This article is part of the new publication — Reconciling India’s Climate and Industrial Targets: A Policy Roadmap.

This article is part of the new publication — Reconciling India’s Climate and Industrial Targets: A Policy Roadmap.

Introduction

India has performed remarkably well in terms of its climate trajectory over the past decade. From 2005 to 2014, the country’s GHG-emission intensity declined by 21 percent.<1> According to Climate Transparency, India is the only G20 nation on-track to achieve the targets under the Paris Agreement.<2> One of the key, albeit unfortunate, reasons behind India’s climate success is the underperformance of its manufacturing sector. Since industries constitute approximately one-fourth of the economy’s total GHG emissions,<3> the sector’s sluggish growth has led to only a moderate increase in industrial power demand and emission-intensity of the gross domestic product (GDP).<4>

The current government has set robust growth targets for the country’s manufacturing sector, which includes increasing its contribution to GDP from the current 16 percent to 25 percent by 2025. However, experience indicates that growth in the manufacturing sector is likely to place it in conflict with India’s climate goals. For instance, in China, the manufacturing sector is the engine of growth and has powered unprecedented economic development over the last two decades. However, the sector also accounts for 68 percent of the national energy consumption, 84 percent of the national CO2 emissions, and 24.1 percent of global emissions. The challenge for India is to achieve similar industrial growth on a low-carbon path.

One of the key, albeit unfortunate, reasons behind India’s climate success is the underperformance of its manufacturing sector.

To navigate this (false) trade-off, it will be crucial to identify key drivers that could catalyse Indian industry’s green transition. Some of these drivers — renewable energy, technology, energy security and market creation — have been explored in other chapters in this volume. This chapter examines carbon pricing as a tool that can achieve deep carbon cuts and effectively integrate the climate calculus into India’s developmental goals. It has four sections: section one examines the rationale behind carbon pricing and gives an overview of the global and country landscape; section 2 explores the key challenges to pricing carbon; section three discusses the possible policy pathways for pricing carbon in India; and section four concludes the chapter and outlines a plausible way forward.

Carbon pricing: The rationale

The core of the climate conundrum is often framed as a problem of market failure. The rationale behind this is appealing in its simplicity — the primary driver of climate change is the unabated flow of emissions from industries (and households). These emissions are a negative externality for the environment and the economy, since their true social cost is not reflected by the market price of carbon-intensive goods and services. Thus, instituting a price that reflects the true cost of these emissions seems like an intuitive solution to address this market failure. Indeed, this proposition has received widespread support from multilateral organisations (IMF and World Bank), industry stalwarts (Larry Fink and Anand Mahindra), and religious leaders (Pope Francis).

By internalising the externalities associated with CO2 emissions, carbon pricing can promote cost-effective abatement, deliver powerful innovation incentives, and ameliorate fiscal problems by adding to the government revenue.

According to the IMF, the world needs a global tax of US$ 75 per tonne by 2030 to reduce emissions to a level consistent with a 2˚C warming target.<5> As per the High-Level Commission on Carbon Prices, led by Nobel Laureate Joseph Stiglitz and Lord Nicholas Stern, meeting the world’s climate goals in the most cost-effective way while fostering growth requires individual countries to set a strong carbon price, with the goal of reaching US$ 40-80 per tonne of CO2 by 2020 and US$ 50–100 per tonne by 2030.<6> This can be accomplished using one of two methods: a cap-and-trade system or a carbon tax charge. The first method puts a cap on the total emissions that industries can emit and allows those with low emissions to sell their extra allowances (carbon credits) to larger emitters, thereby creating a marketplace for greenhouse gas emissions. The European Union’s Emissions Trading System (ETS) is the most widely known example of a cap-and-trade system. In the second method, a tax rate is defined on greenhouse gas emissions or, more commonly, on the carbon content of fossil fuels. A prominent example is Sweden, which currently has the highest carbon price in the world at US$ 139.<7>

By internalising the externalities associated with CO2 emissions, carbon pricing can promote cost-effective abatement, deliver powerful innovation incentives, and ameliorate fiscal problems by adding to the government revenue.<8> Countries such as Sweden have been able to effectively thread the needle between carbon pricing and economic growth: Sweden’s economy grew by 60 percent since the introduction of the Swedish carbon tax in 1991, while its carbon emissions decreased by 25 percent.<9>

Current global landscape

While Sweden’s carbon-pricing experience holds promise, the same trend has not been observed in other geographies. After nearly three decades of policy efforts, carbon pricing continues to be a mere footnote in international climate negotiations. Proposals for realistic carbon emissions pricing have so far made little headway around the world.

After nearly three decades of policy efforts, carbon pricing continues to be a mere footnote in international climate negotiations.

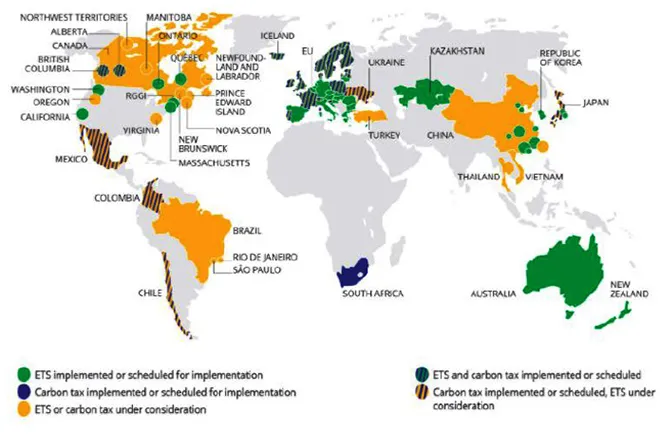

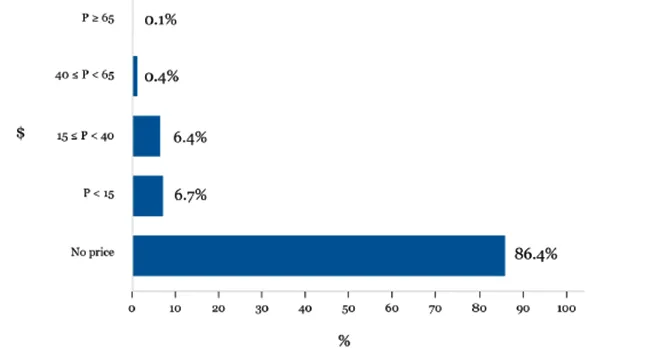

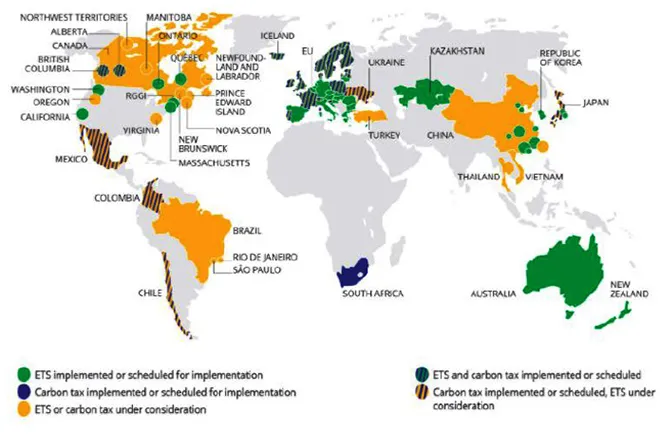

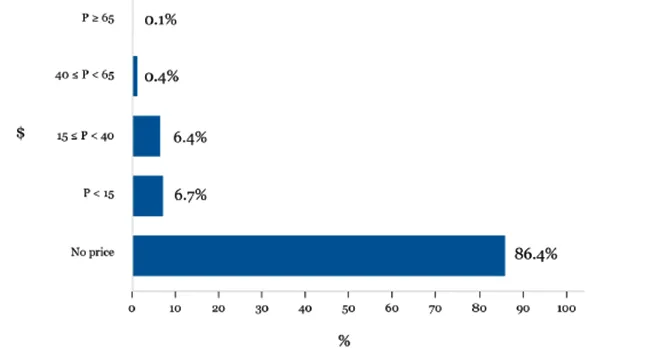

Despite its apparent simplicity, carbon-pricing is supported by rather underwhelming evidence. There are 64 carbon pricing initiatives implemented or scheduled for implementation — 34 in the form of an explicit carbon tax, 31 covered by an ETS — across 46 national jurisdictions and 35 sub-national jurisdictions.<10> In 2020, these initiatives covered 12 GtCO2e, representing just 22.3 percent of global GHG emissions.<11> Even more striking is that less than one percent of global emissions are currently subject to a carbon price equal to even a low-end estimate of the social cost of carbon (See Figure 2).<12> In stark contrast to the IMF’s projected global tax of US$ 75 per tonne, the current average price of carbon globally is US$ 2 a tonne.

Source: Carbon Pricing Dashboard, World Bank Group

Source: Carbon Pricing Dashboard, World Bank Group

Figure 2: Carbon Prices around the World in 2019

Source: Danny Cullenward and David Victor, Making Climate Policy Work

Source: Danny Cullenward and David Victor, Making Climate Policy Work

Carbon pricing in India

India does not have an explicit carbon price or a market-based mechanism such as cap-and-trade. It does, however, have an array of schemes and mechanisms that put an implicit price on carbon.

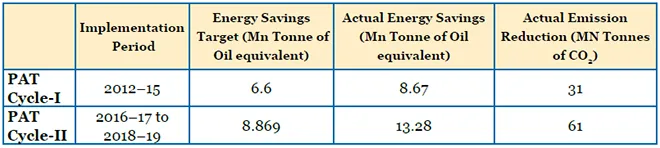

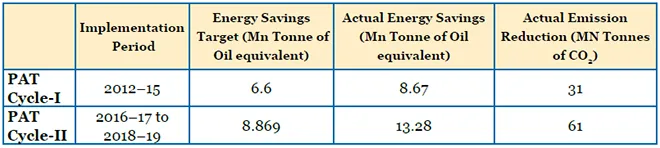

Perform, Achieve and Trade (PAT) Scheme: Under this scheme, energy intensive units from industrial sectors with high emissions are assigned specific energy reduction targets. The units are required to meet these targets by implementing energy-efficient technologies. Those that exceed the targets are awarded Energy Saving Certificates (ESCerts), each equal to one metric tonne of oil (MTOe). On the other hand, those unable to meet their assigned targets are required to purchase ESCerts (from the units that have exceeded their targets) through a centralised online trading mechanism hosted by the Indian Energy Exchange (IEX). The achievements from the first two cycles of the PAT scheme are given Table 1.

Table 1: Achievements of the PAT Scheme

Source: Bureau of Energy Efficiency

Source: Bureau of Energy Efficiency

Since 2017, the PAT scheme is being implemented annually on a rolling cycle basis. The most recent cycle, PAT Cycle-VI, commenced on 1 April 2020. Consistent overachievement of the targets in the first two PAT cycles has begged the question of whether the targets were ambitious enough. Research<13>,<14> on the efficiency of the PAT schemes shows that high energy prices would have incentivised energy savings even in the business-as-usual (absence of PAT) scenario, underscoring the need to set realistic, additional targets that account for rising energy costs.

Coal Cess: In 2010, the government of India introduced a tax on coal, to be levied as excise duty on items listed in the tenth schedule to the Finance Act, 2010. These items are coal, lignite, and peat. The cess was implemented at a rate of INR 50 per tonne, and subsequently increased to INR 100 in 2014, INR 200 in 2015 and INR 400 IN 2016. Revenue collected through the cess was transferred to the National Clean Energy Fund (NCEF), which sought to finance clean-energy initiatives and research in this area. This setup, while promising in theory, failed to achieve the desired outcomes. First, a significant portion of the revenue collected through the coal cess remained unutilised. From 2010–11 to 2017–18, the coal cess collection amounts to about INR 86,440.21 crores. Of this, only INR 29,654.29 crores have been transferred to the NCEF and a mere INR 15,911 crores utilised.<15> Second, in 2017, the coal cess was abolished and replaced by the GST Compensation Cess. The proceeds from this tax are used for compensating states for revenue losses in the wake of shifting to the new indirect tax regime.

Renewable Purchase Obligations (RPO) and Renewable Energy Certificates (REC): To provide a fillip to India’s growing renewable energy sector, all electricity distribution licensees are required to purchase or produce a minimum specified quantity of their requirements from renewable energy sources. The RPO for each state is fixed and regulated by the respective State Electricity Regulatory Commission. The renewable energy certificates (RECs) are market-based instruments that have been introduced to facilitate the fulfilment of RPO by the obligated entities. These certificates are traded at the power exchanges. RECs decouple the electricity component from the environmental attributes of the power generated from renewable sources and enable both the components to be traded separately. Since tradable certificates are not constrained by the geographical limitations of commodity electricity, RECs help in incentivising the production of renewable energy over and above the RPO state limit.

The enforcement of RPO targets, despite the availability of RECs, has been weak. According to the data compiled by the Ministry of Power, RPO compliance remains low across most states, with only four states managing to meet and exceed their renewable purchase obligations (RPO) in FY2019–20.<16>

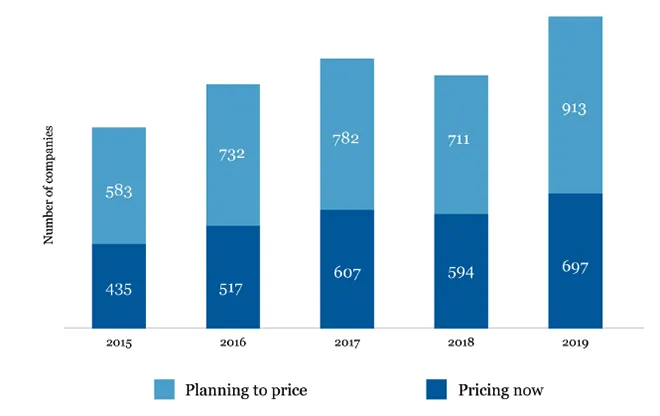

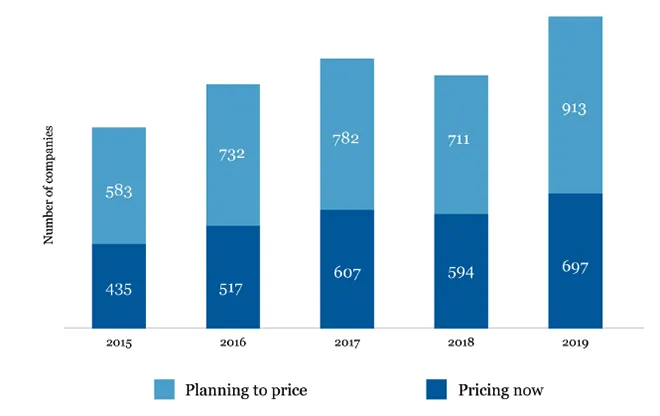

Internal Carbon Pricing (ICP): Over the past few years, there has been remarkable support for carbon pricing by the private sector. As of 2019, 1,600+ companies worldwide are embedding an internal carbon price into their business strategies or are planning to do so in the next two years, up from 1,000+ companies in 2015.<17>,<18> In India, too, as shown in the figure below, there has been an increase in support for adopting ICP.

Figure 3: Internal Carbon Price Trends in India

Source: Carbon Disclosure Project, India Report 2020

Source: Carbon Disclosure Project, India Report 2020

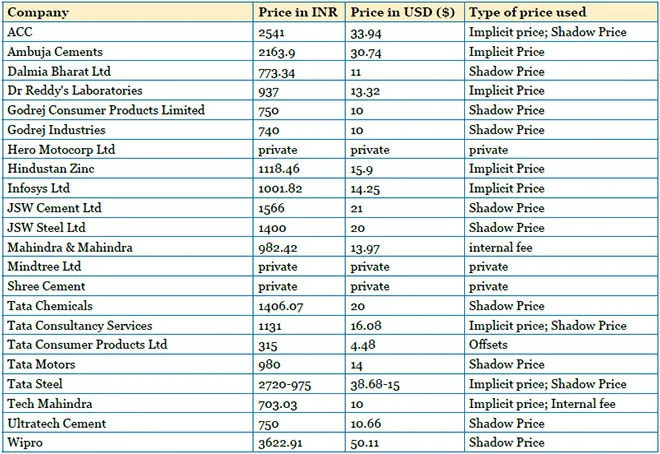

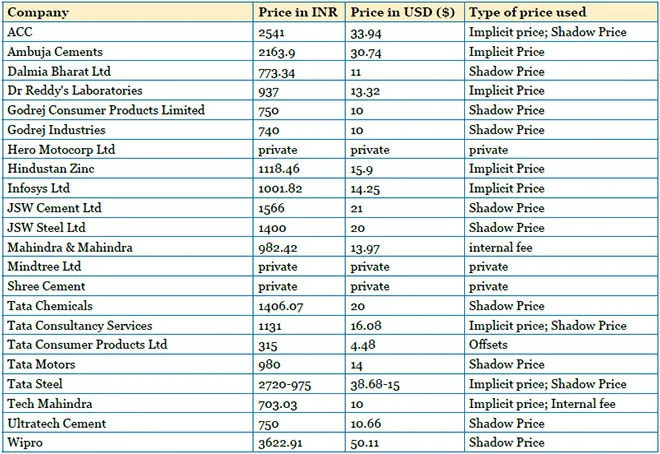

ICP is emerging as a popular tool that companies can voluntarily deploy to reduce emissions; channel investments towards innovative, clean, and energy-efficient technologies; enhance competitiveness; and deliver corporate sustainability goals. Further, it provides companies with an opportunity to improve their climate-risk management and responses to investor queries about the same. The Task Force on Climate-related Financial Disclosures (TCFD) has listed ICP as a key metric to assess climate-related risks and opportunities in line with its strategy and risk-management process, thus positioning it as an important option for companies that want to align themselves with the TCFD recommendations. Some of the leading Indian companies that have adopted an internal carbon price are listed in Table 2.

Table2: Internal Carbon Prices of Companies in 2019

Source: Carbon Disclosure Project, India Report 2020

Source: Carbon Disclosure Project, India Report 2020

The steady rise in the number of Indian companies that have undertaken ICP shows increased momentum towards a low-carbon future in corporate India. Companies need strong policy signals to sustain this momentum and build on it, as they embark on a decarbonisation pathway. A clear, robust regulatory framework for pricing carbon can play a key role in increasing the uptake of carbon pricing by businesses in India. Countries such as China, Mexico and South Africa offer policy precedents. For instance, ICP adoption in Chinese companies doubled in response to China’s plan of rolling out the world’s largest emission trading scheme in 2017.<19>

India’s existing decarbonisation plan for the industrial sector is driven by the initiatives and strategies explained above. While improving enforcement and efficiency across the individual measures is vital, the critical challenge is to explore the potential for linking with the global carbon markets.

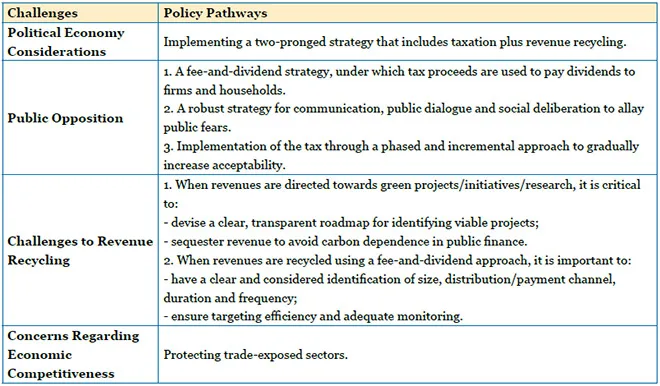

Challenges in pricing carbon

This section explores the key challenges to pricing carbon. The first three are broadly domestic in nature, while the fourth has global implications.

The political economy of carbon pricing constitutes the single-largest hurdle to its successful implementation across the world. The academic logic that presents tax as a tool for addressing market failures, while compelling in theory, is incompatible with the political reality of such an intervention. As is the case with any major policy that attempts to change the status-quo, efforts to catalyse the transition to a low-carbon economy will create winners and losers, economic as well as political.<20> The central challenge with carbon pricing is its diffused benefits and concentrated costs, such that the scattered beneficiaries of the policy are less likely to support it in the political process.<21> On the other hand, carbon-intensive companies (and communities) will vehemently oppose a carbon price, such as oil producers and refiners, large electric utilities with carbon-heavy fleets, large energy-intensive manufacturers, and other such concentrated interests.

The central challenge with carbon pricing is its diffused benefits and concentrated costs.

Households (and firms) have little appetite for new taxes that reduce their disposable incomes (and profits). There is a large body of evidence documenting manifestations of public displeasure towards carbon taxes. Some noteworthy demonstrations include the “Gilets Jaunes”<22> demonstrations in France against fuel price increases; unsuccessful ballots on carbon taxes in US states; and public protests in countries such as Mexico, Iraq, Ecuador, Brazil and Chile. There have been several protests in India, too, against hikes in the price of fuel — for instance, the June 2020 protests against the increase in fuel prices, organised by the members of the Congress Party in several cities across the country.

Carbon tax policy (whether through cap-and-trade or an outright tax) has also been accused of being regressive,<23>,<24> affecting lower-income households more than their middle and high-income counterparts, since they spend a higher proportion of their incomes on energy-intensive goods and services. The distributional and welfare concerns associated with a carbon tax are primarily determined by how the revenues are spent. If the proceeds from the tax are diverted for financing the fiscal deficit, the impact is likely to be more regressive, compared to the proceeds being used for compensating households (in the form of lump-sum dividends or cuts in other taxes). This idea is explained in further detail in the following section.

The distributional and welfare concerns associated with a carbon tax are primarily determined by how the revenues are spent.

Evidence that a carbon price leads to a fall in competitiveness is rather scarce.

Another key barrier to carbon pricing is the concern that higher domestic prices will raise costs for local industries, making them less competitive in global markets. However, evidence that a carbon price leads to a fall in competitiveness is rather scarce. Several assessments find no statistically significant effects of carbon or energy prices in different dimensions of competitiveness, including net imports, foreign direct investments, turnover, value added, employment, profits, productivity, and innovation.<25>,<26> This is primarily because carbon price levels are low internationally and trade-exposed sectors are often granted exemptions from carbon taxes.<27> From an international standpoint, carbon leakage — the movement of carbon-intensive industries to countries with a lax carbon policy — is another serious concern. However, robust evidence of carbon leakage has not been documented, owing to the same reason as above. Concerns relating to competitiveness are likely to become more serious as international carbon price levels rise and sector coverage deepens.

Policy pathways for India

A Revenue Neutral Approach: Carbon Pricing with Revenue Recycling In light of the political volatility and distributional concerns associated with carbon pricing, combining it with a mechanism for revenue recycling would help make the model more palatable. Under such a framework, the proceeds generated from the carbon tax would be earmarked and returned to society. The two most common recycling methods are:

1. diverting funds to green spending initiatives

2. recycling to firms and households

India has experience with the modified version of the first option with regards to its coal cess, as discussed in section one of this paper. An important lesson from the experience with the coal cess is the need to efficiently utilise the revenue by identifying and financing green projects/initiatives/research. That approximately half the funds collected through the coal cess and transferred to the National Clean Energy Fund (NCEF) remained unutilised, indicates a lack of viable projects. Therefore, it is critical to devise a roadmap for identifying viable projects before implementing such a strategy. Moreover, this roadmap would help avoid carbon dependence in public finance, as seen in the case of the coal cess revenues, which have now become important sources for GST compensation.

Incidentally, in India, states own natural resources but the pricing/taxation is decided by the Central government. With regards to coal, the royalties have been kept constant for years (which accrue to districts) while GST is at the lowest slab. The main mechanism for taxing coal is the cess, all of which accrues to the Centre. In other words, the implementation of the coal cess is more aligned to the idea of revenue maximisation instead of emission mitigation. While implementing a carbon tax, it will be vital to ensure that an incentive mismatch of this nature does not occur.

An important lesson from the experience with the coal cess is the need to efficiently utilise the revenue by identifying and financing green projects/initiatives/research.

The second method for recycling revenue entails the use of tax proceeds for compensating households and firms A revenue recycling mechanism that has delivered favourable results internationally is the fee-and-dividend approach. It features a carbon tax (fee) on fossil fuels whose proceeds are used to pay dividends to households. Some regions where this approach has delivered promising results include Switzerland and Canada.

In Switzerland, a carbon tax on fossil heating and process fuels was introduced in 2008. Two-thirds of the collected revenue is redistributed to households (on a per capita basis) and to firms (in proportion to their payroll),while the remainder is being used to pay for a building energy efficiency programme and a technology fund.<28> The tax was introduced at a level of CHF 12 per tonne of CO2 (US$ 13.5/ tCO2) in 2008 and has risen to 96 CHF/tCO2 (US$ 108/ tCO2) in 2018. The tax is estimated to have resulted in a reduction of 6.9 million tonnes of carbon from 2008 to 2015.<29>

The public is more likely to accept a carbon price if they understand how the revenues would be deployed. This underscores the need to establish a robust system of communication, public dialogue and social deliberation.

More recently, in 2018, the Liberal government in Canada, led by Prime Minister Justin Trudeau, announced a carbon tax for provinces that did not have an adequate carbon pricing model of their own. This includes the provinces of Saskatchewan, Manitoba, Ontario, and Alberta. The tax started at US$ 20 per tonne in 2019 and will be raised by US$ 10 per tonne each year, until it reaches US$ 50 per tonne in 2022.<30> For individuals and businesses with a relatively small carbon footprint, the carbon levy is applied to liquid and gaseous fuels at the point of purchase. The proceeds from the tax are remitted to residents, making the tax revenue neutral. This rebate is called the Climate Action Incentive, and the amount varies between provinces and household size. The rebate can be as low as US$ 439 in 2021 in Ontario to as high as US$ 1,419 for a family of four living in Saskatchewan in 2022.<31> To address concerns pertaining to competitiveness, several key industries that face intense trade competition, e.g. steel and chemicals, have been exempted from this tax. Instead, these companies are required to participate in a separate programme and are taxed on a proportion of their emissions.

Given Switzerland and Canada’s experiences, identifying a clear strategy for the recycling of carbon revenues is a critical step for increasing the public acceptability of carbon pricing in India. However, revenue recycling is no silver bullet and comes with its share of challenges. Implementing an economy-wide revenue recycling programme would involve the same challenges that a large-scale welfare programme does. More specifically, it will be important to get the right answers to critical questions such as the rebate size, distribution/payment channel, duration and frequency, and put systems in place to ensure targeting efficiency and adequate monitoring. India’s JAM trinity (Jan Dhan accounts, Aadhaar numbers, and Mobile phones) could be leveraged for this purpose.

Existing literature on climate policy shows that carbon pricing is likely to work well in countries with a high level of political trust and low levels of perceived corruption.<32> India, unarguably, is a poor performer in both categories. The public is more likely to accept a carbon price if they understand how the revenues would be deployed. This underscores the need to establish a robust system of communication, public dialogue and social deliberation. In Sweden, a sound communication strategy reinforced political trust and transparency prior to the implementation of the carbon tax, and played a pivotal role in increasing its public acceptability.<33>

Adoption of a phased and incremental approach while introducing the tax is another key strategy for making a carbon tax successful, as observed in the case of Denmark and Finland.<34> Similarly, Indonesia phased out its consumer fossil-fuel subsidies, which accounted for almost three percent of its GDP in 2008, by reducing its subsidies in a phased manner. To offset the backlash, it conducted effective public communication campaigns and instituted financial compensation programmes for poorer citizens who were hit the hardest by increased fuel prices.

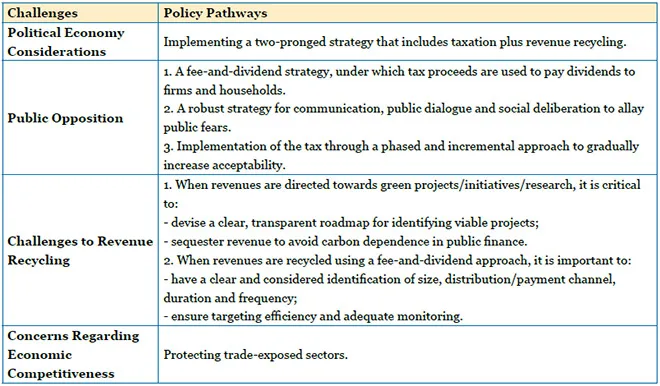

Table 3: Key Challenges to Carbon Pricing and Policy Pathways for India

Way forward

Based on international experience, it is evident that carbon pricing cannot be the cornerstone of global climate policy, nor should it be expected to. This chapter argues that the political economy considerations, coupled with the distributional implications of a carbon tax, make it an extremely complex instrument to implement. Moreover, a carbon tax would deliver the promised outcomes only if the price is high enough. The IMF estimates that a tax of US$ 75 per tonne will increase the price of coal by 230 percent, natural gas by 25 percent, electricity by 83 percent, and petrol by 13 percent.<35>

Carbon pricing in India has frequently met with political and public opposition. Post-pandemic, these hurdles will become even harder to overcome.

For emerging economies, especially India, instituting that high a price would not be a viable option, at least not in the short-run. Carbon pricing in India has frequently met with political and public opposition. Post-pandemic, these hurdles will become even harder to overcome. Carbon taxes must therefore be carefully crafted to avoid political pitfalls and mitigate distributional concerns. A deep dive into the key challenges and their solutions highlights that pathways to implementing a carbon price in India do exist. However, the Indian economy may not be perfectly ready to traverse them just yet. In FY19, subsidies for oil, gas and coal amounted to INR 83,134 crore (US$ 12.4 billion), compared to INR 11,604 crore (US$ 1.7 billion) for renewables and electric mobility.<36> Further, as a part of its COVID-19 recovery response, India announced policies that include up to INR 73,013 crore in favour of coal and other environmentally intensive sectors, with only INR 9,621 crore for the renewable energy industry.<37> In the short term, India should focus on phasing out fossil-fuel subsidies and improving the efficiency of existing policies that place an implicit price on carbon.

Recent advancements in renewable technology, a decline in the cost of renewables, and the downturn in global energy prices provide a conducive policy environment to scale up renewables.<38> India must capitalise on this opportunity to accelerate the decline of the fossil-fuel industry and catalyse the economy’s green transition. In the medium to long term, a carbon price would be a necessary policy tool to engender systemic change. India must start laying the groundwork for introducing a carbon price. Two important aspects of that are: a) streamlining and strengthening the country’s digital infrastructure, and social protection machinery to effectively implement a revenue recycling mechanism; and b) developing a strong strategy for communication and social deliberation to build a coalition for change.

Endnotes

<1> Manisha Jain, “Tracking India’s greenhouse gas emission intensity target”, Ideas for India.

<2> “Climate Transparency Report”, Climate Transparency.

<3> Industry Sector, GHG Platform India.

<4> M. Suresh Babu, “Why ‘Make in India’ has failed", The Hindu, January 20, 2020.

<5> Ian Parry, “Putting a Price on Pollution”, Finance and Development, International Monetary Fund.

<6> “CDP India Annual Report 2019”, Climate Disclosure Project.

<7> “State and Trends of Carbon Pricing”, World Bank Group.

<8> Joseph E. Aldy and Robert N. Stavins, “The Promise and Problems of Pricing Carbon: Theory and Experience", Journal of Environment & Development, 21(2) 152–180.

<9> “When It Comes to Emissions, Sweden Has Its Cake and Eats It Too”, The World Bank.

<10> “How Indian companies use carbon pricing as a planning tool”, GreenBiz, December 21, 2017.

<11> “Carbon pricing”, GreenBiz.

<12> "Why Carbon Pricing Falls Short”, Jesse Jenkins, Kleinman Center for Energy Policy, April 24, 2019.

<13> Divita Bhandari Gireesh Shrimali, “The perform, achieve and trade scheme in India: An effectiveness analysis”, Renewable and Sustainable Energy Reviews, Volume 81, Part 1, 2018, 1286-1295.

<14> Ajay Mathur, “Taking the PAT road to leaner, meaner industries”, The Energy and Resources Institute, 28 February 2018.

<15> Discussion Paper on Carbon Tax Structure for India.

<16> Twesh Mishra, “Renewable purchase obligation compliance remains low in most States”, The Hindu BusinessLine, 7 July, 2020.

<17> “Putting a Price on Carbon: Handbook for Indian Companies 2.0”, January 2020.

<18> Namrata Patodia Rastogi, “Gearing Up for Change: Challenges Faced by Indian Private Sector as they take on Carbon Pricing", Carbon Pricing Leadership Coalition.

<19> Jai Kumar Gaurav and Kundan Burnwal, “What is India Inc’s carbon footprint?”, The Hindu BusinessLine, 9 July 2020.

<20> “Why Carbon Pricing Falls Short”, Kleinman Center for Energy Policy.

<21> “Making carbon pricing work for citizens”, David Klenert, Cameron Hepburn, VoxEU, July 31, 2018.

<22> Gilets Jaunes or the yellow vests protests was a grassroots citizens’ protest movement that began in November 2018 in France against a planned rise in the tax on diesel and petrol.

<23> Julius Andersson, Giles Atkinson, “The distributional effects of a carbon tax: The role of income inequality”, The London School of Economics and Political Science.

<24> Aaqib Ahmad Bhat and Prajna Paramita Mishra, “Are Carbon Taxes Regressive in India? Evidence from NSSO Data”, The Indian Economic Journal, Volume 67, Issue 1-2 (2020).

<25> Jane Ellis, Daniel Nachtigall and Frank Venmans, “Carbon Pricing and Competitiveness: Are they at Odds?” Environment Working Paper No. 152, Organisation for Economic Cooperation and Development.

<26> “What is the Impact of Carbon Pricing on Competitiveness?”, Carbon Pricing Leadership Coalition.

<27> Carbon Pricing Leadership Coalition, “Impact of Carbon Pricing”

<28> Beat Hintermann and Maja Zarkovic , “Carbon Pricing in Switzerland: A Fusion of Taxes, Command-and-Control, and Permit Markets”, ifo DICE Report.

<29> Hintermann and Zarkovic, “Carbon Pricing in Switzerland: A Fusion of Taxes, Command-and-Control, and Permit Markets”

<30> "Carbon Taxes & Rebates Explained”, canadadrives, March 9, 2021.

<31> “Carbon Taxes & Rebates Explained”, canadadrives

<32> “Making carbon pricing work for citizens”, VoxEU.

<33> “How can we make carbon pricing work?”, August 3, 2018, World Economic Forum.

<34> “Discussion Paper on Carbon Tax Structure for India”, Shakti Sustainable Energy Foundation.

<35> “What a carbon tax can and can’t achieve against climate change”, LiveMint, October 15, 2019.

<36> “Mapping India’s Energy Subsidies 2020: Fossil fuels, renewables, and electric vehicles”, International Institute for Sustainable Development.

<37> “India’s Green Recovery”, CarbonCopy.

<38> Christiana Figueres and Benjamin Zycher, “Can we tackle both climate change and Covid-19 recovery?”, Financial Times, May 7, 2020.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This article is part of the new publication — Reconciling India’s Climate and Industrial Targets: A Policy Roadmap.

This article is part of the new publication — Reconciling India’s Climate and Industrial Targets: A Policy Roadmap.

PREV

PREV