-

CENTRES

Progammes & Centres

Location

India has a unique opportunity to capture the emerging trends of globalisation and realise the export potential of the states.

In the midst of COVID-19 pandemic, world trade witnessed a sharp decline in the first half of 2020 as economies around the world entered into a lockdown and consumer demand fell to a historic low. In order to protect their respective domestic economies, nations around the world have turned inwards to reboot their industries and to protect the vital and essential supplies. Even before the pandemic obstructed the global supply chains, the global trade policy environment was experiencing disruptions caused by unilateral and arbitrary actions. These measures included withdrawal of Generalised System of Preferences (GSP) benefits and renegotiation of free trade agreements around the world.

Although India has projected itself as a balanced inward- and outward-oriented economy, hesitation in joining the Regional Comprehensive Economic Partnership (RCEP) Agreement reflects a conservative approach to the national trade policy. Moreover, India currently has the highest number of tariffs and one of the most restrictive trade practices in the world. While India has longed for an export-oriented growth, the economic reforms of 1991 couldn’t change them to an outward-oriented economy. India’s vision to become a US$5 trillion economy by 2024 was deemed impossible by economists as GDP growth fell to 4.2% for FY20. Subsequently, the pandemic made matters worse for the Indian economy, requiring a double digit growth to achieve such a target.

While other countries are looking inward, a focused policy shift in integrating with the major global supply chains and increasing the exports could be a key strategy for India to build its manufacturing capabilities in meeting the future global demand.

On account of disruptions in business operations caused by the COVID-19 pandemic, Prime Minister Narendra Modi envisaged the Atmanirbhar Bharat Abhiyaan or Self-reliant India campaign. The special economic and comprehensive package of INR 20 lakh crores was announced to provide a much needed boost to the domestic manufacturers and small businesses. This scheme further aims to promote ‘Make in India’ manufacturing by encouraging import substitution of low-technology goods from countries like China, and pushing for local produce at lower prices. While other countries are looking inward, a focused policy shift in integrating with the major global supply chains and increasing the exports could be a key strategy for India to build its manufacturing capabilities in meeting the future global demand. Therefore, the current environment offers a blessing in disguise to India to make their exports more competitive in the international markets by focusing on export-oriented growth and become the third largest economy by 2024, only behind the US and China.

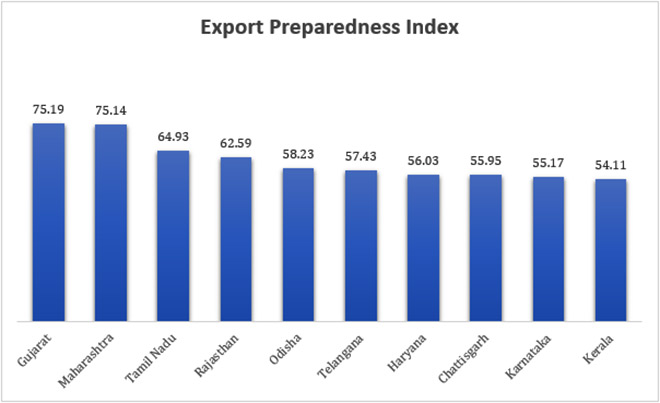

In alignment with India’s ambitions to achieve this growth, NITI Aayog recently released a report — ‘Export Preparedness Index’ (EPI) which discusses the export potential of each state and the role of regional level economies in enhancing India’s share in the global trade. This report was prepared by taking into consideration a number of factors such as business ecosystem, existing policy measures and export performance to suggest the strengths and weaknesses of each state. The EPI 2020 sets forth the importance of exports in driving an economy and enhancing the scale of manufacturing in India. The index ranked Gujarat on top as a result of a strong display across a majority of the factors including export promotion policy, business environment and infrastructure; followed by Maharashtra and Tamil Nadu in the second and the third place respectively.

Source: Export Preparedness Index 2020, NITI Aayog

Source: Export Preparedness Index 2020, NITI Aayog

At the same time, in order to achieve an export-oriented growth, the EPI 2020 reported certain bottlenecks in the Indian economy that require the attention of the policymakers at the sub-national level. These include intra- and inter-regional disparities in export infrastructure as coastal states have performed extremely well compared to the landlocked states in developing export promotion parks and hubs. Secondly, poor trade support and growth orientation among states; other than Uttarakhand and the coastal states, there is an absence of strong support towards the exporters from the respective state governments in improving their quality or quantity. Lastly, poor R&D infrastructure to promote complex and unique exports. The states with higher number of research institutes or NABL accreditation institutes have performed better in manufacturing goods of an international level of acceptance and improved their quality of exports. On the other hand, ‘Himalayan’ states have performed inadequately in this area due to the scarcity of research and quality check institutes. Thus, a paucity in the number of research institutes and significant disparities across states have curbed the innovative tendencies at the sub-national level.

Each state needs to understand their export opportunities and develop the right infrastructure.

For a country like India, that is vast and geographically diverse, it is important that such bottlenecks are addressed at the regional level with the support and supervision of the central government. Each state needs to understand their export opportunities and develop the right infrastructure in order to support the national economy in achieving a double digit growth to surge the country ahead.

| Sl. No. | State | Share of Total Exports (in percentage) |

| 1. | Maharashtra | 22.99 |

| 2. | Gujarat | 22.02 |

| 3. | Tamil Nadu | 9.81 |

| 4. | Karnataka | 5.95 |

| 5. | Uttar Pradesh | 4.55 |

| 6. | Haryana | 4.37 |

| 7. | Andhra Pradesh | 4.29 |

| 8. | West Bengal | 3.02 |

| 9. | Delhi | 2.87 |

| 10. | Kerala | 2.41 |

Source: Directorate General of Commercial Intelligence and Statistics (2017-18)

The Trade Infrastructure for Export Scheme (TIES), a major initiative by the Ministry of Commerce was launched in 2017 to address the existing infrastructure gaps among all the states. This initiative aimed to channelise the funds from the centre towards the state to create robust export infrastructure and establish export linkages. So far, only nine states have projects approved under TIES. Export competitiveness is closely linked with infrastructure as developed countries are able to easily produce and move goods with greater efficiency, resulting in lower trade costs. Union territories and the ‘Himalayan’ states require a focused attention of the respective state governments in building a robust export infrastructure. These states could set Maharashtra as their role model, that has done exceedingly well in promoting the development of export promotion hubs and now boasts the largest number of export promotion zones in the country. From a broader point of view, a decentralisation of decision making to state governments in order to facilitate more investments in infrastructure is required. A joint development of export infrastructure at the regional level with the national development plans; and rewarding the states for the significant steps in export promotion will provide incentives to other states to undertake the same footsteps.

A strong trade support guides the exporters by enhancing their capacity and increases the overall exports. Majority of the states in India lack a proper trade guide for the exporters. As a result there is a lack of information due to which the exporters fail to gain access to a larger share of the global market. Thus, this requires the states to have strategic policy interventions that can provide a platform for the exporters to showcase their products and interact with new partners in the global market. Uttarakhand and Odisha are among the best performing states in terms of holding trade fairs and conducting training workshops to enhance the capacity of the exporters. On the contrary, union territories have failed to provide adequate assistance to the exporters, resulting in limited financial assistance for upgrading the export infrastructure. However, most of the states need to improve their framework in this regard. This can be done by encouraging the exporters to become a part of state export councils and play an active membership role. Since a majority of the producers lack the necessary skills to navigate complex export deals in the international markets, state governments need to hold more capacity building workshops in partnership with institutes of foreign trade and management to help exporters capitalize on the potential export market opportunities.

A direct strategic investment in R&D supports product innovation, which in turn, boosts the capacity of an exporter to make unique and complex exports that can contribute towards the overall export growth. Conclusively, the best performing states on the EPI are also some of the states with high scores on the India Innovation Index. EPI 2020 highlights that regional disparities in R&D infrastructure are high and is the most important challenge to be addressed. Subsequently, this also offers a lot of room for improvement. Cost competitiveness is no longer sufficient for India to establish themselves in the global market due to the rise of other Asian economies such as Vietnam and Bangladesh. As a result, even a little improvement in R&D will reward manufacturers with high quality products that could make India’s exports more competitive in the international markets. Gujarat, Maharashtra and Tamil Nadu could serve as an example for the rest of the country to enhance their innovation tendencies. These states have established industrial clusters to ensure that producers maintain competitiveness while enhancing the innovative tendencies to boost the overall export figures.

Finally, in the face of the numerous perils brought on by the unprecedented COVID-19 pandemic, India has a unique opportunity to capture the emerging trends of globalisation and realise the export potential of the states.

The author is a research intern at ORF.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.