Maldives operates with an open economy heavily dependent on imports, which constitute a significant 61 percent of its Gross Domestic Product (GDP). In stark contrast, the contribution of exports, predominantly fish products, remains modest, fluctuating between 11-15 percent of GDP. The economic scenario is marked by a noteworthy net surplus of approximately 34 percent of GDP, in tourism-related services, and transfers, including remittances from expatriate workers.

The dynamics of the economy's balance of payments are significantly influenced by medium- and long-term debt flows, coupled with capital inflows directed towards direct investments. This is evident in the gross debt of the public sector, averaging over 110 percent of the GDP, indicating a substantial reliance on external financing. The island nation stands out for its absence of exchange control legislation, granting residents and non-residents the freedom to engage in unrestricted import and export of capital. This flexibility extends to holding foreign currency accounts, both domestically and abroad, without requiring official permission. While foreign direct investments (FDI) mandate government approval, there are no restrictions on the subsequent transfer of profits.

The island nation stands out for its absence of exchange control legislation, granting residents and non-residents the freedom to engage in unrestricted import and export of capital.

Import duties assume a pivotal role in the nation's fiscal policy, acting as the primary source of tax revenue. Despite this reliance, plans are underway to introduce a corporate profit tax in the future, signalling a potential shift in the tax structure. However, the high dependence on imports poses multifaceted challenges, including trade and current account deficits. Vulnerability to external shocks, potential exchange rate volatility, and the continual need for external financing highlight the imperative for strategic economic diversification and resilience-building policies.

Table 1: Import Duty (as a share of revenue)

| Period |

Tax Revenue (in million MVR) |

Import Duty (in million MVR) |

Share of import duty in revenue |

| 2018 |

15833.91 |

3148.846 |

19.88673 |

| 2019 |

16530.52 |

3412.275 |

20.64227 |

| 2020 |

10959.21 |

2263.646 |

20.6552 |

| 2021 |

14681.61 |

2843.03 |

19.36457 |

| 2022 |

19528.46 |

3497.234 |

17.9084 |

| 2023 |

24003.33 |

3511.037 |

14.62729 |

| 2024 |

25618.38 |

4022.691 |

15.70237 |

Source: Maldives Monetary Authority

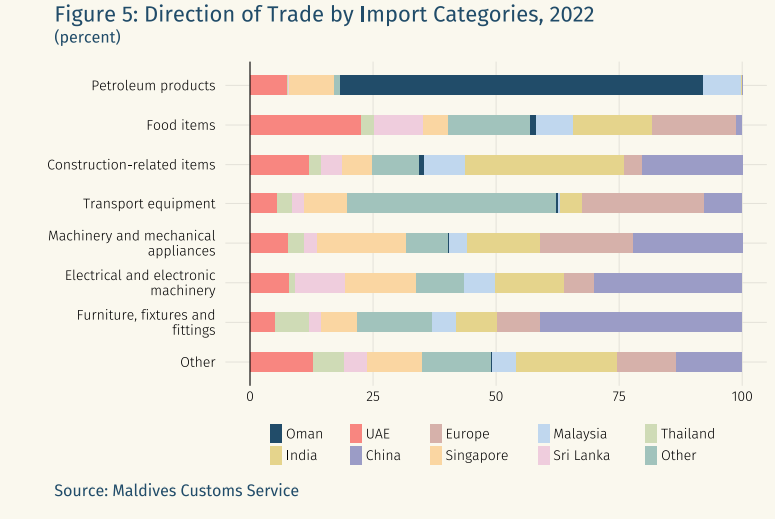

Furthermore, Maldives grapples with the reality of being heavily import-dependent, perennially experiencing a current account deficit. The most imported items include petroleum products, electrical machinery, and food, with the scarcity of agricultural land amplifying the country's vulnerability to external price shocks. Maldives’ heavy reliance on import duties as a source of revenue demands a prudential external policy, which ensures steady and competitive imports flow into the country.

Import sources and the China FTA

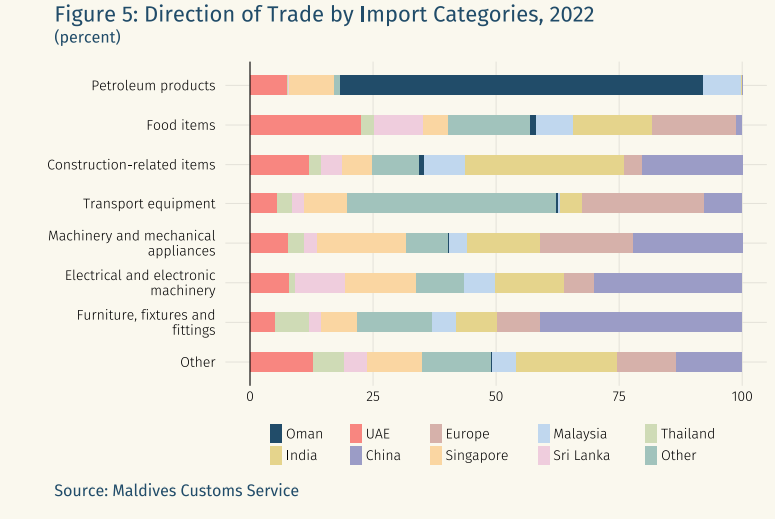

Asia serves as the primary source of Maldivian imports, reserving a share of 83 percent, with Oman securing the largest share in 2022 at 18 percent. India and China contribute 14 percent and 11 percent, respectively, with China primarily exporting manufactured goods, competing notably with Indian exports in the construction sector. The period from January to June 2023 saw China holding a 12-percent share in Maldives' imports, featuring items like transformers, air conditioners, motorboats, trucks, and various manufactured goods.

Figure 1: Direction of Trade by Imports (2022)

Source: MMA

In January 2024, China and the Maldives elevated their bilateral ties to a Comprehensive Strategic Cooperative Partnership, signing 20 key agreements, including one on tourism cooperation. While the agreements covered diverse areas like disaster risk reduction, blue economy, and digital economy investment, the Free Trade Agreement (FTA) signed between Maldives and China in 2014 took centre stage.

President Mohamed Muizzu expressed commitment to the quick implementation of the FTA, emphasising its significance in boosting bilateral trade and investments, particularly in increasing Maldives' exports of fish products to China. Despite the positive aspects, concerns have arisen regarding the potential impact of the Maldives-China FTA on tariff collections for the Maldivian government, with implications for the country's fiscal policy.

The FTA's potential to lower effective prices and promote Chinese imports could have short-term effects on the construction and manufacturing sectors, driving sectoral expansion and employment. However, the concentration of dependence on a single exporter, coupled with vulnerabilities to supply chain disruptions, raises complexities in managing risks associated with economic shifts. The geopolitical context, including strained ties with India and the repatriation of Indian troops, adds another layer of uncertainty to the economic dynamics. In navigating these challenges, Maldives faces the delicate task of balancing its economic dependencies, fostering resilience, and capitalising on opportunities presented by international partnerships.

President Mohamed Muizzu expressed commitment to the quick implementation of the FTA, emphasising its significance in boosting bilateral trade and investments, particularly in increasing Maldives' exports of fish products to China.

Importantly, import tariffs contribute around 20 percent of government revenue on average (Table 1), creating a potential financial constraint and increasing the debt burden. The FTA brings about direct effects of trade creation and diversion, with a likelihood of Maldives shifting to more expensive imports from China due to reduced effective prices following the elimination of tariffs. While this might have adverse effects on more efficient exporters, it also has the potential to strain bilateral ties, particularly with India, a significant exporter of construction machinery and rice to Maldives. The signing of the Chinese FTA and the repatriation of Indian troops might strain India-Maldives ties, granting India the option to withhold consignments on food security grounds.

In conclusion, Maldives faces a complex economic landscape driven by import dependencies, fiscal policy challenges, and the transformative impact of international agreements such as the China FTA. As the nation strives to strike a balance between economic growth and resilience, strategic policymaking becomes paramount in navigating the intricacies of global economic dynamics.

Soumya Bhowmick is an Associate Fellow at the Observer Research Foundation

Arya Roy Bardhan is a Research Assistant with the Centre for New Economic Diplomacy at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV