-

CENTRES

Progammes & Centres

Location

The G20 can help streamline social security systems across countries by initiating innovative mechanisms for sustainable financing and last-mile delivery.

There exists a variety of social security systems in operation among the G20 nations that differ in character, target groups, design as well as financing—intending to provide social protection for nearly 60 percent of the world population in the G20 nations. For instance, developed countries mostly have a contributory system for their various social protection schemes such as unemployment benefits and workplace accident insurance among others. In this system, both the employer as well as the employee share the obligation as per a laid-down contract. It is also common to see that the government contribution is very less in these developed countries, with the European Union (EU) being an exception. On the other hand, we can see significant state involvement when it comes to developing countries such as India.

The financing of social protection for the unorganised sector is particularly challenging due to factors such as the lack of formal contracts, workers facing financial constraints in contributing to schemes, and hurdles in the last-mile delivery of social security.

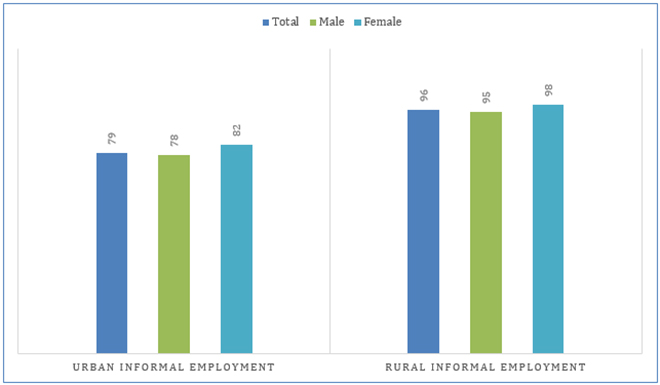

Although social protection serves as a right to livelihood security for all, the focus of most social security systems is on the organised sector. This leaves the unorganised sector employing more than 61 percent of the global workforce that is excluded from adequate social protection, including decent working conditions. The lack of data for a tailored design of policies and the informality of employment in this sector makes the provision of social security difficult. The financing of social protection for the unorganised sector is particularly challenging due to factors such as the lack of formal contracts, workers facing financial constraints in contributing to schemes, and hurdles in the last-mile delivery of social security. With one of the largest unorganised sectors in the world, over 86.8 percent of the Indian workforce derive their incomes from informal employment. It is also characterised by a significant rural-urban divide—with 96 percent of the total rural jobs concentrated in the informal sector compared to 79 percent in the urban areas.

Figure 1. Informal Employment in India (in percent, 2022)

Source: Authors’ own, data from OXFAM India Fact Sheet 2022

Source: Authors’ own, data from OXFAM India Fact Sheet 2022

In addition, roughly 88 percent of female employment in India is informal. Women are more likely to be engaged as unorganised workers in the formal and informal sectors, in both rural and urban India. While traditional concerns like limited access to income-generating assets, wage discrimination, excess burden of unpaid care work and social norms continue to pose challenges to women’s employment in India’s formal economy, the country has made significant strides in facilitating alternative sources of livelihood security for them. Through expansive social security measures for enhanced digital and financial inclusion promoting female entrepreneurship, India has worked to bridge the existing gender gaps and advance poverty alleviation.

More recently, the economic fallout of the COVID-19 pandemic has pushed nearly half a million informal workers deeper into poverty, necessitating greater support for them through social security measures. India’s experience of undertaking public provision of social security at such a large scale can provide learnings for other countries around the world. Moreover, despite progress, a considerable share of the unorganised sector workers in India remain deprived of access to critical social protection measures. The Indian G20 Presidency, therefore, recognises the provision of social protection and livelihood security for all as one of its priorities. Exemplifying innovative mechanisms for sustainable financing and last-mile delivery of various social protection schemes across countries, the G20 has great potential to contribute towards the development of robust social security systems for unorganised workers.

To enable social security in the unorganised sector, there is a need for both social assistance as well as social insurance. The state’s role is enhanced here, for instance, a solidarity financing approach will see the governments subsidising insurance premiums or taking over the responsibility of contribution for the unorganised sector. Another model is where the state promises matching grants as per the worker’s contribution, which is the case of construction workers in India who are under the ambit of the Building and Other Construction Workers Welfare Board. India also operates the Pradhan Mantri Shram Yogi Maandhan Yojana (PMSYMY) which provides old age protection and social security for unorganised workers through equal contribution from the citizens and the government.

Exemplifying innovative mechanisms for sustainable financing and last-mile delivery of various social protection schemes across countries, the G20 has great potential in contributing towards the development of robust social security systems for unorganised workers.

From an economic perspective, it is often the case that informal workers who belong to lower financial strata tend to have a higher propensity to consume—that is, most of their income is spent on short-term necessary consumption rather than long-term savings that could help them during an unforeseen crisis. To mitigate this, the State must provide incentives in the form of educational assistance for children, healthcare, and provision of housing which are typically the cause for subsistence spending. This has become even more relevant in the post-COVID situation with soaring unemployment and falling incomes.

A well-crafted social security system will require the G20 countries to create a sustainable framework that can address their context-specific needs. Enabling social protection of unorganised workers is a pressing issue that needs to be addressed systematically by the G20 governments. To enable this, the G20 states will also need to invest in the development of an efficient delivery system that can facilitate a smooth transfer of social security benefits to the population in need. Additionally, to create a sustainable financing model for this, the developing countries in the G20 must seek assistance from multilateral institutions and other development partners.

As countries embark on expanding their social safety net to the unorganised workers (primarily through public provisioning), a comprehensive plan to ensure the secured and most effective delivery of benefits will be crucial for the realisation of targets without straining the financial sustainability of these systems. The criticality of robust delivery systems of social security became evident during the COVID-19 pandemic as well. Nations that had a social registry-powered, online payment-enabled social security system could quickly spring into action and deliver social security services to their people. In India, the Aadhaar registry was crucial in enabling Direct Benefit Transfers (DBT) to the beneficiaries. Along with this, online payment platforms such as the Unified Payments Interface (UPI) enabled remote customer registration and interoperability to facilitate on-time payments.

Coordination and inclusion have been identified as the main challenges for creating a delivery system, and the G20 presidency of India will be an important factor in developing a common framework to tackle this considering India’s experience in effective DBT mechanisms.

Developing a robust last-mile delivery system has a positive impact on the livelihood development and security of billions of people globally. Coordination and inclusion have been identified as the main challenges for creating a delivery system, and the G20 presidency of India will be an important factor in developing a common framework to tackle this considering India’s experience in effective DBT mechanisms. The delivery chain of social security has been depicted in the following figure, and the G20 countries will have to iron out the challenges that arise in each of these stages.

Figure 2. The Delivery Chain of Social Security

Source: Lindert et al. (2020)

Source: Lindert et al. (2020)

Monitoring, targeting, and delivery of social security are all affected by operational divergences in social security across nations. To overcome this, a common framework for social security must be developed that provides equitable opportunities for the global population, especially in the unorganised sectors of employment. While keeping in mind the context-specific needs, the common adaptive structural framework for social security can be used by all G20 nations to reach a minimum acceptable level of social security while keeping the policy financially sustainable. To enable this, the countries must monitor where the divergences are prevalent in the design of national social security programmes. Enabling a conducive environment for a multi-stakeholder partnership that can mitigate these existing divides through resource, technology and information-sharing also becomes crucial.

The authors acknowledge Aravind J Nampoothiry from the National Law School of India University in Bangalore for his research inputs on this article.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Debosmita Sarkar was an Associate Fellow with the SDGs and Inclusive Growth programme at the Centre for New Economic Diplomacy at Observer Research Foundation, India. Her ...

Read More +

Soumya Bhowmick is a Fellow and Lead, World Economies and Sustainability at the Centre for New Economic Diplomacy (CNED) at Observer Research Foundation (ORF). He ...

Read More +