-

CENTRES

Progammes & Centres

Location

As global borrowing increases across the world, India can make a huge long-term difference in the resolution of the global debt crisis as it takes over the G20 presidency.

While India takes over the G20 presidency, Prime Minister Narendra Modi called for other member countries to make India’s presidency one of “healing, harmony and hope”. He also set the theme of India’s presidency as “One Earth, One Family, One Future”. As the world economy struggles to come out of a pandemic slump, the call for global cooperation by treating the entire earth as one assumes a greater significance.

As the Russia-Ukraine war continues to add pressure on many countries’ public finances, the after-effects of extraordinary fiscal support during the pandemic linger. Deficits increased across countries, inflation soared, debt accumulated much faster than in previous recessions, and as interest rates rose to tackle inflation the cost of debt servicing also soared.

According to the International Monetary Fund’s Global Debt Database, global borrowing jumped by 28 percent to a whopping 256 percent of GDP in 2020, compared to previous year. Governments of different countries borrowed roughly half of that amount. Public debt currently accounts for around 40 percent of total global debt, and this is the highest in almost six decades.

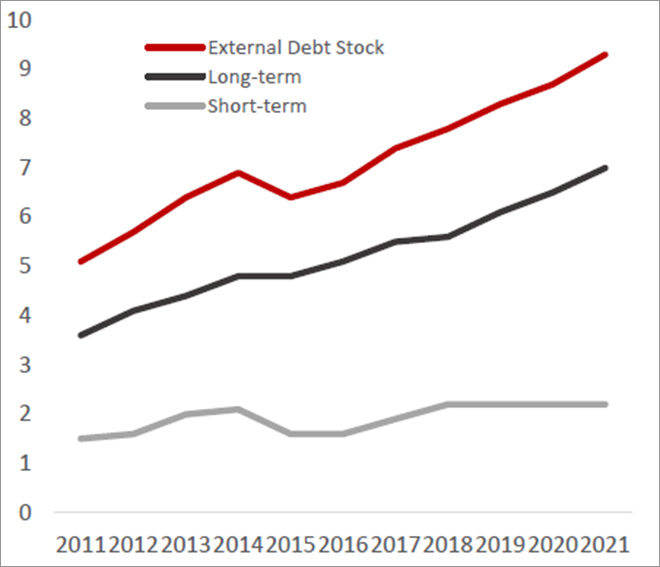

Figure 1. External debt stock of low and middle-income countries (in US$ trillion)

Source: Debt Report 2022, Edition II, The World Bank

Source: Debt Report 2022, Edition II, The World Bank

Preliminary estimates made by the World Bank show that the external debt stock of low- and middle-income countries increased 6.9 percent on an average in 2021 to take the total debt accumulation to US$ 9.3 trillion. This estimated 6.9 percent increase in 2021 is faster than 5.3 percent recorded rise in 2019 and 2020. This rise in growth rate has been partially driven by increased short-term borrowing, particularly in the last quarter of 2021. This was the time when international trade started its rebound. However, long-term borrowing also kept pace, private sector entities being the major contributor (Figure 1).

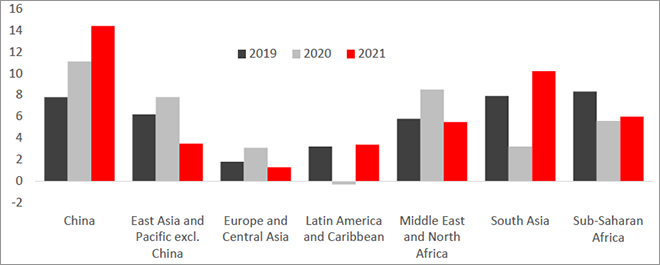

External debt stock accumulation across different geographic regions varied widely in 2021. South Asia saw the sharpest rise in external debt stocks in 2021. Accumulation increased by 10.2 percent - amounting to US$ 900 billion. Sri Lanka was already under severe distress, but Bangladesh and Pakistan also recorded sharp estimated rise of 23 percent and 12 percent in 2021 respectively. However, South Asian debt ballooned largely by estimated 9 percent rise in India’s external debt. India’s external debt now accounts roughly 70 percent of the combined external debt of the region. The sharp jump in China’s external debt reflects its accommodative fiscal policies to support the post-pandemic recovery. Earlier decision to open financial markets also contributed significantly (Figure 2).

Figure 2. Percentage change in external debt stock by region, 2019 – 2021

Source: Debt Report 2022, Edition II, The World Bank

Source: Debt Report 2022, Edition II, The World Bank

External debt stocks in Sub-Saharan Africa have increased by 6 percent in 2021, marginally higher than in 2020. This is despite a 5.6-percent contraction in South Africa’s external debt stock. Public and publicly guaranteed external debt in several countries in Sub-Saharan Africa increased by double digit, including estimated 15 percent increase in Ghana and Nigeria. Debt accumulation has slowed down by 5.5 percent in the Middle East and North Africa (MENA) region in 2021 from 8.5 percent in 2020. Egypt, the largest borrower in MENA, recorded an estimated 13 percent rise (Figure 2).

Three regions that account for the largest share of low- and middle-income countries’ external debt are Latin America and the Caribbeans (LAC), Europe and Centra Asia (ECA), and East Asia and the Pacific (EAP). External debt stocks in LAC countries rose by 3.4 percent in 2021, in sharp contrast to the 0.3-percent contraction in 2020. Brazil’s estimated 4.8 percent increase in debt contributed the most. The ECA rate of accumulation increased by an estimated 1.3 percent in 2021, slower than a 3.1-percent increase in 2020. EAP countries (excluding China) experienced an estimated 3.5 percent rise in debt accumulation, compared to 7.8 percent in 2020 (Figure 2).

External debt stocks in LAC countries rose by 3.4 percent in 2021, in sharp contrast to the 0.3-percent contraction in 2020. Brazil’s estimated 4.8 percent increase in debt contributed the most.

In May 2020, G20 set up the Debt Service Suspension Initiative (DSSI) with the active help of the World Bank and the IMF. Aiding the debt-distressed countries in their efforts to fight the pandemic and safeguarding the lives and livelihood of millions of vulnerable populations was the objective. However, only 48 out of 73 eligible countries participated and the DSSI suspended US$ 12.9 billion in debt service payments till December 2021, when the initiative ended. Though G20 urged private creditors to join the DSSI, only one private creditor participated. The impact of DSSI has been very limited in providing debt relief to the participating countries.

Basic debt crisis signals of crashing currencies and rapidly depleting foreign exchange reserves are now appearing in a record number of low- and middle-income economies. Lebanon, Sri Lanka, Russia, Suriname, and Zambia are already in sovereign debt default in 2022, and Belarus is on the brink of defaulting. However, there are other countries at acute risk as inflation rises, costs of borrowing and debt servicing go up, and more debt accumulates. The list includes countries like Argentina, El Salvador, Ecuador, Ukraine, Tunisia, Ghana, Egypt, Kenya, Ethiopia, Nigeria, and Pakistan.

Basic debt crisis signals of crashing currencies and rapidly depleting foreign exchange reserves are now appearing in a record number of low- and middle-income economies.

In G20 Bali Leaders’ Declaration, the member countries reiterated their commitment “to step up efforts to implement the Common Framework for Debt Treatment (CF) beyond the DSSI in a predictable, timely, orderly and coordinated manner”. The CF entails a broader debt restructuring framework on a case-by-case basis rather than a blanket suspension effort. This is more effective and provides the correct direction in resolution of global debt. A successful implementation of the CF will also result in a reduction of inequalities among countries (SDG 10) and strengthening global partnerships for sustainable development (SDG 17).

As the G20 leadership troika now consists of three developing countries—India, Indonesia, and Brazil, the expectations are high. With a decisive leadership, India can make a huge long-term difference in the successful resolution of the global debt crisis.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Abhijit was Senior Fellow with ORFs Economy and Growth Programme. His main areas of research include macroeconomics and public policy with core research areas in ...

Read More +