-

CENTRES

Progammes & Centres

Location

Despite recent waivers, continuing the withdrawal of FPIs from the Indian economy highlights the perils of an uninsulated capital market in India.

In this year’s Union Budget, the Finance Minister of India floated the vision of a $5 trillion Indian economy by 2024. However, the falling Gross Domestic Product (GDP) growth rate, rising unemployment rate, falling consumption and investment figures make that vision a little far-fetched. The government has tried to engage in a variety of action plans that would incentivise increases in consumption and investment. Those measures are expected to induce a domino effect which might ultimately resuscitate India’s GDP. The most recent example is the removal of the super-rich surcharge on foreign portfolio investments (FPIs).

The surcharge was introduced in the original budget proposals but it immediately led to a hasty withdrawal of investments by foreign investors at an unprecedented level. The flight of these investments from the country made it necessary for the government to provide an antidote, accomplished by waiving off this surcharge. In a country that is growing at the lowest rate in six years, a net outflow in FPIs despite this waiver, demands an investigation into the trends underlying this investment in order to understand one of the deepest problems of our economy. Subsequently the question arises whether the government initiatives are relevant to the problem at hand or not.

In a country that is growing at the lowest rate in six years, a net outflow in FPIs despite this waiver, demands an investigation into the trends underlying this investment in order to understand one of the deepest problems of our economy.

The foreign portfolio investments in India have been falling since last year, as is evident from the National Securities Depositories Limited (NSDL) data (Table 1). Given this history, a surcharge on the super-rich did what was expected. Although, the surcharge removal on 23 August 2019 was supposed to encourage inflows in these investments, rather, as per depositories data, a total net outflow of ₹2,857 crore from the capital markets (both equity and debt) occurred between 23 and 31 August 2019.

Till 23 August 2019, the net inflows in total FPI was ₹3,104 crores and by August 31, 2019 the total net outflows amounted to ₹5,871 crores, implying a net outflow of ₹2,857 crores.

|

Table 1 — Monthly FPI Net Investments (Calendar Year) |

||||

| 2018 | INR crores | |||

| Equity | Debt | Hybrid | Total | |

| January | 13,781 | 8,523 | -32 | 22,272 |

| February | -11,423 | -254 | 3 | -11,674 |

| March | 11,654 | -9,044 | 51 | 2,662 |

| April | -5,552 | -10,036 | 26 | -15,561 |

| May | -10,060 | -19,654 | -61 | -29,776 |

| June | -4,831 | -10,970 | 7 | -15,795 |

| July | 2,264 | 43 | -43 | 2,264 |

| August | 1,775 | 3,414 | -44 | 5,146 |

| September | -10,825 | -10,198 | -11 | -21,035 |

| October | -28,921 | -9,978 | -6 | -38,906 |

| November | 5,981 | 5,610 | 4 | 11,595 |

| December | 3,143 | 4,749 | -3 | 7,889 |

| Total — 2018 | -33,014 | -47,795 | -109 | -80,919 |

|

2019 |

||||

| January | -4,262 | -1,301 | 7 | -5,556 |

| February | 17,220 | -6,037 | 871 | 12,053 |

| March | 33,981 | 12,002 | 2,769 | 48,751 |

| April | 21,193 | -5,099 | 634 | 16,728 |

| May | 7,920 | 1,187 | 2,264 | 11,370 |

| June | 2,596 | 8,319 | 2,196 | 13,111 |

| July | -12,419 | 9,433 | -17 | -3,003 |

| August | -17,592 | 11,672 | 49 | -5,871 |

| Total — 2019 | 48,637 | 30,176 | 8,773 | 87,583 |

Source: National Securities Depository Limited data

This clearly points towards the failure in encouraging fresh foreign portfolio investments, even in the immediate post-waiver period. The withdrawal of FPIs from the Indian market — which has become unsafe and volatile for the foreign investors—is due to macroeconomic issues persisting in the Indian economy, which have been overlooked till now. These macroeconomic issues pertain mainly to jobless growth, lack of consumer demand, lower investments in the economy, and a real estate slump.

Consequentially, these investments have moved into safer assets like dollar and gold, with the latter registering a 19% rise in prices in the last six months. Additionally, such back and forth decisions over FPIs can introduce a factor of uncertainty which could further strain the inflows.

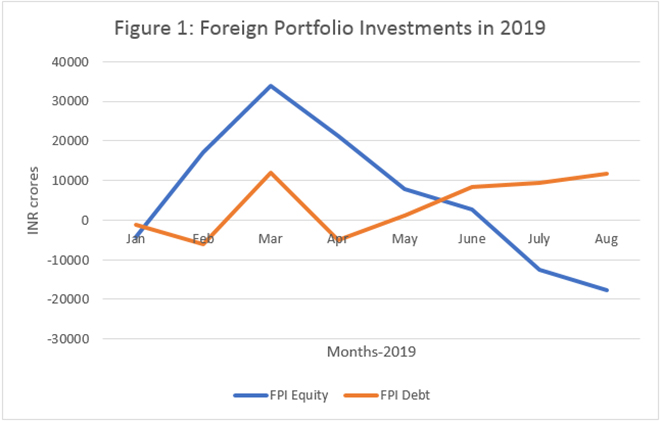

The total FPI has showcased net outflows. In the last two months, there has been a withdrawal of the equity FPI and an insurgence of the debt FPI within the total FPI (Figure 1). While the former has exhibited a consistently declining trend for a long time, the latter is more volatile. In August alone, over ₹17,000 crores were withdrawn from equity FPIs whereas over ₹11,000 crores were pumped into the debt segment. Now, this differentiation is important because debt FPI is more unstable than the equity FPI. While, foreign debt investors are required to be paid in full with interest, irrespective of how the stocks perform, equity investors take on the real risk and do not have a guarantee on potential returns.

Thus this shift can be translated as a movement from the relatively long-term equity segment into shorter term debt segment. This permits an easier and quicker departure for FPIs from risky emerging markets, like India, particularly when things get uncertain.

Source: National Securities Depository Limited Data

Source: National Securities Depository Limited Data

Having seen these negative movements in the FPI trend, a scepticism pertaining to the importance of FPIs emerges. FPI is a monetary or financial investment that does not directly lead to real asset creation or capital formation in the economy. FPI involves foreign investors buying securities or financial assets of India, which can be easily bought and sold. Furthermore, the highest inflow of FPIs in the country is in the banking and financial services sector which does not essentially create productive assets. FPIs, hence, are termed less advantageous than FDI, as the former is a short-term attempt at making money. In contrast, foreign direct investments (FDIs) directly lead to real asset creation. FDI pertain to foreign investments in which the foreign investor has a long-term interest in an enterprise in India. Recent measures taken by the Union Government to allow more FDIs in new sectors, like digital media, contract manufacturing, coal mining, are expected to induce more investment in the country. However, these expectations need to be moderated with caution under current economic circumstances.

Recent measures taken by the Union Government to allow more FDIs in new sectors, like digital media, contract manufacturing, coal mining, are expected to induce more investment in the country.

Although India is in dire need of investments, not a lot has been done to induce fresh public investments. This year’s budget, while recognising an investment dearth, paved the way for regulatory changes that would attract private investment, but did not set aside enough for public expenditure schemes (like infrastructure) which are proven investment boosters. Roads and transport infrastructure are known to have strong linkage effects that generate investment and growth over time. Instead, the share of capital expenditure as a percentage of GDP has fallen down from 14% to 12% in 2016. This is ostensibly done to maintain the fiscal deficit target. However, doing this by containing government expenditure, particularly capital expenditure, is essentially counterproductive for a decelerating economy like ours. The necessity to refocus is evident by the government’s over-reliance on the private sector to generate new investments in an environment where fresh investments had plunged to a 15-year low in June 2019. Thus, the prerequisite for inducing an investment boost in the economy has to be increasing public capital expenditure significantly.

Despite recent waivers, continuing the withdrawal of FPIs from the Indian economy highlights the perils of an uninsulated capital market in India. Extreme reliance on these private foreign investments, given the movement away from equity to debt, can prove fatal for the country as the latter is relatively more volatile. Although fresh initiatives to induce FDIs have been undertaken by the government, there is an urgent requirement to acknowledge the role of public capital expenditure. Increase in capital expenditure sets off investment multipliers in the economy, and results in an upward spiral in GDP growth. Till public expenditure is raised considerably and other core macroeconomic issues are resolved, the capital flight is likely to continue unabated in the short run.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.