-

CENTRES

Progammes & Centres

Location

How can supply reliability be ensured in the Indian power system?

The critical difference is that in an energy-only market, generators must wait and hope for the day when real-time prices increase substantially. With a capacity market, some of that revenue is guaranteed. The capacity market is designed to provide a solution by balancing lower energy market prices with higher revenues for generators in the capacity market. Capacity remuneration mechanisms can remove investment incentives for demand-side response activity in the wholesale market and energy storage. They also impede cross-border electricity trade by reducing the peak-prices that make trade profitable. Over the long term, the energy-only and capacity market constructs could end up delivering similar cost results to consumers. The third alternative, often confused with capacity markets, is to use ancillary service markets, which procure short-term reserve generation and grid support products for everyday system stability. As the proportion of RE continues to increase the demand for ancillary services to ensure daily operational stability is likely to increase. Ancillary services are traded in months, weeks, days and hours, not years like capacity. Ancillary service markets are for securing the right combination of resources for generation quality and not for generation adequacy. Competitive trading of these services is part of some, but not all, wholesale electricity markets. If generators can generate revenue from selling ancillary services, the need for capacity payments to keep plants online can be reduced. A properly functioning energy and services market can deliver all the capacity that the Indian grid requires. India is quite far away from this situation not only because it is an imperfect energy only market but also because India’s energy supply serves non-energy goals such as delivering development subsidies. However, keeping the future in mind, India’s central electricity authority (CEA) has studied the prospect of developing an ancillary services market. But it is too early to say whether a well-designed market that makes it profitable for generators to provide ancillary services (short term reserves and grid support products) would also stimulate investment in future capacity in India. The worry is that continued policy supported RE additions may keep electricity prices low, thereby, reducing the incentive for generators to build new plants. Most of the RE is “aspirational capacity,” capacity directly contracted for to meet climate commitments not necessarily capacity needs. Reconciling environmental goals that demand more RE additions with the need to preserve market incentives for new generation is a critical challenge. If India’s electricity sector matures into a vibrant open market, it can at least in theory, of value reliability and compensate investors for supplying fixed resources. A well-functioning wholesale electricity market should dynamically value energy, support services and capacity in response to the changing forces of supply and demand. An ancillary services market that responds to scarcity of flexible reserves by pushing up their price will make it profitable to operate peaking plant that can rapidly ramp up and down, giving generators a reason to keep plants online and invest in future capacity.In mature energy only markets, regulators ensure reliability through a mechanism called scarcity pricing, which allows real-time electricity prices to increase on days of peak demand. Instead of guaranteeing generation revenue through a capacity market, the promise of high prices is supposed to incentivise generators to build new plants and keep them ready to operate

Another alternative is keeping strategic reserves of power generating capacity where the capacity mechanism is procured completely outside the wholesale market so that it does not compromise the move towards developing an energy market in India. As in the case of strategic oil reserves, it should be owned and operated by the government to provide a national security (energy security), a public good. Strategic reserve for power generation is a pragmatic and relatively simple solution to meet demand for the short periods of extreme system stress. But the risk with a peak strategic reserve is that over time it can become just as expensive as a capacity market. Creating a new system of benefits or an entire new market, to stimulate investment in enough future capacity without interfering with the ancillary market's valuation and procurement of reserve capacity is complicated even in the most mature market and much more so in India.Creating a new system of benefits or an entire new market, to stimulate investment in enough future capacity without interfering with the ancillary market's valuation and procurement of reserve capacity is complicated even in the most mature market and much more so in India.

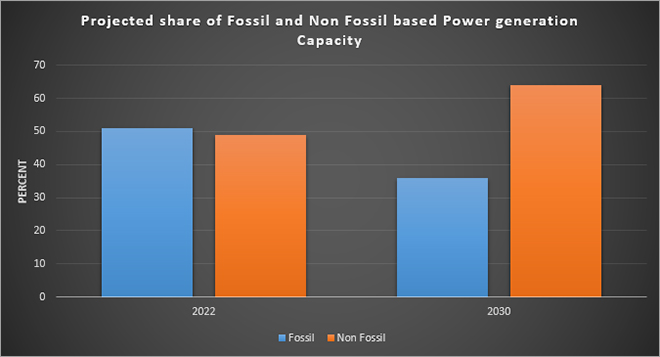

Source: Ministry of Finance, Government of India, “Report of the Sub-Committee for the Assessment of the Financial Requirement s for Implementing India’s Nationally Determined Contribution (NDC)” June 2020.

Source: Ministry of Finance, Government of India, “Report of the Sub-Committee for the Assessment of the Financial Requirement s for Implementing India’s Nationally Determined Contribution (NDC)” June 2020.The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Akhilesh Sati is a Programme Manager working under ORFs Energy Initiative for more than fifteen years. With Statistics as academic background his core area of ...

Read More +

Ms Powell has been with the ORF Centre for Resources Management for over eight years working on policy issues in Energy and Climate Change. Her ...

Read More +

Vinod Kumar, Assistant Manager, Energy and Climate Change Content Development of the Energy News Monitor Energy and Climate Change. Member of the Energy News Monitor production ...

Read More +