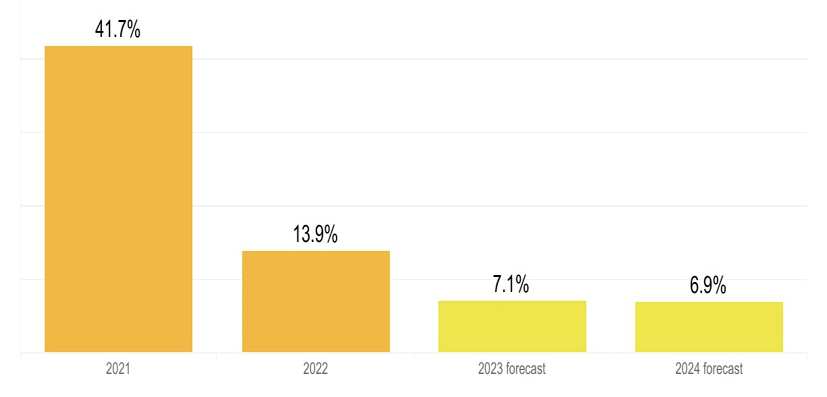

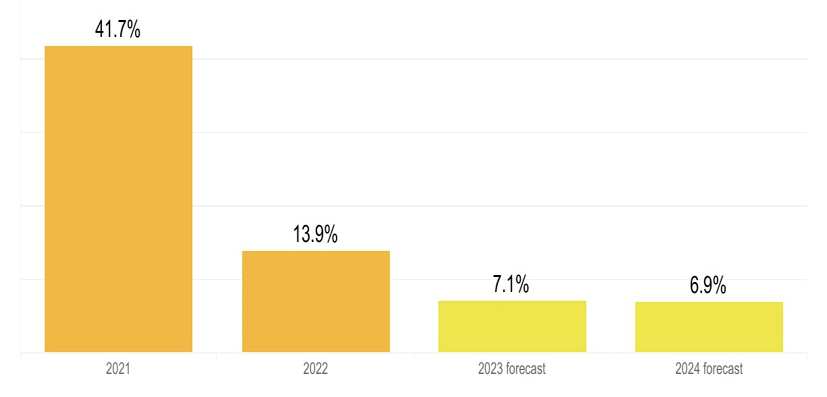

The Republic of Maldives graduated from the Least Developed Country (LDC) status in 2004, based on its high Gross National Income per capita and Human Asset Index (HAI). However, due to the havoc wreaked by the tsunamis, the process was delayed, and Maldives was declared a high-middle-income country only in 2011. With a nominal GDP of around US$ 7 billion, the Maldives economy is heavily dependent on imports and driven primarily by its tourism sector. Sustained economic growth is projected for 2023 and 2024, as 1.8 million tourists are expected in FY23. However, a possible downturn might follow due to projections of lower global GDP, causing the tourism sector to shrink.

Figure 1: Maldives GDP Growth Rate

Source: Asian Development Bank

Another major issue facing the Maldives government is its rising debt burden—at the end of the second quarter of 2023. While total expenditure declined by only 10 percent, government revenue shrunk by a substantial 25 percent, primarily due to the fall in tax revenue. The major private sectors, i.e., tourism, personal loans, commerce and real estate, saw an influx of credit, signalling that the country is focused on promoting the domestic economy. Interest rates on demand and savings deposits have remained stagnant, but private sector loans have become more expensive since 2022. During September 2023, there was a noticeable contraction in trade, with total exports falling by 23 percent compared to the same month in 2022, and imports dipping by 4 percent. The export decline was primarily attributed to a decrease in re-exports and a reduction in domestic exports.

Evolving China-Maldives dynamics

The Maldives holds a crucial strategic position in the Indian Ocean, attracting Indian and Chinese interests. India values the archipelago for cultural, linguistic, and economic ties, considering it vital for trade and defence. Maldives' location aids India in securing its coasts from piracy and terrorism. Pursuing its 'string of pearls' strategy, China sees Maldives as a pivotal pearl to consolidate its Indian Ocean communication lines. Despite environmental concerns threatening Maldives' survival, China is determined to secure a base to protect its energy imports, highlighting the region's complex interplay of geopolitics and ecological challenges.

Pursuing its 'string of pearls' strategy, China sees Maldives as a pivotal pearl to consolidate its Indian Ocean communication lines.

The current President, Mohamed Muizzu, elected in October 2023, during his campaigns, promised to strengthen ties with China and reduce Indian influence. Thus, India-Maldives relations stand at a shaky juncture as policymakers navigate the possible ramifications of China’s influence over the Maldives and the ratification of the Free Trade Agreement (FTA) between the two nations.

The negotiations for a China-Maldives FTA commenced in 2015, intending to strengthen the countries’ bilateral ties and secure a mutually beneficial economic partnership. Maldives signed the FTA on 8 December 2017, its first bilateral trade agreement, which became a subject of scrutiny and criticism due to the enormous scale difference between the two parties. On the other hand, the proponents claimed that the FTA—covering trade in goods and services, investment, and overall economic and technical cooperation—will be mutually beneficial.

The FTA covered 96 percent of the goods traded by both countries, establishing a broad consensus in terms of trade stipulations such as origin rules, customs procedures, and sanitary and phytosanitary measures. However, the then President, Yameen Abdul Gayoom, was unable to ratify the agreement before the end of his tenure in 2018. Ibrahim Solih, his successor, adopted an ‘India First’ policy and did not bring the FTA into effect, leaving Chinese enterprises uncertain about the prospects of any expansion in China-Maldives trade.

Revival of the FTA

Now, as President Muizzu focuses on strengthening Malé-Beijing relations, it is likely that the 2017 FTA will be ratified, possibly with certain moderations. An FTA usually eliminates all tariffs and restrictions on trade between the signatory countries unless specified otherwise. It further stipulates conditions to be followed for trade and promoting cooperation between the countries beyond bilateral trade, i.e., distribution of technology, knowledge, and other resources. Thus, a detailed analysis of the clauses of the FTA is necessary to assess its impact on the two nations and their South-Asian neighbourhood.

Firstly, the revised tariff structures under the FTA need to be explored. The FTA mandated categorising Chinese imports into Maldives into three categories—goods on which tariffs will be eliminated immediately, goods on which tariffs will be eliminated gradually over periods of five and eight years, and goods on which tariffs will remain at base rates declared in 2014.

A key detail in the FTA is that any good produced in China will be included under the FTA tariff structure, i.e., the first category of goods produced in China but imported from another country would not face any tariff barriers. As of 2019, China held the most significant share in Maldivian imports, contributing a major share of government revenue. However, the elimination of tariffs will not only reduce Maldives’ revenue from China but also from countries which re-export Chinese goods. In aggregate, this will pile up the government debt, forcing the government to increase internal debt or raise its domestic tax revenue. Both of these might have severe consequences for household spending, possibly driving the Maldivian economy towards contraction.

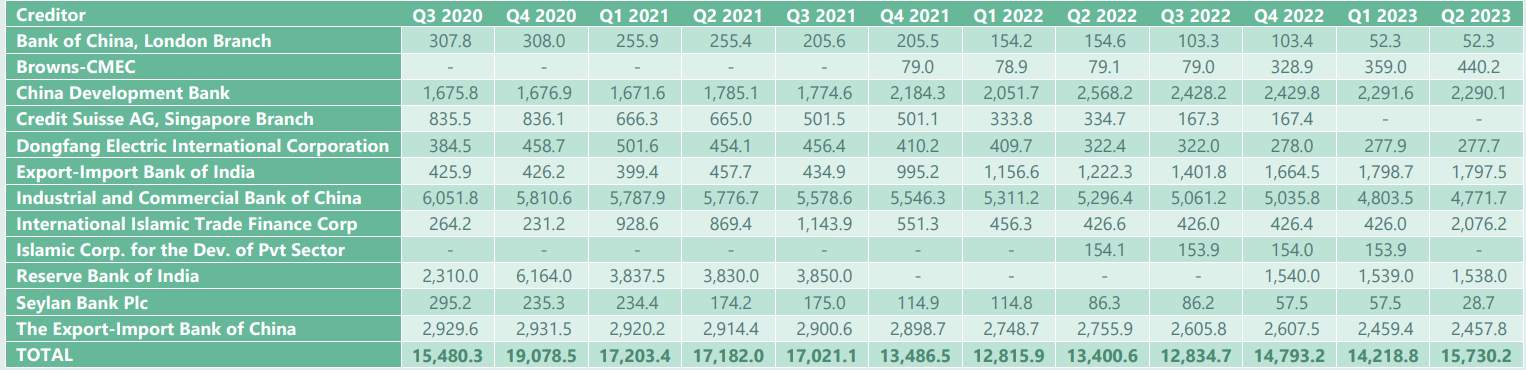

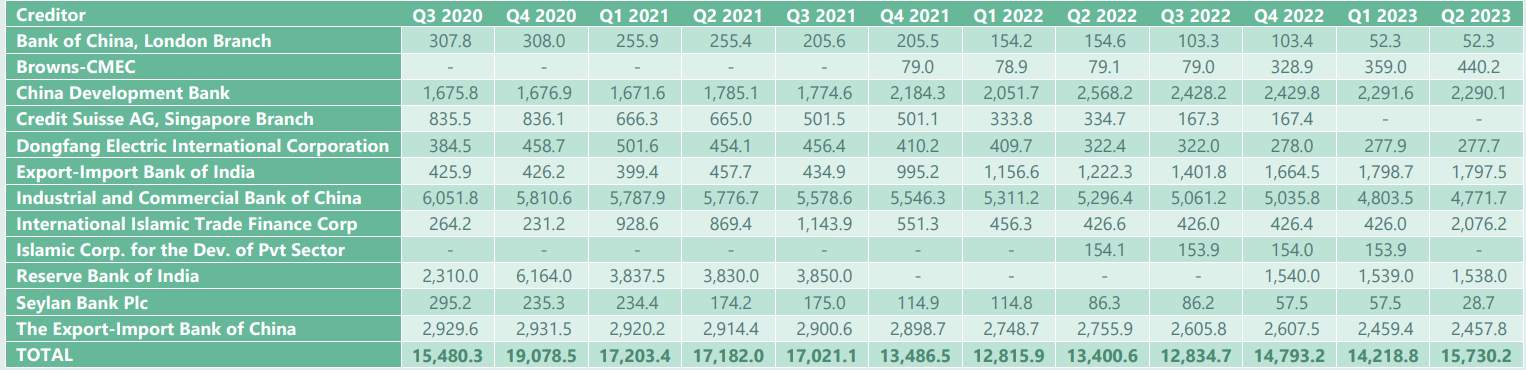

The China Development Bank, the Industrial and Commercial Bank of China, and the Export-Import Bank of China hold over 60 percent of Maldives’ sovereign debt. This results in an exorbitant amount of interest due to the Chinese lenders, increasing Maldives’ credit from China.

Secondly, the more severe concern is China’s debt trap diplomacy, which would cause the Maldives to become a pawn in the Chinese attempt to control the Indian Ocean. In the last decade, Maldives' external debt to GDP ratio has skyrocketed, indicative of growing susceptibility to debt traps. Sovereign-guaranteed debt implies debt which has the irrevocable and unconditional guarantee of the government. The China Development Bank, the Industrial and Commercial Bank of China, and the Export-Import Bank of China hold over 60 percent of Maldives’ sovereign debt. This results in an exorbitant amount of interest due to the Chinese lenders, increasing Maldives’ credit from China.

Table 1: Maldives’ Outstanding of Sovereign-guaranteed External Debt by Creditor

Source: Ministry of Finance, Maldives

The infamous debt-trap diplomacy can cause Malé to succumb to Beijing’s attempts to deepen Chinese penetration in the Maldivian economy.

As the FTA fosters further economic collaboration between the two nations, it can lead to unmanageable debt levels for Maldives. The infamous debt-trap diplomacy can cause Malé to succumb to Beijing’s attempts to deepen Chinese penetration in the Maldivian economy. Thus, the Maldives government should thoroughly investigate the clauses of the FTA, analysing in-depth, the possible implications for the regional economy and security.

Soumya Bhowmick is an Associate Fellow at the Centre for New Economic Diplomacy, Observer Research Foundation

Arya Roy Bardhan is a Research Assistant at the Centre for New Economic Diplomacy, Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV