The India-Bangladesh bilateral relationship has flourished over the past decade. From doubling bilateral trade in 2022 to furthering Free Trade Agreement negotiation talks, the continually deepening economic engagement drives this bilateral relationship. Positive economic growth, their consequential geostrategic location in the Indian Ocean region, and shared cultural traditions have driven the bilateral partners closer.

However, India is not the only country solidifying its partnership with Bangladesh. Over the last few years, China has also enhanced its engagement with Bangladesh, driving investments through its Belt and Road Initiative (BRI). Today, Bangladesh has emerged as a theatre where China and India are stepping in to shore up their foreign direct investments (FDI). This article examines Chinese investments in Bangladesh, particularly under the BRI, between 2016 and 2022 and delineates the geostrategic and eoeconomics implications for China-Bangladesh bilateral relations.

< style="color: #0069a6">Positive economic growth, their consequential geostrategic location in the Indian Ocean region, and shared cultural traditions have driven the bilateral partners closer.

< style="color: #163449">BRI and Vision 2041

In 2016, China signed 26 Memorandums of Understanding (MoUs) with Dhaka, formally making Bangladesh a part of its premier transnational infrastructure programme, the BRI. In a meeting with Chinese Vice-Minister for Foreign Affairs Sun Weidong thereafter, PM Sheikh Hasina said that a ‘developmental’ partnership with Beijing will augment Bangladesh’s capabilities to achieve ‘Vision 2041’—a 20-year plan to transform Bangladesh into a developed nation through poverty alleviation, sustained economic growth, and energy independence. Under the developmental plan, Dhaka will require US$ 1.7 billion every year to finance its transition, a colossal sum for an emerging economy. Even though, in the last decade, Bangladesh’s economy has been on a steady rise, poor regional connectivity and energy scarcity have prevented its economy from unlocking its full potential.

Western multilateral lenders and democracies such as the United States (US), France and the United Kingdom (UK), which provide funding for such infrastructural gaps, have often held back aid and loans to Bangladesh due to concerns over weak institutions, high corruption, and alleged human rights violations and undermining of democratic processes in the 2014 and 2018 elections by the Sheikh Hasina-led Awami League government. This is where Beijing stepped in and furbished Dhaka with aid and loans worth billions in 2016. Today, 240 Chinese companies dominate all major sectors of the Bangladeshi economy. From railroads, energy generation, and power transmission to transport infrastructure, digitisation, e-governance, renewable energy and meeting Bangladesh’s emission reduction targets of 2041, China has become integral to growth in these critical economic sectors.

< style="color: #0069a6">Today, 240 Chinese companies dominate all major sectors of the Bangladeshi economy.

< style="color: #163449">Major Chinese projects in Bangladesh

Between 2016-22, Chinese state-owned and private companies invested nearly US$26 billion in Bangladesh. In 2022, Beijing emerged as the country’s largest FDI provider as its investments topped almost US$1 billion—a 30 percent increase from US$700 million in 2021. In both these years, Chinese investments also accounted for more than 65 percent of FDI registered by the Bangladesh Investment Development Authority (BIDA).

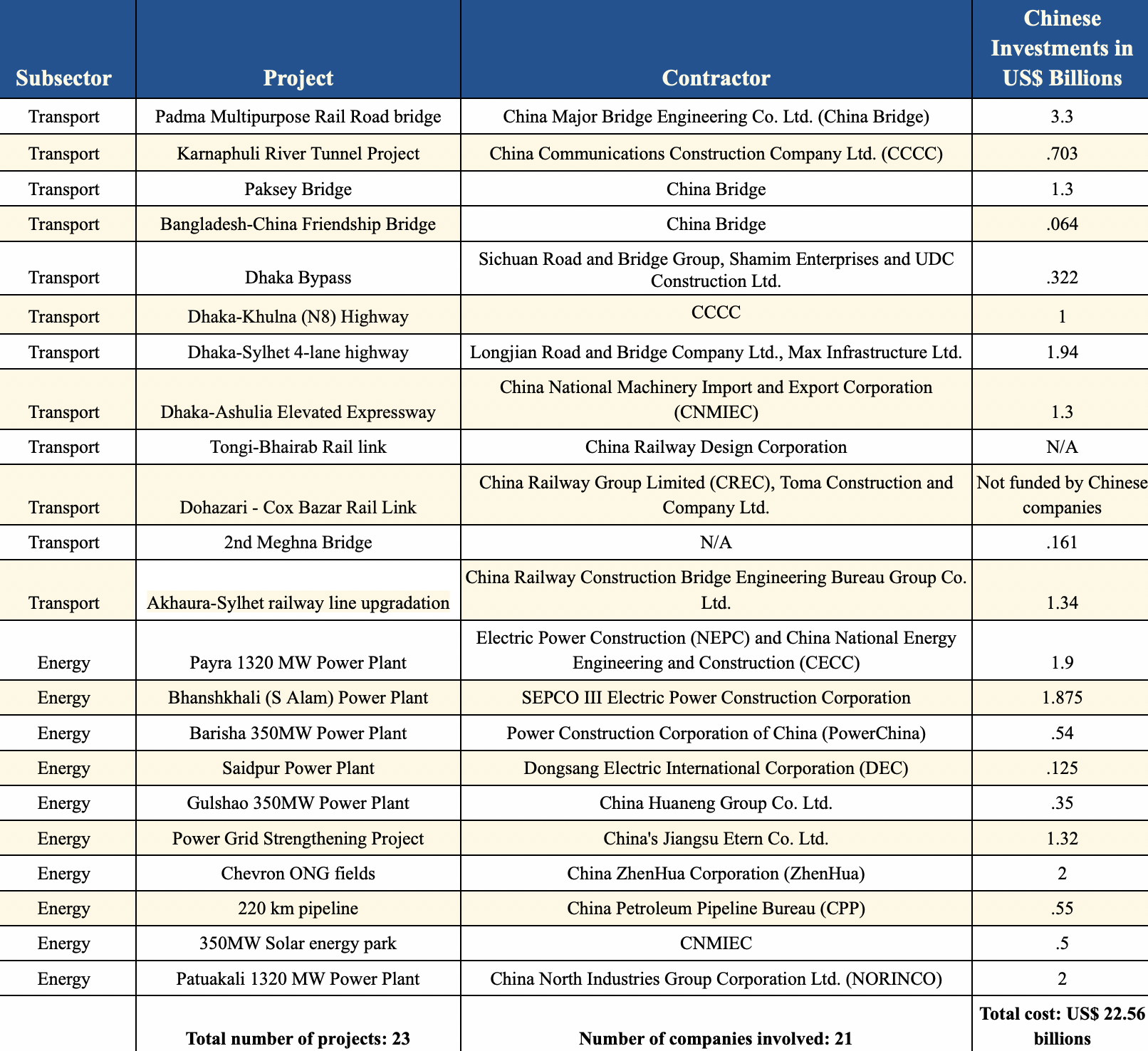

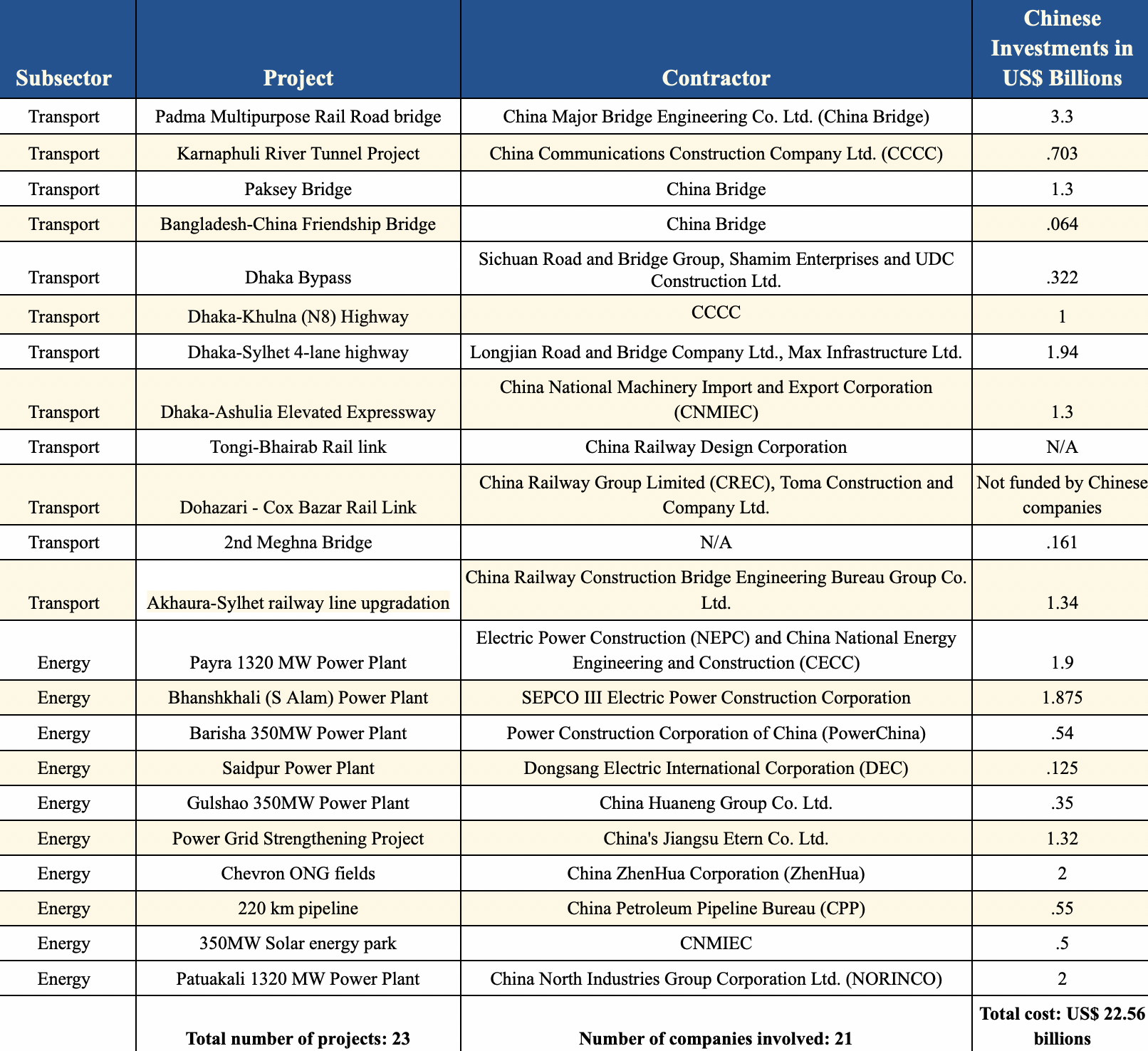

Table 1: Major China-supported Projects in Bangladesh

Source: Compiled by the Author from Bangladeshi and Chinese government data

Source: Compiled by the Author from Bangladeshi and Chinese government data

Chinese investments have covered energy, connectivity, digitisation, renewables, and human resource development projects. Out of these, China has particularly focused on energy and transport infrastructure.

For instance, Beijing constructed Karnaphuli Tunnel, South Asia’s first under-river road tunnel. The tunnel streamlines traffic for 34 million people in the Dhaka-Chittagong-Cox’s Bazar highroads system. Additionally, Beijing has completed crucial projects such as the Dasherkandi Sewage Treatment Plant in Dhaka and the ‘Info-Sarkar’ ICT project—connecting 2,500 government offices centrally.

Besides these projects, in 2023 alone, China invested nearly US$800 million in Bangladesh. These include Sinovac Biotech Ltd.-led US$500 million Plasma Centre in Dhaka; two apparel companies, namely, SSH and Kaixi’s investments in luxury garments manufacturing; and Xinyi Glass’s proposed construction of Bangladesh’s largest glass factory at US$200 million.

< style="color: #0069a6">Chinese investments have also raised concerns in the country, even within the government.

Yet, Chinese investments have also raised concerns in the country, even within the government. In August 2022, Finance Minister Mustafa Kamal said that the developing world ought to be wary of Chinese investments under BRI to avoid falling into a debt trap. He added that China needs to step up and claim responsibility for the debt distress it has created across the developing world.

< style="color: #163449">China’s expanding presence in Bangladesh—A quid-pro-quo partnership

Concerns about the debt trap notwithstanding, China’s integration into the Bangladeshi economy is ongoing. It has built 21 bridges and 11 highways ning 550 kilometres, seven railway lines ning 600 kilometres, and 27 energy and power generation projects, which supply over 50 percent of the local electricity in the country. Furthermore, 90 percent of upcoming energy projects in Bangladesh are financed by Beijing. Besides physical investments, China’s Shanghai and Shenzhen stock exchanges also acquired a 25-percent stake in the Dhaka stock exchange, Bangladesh’s most significant trading market. Chinese state companies have also bought three gas fields in Bangladesh, which generate over half of Bangladesh’s gas for local consumption. In a short time, China has flooded Bangladesh’s economy with heavy investment inflows.

Besides economic assistance, Beijing has also supported Dhaka to subvert Western pressures. China financed the Padma Multipurpose Bridge across the Padma River when the World Bank pulled out in 2013, citing grave concerns regarding corruption in the project. Ten years later, despite objections by India, the Bangladeshi government permitted Beijing to term the Padma Bridge and the remaining 20 bridges and 11 highways as an extension of the BRI in South Asia. In 2017, Chinese state companies also bought gas fields when Chevron Corporation pulled out of the country due to pressure from Washington. Political pressures and the West’s alienation, such as Bangladesh’s exclusion from the Democracy Summit 2021, have further pushed Dhaka towards Beijing.

< style="color: #0069a6">33 percent of the Chinese BRI projects in Bangladesh are commercially unviable, yet they were granted permission as influential individuals within the Bangladeshi polity stood to benefit from them.

China, in turn, benefits immensely as it instrumentalises and reinforces the highly-personalised polity of the country. Reportedly, 33 percent of the Chinese BRI projects in Bangladesh are commercially unviable, yet they were granted permission as influential individuals within the Bangladeshi polity stood to benefit from them. Bangladeshi media reports have speculated that at least two former central government ministers had lobbied for contracting Chinese companies in over four critical infrastructure development projects in the past five years. Such incidences indicate a partnership that goes beyond ‘development’ as promulgated by Dhaka. Rather, it showcases Bangladesh’s all-powerful polity’s increasing dependence on China, which translates into strategic inroads for China.

< style="color: #163449">Conclusion

For a dynamic yet low-income nation like Bangladesh, prudence suggests a diversification in international borrowing and FDI inflows. Yet, Dhaka has leaned heavily on Chinese aid and investments, thereby creating economic dependencies and strategic leverage for China. Today, critical sectors such as defence, transport, energy, and renewables depend on Chinese stimulus to further economic development in the South Asian country. As China reinforces the current political regime in Bangladesh, it gets, in turn, access to further the BRI in various expanding sectors of Bangladesh’s economy. Until now, Bangladesh has been able to seek favourable terms from China. What remains to be seen is whether Dhaka will be able to strike a balance between leveraging China’s economic aid and allowing China strategic inroads in the country through the BRI.

Prithvi Gupta is a Research Assistant with the Strategic Studies Programme at the Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV