This article is part of the series Comprehensive Energy Monitor: India and the World

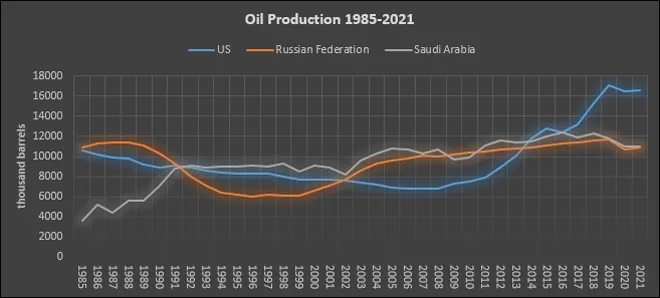

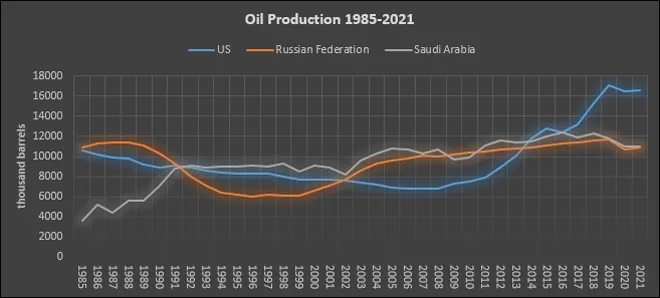

In 1985, Russia was the largest crude oil producer with a production of over 10.8 million barrels per day (mb/d). The USA was a close second with a production of over 10.5 mb/d and Saudi Arabia a distant third with a production of over 3.6 b/d. Together the top three producers accounted for about 43 percent of global oil production. By 1992, Saudi Arabia was the top producer with a production of over 9 mb/d, recording a growth of over 150 percent compared to production in 1985 whilst Russia’s production fell by over 26 percent in the same period to just over 7.9 mb/d and USA retained the second place though production fell by over 16 percent to just over 8.8 mb/d. The combined share of the three countries fell to about 39 percent. From 1992 to 2013 Saudi Arabia retained the top spot but in 2014 the USA overtook Saudi Arabia to become the largest producer of oil with a production of over 11.8 mb/d compared to Saudi production of 11.5 mb/d. In 2014, Russian production was just over 10.9 mb/d and the USA, Saudi Arabia, and Russia accounted for over 38 percent of global production. Since then, the USA has retained its top spot with a production of over 16.5 mb/d in 2021 followed by Saudi Arabia with a production of 10.95 mb/d and Russia with a production of 10.94 mb/d.

Source: BP Statistical Review of World Energy 2022

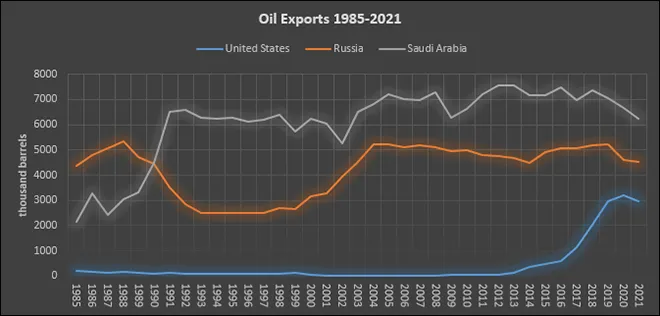

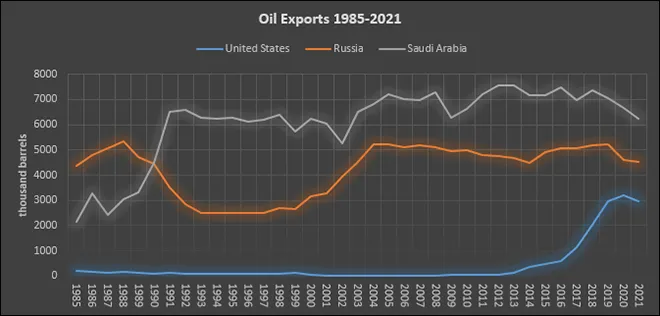

Source: BP Statistical Review of World Energy 2022

Saudi Arabia had retained the top position as the largest exporter of crude oil since the 1980s, except for a brief period in the early 1980s when Russia was the top exporter. In 2021, Saudi Arabia exported over 6.2 mb/d of crude compared to 4.5 mb/d by Russia and 2.9 mb/d by the USA. The status as the largest exporter of oil with large reserves of cheap oil and its role as a swing producer marked Saudi Arabia’s significance in the oil market. The rise of the United States as the largest producer and a significant exporter of crude since the 2010s gave rise to the idea that the United States has replaced Saudi Arabia as the new swing producer. Developments in 2022, especially the limited response to high oil prices from the United States raise some questions over this proposition.

Saudi Arabia as the Swing Producer

The term swing producer has typically represented a supplier that can increase oil production substantially (say 1mb/d) in a short period of time (within 30 to 90 days). A swing producer can exercise price control by setting an effective transaction price and preventing market forces from changing it. Saudi Arabia’s large proven reserves and its large share of global oil production and exports have given it price leadership within the organisation of the petroleum exporting countries (OPEC) to stabilize or moderate oil price. Saudi Arabia as a dominant supplier has a choice between achieving short-run profit goals by raising its price at the expense of losing market share or by setting moderate prices that support its market share and generate highly competitive profits over time. Saudi Arabia adopted the swing producer model when the quota system within OPEC in 1982 to achieve cooperative reductions and expand the OPEC supply so that the supply could match the fluctuations in market demand.

Saudi Arabia’s large proven reserves and its large share of global oil production and exports have given it price leadership within the organisation of the petroleum exporting countries (OPEC) to stabilize or moderate oil price.

In the early 1980s the former strategy resulted in high oil prices that introduced non-OPEC competitors to production substantially reducing Saudi Arabia’s market share. Entry of non-OPEC oil into the market led to a price collapse and by the mid-1980s, the oil industry was in trouble. In 1986, global crude prices collapsed to under $10/b threatening the survival of the global oil industry. Responding to the threat to the American oil industry the then Vice President of the USA George Bush travelled to Saudi Arabia in 1986 for a meeting with the King to seek its assistance to push up the price of crude through production cuts. Bush argued that low prices threatened ‘national security’ of the USA which, in that context, represented the health of the American oil industry.

Since then, Saudi Arabia has played a leading role within the context of OPEC to improve the production discipline and manage the global oil market by signalling the price it strives to maintain. Because Saudi Arabia has a high reserve to output ratio, it aimed to maintain a stable oil price to keep oil competitive over the long term. In April 1999, Saudi Arabia lowered its production to adjust for the increase in production from Venezuela and Mexico so that prices remained high. During the Iraq invasion in 2003, Saudi Arabia varied its output to achieve its price objectives and to compensate for Iraq’s supply shortfalls. In 2009, when the financial crisis caused a decline in global demand for oil, Saudi Arabia decreased its production. Until the early 2010s, Saudi Arabia continued to adjust production to keep oil prices at a stable level. Saudi Arabia along with OPEC did not exactly switch to a “market-share” strategy after 2014 to squeeze higher-cost US shale players out of the market with low profit but rather stuck to a “profit maximisation” strategy that accommodated high prices and higher production of LTO (light tight oil) from the USA. A key partner of Saudi Arabia in this strategy is Russia. Oil provides the revenue for Russia and gas as leverage for gaining a geopolitical advantage.

A deficit supply situation in the oil market shifted into a surplus situation in the beginning of the second quarter of 2012 with a sustained surplus of over 1.5 mb/d emerging by the first quarter of 2015.

USA as the Swing Producer

Between 1970 and the early 2010s, Saudi Arabia increased oil production on several occasions by anywhere between 1-2 mb/d to maintain price stability. Following the technological revolution that increased oil and gas production from shale plays the USA increased oil production dominated by LTO and natural gas liquids (NGL) by just over 1 mb/d in 2013 and by over 1.5 mb/d in 2014. In February 2015, the International Energy Agency (IEA) observed that the USA had emerged as the new swing producer to balance the market. A deficit supply situation in the oil market shifted into a surplus situation in the beginning of the second quarter of 2012 with a sustained surplus of over 1.5 mb/d emerging by the first quarter of 2015. Much of this surplus was attributed to the production of non-conventional oil from non-OPEC regions, primarily from the USA. According to IEA’s World Energy Outlook 2014, non-OPEC production of unconventional oil mainly LTO and NGL from the USA increased from 0.4 mb/d in 1990 to 5.4 mb/d in 2013 which is more than a ten-fold increase in just over a decade. In 2014, the IEA concluded that the oil market correction was different because (1) the USA as the new swing producer was not Saudi Arabia (politically, institutionally, and otherwise) and (2) that the production of LTO in the USA will respond very quickly to changes in supply and demand conditions unlike conventional crude oil. In the words of the IEA, “LTO production in the USA had upended the traditional division of labour between OPEC and Non-OPEC countries and the resilience of LTO production would ensure that price corrections in the oil market would happen as fast as the price rallies”. Reality has not played out as expected. Shale producers in the USA operated in an environment of low interest rates. The desire for yields led to investment banks to direct low-cost capital into smaller US oil exploration & production companies operating in tight oil plays. The financial performance of many of the companies engaged in tight oil plays was characterised by falling cash flows and growing debt. US shale companies had to drill 100 times more wells than Saudi Arabia to reach the same daily production as that Saudi Arabia. If the US had indeed replaced Saudi Arabia as the swing producer, the current US President would not have travelled to Saudi Arabia to request, amongst other things, an increase in oil production to bring oil prices down.

Axis of Oil

The axis of oil dominated by Saudi Arabia, Russia, and the United States that account for 42 percent of global production in 2021 necessarily means that the relationship between the three will continue to influence oil markets in the foreseeable future. The current geopolitical environment and the war on fossil fuels will continue to favour closer ties between Russia and Saudi Arabia rather than a relationship between Saudi Arabia and the USA. This will increase the probability of higher prices and volatility in oil markets.

Source: OPEC Annual Statistical Bulletin, 2022

Source: OPEC Annual Statistical Bulletin, 2022

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV