Current Status

As of April 2023, the total installed capacity for power generation in India was just over

416,091 MW (megawatt). Of this about

51 percent was based on coal,

5.9 percent on natural gas power,

1.6 percent on nuclear energy,

11.26 percent on hydropower and

30.17 percent on renewable energy (RE). Overall, the private sector dominated power generation capacity with roughly

50.6 percent share while the state and centre accounted for

25.4 percent and

24 percent share respectively in 2023.

The private sector accounted for the largest share in coal-based power generation capacity (

35.13 percent), in gas (

42.59 percent) and also in RE (

96.7 percent) based power generating capacity. The lowest share for the private sector was in hydro-power generation capacity at

8.3 percent in 2023. In 2022-23, centrally owned plants accounted for

39.7 percent of power generation followed by state-owned plans with a share of

32.5 percent and private plants with a share of

27.2 percent. Total electricity generation was 1624 TWh (terawatt hour) of which coal and gas (mostly coal) contributed 74.2 percent followed by RE, 13 percent, hydro, 9.9 percent and nuclear, 2.9 percent. The relative shares of electricity actually supplied may be different as the available data for conventional power generation and RE power generation is treated independently.

Capacity Addition 2007-2017

In 2007–2012, (11

th plan period),

48,539.9 MW of thermal (mostly coal with a small share for gas) capacity was added. Roughly

90 percent of the total capacity installed in the five-year period was thermal power, mostly coal. Of the total capacity added roughly

22,319.5 MW or 46 percent was added by the private sector. In 2012-17 (12

th plan period), against a target of

73,339 MW of thermal capacity

91,730.45 MW was added. Thermal power generation capacity accounted for about

90 percent of total capacity addition and coal alone accounted for

85 percent of capacity addition. Of this roughly

41.5 percent used supercritical technology while

58.5 percent used sub-critical technology. The private sector accounted for

58 percent of thermal capacity addition in this period. Growth in power generation capacity additions in the period 2007-2017 was dramatic compared to capacity additions during the previous four decades. Effectively the thermal power generation capacity added in one decade (2007-17) was greater than the thermal power capacity added in the

previous five decades. In the period 1997-2002, total power generation capacity addition grew at an annual average of

6.32 percent while thermal power generation grew at a meagre

0.05 percent. In the five-year period from 2002–2007 total power generation capacity grew at an annual average of

2.19 percent while thermal power generation capacity addition fell by about

2.28 percent. Power generation capacity addition picked up after 2007 and grew at an annual average of

21 percent in the period 2007-2012 driven by the electricity act 2003 that opened power generation to the private sector. Annual average growth of thermal power capacity addition led by coal was a staggering

32 percent in this period. The growth momentum continued in the next five years (2012-17) with total power generation capacity growing at an annual average of over

12 percent and thermal power generation capacity growing at over

13 percent. But growth in power generation capacity far exceeded growth in demand for electricity. In the period 2002 to 2017, total capacity addition grew at an annual average of over

10 percent while demand for electricity grew by only about

5 percent on average. Consequently, the plant load factor of thermal plants fell from close to 80 percent to about

60 percent in 2017. The reserve margin which is the difference between installed capacity and the peak load met - expressed as a percent of peak load met—increased from less than 50 percent to over

70 percent. The surplus thermal capacity rendered many of the thermal projects commercially unviable affecting the balance sheets of public sector banks that financed these projects in the form of non-performing assets.

Capacity addition post-2017

The

national electricity plan 2018 (NEP 2018) took the substantial capacity addition in the previous decade into consideration and observed that only 6445 MW of new coal-based capacity will be required in the period 2017-2022 in addition to 47,855 MW of coal-based capacity that was under various stages of construction and the impending retirement of the coal-based capacity of

22,716 MW. This projection by the NEP 2018 was read as India’s decision to phase out coal by media. In March 2019, India had about

68,681 MW of coal-based power projects under various stages of construction. The private sector had a share of

35 percent of ‘under-construction’ coal projects while the rest was almost evenly split between the state and central sector. In March 2020, coal projects under construction fell to about

60,916 MW and in March 2021 coal projects under construction fell to

58,240 MW. Between 2019-2021, central-sector coal projects fell by

26 percent in terms of capacity, state-sector projects by 18 percent and private sector projects by just over 1 percent. Over

71 percent of the projects ‘under construction’ in 2021 were super-critical plants. Super-critical plants improve operating efficiency to about

38-40 percent which will reduce carbon-di-oxide (CO

2) emissions. A 5-percent improvement in the coal combustion efficiency of thermal power plants will lead to a

10 percent reduction in CO

2 emissions. However, India’s policy to reduce coal imports could allow older subcritical plants to continue operation thus reducing overall fleet efficiency. In addition, coal plants tend to operate less efficiently when running under lower rates of utilisation or subjected to more frequent ramping as it is now the case with an increasing share of intermittent RE.

Future coal capacity additions

According to the draft of the

National Electricity Policy 2022 (NEP 2022), about 25,580 MW of coal-based capacity addition is required for 2026–27 much lower than the capacity addition target of

187,909 MW for RE. For the period 2027-32, the target for coal-based capacity addition was 9434 MW about 25 times lower than the capacity addition target for RE which was set at

224,908 MW. In 2021-25, coal-based capacity addition is to be mainly through ultra-super critical (USC) / supercritical (SC) units. USC and SC units with a total capacity of

62,370 MW (including 2 units of USC with capacity of 1320 MW) were commissioned by early 2022 and

27,840 MW USC and SC units were under construction while construction of 9,900 MW was held up due to various reasons.

The least cost optimal generation capacity addition

model for 2029-30 forecasts 62,370 MW of coal-based capacity addition compared to over

430,155 MW of RE along with 27,000 MW of active storage. Given that coal-based power generation capacity is

205,235 MW in April 2023, an additional capacity of over 61,676 MW will be required to meet the target of

266,911 MW for coal-based capacity in 2029-30.

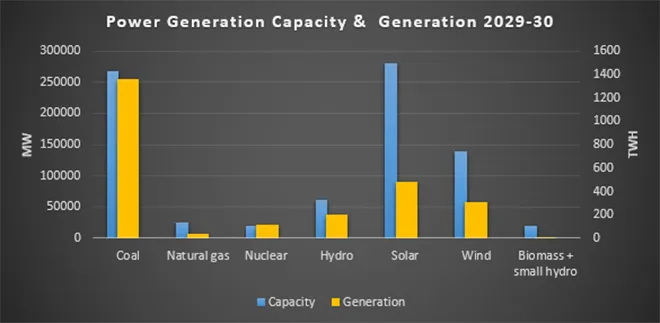

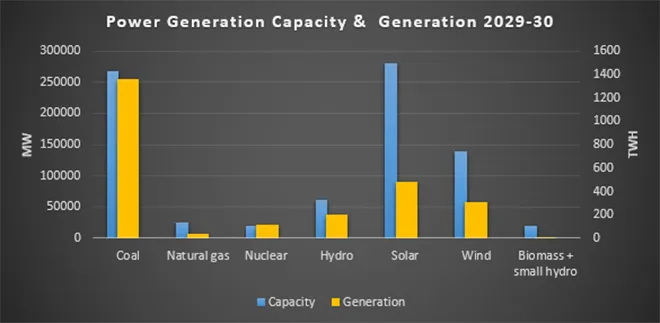

In 2029-30, RE (not including hydro, small hydro and pumped storage) is expected to have the largest share in power generation capacity accounting for

52 percent of capacity with coal a distant second with

266,911 MW capacity accounting for 33 percent of total capacity. However, coal will continue to account for the largest share in power generation at

1357.7 TWh that is 54 percent of total generation followed by RE with

800.5 TWh or 31 percent of total generation. While RE capacity is being pursued with great zeal, coal-based USC plants could have achieved the same amount of carbon emissions. For example, a 10 GW (gigawatt) USC coal plant can achieve the same level of carbon emission saving, 100 GW of solar capacity would be required. A 10 GW USC coal power plant will generate

60 billion kWh (kilowatt hour) of electricity at 70 percent plant load factor. The USC with heat rate of

1870 kcal/kWh (kilo calories/kilowatt hour) compared to 2530 kcal/kWh of sub-critical plants will save

9.9 million tonnes of coal and corresponding emissions. For the same level of emission reduction, a

100 GW solar installation will be required.

Coal-based capacity additions are giving way to RE-based capacity addition. This has two implications. RE generation capacity of which the private sector controls over 96 percent will push for regulations that favour despatch of RE-based power over conventional power. Second, the private sector will eventually achieve de-licencing of distribution, in spite of all odds to prioritise RE despatch.

Source: CEA, Report on Optimal Generation Capacity Mix for 2029-30

Source: CEA, Report on Optimal Generation Capacity Mix for 2029-30

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV