RPOs are complimented by renewable energy certificates (RECs), a tradable market-based instrument. RECs were originally designed to facilitate compliance with RPO mandates and serve as a channel for alternative valuation for low-carbon electricity generation. Distribution companies, open-access consumers, and captive power plants had the option of purchasing the REC to meet their RPO. The value of REC is equivalent to 1 MWh (megawatt hour) of electricity injected into the grid from RE sources. States like Rajasthan, Maharashtra, and Tamil Nadu which have a high RE resource endowment, generate RE-based power beyond the RPO targets fixed by the SERCs. However, states like Delhi, West Bengal and Bihar, which have low RE potential, generate RE-based power that is much lower than their RPO target. RECs were designed to address this mismatch. RE generators either sell RE-based power directly at a preferential tariff fixed by the CERC or sell environmental benefits in the form of REC.

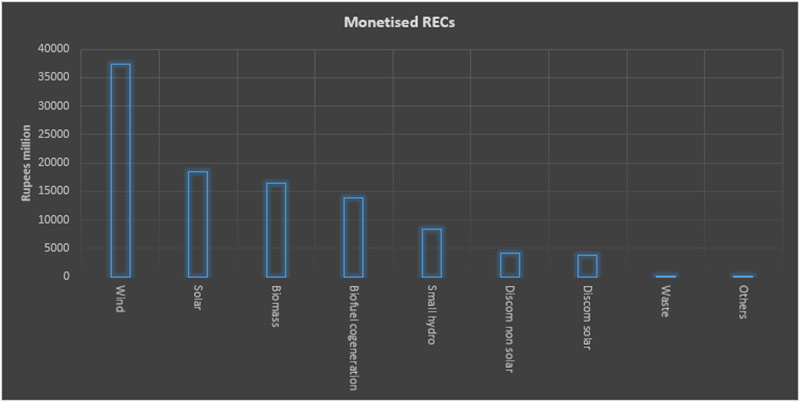

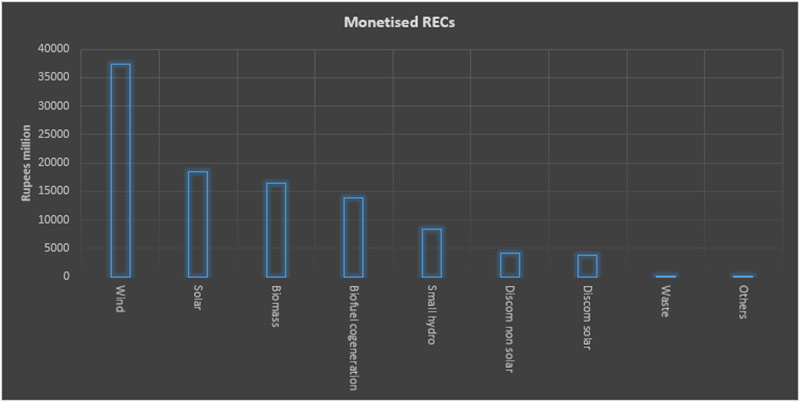

Since the inception of the REC mechanism, over 53 percent of RECs have been purchased by discoms, and over 45 percent by captive power producers (CPPs) and open access (OA) consumers. More than 36 million RECs have been purchased by discoms to offset their RPOs and more than 31 million RECs have been purchased by OA consumers and CPPs. As of March 2022, 1043 RE projects (with 4.5 GW capacity) and 4 discoms were registered under the REC mechanism. More than 56 percent of the capacity registered under the REC belongs to wind generators, and more than 22 percent of capacity is registered to solar power plants. Tamil Nadu state has the highest capacity (more than 1.2 GW) registered under REC.

The REC market has not lived up to expectations, with only a few states fulfilling their RPO through the purchase of either RE or RECs. The failure of the REC mechanism to promote RE adoption by discoms reflects the chronic non-compliance of RPO mandates that are tolerated. REC certification rates have fallen from their peak in 2014-15, and unsold inventory increased to over 19 million in 2023. Until 2022 RECs were exchanged only in the power exchanges approved by CERC within the band of a floor price and a forbearance (ceiling) price determined by CERC. The ceiling price of a solar REC has fallen by over 90 percent since 2010-12 and the price of non-solar REC by over 30 percent. Only about 5 percent of total RE capacity is REC accredited as of December 2023. Freedom to purchase RE type that best suit the load profile of a particular discom may perform better in terms of RPO targets.

Technologies such as floating solar, offshore wind, green hydrogen and energy storage are not included under RPO. A separate solar RPO was mandated at a time when solar prices were above INR 10/kWh and no discom would have purchased it without a mandatory separate obligation. Now solar is the cheapest generation source among RE sources. Merging solar and non-solar RPOs and making them fungible is an option that discoms are likely to prefer. The Maharashtra Electricity Regulatory Commission (MERC) has imposed higher penalties for non-compliance and introduced incentives for over-compliance on RPO mandates. This included a reduction in the annual revenue requirement (ARR) of the distribution licensees at a rate of INR 0.10/kWh for the cumulative shortfall in the total RE procurement target for each year. At the same time, MERC allows an incentive of INR 0.25/kWh of additional RE power procured over and above the specified RPO target by MERC up to the yearly percentage notified by the central government till 2021-22.

REC regulations in 2022 that came into effect in December aimed to restructure the REC mechanism. The new regulations introduced the concept of REC multipliers by technology, increased the validity of RECs to perpetuity until sold and, most vitally, removed the floor and the ceiling price for REC trading. The new rules may add to the uncertainty and risk associated with the REC mechanism in terms of technologies and policies at the state and central levels.

Issues

The REC market is likely to remain constrained due to high market and regulatory uncertainty at the state and central levels. The planned introduction of a carbon market that could potentially absorb the REC market, and competition from other emission reduction solutions adds to the uncertainty. More recent RE procurement methods such as competitive bidding, instruments like green term ahead market (GTAM) and integrated day-ahead market (or green day ahead market or GDAM) and through the inter-state transmission system (ISTS) that waive charges now compete with REC for RPO compliance. If competition in retail electricity is introduced, discoms are likely to prefer the emerging mechanisms that carry greater transparency and predictability than the REC mechanism.

Source: Grid India

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV