This article is part of the series Comprehensive Energy Monitor: India and the World

In 2004, the target set for nuclear power capacity was 20 GWe (gigawatts electric) by 2020. In 2007, the government stated that this target could be doubled with the option of international cooperation through the 123 nuclear agreement that was to be signed with the United States in 2008. In 2009, the Nuclear Power Corporation of India Limited (NPCIL) said that it aimed for a capacity of 60 GWe by 2032 including 40 GWe of PWRs (pressurised water reactors) and 7 GWe of PHWRs (pressurised heavy water reactors) all powered by imported uranium. Projections in the draft energy policy of 2011 are more modest with 12 GW nuclear power capacity in 2022 and 34 GWe in 2040 even under the ‘ambitious’ scenario. In 2021, the government stated in the Parliament that nuclear power generation capacity would increase to 22,480 MWe (megawatts electric) by 2031. In 2022, nuclear power capacity stands at 6,885 MWe. Consistence under-performance of the nuclear industry in meeting capacity targets have led experts from the Department of Atomic Energy (DAE) to refer to capacity targets as aspirational.

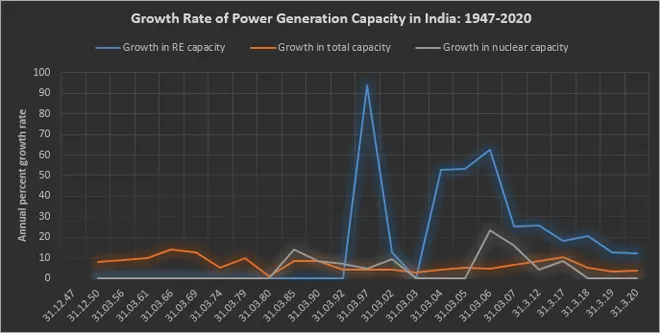

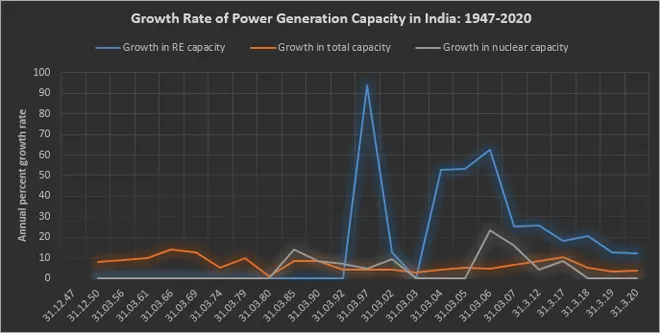

The nuclear power sector has the slowest growth rate amongst fuels despite ambitious targets, strong protection, and generous budgetary allocations.

In 2020, nuclear energy accounted for 10 percent of global electricity generation, which is much lower than the peak of over 17.45 percent in 1996. In India, the share of nuclear generation has not exceeded 4 percent since nuclear generation began in the early 1970s. In 2002, nuclear power generation in India touched a peak of 3.7 percent of total generation which was substantial improvement from a share of about 1.8 percent in the early 1990s. In terms of capacity addition, the nuclear power sector has the slowest growth rate amongst fuels despite ambitious targets, strong protection, and generous budgetary allocations. Commentators have offered a range of reasons from huge upfront capital investment, cost escalations, technological problems to opposition from local populations to explain the slow pace of capacity addition in the nuclear sector.

Between 2002 and 2006 nuclear capacity grew by over 23 percent and by over 9 percent between 2006 and 2017 but capacity has not grown since 2017. This is in stark contrast to renewable energy (RE) capacity that started at 32 MWp (megawatt peak) in 1992 and increased to over 100,000p MW in 2021. This is not difficult to explain because unlike nuclear energy, RE enjoys the unanimous support of the global investment community and that of domestic policy makers and receives financial and non-financial incentives across the value chain. More importantly the decentralised modular nature of RE, particularly solar energy, with investments in the range of INR 40-50 million has attracted even small private sector players which in turn has contributed to the growth in RE capacity. In this context, it is not surprising that the debate over the future of nuclear power in India has shifted to reactor size, specifically over whether reactors with a substantially smaller power output labelled small modular reactors (SMRs) are a better choice to increase the rate of capacity addition.

More importantly the decentralised modular nature of RE, particularly solar energy, with investments in the range of INR 40-50 million has attracted even small private sector players which in turn has contributed to the growth in RE capacity.

Small Modular Reactors

Globally, there are about 50 SMR designs and concepts at different stages of development. Argentina, South Korea, China, Canada and Russia have advanced state funded programmes with operational plants. Private companies often with state assistance based in industrialised countries including the USA, and the UK are also in the race to commercialise SMRs. Reactors that dominate the SMR experiment today are PWRs, the predominant nuclear technology deployed today. The long record of operation and the licensing experience, SMRs based on PWR technology have a substantial head start. As the components of PWR technology based SMRs are like those in larger reactors, the licensing process is expected to be straight forward for developers. There are SMR initiatives that are experimenting on old technologies that were not actively considered after the 1970s. These include pebble-bed reactors and molten salt reactors. Other SMR concepts focus on the nuclear waste problem by trying to burn or transmute various isotopes in spent fuel. Yet another SMR concept is a nuclear battery or fuel for a lifetime that would not require onsite refuelling throughout its commercial life.

Economics of Small Reactors

A nuclear reactor is qualified as “small,” when its capacity is less than 300 MWe which is about one-third the capacity of a standard nuclear reactor. The choice of a cluster of SMRs over one large reactor involves two competing economic principles: economies of scale and economies of mass production. Building five SMRs of 200 MW capacity will cost more than building one 1,000 MW nuclear reactor. But this loss in economies of scale is expected to be made up in economies of mass production. The argument is that if there is demand for several SMRs, unit cost will be reduced contributing to an overall reduction in cost of building nuclear reactors. India’s nuclear industry which consists mostly of small reactors challenges this assumption.

The assumption that additional costs incurred by SMRs can be offset through economies of mass production remains to be tested because as of 2022, there are no mass orders for SMRs.

Out of India’s 23 nuclear power reactors, 18 have a capacity of less than 300 MWe which means that most are “small” reactors. The small size of India’s nuclear reactors has meant that India’s total nuclear power capacity is low compared to the number of nuclear power reactors. For example, the 10 largest nuclear islands of China consist of 43 nuclear reactors with total capacity of 45.6 GWe. All the reactors in these nuclear islands have capacity of 1,000 MWe barring the oldest reactor that has a capacity of 600 MWe. With double the number of reactors compared to India, China has more than six times the nuclear capacity of India. A better example is South Korea. It has 24 nuclear power reactors, just one more than that of India, but the total nuclear power capacity of South Korea is 23.15 GWe, more than three times that of India. India’s small reactors has not necessarily meant lower costs, nor has it meant fewer experts employed per reactor. It has in fact reduced the contribution of the nuclear sector to overall power generation and consequently not contributed substantially to reduce carbon dioxide emissions. It also increased the tariff for nuclear power as costs could be spread over larger capacity. The assumption that additional costs incurred by SMRs can be offset through economies of mass production remains to be tested because as of 2022, there are no mass orders for SMRs. Though Westinghouse’s AP 1,000 reactors made in USA and China were based on the concept of modular construction they have had huge cost overruns and schedule delays. Even if the SMR concept does take off and supply chains for modular construction of SMRs are established, they are likely to be based outside India. This would mean import of SMRs which would mean higher cost and outgo of foreign exchange.

Other Challenges

SMRs are expected to reduce the long lead times for nuclear power plant construction but new features introduced in SMRs may initially increase time required for licencing. SMRs are promoted as a complement to RE-based power generation but this goes against the logic of nuclear power generation. Nuclear power generation has high fixed costs and low variable cost, which makes nuclear power suitable for baseload power generation at reasonable tariff. Responding to RE variability would mean operating at partial loads which will increase cost and potentially lead to technical risks. For example, if SMRs are operated at low power during the day when solar power generation is available and increased in the evening when solar generation falls, the result will be wide temperature difference (from 450°C to 1,600°C) between the two modes of operation. This could potentially lead to crack formation in uranium oxide fuel leading to rupture of the cladding surrounding the fuel and eventual leakage of fission products. This would put the reactor in the dangerous zone.

Nuclear power generation has high fixed costs and low variable cost, which makes nuclear power suitable for baseload power generation at reasonable tariff.

Since the 1950s when nuclear power generation was established, the size of the reactors has increased from 60 MWe to more than 1,600 MWe, with corresponding economies of scale in operation. Competition from RE has pushed the nuclear industry to reverse this trend to become as small and as nimble as RE. Enormous expertise in the engineering of small power units built for naval use (up to 190 MW thermal) and as neutron sources can assist the nuclear industry in producing SMRs that strike the right balance between economies of scale and economies of mass production. But until then, the 700 MWe PHWR that is mostly indigenous, safe, and reasonably economic to build and operate is the bird in the hand for the Indian nuclear industry compared to many SMRs that are still in the bush.

Source: Central Electricity Authority

Source: Central Electricity Authority

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV