-

CENTRES

Progammes & Centres

Location

The future of embedded finance in India looks promising, and 2023 could be a decisive year for its development

Embedded finance represents a paradigm shift in how financial services are delivered, characterised by incorporating financial services into non-financial products and services, such as mobile applications and digital marketplaces. For instance, social media platforms such as WhatsApp and Facebook now offer peer-to-peer money transfers and digital payments through their platforms.

The future of embedded finance in India appears promising, owing to a confluence of favourable factors, including a large population, rising income levels, expanding smartphone and internet penetration, and a rapidly growing digital economy. Furthermore, the Indian government's plans for financial inclusion align well with the potential of embedded finance to transform various aspects of the economy and further India's digital journey.

The Fintech ecosystem will likely play an important role in this growth by providing financial services to people previously underserved by traditional financial institutions.

Embedded finance in India

The embedded finance market has grown significantly, with the COVID-19 pandemic acting as a catalyst for e-commerce, triggering the digitalisation of financial services and a shift in consumer preferences. Fintech firms are also gaining consumer trust and, in some cases, outperforming traditional banks, creating numerous opportunities in the embedded finance industry. Embedded finance is expected to be more widely used in emerging markets in 2023. The Fintech ecosystem will likely play an important role in this growth by providing financial services to people previously underserved by traditional financial institutions. Furthermore, conventional financial services and fintech firms will form stronger alliances, particularly between banks and payment companies. This collaboration will enable banks to provide critical infrastructure while fintech firms tailor services to different business models, unlocking greater potential.

Internet and smartphone penetration

The proliferation of smartphones and internet access in India is a critical catalyst in the growth of embedded finance. As more Indians gain access to these technologies, so will the demand for mobile-based financial services. This trend is evident in the growing popularity of mobile wallets and Unified Payments Interface (UPI) in recent years.

The expansion of internet access in India has also increased the number of individuals utilising the internet to access financial services. It has subsequently led to a spike in digital transactions and the adoption of digital financial services, making them more easily accessible and convenient through the use of smartphones.

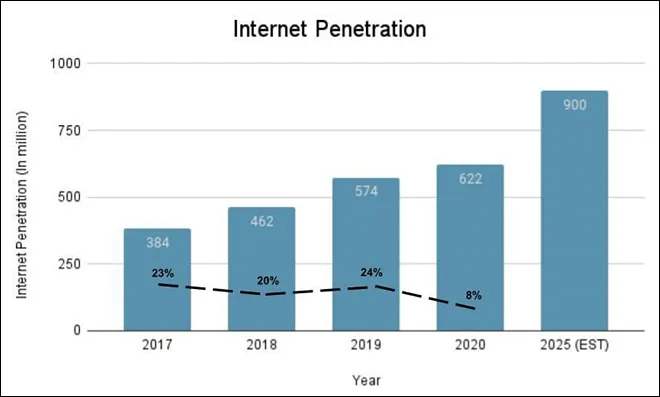

Source: Kantar ICUBE 2020 Report, Active Internet Users (AIU) and YoY Growth

Source: Kantar ICUBE 2020 Report, Active Internet Users (AIU) and YoY Growth

Despite the challenging pandemic period, the number of active internet users (AIUs) increased at a stable pace. For instance, India has witnessed tremendous growth in active internet users, almost doubling its active internet users from 384 million to 622 million from 2017 to 2020. Moreover, the 622 million active internet users in the overall population of 1,433 million individuals equate to 43 percent of the total population in 2020, both urban and rural. As per estimates, the number of active internet users in India across all segments will reach 900 million by 2025.

The increasing popularity of smartphones and the expansion of digital platforms have directly impacted the country's e-commerce growth. As a result, more businesses are incorporating financial services into their platforms to provide customers with a more seamless and convenient shopping experience.

E-commerce in India

India's e-commerce growth is expected to drive the growth of embedded finance as businesses integrate financial services into their platforms to provide customers with a seamless and convenient experience. They include options such as payments, lending, and insurance, creating an all-in-one platform that streamlines the process of shopping and financial transactions.

India's Micro, Small, and Medium Enterprises (MSME) sector also plays a significant role in the growth of e-commerce in the country. MSMEs make up a large portion of the Indian economy and contribute significantly to employment and economic growth. The COVID-19 pandemic accelerated the shift towards e-commerce.

Government initiatives such as the Digital India programme and Make in India campaign have played a crucial role in promoting the growth of e-commerce, especially for India’s MSME sector. These initiatives have helped increase the availability of digital infrastructure and services across the country and provided MSMEs with access to various digital tools and services, enabling them to improve their operations and reach new customers.

Government initiatives such as the Digital India programme and Make in India campaign have played a crucial role in promoting the growth of e-commerce, especially for India’s MSME sector.

The demand for goods and services in rural areas is high, but the availability of financial services is limited. Rural India, thus, presents a largely untapped market for e-commerce companies. With increasing internet penetration and the growth of mobile commerce, more and more people in rural India are gaining access to e-commerce platforms and online marketplaces. This presents a significant opportunity for e-commerce companies to tap into this market and reach new customers.

India's online shopper population will continue to experience a significant growth in the coming years, estimated to reach between 400-450 million by 2027. This is a notable increase from the current shopper base, which has already scaled to between 180-190 million in 2021, with an additional 40-50 million shoppers added to that base in the same year alone. Furthermore, it is worth noting that most of these shoppers are coming from smaller and tier-3 cities, indicating a growing trend of digital adoption amongst a wider range of demographics. Additionally, a new generation of digital natives, known as Gen Z (those aged between 18-25), has begun transacting online and will likely play an increasingly critical role in shaping the e-retail landscape in the future. These projections show that e-commerce and online purchasing are becoming increasingly popular in India, aided by underlying embedded payment systems.

Financial inclusion goals

The push for financial inclusion is a crucial contributor to embedded finance in India. The Indian government has implemented several initiatives to promote digital financial services and expand access to financial products and services for the unbanked and underbanked population, particularly in rural areas. As a result, the number of digital transactions and digital financial services has increased significantly.

Financial inclusion, aided by embedded finance, makes financial services more convenient and accessible. For example, by incorporating financial services into mobile apps, people can use their smartphones to access financial products and services anytime and from any location. Developing countries such as India, where many people in rural areas lack access to traditional brick-and-mortar financial institutions, stand to benefit from financial inclusion.

| Month | No. of Banks live on UPI | Volume (In million) | Value (in Cr) |

| Dec 22 | 382 | 7,829.49 | 12,82,055.01 |

| Nov 22 | 376 | 7,309.45 | 11,90,593.39 |

| Oct 22 | 365 | 7,305.42 | 12,11,582.51 |

| Sep 22 | 358 | 6,780.80 | 11,16,438.10 |

| Aug 22 | 346 | 6,579.63 | 10,72,792.68 |

| Jul 22 | 338 | 6,288.40 | 10,62,747.00 |

| Jun 22 | 330 | 5,862.75 | 10,14,384.00 |

| May 22 | 323 | 5,955.20 | 10,41,506.00 |

| Apr 22 | 316 | 5,583.05 | 9,83,302.27 |

| Mar 22 | 314 | 5,405.65 | 9,60,581.66 |

| Feb 22 | 304 | 4,527.49 | 8,26,843.00 |

| Jan 22 | 297 | 4,617.15 | 8,31,993.11 |

| Dec 21 | 282 | 4,566.30 | 8,26,848.22 |

Source: npci.org.in

The rise of UPI in India indicates the progress India is making in the financial and digital financial inclusion space. This progress is heavily supported by India’s growing internet penetration, smartphone usage, and the growth of embedded payments infrastructure supporting e-commerce platforms. The staggering growth of UPI, for instance, is encapsulated by the total growth in volume and value of transactions in 2022, where transaction volume reached 7,829 million, and transaction value hit INR 1,282,055 billion in December 2022.

Embedded finance also promotes financial inclusion by opening new channels for financial service delivery. Traditional financial institutions frequently struggle to reach out to specific populations, such as low-income individuals, rural areas, and small businesses. Embedded finance can provide new channels for delivering financial services to those underserved by integrating financial services into non-financial products and services. Additionally, it can potentially increase competition in the financial services market, resulting in better products and services for customers. Customers, for example, can easily compare and choose from a wide range of financial products and services, resulting in better deals and improved customer outcomes.

Embedded finance can provide new channels for delivering financial services to those underserved by integrating financial services into non-financial products and services.

Embedded finance for development goals

Embedded finance is almost a laissez-faire approach to development as it provides the frameworks and essential building blocks to firms that want to develop better and more customer-centric products. Through this process, firms integrate financial products into their core business platforms and create unique customer experiences for existing users and underserved populations. A significant section of India’s population is still underserved due to their economic and social predispositions. Therefore, the economic opportunity and moral imperative lie in serving such underserved populations in India and creating an environment that supports entrepreneurs and small businesses from all walks of life.

Conclusion

The future of embedded finance in India looks promising, and 2023 could be a decisive year for its development. The overarching goal of creating in-context financial products is to impartially help individuals and businesses, having a spillover effect on India’s development goals of poverty, gender, and economic growth.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Sauradeep is an Associate Fellow at the Centre for Security, Strategy, and Technology at the Observer Research Foundation. His experience spans the startup ecosystem, impact ...

Read More +