This essay is part of the series “Reimaging Education | International Day of Education 2024”.

As the world celebrates the International Day of Education 2024, it is worth taking stock of how the Indian edtech sector is faring. As recently as 2021, India was being projected as the potential “edtech capital of the world”. Subsequently, though, there has been a sectoral downturn, and optimism among investors and edtech firms has waned.

The peak years of the COVID-19 pandemic saw edtech explode across the country as educational institutes and students scrambled to avoid disruptions to teaching and learning. Since 2022, a worrying decline has become evident. An overcrowded market with nearly 4,500 edtech startups means that funding is harder to attract, and new customers harder to acquire. Intense competition has led to relentless cost-cutting, and mass layoffs are marring the promise of a transformational industry. But do these trends mark the tail end of an edtech boom, a sector going bust for good, or a bubble burst whose aftermath may surprise us?

Boom?

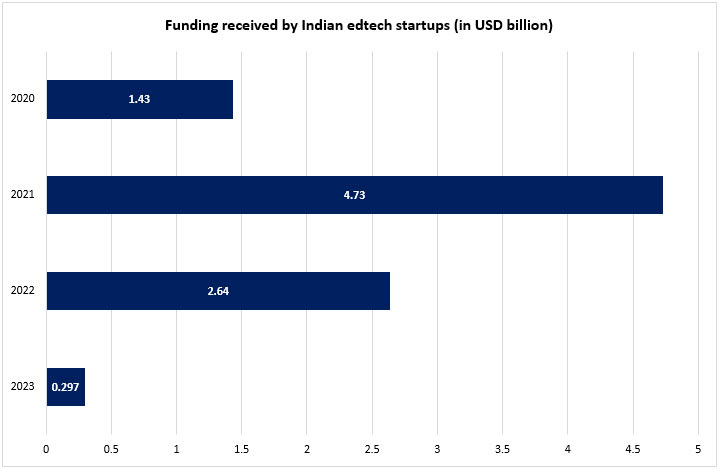

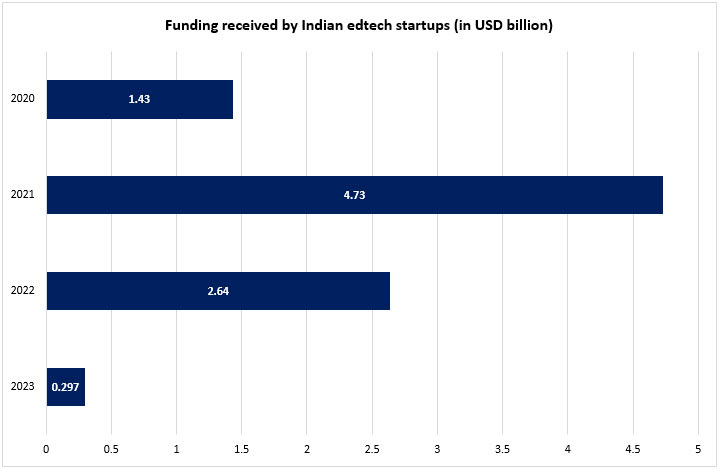

Edtech has been on the rise in India since pre-COVID times, with startups in the space raising around US$ 1.32 billion between 2014 and 2020. The pandemic was an inflexion point. With a massive overnight surge in the demand for e-learning solutions, the edtech sector raised a staggering US$ 1.88 billion in 2020 alone, surpassing in a single year its record of investments received over the five preceding years.

As India locked itself down against the coronavirus, over 320 million students and teachers in Indian schools and higher education institutes found themselves at home for the better part of 2020–2021. That prompted a mass transition to tech-enhanced learning, with online classes, e-learning software, virtual tutorials, innovative tools for managing coursework, and the use of open collaborative educational platforms, digital libraries, and newly created repositories of e-content becoming the norm across large parts of urban India. Enrolments in professional online courses skyrocketed too. At Udemy, for instance, course signups tripled as people began to use the platform to keep themselves productive and learn new skills. As 2020 drew to a close, the uptake of Udemy’s courses on business fundamentals, financial analysis and professional communication had grown by up to 606 percent.

By 2021, India’s edtech boom seemed unstoppable. The country had emerged decisively as the world’s second-largest edtech market after the United States (US). Edtech was also India’s most heavily funded startup segment, receiving an influx of US$ 4.73 billion in 2021 alone. Encouraged by their domestic success, Indian firms were increasingly foraying into global markets, often through strategic acquisitions, with major players like BYJU’S, Scaler Academy, Emeritus, and Simplilearn building their presence chiefly in the US, and also in other countries in Southeast Asia, the Middle East, and Africa.

Bust?

Indian edtech faced a reversal of fortunes in 2022. As schools reopened and hybrid and conventional learning—rather than pure online learning—resumed, the sector took a hit. Besides, the marketplace spurred by the boom years was oversaturated with companies large and small, all vying for a fast-shrinking customer base. The competition for market share relentlessly drove down prices and margins, which in turn impacted profitability, and discouraged investors. Funding for edtech startups dropped to US$ 2.6 billion in 2022 and then plummeted to US$ 297.3 million in 2023. “Cost optimisation measures” and layoffs beleaguered the sector. Over 14,000 edtech employees lost jobs in 2022, with major companies like BYJU’S, Vedantu and Unacademy accounting for half of these job losses; the next year, the numbers were even higher. The sector seemed to have gone bust, with little hope of recovery.

Source: INC42 and The Mint

In a bid to adapt to a changed environment, India’s edtech unicorns have begun to provide offline educational services. BYJU’S, for example, had acquired the Aakash Institute tutorial centre chain in early 2021; and as the funding winter of 2022 began, BYJU’S started rolling out its ambitious plan to set up 500 offline centres across 200 cities within a year, and to recruit 10,000 staff to manage them. Going offline has become part of the playbook for negotiating India’s volatile edtech landscape. PhysicsWallah too announced in mid-2023 that it intended to invest heavily in its offline tech-enabled centres—called Vidyapeeths and Pathshalas—and open over 60 of them across India by 2024. These centres have already proven to be the company’s fastest-growing vertical in terms of revenue generation and learner enrolment. Other companies like BrightChamps, Unacademy, and Vedantu are also boosting their offline capabilities as contemporary learners today clearly want the best of both worlds—the online and the offline.

Bubble?

A bubble refers to an economic cycle characterised by a spike in market value, especially in asset prices. The surge in inflation is followed by an equally rapid contraction in value. As a whole, the phenomenon is called a bubble burst or crash. As a new year dawns, the experience of edtech in India between 2020 and 2023 would appear to be a textbook case of a bubble burst.

But there is hope yet. Even as investors remain cautious, having burnt their fingers in the post-pandemic years, there is a growing realisation that there are new opportunities to be tapped. A US-based edtech venture firm has pointed out, for instance, that education and skills are “long-tail investment themes driven by rising demand and a growing middle-class”. These attributes help maintain India’s attractiveness as an edtech investment destination. Indeed, small signs of recovery are already becoming apparent. The fact that edtech majors are ramping up their offline services is being keenly watched. Indeed, a sharper focus on hybrid solutions and the application of cutting-edge tech tools in traditional classroom or tutorial settings could yield rich dividends. More broadly, the burst of the edtech bubble could ultimately lead to a more rationalised market in India, with only the most viable, sustainable, competitive, and consumer-centric companies surviving.

Artificial intelligence (AI) is likely to emerge as the next frontier for Indian edtech innovation. 2023 demonstrated generative AI’s potential for supporting teachers and students, and reimagining education. 2024 holds out the promise of a wave of collective upskilling for stakeholders in the education ecosystem, the growing use of AI-based edu-solutions, and more AI-generated educational content.

Finally, as efforts to implement the National Education Policy 2020—with its strong orientation towards tech-enhanced teaching and learning—enter into its fourth year, there will be a broad spectrum of opportunities for edtech-focused public-private partnerships. These could contribute towards the revival and resurgence of edtech in India.

Anirban Sarma is a Deputy Director and Senior Fellow at ORF

Shrushti Jaybhaye is a Research Intern at ORF

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV