-

CENTRES

Progammes & Centres

Location

How will the fossil fuel sector respond to the known energy pressures of 2022?

This article is part of the series Comprehensive Energy Monitor: India and the World

Global

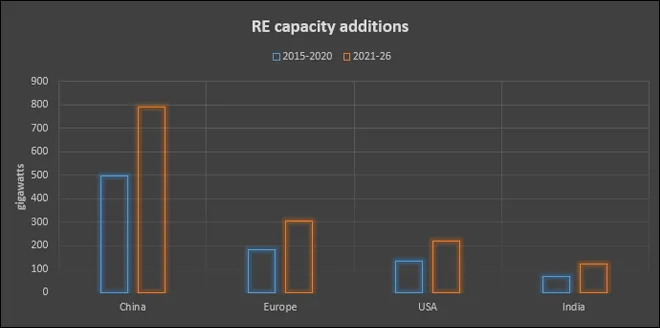

Optimistic forecasts for renewable energy (RE) capacity additions, particularly for photovoltaic (PV) power generation capacity and less optimistic forecasts for fossil fuel investment are two key threads that run through most reports on energy sector expectations for 2022. Unwavering policy and public support along with financial and non-financial subsidies for RE (for capacity additions and for research & development) in most of the developed world and in large markets like India make optimistic forecasts for RE capacity additions a ‘known’ known.

Prospects for decentralised RE are projected to be bright in the USA although most reports express some uncertainty over setting of carbon mitigation targets.

RE is expected to account for 90 percent of global capacity additions and PV capacity is expected to touch 162 GW (gigawatts) in 2022. Growth of wind energy capacity additions is expected to slow down in 2022 but grow faster than the average growth of the sector in 2017-19 with 80 GW of capacity addition. RE capacity addition of 49 GW in 2022 is expected in Europe on account of continued policy support and corporate power purchase agreements (PPAs) with RE producers. Prospects for decentralised RE are projected to be bright in the USA although most reports express some uncertainty over setting of carbon mitigation targets. RE capacity addition in China is projected to decelerate in 2022 primarily because of impending subsidy phase-outs but even then RE capacity addition is expected to increase by 58 percent. Given that China accounts for over 50 percent of wind turbine manufacturing capacity and almost 70 percent of solar panel output, tight global supply chains are expected to challenge global RE capacity additions in 2022.

Carbon prices in compliance markets, including the EU’s Emissions Trading System (EUETS) and China’s National Emission Trading Scheme are expected to increase in 2022 on the back of policy support. In industrialised countries, governments are expected to increase carbon tax rates and introduce new taxes to meet their decarbonisation pledges. On voluntary carbon markets corporate entities with ambitious net-zero targets are expected to drive up demand for high quality carbon offsets.

Carbon prices in compliance markets, including the EU’s Emissions Trading System (EUETS) and China’s National Emission Trading Scheme are expected to increase in 2022 on the back of policy support.

In 2022, electric vehicles (EV) are expected to take a double-digit share of the global market for the first time and EV sales are expected to touch 5.8 million. Some projections are more optimistic with sales of over 7.8 million units. While Europe is expected roll-out its super-credit for EVs subsidy reductions are forecast for China. Though production costs of EVs are expected to increase as cost of lithium, aluminium, and copper are anticipated to increase, these price increases are not likely to be passed on to consumers as the EV price must remain below price caps set by government EV incentive schemes.

India’s RE capacity additions are expected to set new records in 2022 as delayed projects from various competitive auctions are completed. Despite this, growth of RE capacity additions are expected to be far lower than the annual capacity addition of 40 GW required for India to reach the target of 500 GW pledged at the COP26. The target of the government is to achieve 227 GW of RE capacity (including 114 GW of solar capacity and 67 GW of wind power capacity) by 2022, more than its 175 GW target as per the Paris Agreement. India’s renewable energy sector is expected to attract investment worth US$ 15 billion in 2022.

Investments in fossil fuels that used to be determined largely by market fundamentals are increasingly influenced by climate change related disincentives, pressure from activist investors, and government policies to mitigate carbon emissions. In 2014, investors with just US $52 billion assets under management had pledged to shift investments away from fossil fuels. In 2021, as many as 1,485 institutional investors, representing a massive US $39.2 trillion of assets under management, committed to at least some form of divestment from fossil fuels. Banks now view lending to fossil fuel companies as carrying political risk. All this has decreased investment in supply of fossil fuels but this has not translated into decrease in demand.

Towards the end of 2021, global economic recovery from the pandemic increased demand for fossil fuels leading to unanticipated surge in the price of fossil fuels. What this suggests is that while the pressure to shift away from fossil fuels by constraining supply is known, how the global energy market that still depends on fossil fuels to meet 83 percent of demand remains unknown. The IEA’s (International Energy Agency) simultaneous call to stop investment in fossil fuels in its net zero report and to the OPEC (organisation of petroleum exporting countries) for opening its taps to keep oil markets well supplied best illustrates this contradiction.

Fossil fuel companies’ investment in technologies like carbon capture, utilisation & storage (CCUS) and low carbon hydrogen may coalesce into the beginning of an RE versus RE race with the solar plus batteries camp pitched against the CCUS and hydrogen camp.

In North America and Europe, gas demand has increased as replacement of coal-fired power generation. However, the decline in coal-fired generation has removed an important buffer for gas demand and prices. The result is less elastic gas demand, soaring natural gas prices, increase in price volatility and ironically a return to coal in some markets. After falling in 2019 and 2020, global power generation from coal is expected to jump by 9 percent in 2021 to an all-time high of 10,350 TWh (terawatt-hours). Depending on weather patterns and economic growth, overall coal demand is projected to reach new all-time highs in 2022 with global production touching an all-time high of over 8 billion tonnes (BT) in 2022 and remain at that level for the following two years, underscoring the importance of energy security. Diversifying energy supply with RE may insulate the energy sector from the impulses of market forces to some extent but increase dependence on more volatile natural forces such as the weather.

In 2022, fossil fuel companies’ investment in technologies like carbon capture, utilisation & storage (CCUS) and low carbon hydrogen may coalesce into the beginning of an RE versus RE race with the solar plus batteries camp pitched against the CCUS and hydrogen camp. Incentives in advanced markets such as the production credit of US $3 per kilogram of low carbon hydrogen and 45Q tax credit for blue (hydrogen derived from fossil fuels with CCUS) hydrogen could level the RE playing field for the two camps adding momentum to the competition.

The largest increase in coal production of 163 million tonnes is expected from India in 2022 with overall production crossing the 1 BT mark.

For India, the perennial ‘known’ unknown of efforts to reform the bankrupt discoms will continue in 2022. The fate of the draft electricity amendment bill (2020) will add to the ‘unknown’ component. With GDP (gross domestic product) projected to grow at over 9-10 percent, electricity demand and demand for coal are projected to increase substantially in 2022. The largest increase in coal production of 163 million tonnes is expected from India in 2022 with overall production crossing the 1 BT mark. But hitting this target depends on the big unknown of how the pandemic plays out and how the economy responds. 2022 may pose another challenge for India’s RE capacity addition which is underpinned by its cost competitiveness over coal. While inputs for coal are declining, the spike in global demand for critical minerals required for solar, wind and storage technologies have increased their capital costs. This may have a negative impact on capacity additions for RE. In addition, the substantial increase in RE capacity expected in 2022 may drive down tariff compromising the economic viability of RE projects.

Overall, 2022 is likely to hail the beginning of interesting times highlighting the tension between ‘known’ known energy outcomes that are the result of state-led policy decisions to increase RE investments and ‘known’ unknowns that are market response to the state-led interventions primarily from the fossil fuel sector.

Source: International Energy Agency

Source: International Energy Agency

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Akhilesh Sati is a Programme Manager working under ORFs Energy Initiative for more than fifteen years. With Statistics as academic background his core area of ...

Read More +

Ms Powell has been with the ORF Centre for Resources Management for over eight years working on policy issues in Energy and Climate Change. Her ...

Read More +

Vinod Kumar, Assistant Manager, Energy and Climate Change Content Development of the Energy News Monitor Energy and Climate Change. Member of the Energy News Monitor production ...

Read More +