Immediately after the International Monetary Fund (IMF)

lowered India’s growth projection to 6.8 percent in 2022-23, the Indian economy encountered the double blow of rising retail inflation in September 2022 and an unexpected Index of Industrial Production (IIP) contraction in August 2022.

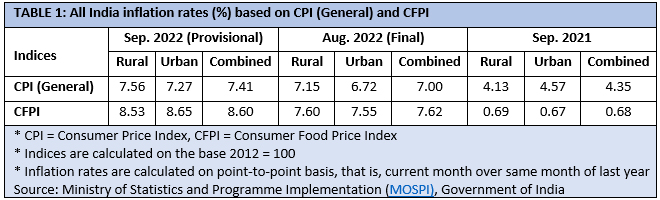

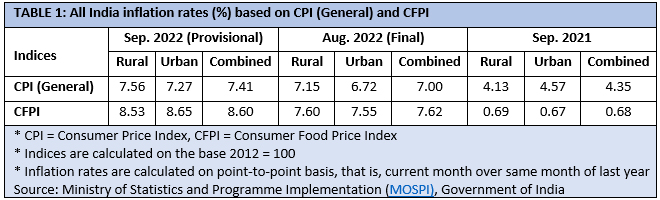

Combined consumer price index (CPI) rose to 7.41 percent in September provisional figures. Two alarming trends emerged in this month. First, rural CPI increased marginally more than the urban CPI—indicating slightly greater impact of inflation in rural India. Second, consumer food price index (CFPI) has gone up to 8.6 percent year-on-year in this month (

Table 1). This implies that food prices are driving the price rise. For those in the population at the margins of survival, this is quite damaging.

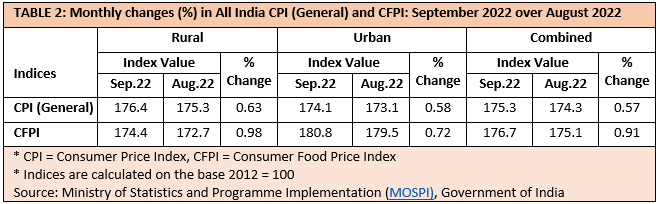

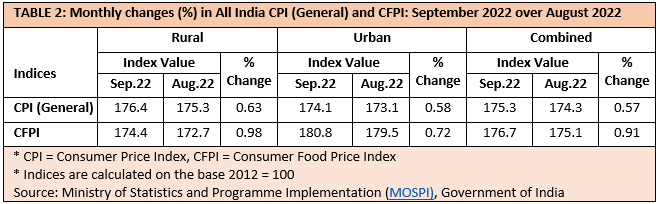

Even if one looks at the monthly changes in the CPI and CFPI, these two trends are evident. Compared to August 2022 figures, both CPI and CFPI increased more in rural areas in September than in urban areas (

Table 2).

Food inflation accounts for roughly 39 percent of the CPI basket (if one leaves aside non-alcoholic beverages and prepared meals, snacks, sweets etc.). The rise in September CPI inflation is largely driven by vegetables (18.05 percent), spices (16.88 percent), and cereals and products (11.53 percent). This September, inflation figures for cereals and products is the highest since September 2013. The two most important cereals—non-PDS (public distribution system) categories of rice and wheat—have

undergone inflation rates of 9.2 percent and 17.4 percent this September. This is alarming.

A couple of days later, the wholesale price index (WPI) figures were announced as well.

WPI grew 10.7 percent in September 2022, lower than the 12.4 percent growth rate in August. While WPI is primarily meant to be a tracker of producer prices, the CPI is supposed to measure the prices facing an average household in the economy. So, marginal cooling down of the WPI inflation may indicate peaking of producer prices two months earlier. But the problematic part is that it remains at a higher double-digit level. If WPI inflation stabilises at this level, then it is not good news.

A

Bloomberg poll of economists anticipated retail inflation to be higher at 7.36 percent, largely in line with the actual 7.41 percent figure. However, the Bloomberg forecast faltered at predicting the IIP slowdown; it projected a 1.7 percent growth.

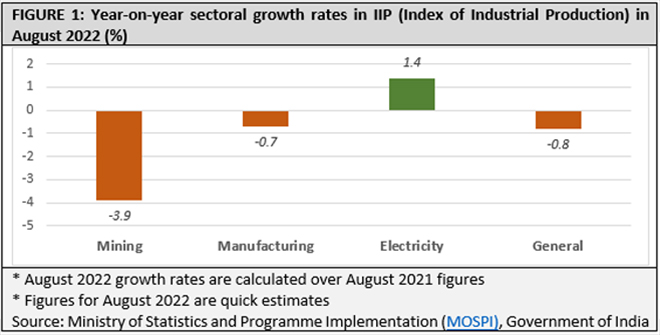

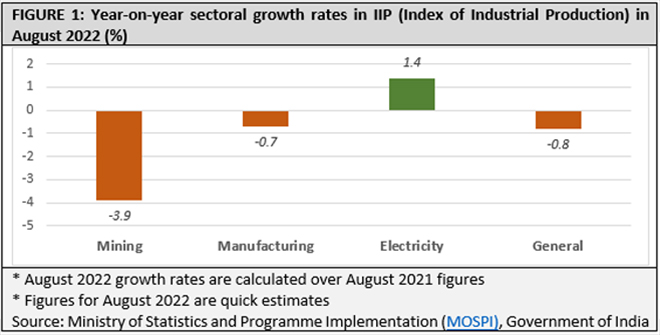

As around 77 percent of IIP tracks all kinds of manufacturing activities, a 0.8 percent contraction in August does not bode well for the economy. Manufacturing contracted by 0.7 percent, but a 3.9 percent contraction in mining also contributed to the overall decline (

Figure 1). The monsoon rains affecting mining and construction, and a reduction in exports due to a global slowdown may be two probable factors contributing to this contraction.

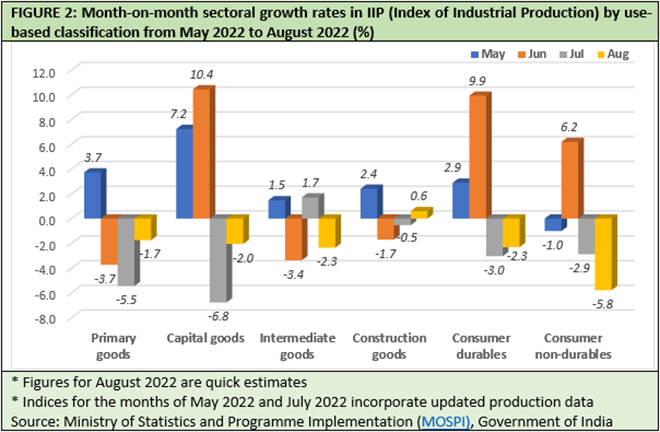

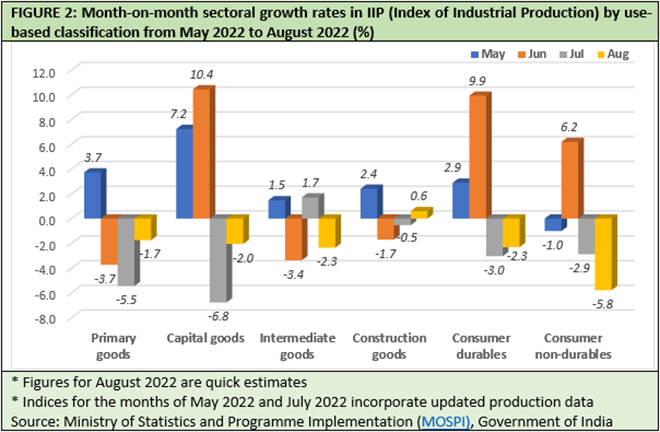

While mining contraction significantly contributed to the slowdown, a comparison of month-on-month sectoral IIP growth rates by use-based classifications reveals other aspects of this contraction. Primary goods have been contracting since the month of June; the capital goods index has been in the negative during July and August; intermediate goods production had gone negative in August; and construction goods experienced a marginal 0.6 percent growth in August after being in the negative zone in both May and June (

Figure 2). There is, indeed, a general trend of slowdown and/or contraction across sectors in the last three months or so.

However, this comparison highlights significant month-to-month contractions in both consumer durables and non-durables in July and August. Contraction in consumer non-durables is more pronounced in August. Before festive seasons, this trend is worrying. The next two to four months may boost sectoral growths due to festive buying and selling. However, from the production side, this kind of a contraction – particularly in consumer non-durables (-5.8 percent) – belies the official optimism about future growth prospects.

Sectoral month-to-month growth rates by use-based classification points towards a disturbing trend. It may or may not get reversed in the next few months, but ignoring it altogether may prove fatal in the longer run.

Higher retail inflation, along with a slowdown in manufacturing, is likely to result in a rise in survival challenges for the lowest section in the income distribution. Therefore, it is necessary to provide basic food security by continuing and widening the scope of existing welfare schemes like the PM Garib Kalyan Yojana. If not anything else, these government-sponsored efforts can ensure the survival of a significant part of the population.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Immediately after the International Monetary Fund (IMF)

Immediately after the International Monetary Fund (IMF)

PREV

PREV