This article is part of the series Comprehensive Energy Monitor: India and the World

This article is part of the series Comprehensive Energy Monitor: India and the World

In India, liquefied petroleum gas (LPG) is perceived primarily as household cooking fuel. But LPG supports a wide range of

industrial processes and services that require a high degree of precision and flexibility in process temperatures, as well as a strong flame. Space, process and water heating, metal processing, drying, food production,

petrochemical production as well as powering industrial ovens, kilns and furnaces are among industrial activities that use LPG. It is valued by industry for its highly controllable temperatures,

homogeneous content, low emission of pollutants (negligible NOx

, SOx and PM emissions) and easy availability. LPG has a higher calorific value and hence burns ‘hotter’ than natural gas. LPG is particularly useful in the manufacture of glass / ceramic products that involve a number of chemical reactions. The use of a clean fuel like LPG enhances the product quality and reduces the technical problems related to the manufacturing activity. LPG is used for heating bitumen, repairing and laying roads, illuminating road signs and floodlighting. Manufacturers of aerosol products also use pure field-grade LPG as a propellant for household products.

LPG is used for heating bitumen, repairing and laying roads, illuminating road signs and floodlighting.

Chlorofluorocarbons (CFC’s) are the most common refrigerants used but CFCs are known to destroy the ozone layer that limits the passage of ultraviolet radiation from the Sun. LPG, with zero ozone depletion potential (ODP) is emerging as a credible replacement for CFCs in industrial and household refrigeration. Although various LPG classifications have refrigeration applications, isobutane is most frequently found in domestic fridges and freezers, whilst propane is common in commercial heat pumps, air conditioning, refrigeration and freezer applications. The cooling capacity of LPG is 10 percent higher than alternatives and its excellent thermodynamic properties lead to energy efficiency gains of 10-20 percent. LPG operates at slightly lower pressures than other main refrigerants whilst maintaining a similar volumetric refrigerating effect. LPG does not form acids and thereby eliminates the problem of blocked capillaries.

Despite these benefits, consumption of LPG by the service and industrial sectors accounts for less than 10 percent of total LPG consumption in India. Strong policy support for LPG use as fuel for cooking in households driven by political and environmental goals has marginalised LPG consumption in other segments. Promoting industrial use of LPG, a relatively clean, alternative fuel with modular packaging and transportation features can serve India’s economic and environmental goals.

Status

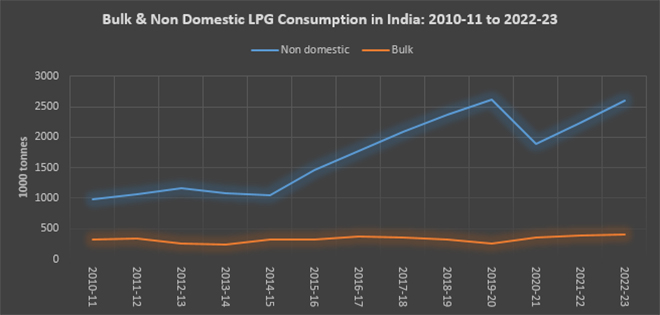

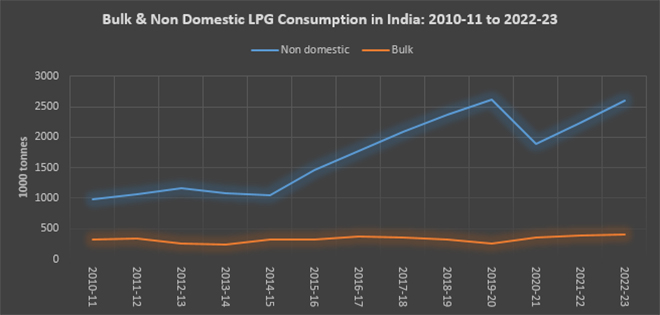

In India, bulk consumption of LPG accounted for about 1.4 percent and non-domestic consumption of LPG accounted for about 9.1 percent of total LPG consumption in 2022-23. Bulk and non-domestic LPG consumption is growing though consumption growth has started declining in the domestic and transportation sectors. Between 2010-11 and 2022-23, non-domestic consumption of LPG has grown by an annual average of over 8.4 percent while bulk consumption has grown by about 1.8 percent. Overall LPG consumption grew by about 6.1 percent in the same period. The share of bulk consumption of LPG fell from about 2.3 percent in 2010-11 to about 1.4 percent in 2022-23 while the share of non-domestic consumption increased marginally from about 7 percent in 2010-11 to about 9 percent in 2022-23. In 2022-23, India imported 18.3 million tonnes (MT) of LPG accounting for about 64 percent of consumption which is a substantial increase in import dependency that stood at 49 percent in 2016-17. Despite growth in consumption since 2009-10, Indian refiners have not ramped-up LPG production capability. LPG produced by Indian refineries was only 4.2 percent of total crude processing capacity in 2022-23. Indian refineries are more optimally designed to produce petrol and diesel and have lower LPG yields, which in turn limits domestic LPG production.

Issues

One of the key factors inhibiting the widespread adoption of LPG by industries is the competition from natural gas. In all three LPG-consuming sectors (household, transport and industries) availability of piped natural gas at regulated prices makes LPG a more expensive option. Policy support to increase natural gas consumption to about 15 percent of India’s primary energy basket has increased investment in transport infrastructure for natural gas such as pipelines. In addition, accommodative pricing incentivises domestic production of natural gas from complex and difficult offshore fields.

Refineries can increase internal consumption of propane as process fuel to reduce the need for expensive natural gas. Industries can also substitute LPG for natural gas but this depends on regulatory restrictions.

Historically, natural gas has traded at a discount to oil and oil products. However, the current volatility in imported natural gas prices opens the possibility of substituting oil products including LPG for natural gas to contain costs. Refineries can increase internal consumption of propane as process fuel to reduce the need for expensive natural gas. Industries can also substitute LPG for natural gas but this depends on regulatory restrictions. Many industrial plants in China used LPG as their primary fuel source for local power generation and/or process fuel in the past. As natural gas supply expanded, many of these facilities were linked to gas distribution networks but still retained LPG storage tanks and the ability to switch back if needed. As in the case of India, most of China’s state-owned industrial plants are connected to domestic gas supply, which is subject to price controls while most of the private sector gas users were buying imported re-gasified LNG (liquefied natural gas). Private sector gas users were thus exposed to the price volatility in LNG-based natural gas which is not subject to price regulation. When the price of globally traded natural gas increased, LPG became competitive compared to imported LNG and this led to “reverse switching” from gas to LPG and contributed to Chinese LPG import demand. As per current regulations in China, fuel switching is not permitted. Once an industrial user gets connected to the natural gas grid, LPG has to be eliminated in the system.

Domestic consumption of LPG in India declined from 25,502,000 tonnes in 2021-11 to 25,382,000 tonnes in 2022-23. Consumption of LPG by the transportation segment also declined from 122,000 tonnes in 2021-11 to 107 tonnes in 2022-23. However, non-domestic and bulk consumption of LPG increased from 2,630,000 tonnes in 2021-22 to 3,015,000 tonnes in 2022-23. For industries that are not connected to the gas grid, LPG may be promoted as a source of power generation and process heat. Decentralised nature of LPG as fuel can facilitate industrialisation of rural areas. For industries that are connected to the natural gas grid, policy provision to switch between LPG and natural gas by industries in India will not only sustain the momentum in consumption growth but also alleviate the cost pressure on industries by reducing exposure to volatility in natural gas prices.

Source: Petroleum Planning & Analysis Cell (PPAC)

Source: Petroleum Planning & Analysis Cell (PPAC)

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This article is part of the series

This article is part of the series

PREV

PREV