This article is part of the series Comprehensive Energy Monitor: India and the World

Background

On 23 November 2021, the US administration authorised the release of 50 million barrels of crude oil from the strategic petroleum reserve (SPR) operated by the US Department of Energy (DOE). 50 million barrels of oil is about half the global oil consumption per day and about three days of US oil consumption. Oil prices had touched levels not seen in seven years driving the US decision to release SPR oil crude oil. In the words of the Secretary DOE, the release of oil from the SPR underscored the US President’s commitment to use the tools available to bring down costs for working families (by reducing the retail price of gasoline in the US) and continue economic recovery. The decision to release SPR oil by the US was coordinated with parallel decisions in China, India, Japan, South Korea, and the United Kingdom. India’s share in the coordinated release of oil stored in SPRs was 5 million barrels, a tenth of US SPR release, not sufficient to influence oil prices given that the world consumes 100 million barrels a day (b/d).

The goal of SPR oil release was not achieved as oil prices increased marginally by US $1/barrel (b), after the announcement of SPR release. But when news of a new COVID-19 variant in South Africa broke on 26 November 2021, it did what the release of the SPR by the Biden administration could not, that is reduce oil prices and that too by a significant 10 percent. This implies that expectations of oil demand growth influenced by factors like the pandemic are more important in moving oil prices than expectations of supply corrections such as the oil release by the SPR. The apparent impotence of the SPR release raises questions over the costs and benefits of maintaining SPRs.

India’s share in the coordinated release of oil stored in SPRs was 5 million barrels, a tenth of US SPR release, not sufficient to influence oil prices given that the world consumes 100 million barrels a day (b/d).

Indian Strategic Petroleum Reserves Limited

India’s SPR is managed by the State-controlled Indian Strategic Petroleum Reserves Limited (ISPRL), which was set up in 2004 as a wholly owned subsidiary of Indian Oil and then handed over to Oil Industry Development Board (OIDB) in 2006. Under Phase I, ISPRL established petroleum storage facilities with total capacity of 5.33 million tonnes (MT) at 3 locations: (i) Vishakhapatnam (1.33 MT), (ii) Mangaluru (1.5 MT) and (iii) Padur (2.5 MT), all of which have been filled with crude oil. This will be sufficient to meet nine and a half days of India’s crude requirement. In July 2021, the government approved establishment of two additional commercial-cum strategic facilities with total storage capacity of 6.5 MT underground storages at Chandikhol (4 MT) and Padur (2.5 MT) under public private partnership (PPP) mode under phase II of the SPR programme. When phase II is completed, it will meet an additional 12 days of India’s crude requirement.

The capital cost for constructing the SPR facilities (phase I) was originally estimated to be INR 23.97 billion at September 2005 prices. The revised cost estimate for the three locations stands at INR 40.98 billion. Most of the capital cost was met with funds available with OIDB while Hindustan Petroleum Corporation Limited (HPCL) met the cost of 0.3 MT compartment at Visakhapatnam. Operation and maintenance cost of the strategic reserves is met by the Government of India. In the year 2019-20, ISPRL recorded a net loss of over INR 1 billion.

Origin and Rationale of SPRs

The dramatic increase in the price of oil in the late 1970s redefined the energy policies of industrialised nations from one that managed abundance to one that managed scarcity. Countries in Western Europe, barring France, and the United States reached an agreement to create the International Energy Agency (IEA) in 1974 to counter actions of the OPEC (Oil Producing and Exporting Countries). France and the US joined the IEA later. Though Henry Kissinger who coordinated the international response to the oil crisis had ambitious plans for the IEA, it eventually became a modest mechanism for managing scarcity through an oil sharing arrangement between member countries that required maintenance of strategic oil stocks to mitigate supply risk. All oil importing member countries of the IEA have an obligation to hold emergency oil stocks equivalent to at least 90 days of net oil imports. Industrialised countries represented by the IEA pushed for China and India to build and maintain strategic stocks of oil to address short term volume and price risk. Crude oil price increases generally result from actual or anticipated increase in demand or decrease in supply or both. The logic is that the release of SPR oil would potentially provide temporary relief from rising prices but more importantly make up for temporary supply losses that are behind the price rises.

All oil importing member countries of the IEA have an obligation to hold emergency oil stocks equivalent to at least 90 days of net oil imports.

Issues

Though strategic stockpiling of oil was promoted by policymakers as the best way of insuring against supply shocks, questions remain as to whether the high cost of maintaining these stocks justified the benefits, especially for developing economies. Theoretically, release of SPR oil by rich industrialised nations to influence crude oil prices provides a global public good of lower oil prices. No country can be excluded from lower prices that is expected follow the release of SPR oil, and therefore, it is possible for poor countries to ‘free ride’ on the SPRs held by industrialised countries. But industrialised countries have put pressure on India and China, now large importers of oil to share the burden of holding SPR reserves. Most studies estimate that the opportunity cost of holding crude oil is more than the cost of crude oil. To reduce this cost, auctioning or trading oil in SPRs is suggested.

No country can be excluded from lower prices that is expected follow the release of SPR oil, and therefore, it is possible for poor countries to ‘free ride’ on the SPRs held by industrialised countries.

India initiated selling crude from its SPR five months ago in July 2021, following news of China’s decision to auction crude from its SPR. India’s goal was to commercialise SPR crude reserves to generate revenue using oil stocks for trading and from licensing capacity. The logic behind this is to purchase crude at lower levels and supply in the domestic market when prices rise meaningfully. For example, China’s SPR crude that was bought in April-May 2020 when oil prices were about US$40/b was auctioned on 24 September 2021 at US$65-$70/b which helped improve refining margins for buyers of crude and also improved state finances. ISPRL has leased capacity to United Arab Emirates’ ADNOC (Abu Dhabi National Oil Company) to hold 750,000 MT of crude under a government-to-government deal. ISPRL plans to lease out an additional 30 percent capacity to international investors with the option of exporting crude.

Overall, the SPR is like an insurance policy against future oil supply or price shocks. The premium is the cost of maintaining the SPR. The issue is whether the premium is justified. The strategic importance of oil has reduced substantially partly because of abundant availability of oil resources and partly because of the negative perception of oil and other fossil fuels as sources of carbon emissions. Oil supply shocks have not only become rarer but also short lived. The benefit of SPR release in influencing price is probably overstated as the most recent SPR release illustrated. Maintenance of SPR is perhaps justified under current circumstances as oil continues to underpin almost all other energy sources including renewables (in manufacture and transport of renewable energy equipment). But in the future the value of the insurance premium on oil storage may have to be re-evaluated.

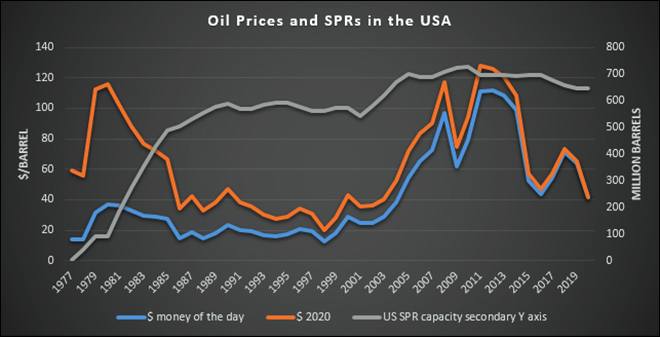

Source: BP statistical review 2021 for oil price, EIA, Energy Information & Administration, USA for US SPR capacity

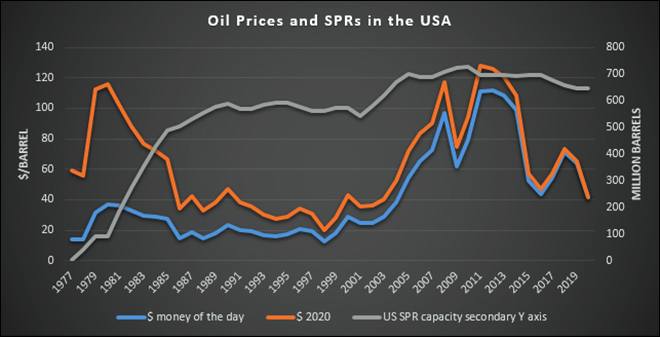

Source: BP statistical review 2021 for oil price, EIA, Energy Information & Administration, USA for US SPR capacity

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV