-

CENTRES

Progammes & Centres

Location

Although the reduction in the retail price of LPG has been hailed, more long-term factors such as an increase in household incomes, female literacy, and urbanisation will influence LPG demand

This article is part of the series Comprehensive Energy Monitor: India and the World

The government announced that the price of the 14.2-kilogram Liquefied Petroleum Gas(LPG) cylinder will be reduced by INR 200 from 30 August 2023. According to the government, the price reduction is a festive gift that will improve the quality of life and benefit the poor and middle classes implying that consumption of LPG will increase. Other comments said that it is a means to tame inflation or that it is a pre-poll incentive to script electoral victory. While all these claims may be true, the blanket reduction of the retail price of LPG across the country is essentially a regression to the mean in the history of LPG subsidies. An increase in the financial burden for the government and possibly also for LPG retailers is inevitable but will this cost result in the benefit of increasing LPG consumption by poorer households?

In 2022-23, LPG consumption constituted about 12.7 percent of total petroleum product consumption. About 89 percent of LPG was consumed by households, 10.5 percent by non-domestic and bulk industrial users and less than 1 percent by vehicles. Over 55 percent of LPG was imported and over 99 percent of domestic production was from public sector refineries.

LPG subsidies (through direct benefit transfer, not including spending on the Ujjwala Yojana Scheme) have been reduced substantially over the last decade partly because of falling LPG prices and partly because of the systematic effort to reduce the subsidy burden on the government. LPG subsidy burden on the government and government-owned LPG retailers fell from INR 321.52 billion in 2011-12 to about INR 8.55 billion in 2022-23. If the blanket subsidy of INR200/cylinder offered recently is continued for a year, the subsidy burden will return to over INR 377 billion assuming each of the over 300 million domestic LPG connections consumes about 6 cylinders per year on average. However, it is likely that the price of LPG before taxes and dealers’ commission will remain subdued in the second half of 2023 (calendar year) reducing the need to sustain retail price subsidies. In January 2022, the international price of LPG was US$ 770/MT (metric tonne, CFR, cost & freight) which rose to over US$ 1000/MT in April. Since then, the price has fallen to about US$ 490/MT in August and it is expected to remain in the range of US$ 400-500/MT until the end of the year.

In July 2023, the price of LPG before taxes and distributers commission was INR 985.63 for the standard 14.2 kg cylinder. The retail price of a domestic LPG cylinder in Delhi in August was INR 1,103. This includes GST, 5 percent for domestic LPG since July 2017) of INR52.53 /cylinder plus GST on dealer’s commission and dealer commission of INR 64.84/cylinder. The share of taxes in the retail price of LPG in Delhi was 10.6 percent. The highest price for LPG in India was in Ladakh at INR 1,340/cylinder and the lowest was in Maharashtra at INR 1,102.50/cylinder.

Comparison of LPG prices in South Asian countries adjusting for currency and weight difference shows that in August 2023, LPG prices in Bangladesh and Nepal were higher than that in India but LPG prices in Sri Lanka and Pakistan were lower than that of India. If one were to pay for 14.2 kg of LPG in Indian currency in Bangladesh it would cost INR 1,126 and in Nepal INR 1,183.81. In Pakistan LPG would cost only INR 768.87 for a 14.2 kg cylinder and in Sri Lanka about INR 845.23.

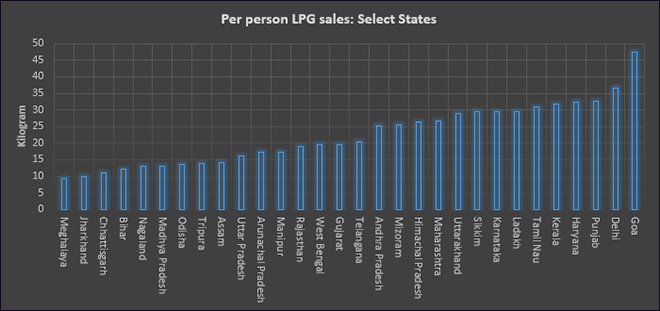

In 2014-15, per-person sale of LPG was lowest in Meghalaya at 5.4 kg with Jharkhand a close second with a per-person LPG sale of 5.9 kg. Meghalaya had the lowest per-person LPG sales despite the fact that the per-person net state domestic product (SDP) of Meghalaya was not the lowest among states. In 2014-15, the person net SDP of Meghalaya was INR39,503 which was higher than that in Bihar (INR 16,804) and Uttar Pradesh (INR 20,057). Delhi had the highest per person LPG sale of 43.7 kg in 2014-15, 8 times that of Meghalaya but its per person net SDP was only about 3 times larger at INR 129,809.

The per-person LPG sales in Meghalaya continued to remain the lowest among states at 9.3 kg in 2022-23 with Jharkhand a close second with per-person LPG sale of 9.9 kg. The per person SDP of Meghalaya had increased by over 53 percent to INR60,606 in 2022-23 compared to its per person net SDP in 2014-15 and that of Jharkhand increased by over 32 percent to INR55,126 in 2022-23. Uttar Pradesh had the largest dealer network with 4142 outlets but the per-person LPG sales in Uttar Pradesh were only 16 kg, lower than the all-India average per-person LPG sale 20.5 kg in 2022-23. The per-person SDP of Uttar Pradesh had doubled to INR40,432 in 2022-23 but it was still lower than that of Meghalaya. Goa had the highest per-person LPG sale of 47.4 kg while the per-person LPG sales in Delhi fell to 36.7 kg in 2022-23 primarily because of the increase in access to piped natural gas in and around Delhi. Both Delhi and Goa are almost 100 percent urbanised.

As demonstrated above, there is a strong correlation between per-person LPG sales in a particular state and its per-person SDP. Other factors like the level of urbanisation may also strongly influence the adoption of LPG but state-by-state urbanisation figures are available only up to 2011 when the last census was taken. Countries like China and South Africa show a close correlation between the level of industrialisation, urbanisation, and adoption of clean cooking fuels such as LPG rather than with the retail price of LPG. Though the reduction in the retail price of LPG has been hailed as enabling poorer households to procure LPG refills, more long-term influences like increase in household incomes, increase in female literacy and urbanisation are likely to have stronger influence on LPG purchase decisions.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Ms Powell has been with the ORF Centre for Resources Management for over eight years working on policy issues in Energy and Climate Change. Her ...

Read More +

Akhilesh Sati is a Programme Manager working under ORFs Energy Initiative for more than fifteen years. With Statistics as academic background his core area of ...

Read More +

Vinod Kumar, Assistant Manager, Energy and Climate Change Content Development of the Energy News Monitor Energy and Climate Change. Member of the Energy News Monitor production ...

Read More +