Low and middle-income countries in the African Region are the only group of countries in which mortality rates due to acute diseases are expected to remain in excess of those for chronic diseases, according to the World Health Organisation (WHO). It is estimated that 73 percent of the global deaths each year from AIDS are in Africa. This unacceptable human cost is only because of the lack of access to reliable medicines and treatment; advances in modern medicine allow people living with AIDS to lead fulfilling lives. Indeed, the lack of access to quality medicines drives up mortality. Supply of safe, efficacious and affordable medicines across the continent is, therefore, an ethical imperative.

The state of the pharmaceutical market in Africa

The pharmaceutical market in Africa is expanding, since Africans– accounting for 13 percent of the world's population- have more disposable income and better ability to pay than before. Analysts observe that Africa’s average annual growth rate in the pharmaceutical market will be at an estimated 10 percent between 2010 and 2020. The primary drivers of growth in pharmaceutical markets in Africa,along with the AIDS impact, are expansion in health insurance schemes and enhanced investments, an improved business climate, a maturing regulatory environment, and increased confidence in generic products.

With country health systems depending exceedingly on imports for pharmaceutical requirements, the fragmented supply chains in Africa have an excessive number of intermediaries between the production facility and the pharmacy where the medicines are sold. Intermediary margins are estimated to be up to 50 percent of the final price in Kenya and up to 90 percent of the price in lesser developed countries- while margins account for only two percent to 24 percent in the OECD countries.

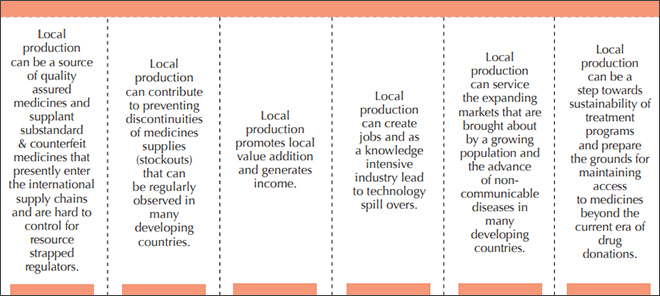

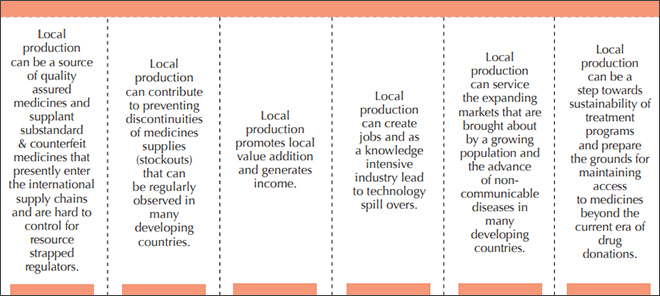

It is observed that Africa accounts only for three percent of global medicine production while 95 percent of the medicines consumed in Africa are imported with countries like South Africa and Morocco managing to produce 70% to 80% of their medicines and certain central African countries importing close to 100% of their need. However, given the market growth prospects, western pharmaceutical multinationals and Asian generic manufacturers have started investing in developing production capacity within the continent. Scoping initiatives have identified various benefits of local production; like ensuring the quality of medicines, avoiding stock outs, supporting local incomes and jobs, triggering technology spillovers, addressing new challenges like non-communicable diseases, and helping the sustainability of government medical schemes (Figure 1).

Figure 1: The benefits of local pharmaceutical production

Source: UNIDO (2015) Supporting Pharmaceutical Production in Africa

Source: UNIDO (2015) Supporting Pharmaceutical Production in Africa

A groundswell of support for developing the local pharmaceutical industry

As early as in 2005, a World Bank study had identified that Africa, South Africa, Kenya, Nigeria, and Zimbabwe have the industrial capacity that can be made available to produce medicines for export or for domestic consumption in the face of the diminishing supply of generic medicines from the major producers. The authors, however, warned that if the economic cost of creating local production capacity is excessive or the quality of the products is doubtful, promoting local production will be no solution at all.

In the last decade, there has been an interest in policies to strengthen local manufacturing in pharmaceuticals. In 2012, African Heads of State adopted the African Union Commission’s (AUC) Business Plan for implementing the Pharmaceutical Manufacturing Plan for Africa (PMPA), endorsed way back in 2007. A year later, in 2013, African leaders called for the strengthening of south-south cooperation to scale up investment in Africa's pharmaceutical manufacturing capacity, with a focus on generic essential medicines.

In 2014, the Joint United Nations Programme on HIV/AIDS (UNAIDS), the United Nation Industrial Development Organization (UNIDO) and WHO came together to appeal to Africa's development partners, especially the BRICS countries, to have a special role in supporting this critical transition: scaling up local production. In 2015, Ethiopia has been able to prepare a National Strategy and Plan of Action for Pharmaceutical Manufacturing Development in Ethiopia (2015–2025) with the support of the WHO.

A report by the European Commission and the WHO in 2017 found that China Government authorities and stakeholders have already started to engage in the development of the pharmaceutical sector in the African region. The Chinese Development Bank is undertaking studies and projects, and some Chinese companies have initiated operations, albeit of a limited nature.

A similar report in 2017 that explored India’s pharmaceutical sector found that some Indian companies, such as Cipla and Zydus-Cadila have invested in and/or partnered with African companies and that Indian industry already plays a significant role in the South African pharmaceutical market. The Indian presence in the African medicine marketing landscape is so strong that some authors have classified foreign firms active in Africa into two categories: the multinational corporations (MNCs) and the Indian generic companies. Some of these firms- like Cadila in Ethiopia, Cipla in Uganda and South Africa and Ranbaxy in Nigeria- are actively involved in manufacturing through foreign direct investments.

Is local production economically viable?

However, strong barriers to local pharmaceutical production exist across the African continent; such as, human resource constraints, inadequate infrastructure, high operating costs, weak links between local and international suppliers, high cost of local commercial capital, poor regulation, industry fragmentation, and low production quality standards. Early experience in countries like Tanzania has shown that majority of the employees in some major drug facilities are from countries like India, due to lack of skilled local workers.

There is a groundswell in Africa in support of local pharmaceutical production and Africa's dependency on the rest of the world for medicines may not last long. Recent analyses suggests that African governments are increasingly considering medicines supply as a national security issue. But what does the economics say?

Recent research paints a mixed picture. A recent report by McKinsey Consulting focusing on sub-Saharan Africa offers a systematic analysis of the potential business, economic, public health impact, and feasibility of local production of pharmaceuticals in the region. The report found that for many countries in Africa, because of structural reasons, the development of a local pharmaceutical production hub may not be economical. For 5-6 sub-Saharan African countries, the report concluded that increased local drug production is feasible at current and projected demand levels. According to McKinsey researchers, a focus on quality, attention to scale, the creation of regional hubs, strategic focus on the drug-product formulation, and upgradation of existing value-chains will help these countries build a local pharmaceutical industry.

Researchers have pointed out that in order to attract more investments in the pharmaceutical sector, countries may have to shift to an active industrial policy, which incentivises and nudges major players to move away from the relatively less risky alternative of importing. Any industrialisation effort will have to also take into account the current global market context where current Africa-based medicine manufacturers are facing high competition from the rest of the world. Given the diversity of economic, health and market situation, any monolithic policy framework will be impractical for most of Africa.

However, a flexible policy approach that allows for adapting to change may help convert some of the current support to the idea into augmented manufacturing capacity. In conclusion it needs to be emphasised that India’s case reminds us that while having a successful pharmaceutical manufacturing industry may be a necessary condition for people’s access to quality healthcare, but not necessarily a sufficient one.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: UNIDO (2015)

Source: UNIDO (2015)  PREV

PREV