This article is part of the series Comprehensive Energy Monitor: India and the World

This article is part of the series Comprehensive Energy Monitor: India and the World

Global economic growth and prosperity in the last two centuries were fuelled largely by fossil fuels (coal, oil and natural gas). Oil, in particular, became fuel for defending national security, promoting economic activity and sustaining global trade after the First World War. Academic narratives such as

‘peak oil’ and ‘

energy security’ originating from industrialised nations that saw disruption to oil supply as a key source of national security and economic risk, imposed a premium on oil prices. This resulted in

surplus revenues for oil-exporting countries, particularly those in the Persian Gulf (“Gulf”). These surpluses were ‘externalised’ by industrialised nations through ‘

petrodollar recycling.’ The changes in geopolitical alignments between oil-producing and consuming nations are likely to have a significant impact on petrodollar recycling in the short term.

Petrodollar Recycling

Economic growth characterised by an increase in the demand for oil and the consequent high oil prices not only benefited oil export revenue dependent economies in the Gulf but also other affluent nations particularly the United States (US) that appropriated oil rents by various means.

Petrodollar recycling, as it came to be known, is essentially the flow of petroleum revenue denominated in dollars from oil-exporting countries to the rest of the world. Broadly there were

two channels through which the petrodollars were recycled.

One was the

absorption channel through which petrodollars were spent to finance domestic consumption and investment, thus increasing the demand for the import of goods and services. The other was the

capital account channel through which petrodollars not spent on imports were saved in foreign assets held abroad, resulting in capital account outflow. These assets were held by central banks as part of their

international reserves or by institutional funds of oil-exporting countries. Petrodollar recycling generally refers to the capital account channel.

The origin of petrodollar recycling is traced back to the post-war Bretton Woods agreements of 1944 that made the US dollar the sole reserve currency of the World. This meant that all oil contracts had to be

priced in US dollars. In 1945, a meeting between the

US President and the King of Saudi Arabia strengthened the relationship between the two countries and added momentum to American oil investments in Saudi Arabia. In 1971, the

US President ended dollar convertibility to gold to address the looming problem of gold run and the domestic problem of inflation. The resulting devaluation of the dollar

hurt the revenues of oil exporters in the Gulf region while the cost of imports increased.

The

oil embargoes that were initiated in 1973 by Gulf oil exporters reversed the situation as oil prices quadrupled in a matter of months. This resulted in what would become the first taste of

windfall rents for oil exporters in the Gulf region.

The accumulation of dollars by oil exporters was an unexpected development and it was a matter of serious concern for the US.

In 1974, Saudi Arabia agreed to use American dollars for paying for US contracts as per the US Saudi Arabian Joint Commission on Economic Cooperation which

essentially formalised ‘petrodollar’ recycling. The so -called ‘petrodollar’ thus became the de facto replacement for the pre-1971 gold standard as it offered a reason for the rest of the world to hold dollars. This neutralised the use

of crude oil prices as an economic weapon. In addition, the ‘petrodollar’ became a means to finance the

widening trade deficit of the US. In 2022, Saudi Arabia, the UAE, Kuwait and Iraq were among key creditors to the US with over

US$ 271 billion in treasury security holdings.

Weapons Trade

The surplus rents of oil exporters in the Gulf region also found their way back into industrialised economies

through weapons trade. As per the ‘

Nixon doctrine’, The US supply of tools and experts to friendly states including those in the Gulf combined with low-cost troops from client states was the best way to secure western economic interests. Economists in the US saw the purchase of weapons by oil exporting economies as a way

to reduce petrodollar surpluses circulating in short-term capital markets of the World. In 1976, the then deputy assistant secretary of defence for material acquisition told the

US Congress that arms sales helped the US maintain the viability of the declining military industrial base, reduced procurement costs and improved the US balance of payments status. Payments for arms delivered (not including construction, training and services) are estimated to account for

4.5-7 percent of total US export earnings since the late 1960s.

This was in contrast to the US arms export policy before the 1950s when 95 percent of the

arms were provided as foreign aid. By the 1980s, the share of arms exported as foreign aid had fallen to 45 percent and

by 2000 to less than 25 percent. In the 1970s, when the link between the dollar and oil strengthened, the defence industry in the US was subject to

privatisation and internationalisation. Since then, the flow of oil into the US and the flow of weapons into the Gulf region became an

important part of the US economy. Countries in the Gulf region became the largest

importers of arms and defence equipment. In 1974, Saudi Arabia’s import of arms and defence equipment was worth US$2.6 billion whereas between 1985 and 1992 it

increased ten times to US$25.4 billion.

During periods of high oil prices, oil exporters from the Gulf and elsewhere also loaned a part of their

foreign currency reserves to the IMF (International Monetary Fund) to finance the balance of payment needs of a number of oil-importing countries, a system that recycled oil rents through developing countries. Developing countries that were assisted by the

IMF were often required to adopt policies that sought to open up their economies to western goods and services as well as western policies.

In the period between 2001 and 2011, oil prices were relatively high and consequently, oil exporters in the Gulf enjoyed windfall oil rents. Cumulative revenues exceeded

US$12 trillion of which 67 percent was spent on the import of goods and 12 percent on service imports. Of the remaining oil revenue, about

5 percent (US$100 billion) went towards foreign worker’s remittances and 15 percent was

invested in foreign assets. Arms imports by countries in the Gulf region increased by

86 percent between 2007-11 and 2012-16 while the increase for Saudi Arabia alone was 212 percent. The US arms exports grew by

14 percent between 2013-17 and 2018-22 and its share of total global arms exports rose from

33 percent to 40 percent. A total of

41 percent of US arms exports went to the Gulf region in 2018-22, down from 49 percent in 2013-17.

Four Gulf states were among the top 10 importers of US arms in 2018-22. Saudi Arabia, Qatar, Kuwait and the UAE (United Arab Emirates) which were in the top

10 export destinations for US arms accounted for nearly 35 percent of US arms exports.

Excessive oil rents that accrued to oil producers during periods of high oil prices precipitated an imbalance in World trade that was

skewed against large oil importing developing countries with a trade deficit such as India. Though the US also had a huge trade deficit, its ability to print dollars to

finance imports put it at a significant advantage over countries such as India that had to borrow to finance oil imports. Circulation of the oil rents around the world through trade in goods and services (including trade in arms) or through capital markets externalised the imbalance between oil importers and oil exporters. Oil-importing developing countries such as India paid a high price in restoring balance.

Issues

In the short to medium term,

the threat to petrodollar recycling is likely to come from changes in geopolitical preferences of oil-exporting and importing countries. In 2022, Saudi Arabia said it was considering

trading its oil with China in the yuan. At Davos in January 2023, The Finance Minister of Saudi Arabia said that the country is

willing to trade in not just the yuan, but also a variety of other currencies.

India, Pakistan, Iraq and UAE have struck deals with Russia and China to pay for oil or other commodities in their

various respective local currencies. This may galvanise a more decentralised global monetary system away from the dollar. In the longer term,

policies to contain climate change will limit or even eliminate oil production and make the petrodollar system redundant.

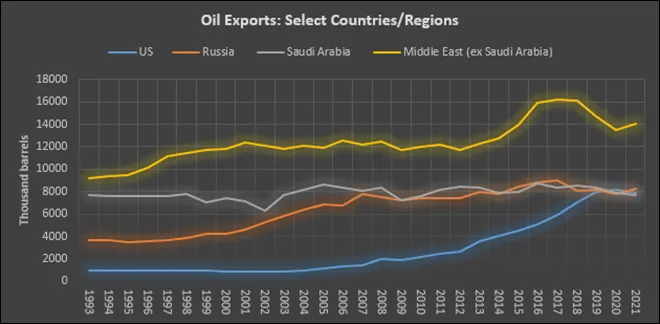

Source: BP Statistical Review of World Energy 2022

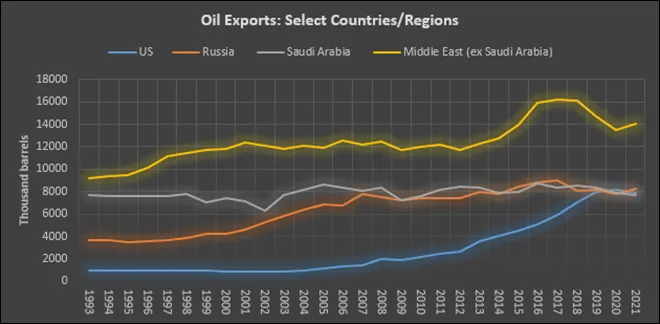

Source: BP Statistical Review of World Energy 2022

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This article is part of the series

This article is part of the series

PREV

PREV