India was the third-largest oil consumer after the United States (US) and China in 2022 and its total consumption was about a third of the consumption of the US and half the consumption of China. In the US, oil consumption per person was 20 barrels in 2022 compared to 3.6 barrels in China and 1.3 barrels in India. Forecasts suggest that in the coming decade, India will take China’s place as the main driver of oil demand growth. Given that China’s oil demand in 2022 was 14.2 million barrels per day (mbpd) compared to India’s 5.1 mbpd, oil demand growth in India will not have the same impact as that of China even though headlines say so. Expectations of high economic growth rates, industrialisation, and a rising middle class are the key drivers behind the projections for oil demand in India. According to projections by the International Energy Agency (IEA), India is expected to narrowly overtake China and become the world’s largest driver of global oil demand growth between 2023 and 2030. India’s oil demand is expected to increase by 1.2 mbpd in the next seven years, accounting for over a third of global increases. This would require an annual average growth of 3.5 percent in oil demand till 2030. The IEA projections say that diesel would account for half the rise in national demand and over a sixth of global oil demand growth till 2030. The IEA expects electrification of India's mobility to reduce growth in demand for petrol to an annual average of just 0.7 percent by 2030. Electric Vehicles (EVs) and energy efficiency improvements will avoid 480,000 bpd of extra oil demand from India until 2030 observes the IEA. The Organisation of Petroleum Exporting Countries (OPEC) projections are more optimistic on oil demand growth. India is expected to contribute around 28 percent of non-OECD growth in oil demand. OPEC expects India’s oil demand to increase by about 2.2 million bpd by 2030 which means oil demand will grow by an annual average of over 5.9 percent. Rystad Energy— an independent energy research and business intelligence company—expects India’s oil demand growth to fall from 290,000 bpd in 2023 to 150,000 bpd in 2024.

India’s oil demand is expected to increase by 1.2 mbpd in the next seven years, accounting for over a third of global increases.

Consumption Trends: 2022-23

In 2022-23, oil demand grew by over 10.5 percent compared to demand in 2021-22. Though this is impressive, it is not the highest growth rate in the last two decades. In 2015-16, oil demand grew by over 11.6 percent. Aviation Turbine Fuel (ATF) recorded the highest annual growth of 48 percent in 2022-23 with a consumption of 7.4 million tonnes (MT) but consumption was lower than its pre-pandemic peak of 8.3 MT in 2018-19. Petrol consumption recorded an annual growth of 13.6 percent with a consumption of 35 MT that far exceeded the pre-pandemic peak of 29.98 MT in 2019-20. Petrol consumption growth may be attributed to increase in personal vehicles. In 2022-23, total number of vehicle registrations grew by an annual rate of over 11 percent while passenger vehicle registrations and two-wheeler registrations grew by over 9 percent each. Kerosene recorded a dramatic annual decline of 66 percent in 2022-23 indicating increase in electrification for lighting and Liquified Petroleum Gas (LPG) for cooking. However, LPG consumption grew only marginally by 0.7 percent from 28.3 MT in 2021-22 to 28.5 MT in 2022-23. This may indicate a shift to biomass as cooking fuel by poor households. As close to 90 percent of LPG is consumed by households the slowdown in growth may be attributed to saturation of demand in urban areas along with lower demand from poor households on account of a reduction in subsidies.

Consumption Trends: 2002-2023

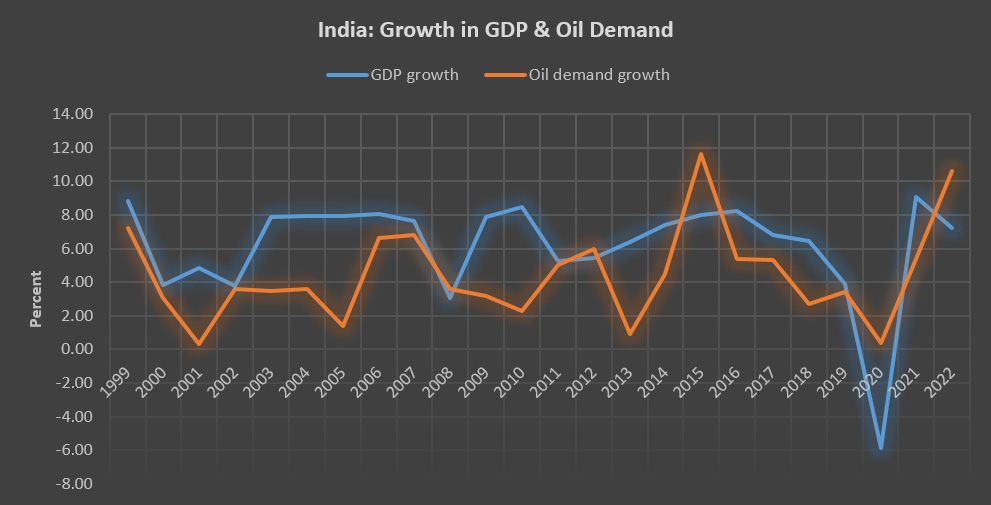

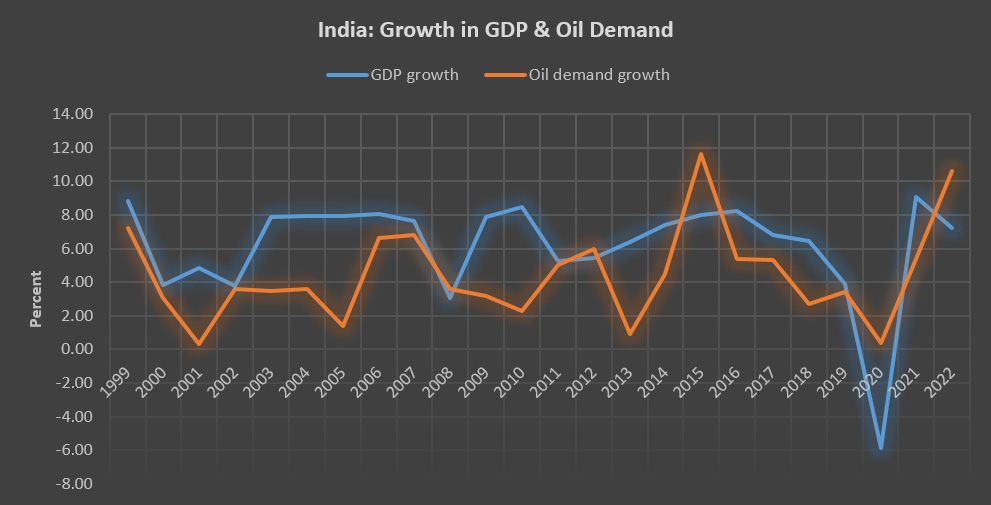

Longer-term consumption trends of petroleum products indicate a slowdown in consumption growth of petroleum products in all product categories except petrol. Some of the slowdown may be attributed to a slowdown in economic activity on account of demonetisation in 2016 and the pandemic in 2020. In the decade ending in March 2013, oil demand grew by 4.1 percent while in the decade ending in March 2023, growth slowed down to 3.5 percent. In the same periods, LPG consumption grew by 6.4 percent and 6.2 percent respectively. Petrol consumption grew by 7.5 percent and 8.3 percent respectively while diesel consumption grew by 6.61 percent and 2.2 percent respectively in the two periods. The decline in diesel demand is hard to explain. The number of petrol vehicles (including two-wheelers) increased by 4.2 percent in 2020-2023 while the number of diesel vehicles grew by 7.9 percent. However, an average growth of gross domestic product (GDP) in the decade ending in March 2023 was about 5.8 percent while the average growth of GDP in the decade ending in March 2013 was 6.9 percent which is probably one of the explanations why diesel demand slowed down dramatically in the decade ending in March 2023. Consumption of kerosene declined by 3.2 percent in the decade ending in March 2013 while it declined by over 23 percent in the decade ending in March 2023. Over the last two decades, the increase in access to LPG as fuel for cooking and the increase in electricity for lighting explains the decline in demand for kerosene.

Consumption of kerosene declined by 3.2 percent in the decade ending in March 2013 while it declined by over 23 percent in the decade ending in March 2023.

Issues

There are no official projections for oil demand from India but capacity expansion of Indian refineries offers some clues. India has a cumulative refining capacity of almost 254 MT/year or a little over 5 million bpd. India’s refining capacity is projected to increase by about 56 MT/year or about 1.1 million bpd by 2028. The government’s optimistic expansion of refining capacity is driven by the expectation of policies for growth in the industrial, construction and manufacturing sectors to succeed. Private refiners’ investment in capacity addition is driven by profitability on account of the substantial increase in gross refinery margins (GRMs) following the Russia-Ukraine war and the availability of Russian crude at a discount.

However, some developments could slow down oil demand. The energy transition is a negative demand shock to fossil fuels demand particularly oil. India has broadly committed to replacing fossil fuels and is pushing for the electrification of mobility. This shift could transform the sector into one consistent with climate goals. India’s oil demand is price-sensitive. Institutions such as the International Monetary Fund (IMF) observe that the energy transition could increase or decrease the price of oil. If only demand-side policies such as electrification of transport are considered oil prices are expected to touch US$20/b by 2030. Low prices may increase oil demand. However, supply-side policies such as the restriction on investment in oil, gas and coal sectors could lead to high prices for oil. This may curb oil demand growth.

There are far too many moving parts and it is difficult to comment on oil demand forecasts. However, trends in consumption growth in the last two decades suggest that IEA’s expectation of a decline in demand for petrol in India on account of growth in electric vehicles is optimistic. The same could be said of Rystad Energy’s expectation that oil demand growth in India will decline in 2024 and OPEC’s projection that oil demand in India will grow by an annual average of 5.6 percent till 2030. The projections likely reflect hope rather than reality.

Source: PPAC for oil demand growth and RBI for GDP growth

Lydia Powell is a Distinguished Fellow at the Observer Research Foundation.

Akhilesh Sati is a Program Manager at the Observer Research Foundation.

Vinod Kumar Tomar is a Assistant Manager at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV