This article is part of the series Comprehensive Energy Monitor: India and the World

Grid connected battery energy storage system (BESS) is a technology option that can accommodate high share of renewable energy and contribute to grid stability. India’s proposed target of 500 GW (gigawatts) of renewable energy (RE) capacity by 2030 requires that intermittent solar is paired with BESS to supply power day and night and through summer, winter and monsoon. BESS is projected as the most suitable option for India because it requires short run flexibility that will align peak solar generation in the middle of the day with evening peak demand. The International Energy Agency (IEA) expects India to have about 140 GW of battery storage by 2040, the largest in any country. The government estimates that India will require 27 GW of grid‐connected BESS by 2030. A more recent academic study estimates that India will require 63GW/252 GWh (gigawatt hour) BESS to achieve the goal of 500 GW of solar energy generation capacity.

BESS is projected as the most suitable option for India because it requires short run flexibility that will align peak solar generation in the middle of the day with evening peak demand.

Battery Storage Projects in India

India got its first grid-scale advanced lithium-ion battery storage system in 2019 when a 10 MW (megawatt) / 10 MWh (megawatt hour) system offering one hour storage was deployed on Tata Power distribution networks in Delhi. The project by AES and Mitsubishi with energy storage technology and integration services provider Fluence, itself a joint venture of Siemens and AES initiated the process of investigating the optimal deployment of energy storage for the distribution of Tata Power’s 2,000 MW electricity network. In March 2021, Tata Power in collaboration with lithium-ion battery and storage company Nexcharge installed a 150 KW (kilowatt)/528 kWh (kilowatt hour) battery storage system offering six hour storage to improve the supply reliability at the distribution level and reduce peak load on its distribution transformers. The BESS systems designed to charge during the off-peak hours and discharge the power during peak hours, are expected to support the distribution transformers to manage peak load, regulate voltage, improve power factor, regulate frequency, settle deviations, support grid stabilisation, prevent overload of power transformer, manage reactive power and defer CAPEX (capital expenditure). More recently Tata Power Solar Systems received a letter of award from the Solar Energy Corporation of India (SECI) for the engineering, procurement and construction (EPC) of an INR 9.45 billion (US $126 million) 100 MW solar project with a 120 MWh battery in Chhattisgarh. It is too early to assess the success of these initiatives but developments in industrialised countries offer some lessons.

Challenges

While there are several BESS systems operating in industrialised countries, the one that has grabbed consistent media attention is the Hornsdale Power Reserve (HPR) project in South Australia. HPR, a 100 MW/129 MWh system is the largest lithium-ion BESS in the world built by Tesla and operated by a French company. HPR that started operations in December 2017, was expected to provide two distinct services: 1) Energy arbitrage; and 2) contingency spinning reserve. In 2017, after a large coal plant tripped offline unexpectedly, HPR was able to inject several megawatts of power into the grid within milliseconds, arresting the fall in grid frequency until a gas generator could respond. By arresting the fall in frequency, the BESS was able to prevent a likely cascading blackout. But in September 2021, the Australian Energy Regulator (AER), the body that oversees the country’s wholesale electricity and gas markets, filed a federal lawsuit against the HPR for failing to provide “frequency control ancillary services” numerous times over the course of four months in the summer and fall of 2019. Another Tesla battery, the 300 MW BESS also in Australia caught fire in July 2021. In 2020 there were some high-profile safety-related issues with battery storage, including an explosion at an Arizona Public Service facility and multiple storage-related fires in South Korea.

According to an academic study, in competitive electricity markets investing in storage is not profitable but it increases consumer surplus, reduces electricity production cost and in certain cases reduces emissions.

Until 2019, technological optimism dominated the BESS market. Since then, concerns over reliability, safety and prospects for return on investment are being raised. According to an academic study, in competitive electricity markets investing in storage is not profitable but it increases consumer surplus, reduces electricity production cost and in certain cases reduces emissions. This means even in open competitive markets, policy must provide for subsidies or payment for capacity in BESS. In India, electricity markets are not competitive and implicit subsidies can be built into system costs. The BESS projects listed above are invariably funded by low-cost capital from international development agencies that are aggressively promoting decarbonisation in India. How this model will play out in the long run when BESS systems must be scaled up dramatically is unclear.

In India, thermal generators are currently utilised for providing ancillary support but they are classified as ramp-limited resources (RLRs) because they take time to ramp up and down but sustain energy output for indefinite periods. Batteries (stationary or in electric vehicles) and hydro generators are classified as energy-limited resources (ELRs) as they can respond at sub-second time intervals but cannot sustain energy output. The debate over uncontrollable (or weather dependent) RE which makes the provision of relatively expensive stand-by ancillary services necessary and controllable fossil fuel-based sources of energy is not new.

In 1867, Karl Marx observed that the energy sources powering industrialisation had to be ‘dependable, urban and completely under the control of man’. Dismissing the ‘horse’ as the worst form of energy, he observed that the horse had a head of its own, was costly to maintain and was limited in factory applications’. He also dismissed wind because it was ‘inconsistent and uncontrollable’. He had more charitable views on the kinetic energy of flowing water, but he noted that ‘it could not be controlled at will, failed at certain seasons and was essentially local’. Marx’s vote was for coal (with water in the steam turbine of Watt) which he said was ‘entirely under the control of man, mobile, and a means of locomotion, and also urban unlike wind and water that were scattered up and down the countryside.’

Solar energy is the horse with a head of its own. But it is already urban (as opposed to being scattered up and down the countryside) because photovoltaic (PV) panels can convert sunlight into electricity from urban roof tops.

Marx’s observations on characteristics of energy such as ‘certainty’ ‘mobility’ and ‘controllability’ that would make certain sources of energy indispensable for industrialisation were accurate. Solar energy is the horse with a head of its own. But it is already urban (as opposed to being scattered up and down the countryside) because photovoltaic (PV) panels can convert sunlight into electricity from urban roof tops. The hope is that Elon Musk’s lithium-ion battery will tame the ‘uncertain and uncontrollable’ horse that is solar energy and make it mobile (in batteries).

But for this to happen, the cost of solar energy and storage have to fall at a rate predicted by Moor’s law. Gordon Moore, Co-founder of Intel, famously said in 1965 that the circuit density of semiconductors (made of high-grade silicon) will double every 18 months. Moore’s law as it has come to be known has proved to be true in the micro-chip industry. The number of transistors on a circuit has doubled almost every two years and the cost has fallen dramatically. In the last 50 years, the power of a given sized microchip has increased by a factor of over a billion, but the power output of a solar panel has merely doubled. From 1976 to 2019, the cost of PV modules dropped from US$106/watt to US$0.38/watt. This is nowhere near a Moore scale decline but impressive. Most of the cost declines of PV are on account of lower input material cost (solar grade silicon) and on account of increased scale of production (economies of scale), lower labour costs through manufacturing automation and lower waste from efficient processing. In other words, the cost declines of PV modules are the result of production experience and not the result of a breakthrough in fundamental physics. Solar has not managed to make a break-through on the scale of micro-chips because of fundamental technical limitations of crystalline silicon. Most projections for scaling up energy storage in batteries make optimistic assumptions of cost declines on a Moore scale. Unless this assumption proves to be accurate, projections for scaling up BESS will not materialise as the cost of storage will become an unsurmountable barrier for poor countries.

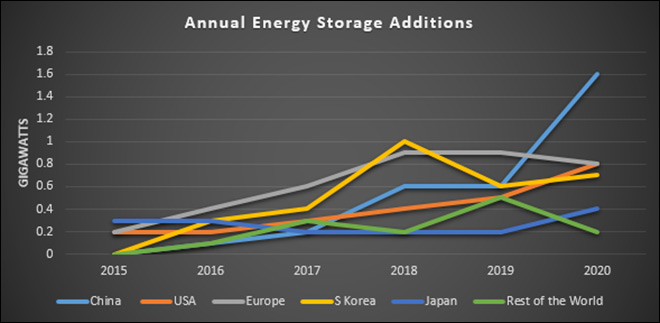

Source: International Energy Agency

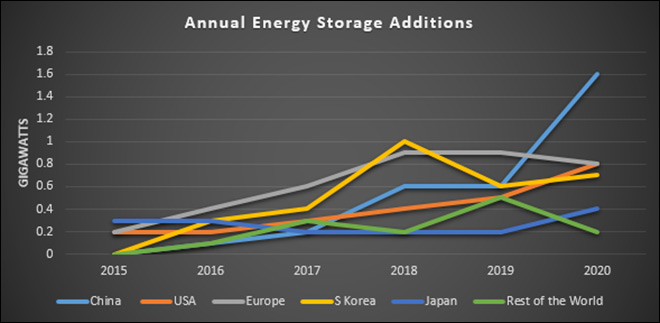

Source: International Energy Agency

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV